What is a Business Plan? Definition, Tips, and Templates

Published: June 07, 2023

In an era where more than 20% of small enterprises fail in their first year, having a clear, defined, and well-thought-out business plan is a crucial first step for setting up a business for long-term success.

Business plans are a required tool for all entrepreneurs, business owners, business acquirers, and even business school students. But … what exactly is a business plan?

In this post, we'll explain what a business plan is, the reasons why you'd need one, identify different types of business plans, and what you should include in yours.

What is a business plan?

A business plan is a documented strategy for a business that highlights its goals and its plans for achieving them. It outlines a company's go-to-market plan, financial projections, market research, business purpose, and mission statement. Key staff who are responsible for achieving the goals may also be included in the business plan along with a timeline.

The business plan is an undeniably critical component to getting any company off the ground. It's key to securing financing, documenting your business model, outlining your financial projections, and turning that nugget of a business idea into a reality.

What is a business plan used for?

The purpose of a business plan is three-fold: It summarizes the organization’s strategy in order to execute it long term, secures financing from investors, and helps forecast future business demands.

Business Plan Template [ Download Now ]

Working on your business plan? Try using our Business Plan Template . Pre-filled with the sections a great business plan needs, the template will give aspiring entrepreneurs a feel for what a business plan is, what should be in it, and how it can be used to establish and grow a business from the ground up.

Purposes of a Business Plan

Chances are, someone drafting a business plan will be doing so for one or more of the following reasons:

1. Securing financing from investors.

Since its contents revolve around how businesses succeed, break even, and turn a profit, a business plan is used as a tool for sourcing capital. This document is an entrepreneur's way of showing potential investors or lenders how their capital will be put to work and how it will help the business thrive.

All banks, investors, and venture capital firms will want to see a business plan before handing over their money, and investors typically expect a 10% ROI or more from the capital they invest in a business.

Therefore, these investors need to know if — and when — they'll be making their money back (and then some). Additionally, they'll want to read about the process and strategy for how the business will reach those financial goals, which is where the context provided by sales, marketing, and operations plans come into play.

2. Documenting a company's strategy and goals.

A business plan should leave no stone unturned.

Business plans can span dozens or even hundreds of pages, affording their drafters the opportunity to explain what a business' goals are and how the business will achieve them.

To show potential investors that they've addressed every question and thought through every possible scenario, entrepreneurs should thoroughly explain their marketing, sales, and operations strategies — from acquiring a physical location for the business to explaining a tactical approach for marketing penetration.

These explanations should ultimately lead to a business' break-even point supported by a sales forecast and financial projections, with the business plan writer being able to speak to the why behind anything outlined in the plan.

.webp)

Free Business Plan Template

The essential document for starting a business -- custom built for your needs.

- Outline your idea.

- Pitch to investors.

- Secure funding.

- Get to work!

You're all set!

Click this link to access this resource at any time.

Free Business Plan [Template]

Fill out the form to access your free business plan., 3. legitimizing a business idea..

Everyone's got a great idea for a company — until they put pen to paper and realize that it's not exactly feasible.

A business plan is an aspiring entrepreneur's way to prove that a business idea is actually worth pursuing.

As entrepreneurs document their go-to-market process, capital needs, and expected return on investment, entrepreneurs likely come across a few hiccups that will make them second guess their strategies and metrics — and that's exactly what the business plan is for.

It ensures an entrepreneur's ducks are in a row before bringing their business idea to the world and reassures the readers that whoever wrote the plan is serious about the idea, having put hours into thinking of the business idea, fleshing out growth tactics, and calculating financial projections.

4. Getting an A in your business class.

Speaking from personal experience, there's a chance you're here to get business plan ideas for your Business 101 class project.

If that's the case, might we suggest checking out this post on How to Write a Business Plan — providing a section-by-section guide on creating your plan?

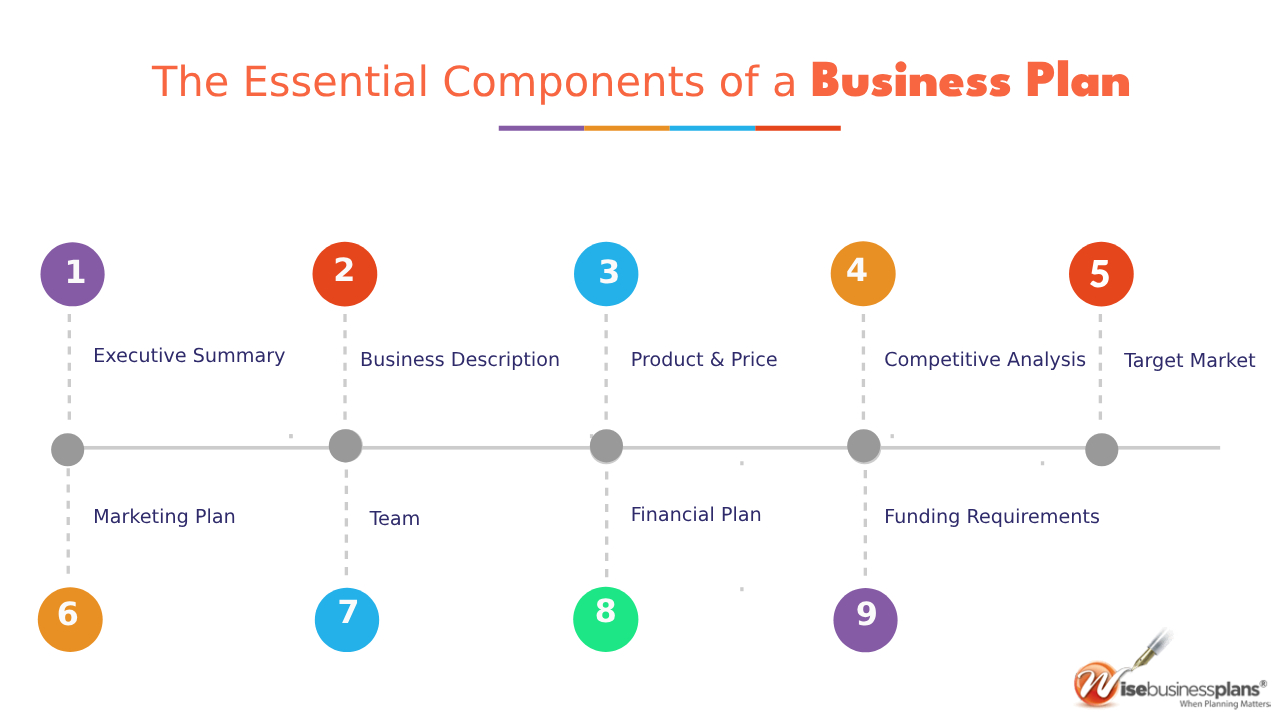

What does a business plan need to include?

- Business Plan Subtitle

- Executive Summary

- Company Description

- The Business Opportunity

- Competitive Analysis

- Target Market

- Marketing Plan

- Financial Summary

- Funding Requirements

1. Business Plan Subtitle

Every great business plan starts with a captivating title and subtitle. You’ll want to make it clear that the document is, in fact, a business plan, but the subtitle can help tell the story of your business in just a short sentence.

2. Executive Summary

Although this is the last part of the business plan that you’ll write, it’s the first section (and maybe the only section) that stakeholders will read. The executive summary of a business plan sets the stage for the rest of the document. It includes your company’s mission or vision statement, value proposition, and long-term goals.

3. Company Description

This brief part of your business plan will detail your business name, years in operation, key offerings, and positioning statement. You might even add core values or a short history of the company. The company description’s role in a business plan is to introduce your business to the reader in a compelling and concise way.

4. The Business Opportunity

The business opportunity should convince investors that your organization meets the needs of the market in a way that no other company can. This section explains the specific problem your business solves within the marketplace and how it solves them. It will include your value proposition as well as some high-level information about your target market.

5. Competitive Analysis

Just about every industry has more than one player in the market. Even if your business owns the majority of the market share in your industry or your business concept is the first of its kind, you still have competition. In the competitive analysis section, you’ll take an objective look at the industry landscape to determine where your business fits. A SWOT analysis is an organized way to format this section.

6. Target Market

Who are the core customers of your business and why? The target market portion of your business plan outlines this in detail. The target market should explain the demographics, psychographics, behavioristics, and geographics of the ideal customer.

7. Marketing Plan

Marketing is expansive, and it’ll be tempting to cover every type of marketing possible, but a brief overview of how you’ll market your unique value proposition to your target audience, followed by a tactical plan will suffice.

Think broadly and narrow down from there: Will you focus on a slow-and-steady play where you make an upfront investment in organic customer acquisition? Or will you generate lots of quick customers using a pay-to-play advertising strategy? This kind of information should guide the marketing plan section of your business plan.

8. Financial Summary

Money doesn’t grow on trees and even the most digital, sustainable businesses have expenses. Outlining a financial summary of where your business is currently and where you’d like it to be in the future will substantiate this section. Consider including any monetary information that will give potential investors a glimpse into the financial health of your business. Assets, liabilities, expenses, debt, investments, revenue, and more are all useful adds here.

So, you’ve outlined some great goals, the business opportunity is valid, and the industry is ready for what you have to offer. Who’s responsible for turning all this high-level talk into results? The "team" section of your business plan answers that question by providing an overview of the roles responsible for each goal. Don’t worry if you don’t have every team member on board yet, knowing what roles to hire for is helpful as you seek funding from investors.

10. Funding Requirements

Remember that one of the goals of a business plan is to secure funding from investors, so you’ll need to include funding requirements you’d like them to fulfill. The amount your business needs, for what reasons, and for how long will meet the requirement for this section.

Types of Business Plans

- Startup Business Plan

- Feasibility Business Plan

- Internal Business Plan

- Strategic Business Plan

- Business Acquisition Plan

- Business Repositioning Plan

- Expansion or Growth Business Plan

There’s no one size fits all business plan as there are several types of businesses in the market today. From startups with just one founder to historic household names that need to stay competitive, every type of business needs a business plan that’s tailored to its needs. Below are a few of the most common types of business plans.

For even more examples, check out these sample business plans to help you write your own .

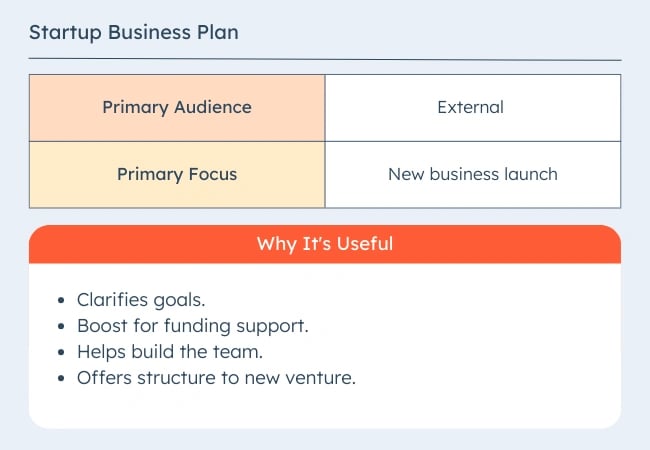

1. Startup Business Plan

As one of the most common types of business plans, a startup business plan is for new business ideas. This plan lays the foundation for the eventual success of a business.

The biggest challenge with the startup business plan is that it’s written completely from scratch. Startup business plans often reference existing industry data. They also explain unique business strategies and go-to-market plans.

Because startup business plans expand on an original idea, the contents will vary by the top priority goals.

For example, say a startup is looking for funding. If capital is a priority, this business plan might focus more on financial projections than marketing or company culture.

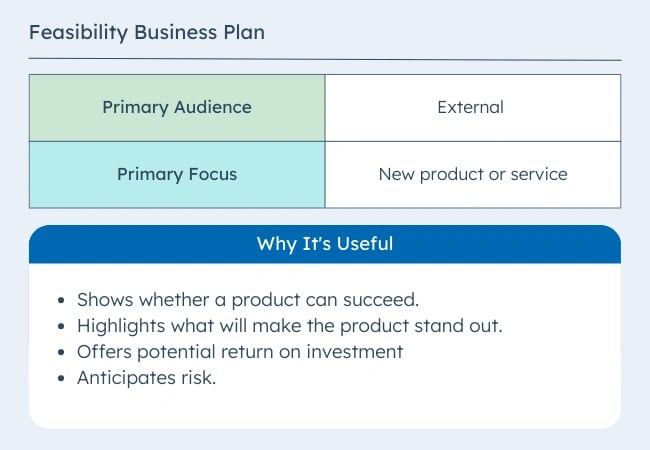

2. Feasibility Business Plan

This type of business plan focuses on a single essential aspect of the business — the product or service. It may be part of a startup business plan or a standalone plan for an existing organization. This comprehensive plan may include:

- A detailed product description

- Market analysis

- Technology needs

- Production needs

- Financial sources

- Production operations

According to CBInsights research, 35% of startups fail because of a lack of market need. Another 10% fail because of mistimed products.

Some businesses will complete a feasibility study to explore ideas and narrow product plans to the best choice. They conduct these studies before completing the feasibility business plan. Then the feasibility plan centers on that one product or service.

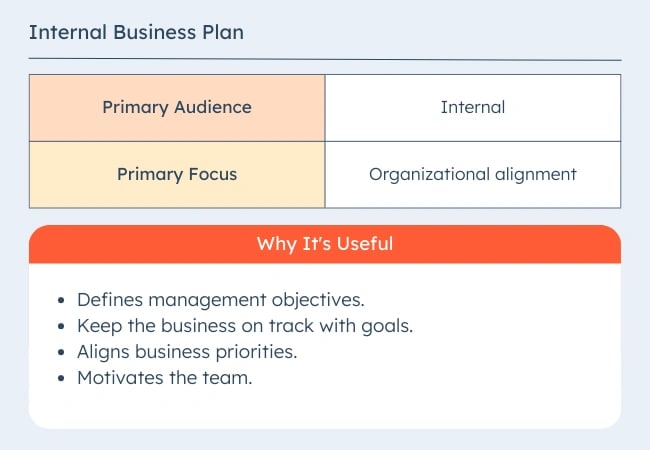

3. Internal Business Plan

Internal business plans help leaders communicate company goals, strategy, and performance. This helps the business align and work toward objectives more effectively.

Besides the typical elements in a startup business plan, an internal business plan may also include:

- Department-specific budgets

- Target demographic analysis

- Market size and share of voice analysis

- Action plans

- Sustainability plans

Most external-facing business plans focus on raising capital and support for a business. But an internal business plan helps keep the business mission consistent in the face of change.

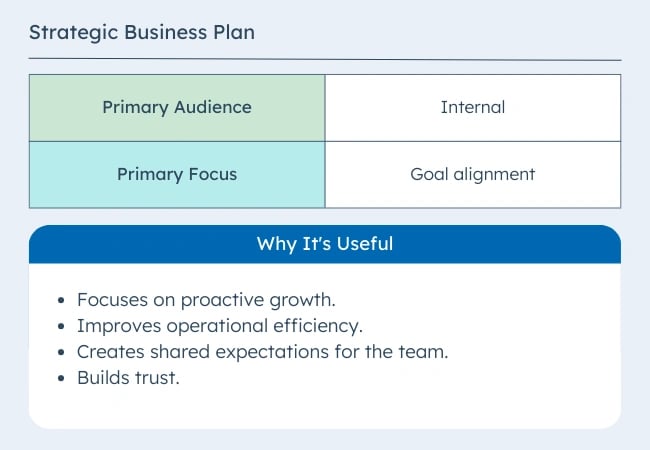

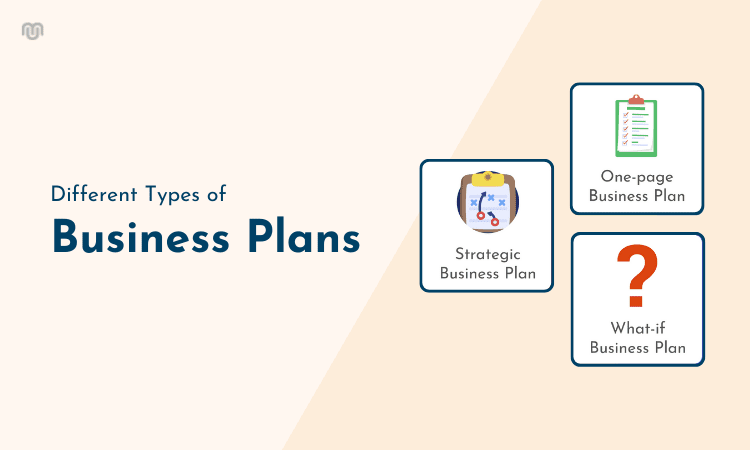

4. Strategic Business Plan

Strategic business plans focus on long-term objectives for your business. They usually cover the first three to five years of operations. This is different from the typical startup business plan which focuses on the first one to three years. The audience for this plan is also primarily internal stakeholders.

These types of business plans may include:

- Relevant data and analysis

- Assessments of company resources

- Vision and mission statements

It's important to remember that, while many businesses create a strategic plan before launching, some business owners just jump in. So, this business plan can add value by outlining how your business plans to reach specific goals. This type of planning can also help a business anticipate future challenges.

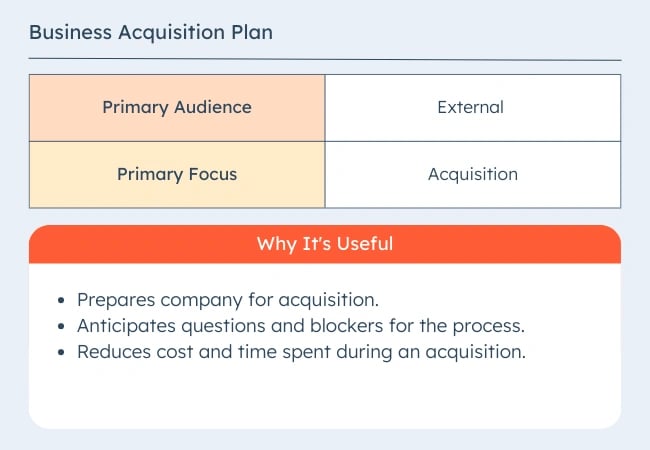

5. Business Acquisition Plan

Investors use business plans to acquire existing businesses, too — not just new businesses.

A business acquisition plan may include costs, schedules, or management requirements. This data will come from an acquisition strategy.

A business plan for an existing company will explain:

- How an acquisition will change its operating model

- What will stay the same under new ownership

- Why things will change or stay the same

- Acquisition planning documentation

- Timelines for acquisition

Additionally, the business plan should speak to the current state of the business and why it's up for sale.

For example, if someone is purchasing a failing business, the business plan should explain why the business is being purchased. It should also include:

- What the new owner will do to turn the business around

- Historic business metrics

- Sales projections after the acquisition

- Justification for those projections

6. Business Repositioning Plan

.webp?width=650&height=450&name=businessplan_6%20(1).webp)

When a business wants to avoid acquisition, reposition its brand, or try something new, CEOs or owners will develop a business repositioning plan.

This plan will:

- Acknowledge the current state of the company.

- State a vision for the future of the company.

- Explain why the business needs to reposition itself.

- Outline a process for how the company will adjust.

Companies planning for a business reposition often do so — proactively or retroactively — due to a shift in market trends and customer needs.

For example, shoe brand AllBirds plans to refocus its brand on core customers and shift its go-to-market strategy. These decisions are a reaction to lackluster sales following product changes and other missteps.

7. Expansion or Growth Business Plan

When your business is ready to expand, a growth business plan creates a useful structure for reaching specific targets.

For example, a successful business expanding into another location can use a growth business plan. This is because it may also mean the business needs to focus on a new target market or generate more capital.

This type of plan usually covers the next year or two of growth. It often references current sales, revenue, and successes. It may also include:

- SWOT analysis

- Growth opportunity studies

- Financial goals and plans

- Marketing plans

- Capability planning

These types of business plans will vary by business, but they can help businesses quickly rally around new priorities to drive growth.

Getting Started With Your Business Plan

At the end of the day, a business plan is simply an explanation of a business idea and why it will be successful. The more detail and thought you put into it, the more successful your plan — and the business it outlines — will be.

When writing your business plan, you’ll benefit from extensive research, feedback from your team or board of directors, and a solid template to organize your thoughts. If you need one of these, download HubSpot's Free Business Plan Template below to get started.

Editor's note: This post was originally published in August 2020 and has been updated for comprehensiveness.

Don't forget to share this post!

Related articles.

24 of My Favorite Sample Business Plans & Examples For Your Inspiration

![what are 3 types of business plans How to Write a Powerful Executive Summary [+4 Top Examples]](https://blog.hubspot.com/hubfs/executive-summary-example_5.webp)

How to Write a Powerful Executive Summary [+4 Top Examples]

Maximizing Your Social Media Strategy: The Top Aggregator Tools to Use

The Content Aggregator Guide for 2023

![what are 3 types of business plans 7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]](https://blog.hubspot.com/hubfs/gantt-chart-example.jpg)

7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]

![what are 3 types of business plans The 8 Best Free Flowchart Templates [+ Examples]](https://blog.hubspot.com/hubfs/flowchart%20templates.jpg)

The 8 Best Free Flowchart Templates [+ Examples]

16 Best Screen Recorders to Use for Collaboration

The 25 Best Google Chrome Extensions for SEO

Professional Invoice Design: 28 Samples & Templates to Inspire You

Customers’ Top HubSpot Integrations to Streamline Your Business in 2022

2 Essential Templates For Starting Your Business

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

BUSINESS STRATEGIES

7 types of business plans every entrepreneur should know

- Amanda Bellucco Chatham

- Aug 3, 2023

What’s the difference between a small business that achieves breakthrough growth and one that fizzles quickly after launch? Oftentimes, it’s having a solid business plan.

Business plans provide you with a roadmap that will take you from wantrepreneur to entrepreneur. It will guide nearly every decision you make, from the people you hire and the products or services you offer, to the look and feel of the business website you create.

But did you know that there are many different types of business plans? Some types are best for new businesses looking to attract funding. Others help to define the way your company will operate day-to-day. You can even create a plan that prepares your business for the unexpected.

Read on to learn the seven most common types of business plans and determine which one fits your immediate needs.

What is a business plan?

A business plan is a written document that defines your company’s goals and explains how you will achieve them. Putting this information down on paper brings valuable benefits. It gives you insight into your competitors, helps you develop a unique value proposition and lets you set metrics that will guide you to profitability. It’s also a necessity to obtain funding through banks or investors.

Keep in mind that a business plan isn’t a one-and-done exercise. It’s a living document that you should update regularly as your company evolves. But which type of plan is right for your business?

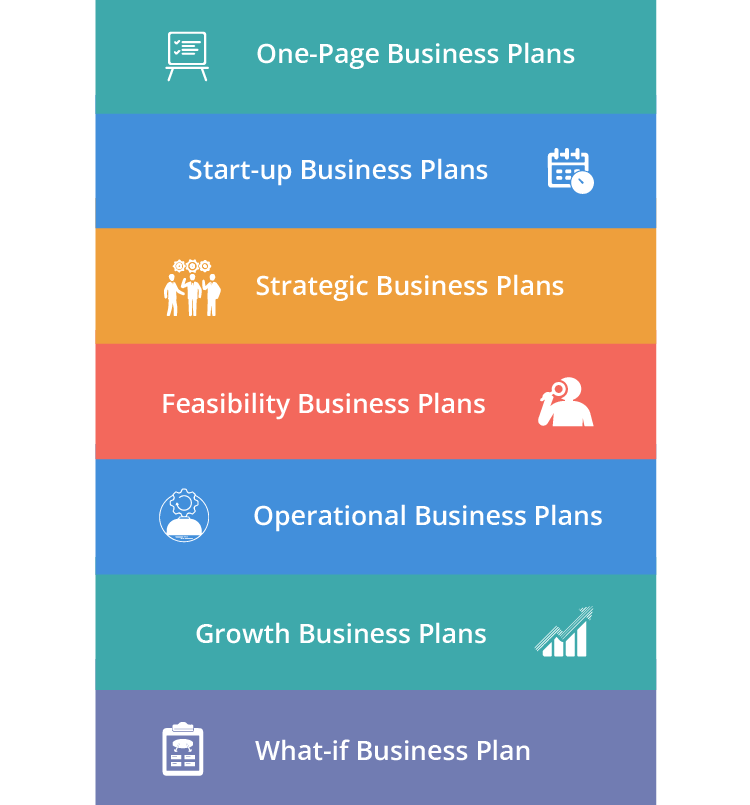

7 common types of business plans

Startup business plan

Feasibility business plan

One-page business plan

What-if business plan

Growth business plan

Operations business plan

Strategic business plan

01. Startup business plan

The startup business plan is a comprehensive document that will set the foundation for your company’s success. It covers all aspects of a business, including a situation analysis, detailed financial information and a strategic marketing plan.

Startup plans serve two purposes: internally, they provide a step-by-step guide that you and your team can use to start a business and generate results on day one. Externally, they prove the validity of your business concept to banks and investors, whose capital you’ll likely need to make your entrepreneurial dreams a reality.

Elements of a startup business plan should include the following steps:

Executive summary : Write a brief synopsis of your company’s concept, potential audience, product or services, and the amount of funding required.

Company overview: Go into detail about your company’s location and its business goals. Be sure to include your company’s mission statement , which explains the “why” behind your business idea.

Products or services: Explain exactly what your business will offer to its customers. Include detailed descriptions and pricing.

Situation analysis: Use market research to explain the competitive landscape, key demographics and the current status of your industry.

Marketing plan: Discuss the strategies you’ll use to build awareness for your business and attract new customers or clients.

Management bios: Introduce the people who will lead your company. Include bios that detail their industry-specific background.

Financial projections: Be transparent about startup costs, cash flow projections and profit expectations.

Don’t be afraid to go into too much detail—a startup business plan can often run multiple pages long. Investors will expect and appreciate your thoroughness. However, if you have a hot new product idea and need to move fast, you can consider a lean business plan. It’s a popular type of business plan in the tech industry that focuses on creating a minimum viable product first, then scaling the business from there.

02. Feasibility business plan

Let’s say you started a boat rental company five years ago. You’ve steadily grown your business. Now, you want to explore expanding your inventory by renting out jet skis, kayaks and other water sports equipment. Will it be profitable? A feasibility business plan will let you know.

Often called a decision-making plan, a feasibility business plan will help you understand the viability of offering a new product or launching into a new market. These business plans are typically internal and focus on answering two questions: Does the market exist, and will you make a profit from it? You might use a feasibility plan externally, too, if you need funding to support your new product or service.

Because you don’t need to include high-level, strategic information about your company, your feasibility business plan will be much shorter and more focused than a startup business plan. Feasibility plans typically include:

A description of the new product or service you wish to launch

A market analysis using third-party data

The target market , or your ideal customer profile

Any additional technology or personnel needs required

Required capital or funding sources

Predicted return on investment

Standards to objectively measure feasibility

A conclusion that includes recommendations on whether or not to move forward

03. One-page business plan

Imagine you’re a software developer looking to launch a tech startup around an app that you created from scratch. You’ve already written a detailed business plan, but you’re not sure if your strategy is 100% right. How can you get feedback from potential partners, customers or friends without making them slog through all 32 pages of the complete plan?

That’s where a one-page business plan comes in handy. It compresses your full business plan into a brief summary. Think of it as a cross between a business plan and an elevator pitch—an ideal format if you’re still fine-tuning your business plan. It’s also a great way to test whether investors will embrace your company, its mission or its goals.

Ideally, a one-page business plan should give someone a snapshot of your company in just a few minutes. But while brevity is important, your plan should still hit all the high points from your startup business plan. To accomplish this, structure a one-page plan similar to an outline. Consider including:

A short situation analysis that shows the need for your product or service

Your unique value proposition

Your mission statement and vision statement

Your target market

Your management team

The funding you’ll need

Financial projections

Expected results

Because a one-page plan is primarily used to gather feedback, make sure the format you choose is easy to update. That way, you can keep it fresh for new audiences.

04. What-if business plan

Pretend that you’re an accountant who started their own financial consulting business. You’re rapidly signing clients and growing your business when, 18 months into your new venture, you’re given the opportunity to buy another established firm in a nearby town. Is it a risk worth taking?

The what-if business plan will help you find an answer. It’s perfect for entrepreneurs who are looking to take big risks, such as acquiring or merging with another company, testing a new pricing model or adding an influx of new staff.

A what-if plan is additionally a great way to test out a worst-case scenario. For example, if you’re in the restaurant business, you can create a plan that explores the potential business repercussions of a public health emergency (like the COVID-19 pandemic), and then develop strategies to mitigate its effects.

You can share your what-if plan internally to prepare your leadership team and staff. You can also share it externally with bankers and partners so that they know your business is built to withstand any hard times. Include in your plan:

A detailed description of the business risk or other scenario

The impact it will have on your business

Specific actions you’ll take in a worst-case scenario

Risk management strategies you’ll employ

05. Growth business plan

Let’s say you’re operating a hair salon (see how to create a hair salon business plan ). You see an opportunity to expand your business and make it a full-fledged beauty bar by adding skin care, massage and other sought-after services. By creating a growth business plan, you’ll have a blueprint that will take you from your current state to your future state.

Sometimes called an expansion plan, a growth business plan is something like a crystal ball. It will help you see one to two years into the future. Creating a growth plan lets you see how far—and how fast—you can scale your business. It lets you know what you’ll need to get there, whether it’s funding, materials, people or property.

The audience for your growth plan will depend on your expected sources of capital. If you’re funding your expansion from within, then the audience is internal. If you need to attract the attention of outside investors, then the audience is external.

Much like a startup plan, your growth business plan should be rather comprehensive, especially if the people reviewing it aren’t familiar with your company. Include items specific to your potential new venture, including:

A brief assessment of your business’s current state

Information about your management team

A thorough analysis of the growth opportunity you’re seeking

The target audience for your new venture

The current competitive landscape

Resources you’ll need to achieve growth

Detailed financial forecasts

A funding request

Specific action steps your company will take

A timeline for completing those action steps

Another helpful thing to include in a growth business plan is a SWOT analysis . SWOT stands for strengths, weaknesses, opportunities and threats. A SWOT analysis will help you evaluate your performance, and that of your competitors. Including this type of in-depth review will show your investors that you’re making an objective, data-driven decision to expand your business, helping to build confidence and trust.

06. Operations business plan

You’ve always had a knack for accessories and have chosen to start your own online jewelry store. Even better, you already have your eCommerce business plan written. Now, it’s time to create a plan for how your company will implement its business model on a day-to-day basis.

An operations business plan will help you do just that. This internal-focused document will explain how your leadership team and your employees will propel your company forward. It should include specific responsibilities for each department, such as human resources, finance and marketing.

When you sit down to write an operations plan, you should use your company’s overall goals as your guide. Then, consider how each area of your business will contribute to those goals. Be sure to include:

A high-level overview of your business and its goals

A clear layout of key employees, departments and reporting lines

Processes you’ll use (i.e., how you’ll source products and fulfill orders)

Facilities and equipment you’ll need to conduct business effectively

Departmental budgets required

Risk management strategies that will ensure business continuity

Compliance and legal considerations

Clear metrics for each department to achieve

Timelines to help you reach those metrics

A measurement process to keep your teams on track

07. Strategic business plan

Say you open a coffee shop, but you know that one store is just the start. Eventually, you want to open multiple locations throughout your region. A strategic business plan will serve as your guide, helping define your company’s direction and decision-making over the next three to five years.

You should use a strategic business plan to align all of your internal stakeholders and employees around your company’s mission, vision and future goals. Your strategic plan should be high-level enough to create a clear vision of future success, yet also detailed enough to ensure you reach your eventual destination.

Be sure to include:

An executive summary

A company overview

Your mission and vision statements

Market research

A SWOT analysis

Specific, measurable goals you wish to achieve

Strategies to meet those goals

Financial projections based on those goals

Timelines for goal attainment

Related Posts

What is a target market and how to define yours

21 powerful mission statement examples that stand out

Free business plan template for small businesses

Was this article helpful?

What is a Business Plan? Definition and Resources

9 min. read

Updated May 10, 2024

If you’ve ever jotted down a business idea on a napkin with a few tasks you need to accomplish, you’ve written a business plan — or at least the very basic components of one.

The origin of formal business plans is murky. But they certainly go back centuries. And when you consider that 20% of new businesses fail in year 1 , and half fail within 5 years, the importance of thorough planning and research should be clear.

But just what is a business plan? And what’s required to move from a series of ideas to a formal plan? Here we’ll answer that question and explain why you need one to be a successful business owner.

- What is a business plan?

A business plan lays out a strategic roadmap for any new or growing business.

Any entrepreneur with a great idea for a business needs to conduct market research , analyze their competitors , validate their idea by talking to potential customers, and define their unique value proposition .

The business plan captures that opportunity you see for your company: it describes your product or service and business model , and the target market you’ll serve.

It also includes details on how you’ll execute your plan: how you’ll price and market your solution and your financial projections .

Reasons for writing a business plan

If you’re asking yourself, ‘Do I really need to write a business plan?’ consider this fact:

Companies that commit to planning grow 30% faster than those that don’t.

Creating a business plan is crucial for businesses of any size or stage. It helps you develop a working business and avoid consequences that could stop you before you ever start.

If you plan to raise funds for your business through a traditional bank loan or SBA loan , none of them will want to move forward without seeing your business plan. Venture capital firms may or may not ask for one, but you’ll still need to do thorough planning to create a pitch that makes them want to invest.

But it’s more than just a means of getting your business funded . The plan is also your roadmap to identify and address potential risks.

It’s not a one-time document. Your business plan is a living guide to ensure your business stays on course.

Related: 14 of the top reasons why you need a business plan

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

What research shows about business plans

Numerous studies have established that planning improves business performance:

- 71% of fast-growing companies have business plans that include budgets, sales goals, and marketing and sales strategies.

- Companies that clearly define their value proposition are more successful than those that can’t.

- Companies or startups with a business plan are more likely to get funding than those without one.

- Starting the business planning process before investing in marketing reduces the likelihood of business failure.

The planning process significantly impacts business growth for existing companies and startups alike.

Read More: Research-backed reasons why writing a business plan matters

When should you write a business plan?

No two business plans are alike.

Yet there are similar questions for anyone considering writing a plan to answer. One basic but important question is when to start writing it.

A Harvard Business Review study found that the ideal time to write a business plan is between 6 and 12 months after deciding to start a business.

But the reality can be more nuanced – it depends on the stage a business is in, or the type of business plan being written.

Ideal times to write a business plan include:

- When you have an idea for a business

- When you’re starting a business

- When you’re preparing to buy (or sell)

- When you’re trying to get funding

- When business conditions change

- When you’re growing or scaling your business

Read More: The best times to write or update your business plan

How often should you update your business plan?

As is often the case, how often a business plan should be updated depends on your circumstances.

A business plan isn’t a homework assignment to complete and forget about. At the same time, no one wants to get so bogged down in the details that they lose sight of day-to-day goals.

But it should cover new opportunities and threats that a business owner surfaces, and incorporate feedback they get from customers. So it can’t be a static document.

Related Reading: 5 fundamental principles of business planning

For an entrepreneur at the ideation stage, writing and checking back on their business plan will help them determine if they can turn that idea into a profitable business .

And for owners of up-and-running businesses, updating the plan (or rewriting it) will help them respond to market shifts they wouldn’t be prepared for otherwise.

It also lets them compare their forecasts and budgets to actual financial results. This invaluable process surfaces where a business might be out-performing expectations and where weak performance may require a prompt strategy change.

The planning process is what uncovers those insights.

Related Reading: 10 prompts to help you write a business plan with AI

- How long should your business plan be?

Thinking about a business plan strictly in terms of page length can risk overlooking more important factors, like the level of detail or clarity in the plan.

Not all of the plan consists of writing – there are also financial tables, graphs, and product illustrations to include.

But there are a few general rules to consider about a plan’s length:

- Your business plan shouldn’t take more than 15 minutes to skim.

- Business plans for internal use (not for a bank loan or outside investment) can be as short as 5 to 10 pages.

A good practice is to write your business plan to match the expectations of your audience.

If you’re walking into a bank looking for a loan, your plan should match the formal, professional style that a loan officer would expect . But if you’re writing it for stakeholders on your own team—shorter and less formal (even just a few pages) could be the better way to go.

The length of your plan may also depend on the stage your business is in.

For instance, a startup plan won’t have nearly as much financial information to include as a plan written for an established company will.

Read More: How long should your business plan be?

What information is included in a business plan?

The contents of a plan business plan will vary depending on the industry the business is in.

After all, someone opening a new restaurant will have different customers, inventory needs, and marketing tactics to consider than someone bringing a new medical device to the market.

But there are some common elements that most business plans include:

- Executive summary: An overview of the business operation, strategy, and goals. The executive summary should be written last, despite being the first thing anyone will read.

- Products and services: A description of the solution that a business is bringing to the market, emphasizing how it solves the problem customers are facing.

- Market analysis: An examination of the demographic and psychographic attributes of likely customers, resulting in the profile of an ideal customer for the business.

- Competitive analysis: Documenting the competitors a business will face in the market, and their strengths and weaknesses relative to those competitors.

- Marketing and sales plan: Summarizing a business’s tactics to position their product or service favorably in the market, attract customers, and generate revenue.

- Operational plan: Detailing the requirements to run the business day-to-day, including staffing, equipment, inventory, and facility needs.

- Organization and management structure: A listing of the departments and position breakdown of the business, as well as descriptions of the backgrounds and qualifications of the leadership team.

- Key milestones: Laying out the key dates that a business is projected to reach certain milestones , such as revenue, break-even, or customer acquisition goals.

- Financial plan: Balance sheets, cash flow forecast , and sales and expense forecasts with forward-looking financial projections, listing assumptions and potential risks that could affect the accuracy of the plan.

- Appendix: All of the supporting information that doesn’t fit into specific sections of the business plan, such as data and charts.

Read More: Use this business plan outline to organize your plan

- Different types of business plans

A business plan isn’t a one-size-fits-all document. There are numerous ways to create an effective business plan that fits entrepreneurs’ or established business owners’ needs.

Here are a few of the most common types of business plans for small businesses:

- One-page plan : Outlining all of the most important information about a business into an adaptable one-page plan.

- Growth plan : An ongoing business management plan that ensures business tactics and strategies are aligned as a business scales up.

- Internal plan : A shorter version of a full business plan to be shared with internal stakeholders – ideal for established companies considering strategic shifts.

Business plan vs. operational plan vs. strategic plan

- What questions are you trying to answer?

- Are you trying to lay out a plan for the actual running of your business?

- Is your focus on how you will meet short or long-term goals?

Since your objective will ultimately inform your plan, you need to know what you’re trying to accomplish before you start writing.

While a business plan provides the foundation for a business, other types of plans support this guiding document.

An operational plan sets short-term goals for the business by laying out where it plans to focus energy and investments and when it plans to hit key milestones.

Then there is the strategic plan , which examines longer-range opportunities for the business, and how to meet those larger goals over time.

Read More: How to use a business plan for strategic development and operations

- Business plan vs. business model

If a business plan describes the tactics an entrepreneur will use to succeed in the market, then the business model represents how they will make money.

The difference may seem subtle, but it’s important.

Think of a business plan as the roadmap for how to exploit market opportunities and reach a state of sustainable growth. By contrast, the business model lays out how a business will operate and what it will look like once it has reached that growth phase.

Learn More: The differences between a business model and business plan

- Moving from idea to business plan

Now that you understand what a business plan is, the next step is to start writing your business plan .

The best way to start is by reviewing examples and downloading a business plan template. These resources will provide you with guidance and inspiration to help you write a plan.

We recommend starting with a simple one-page plan ; it streamlines the planning process and helps you organize your ideas. However, if one page doesn’t fit your needs, there are plenty of other great templates available that will put you well on your way to writing a useful business plan.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

Table of Contents

- Reasons to write a business plan

- Business planning research

- When to write a business plan

- When to update a business plan

- Information to include

- Business vs. operational vs. strategic plans

Related Articles

13 Min. Read

How to Write an Online Fitness Business Plan

12 Min. Read

Free Amazon FBA Business Plan PDF [2024 Template + Sample Plan]

8 Min. Read

How to Format a Business Plan in 8 Simple Steps

6 Min. Read

How to Write Your Business Plan Cover Page + Template

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, how often should a business plan be updated, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

A business plan is a document that details a company's goals and how it intends to achieve them. Business plans can be of benefit to both startups and well-established companies. For startups, a business plan can be essential for winning over potential lenders and investors. Established businesses can find one useful for staying on track and not losing sight of their goals. This article explains what an effective business plan needs to include and how to write one.

Key Takeaways

- A business plan is a document describing a company's business activities and how it plans to achieve its goals.

- Startup companies use business plans to get off the ground and attract outside investors.

- For established companies, a business plan can help keep the executive team focused on and working toward the company's short- and long-term objectives.

- There is no single format that a business plan must follow, but there are certain key elements that most companies will want to include.

Investopedia / Ryan Oakley

Any new business should have a business plan in place prior to beginning operations. In fact, banks and venture capital firms often want to see a business plan before they'll consider making a loan or providing capital to new businesses.

Even if a business isn't looking to raise additional money, a business plan can help it focus on its goals. A 2017 Harvard Business Review article reported that, "Entrepreneurs who write formal plans are 16% more likely to achieve viability than the otherwise identical nonplanning entrepreneurs."

Ideally, a business plan should be reviewed and updated periodically to reflect any goals that have been achieved or that may have changed. An established business that has decided to move in a new direction might create an entirely new business plan for itself.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. These include being able to think through ideas before investing too much money in them and highlighting any potential obstacles to success. A company might also share its business plan with trusted outsiders to get their objective feedback. In addition, a business plan can help keep a company's executive team on the same page about strategic action items and priorities.

Business plans, even among competitors in the same industry, are rarely identical. However, they often have some of the same basic elements, as we describe below.

While it's a good idea to provide as much detail as necessary, it's also important that a business plan be concise enough to hold a reader's attention to the end.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, it's best to fit the basic information into a 15- to 25-page document. Other crucial elements that take up a lot of space—such as applications for patents—can be referenced in the main document and attached as appendices.

These are some of the most common elements in many business plans:

- Executive summary: This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services: Here, the company should describe the products and services it offers or plans to introduce. That might include details on pricing, product lifespan, and unique benefits to the consumer. Other factors that could go into this section include production and manufacturing processes, any relevant patents the company may have, as well as proprietary technology . Information about research and development (R&D) can also be included here.

- Market analysis: A company needs to have a good handle on the current state of its industry and the existing competition. This section should explain where the company fits in, what types of customers it plans to target, and how easy or difficult it may be to take market share from incumbents.

- Marketing strategy: This section can describe how the company plans to attract and keep customers, including any anticipated advertising and marketing campaigns. It should also describe the distribution channel or channels it will use to get its products or services to consumers.

- Financial plans and projections: Established businesses can include financial statements, balance sheets, and other relevant financial information. New businesses can provide financial targets and estimates for the first few years. Your plan might also include any funding requests you're making.

The best business plans aren't generic ones created from easily accessed templates. A company should aim to entice readers with a plan that demonstrates its uniqueness and potential for success.

2 Types of Business Plans

Business plans can take many forms, but they are sometimes divided into two basic categories: traditional and lean startup. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These plans tend to be much longer than lean startup plans and contain considerably more detail. As a result they require more work on the part of the business, but they can also be more persuasive (and reassuring) to potential investors.

- Lean startup business plans : These use an abbreviated structure that highlights key elements. These business plans are short—as short as one page—and provide only the most basic detail. If a company wants to use this kind of plan, it should be prepared to provide more detail if an investor or a lender requests it.

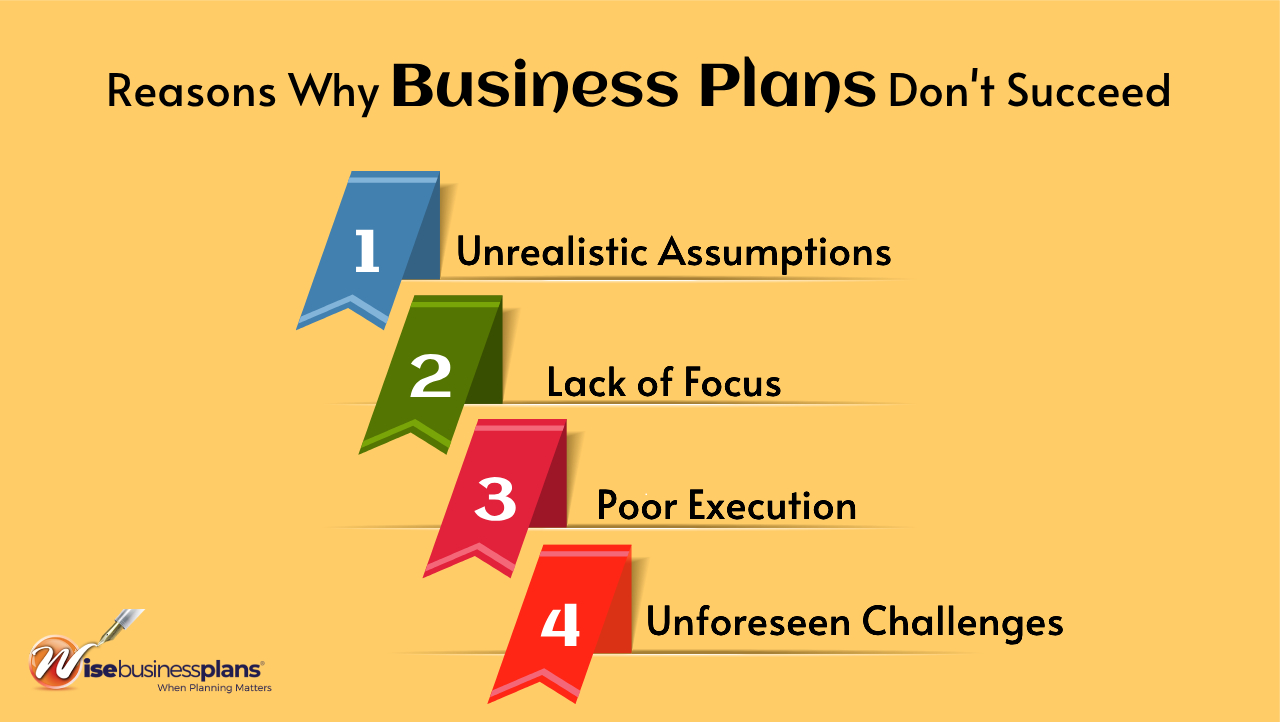

Why Do Business Plans Fail?

A business plan is not a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections to begin with. Markets and the overall economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All of this calls for building some flexibility into your plan, so you can pivot to a new course if needed.

How frequently a business plan needs to be revised will depend on the nature of the business. A well-established business might want to review its plan once a year and make changes if necessary. A new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is an option when a company prefers to give a quick explanation of its business. For example, a brand-new company may feel that it doesn't have a lot of information to provide yet.

Sections can include: a value proposition ; the company's major activities and advantages; resources such as staff, intellectual property, and capital; a list of partnerships; customer segments; and revenue sources.

A business plan can be useful to companies of all kinds. But as a company grows and the world around it changes, so too should its business plan. So don't think of your business plan as carved in granite but as a living document designed to evolve with your business.

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

U.S. Small Business Administration. " Write Your Business Plan ."

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans for May 2024 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How To Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1456193345-2cc8ef3d583f42d8a80c8e631c0b0556.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

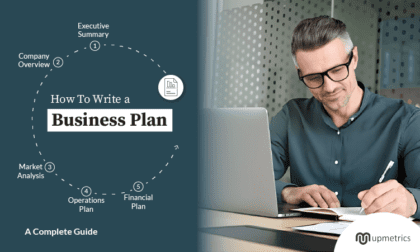

How to Write a Business Plan, Step by Step

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

What is a business plan?

1. write an executive summary, 2. describe your company, 3. state your business goals, 4. describe your products and services, 5. do your market research, 6. outline your marketing and sales plan, 7. perform a business financial analysis, 8. make financial projections, 9. summarize how your company operates, 10. add any additional information to an appendix, business plan tips and resources.

A business plan outlines your business’s financial goals and explains how you’ll achieve them over the next three to five years. Here’s a step-by-step guide to writing a business plan that will offer a strong, detailed road map for your business.

ZenBusiness

A business plan is a document that explains what your business does, how it makes money and who its customers are. Internally, writing a business plan should help you clarify your vision and organize your operations. Externally, you can share it with potential lenders and investors to show them you’re on the right track.

Business plans are living documents; it’s OK for them to change over time. Startups may update their business plans often as they figure out who their customers are and what products and services fit them best. Mature companies might only revisit their business plan every few years. Regardless of your business’s age, brush up this document before you apply for a business loan .

» Need help writing? Learn about the best business plan software .

This is your elevator pitch. It should include a mission statement, a brief description of the products or services your business offers and a broad summary of your financial growth plans.

Though the executive summary is the first thing your investors will read, it can be easier to write it last. That way, you can highlight information you’ve identified while writing other sections that go into more detail.

» MORE: How to write an executive summary in 6 steps

Next up is your company description. This should contain basic information like:

Your business’s registered name.

Address of your business location .

Names of key people in the business. Make sure to highlight unique skills or technical expertise among members of your team.

Your company description should also define your business structure — such as a sole proprietorship, partnership or corporation — and include the percent ownership that each owner has and the extent of each owner’s involvement in the company.

Lastly, write a little about the history of your company and the nature of your business now. This prepares the reader to learn about your goals in the next section.

» MORE: How to write a company overview for a business plan

The third part of a business plan is an objective statement. This section spells out what you’d like to accomplish, both in the near term and over the coming years.

If you’re looking for a business loan or outside investment, you can use this section to explain how the financing will help your business grow and how you plan to achieve those growth targets. The key is to provide a clear explanation of the opportunity your business presents to the lender.

For example, if your business is launching a second product line, you might explain how the loan will help your company launch that new product and how much you think sales will increase over the next three years as a result.

» MORE: How to write a successful business plan for a loan

In this section, go into detail about the products or services you offer or plan to offer.

You should include the following:

An explanation of how your product or service works.

The pricing model for your product or service.

The typical customers you serve.

Your supply chain and order fulfillment strategy.

You can also discuss current or pending trademarks and patents associated with your product or service.

Lenders and investors will want to know what sets your product apart from your competition. In your market analysis section , explain who your competitors are. Discuss what they do well, and point out what you can do better. If you’re serving a different or underserved market, explain that.

Here, you can address how you plan to persuade customers to buy your products or services, or how you will develop customer loyalty that will lead to repeat business.

Include details about your sales and distribution strategies, including the costs involved in selling each product .

» MORE: R e a d our complete guide to small business marketing

If you’re a startup, you may not have much information on your business financials yet. However, if you’re an existing business, you’ll want to include income or profit-and-loss statements, a balance sheet that lists your assets and debts, and a cash flow statement that shows how cash comes into and goes out of the company.

Accounting software may be able to generate these reports for you. It may also help you calculate metrics such as:

Net profit margin: the percentage of revenue you keep as net income.

Current ratio: the measurement of your liquidity and ability to repay debts.

Accounts receivable turnover ratio: a measurement of how frequently you collect on receivables per year.

This is a great place to include charts and graphs that make it easy for those reading your plan to understand the financial health of your business.

This is a critical part of your business plan if you’re seeking financing or investors. It outlines how your business will generate enough profit to repay the loan or how you will earn a decent return for investors.

Here, you’ll provide your business’s monthly or quarterly sales, expenses and profit estimates over at least a three-year period — with the future numbers assuming you’ve obtained a new loan.

Accuracy is key, so carefully analyze your past financial statements before giving projections. Your goals may be aggressive, but they should also be realistic.

NerdWallet’s picks for setting up your business finances:

The best business checking accounts .

The best business credit cards .

The best accounting software .

Before the end of your business plan, summarize how your business is structured and outline each team’s responsibilities. This will help your readers understand who performs each of the functions you’ve described above — making and selling your products or services — and how much each of those functions cost.

If any of your employees have exceptional skills, you may want to include their resumes to help explain the competitive advantage they give you.

Finally, attach any supporting information or additional materials that you couldn’t fit in elsewhere. That might include:

Licenses and permits.

Equipment leases.

Bank statements.

Details of your personal and business credit history, if you’re seeking financing.

If the appendix is long, you may want to consider adding a table of contents at the beginning of this section.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

Here are some tips to write a detailed, convincing business plan:

Avoid over-optimism: If you’re applying for a business bank loan or professional investment, someone will be reading your business plan closely. Providing unreasonable sales estimates can hurt your chances of approval.

Proofread: Spelling, punctuation and grammatical errors can jump off the page and turn off lenders and prospective investors. If writing and editing aren't your strong suit, you may want to hire a professional business plan writer, copy editor or proofreader.

Use free resources: SCORE is a nonprofit association that offers a large network of volunteer business mentors and experts who can help you write or edit your business plan. The U.S. Small Business Administration’s Small Business Development Centers , which provide free business consulting and help with business plan development, can also be a resource.

On a similar note...

Find small-business financing

Compare multiple lenders that fit your business

- Top Courses

- Online Degrees

- Find your New Career

- Join for Free

Business Plan: What It Is + How to Write One

Discover what a business plan includes and how writing one can foster your business’s development.

![what are 3 types of business plans [Featured image] Woman showing a business plan to a man at a desk](https://d3njjcbhbojbot.cloudfront.net/api/utilities/v1/imageproxy/https://images.ctfassets.net/wp1lcwdav1p1/8jaIrEmfb9uCidnAGOr2F/c551eade2b440294787de7afd2acb369/GettyImages-1127726432__1_.jpg?w=1500&h=680&q=60&fit=fill&f=faces&fm=jpg&fl=progressive&auto=format%2Ccompress&dpr=1&w=1000)

What is a business plan?

A business plan is a written document that defines your business goals and the tactics to achieve those goals. A business plan typically explores the competitive landscape of an industry, analyzes a market and different customer segments within it, describes the products and services, lists business strategies for success, and outlines financial planning.

In your research into business plans, you may come across different formats, and you might be wondering which kind will work best for your purposes.

Let’s define two main types of business plans , the traditional business pla n and the lean start-up business plan . Both types can serve as the basis for developing a thriving business, as well as exploring a competitive market analysis, brand strategy , and content strategy in more depth. There are some significant differences to keep in mind [ 1 ]:

The traditional business plan is a long document that explores each component in depth. You can build a traditional business plan to secure funding from lenders or investors.

The lean start-up business plan focuses on the key elements of a business’s development and is shorter than the traditional format. If you don’t plan to seek funding, the lean start-up plan can serve mainly as a document for making business decisions and carrying out tasks.

Now that you have a clear business plan definition , continue reading to begin writing a detailed plan that will guide your journey as an entrepreneur.

How to write a business plan

In the sections below, you’ll build the following components of your business plan:

Executive summary

Business description

Products and services

Competitor analysis

Marketing plan and sales strategies

Brand strategy

Financial planning

Explore each section to bring fresh inspiration to the surface and reveal new possibilities for developing your business. You may choose to adapt the sections, skip over some, or go deeper into others, depending on which format you’re using. Consider your first draft a foundation for your efforts and one that you can revise, as needed, to account for changes in any area of your business.

Read more: What Is a Marketing Plan? And How to Create One

1. Executive summary

This is a short section that introduces the business plan as a whole to the people who will be reading it, including investors, lenders, or other members of your team. Start with a sentence or two about your business, your goals for developing it, and why it will be successful. If you are seeking funding, summarize the basics of the financial plan.

2. Business description

Use this section to provide detailed information about your company and how it will operate in the marketplace.

Mission statement: What drives your desire to start a business? What purpose are you serving? What do you hope to achieve for your business, the team, your customers?

Revenue streams: From what sources will your business generate revenue? Examples include product sales, service fees, subscriptions, rental fees, license fees, and more.

Leadership: Describe the leaders in your business, their roles and responsibilities, and your vision for building teams to perform various functions, such as graphic design, product development, or sales.

Legal structure: If you’ve incorporated your business or registered it with your state as a legal entity such as an S-corp or LLC, include the legal structure here and the rationale behind this choice.

3. Competitor analysis

This section will include an assessment of potential competitors, their offers, and marketing and sales efforts. For each competitor, explore the following:

Value proposition: What outcome or experience does this brand promise?

Products and services: How does each one solve customer pain points and fulfill desires? What are the price points?

Marketing: Which channels do competitors use to promote? What kind of content does this brand publish on these channels? What messaging does this brand use to communicate value to customers?

Sales: What sales process or buyer’s journey does this brand lead customers through?

Read more: What Is Competitor Analysis? And How to Conduct One

4. Products and services

Use this section to describe everything your business offers to its target market . For every product and service, list the following:

The value proposition or promise to customers, in terms of how they will experience it

How the product serves customers, addresses their pain points, satisfies their desires, and improves their lives

The features or outcomes that make the product better than those of competitors

Your price points and how these compare to competitors

5. Marketing plan and sales strategies

In this section, you’ll draw from thorough market research to describe your target market and how you will reach them.

Who are your ideal customers?

How can you describe this segment according to their demographics (age, ethnicity, income, location, etc.) and psychographics (beliefs, values, aspirations, lifestyle, etc.)?

What are their daily lives like?

What problems and challenges do they experience?

What words, phrases, ideas, and concepts do consumers in your target market use to describe these problems when posting on social media or engaging with your competitors?

What messaging will present your products as the best on the market? How will you differentiate messaging from competitors?

On what marketing channels will you position your products and services?

How will you design a customer journey that delivers a positive experience at every touchpoint and leads customers to a purchase decision?

Read more: Market Analysis: What It Is and How to Conduct One

6. Brand strategy

In this section, you will describe your business’s design, personality, values, voice, and other details that go into delivering a consistent brand experience.

What are the values that define your brand?

What visual elements give your brand a distinctive look and feel?

How will your marketing messaging reflect a distinctive brand voice, including the tone, diction, and sentence-level stylistic choices?

How will your brand look and sound throughout the customer journey?

Define your brand positioning statement. What will inspire your audience to choose your brand over others? What experiences and outcomes will your audience associate with your brand?

Read more: What Is a Brand Strategy? And How to Create One

7. Financial planning

In this section, you will explore your business’s financial future. If you are writing a traditional business plan to seek funding, this section is critical for demonstrating to lenders or investors that you have a strategy for turning your business ideas into profit. For a lean start-up business plan, this section can provide a useful exercise for planning how you will invest resources and generate revenue [ 2 ].

Use any past financials and other sections of this business plan, such as your price points or sales strategies, to begin your financial planning.

How many individual products or service packages do you plan to sell over a specific time period?

List your business expenses, such as subscribing to software or other services, hiring contractors or employees, purchasing physical supplies or equipment, etc.

What is your break-even point, or the amount you have to sell to cover all expenses?

Create a sales forecast for the next three to five years: (No. of units to sell X price for each unit) – (cost per unit X No. of units) = sales forecast

Quantify how much capital you have on hand.

When writing a traditional business plan to secure funding, you may choose to append supporting documents, such as licenses, permits, patents, letters of reference, resumes, product blueprints, brand guidelines, the industry awards you’ve received, and media mentions and appearances.

Business plan key takeaways and best practices

Remember: Creating a business plan is crucial when starting a business. You can use this document to guide your decisions and actions and even seek funding from lenders and investors.

Keep these best practices in mind:

Your business plan should evolve as your business grows. Return to it periodically, such as every quarter or year, to update individual sections or explore new directions your business can take.

Make sure everyone on your team has a copy of the business plan and welcome their input as they perform their roles.

Ask fellow entrepreneurs for feedback on your business plan and look for opportunities to strengthen it, from conducting more market and competitor research to implementing new strategies for success.

Start your business with Coursera

Ready to start your business? Watch this video on the lean approach from the Entrepreneurship Specialization :

Article sources

1. US Small Business Administration. “ Write Your Business Plan , https://www.sba.gov/business-guide/plan-your-business/write-your-business-plan." Accessed April 19, 2022.

2. Inc. " How to Write the Financial Section of a Business Plan , https://www.inc.com/guides/business-plan-financial-section.html." Accessed April 14, 2022.

Keep reading

Coursera staff.

Editorial Team

Coursera’s editorial team is comprised of highly experienced professional editors, writers, and fact...

This content has been made available for informational purposes only. Learners are advised to conduct additional research to ensure that courses and other credentials pursued meet their personal, professional, and financial goals.

- Customer Reviews

- Net 30 Account

- Wise Services

- Steps & Timeline

- Work at a Glance

- Market Research at a Glance

- Business Plan Writing Services

- Bank Business Plan

- Investor Business Plan

- Franchise Business Plan

- Cannabis Business Plan

- Strategic Business Plan

- Corporate Business Plan

- Merge and Acquisition Business Plan (M&A)

- Private Placement Memorandums (PPM)

- Sample Business Plans

- Professional Feasibility Study

- PowerPoint Presentations

- Pitch Deck Presentation Services

- Business Plan Printing

- Market Research

- L-1 Business Plan

- E-2 Business Plan

- EB-5 Business Plan

- EB-5 Regional Centers

- Immigration Attorneys

- Nonprofit Business Plan

- Exit Business Planning

- Business Planning

- Business Formation

- Business License

- Business Website

- Business Branding

- Business Bank Account

- Digital Marketing

- Business Funding Resources

- Small Business Loans

- Venture Capital

- Net 30 Apply

What is a business plan? Definition, Purpose, and Types

In the world of business, a well-thought-out plan is often the key to success. This plan, known as a business plan, is a comprehensive document that outlines a company’s goals, strategies , and financial projections. Whether you’re starting a new business or looking to expand an existing one, a business plan is an essential tool.

As a business plan writer and consultant , I’ve crafted over 15,000 plans for a diverse range of businesses. In this article, I’ll be sharing my wealth of experience about what a business plan is, its purpose, and the step-by-step process of creating one. By the end, you’ll have a thorough understanding of how to develop a robust business plan that can drive your business to success.

What is a business plan?

Purposes of a business plan, what are the essential components of a business plan, executive summary, business description or overview, product and price, competitive analysis, target market, marketing plan, financial plan, funding requirements, types of business plan, lean startup business plans, traditional business plans, how often should a business plan be reviewed and revised, what are the key elements of a lean startup business plan.

- What are some of the reasons why business plans don't succeed?

A business plan is a roadmap for your business. It outlines your goals, strategies, and how you plan to achieve them. It’s a living document that you can update as your business grows and changes.

Looking for someone to write a business plan?

Find professional business plan writers for your business success.

These are the following purpose of business plan:

- Attract investors and lenders: If you’re seeking funding for your business , a business plan is a must-have. Investors and lenders want to see that you have a clear plan for how you’ll use their money to grow your business and generate revenue.

- Get organized and stay on track: Writing a business plan forces you to think through all aspects of your business, from your target market to your marketing strategy. This can help you identify any potential challenges and opportunities early on, so you can develop a plan to address them.

- Make better decisions: A business plan can help you make better decisions about your business by providing you with a framework to evaluate different options. For example, if you’re considering launching a new product, your business plan can help you assess the potential market demand, costs, and profitability.