The Business Planning Process: 6 Steps To Creating a New Plan

In this article, we will define and explain the basic business planning process to help your business move in the right direction.

What is Business Planning?

Business planning is the process whereby an organization’s leaders figure out the best roadmap for growth and document their plan for success.

The business planning process includes diagnosing the company’s internal strengths and weaknesses, improving its efficiency, working out how it will compete against rival firms in the future, and setting milestones for progress so they can be measured.

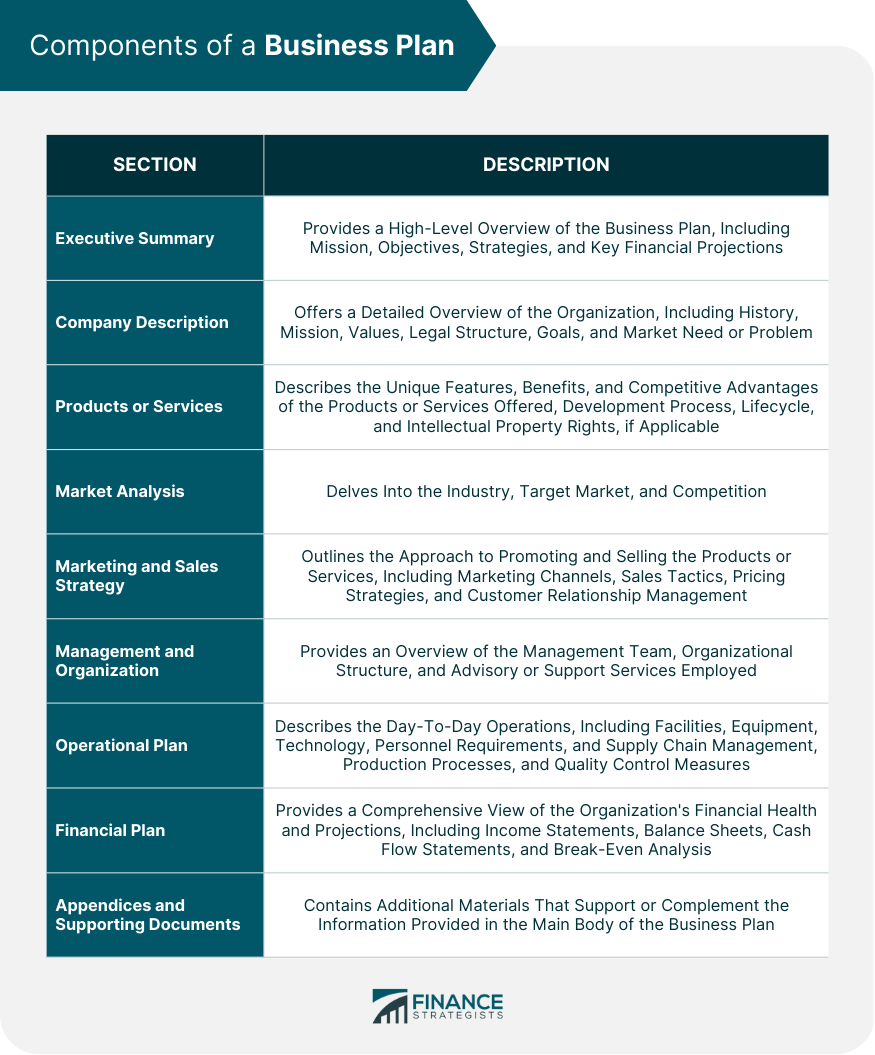

The process includes writing a new business plan. What is a business plan? It is a written document that provides an outline and resources needed to achieve success. Whether you are writing your plan from scratch, from a simple business plan template , or working with an experienced business plan consultant or writer, business planning for startups, small businesses, and existing companies is the same.

Finish Your Business Plan Today!

The best business planning process is to use our business plan template to streamline the creation of your plan: Download Growthink’s Ultimate Business Plan Template and finish your business plan & financial model in hours.

The Better Business Planning Process

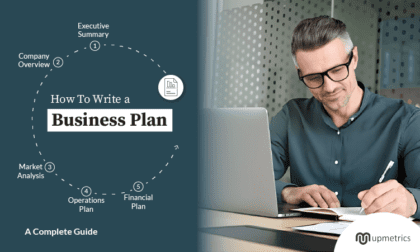

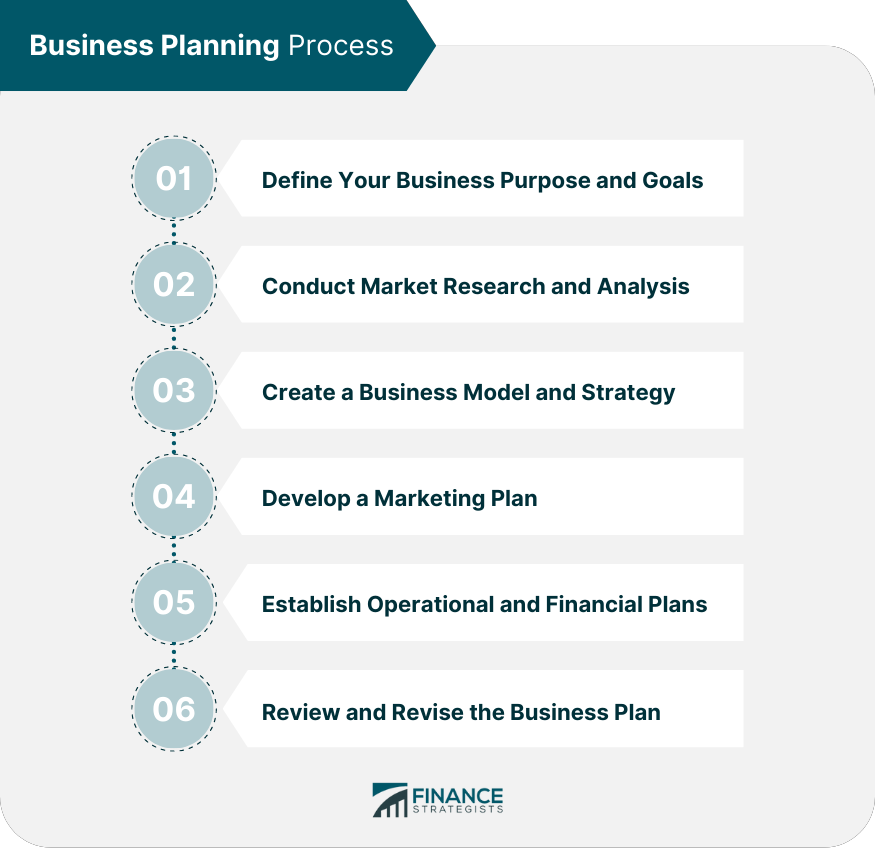

The business plan process includes 6 steps as follows:

- Do Your Research

- Calculate Your Financial Forecast

- Draft Your Plan

- Revise & Proofread

- Nail the Business Plan Presentation

We’ve provided more detail for each of these key business plan steps below.

1. Do Your Research

Conduct detailed research into the industry, target market, existing customer base, competitors, and costs of the business begins the process. Consider each new step a new project that requires project planning and execution. You may ask yourself the following questions:

- What are your business goals?

- What is the current state of your business?

- What are the current industry trends?

- What is your competition doing?

There are a variety of resources needed, ranging from databases and articles to direct interviews with other entrepreneurs, potential customers, or industry experts. The information gathered during this process should be documented and organized carefully, including the source as there is a need to cite sources within your business plan.

You may also want to complete a SWOT Analysis for your own business to identify your strengths, weaknesses, opportunities, and potential risks as this will help you develop your strategies to highlight your competitive advantage.

2. Strategize

Now, you will use the research to determine the best strategy for your business. You may choose to develop new strategies or refine existing strategies that have demonstrated success in the industry. Pulling the best practices of the industry provides a foundation, but then you should expand on the different activities that focus on your competitive advantage.

This step of the planning process may include formulating a vision for the company’s future, which can be done by conducting intensive customer interviews and understanding their motivations for purchasing goods and services of interest. Dig deeper into decisions on an appropriate marketing plan, operational processes to execute your plan, and human resources required for the first five years of the company’s life.

3. Calculate Your Financial Forecast

All of the activities you choose for your strategy come at some cost and, hopefully, lead to some revenues. Sketch out the financial situation by looking at whether you can expect revenues to cover all costs and leave room for profit in the long run.

Begin to insert your financial assumptions and startup costs into a financial model which can produce a first-year cash flow statement for you, giving you the best sense of the cash you will need on hand to fund your early operations.

A full set of financial statements provides the details about the company’s operations and performance, including its expenses and profits by accounting period (quarterly or year-to-date). Financial statements also provide a snapshot of the company’s current financial position, including its assets and liabilities.

This is one of the most valued aspects of any business plan as it provides a straightforward summary of what a company does with its money, or how it grows from initial investment to become profitable.

4. Draft Your Plan

With financials more or less settled and a strategy decided, it is time to draft through the narrative of each component of your business plan . With the background work you have completed, the drafting itself should be a relatively painless process.

If you have trouble writing convincing prose, this is a time to seek the help of an experienced business plan writer who can put together the plan from this point.

5. Revise & Proofread

Revisit the entire plan to look for any ideas or wording that may be confusing, redundant, or irrelevant to the points you are making within the plan. You may want to work with other management team members in your business who are familiar with the company’s operations or marketing plan in order to fine-tune the plan.

Finally, proofread thoroughly for spelling, grammar, and formatting, enlisting the help of others to act as additional sets of eyes. You may begin to experience burnout from working on the plan for so long and have a need to set it aside for a bit to look at it again with fresh eyes.

6. Nail the Business Plan Presentation

The presentation of the business plan should succinctly highlight the key points outlined above and include additional material that would be helpful to potential investors such as financial information, resumes of key employees, or samples of marketing materials. It can also be beneficial to provide a report on past sales or financial performance and what the business has done to bring it back into positive territory.

Business Planning Process Conclusion

Every entrepreneur dreams of the day their business becomes wildly successful.

But what does that really mean? How do you know whether your idea is worth pursuing?

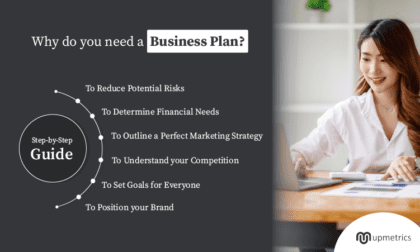

And how do you stay motivated when things are not going as planned? The answers to these questions can be found in your business plan. This document helps entrepreneurs make better decisions and avoid common pitfalls along the way.

Business plans are dynamic documents that can be revised and presented to different audiences throughout the course of a company’s life. For example, a business may have one plan for its initial investment proposal, another which focuses more on milestones and objectives for the first several years in existence, and yet one more which is used specifically when raising funds.

Business plans are a critical first step for any company looking to attract investors or receive grant money, as they allow a new organization to better convey its potential and business goals to those able to provide financial resources.

How to Finish Your Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Click here to finish your business plan today.

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success.

Click here to see how Growthink business plan consultants can create your business plan for you.

Other Helpful Business Plan Articles & Templates

- school Campus Bookshelves

- menu_book Bookshelves

- perm_media Learning Objects

- login Login

- how_to_reg Request Instructor Account

- hub Instructor Commons

Margin Size

- Download Page (PDF)

- Download Full Book (PDF)

- Periodic Table

- Physics Constants

- Scientific Calculator

- Reference & Cite

- Tools expand_more

- Readability

selected template will load here

This action is not available.

17.2: The Planning Process

- Last updated

- Save as PDF

- Page ID 15047

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

Learning Objectives

- Outline the planning and controlling processes.

Planning is a process. Ideally, it is future-oriented, comprehensive, systematic, integrated, and negotiated. 11 It involves an extensive search for alternatives and analyzes relevant information, is systematic in nature, and is commonly participative. 12 The planning model described in this section breaks the managerial function of planning into several steps, as shown in Figure 17.2.1. Following this step-by-step procedure helps ensure that organizational planning meets these requirements.

Figure \(\PageIndex{1}\): The Planning Process Source: Adapted from H. Koontz and C. O’Donnell, 1972. Principles of management: An analysis of managerial functions . New York: McGraw-Hill, 113.

Step 1: Developing an Awareness of the Present State

According to management scholars Harold Koontz and Cyril O’Donnell, the first step in the planning process is awareness. 13 It is at this step that managers build the foundation on which they will develop their plans. This foundation specifies an organization’s current status, pinpoints its commitments, recognizes its strengths and weaknesses, and sets forth a vision of the future. Because the past is instrumental in determining where an organization expects to go in the future, managers at this point must understand their organization and its history. It has been said—“The further you look back, the further you can see ahead.” 14

Step 2: Establishing Outcome Statements

The second step in the planning process consists of deciding “where the organization is headed or is going to end up.” Ideally, this involves establishing goals. Just as your goal in this course might be to get a certain grade, managers at various levels in an organization’s hierarchy set goals. For example, plans established by a university’s marketing department curriculum committee must fit with and support the plans of the department, which contribute to the goals of the business school, whose plans must, in turn, support the goals of the university. Managers, therefore, develop an elaborate network of organizational plans, such as that shown in Figure 17.2.2, to achieve the overall goals of their organization.

Figure \(\PageIndex{2}\): Network of Organization Plans (Attribution: Copyright Rice University, OpenStax, under CC-BY 4.0 license)

Goal vs. Domain Planning

Outcome statements can be constructed around specific goals or framed in terms of moving in a particular direction toward a viable set of outcomes. In goal planning , people set specific goals and then create action statements. 15 For example, freshman Kristin Rude decides that she wants a bachelor of science degree in biochemistry (the goal). She then constructs a four-year academic plan that will help her achieve this goal. Kristin is engaging in goal planning. She first identifies a goal and then develops a course of action to realize her goal.

Another approach to planning is domain/directional planning, in which managers develop a course of action that moves an organization toward one identified domain (and therefore away from other domains). 16 Within the chosen domain may lie a number of acceptable and specific goals. For example, high-school senior Neil Marquardt decides that he wants to major in a business-related discipline in college. During the next four years, he will select a variety of courses from the business school curriculum yet never select a major. After selecting courses based on availability and interest, he earns a sufficient number of credits within this chosen domain that enables him to graduate with a major in marketing. Neil never engaged in goal planning, but in the end, he will realize one of many acceptable goals within an accepted domain.

The development of the Post-it® product by the 3M Corporation demonstrates how domain planning works. In the research laboratories at 3M, efforts were being made to develop new forms and strengths of cohesive substances. One result was cohesive material with no known value because of its extremely low cohesive level. A 3M division specialist, Arthur L. Fry, frustrated by page markers falling from his hymn book in church, realized that this material, recently developed by Spencer F. Silver, would stick to paper for long periods and could be removed without destroying the paper. Fry experimented with the material as page markers and note pads—out of this came the highly popular and extremely profitable 3M product Scotch Post-it®. Geoff Nicholson, the driving force behind the Post-it® product, comments that rather than get bogged down in the planning process, innovations must be fast-tracked and decisions made whether to continue or move on early during the product development process. 17

Figure \(\PageIndex{3}\): Post-it® notes, a 3M product, are often used to create and edit shared documents, such as a company strategic plan. How might technology that allows multiple people to share and edit documents such as Word or PowerPoint files affect the sales of Post-it® products? (Credit: Kevin Wen/ flickr/ Attribution 2.0 Generic (CC BY 2.0))

Situations in which managers are likely to engage in domain planning include (1) when there is a recognized need for flexibility, (2) when people cannot agree on goals, (3) when an organization’s external environment is unstable and highly uncertain, and (4) when an organization is starting up or is in a transitional period. In addition, domain planning is likely to prevail at upper levels in an organization, where managers are responsible for dealing with the external environment and when task uncertainty is high. Goal planning (formulating goals compatible with the chosen domain) is likely to prevail in the technical core, where there is less uncertainty.

Hybrid Planning

Occasionally, the coupling of domain and goal planning occurs, creating a third approach, called hybrid planning. In this approach, managers begin with more general domain planning and commit to moving in a particular direction. As time passes, learning occurs, uncertainty is reduced, preferences sharpen, and managers are able to make the transition to goal planning as they identify increasingly specific targets in the selected domain. Movement from domain planning to goal planning occurs as knowledge accumulates, preferences for a particular goal emerge, and action statements are created.

Consequences of Goal, Domain, and Hybrid Planning

Setting goals not only affects performance directly, but also encourages managers to plan more extensively. That is, once goals are set, people are more likely to think systematically about how they should proceed to realize the goals. 18 When people have vague goals, as in domain planning, they find it difficult to draw up detailed action plans and are therefore less likely to perform effectively. When studying the topic of motivation, you will learn about goal theory. Research suggests that goal planning results in higher levels of performance than does domain planning alone. 19

Step 3: Premising

In this step of the planning process, managers establish the premises, or assumptions, on which they will build their action statements. The quality and success of any plan depend on the quality of its underlying assumptions. Throughout the planning process, assumptions about future events must be brought to the surface, monitored, and updated. 20

Managers collect information by scanning their organization’s internal and external environments. They use this information to make assumptions about the likelihood of future events. As Kristin considers her four-year pursuit of her biochemistry major, she anticipates that in addition to her savings and funds supplied by her parents, she will need a full-time summer job for two summers in order to cover the cost of her undergraduate education. Thus, she includes finding full-time summer employment between her senior year of high school and her freshman year and between her freshman and sophomore years of college as part of her plan. The other two summers she will devote to an internship and finding postgraduate employment—much to mom and dad’s delight! Effective planning skills can be used throughout your life. The plan you develop to pay for and complete your education is an especially important one.

Step 4: Determining a Course of Action (Action Statements)

In this stage of the planning process, managers decide how to move from their current position toward their goal (or toward their domain). They develop an action statement that details what needs to be done, when, how, and by whom. The course of action determines how an organization will get from its current position to its desired future position. Choosing a course of action involves determining alternatives by drawing on research, experimentation, and experience; evaluating alternatives in light of how well each would help the organization reach its goals or approach its desired domain; and selecting a course of action after identifying and carefully considering the merits of each alternative.

Step 5: Formulating Supportive Plans

The planning process seldom stops with the adoption of a general plan. Managers often need to develop one or more supportive or derivative plans to bolster and explain their basic plan. Suppose an organization decides to switch from a 5-day, 40-hour workweek (5/40) to a 4-day, 40-hour workweek (4/40) in an attempt to reduce employee turnover. This major plan requires the creation of a number of supportive plans. Managers might need to develop personnel policies dealing with payment of daily overtime. New administrative plans will be needed for scheduling meetings, handling phone calls, and dealing with customers and suppliers.

Planning, Implementation, and Controlling

After managers have moved through the five steps of the planning process and have drawn up and implemented specific plans, they must monitor and maintain their plans. Through the controlling function (to be discussed in greater detail later in this chapter), managers observe ongoing human behavior and organizational activity, compare it to the outcome and action statements formulated during the planning process, and take corrective action if they observe unexpected and unwanted deviations. Thus, planning and controlling activities are closely interrelated (planning ➨ controlling ➨ planning...). Planning feeds controlling by establishing the standards against which behavior will be evaluated during the controlling process. Monitoring organizational behavior (the control activity) provides managers with input that helps them prepare for the upcoming planning period—it adds meaning to the awareness step of the planning process.

Influenced by total quality management (TQM) and the importance of achieving continuous improvement in the processes used, as well as the goods and services produced, organizations such as IBM-Rochester have linked their planning and controlling activities by adopting the Deming cycle (also known as the Shewhart cycle).

It has been noted on numerous occasions that many organizations that do plan fail to recognize the importance of continuous learning. Their plans are either placed on the shelf and collect dust or are created, implemented, and adhered to without a systematic review and modification process. Frequently, plans are implemented without first measuring where the organization currently stands so that future comparisons and evaluations of the plan’s effectiveness cannot be determined. The Deming cycle, shown in Figure 17.2.4, helps managers assess the effects of planned action by integrating organizational learning into the planning process. The cycle consists of four key stages: (1) Plan—create the plan using the model discussed earlier. (2) Do—implement the plan. (3) Check—monitor the results of the planned course of action; organizational learning about the effectiveness of the plan occurs at this stage. (4) Act—act on what was learned, modify the plan, and return to the first stage in the cycle, and the cycle begins again as the organization strives for continuous learning and improvement.

Figure \(\PageIndex{4}\): The Deming (Shewhart) Cycle (Attribution: Copyright Rice University, OpenStax, under CC-BY 4.0 license)

concept check

- What are the five steps in the planning process?

- What is the difference between goal, domain, and hybrid planning?

- How are planning, implementation, and controlling related?

- Product overview

- All features

- App integrations

CAPABILITIES

- project icon Project management

- Project views

- Custom fields

- Status updates

- goal icon Goals and reporting

- Reporting dashboards

- workflow icon Workflows and automation

- portfolio icon Resource management

- Time tracking

- my-task icon Admin and security

- Admin console

- asana-intelligence icon Asana Intelligence

- list icon Personal

- premium icon Starter

- briefcase icon Advanced

- Goal management

- Organizational planning

- Campaign management

- Creative production

- Marketing strategic planning

- Request tracking

- Resource planning

- Project intake

- View all uses arrow-right icon

- Project plans

- Team goals & objectives

- Team continuity

- Meeting agenda

- View all templates arrow-right icon

- Work management resources Discover best practices, watch webinars, get insights

- What's new Learn about the latest and greatest from Asana

- Customer stories See how the world's best organizations drive work innovation with Asana

- Help Center Get lots of tips, tricks, and advice to get the most from Asana

- Asana Academy Sign up for interactive courses and webinars to learn Asana

- Developers Learn more about building apps on the Asana platform

- Community programs Connect with and learn from Asana customers around the world

- Events Find out about upcoming events near you

- Partners Learn more about our partner programs

- Support Need help? Contact the Asana support team

- Asana for nonprofits Get more information on our nonprofit discount program, and apply.

Featured Reads

- Business strategy |

- What is strategic planning? A 5-step gu ...

What is strategic planning? A 5-step guide

Strategic planning is a process through which business leaders map out their vision for their organization’s growth and how they’re going to get there. In this article, we'll guide you through the strategic planning process, including why it's important, the benefits and best practices, and five steps to get you from beginning to end.

Strategic planning is a process through which business leaders map out their vision for their organization’s growth and how they’re going to get there. The strategic planning process informs your organization’s decisions, growth, and goals.

Strategic planning helps you clearly define your company’s long-term objectives—and maps how your short-term goals and work will help you achieve them. This, in turn, gives you a clear sense of where your organization is going and allows you to ensure your teams are working on projects that make the most impact. Think of it this way—if your goals and objectives are your destination on a map, your strategic plan is your navigation system.

In this article, we walk you through the 5-step strategic planning process and show you how to get started developing your own strategic plan.

How to build an organizational strategy

Get our free ebook and learn how to bridge the gap between mission, strategic goals, and work at your organization.

What is strategic planning?

Strategic planning is a business process that helps you define and share the direction your company will take in the next three to five years. During the strategic planning process, stakeholders review and define the organization’s mission and goals, conduct competitive assessments, and identify company goals and objectives. The product of the planning cycle is a strategic plan, which is shared throughout the company.

What is a strategic plan?

![the planning process in business [inline illustration] Strategic plan elements (infographic)](https://assets.asana.biz/transform/7d1f14e4-b008-4ea6-9579-5af6236ce367/inline-business-strategy-strategic-planning-1-2x?io=transform:fill,width:2560&format=webp)

A strategic plan is the end result of the strategic planning process. At its most basic, it’s a tool used to define your organization’s goals and what actions you’ll take to achieve them.

Typically, your strategic plan should include:

Your company’s mission statement

Your organizational goals, including your long-term goals and short-term, yearly objectives

Any plan of action, tactics, or approaches you plan to take to meet those goals

What are the benefits of strategic planning?

Strategic planning can help with goal setting and decision-making by allowing you to map out how your company will move toward your organization’s vision and mission statements in the next three to five years. Let’s circle back to our map metaphor. If you think of your company trajectory as a line on a map, a strategic plan can help you better quantify how you’ll get from point A (where you are now) to point B (where you want to be in a few years).

When you create and share a clear strategic plan with your team, you can:

Build a strong organizational culture by clearly defining and aligning on your organization’s mission, vision, and goals.

Align everyone around a shared purpose and ensure all departments and teams are working toward a common objective.

Proactively set objectives to help you get where you want to go and achieve desired outcomes.

Promote a long-term vision for your company rather than focusing primarily on short-term gains.

Ensure resources are allocated around the most high-impact priorities.

Define long-term goals and set shorter-term goals to support them.

Assess your current situation and identify any opportunities—or threats—allowing your organization to mitigate potential risks.

Create a proactive business culture that enables your organization to respond more swiftly to emerging market changes and opportunities.

What are the 5 steps in strategic planning?

The strategic planning process involves a structured methodology that guides the organization from vision to implementation. The strategic planning process starts with assembling a small, dedicated team of key strategic planners—typically five to 10 members—who will form the strategic planning, or management, committee. This team is responsible for gathering crucial information, guiding the development of the plan, and overseeing strategy execution.

Once you’ve established your management committee, you can get to work on the planning process.

Step 1: Assess your current business strategy and business environment

Before you can define where you’re going, you first need to define where you are. Understanding the external environment, including market trends and competitive landscape, is crucial in the initial assessment phase of strategic planning.

To do this, your management committee should collect a variety of information from additional stakeholders, like employees and customers. In particular, plan to gather:

Relevant industry and market data to inform any market opportunities, as well as any potential upcoming threats in the near future.

Customer insights to understand what your customers want from your company—like product improvements or additional services.

Employee feedback that needs to be addressed—whether about the product, business practices, or the day-to-day company culture.

Consider different types of strategic planning tools and analytical techniques to gather this information, such as:

A balanced scorecard to help you evaluate four major elements of a business: learning and growth, business processes, customer satisfaction, and financial performance.

A SWOT analysis to help you assess both current and future potential for the business (you’ll return to this analysis periodically during the strategic planning process).

To fill out each letter in the SWOT acronym, your management committee will answer a series of questions:

What does your organization currently do well?

What separates you from your competitors?

What are your most valuable internal resources?

What tangible assets do you have?

What is your biggest strength?

Weaknesses:

What does your organization do poorly?

What do you currently lack (whether that’s a product, resource, or process)?

What do your competitors do better than you?

What, if any, limitations are holding your organization back?

What processes or products need improvement?

Opportunities:

What opportunities does your organization have?

How can you leverage your unique company strengths?

Are there any trends that you can take advantage of?

How can you capitalize on marketing or press opportunities?

Is there an emerging need for your product or service?

What emerging competitors should you keep an eye on?

Are there any weaknesses that expose your organization to risk?

Have you or could you experience negative press that could reduce market share?

Is there a chance of changing customer attitudes towards your company?

Step 2: Identify your company’s goals and objectives

To begin strategy development, take into account your current position, which is where you are now. Then, draw inspiration from your vision, mission, and current position to identify and define your goals—these are your final destination.

To develop your strategy, you’re essentially pulling out your compass and asking, “Where are we going next?” “What’s the ideal future state of this company?” This can help you figure out which path you need to take to get there.

During this phase of the planning process, take inspiration from important company documents, such as:

Your mission statement, to understand how you can continue moving towards your organization’s core purpose.

Your vision statement, to clarify how your strategic plan fits into your long-term vision.

Your company values, to guide you towards what matters most towards your company.

Your competitive advantages, to understand what unique benefit you offer to the market.

Your long-term goals, to track where you want to be in five or 10 years.

Your financial forecast and projection, to understand where you expect your financials to be in the next three years, what your expected cash flow is, and what new opportunities you will likely be able to invest in.

Step 3: Develop your strategic plan and determine performance metrics

Now that you understand where you are and where you want to go, it’s time to put pen to paper. Take your current business position and strategy into account, as well as your organization’s goals and objectives, and build out a strategic plan for the next three to five years. Keep in mind that even though you’re creating a long-term plan, parts of your plan should be created or revisited as the quarters and years go on.

As you build your strategic plan, you should define:

Company priorities for the next three to five years, based on your SWOT analysis and strategy.

Yearly objectives for the first year. You don’t need to define your objectives for every year of the strategic plan. As the years go on, create new yearly objectives that connect back to your overall strategic goals .

Related key results and KPIs. Some of these should be set by the management committee, and some should be set by specific teams that are closer to the work. Make sure your key results and KPIs are measurable and actionable. These KPIs will help you track progress and ensure you’re moving in the right direction.

Budget for the next year or few years. This should be based on your financial forecast as well as your direction. Do you need to spend aggressively to develop your product? Build your team? Make a dent with marketing? Clarify your most important initiatives and how you’ll budget for those.

A high-level project roadmap . A project roadmap is a tool in project management that helps you visualize the timeline of a complex initiative, but you can also create a very high-level project roadmap for your strategic plan. Outline what you expect to be working on in certain quarters or years to make the plan more actionable and understandable.

Step 4: Implement and share your plan

Now it’s time to put your plan into action. Strategy implementation involves clear communication across your entire organization to make sure everyone knows their responsibilities and how to measure the plan’s success.

Make sure your team (especially senior leadership) has access to the strategic plan, so they can understand how their work contributes to company priorities and the overall strategy map. We recommend sharing your plan in the same tool you use to manage and track work, so you can more easily connect high-level objectives to daily work. If you don’t already, consider using a work management platform .

A few tips to make sure your plan will be executed without a hitch:

Communicate clearly to your entire organization throughout the implementation process, to ensure all team members understand the strategic plan and how to implement it effectively.

Define what “success” looks like by mapping your strategic plan to key performance indicators.

Ensure that the actions outlined in the strategic plan are integrated into the daily operations of the organization, so that every team member's daily activities are aligned with the broader strategic objectives.

Utilize tools and software—like a work management platform—that can aid in implementing and tracking the progress of your plan.

Regularly monitor and share the progress of the strategic plan with the entire organization, to keep everyone informed and reinforce the importance of the plan.

Establish regular check-ins to monitor the progress of your strategic plan and make adjustments as needed.

Step 5: Revise and restructure as needed

Once you’ve created and implemented your new strategic framework, the final step of the planning process is to monitor and manage your plan.

Remember, your strategic plan isn’t set in stone. You’ll need to revisit and update the plan if your company changes directions or makes new investments. As new market opportunities and threats come up, you’ll likely want to tweak your strategic plan. Make sure to review your plan regularly—meaning quarterly and annually—to ensure it’s still aligned with your organization’s vision and goals.

Keep in mind that your plan won’t last forever, even if you do update it frequently. A successful strategic plan evolves with your company’s long-term goals. When you’ve achieved most of your strategic goals, or if your strategy has evolved significantly since you first made your plan, it might be time to create a new one.

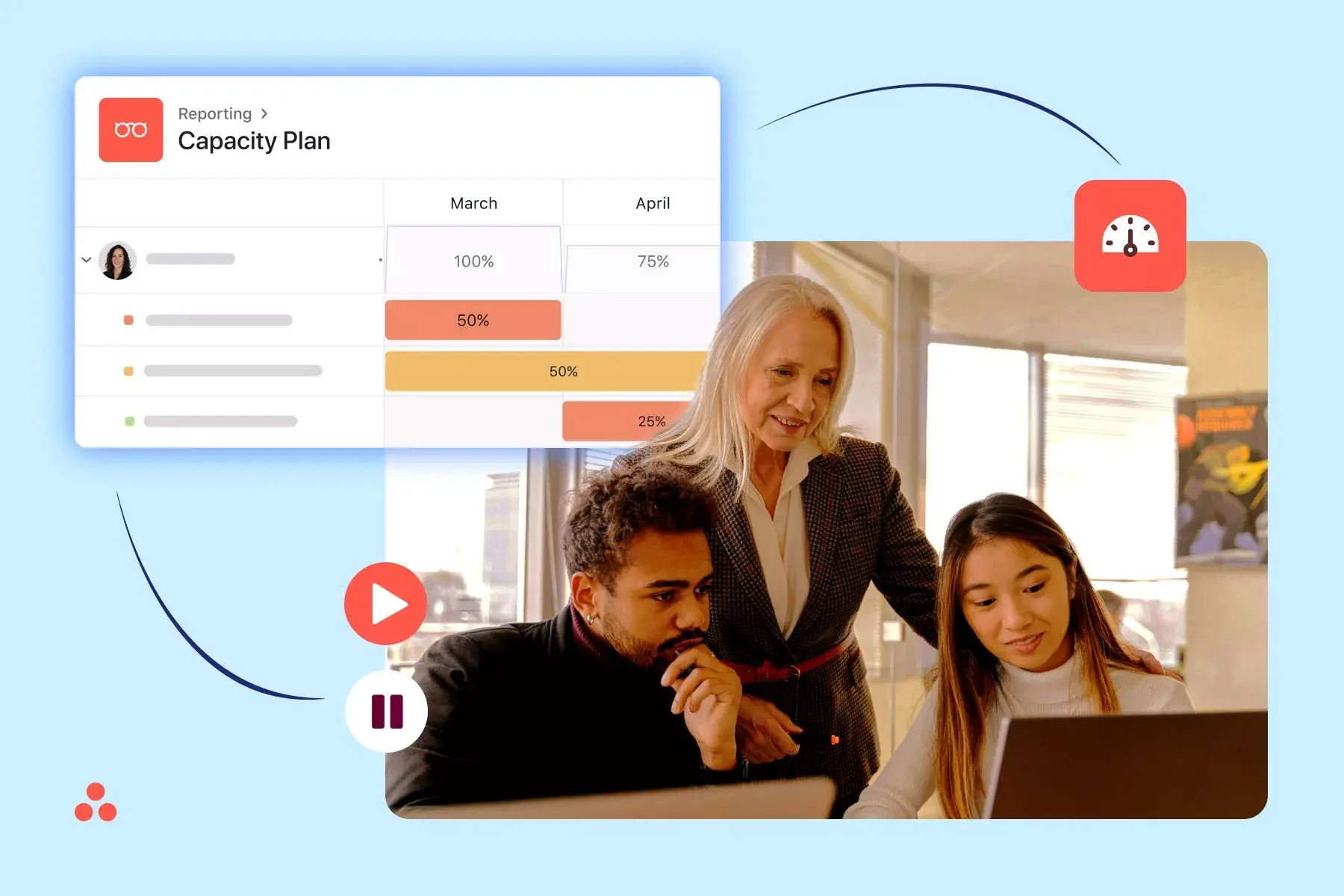

Build a smarter strategic plan with a work management platform

To turn your company strategy into a plan—and ultimately, impact—make sure you’re proactively connecting company objectives to daily work. When you can clarify this connection, you’re giving your team members the context they need to get their best work done.

A work management platform plays a pivotal role in this process. It acts as a central hub for your strategic plan, ensuring that every task and project is directly tied to your broader company goals. This alignment is crucial for visibility and coordination, allowing team members to see how their individual efforts contribute to the company’s success.

By leveraging such a platform, you not only streamline workflow and enhance team productivity but also align every action with your strategic objectives—allowing teams to drive greater impact and helping your company move toward goals more effectively.

Strategic planning FAQs

Still have questions about strategic planning? We have answers.

Why do I need a strategic plan?

A strategic plan is one of many tools you can use to plan and hit your goals. It helps map out strategic objectives and growth metrics that will help your company be successful.

When should I create a strategic plan?

You should aim to create a strategic plan every three to five years, depending on your organization’s growth speed.

Since the point of a strategic plan is to map out your long-term goals and how you’ll get there, you should create a strategic plan when you’ve met most or all of them. You should also create a strategic plan any time you’re going to make a large pivot in your organization’s mission or enter new markets.

What is a strategic planning template?

A strategic planning template is a tool organizations can use to map out their strategic plan and track progress. Typically, a strategic planning template houses all the components needed to build out a strategic plan, including your company’s vision and mission statements, information from any competitive analyses or SWOT assessments, and relevant KPIs.

What’s the difference between a strategic plan vs. business plan?

A business plan can help you document your strategy as you’re getting started so every team member is on the same page about your core business priorities and goals. This tool can help you document and share your strategy with key investors or stakeholders as you get your business up and running.

You should create a business plan when you’re:

Just starting your business

Significantly restructuring your business

If your business is already established, you should create a strategic plan instead of a business plan. Even if you’re working at a relatively young company, your strategic plan can build on your business plan to help you move in the right direction. During the strategic planning process, you’ll draw from a lot of the fundamental business elements you built early on to establish your strategy for the next three to five years.

What’s the difference between a strategic plan vs. mission and vision statements?

Your strategic plan, mission statement, and vision statements are all closely connected. In fact, during the strategic planning process, you will take inspiration from your mission and vision statements in order to build out your strategic plan.

Simply put:

A mission statement summarizes your company’s purpose.

A vision statement broadly explains how you’ll reach your company’s purpose.

A strategic plan pulls in inspiration from your mission and vision statements and outlines what actions you’re going to take to move in the right direction.

For example, if your company produces pet safety equipment, here’s how your mission statement, vision statement, and strategic plan might shake out:

Mission statement: “To ensure the safety of the world’s animals.”

Vision statement: “To create pet safety and tracking products that are effortless to use.”

Your strategic plan would outline the steps you’re going to take in the next few years to bring your company closer to your mission and vision. For example, you develop a new pet tracking smart collar or improve the microchipping experience for pet owners.

What’s the difference between a strategic plan vs. company objectives?

Company objectives are broad goals. You should set these on a yearly or quarterly basis (if your organization moves quickly). These objectives give your team a clear sense of what you intend to accomplish for a set period of time.

Your strategic plan is more forward-thinking than your company goals, and it should cover more than one year of work. Think of it this way: your company objectives will move the needle towards your overall strategy—but your strategic plan should be bigger than company objectives because it spans multiple years.

What’s the difference between a strategic plan vs. a business case?

A business case is a document to help you pitch a significant investment or initiative for your company. When you create a business case, you’re outlining why this investment is a good idea, and how this large-scale project will positively impact the business.

You might end up building business cases for things on your strategic plan’s roadmap—but your strategic plan should be bigger than that. This tool should encompass multiple years of your roadmap, across your entire company—not just one initiative.

What’s the difference between a strategic plan vs. a project plan?

A strategic plan is a company-wide, multi-year plan of what you want to accomplish in the next three to five years and how you plan to accomplish that. A project plan, on the other hand, outlines how you’re going to accomplish a specific project. This project could be one of many initiatives that contribute to a specific company objective which, in turn, is one of many objectives that contribute to your strategic plan.

What’s the difference between strategic management vs. strategic planning?

A strategic plan is a tool to define where your organization wants to go and what actions you need to take to achieve those goals. Strategic planning is the process of creating a plan in order to hit your strategic objectives.

Strategic management includes the strategic planning process, but also goes beyond it. In addition to planning how you will achieve your big-picture goals, strategic management also helps you organize your resources and figure out the best action plans for success.

Related resources

How to find alignment on AI

What is content marketing? A complete guide

Grant management: A nonprofit’s guide

How Asana uses work management to optimize resource planning

17.2 The Planning Process

- Outline the planning and controlling processes.

Planning is a process. Ideally it is future oriented, comprehensive, systematic, integrated, and negotiated. 11 It involves an extensive search for alternatives and analyzes relevant information, is systematic in nature, and is commonly participative. 12 The planning model described in this section breaks the managerial function of planning into several steps, as shown in Exhibit 17.3 . Following this step-by-step procedure helps ensure that organizational planning meets these requirements.

Step 1: Developing an Awareness of the Present State

According to management scholars Harold Koontz and Cyril O’Donnell, the first step in the planning process is awareness. 13 It is at this step that managers build the foundation on which they will develop their plans. This foundation specifies an organization’s current status, pinpoints its commitments, recognizes its strengths and weaknesses, and sets forth a vision of the future. Because the past is instrumental in determining where an organization expects to go in the future, managers at this point must understand their organization and its history. It has been said—“The further you look back, the further you can see ahead.” 14

Step 2: Establishing Outcome Statements

The second step in the planning process consists of deciding “where the organization is headed, or is going to end up.” Ideally, this involves establishing goals. Just as your goal in this course might be to get a certain grade, managers at various levels in an organization’s hierarchy set goals. For example, plans established by a university’s marketing department curriculum committee must fit with and support the plans of the department, which contribute to the goals of the business school, whose plans must, in turn, support the goals of the university. Managers therefore develop an elaborate network of organizational plans, such as that shown in Exhibit 17.4 , to achieve the overall goals of their organization.

Goal vs. Domain Planning

Outcome statements can be constructed around specific goals or framed in terms of moving in a particular direction toward a viable set of outcomes. In goal planning , people set specific goals and then create action statements. 15 For example, freshman Kristin Rude decides that she wants a bachelor of science degree in biochemistry (the goal). She then constructs a four-year academic plan that will help her achieve this goal. Kristin is engaging in goal planning. She first identifies a goal and then develops a course of action to realize her goal.

Another approach to planning is domain/directional planning , in which managers develop a course of action that moves an organization toward one identified domain (and therefore away from other domains). 16 Within the chosen domain may lie a number of acceptable and specific goals. For example, high-school senior Neil Marquardt decides that he wants to major in a business-related discipline in college. During the next four years, he will select a variety of courses from the business school curriculum yet never select a major. After selecting courses based on availability and interest, he earns a sufficient number of credits within this chosen domain that enables him to graduate with a major in marketing. Neil never engaged in goal planning, but in the end he will realize one of many acceptable goals within an accepted domain.

The development of the Post-it® product by the 3M Corporation demonstrates how domain planning works. In the research laboratories at 3M, efforts were being made to develop new forms and strengths of cohesive substances. One result was cohesive material with no known value because of its extremely low cohesive level. A 3M division specialist, Arthur L. Fry, frustrated by page markers falling from his hymn book in church, realized that this material, recently developed by Spencer F. Silver, would stick to paper for long periods and could be removed without destroying the paper. Fry experimented with the material as page markers and note pads—out of this came the highly popular and extremely profitable 3M product Scotch Post-it®. Geoff Nicholson, the driving force behind the Post-it® product, comments that rather than get bogged down in the planning process, innovations must be fast-tracked and decisions made whether to continue or move on early during the product development process. 17

Situations in which managers are likely to engage in domain planning include (1) when there is a recognized need for flexibility, (2) when people cannot agree on goals, (3) when an organization’s external environment is unstable and highly uncertain, and (4) when an organization is starting up or is in a transitional period. In addition, domain planning is likely to prevail at upper levels in an organization, where managers are responsible for dealing with the external environment and when task uncertainty is high. Goal planning (formulating goals compatible with the chosen domain) is likely to prevail in the technical core, where there is less uncertainty.

Hybrid Planning

Occasionally, coupling of domain and goal planning occurs, creating a third approach, called hybrid planning . In this approach, managers begin with the more general domain planning and commit to moving in a particular direction. As time passes, learning occurs, uncertainty is reduced, preferences sharpen, and managers are able to make the transition to goal planning as they identify increasingly specific targets in the selected domain. Movement from domain planning to goal planning occurs as knowledge accumulates, preferences for a particular goal emerge, and action statements are created.

Consequences of Goal, Domain, and Hybrid Planning

Setting goals not only affects performance directly, but also encourages managers to plan more extensively. That is, once goals are set, people are more likely to think systematically about how they should proceed to realize the goals. 18 When people have vague goals, as in domain planning, they find it difficult to draw up detailed action plans and are therefore less likely to perform effectively. When studying the topic of motivation, you will learn about goal theory. Research suggests that goal planning results in higher levels of performance than does domain planning alone. 19

Step 3: Premising

In this step of the planning process, managers establish the premises, or assumptions, on which they will build their action statements. The quality and success of any plan depends on the quality of its underlying assumptions. Throughout the planning process, assumptions about future events must be brought to the surface, monitored, and updated. 20

Managers collect information by scanning their organization’s internal and external environments. They use this information to make assumptions about the likelihood of future events. As Kristin considers her four-year pursuit of her biochemistry major, she anticipates that in addition to her savings and funds supplied by her parents, she will need a full-time summer job for two summers in order to cover the cost of her undergraduate education. Thus, she includes finding full-time summer employment between her senior year of high school and her freshman year and between her freshman and sophomore years of college as part of her plan. The other two summers she will devote to an internship and finding postgraduate employment—much to mom and dad’s delight! Effective planning skills can be used throughout your life. The plan you develop to pay for and complete your education is an especially important one.

Step 4: Determining a Course of Action (Action Statements)

In this stage of the planning process, managers decide how to move from their current position toward their goal (or toward their domain). They develop an action statement that details what needs to be done, when, how, and by whom. The course of action determines how an organization will get from its current position to its desired future position. Choosing a course of action involves determining alternatives by drawing on research, experimentation, and experience; evaluating alternatives in light of how well each would help the organization reach its goals or approach its desired domain; and selecting a course of action after identifying and carefully considering the merits of each alternative.

Step 5: Formulating Supportive Plans

The planning process seldom stops with the adoption of a general plan. Managers often need to develop one or more supportive or derivative plans to bolster and explain their basic plan. Suppose an organization decides to switch from a 5-day, 40-hour workweek (5/40) to a 4-day, 40-hour workweek (4/40) in an attempt to reduce employee turnover. This major plan requires the creation of a number of supportive plans. Managers might need to develop personnel policies dealing with payment of daily overtime. New administrative plans will be needed for scheduling meetings, handling phone calls, and dealing with customers and suppliers.

Planning, Implementation, and Controlling

After managers have moved through the five steps of the planning process and have drawn up and implemented specific plans, they must monitor and maintain their plans. Through the controlling function (to be discussed in greater detail later in this chapter), managers observe ongoing human behavior and organizational activity, compare it to the outcome and action statements formulated during the planning process, and take corrective action if they observe unexpected and unwanted deviations. Thus, planning and controlling activities are closely interrelated (planning ➨ controlling ➨ planning . . .). Planning feeds controlling by establishing the standards against which behavior will be evaluated during the controlling process. Monitoring organizational behavior (the control activity) provides managers with input that helps them prepare for the upcoming planning period—it adds meaning to the awareness step of the planning process.

Influenced by total quality management (TQM) and the importance of achieving continuous improvement in the processes used, as well as the goods and services produced, organizations such as IBM-Rochester have linked their planning and controlling activities by adopting the Deming cycle (also known as the Shewhart cycle).

It has been noted on numerous occasions that many organizations that do plan fail to recognize the importance of continuous learning. Their plans are either placed on the shelf and collect dust or are created, implemented, and adhered to without a systematic review and modification process. Frequently, plans are implemented without first measuring where the organization currently stands so that future comparisons and evaluations of the plan’s effectiveness cannot be determined. The Deming cycle , shown in Exhibit 17.6 , helps managers assess the effects of planned action by integrating organizational learning into the planning process. The cycle consists of four key stages: (1) Plan—create the plan using the model discussed earlier. (2) Do—implement the plan. (3) Check—monitor the results of the planned course of action; organizational learning about the effectiveness of the plan occurs at this stage. (4) Act—act on what was learned, modify the plan, and return to the first stage in the cycle, and the cycle begins again as the organization strives for continuous learning and improvement.

Concept Check

- What are the five steps in the planning process?

- What is the difference between goal, domain, and hybrid planning?

- How are planning, implementation, and controlling related?

As an Amazon Associate we earn from qualifying purchases.

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution License and you must attribute OpenStax.

Access for free at https://openstax.org/books/principles-management/pages/1-introduction

- Authors: David S. Bright, Anastasia H. Cortes

- Publisher/website: OpenStax

- Book title: Principles of Management

- Publication date: Mar 20, 2019

- Location: Houston, Texas

- Book URL: https://openstax.org/books/principles-management/pages/1-introduction

- Section URL: https://openstax.org/books/principles-management/pages/17-2-the-planning-process

© Jan 9, 2024 OpenStax. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution License . The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

Module 3: Planning and Mission

The planning cycle, learning outcomes.

- Explain the stages of the planning cycle.

- Explain why the planning cycle is an essential part of running a business.

Organizations have goals they want to achieve, so they must consider the best way of reaching their goals and must decide the specific steps to be taken. However, this is not a linear, step-by-step process. It is an iterative process with each step reconsidered as more information is gathered. As organizations go through the planning, they may realize that a different approach is better and go back to start again.

Remember that planning is only one of the management functions and that the functions themselves are part of a cycle. Planning, and in fact all of the management functions, is a cycle within a cycle. For most organizations, new goals are continually being made or existing goals get changed, so planning never ends. It is a continuing, iterative process.

In the following discussion, we will look at the steps in the planning cycle as a linear process. But keep in mind that at any point in the process, the planner may go back to an earlier step and start again.

Stages in the Planning Cycle

The stages in the planning cycle

Define objectives

The first, and most crucial, step in the planning process is to determine what is to be accomplished during the planning period. The vision and mission statements provide long-term, broad guidance on where the organization is going and how it will get there. The planning process should define specific goals and show how the goals support the vision and mission. Goals should be stated in measurable terms where possible. For example, a goal should be “to increase sales by 15 percent in the next quarter” not “increase sales as much as possible.”

Develop premises

Planning requires making some assumptions about the future. We know that conditions will change as plans are implemented and managers need to make forecasts about what the changes will be. These include changes in external conditions (laws and regulations, competitors’ actions, new technology being available) and internal conditions (what the budget will be, the outcome of employee training, a new building being completed). These assumptions are called the plan premises. It is important that these premises be clearly stated at the start of the planning process. Managers need to monitor conditions as the plan is implemented. If the premises are not proven accurate, the plan will likely have to be changed.

Evaluate alternatives

There may be more than one way to achieve a goal. For example, to increase sales by 12 percent, a company could hire more salespeople, lower prices, create a new marketing plan, expand into a new area, or take over a competitor. Managers need to identify possible alternatives and evaluate how difficult it would be to implement each one and how likely each one would lead to success. It is valuable for managers to seek input from different sources when identifying alternatives. Different perspectives can provide different solutions.

Identify resources

Next, managers must determine the resources needed to implement the plan. They must examine the resources the organization currently has, what new resources will be needed, when the resources will be needed, and where they will come from. The resources could include people with particular skills and experience, equipment and machinery, technology, or money. This step needs to be done in conjunction with the previous one, because each alternative requires different resources. Part of the evaluation process is determining the cost and availability of resources.

Plan and implement tasks

Management will next create a road map that takes the organization from where it is to its goal. It will define tasks at different levels in the organizations, the sequence for completing the tasks, and the interdependence of the tasks identified. Techniques such as Gantt charts and critical path planning are often used to help establish and track schedules and priorities.

Determine tracking and evaluation methods

It is very important that managers can track the progress of the plan. The plan should determine which tasks are most critical, which tasks are most likely to encounter problems, and which could cause bottlenecks that could delay the overall plan. Managers can then determine performance and schedule milestones to track progress. Regular monitoring and adjustment as the plan is implemented should be built into the process to assure things stay on track.

Practice Question

The planning cycle: essential part of running a business.

Following the planning cycle process assures the essential aspects of running a business are completed. In addition, the planning process itself can have benefits for the organization. The essential activities include the following:

- Maintaining organizational focus: Defining specific goals requires managers to consider the vision, mission, and values of the organization and how these will be operationalized. The methods and selected goals can demonstrate that the vision, mission, and values statements are working documents that are not just for show but prescribe activities.

- Encouraging diverse participation: Planning activities provide an opportunity for input from different functions, departments, and people. Some organizations establish planning committees that intentionally include people from diverse backgrounds to bring new perspectives into the planning process.

- Empowering and motivating employees: When people are involved in developing plans they will be more committed to the plans. Allowing diverse input into the planning cycle empowers people to contribute and motivates them to support the outcomes.

PRactice Question

There are several stages, or steps, in the planning process. It is not unusual to have to repeat steps as conditions change. This process is essential to a business to maintain focus, gather diverse opinions, and empower and motivate employees.

- The Planning Cycle. Authored by : John/Lynn Bruton and Lumen Learning. License : CC BY: Attribution

- Image: Stages in the Planning Cycle. Authored by : Lumen Learning. License : CC BY: Attribution

The 7 Steps of the Business Planning Process: A Complete Guide

In this article, we'll provide a comprehensive guide to the seven steps of the business planning process, and discuss the role of Strikingly website builder in creating a professional business plan.

Step 1: Conducting a SWOT Analysis

The first step in the business planning process is to conduct a SWOT analysis. SWOT stands for Strengths, Weaknesses, Opportunities, and Threats. This analysis will help you understand your business's internal and external environment, and it can help you identify areas of improvement and growth.

Strengths and weaknesses refer to internal factors such as the company's resources, capabilities, and culture. Opportunities and threats are external factors such as market trends, competition, and regulations.

You can conduct a SWOT analysis by gathering information from various sources such as market research, financial statements, and feedback from customers and employees. You can also use tools such as a SWOT matrix to visualize your analysis.

What is a SWOT Analysis?

A SWOT analysis is a framework for analyzing a business's internal and external environment. The acronym SWOT stands for Strengths, Weaknesses, Opportunities, and Threats.

Strengths and weaknesses include internal factors such as the company's resources, capabilities, and culture. Opportunities and threats are external factors such as market trends, competition, and regulations.

A SWOT analysis can help businesses identify areas of improvement and growth, assess their competitive position, and make informed decisions. It can be used for various purposes, such as business planning, product development, marketing strategy, and risk management.

Importance of Conducting a SWOT Analysis

Conducting a SWOT analysis is crucial for businesses to develop a clear understanding of their internal and external environment. It can help businesses identify their strengths and weaknesses and uncover new opportunities and potential threats. By doing so, businesses can make informed decisions about their strategies, resource allocation, and risk management.

A SWOT analysis can also help businesses identify their competitive position in the market and compare themselves to their competitors. This can help businesses differentiate themselves from their competitors and develop a unique value proposition.

Example of a SWOT Analysis

Here is an example of a SWOT analysis for a fictional business that sells handmade jewelry:

- Unique and high-quality products

- Skilled and experienced craftsmen

- Strong brand reputation and customer loyalty

- Strategic partnerships with local boutiques

- Limited production capacity

- High production costs

- Limited online presence

- Limited product variety

Opportunities

- Growing demand for handmade products

- Growing interest in sustainable and eco-friendly products

- Opportunities to expand online presence and reach new customers

- Opportunities to expand product lines

- Increasing competition from online and brick-and-mortar retailers

- Fluctuating consumer trends and preferences

- Economic downturns and uncertainty

- Increased regulations and compliance requirements

This SWOT analysis can help the business identify areas for improvement and growth. For example, the business can invest in expanding its online presence, improving its production efficiency, and diversifying its product lines. The business can also leverage its strengths, such as its skilled craftsmen and strategic partnerships, to differentiate itself from its competitors and attract more customers.

Step 2: Defining Your Business Objectives

Once you have conducted a SWOT analysis, the next step is to define your business objectives. Business objectives are specific, measurable, achievable, relevant, and time-bound (SMART) goals that align with your business's mission and vision.

Your business objectives can vary depending on your industry, target audience, and resources. Examples of business objectives include increasing sales revenue, expanding into new markets, improving customer satisfaction, and reducing costs.

You can use tools such as a goal-setting worksheet or a strategic planning framework to define your business objectives. You can also seek input from your employees and stakeholders to ensure your objectives are realistic and achievable.

What is Market Research?

Market research is an integral part of the business planning process. It gathers information about a target market or industry to make informed decisions. It involves collecting and analyzing data on consumer behavior, preferences, and buying habits, as well as competitors, industry trends, and market conditions.

Market research can help businesses identify potential customers, understand their needs and preferences, and develop effective marketing strategies. It can also help businesses identify market opportunities, assess their competitive position, and make informed product development, pricing, and distribution decisions.

Importance of Market Research in Business Planning

Market research is a crucial component of the business planning process. It can help businesses identify market trends and opportunities, assess their competitive position, and make informed decisions about their marketing strategies, product development, and business operations.

By conducting market research, businesses can gain insights into their target audience's behavior and preferences, such as their purchasing habits, brand loyalty, and decision-making process. This can help businesses develop targeted marketing campaigns and create products that meet their customers' needs.

Market research can also help businesses assess their competitive position and identify gaps in the market. Businesses can differentiate themselves by analyzing their competitors' strengths and weaknesses and developing a unique value proposition.

Different Types of Market Research Methods

Businesses can use various types of market research methods, depending on their research objectives, budget, and time frame. Here are some of the most common market research methods:

Surveys are a common market research method that involves asking questions to a sample of people about their preferences, opinions, and behaviors. Surveys can be conducted through various channels like online, phone, or in-person surveys.

- Focus Groups

Focus groups are a qualitative market research method involving a small group to discuss a specific topic or product. Focus groups can provide in-depth insights into customers' attitudes and perceptions and can help businesses understand the reasoning behind their preferences and behaviors.

Interviews are a qualitative market research method that involves one-on-one conversations between a researcher and a participant. Interviews can be conducted in person, over the phone, or through video conferencing and can provide detailed insights into a participant's experiences, perceptions, and preferences.

- Observation

Observation is a market research method that involves observing customers' behavior and interactions in a natural setting such as a store or a website. Observation can provide insights into customers' decision-making processes and behavior that may not be captured through surveys or interviews.

- Secondary Research

Secondary research involves collecting data from existing sources, like industry reports, government publications, or academic journals. Secondary research can provide a broad overview of the market and industry trends and help businesses identify potential opportunities and threats.

By combining these market research methods, businesses can comprehensively understand their target market and industry and make informed decisions about their business strategy.

Step 3: Conducting Market Research

Market research should always be a part of your strategic business planning. This step gathers information about your target audience, competitors, and industry trends. This information can help you make informed decisions about your product or service offerings, pricing strategy, and marketing campaigns.

There are various market research methods, such as surveys, focus groups, and online analytics. You can also use tools like Google Trends and social media analytics to gather data about your audience's behavior and preferences.

Market research can be time-consuming and costly, but it's crucial for making informed decisions that can impact your business's success. Strikingly website builder offers built-in analytics and SEO optimization features that can help you track your website traffic and audience engagement.

Step 4: Identifying Your Target Audience

Identifying your target audience is essential in the business planning process. Your target audience is the group of people who are most likely to buy your product or service. Understanding their needs, preferences, and behaviors can help you create effective marketing campaigns and improve customer satisfaction.

You can identify your target audience by analyzing demographic, psychographic, and behavioral data. Demographic data include age, gender, income, and education level. Psychographic data includes personality traits, values, and lifestyle. Behavioral data includes buying patterns, brand loyalty, and online engagement.

Once you have identified your target audience, you can use tools such as buyer personas and customer journey maps to create a personalized and engaging customer experience. Strikingly website builder offers customizable templates and designs to help you create a visually appealing and user-friendly website for your target audience.

What is a Target Audience?

A target audience is a group most likely to be interested in and purchase a company's products or services. A target audience can be defined based on various factors such as age, gender, location, income, education, interests, and behavior.

Identifying and understanding your target audience is crucial for developing effective marketing strategies and improving customer engagement and satisfaction. By understanding your target audience's needs, preferences, and behavior, you can create products and services that meet their needs and develop targeted marketing campaigns that resonate with them.

Importance of Identifying Your Target Audience

Identifying your target audience is essential for the success of your business. By understanding your target audience's needs and preferences, you can create products and services that meet their needs and develop targeted marketing campaigns that resonate with them.

Here are reasons why identifying your target audience is important:

- Improve customer engagement. When you understand your target audience's behavior and preferences, you can create a more personalized and engaging customer experience to improve customer loyalty and satisfaction.

- Develop effective marketing strategies. Targeting your marketing efforts to your target audience creates more effective and efficient marketing campaigns that can increase brand awareness, generate leads, and drive sales.

- Improve product development. By understanding your target audience's needs and preferences, you can develop products and services that meet their specific needs and preferences, improving customer satisfaction and retention.

- Identify market opportunities. If you identify gaps in the market or untapped market segments, you can develop products and services to meet unmet needs and gain a competitive advantage.

Examples of Target Audience Segmentation

Here are some examples of target audience segmentation based on different demographic, geographic, and psychographic factors:

- Demographic segmentation. Age, gender, income, education, occupation, and marital status.

- Geographic segmentation. Location, region, climate, and population density.

- Psychographic segmentation. Personality traits, values, interests, and lifestyle.

Step 5: Developing a Marketing Plan

A marketing plan is a strategic roadmap that outlines your marketing objectives, strategies, tactics, and budget. Your marketing plan should align with your business objectives and target audience and include a mix of online and offline marketing channels.

Marketing strategies include content marketing, social media marketing, email marketing, search engine optimization (SEO), and paid advertising. Your marketing tactics can include creating blog posts, sharing social media posts, sending newsletters, optimizing your website for search engines, and running Google Ads or Facebook Ads.

To create an effective marketing plan , research your competitors, understand your target audience's behavior, and set clear objectives and metrics. You can also seek customer and employee feedback to refine your marketing strategy.

Strikingly website builder offers a variety of marketing features such as email marketing, social media integration, and SEO optimization tools. You can also use the built-in analytics dashboard to track your website's performance and monitor your marketing campaign's effectiveness.

What is a Marketing Plan?

A marketing plan is a comprehensive document that outlines a company's marketing strategy and tactics. It typically includes an analysis of the target market, a description of the product or service, an assessment of the competition, and a detailed plan for achieving marketing objectives.

A marketing plan can help businesses identify and prioritize marketing opportunities, allocate resources effectively, and measure the success of their marketing efforts. It can also provide the marketing team with a roadmap and ensure everyone is aligned with the company's marketing goals and objectives.

Importance of a Marketing Plan in Business Planning

A marketing plan is critical to business planning. It can help businesses identify their target audience, assess their competitive position, and develop effective marketing strategies and tactics.

Here are a few reasons why a marketing plan is important in business planning:

- Provides a clear direction. A marketing plan can provide a clear direction for the marketing team and ensure everyone is aligned with the company's marketing goals and objectives.

- Helps prioritize marketing opportunities. By analyzing the target market and competition, a marketing plan can help businesses identify and prioritize marketing opportunities with the highest potential for success.

- Ensures effective resource allocation. A marketing plan can help businesses allocate resources effectively and ensure that marketing efforts are focused on the most critical and impactful activities.

- Measures success. A marketing plan can provide a framework for measuring the success of marketing efforts and making adjustments as needed.

Examples of Marketing Strategies and Tactics

Here are some examples of marketing strategies and tactics that businesses can use to achieve their marketing objectives:

- Content marketing. Creating and sharing valuable and relevant content that educates and informs the target audience about the company's products or services.