YNAB review: Personalized budgeting that accounts for every dollar

With a streamlined interface and the flexibility of unlinked accounts, ynab can positively impact your wallet and your money mindset.

Tom's Guide Verdict

YNAB provides powerful and personalized tools for visualizing your accounts and how you spend your money.

Simple, attractive interface

Can create custom labels that match how you think about your expenses

Easy to get benefit without directly connecting accounts

Terrific help, including regular live how-to webinars

Little personal finance context beyond budgeting

Many financial institutions require a third party intermediary to make the connection

Regular hands-on updates input can get tedious

Why you can trust Tom's Guide Our writers and editors spend hours analyzing and reviewing products, services, and apps to help find what's best for you. Find out more about how we test, analyze, and rate.

YNAB has a very clear mission, as reflected in its name – which stands for You Need a Budget. Unlike competing personal finance packages, YNAB is all about budgets. Specifically, about creating zero-sum budgets that are designed around four rules that create mindfulness around how you think about money management and budgeting.

The idea behind YNAB is to spend with intention, whereby you allocate your income to different expenses. YNAB’s singular focus is its strength, and sets it apart from the other personal finance services scrabbling for attention. Those services, including Mint and Simplifi, offer budgeting as a part of a broad spectrum snapshot of your money management. Generous guidance coupled with its clear focus on budgeting through managing income and expenses make YNAB the best budgeting app around. However, it’s more expensive than the other best budgeting apps we reviewed. Read the rest of our YNAB review to see if its price is worth it for you.

YNAB review: Cost

YNAB costs $14.99 billed monthly, or $8.25 per month billed annually at $98.99. Both plans have a 34-day trial period – clever and useful to showcase the impact the service can have across a full month and change. College students get 12-months free after the 34-day trial.

YNAB review: Features

YNAB has a zero-sum approach to budgeting, and it likens itself to a digital version of the envelope budgeting approach. YNAB outlines four guiding rules around which its service is based: Give every dollar a job, embrace your true expenses, roll with the punches, and age your money. The last rule stands on the foundation of the first three, the idea being that as you become more intentional in your spending, you’ll spend less and be able to use money you’ve saved for more than 30-days.

The service collects your income and expense data and provides a way to categorize your expenses. You’ll assign all of your funds into categories that you can label yourself, and then you’ll use that plan to inform your spending for the month. With a few clicks you can re-allocate funds from one category to another, a powerful visual tool for the mental calculus many of us make when making decisions to spend money.

You’ll next need to set up accounts to populate those categories with actual transactions. YNAB supports importing financial data from U.S. and Canadian banks and select banks from the United Kingdom and European Union. If you don’t want to connect your accounts or YNAB doesn’t support your financial institution, you can directly import QFX, OFX, QIF, or CSV files. Or simply manually enter the information yourself.

Additional tools help you track spending and savings goals, view spending and net worth trends, and navigate loan repayment (represented as another account).

YNAB review: Available Help

YNAB’s help and customized assistance is unparalleled. The initial set-up guides you through the three basic set-up steps; further help is found outside the service on the YNAB Help Center, or via the occasional in-service question mark. The jam-packed Help Center hosts blogs, videos, podcasts, and even live Zoom classes to introduce and complement the YNAB method and service.

For all its simplicity, using YNAB requires an understanding of the method behind the service, and the interactive classes are incredibly useful for delving deeper and getting your questions answered by a live human. The Zooms cover everything from getting started to maintaining your budget and managing credit cards and debt set YNAB apart from the crowd. The site has clearly organized documentation to walk you through setting up your budget in four steps. Got more questions? You can use the pop-up interface to ask questions, and you’ll get a reply in 24-hours.

We really liked YNAB’s Help Center guidance, which not only helps you get started but gives tips based on what brings you on a journey to track a budget (such as, you’re doing a budget because you have debt or you can’t save money). These scenarios really help drive home the why and how of YNAB’s benefit.

YNAB review: Ease of use

Signing up is simple, and doesn’t require a credit card to start. Just set up your username and password, approve the terms of service, and you’re in. A pop-up bar along the bottom guides you through three steps to set up your budget.

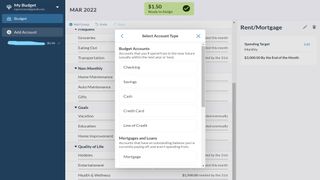

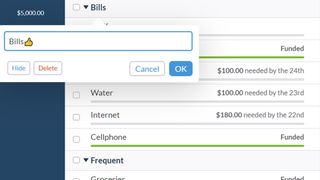

YNAB starts with a basic three steps to get set up, with useful explanations integrated into the interface (but little integrated help beyond that). The first step involves estimating your expenses by entering amounts into predefined monetary events populated across five categories: Bills, Frequent, Non-Monthly, Goals, and Quality of Life. We liked that these category titles and breakdowns are fully customizable – the titles, language, and order can be edited and moved at-will, and you can even add emojis to make something more visually (for example, a calendar next to Bills).

Even so, the pre-defined category breakdowns and their underlying monetary events made sense because they loosely matched our behavior around those activities. For example, vacation and education are listed under goals; health and wellness under Quality of Life; regular staples like Rent/Mortgage, Electric, Water, Internet, and Cellphone are listed under Bills.

YNAB’s ability to customize these names and actions is a powerful way to make your budget your own, rather than fit your line items into another service’s structure. For example, Mint lets you set targets, but you can’t customize the category labels in a way that matches how you think about the expenditure.

Monetary events each have three corresponding columns for you to complete: Assigned, Activity, and Available. Available represents what you’ve budgeted for a specific event on a monthly basis, and it rolls over each month since that’s your “budget” for that event. Assigned represents how you’ve taken available money from an account and allocated, or “assigned,” it to a given event, thereby giving each dollar in your account a “job” per YNAB’s first rule of budgeting. The Assigned column resets each month, since the amount can vary as needed (for example, assigning funds to home maintenance so you build up savings allocated to that category may not happen every month). Activity represents the transactional data you’ll enter manually or import under a given account, a step that is not as well-communicated as the rest of the onboarding setup.

YNAB stands out for how it specifically works with the dollars you have at the moment, and doesn’t forecast income. Your available funds need to be fully assigned down to zero. You can shift funds on the fly, and see where you’re taking it from.

We liked YNAB’s first step since we generally have a general idea of our fixed and recurring expenditures – either in terms of how much we know we’ve typically spent, or how much we know we want to target as our spend. We also know the activities we’d want to allocate funds to, like home maintenance, eating out, or travel. So this approach worked well to set targets.

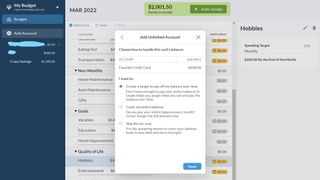

The second step is all about adding accounts. You can choose to link accounts (including credit cards) to automatically import transactions, or you can choose unlinked and enter your current balance and transactions manually. YNAB connects directly to some financial accounts, and uses several third-party services, depending upon the account. We experienced the direct connection for a credit card, and the third-party Plaid experience for a different card.

Plaid asks for your username and log-in information for the institution, and uses those details to create a secure link between your accounts and your financial service. We were hesitant at first to give up our information, since we specifically had accounts we did not want to link to. At the time of our review, Plaid informed us that in April it would start rolling out a feature to give consumers choice over which accounts to link to a given service. If the feature is available, consumers won’t have to do anything new and to gain this ability; however, if they’d used Plaid before the update, you’ll need to get an account update from the service you're using (such as YNAM).

In addition to linking accounts, YNAB lets you add accounts manually. We used this nifty feature to create accounts with custom names and balances, and build out our YNAB budget. For a credit card balance, we could choose how we want to pay the bill; we chose to pay the whole card off, and it added this as a payment category in the budget. The concept of unlinked accounts is tremendous, and lets you have greater control on how you construct and represent your digital budget.

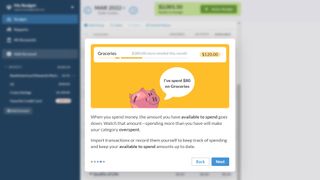

Step three is to assign your money to different categories. Once done, you have a working budget that will guide your spending moving forward. Assigning money and adding transaction activity could be clearer in the YNAB, but once you get it, it’s not an issue. You’ll update transactions (or they’ll update automatically if you’ve established a link, to see what your available spend remains). We especially liked how the software could auto-assign funds, choosing priorities in the event you don’t have enough money to fund everything. However, this is a capability we stumbled on by clicking around on the screen; the YNAB interface was light on direction and guidance after taking you through the first three initial steps.

YNAB review: Mobile

The mobile app is clearly designed and easy to navigate, and even makes some abilities more apparent than on the web service. The app interface drops the activity column and is simpler in its presentation, with clear text and color coding. That makes sense since the activity column data is populated based on actions performed and entered elsewhere in the service.

We particularly liked the immediacy of being able to add transaction data from within the app. That means, if you eat out or shop you could conceivably hop into the app and add your transactions at the time, especially useful if you choose not to link accounts for real-time updates.

YNAB review: Verdict

YNAB’s learning curve is steep. The service requires you to think about how you’re constructing your budget and spending your money, rather than analyzing money you’ve already spent – a hallmark of competing products like Mint. And to get the most benefit, you’ll either have to have accounts linked or you’ll have to manually enter transaction data, a unique and powerful feature.

YNAB is the only one of the best budgeting apps that lets you fully customize the names of your categories and expenses, and lets you trace your mindful decision to take money allocated for X and move it to Y. The service requires regular inputs to keep it up-to-date, which for some might become a burden over a time.

Only Simplifi comes close in how you can plan for using your money, but that app doesn’t get into the minutiae of assigning your incoming dollars to specific transactions. If you get in the habit of using the service, though, and once you get the hang of it, YNAB can definitely help change your money mindset and improve your bottom line in a way that none of the other best budgeting apps can.

Melissa Perenson is a freelance writer. She has reviewed the best tax software for Tom's Guide for several years, and has also tested out fax software, among other things. She spent more than a decade at PC World and TechHive, and she has freelanced for numerous publications including Computer Shopper, TechRadar and Consumers Digest.

New Beats Pill spotted in iOS 17.5 beta — what we know so far

Samsung is working on a One UI 7 update for Galaxy S24

TCL S4 S-Class 4K TV (65S450G) review

Most Popular

YNAB review

YNAB is an excellent app for people who have repeatedly mishandled their finances in the past and/or are in a shared financial situation, like a marriage. YNAB helps you set a monthly budget in a way that actually teaches you about money management while helping you stay on target and potentially saving you thousands.

Our editorial team has decades of experience researching the best personal finance products. When we look at the best apps for budgeting, we look at cost (free may not always be best), application towards personal goals, and what value is ultimately being provided. Read our review of You Need A Budget for our personal experience and let us explain why we’re such huge fans.

You Need a Budget (YNAB) is more than a software program; it’s a lifestyle for budgeting.

Whether your goal is to get out of debt, break the paycheck-to-paycheck cycle, grow your savings accounts, or all of the above, YNAB’s theory is that giving every dollar “a job” can help.

- Easy to get started with free trial

- Track spending and saving goals

- Both automatic and manual account linking

- No spammy advertising or upsells

- Learning curve for best use

- Ongoing fee applies

What is YNAB?

You Need a Budget (YNAB) is a budgeting app/software program that can be used on a regular computer or mobile device. It’s also a lifestyle, as it requires you to take a proactive approach to budgeting. You’ll give every dollar a job and then adjust as needed between paydays/inflows of money. In addition to the app, YNAB is also a financial education company, with tons of useful blog articles and free workshops to help you use the app more efficiently and reach your goals.

- Cost: $14.99/month or $99/year (with a 34-day free trial)

- Link to bank account? Yes

- Best budgeting features: You can “give every dollar a job,” so ALL of your money will be budgeted

In my experience, there’s a bit of a learning curve when you first start using YNAB , but it’s totally worth it to keep going. You can even do a budget restart if you need to (I did).

How to use YNAB

Head to the YNAB sign-up page. Your YNAB journey begins with a free 34-day trial when you use our link. I appreciated the fact that they didn’t ask for a credit card at sign-up.

Once you put in your email and create a password, you have to agree to the Terms of Service.

Then you’ll answer some questions about your circumstances and reasons for trying YNAB. And that’s it. Y ou’re all set and ready to start budgeting. Quick and easy.

The first step is to add a bank account, which can be linked or unlinked. Personally, I linked mine for easy transaction importing, but since YNAB’s approach is all about being proactive, you can manually add a starting balance and each transaction. This is also good for anyone who feels uncomfortable sharing their bank account login information in spite of YNAB’s security measures.

You can add a variety of accounts , for both budgeting and tracking. To be honest, I haven’t found the tracking feature to be that useful (I prefer Mint’s dashboard for watching my retirement account grow). To keep it simple, just start with a checking account. You’ll give it a nickname and enter a starting balance.

You’ll see default budget categories, but you can delete anything that doesn’t apply to you and add categories as needed. For example, I created a “homemaking” category for getting pictures framed, buying holiday decorations, and other expenses related to preserving family memories and making our house feel like a home.

Pros & cons of YNAB

- Easy to get started — While there are plenty of features to explore, you don’t have to learn everything to set up your account and start budgeting.

- Subscription renewal reminder — YNAB will email you a whole week or so before your subscription is set to renew.

- Manual account linking — For people who don’t want to share their account login with budgeting software, YNAB provides a manual option.

- No advertising — Since you’re paying for YNAB, they don’t use your data to make targeted offers for credit cards and other financial products. Maybe it’s not the biggest deal in the world, but I do find the lack of ads refreshing.

- No free version — You have to pay for it if you want to use it past the 34-day trial.

- Learning curve — You can get started right away, but if you want to get the most out of YNAB, which we recommend, you’ll need to spend some time reading or watching workshops.

How much is YNAB?

YNAB offers a monthly or annual subscription after a 34-day free trial.

- $14.99/month.

- Taxes may apply.

The annual option would come to only $8.25/month and save you $80 annually. The return on said annual subscription, according to YNAB survey responses, is $600 saved by new budgeters by their second month using YNAB and $6,000 saved by new budgeters in their first year. YNAB hosted a debt-payoff challenge in 2021 and the average YNAB customer paid off $8,000 during the event. YNAB can potentially provide you a serious return with less stress and more control.

» Sign up for YNAB with our link and you’ll get a 34-day free trial

YNAB features

There are plenty of free budgeting apps out there. Here’s what sets YNAB apart and, in my opinion, makes it worth paying for.

Working balance

Whether you link your bank account to YNAB or add transactions manually, you don’t just see your current available balance (as shown in your online or mobile banking app). Instead, YNAB takes your cleared (available) balance and subtracts any transactions you’ve logged (such as a check you wrote) that haven’t hit your bank account yet.

Cleared balance – uncleared balance = working balance

This is how much money you actually have. Use your working balance to make spending decisions and you’ll avoid overspending your account before a check or recurring payment is processed.

To be budgeted

One of YNAB’s basic rules is to “give every dollar a job.”

The “To Be Budgeted” box at the top of your budget display shows you how much money has come into your account that hasn’t been assigned a job in your budget yet. The goal is to always have TBB at $0.00. This means every cent has been allocated to your regular expenses and priorities. It doesn’t mean that every dollar has been spent .

For example, let’s say you add $100 each to your auto maintenance and vacation categories. That money will remain in your checking account but you won’t spend it because you’re budgeting with YNAB, not making spending decisions based on your available balance.

Setting money aside for both the inevitable (a car repair) as well as the desired (a week at the beach) will keep you from frittering your extra cash away on takeout dinners and other impulse spending that doesn’t reflect your true priorities.

Age of money

The Age of Money feature shows you how long you’ve had your cash without spending it. If your money ages beyond 30 days, you’ve officially graduated from living paycheck to paycheck.

This is one of my favorite features, as it helped me grasp the importance of not spending every cent and building a cushion instead, not just in savings and retirement accounts, but also in my checking account.

You can set a monthly goal for each of your spending categories. For example, if you want to save your $1,000 after getting a new job or for a vacation in 10 months, you’d set a monthly goal of $100 to keep yourself on track.

What I found particularly helpful is the “Payoff Balance by Date” function of goals for credit card accounts. It’s one thing to think, “I’d like to be debt-free by X date,” but is it actually feasible?

With YNAB, you put your balance payoff date into their calculator, which then tells you how much you’d need to pay each month.

You can then decide if that’s reasonable, or if you should make extra money on the side to meet your goal. If not, you can choose a payoff date goal that fits your budget.

To ensure your budget reflects every last cent you bring in and spend, you can add a cash account called “Wallet” to your ledger. Simply manually enter any cash you earn or are gifted, as well as what you spend it on.

This could be especially helpful for people working in hospitality, restaurants, and other professions in which cash tips or wages are paid.

This feature provides a big-picture view of your spending habits and finances. You can see how much you spent in each category over a certain period of time.

Depending on how many accounts you link for tracking, you can see your total net worth of assets minus debt. It’s one of the best net worth tracking apps for an automatic view of your financial health.

My YNAB experience

One side perk of being a personal finance writer is learning about every new budgeting system, high-interest savings account, spare change investment app, and so on. Once I’d read enthusiastic reviews of YNAB in a few different places, I decided to try it for myself.

Here are the five most important lessons I’ve learned:

1. Checking account balance ≠ spending money

I used to simply check how much money was in our joint account when I wanted to know if I could afford to sign the kids up for a new activity or pay someone to paint our bedroom.

If there was enough cash in there, I’d spend it. A few days or a week later, my husband would ask why I’d spent money on x when y bill was scheduled to come out later in the month.

2. Give every dollar a job

The YNAB system actually looks a lot like my father-in-law’s handwritten ledger. He has categories for “next car,” “home repairs,” etc. His actual checking account balance has nothing to do with how much he spends on a dinner out when we visit — that’s dictated by the “Fun Money” category in his ledger.

YNAB essentially digitizes this, helping me see that I shouldn’t spend on home improvement until I’ve saved enough in that category.

3. All credit card charges should be budgeted

One of my favorite things about YNAB is how it holds you accountable for credit card spending. If you currently carry a balance, you can set up a payoff goal and YNAB will help you stay on track for the necessary monthly payments.

It also includes all of your card charges in the “transactions to be categorized” ledger. That cured me of the delusion that credit card spending was somehow separate from my family’s regular budget.

4. Spend way below your means

By reminding me to set money aside for car repairs, medical bills, and the other “unexpected” expenses that are really just inevitable over the course of a year, YNAB has helped me see how far below my net income I should really be spending.

A separate emergency fund is fine, but I now see how much of a cash cushion I should have in my checking account. Done correctly, YNAB eliminates the need for a separate emergency fund or other type of savings account, unless you want one.

5. Change doesn’t happen overnight

When I was young and making a lot less money, I cut my spending naturally. My friends were mostly of the liberal arts variety, too; we didn’t have money to blow on drinking in bars or eating at expensive restaurants. So, we cooked together and shared large bottles of cheap wine in each other’s apartments.

Somewhere along the way that changed. It’s like we all progressed through “lifestyle creep” at the same pace. Now, my biggest expenses are related to my kids, like the aforementioned preschool/childcare costs. There’s only so much I can do about that without quitting my job or putting my kids in an unlicensed facility.

However, I’m embracing the “change happens slowly” mantra. After temporarily giving up on YNAB before I returned to it to write this article, I’m making a daily habit of checking my budget and categorizing my spending. I see the change in my attitudes toward money and everyday spending habits. Eventually, that will translate to more dramatic changes in my finances as I pay off debt and amass that cash cushion.

Who should use YNAB?

People who overspend.

For many of us (myself included), ‘mental budgeting’ isn’t a strong or concrete enough framework to deter overspending. Using YNAB will make you more aware of how much money you actually have, where it’s going, and what you need to change to stop running out of money before the next paycheck.

If you’re trying to budget together (as opposed to letting one person manage the money), YNAB can give you a neutral picture of your budget and money. This may help you avoid arguments and other strong emotions many of us have about spending. It can also empower you to make choices together and celebrate as a team when you reach a specific goal.

As mentioned earlier, the Goals feature is a useful tool for figuring out how much you need to pay monthly to pay off a balance by a certain date. This replaces the hazy sense of “someday” I’ll be debt-free with “I’ll pay off my student loan by January 2025.”

Those with finance-induced stress

Budgeting can benefit both your financial and psychological well-being by restoring your sense of control and agency.

If you feel limited by the info your checking and savings accounts provide, and/or if you don’t have the patience for budgeting manually, paying for an in-depth, automated budgeting solution might be money well spent. $100 a year is worth a significant reduction in stress.

What are the drawbacks of YNAB?

It may not be necessary or affordable for someone living on a budget.

In my current stage of life, with a spouse to co-budget with and two children to support, YNAB helped me get a handle on my complicated finances. But the less money you have, the more aware you are of every cent you have, because there’s no room to mess up. And while I think everyone could get something out of YNAB, It may not be for for someone truly living on a shoestring budget.

If you’re just learning how to start budgeting and trying out budgeting apps for the first time with a financial situation that is relatively straightforward (e.g., you’re single with no children), experiment with a simple, free budgeting app first before you allocate money to an all-encompassing app like YNAB.

The competition

YNAB isn’t the only budgeting software/app. There’s a whole list of best budgeting apps we recommend and some may be better options for you.

We really like YNAB but here are some of those competitor options if $14.99/month or $99/year is above your current price range.

YNAB vs Simplifi

Simplifi not only links to your checking and credit card accounts but also to your loans, savings, and investment accounts – even your 401(k). This means you can see your whole financial picture in one place, which can be very motivating as you work to make changes to your spending habits.

Simplifi by Quicken delivers a fresh personal finance app from an undeniably trustworthy brand to keep up with all of your money in one easy-to-use interface.

You won’t have to spend time bopping from account to account just to see where your finances stand. Instead, you can log into Simplifi to see the big picture at a moment’s notice.

- Provides extensive financial reports

- User friendly experience

- No free version

- No credit score insights

- Cost: $5.99/month with an offer to save annually (+ 30-day free trial)

- Link to bank accounts?: Yes

- Best budgeting feature: You can see your whole financial picture in one place.

Simplifi was created by Quicken which is a powerhouse in the world of financial software. The Quicken products have been used by over 25 million people over four decades. You know you are in good hands.

» MORE: Read our full Simplifi Review

YNAB vs PocketSmith

PocketSmith helps you build better financial habits through a timeline that includes your past and present behaviors. You can see how far you’ve come, as well as where your finances will likely be months and years into the future. This visualization can help keep you motivated as you budget and save.

PocketSmith is an app that acts somewhat like a financial personal assistant. It helps you manage and organize your expenses in a way that allows you to understand your complete financial picture.

You can understand where you spend and then create a financial plan to better organize your spending.

- Excellent budgeting features

- Comprehensive financial dashboard

- Links with multiple accounts

- Pricing can be expensive

- Cost: Free for basic features and paid plans start at $9.99 per month

- Link to bank accounts? Yes

- Best budgeting features: A personalized dashboard where you can see all your “financial key metrics” like your net worth and spending activity

With PocketSmith , you can connect to your financial institution to track spending. The budget-setting feature helps you see the impact your spending will have in future years. PocketSmith is a great app, but if you aren’t interested in seeing your finances on a timeline, you may be better off with YNAB.

» MORE: Read our full PocketSmith Review

YNAB vs MoneyPatrol

- Cost: $59.99 per year (after a 15-day free trial)

- Link to bank accounts? Yes

- Best budgeting features: You can set a spending projection for each expense, and since your spending is monitored, the platform will know when you exceed that budget

Although budgeting and insights are part of MoneyPatrol, the app is really geared toward helping you track your spending. In the process, you’ll learn more about your habits so that you can make adjustments in order to reach your goals.

Summary: Is YNAB worth using?

Since there are plenty of free budgeting apps and tools out there, you may wonder why you should pay for YNAB.

As is often true with personal finance, the answer depends on your temperament and situation. Some people can stick to a new budget or habit without external accountability. For me, the cost is worth it because:

- I think YNAB offers a superior product to comparable free options.

- Knowing I’m paying for it encourages me to use it, just like my gym membership.

» Try YNAB free for 34 days today

Your money deserves more than a soundbyte.

Get straightforward advice on managing money well.

Most financial content is either an echo chamber for the "Already Rich" or a torrent of dubious advice designed only to profit its creators. For nearly 20 years, we've been on a mission to help our readers acheive their financial goals with no judgement, no jargon, and no get-rich-quick BS. Join us today.

We hate spam as much as you do. We generally send out no more than 2-3 emails per month featuring our latest articles and, when warranted, commentary on recent financial news. You can unsubscribe at any time.

- Recommended Reading

- Shareable Images

Select Page

Is YNAB Really Better than a Simple Spreadsheet?

It depends on what simple means to you..

Is it worth it to sign up for a service like YNAB to create a budget? Or can you get by just fine setting up your own ledger in a spreadsheet?

Sort answer, yes. And yes.

For thousands of years, businesses and individuals have been tracking what they earn and spend on paper, clay tablets, and bee’s wax . In fact, the oldest known written document is a 5,000-year-old shopping receipt for clothes .

These people all got by without YNAB. That doesn’t mean that you shouldn’t consider using a specialized tool for the job. Technological advances make the impossible possible and the difficult easier.

So while it’s perfectly possible to implement an envelope-based budget system on paper to plan and track your spending, there are several reasons why YNAB makes the experience better.

- Automatic import of transactions. YNAB will connect to most banks and automatically import your transactions. If your bank doesn’t support this, YNAB can import QFX files, which almost every bank can export. This makes updating the ledger quick, painless, and mostly free of mistakes.

- You can take it with you. Sure, you can throw a spreadsheet into cloud storage somewhere and access it from any device, but it’s going to be a little awkward. In addition to being available on the web, YNAB has mobile apps that are designed for smaller screens.

- Reconciliation is a breeze. YNAB walks you through the process of reconciling your account. When you roll your own spreadsheet, it’s surprisingly complex to allow for cleared and uncleared transactions.

- Budgeting doesn’t require double-entry. On a spreadsheet, you basically need to enter each transaction twice: once in the checking register to reflect you spent $88.37 at Safeway and again on the budget side to track that you used $62.89 on Groceries, $10.48 from Household, and $15 from Gifts. If creating a budget (planning your spending) is the point of the exercise, use an application that handles it for you automatically.

- You’re not alone. Trying to figure out how something works? With YNAB, you have a large community dedicated to your budgeting success. Their support forums are actively monitored, there’s an active subreddit , and they hold frequent training classes to sharpen your skills.

If you want to develop your own spreadsheet, you don’t have to faithfully reproduce every feature. The YNAB team has spent a lot of time refining and fixing what the app does. (This is their day job, after all.)

No app is perfect. There are some valid reasons why you may prefer to craft your own spreadsheet that suits you.

- You have to give YNAB your banking passwords. In order to automatically import transactions from your bank, you have to give YNAB your banking passwords. If that makes your blood run chill, good. It should. It runs contrary to every principle of keeping your accounts safe. It takes no small amount of trust to hand over the keys and assume YNAB isn’t going to cause a problem. If you’re not comfortable doing this, you can still import transactions manually, but you’re losing out on a major convenience feature.

- YNAB may not do everything you want. Software features take time to implement. Once they’re implemented, they take time to maintain. This is why new features get added over time. That’s all fine and good, but if you roll your own spreadsheet, you can have it do exactly what you want and nothing more.

- YNAB may not work the way you want it to. Some features may not work the way you expect them to, and it will take some time for you to wrap your head around how it works. (Although, if you’re honest, your spreadsheet is going to have its quirks, too.)

- It’s another bill. You probably already have Excel, Numbers, or Google Sheets.

- What happens if the company goes away? Should the unthinkable happen and YNAB closes up shop, you’d lose the use of the web app. Hopefully, there would be a migration path to help you export your data. But what then? You’d either need to roll your own spreadsheet at that point or learn another tool (and hope it doesn’t go away).

You can absolutely plan and track your spending using just a spreadsheet. (In fact, YNAB originally was a spreadsheet .) You can create exactly the reports you want to see. You have full control.

That control does come at a price, though. You’ll spend time to set up and maintain the system, and you could spend that time doing something else. If it contains a mistake, you’re the one that has to notice it and fix it.

The question you need to ask yourself is whether you want to spend the time developing a custom spreadsheet or go with an off-the-shelf solution that’s good enough —and honestly, quite great.

The important thing is that you create a written budget every month and plan your spending ahead of time. (Yes, “writing” digitally counts.) Being intentional about your spending is one of the strongest indicators of how successful you will be with money.

Question: Do you plan your spending with an app like YNAB or with your own spreadsheet? Share your thoughts in the comments , on Twitter , LinkedIn , or Facebook .

Never Miss a Post

When you sign up to receive my blog posts by email, you’ll get a FREE copy of The Digital Goal Domination Guide , my new ebook that will show you how to reach your goals using OmniFocus and Evernote. Get more done this year than you ever thought possible!

PLUS, you’ll receive occasional bonus content and special offers, some of it not available on the blog.

You’re subscribed! Check your email for instructions on how to download your book.

.png)

- For Employers

Why Doesn't My Account Balance Match My Budget?

You’re looking at your YNAB budget. Checking account balance: $1,029. But then you look at your bank, and you see your actual checking account balance: $972. Your account balances don’t match your budget! WHY? WHY?!!! Cue: despair, anger, frustration, gray hair (and that’s hair—plural).

After poring over your transactions line by line , you can’t figure out why the account balances don’t match. Instead of a happy reconciliation dance, you’re stomping around with a scowl. At this point, you might be tempted (or MORE than tempted) to just give up on budgeting. Before you throw up your hands to quit, hear me out.

There’s a difference (a big difference) between Bank Time and My Time .

In Bank Time , transactions move along the bank’s timeline, and there’s a lag. They’re always a little behind. That’s because they’re running on Bank Time , not My Time .

I went to the store and bought the groceries on the 3rd, but by the time the bank finished dealing with that transaction and subtracted it, it’s now the 7th.

That lag can get you into trouble because you don’t have up-to-date information. There are certain categories, like groceries, where you need the most recent info, pronto. And this is especially true if you’re budgeting with a partner.

That’s why—for certain categories—we recommend entering things on your timeline—AKA My Time . This protects from Bank Time surprises. You have your own timeline with the most up-to-date information.

YNAB will automatically match these transactions together when Bank Time catches up, so no need to worry about duplicates. And when you reconcile, you’re checking both timelines for agreement. That’s it.

So Where Am I Going Wrong?

Most of the problems we see with account balances are in those early days of learning how to budget. Maybe you had a few pending transactions that get imported (surprise!) on day three. You forgot about them, and now you’re overspent. Or maybe there are some not-even-pending-yet transactions or paper checks out there just waiting to drop a bomb on your budget.

To add to the headache, connecting the bank immediately takes control out of your hands. Things seem to be “happening” to your accounts and your budget before you’ve had a chance to learn how things work.

So, let’s get to the bottom of these headaches and solve them once and for all. I’ve got a simple, easy plan tp turn around this crazy-making reconciliation problem.

If you follow my plan, here’s what’ll happen. You will:

- Wrestle those bank balances to the ground once and for all.

- Understand the timeline between Budget and Bank time, giving yourself (and your budget) a bit of grace.

- Learn how to manage your accounts and the budget much better.

- See the cause and effect of your actions in the app more clearly.

- Have more awareness and be closer to your finances.

Follow my plan for a winning strategy. Here we go:

The 7-Day Plan to Reconciliation Bliss

We’re going to slow things down and go old school here for one week. We’re going to learn to drive a regular car before we get in the self-driving car. You’re going to enter everything yourself for the next seven days. If your bank is available to connect, we’ll eventually connect it near the end of the week—don’t you worry. But we’re gonna ease in.

Day 1: Start Fresh

- Give your budget a Fresh Start.

- Grab your account balances.

- Don’t add your mortgage, car loan, etc. Let’s keep things simple. Just add the accounts you spend from.

- Turn off Direct Import.

- Budget whatever money you have down to zero.

- Add a little extra to the “Stuff I forgot to budget for” category, in case of surprises.

- Log into your bank online and look for pending transactions. Enter them in YNAB and leave them uncleared. Did you budget for them? Make sure you did!

Your checking account might look something like this:

The Amazon charge and the Gas Station charge—I can see they are marked pending at my bank. They will eventually be processed, but I left them uncleared (the gray c) until that happens.

I need to know about them right now to make sure I have up-to-date information. So I entered them and naturally, budgeted money for them.

At the top of that screenshot, you’ll notice a green Cleared Balance. That shoul d match your bank.

Final Step Today: If you spend any money today , enter those transactions yourself when you spend. This will be easier if you keep your spending to one or two accounts.

Day 2: Starting Your Routine

Good morning! It’s a new day. Now we start our routine. Open YNAB and login to your bank’s website or app.

- Did anything clear? Mark it cleared.

- Did you miss one that cleared the bank? It’s okay. Go ahead and enter it and mark it cleared.

- Reconcile every account by opening YNAB on your computer and clicking on the “Reconcile Account” button at the top of the register. For some accounts, this will be super simple. You may not have had any spending at all in the last 24 hours. Great, you’ll hit that button, it’ll match the bank, and you’re done.

- Check the budget. Is there overspending? Fix it.

This routine will get faster as you do it each day. You’ll get this down to just a few minutes very soon.

Go on with your day—I hope it’s a nice one. If you spend any money, enter those transactions yourself as they happen.

Day 3: Pin Categories to Make Things Easier

You made it to day three. Excellent. It’s time for our daily routine.

- Did you miss any transactions? Enter it. There will be fewer of these as we move forward.

- Reconcile every account.

- Continue entering transactions yourself.

But let’s make entering transactions a bit easier today. There are some categories we spend from multiple times a month—the “Out and About” categories. For example:

- Entertainment

You may have a few that are specific to you. (For me, it’s quilting supplies.) Did you know you can pin those categories to the top of the mobile app for easy access? Try it!

Select the category you want to pin, and tap “details”. Then tap the pin icon in the top right corner. Boom. That category is now at the top of the mobile app. You’re welcome.

Day 4: Stay the Course.

Hopefully this is getting a little boring. We’ll do something exciting tomorrow, I promise.

- Did you miss a transaction? Enter it.

- Enter transactions yourself.

Are you noticing a pattern? It’s getting easier now.

Here’s a fun game to play: today if you’re shopping, try to enter the transaction on your phone before the cashier hands you your receipt.

Still having account balance problems? You can enable Running Balance on your computer to make your transaction history easier to see. Make sure you’re looking at the right balance on your bank’s website and that you understand how they are arriving at that number. Some banks subtract pending transactions, some don’t. Every bank is different!

Day 5: Connect One Bank Account

Alrighty. At this point, you’re probably past any surprise pending transactions. (Except maybe for that check you wrote your nephew for his birthday. He may not cash that for months. Note to self: next time, Amazon gift card.)

Anyhoo. Let’s connect your main spending account today. This should be the account you use most often.

YNAB will start importing cleared transactions. But remember—and this is important— Direct Import is running on Bank Time. Direct Import can only enter what the bank reports—and bank time lags. So you still need to enter on My Time .

I do have an exception to this rule, for the sake of practicality. Think about it. Your cable bill gets paid automatically on the 17th. It’s $89 every month. As long as you’ve budgeted the $89 before the 17th, you don’t really care what day it’s imported. So if you want, you can let the bank import those types of transactions.

However, for those “Out and About” categories, we recommend still entering those on your mobile device when they happen. Keep operating on My Time . This is how you stay ahead of Bank Time .

The routine is almost the same.

- Was anything imported? Categorize and approve!

- Did you miss one? Enter it. Or you know what, YNAB may catch it for you on the import. Sweet.

- Enter transactions yourself in your “Out and About” categories.

Day 6: Nailing the Routine

- Did you miss one? Enter it.

It should be getting easier now.

Pro tip: Did you know a paycheck is just another transaction? When you get paid, enter it and categorize it as To Be Budgeted. Then head to the budget and give those dollars jobs.

Day 7: Keep Doing All The Things!

You should be feeling pretty good by the end of day seven. Connect another spending account if you have one. I’m honestly hoping you don’t have too many . But every few days, connect one until they are all connected.

You Made It!

That’s it! Seven days are complete! What you’ve just done is learned to drive a regular car before you drive a self-driving car. Now you know how to handle everything— Bank Time and beyond—and can always take back the wheel if things are getting out of control.

Now, do you have to reconcile every single account every single day? Probably not. Your savings account probably doesn’t have a lot of activity. I reconcile mine once a week. In fact, you could do this routine on a schedule that works for you. But we do strongly recommend reconciling all your accounts at least once a week.

Why? Because if something is off, you’ll have fewer transactions to sort through to find the problem. During this exercise, if something was off, we only had one day of transactions to sort through. Imagine if things were off and you had to sort through a month of transactions. In other words, if you’re looking for a needle in a haystack, you want the haystack to be as small as possible.

Thanks for sticking with me. I’m wishing you endless reconciliation dances for the future. Happy budgeting!

COMMENTS

Budget/Budgeting: Budgeting involves making a realistic, flexible plan for the money that you have in your possession right now. It should ideally feel less like a diet, and more like a well-balanced meal plan that includes your favorite things. Budgeting isn't a set-it-and-forget-it one-time activity.

YNAB is envelope budgeting, except the envelopes are called categories and it has an annual fee. Assigned = how much money you put in the envelope this month (negative if you moved money from that envelope to another envelope instead) Activity = spending or income from this month to this catehory. Available = the amount of money in the envelope.

When you add money to a Budget account, it appears in Ready to Assign. This article covers three different ways you can assign money to your budget.

Current Month's Assigned + Current Month's Activity + Last Month's Available (only if it was a positive amount) = Current Month's Available. Note that these can be positive or negative, but the calculation will be balanced. In particular, Assigned is a very manual line item.

First, login to YNAB. Then hover over "My Budget" and click "Make a Fresh Start" in the top left-hand corner of the screen. You'll see this pop-up with reassuring bolded text (See? I told you that YNAB saves a copy of your old budget!): Enter a name for your new budget, I'll use "My Budget2" and click "Continue," and you ...

This keeps the refund from being counted as income or from being counted as new money to the clothing category. For real income, allow the paycheck to inflow into To Be Assigned. Now YNAB knows this isn't a refund, this is real income and it will account for it accurately. Then you can assign it to categories.

Scenario 2. Let's say that, after you charged $100 for clothing on December 5th, you pay your card in full on the 21st. You don't realize that swoveralls aren't the new hotness until January (Egads, you've already made the credit card payment!). That $100 refund will show up, in red, under your credit card category.

Schedule Future Income Transactions. The real power of YNAB—to make good decisions with your money and use it to live the life you want—comes from only using what you currently have. Of course, it's important to plan for what's next. You won't assign future income, but you can still anticipate its effect and set yourself up for success.

When a new month starts in your budget we call this the monthly rollover. Here's what changes in your budget and how to trust your numbers going forward!

YNAB costs $14.99 billed monthly, or $8.25 per month billed annually at $98.99. Both plans have a 34-day trial period - clever and useful to showcase the impact the service can have across a ...

Assigned vs available? Im looking at the home page of YNAB on mobile compared to my bank app and there is some small descrepancies. Can anyone explain what the difference is between the assigned column and the available column? Maybe thats why my arithmatic isnt working out.

YNAB scored 3.8 out of 5 stars on Trustpilot . While most reviews were positive, the negative reviews complained about the price and lack of access to the product outside of the United States. The tool earned 4.8 out of 5 stars on the Apple App Store. Over 38.8K people reviewed YNAB on this platform.

4.0. Money Under 30 rating. YNAB is an excellent app for people who have repeatedly mishandled their finances in the past and/or are in a shared financial situation, like a marriage. YNAB helps you set a monthly budget in a way that actually teaches you about money management while helping you stay on target and potentially saving you thousands.

Auto-Assign is a feature in YNAB that makes budgeting simple and fast. It has numerous options, allowing for flexibility as you assign your dollars.

Choose your own Auto-Assign Adventure from these options. Underfunded: This option will budget enough to fund your targets in their order of priority, in addition to covering upcoming transactions and overspending.We'll go into more detail about that below. Assigned Last Month: If you generally assign the same amounts to your categories, you can select this option to avoid toggling back and ...

In YNAB terms, there's no need to create a new budget from scratch, just use the fresh start option. ... Last Month's Available + This Month's Budgeted + This Month's Activity = This Month's Available. So last month you had $79.70 Available left over. This month so far you had $5 spending in that category and transferred $74.70 to another ...

YNAB has a unique language for actions and features in the app. This guide can help translate some of those key terms!

If not, you need to find the missing transaction in YNAB, or you need to just give up and reconcile the difference. Then in your budget, if all the Available lines are $0, that's when your account will match the [Ready to Assign] number up top. But that's not how it should be used. [Ready to Assign] should always be at or very close to $0.

Sort answer, yes. And yes. For thousands of years, businesses and individuals have been tracking what they earn and spend on paper, clay tablets, and bee's wax. In fact, the oldest known written document is a 5,000-year-old shopping receipt for clothes. These people all got by without YNAB.

I need help reconciling my accounts! Because you use YNAB to make spending decisions, your records in YNAB need to be in complete agreement with your bank's records—this process is called reconciliation. Getting Started with Reconciling Accounts. Read. Reconciling Accounts: A Guide.

When Ready to Assign is negative, this means you have overassigned. Here are several scenarios that can cause this—and how to fix it!

You budget for them by, one time, moving enough money from another category to the credit card category. Then you just set the card to auto pay the statement balance and when the statement arrives, you enter a scheduled transaction for the statement balance on the autopsy date. 2. Reply. somanyquestions333.

Reconcile every account by opening YNAB on your computer and clicking on the "Reconcile Account" button at the top of the register. For some accounts, this will be super simple. You may not have had any spending at all in the last 24 hours. Great, you'll hit that button, it'll match the bank, and you're done.