- Starting a Business

Our Top Picks

- Best Small Business Loans

- Best Business Internet Service

- Best Online Payroll Service

- Best Business Phone Systems

Our In-Depth Reviews

- OnPay Payroll Review

- ADP Payroll Review

- Ooma Office Review

- RingCentral Review

Explore More

- Business Solutions

- Entrepreneurship

- Franchising

- Best Accounting Software

- Best Merchant Services Providers

- Best Credit Card Processors

- Best Mobile Credit Card Processors

- Clover Review

- Merchant One Review

- QuickBooks Online Review

- Xero Accounting Review

- Financial Solutions

Human Resources

- Best Human Resources Outsourcing Services

- Best Time and Attendance Software

- Best PEO Services

- Best Business Employee Retirement Plans

- Bambee Review

- Rippling HR Software Review

- TriNet Review

- Gusto Payroll Review

- HR Solutions

Marketing and Sales

- Best Text Message Marketing Services

- Best CRM Software

- Best Email Marketing Services

- Best Website Builders

- Textedly Review

- Salesforce Review

- EZ Texting Review

- Textline Review

- Business Intelligence

- Marketing Solutions

- Marketing Strategy

- Public Relations

- Social Media

- Best GPS Fleet Management Software

- Best POS Systems

- Best Employee Monitoring Software

- Best Document Management Software

- Verizon Connect Fleet GPS Review

- Zoom Review

- Samsara Review

- Zoho CRM Review

- Technology Solutions

Business Basics

- 4 Simple Steps to Valuing Your Small Business

- How to Write a Business Growth Plan

- 12 Business Skills You Need to Master

- How to Start a One-Person Business

- FreshBooks vs. QuickBooks Comparison

- Salesforce CRM vs. Zoho CRM

- RingCentral vs. Zoom Comparison

- 10 Ways to Generate More Sales Leads

Digital Disrupt: What We Can All Learn From the Netflix Model

Table of Contents

The past 20 years have been a fantastic journey in the world of technology, drastically changing the complexion of most businesses that survived the ride. For example, Netflix went from a modest DVD movie-rental subscription model to a digital media powerhouse that forever changed how we view entertainment.

Netflix’s ability to pivot, stay ahead of the competition, and set trends provides lessons for all businesses seeking success, growth and longevity in the digital age. We’ll take a closer look at Netflix’s journey, how it disrupted the media landscape, and what we can learn about digital transformation and innovation.

The evolution of Netflix

Netflix’s evolution is a modern tale of pivoting, staying ahead of the competition, and recognizing opportunities. Here’s a brief history of Netflix:

- Snail-mail DVD subscription service. Netflix started its snail-mail subscription service in 1999. Internet speed was slow, and there was nowhere near today’s digital infrastructure. Streaming technology as we now know it didn’t exist, and Netflix was about ordering your movies online and having them delivered to your mailbox.

- Almost an early exit. Most people felt Netflix’s DVD-rental business wasn’t a scalable model and would die on the vine. Netflix didn’t disagree; in 2000, the company sought a $50 million buyout from Blockbuster, but Blockbuster wasn’t interested.

- Fine-tuned business model. Netflix figured out how to fine-tune its distribution model for fast mail delivery. Still, users had to plan their entertainment at least two days ahead of time – for example, by ordering movies on a Wednesday to arrive for weekend viewing. Video stores like Blockbuster continued to prosper for last-minute needs.

- Pivot to streaming video. As technology improved, Netflix started providing streaming video for its ballooning customer base. Its customers enthusiastically welcomed the new model. Streaming video wasn’t a new idea, and competitors lurked on the sidelines. Still, Netflix’s ample, established customer base gave the company an advantage in this burgeoning arena. Blockbuster tried to follow Netflix into streaming, but it was too late for both Blockbuster and its movie-rental competitors.

- Content giant. With viewers enjoying more streaming entertainment, Netflix branched out into original content, creating award-winning movies and series. It has fierce competition from the likes of Hulu, HBO Max, Apple TV and many more services.

What can we learn from Netflix’s success?

Here are some lessons we can learn from Netflix’s continued success:

- Stay ahead of competitors. Netflix has been an innovator throughout its history. Being the innovator meant it was ahead of the competition at every step. Netflix revolutionized how people rented DVDs, innovated with viewer subscriptions, pivoted to online streaming, and turned itself into an award-winning content producer. Netflix is a household name and industry marker. Similarly, businesses should try to beat the competition by staying one step ahead in technology, service, operations and more.

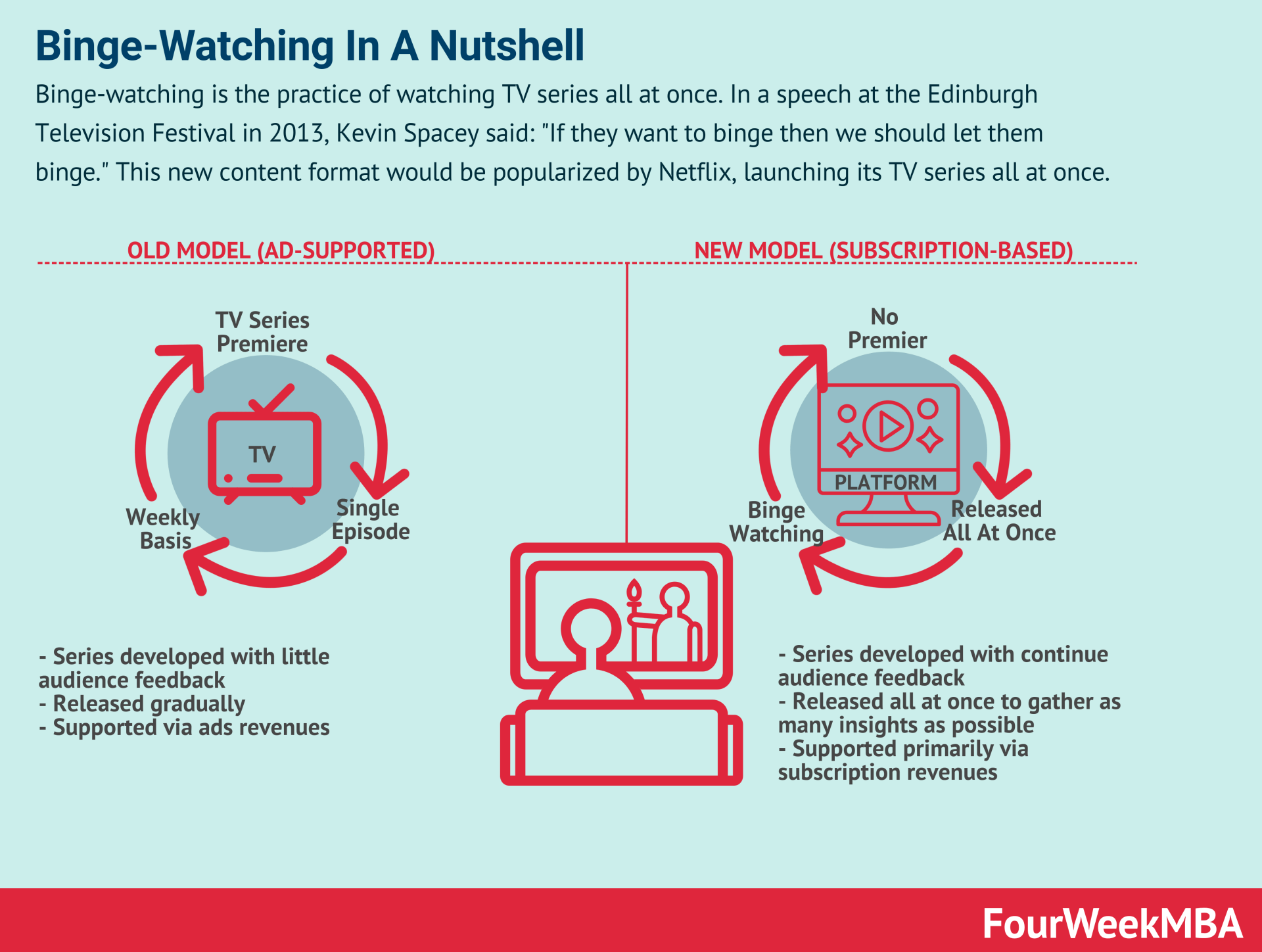

- Set trends. Netflix introduced the concept of binge-watching, so consumers didn’t have to wait for a new episode of their favorite show each week. Binge-watching became an entertainment cornerstone, particularly during the pandemic. But setting trends means mixing things up, and Netflix is showing signs of new watch models. For example, with high-interest shows such as Stranger Things , Netflix is testing weekly releases. In your business, monitor technology trends and see how you can implement them to set new standards in your arena.

- Be opportunistic. Netflix took the leap into independent film production and distribution with hit shows such as Orange Is the New Black and The Umbrella Academy . Going from a streaming service to a filmmaker was a big step, but Netflix saw an opportunity to meet the demands of its target audience . Similarly, look for ways your business can seize opportunities and stay ahead of the competition.

- Focus on the consumer experience. Netflix makes the experience about the consumer. The navigation menu is intuitive and highly praised, and the system tracks what you watch so Netflix can recommend similar content. These elements help to improve the user experience and build customer loyalty . In your business, get customer feedback and insights to improve your systems and services.

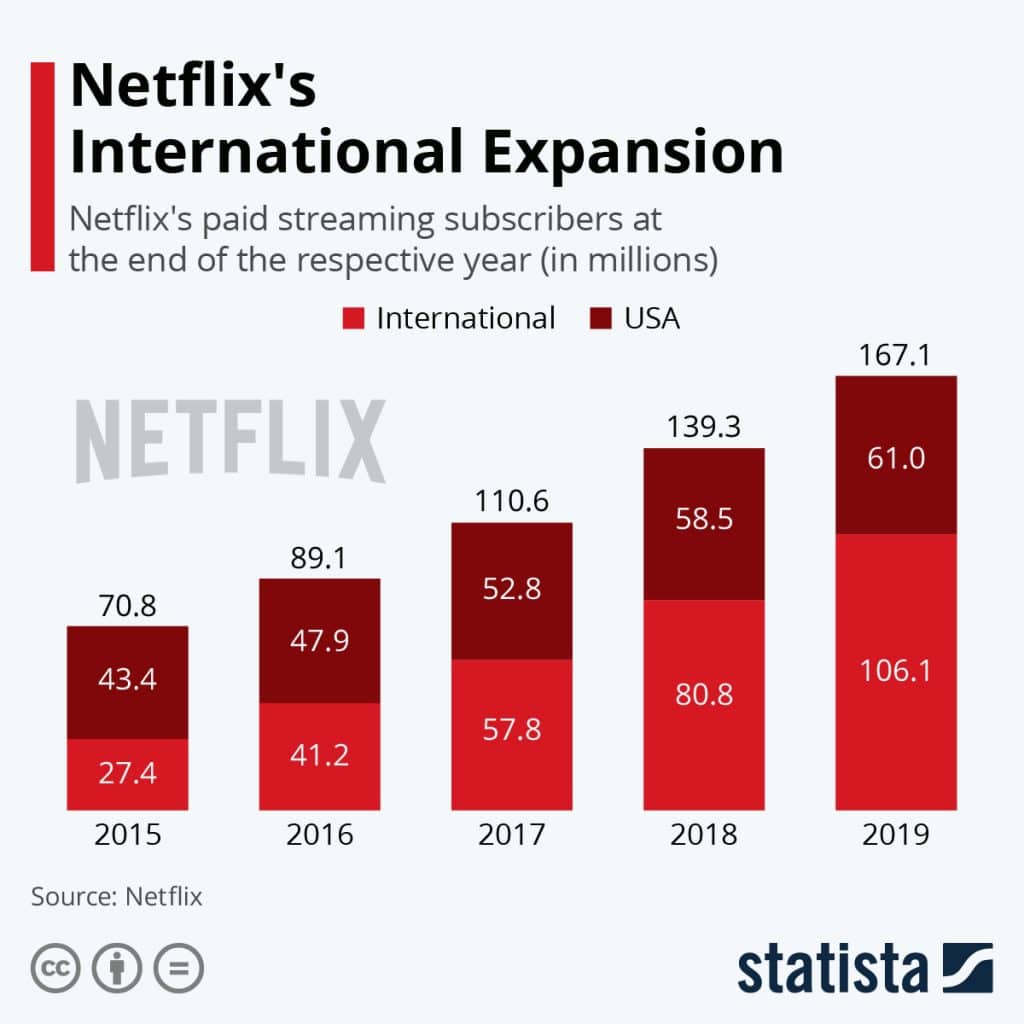

- Expand wisely. When Netflix decided to go global, it didn’t just roll out the same platform of shows and movies to everyone; the company researched each country’s target audience to customize the user experience. Today, Netflix streams in more than 190 countries. In your business, scale carefully. Ensure you don’t grow your business too quickly , and research your customers’ needs.

What can we learn from Netflix’s growing pains?

Recent choppy waters indicate there may be additional digital media and business pivots ahead for Netflix.

In August 2022, Netflix lost more than 200,000 users – the first time it lost subscribers since 2011 – and its stock spiraled. Although those lost subscribers represented only 0.1% of Netflix’s customer base, the loss caused the company to assess content strategies in new ways.

For example, at the Cannes Lions advertising festival, Netflix co-CEO Ted Sarandos said the company plans to partner with Microsoft to test an ad-supported, lower-priced subscription level. It has also begun releasing some shows weekly or monthly instead of all at once – a departure from its “binge” reputation – and has started cracking down on rampant password sharing.

Netflix must also contend with other streaming platforms that produce excellent original content – an area where it once stood unchallenged.

As Netflix faces industry changes and pressure from the competition, it will likely strike a balance between continuing to do what made it successful and staying ahead of the competition by pivoting and identifying new trends. Netflix is sure to remain a streaming and original-content leader, but it also must continue to innovate.

Examples of industry disruptors like Netflix

Netflix isn’t the only digital disruptor. Here are some other major examples of innovation by industry leaders:

1. Apple’s iTunes changed digital content distribution.

iTunes was the first major system for providing widely distributed digital content, and the concept turned the music industry on its ear. An antiquated system of music production, distribution and sales gave way to the new method of paying for only what you wanted and accessing it immediately.

Industry resistance to the iTunes distribution model was fierce, but iTunes prevailed. Artists could even self-produce and release music without studios or physical music stores.

Today, iTunes has pivoted to become the Apple Music app, which lets you stream and download millions of songs and access your music library.

2. eBay’s auction marketplace was one of the first “killer apps.”

eBay was founded in 1995 as AuctionWeb and went public in 1998. It was, in fact, the first “killer app.” The online auction model quickly took hold and became a favorite of internet-savvy users.

Initially, traditional retailers weren’t concerned because eBay was considered a place where people sold their “junk.” However, eBay became an e-commerce player with PayPal digital payment integration and took on the features of more traditional online sellers, such as implementing a “Buy It Now” button to avoid auction haggling.

3. Amazon started with books and became an e-commerce powerhouse.

Amazon’s book sales proved that the internet was a hugely scalable retail platform that didn’t require a massive real estate and workforce investment. Still, many retailers didn’t see the promise. The thought of shipping costs, packaging and returns gave them a headache, and adoption was slow.

However, Amazon began selling more than just books, and the concept exploded. At the same time, shippers such as UPS and FedEx saw the promise of this digital retail world.

Today, Amazon is the undisputed e-commerce leader, with offshoots such as Amazon Prime, Amazon Prime Video and its own digital devices. There are even Amazon business features to help small businesses.

What other industries are being disrupted?

Here’s a glance at some other industries undergoing digital disruption.

Keep an eye on innovation in your industry

Digital technology has been a massive disruptor in many industries, including retail, entertainment, communications and travel. Trying to track industry trends and predict their impact is complicated. However, seemingly unrelated or new innovations can damage your business or industry if you don’t take notice – and you can be sure someone will.

Sometimes, businesses have invested so much in infrastructure that it’s almost impossible to turn the ship, so getting an early start is crucial. Digital makes everything fast; it won’t take 30 years to scuttle an outdated business concept. No matter your industry, keep an eye on digital innovations and look toward the future.

Kimberlee Leonard contributed to the reporting and writing in this article.

Get Weekly 5-Minute Business Advice

B. newsletter is your digest of bite-sized news, thought & brand leadership, and entertainment. All in one email.

Our mission is to help you take your team, your business and your career to the next level. Whether you're here for product recommendations, research or career advice, we're happy you're here!

How Netflix Moved Operations to the Cloud and Saw Revenue Boom: A Digital Transformation Case Study

Remember the time you had to request mail-order DVDs to catch the latest flicks while munching popcorn on your couch?

Me neither.

It’s strange to think that about a decade ago, streaming giant Netflix had a business model built around direct mail.

Request a movie, put a few in your queue for next time, and let the anticipation build as you wait for your first DVD to arrive on your doorstep.

Now, our instant gratification bells ring daily as we pour through episode after episode of new material. And, we can barely remember the (dark) time where we waited days for entertainment instead of having it literally at our fingertips.

The shift from mail-in orders to a cloud streaming service improved customer satisfaction and made Netflix billions.

The company’s move to the cloud came with a hike in customer loyalty and a brand that competitors still fight tooth and nail to beat in the market.

Netflix serves as the ultimate digital transformation case study.

They transformed their entire business model and charted unprecedented waters. Here’s how to use their model as inspiration for your contact center’s digital transformation.

How to move your operations to the cloud, Netflix style: A digital transformation case study.

21 years after they started renting DVDs, Netflix now sits at a valuation of almost $145 Billion .

They came to market as a disruptor of traditional video stores like Blockbuster and Family Video.

Netflix founders Reed Hastings and Marc Randolph wanted to bring customer-centricity to the video rental market. At the time, renting videos was inconvenient and costly, with customers often plagued by expensive late fees.

They created an entirely new way to watch movies and consume content. And as time went on and subscribers grew, they continued to shift to keep pace with new consumer demands.

In 2007 , they took their first step into the world of streaming video. They offered customers a streaming subscription in addition to the more traditional DVD rental service, giving customers the option to chart their own path.

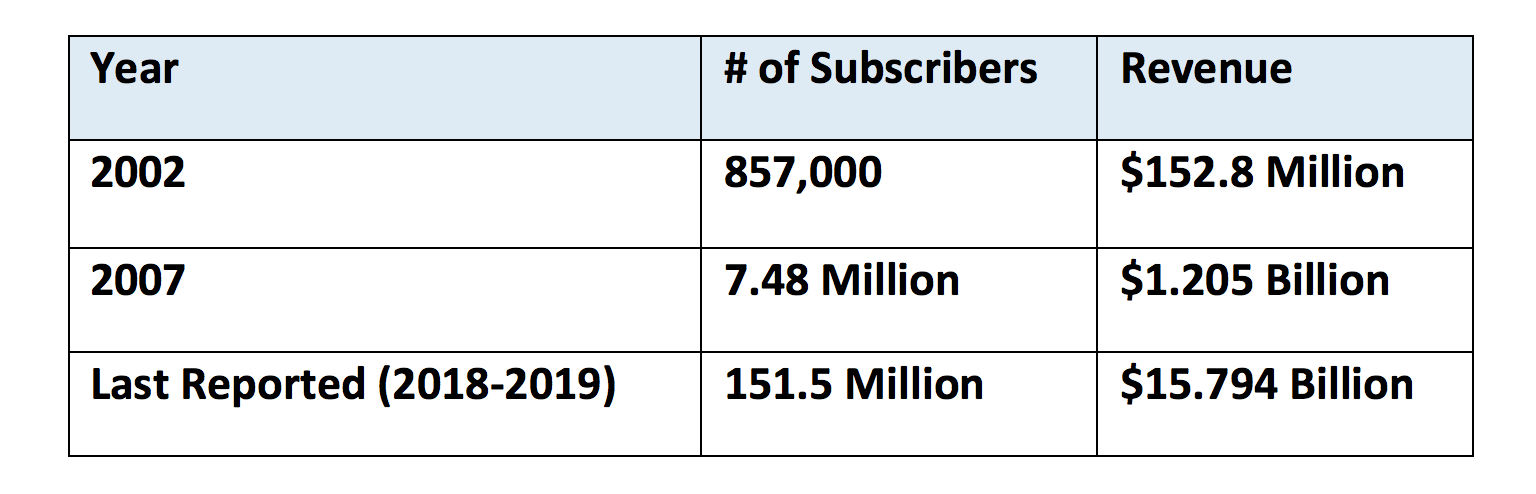

Since then, they’ve seen exponential growth in subscribers and revenue. Let’s take a look at their trends over time. We’ll skip over the first few years of the company’s infancy and jump to the year the company went public.

Here’s how Netflix has grown since 2002.

That incredible growth trajectory, and willingness to change, made Netflix stock skyrocket by 6,230% in a 10-year period.

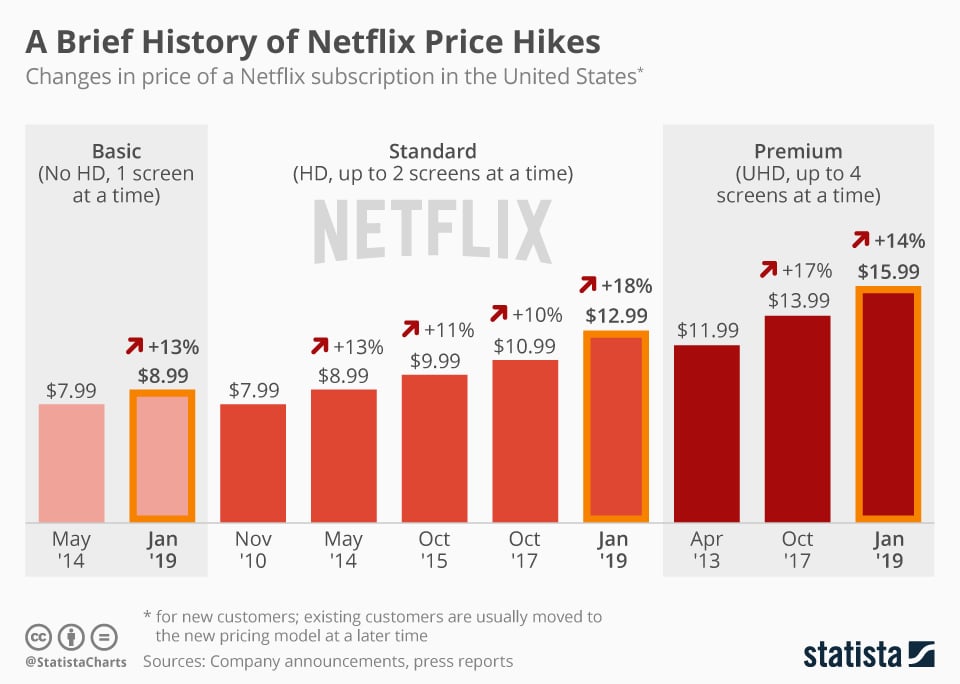

And, they did it all without crazy price hikes, keeping customers top-of-mind.

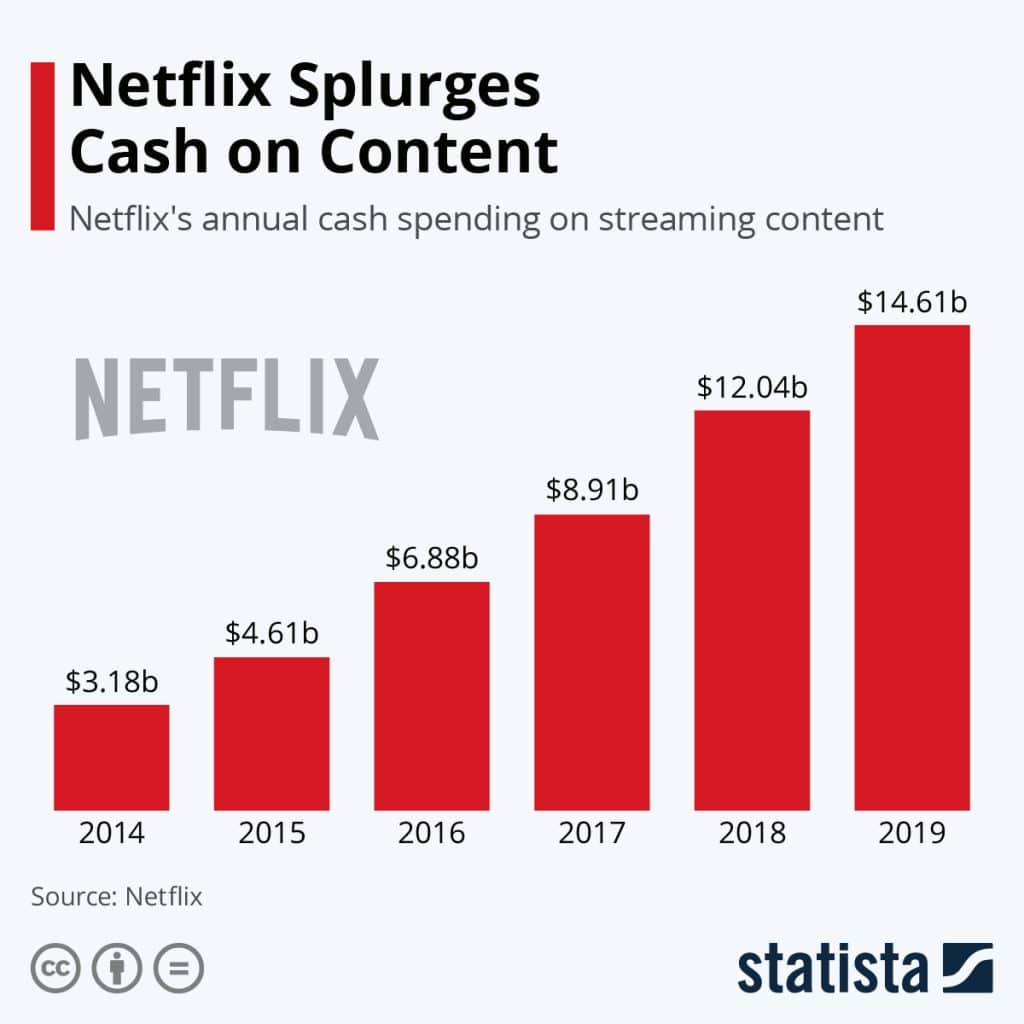

While Netflix has adjusted prices over the years, they strike a balance by adding more value and services for the dollar. In 2019 , the Basic plan increased by $1 a month (adding up to $12 annually). While the Standard and Premier plans rose by $2 per month, (adding up to $24 annually, for each plan).

Meanwhile, the company is putting some $15 billion towards creating new content binge-watchers will love.

After this price change, Netflix saw a slight blip in subscriber growth, with growth in Q2 coming in low. But, analysts don’t think for a second it’s the beginning of a downward trend. In fact, a similar event happened back in 2010 when Netflix moved to a pricing model that broke out streaming and video rentals. And they clearly rebounded.

When you put the numbers into perspective, you see this is the first dip in subscriber growth in nearly a decade. That’s pretty remarkable. And, revenue still increased for the quarter. It’s clear the value of the digital innovator’s services still outweighs the cost for most.

Plus, if you can post positive revenue numbers for over a decade and become a multi-billion-dollar company in about 20 years, you’re doing alright.

Here’s what Netflix did to reach these lofty heights. And, how you study the same tactics to lead your contact center through a successful digital transformation.

Stay true to your vision.

Netflix started out with the idea to make it easier and less expensive for people to watch movies.

But they didn’t want to stay in the DVD game forever. They had the foresight to predict that consumer behaviors would continue to shift. And, they wanted to stay ahead of the competition.

Only, they didn’t sacrifice their vision when it came time for company-wide changes. Instead, they realigned their business strategies to fit their vision, even as consumers and trends shifted.

What you can do:

As you make digital shifts in your contact center and your company, keep your vision constant. While tons of other factors may orbit around you, your vision keeps you grounded.

Use your company vision to guide your decision-making. And, use data and trends to predict how your customer behavior will shift.

As you shift to keep pace with your customers’ needs, align your operations to your customer behaviors to realize your vision.

Reinvent the wheel if the old one doesn’t solve customer problems.

Netflix soared from seed idea to a $145-billion-dollar valuation in only 21 years. (Wow, they did that in less time than it took big tech vendors to break CSAT scores.)

And they didn’t get there by spinning up a new-and-improved version of Blockbuster.

Ted Sarandos, Head of Content at Netflix said when he came on board at the early stages of the company founder Reed Hastings used his vision to scale and innovate at Netflix.

“We never spent one minute trying to save the DVD business,” said Sarandos .

The company leaders didn’t stick to traditional best practices because they no longer worked for modern customers.

Instead of piggybacking off what other companies did, Netflix solved problems differently. And, they solved them better. The proof is in a bankrupt Blockbuster and dwindling Family Video stores.

Want to know what you’re missing when you only look at digital transformation best practices? Pop over to our article on the topic.

Tailor your path and contact center strategies to your specific business needs. Focus on listening and understanding your customers, with the help of better data and customer surveys .

Find out what’s causing your customers’ pain. See what common questions your customers have. Work with your sales team to find out why customers are fleeing competitors. Discover why they choose your products and services in the first place. Then, work with your contact center and company leaders to develop the methods to solve these pains.

Don’t get caught up in what your competition is doing. What they’re doing might work, but your actionable data and customer information can guide you to a way that works better.

If you’re going to be consumed by one thought, let it be this one: how might we better serve our customers?

Don’t force your customers down a single path.

In the early phases of Netflix, internet speeds weren’t built for streaming movies. People who tried to download and view movies online were only frustrated by the lengthy, often interrupted experience of watching a film online.

Netflix didn’t want to enter the streaming market until the right infrastructure was available to support a platform with high-quality and high-speed content. They didn’t want to taint their brand from day one, linking the Netflix name to all the baggage that came with poor streaming experiences.

At the same time, they were watching postage prices. The price of postage kept rising, and internet speeds were on the ups. By watching how the market and internet infrastructure changed, they identified the right moment to launch their first streaming service.

They tested their streaming service with lower-quality video, first. They wanted to gauge interest and customer experience without canceling their bread-and-butter DVD service.

Those who wanted access to the crisp DVD picture could still order movies to their doorstep. Others who wanted instant access could forgo the high-quality picture for convenience, instead.

Your contact center and customer experience will change. It has to. But as you make changes and shift your operations to the digital era, keep options open for your customers.

Just because chat and email are on the rise as popular customer service channels doesn’t mean every customer wants to use them. Use past data and communication history to learn more about your customers. Then, coach your agents to handle each interaction based on the customer’s preferences.

Bringing changes to your contact center has the potential to transform your customer experience for the better. But, without careful intention, it can also cause friction. Introduce changes to your customers slowly, and make sure your agents are always there to offer extra help through the process.

Use data and trends to personalize your customer experiences.

This one’s huge. It’s how Netflix keeps customers engaged with their platform, and how they coined the term binge-watching

As Netflix made changes in their operations, they watched their data like a hawk. They looked for trends on how people watched content, what kept them watching, and how personalization fueled content absorption. Then, they used an algorithm to serve up content tailored to their customers’ specific interests.

“Like a helpful video-store clerk, it recommended titles viewers might like based on others they’d seen.” – Twenty Years Ago, Netflix.com Launched. The Movie Business Has Never Been the Same , by Ashley Rodriguez for Quartz .

And, as their new cloud-based business let them scale globally, their data points multiplied.

Previously, Netflix could only mail DVDs to U.S. customers. Shipping DVDs overseas wouldn’t have been financially sustainable while keeping prices fair for all customers. Moving to an online business model allowed Netflix to target and reach new audiences without taking on the costs of shipping globally.

Doing this not only scaled their business, but it diversified their data and made their algorithm smarter. Enter, extreme personalization and binge-watching fever on a global scale.

Track and analyze data from your customer interactions. Create custom reports and dashboards to distill important findings from your data. Then, use the trends and patterns you find to personalize your customer service experiences.

From the way you send customer surveys to the tone your agents use, your interactions tell you what your customers want. Lean into your analytics for valuable insight into how to help your customers.

And, use the data to transform your contact center too. Customer data is a powerful tool to drive business change. If your metrics show customers aren’t happy, your company leaders want to know about it. And, they’ll want to fix it. There’s no better case for company transformation.

Netflix took risks to transform their business. But, there’s no bigger risk than stagnation. Staying the same doesn’t help you reach your contact center goals. Innovating and trying out your big ideas is what separates the leaders from the laggards.

Can your tech vendor survive in your digital transformation?

Learn how to choose vendors who make your transformation strategy possible.

- Search 86128

- Search 96762

- Search 59024

Netflix Business Model (2023) | How does Netflix make money

Last Updated: Feb 3, 2023

Company: Netflix, Inc. Co-CEO: Ted Sarandos & Greg Peters Year founded: 1997 Headquarter: Los Gatos, USA Type: Public Ticker Symbol: NFLX (NASDAQ) Market Cap (Feb 2023): $ 162.95 Billion Annual Revenue(FY22): $ 31.6 Billion Profit |Net income (FY22): $ 4.49 Billion

Products & Services: Netflix Official Website | Monthly Subscription Plans | Video Recommendation-Algorithm System Offerings Streaming Options Domestic (featured tool) | International Streaming Options and Features Competitors: Amazon Prime Video | HULU | YouTube | Direct TV | Sony PlayStation’s Vue | HBO | Sling TV | HotStar | Disney + | Apple TV+

Table of Contents

Introduction to Netflix, Inc.

Netflix, Inc . happens to be one of the most successful entertainment mass-media-companies of all times. Netflix, Inc. originally began its inception in 1998 by providing services to customers through means of mailing out physical copies of movies, shows, video games and other forms of media through standard mailing system.

Through its successful startup and the rapid changes that technology introduced over time, Netflix converted its business model . They went from physical copies handouts to allowing customers streaming their favorite contents from the comfort of their own convenience.

Today, the platform has advanced to streaming technologies that have elevated and improved Netflix’s overall business structure and revenue. The platform provides its viewers the ability to stream and watch a variety of TV shows, movies, documentaries and much more, through means of using a software application.

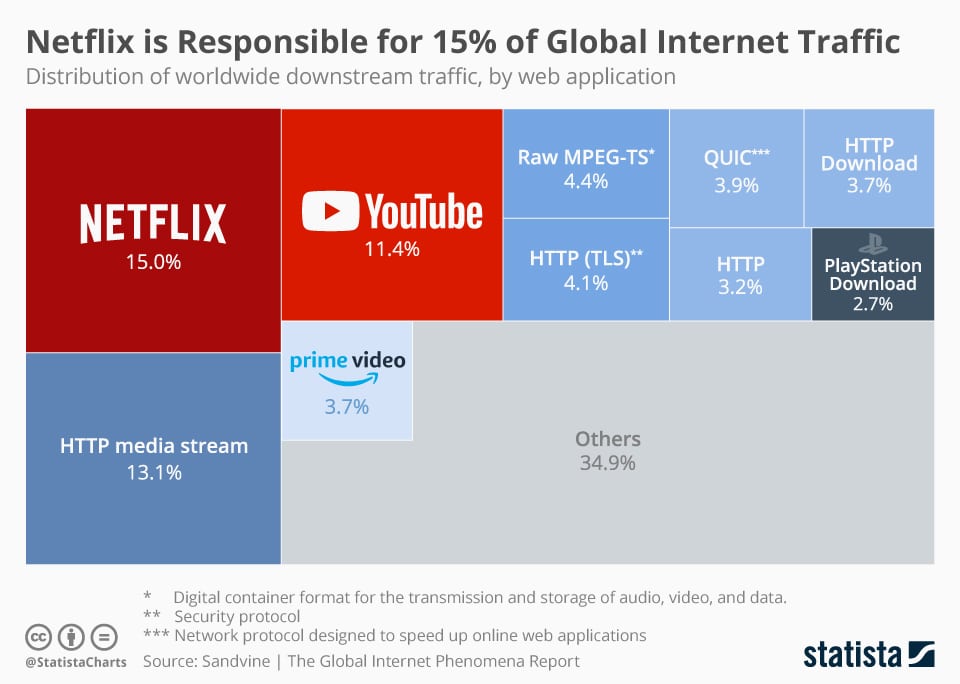

Since Netflix converted to streaming, it is the world’s ninth-largest internet company by revenue , ranging its presence at a global scale. The following is a compilation that comprises specifications of Netflix’s business canvas model and its core operations.

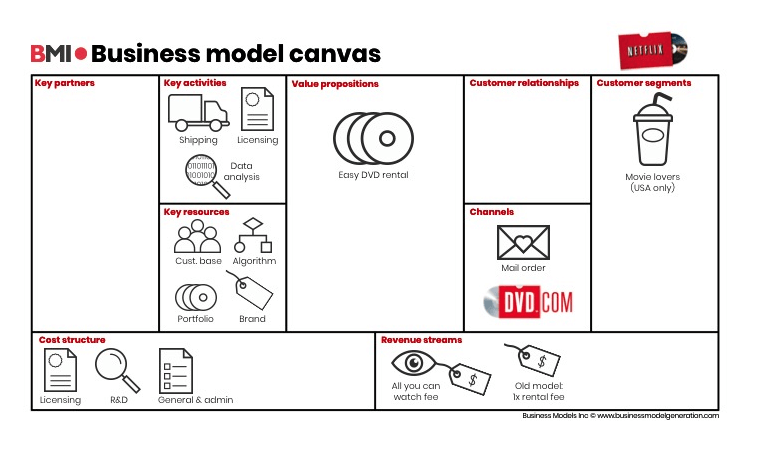

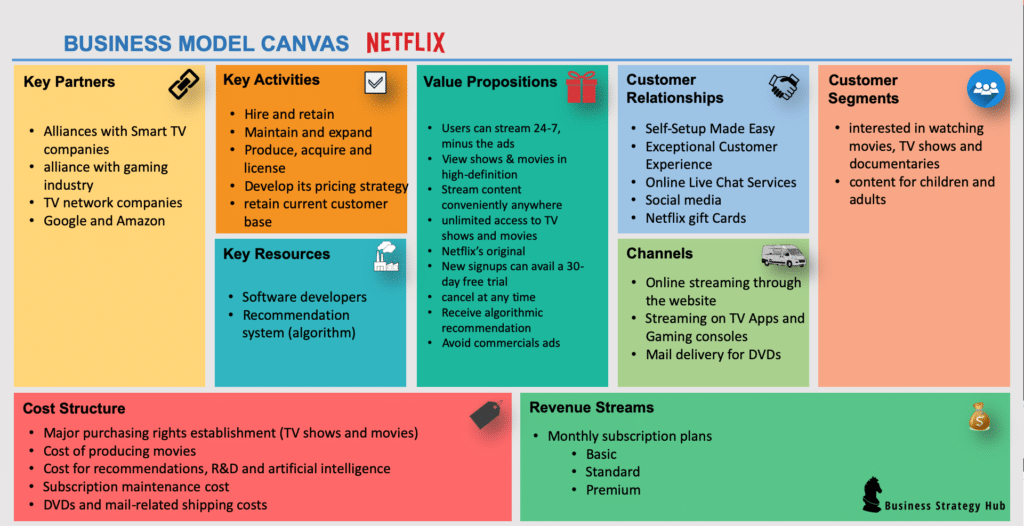

Business Model Canvas of Netflix

1. Netflix’s Key Partners

Netflix has built more than 35+ partners across the media business. Netflix today has millions of different types of genres for subscribers to select from and enjoy watching.

- Built alliances with Smart TV companies like LG and Sony for new emerging markets and several other aspects.

- Netflix has set an alliance with Wii , X-Box , PlayStation and many other brands in the gaming industry. Netflix built partnerships to provide and cater its “ gamer-clients ” with an entertainment video game.

- Netflix joined forces and partnered with Dish, Tivo and other TV network companies.

- Netflix crucial phase of converting the business from mail-in-system to streaming, Netflix established a partnership with Apple , Android, and Microsoft .

- Finally, Netflix joined the network and big data providers like Google and Amazon . (Amazon was accompanied to promote Netflix listings and subscription options)

- Netflix recently partnered with Samsung to further integrate its streaming service with Galaxy smartphones. In exchange, Samsung users will benefit from Netflix’s original shows and special bonus content.

- To expand in West Africa more aggressively, Netflix partnered with Nigerian filmmaker Mo Abudu , the owner of Ebony Life TV. This partnership will enable Netflix to create new content targeting consumers in West African nations.

2. Netflix’s Value Propositions

Netflix strategizes methods and aims to provide the best customer experience by deploying valuable propositions.

Here are a few of what Netflix idolizes:

- Users can stream 24-7, minus the ads !

- View shows & movies in high-definition

- Stream content conveniently anywhere without going to a DVD store or theatre

- Get unlimited access to TV shows and movies

- Access to exclusive Netflix’s original movies or shows

- New signups can avail a 30-day free trial ( 1 month free of services )

- Contract-oriented but can cancel at any time !

- Access locally-produced and culturally-relevant content

- Receive algorithmic recommendation for new items to watch

- Avoid commercials ads- Some people like looking at commercials and other advertisements and some people avoid them.

- At Netflix, users have the flexibility to either turn on notifications and suggestions or keep them switched off.

- Netflix “ user profiles ” gives leverage for users to personalize their user account and preferences. The User profiles allow the “admin-user” to modify, allow or ever restrict certain users

- Sharing accounts options is one of the rarest features a movie platform can provide. Sharing accounts feature on Netflix allows spouses, friends or even groups to share an account with specific filters and preferences already set.

- Netflix solves the issues with theaters and mainstream media that frustrated most consumers. The company promises to solve the problems of its target with four simple words – Watch Anywhere. Cancel Anytime .

3. Netflix’s Key Activities

- Hire and retain software and tech geeks

- Maintain and expand its platform on the website, Mobile apps, TV apps.

- Produce, acquire and license Netflix’s original content to expand its video library

- Develop its pricing strategy and subscription model to ensure affordability and new customer acquisition.

- Develop a roadmap to enter into the new market .

- Ensure great user recommendation to retain current customer base.

- Build and secure a partnership with Studios and content production house

- Negotiate the deals with Studios, Content providers and Movie production houses

- Comply with the laws (laws as per to State or Region/country), maintaining compliance to censorship , specifically for minors and children. Netflix has always promoted and operated within the boundaries of censorship.

- Supporting disadvantaged communities and other ideological issues that are important to its customers.

- Building local communities and economies that support the development of its local original content .

4. Netflix’s Customer Segments

- The Netflix platform is designed to offer a vast collection of different types of genres for subscribers to select from. Their collection (movies or shows) are designed appropriately for

- Everyone, who is interested in watching movies, TV shows and documentaries – and honestly who isn’t?

- Although Netflix offers content for children and adults alike, Netflix aims to promote Family-friendly , educational and entertaining content to help capture the better interests of families.

5. Netflix’s Customer Relationships

Self-setup made easy.

- Netflix platform was originally designed to ensure that it is simple and easy to use.

- Developers of the Website ensured to associate elements and themes that serves and promotes friendliness and provides a self-setup

Exceptional Customer Experience

- Netflix provides customer services through means of the website portal, email inquiries and users have the option to reach a representative directly, by telephone and live chat.

Online Live Chat Services

- Users have the option to opt-in to a live chat session with a Netflix representative.

- Users can directly chat with a Netflix representative to ask questions and support related inquiries.

- Request for discounts and other special promotional deals that they may qualify or offer such user or subscriber.

Social media

- Channeling major advertisements, deals, and other promotional deals through Social media channels and other relative platforms to help gain the high attraction of customer and new sign up users conversions.

- Social media is also used to inform and update individuals that operate or are familiar with the Netflix platform. Such platforms may include Facebook , LinkedIn , Instagram, Twitter , Snapchat etc.

Netflix gift Cards

- Part of the subscription plan, all users will be geared to receive special promotional discounts and other gift cards to avail.

6. Netflix’s Key Resources

Software developers.

- Software developers at Netflix are at constant innovation

- Design and enhance to help create a better customer-user experience

Recommendation system (algorithm)

- Artificial intelligence and selection preference sequence technology helps developers design and build the recommendation algorithm system for its users.

- Some data are based on “new releases,” or internal data that identifies user watch selection and the most viewed.

- Provides users with relative results based off of frequent searches

7. Netflix’s Channels

Through Netflix’s channeling sequence, users and interested users can access Netflix platform from one or more of the following;

- Online streaming through the website

- Streaming through Mobile apps

- Streaming on TV Apps and Gaming consoles

- Mail delivery for DVDs

8. Netflix’s Cost Structure

- Major purchasing rights establishment (TV shows and movies)

- Cost of producing movies

- Cost for providing personalized recommendations, R&D and artificial intelligence

- Subscription maintenance cost

- Paid-Connection deal with Internet Service Provider (ISP) such as Comcast to stream Netflix data at high speed.

- Infrastructure (data centers) cost of streaming content

- DVDs and mail-related shipping costs

- Employee salary distribution (customer service, Engineers, etc.)

9. Netflix’s Revenue Streams

It wasn’t until 2007, when Netflix launched “streaming” services through Netflix subscription plans , that it attained significant revenue streams and additional revenues.

- Monthly subscriptions fees with three different price options In US market (Basic – $8.99/month, Standard – $12.99/ month & Premium – $15.99/ month)

- Netflix has established a global presence with international streaming to expand its customer base.

- Upselling opportunities – Upgrade from Basic to Premium Plan etc.

- Money-making movie studio with Netflix original shows like fuller house, house of cards, etc.

How does Netflix Make Money?

Netflix was a platform which started as only offering an extensive collection of movies, shows and dramas (925 listings) through the mail-in-delivery system . It wasn’t till 2007 when Netflix has decided to convert their business structure from mail-in-system to streaming content based on subscriptions. Before launching online streaming in 2007, Netflix revenue on average summed at annually at around $997 million .

Subscription-based Business Model

- Netflix has over 230 million members from over 190 countries (as of Dec 2022)

- In fiscal year 2022, Netflix generated $31.6 billion annual revenue from both the United States and international regions.

Important partnerships

- One of the most influential tactics implemented was its ability to build alliances with a wide range of movie producers, filmmakers , writer, and animators to receive content and legally broadcasting the contents required aligning licenses.

- To make the Netflix platform and its streaming possible, setting the partnership between Internet Service provider was also crucially important.

Technology ( Monolithic architecture )

- Technology platforms allowed “streaming” accessibility to become convenient and unique and during their conversion year in 2007, not a lot of media companies offered such, which made the platform greatly attractive.

During the early year in 2000, Blockbuster was offered to purchase Netflix and all of its assets for only $50 million .

As of feb 2023, Netflix is worth $163 Billion in market cap value. Perhaps, it isn’t really about what a company sells, rather, it’s about how a company sells or promotes its products.

Through Netflix’s powerful technological tactics, innovating the accessibilities has helped to increase customer/user experience positively. Netflix implemented in several areas that helped to capture the global market.

References & more information

- Netflix Annual Report

Tell us what you think? Did you find this article interesting? Share your thoughts and experiences in the comments section below.

A management consultant and entrepreneur. S.K. Gupta understands how to create and implement business strategies. He is passionate about analyzing and writing about businesses.

11 comments

Cancel reply.

Informative article, exactly what I needed.

Informative article!

Thanks Umar, Happy reading !

Disney+ next?:)

really a good one

Thanks Luca !

Yes, artical was very informative. Thank you.

Kirby – Thank you for the great feedback, really appreciate it. Happy reading !!!

excellent insight

Great article! Where can I find the list of sources you used? Thank you!

The Primary source of the article is Netflix’s Annual report – you can find the link in the reference section. And for secondary sources, links are embedded within the article.

You may also like

Twitter Business Model | How Does Twitter Make Money?

Company: Twitter CEO: Jack Dorsey Year founded: 2006 Headquarter: San Francisco, California, USA Number of Employees (2018): 4,100 Public or Private: Public Ticker Symbol: TWTR Market Cap...

What is ProctorU, how it works and makes money?

Company: ProctorU Founders: Jarrod Morgan Year founded: 2008 CEO: Scott McFarland Headquarter: Birmingham, Alabama Number of Employees (Dec 2018): 400+ Type: Private Ticker Symbol: NYSE: UBER Annual Revenue (Dec...

How Does Whatsapp Make Money – Billion $ Startup

Last updated: March 21, 2020 Company: WhatsApp Inc (a subsidiary of Facebook Inc.) CEO: Jan Koum Year founded: 2009 Headquarter: Menlo Park, California, USA Number of Employees (2018): 200 User...

How does Letgo make money?

Company: Letgo CEO: Enrique Linares Plaza Founders: Alec Oxenford, Enrique Linares Plaza, and Jordi Castello Year founded: 2015 Headquarter: New York, New York Number of Employees (Dec 2018): 270+ Type:...

How Does Turnitin Work & Make Money

Last updated: May 30, 2020 Company: Turnitin CEO: Chris Caren Founders: John Barrie Year founded: 1998 Headquarter: Oakland, California, USA Employees: Est. 417 Type: Private Annual...

How does Audible work & its business model

Company: Audible Founder: Don Katz Year founded: 1995 CEO: Don Katz Headquarter: Newark, NJAnnual Revenue (FY18): $ 2.5 Billion Products & Services: Online and Mobile Audio Book & Entertainment...

How does Fabletics work and make money?

Company: Fabletics Founders: Kate Hudson, Adam Goldenberg, Don Ressler Year founded: 2013 CEO: Don Ressler and Adam Goldenberg Headquarter: El Segundo, CA Employees (2020): Est. 500 Annual Revenue (2020): Est...

LinkedIn Business Model (2022)| How does LinkedIn make money?

Last updated: Out 9, 2021 Company: LinkedIn (a subsidiary of Microsoft Corporation) CEO: Jeff Weiner Year founded: 2002 Headquarter: Sunnyvale, California, USA Number of Employees (Dec 2018): 13,000...

How Does Waze Make Money?

Company: Waze Inc. (a subsidiary of Google Inc) Industry: GPS Navigation Software Founder(s): Amir Shinar, Ehud Shabtai, Uri Levine Year founded: 2006 CEO(s): Noam Bardin Headquarter: Palo Alto, CA, USA Acquisition...

Swiggy Business Model (2022)| How does Swiggy make money

Last updated: Sept 07, 2020 Company: Swiggy CEO: Sriharsha Majety, Nandan Reddy, and Rahul Jaimini Year founded: 2014 Headquarter: Bangalore, India For all the foodies, what more could you ask for...

Recent Posts

- Who Owns Ulta Beauty?

- Who Owns History Channel?

- Who Owns Cheesecake Factory?

- Who Owns Westin Hotels & Resorts?

- Who Owns Truist Bank?

- Who Owns Alfa Romeo?

- Who Owns Burt’s Bees?

- Top 15 Ruggable Competitors and Alternatives

- Top 15 Ticketmaster Competitors and Alternatives

- Who owns Kidz Bop?

Business Strategy Hub

- A – Z Companies

- Privacy Policy

Subscribe to receive updates from the hub!

- Red Queen Effect

- Blue Ocean Strategy

- Only the paranoid survives

- Co-opetition Strategy

- Mintzberg’s 5 Ps

- Ansoff Matrix

- Target Right Customers

- Product Life Cycle

- Diffusion of Innovation Theory

- Bowman’s Strategic Clock

- Pricing Strategies

- 7S Framework

- Porter’s Five Forces

- Strategy Diamond

- Value Innovation

- PESTLE Analysis

- Gap Analysis

- SWOT Analysis

- Strategy Canvas

- Business Model

- Mission & Vision

- Competitors

London, United Kingdom

Mon - fri: 9am to 5pm, from a small ecommerce model to a fortune 500 saas company: a comprehensive case study on how netflix leveraged digital transformation.

Jan 16, 2023 Business 0 comments

Get an in-depth look at the strategies, technologies, and best practices used to grow Netflix into a streaming giant. Discover what you can do to replicate their success and stay ahead of the competition.

In 1997, a small company was founded by two men named Reed Hastings and Marc Randolph in a small town in California named Scotts Valley.

The true story started when Marc discovered how DVD—a new product invented in Japan—would send the timely VHS packing.

So after brainstorming on what they could do with this new DVD product and successfully pitching the idea to Reed Hastings, both Marc and Reed walked into a record store in Santa Cruz, California, and purchased a CD. Then they proceeded to mail the CD to Reed’s house across town.

When the CD arrived intact, Reed and Hastings knew they had struck gold with this idea; and on August 29, 1997, Marc Randolph and Reed Hastings launched a subscription-based business model that afforded customers unlimited content for $19.95 (£16.31) with no due dates and late fees.

They would call it Netflix , and it would go on to epitomise the true essence of digital transformation over the years while changing the course of TV culture forever.

But to understand how Netflix went from a small eCommerce business model to a giant Software-As-A-Service company, the question you should ask is:

What Is Digital Transformation, and How Did It Work for Netflix?

To answer both questions, let’s consider the “what?” before the “how?”

What Exactly Is Digital Transformation?

To put it succinctly, “digital transformation” is the process of shifting away from a more traditional business model and toward those that use more cutting-edge digital technology and processes.

Contrary to popular belief, digital transformation is a strategy implemented through the use of new and advanced technologies to bring about developmental changes in the way business is conducted, improve the customer experience, and scale a business model.

How Did It Work For Netflix?

Netflix is a great example of how digital transformation has worked for a company. It has proven that digital transformation isn’t a sprint; it is a marathon. A journey of digital evolution over the course of time

Since Netflix was just a DVD rental service, it has had to resort to physical stores and mailing DVDs to serve its customers.

However, when it shifted its focus to streaming services, it was able to reach an even wider audience and expand its reach globally.

The success of Netflix can be attributed to its early adoption of digital transformation methods that allowed it to make the most of new technologies and maximise profits.

To fully understand how Netflix leverages digital transformation, we must first ask:

What Steps Has Netflix Taken in Their Digital Transformation Journey?

Netflix developed a recommendation algorithm.

Before Netflix introduced streaming services, they were using a recommendation system called Cinematch for their DVD rental service.

However, the transition to video-on-demand would mean that they could replicate that for their streaming services and even make it better.

To do this, they;

Used available cache data from their former system of customers and users to execute a proper recommendation system.

Used metadata to categorise movies under similar or the same genres to make recommendations easier for users.

Used A/B testing to test and improve their customer experience.

Netflix used cloud computing to improve their storage processes.

One of the perks of going digital for any business is that you get unlimited storage for data. And for a company like Netflix with an outrageous amount of data to store, cloud computing was the smart choice to proceed.

Netflix integrated with Amazon Web Services to manage this issue.

Netflix’s Pioneering Approach to Monetizing Content and Generating Revenue

Before Netflix, subscription-based content wasn’t a popular model. The emergence of Netflix disrupted the industry and sent Blockbuster, which was using the traditional method of disrupting content and generating revenue, into bankruptcy.

It was a classic illustration of how businesses can be left in the dust when they fail to evolve with the times. Also discussed is how businesses can scale through effective digital transformation.

Netflix pioneered a subscription-based model for DVD rentals and eventually revamped the idea into a streaming service business model.

Today, Netflix’s pioneering approach to monetizing content and generating revenue has only just evolved.

Based on the desired video quality, Netflix offers three different pricing tiers: basic, standard, and premium. Typically, the first month of the subscription is free.

Basic with the normal resolution is $7.99 a month, but only one device may utilise it simultaneously.

On the other side, paying $13.99 a month gets you access to Ultra HD streaming on four devices in addition to HD content on two devices.

The Use of Data Analytics by Netflix to Improve Decision-Making

With the help of data analytics, Netflix has been able to gain new insights into their customers’ likes and dislikes, helping them make more informed decisions when it comes to content development and marketing strategies.

Data analytics have played a pivotal role in Netflix’s digital transformation, giving them an edge over its competitors.

This is evident from the fact that Netflix uses advanced data analytics techniques such as predictive modelling, sentiment analysis, customer segmentation, and natural language processing to gain deeper insights into customer behaviour.

By understanding their customers better, they have been able to create personalised recommendations and optimise content for each customer segment.

Monumental Netflix Milestones To Illustrate Their Digital Transformation Journey

The 1990s–2000s: At the time that Netflix launched, Blockbuster was already the leading giant in the movie rental business.

However, a subscription-based DVD rental service was a genius business model in the 90s and maybe in the early 2000s. But this didn’t stop Netflix from facing a financial crisis due to, the high cost of shipping DVDs through the US postal service.

Netflix solved this logistics problem by cutting ties with postal services and developing a web-based chain with warehouses for DVD distribution.

This move catapulted Netflix subscribers from around 300,000 to 6.3 million in 2006 and generated $80 million in the process.

2007: What makes Netflix’s story admirable and worthy of imitation is how well it adapts to changing times. Which is what digital transformation is all about.

Netflix, seeing how the world of technology keeps on advancing and how much speed the 21st century brought to internet users around the world, launched the next facet of their business model—the video-on-demand (VOD) model.

And for the first time ever, Netflix reimagined their identity and introduced streaming services into its business model.

2012: Five years later, after introducing and focusing on streaming services, Netflix starts creating original content for their subscribers.

2013: In August, Netflix launches user-profiles and makes this service available to all users.

2015-2016: Netflix reaches monumental milestones of 50 and 130 countries, respectively, in both 2015 and 2016.

2021: 24 years after it was founded in a small town in California, Netflix hits 209 million subscribers in 190 countries while generating an annual income of over $25 billion.

How Can Digital Socius Help You With Your Business’s Digital Transformation Journey?

Digital transformation is not a goal; it is a journey.

So it is no surprise that businesses have been struggling to keep up with the rapidly changing digital landscape, often feeling overwhelmed and confused by the many options that are available.

As a business owner, it can be hard to stay on top of the latest trends, know what digital solutions are best for your company, and figure out how to get started with digital transformation.

Digital Socius is here to help! Our team of experts can guide you through the entire journey of digital transformation, from assessing your current situation to setting goals and creating a plan of action to reach them.

We’ll provide you with tailored strategies that are specific to your business, so you can move forward confidently and quickly.

Join our many satisfied and returning clients, and let us walk you through the journey step by step and show you how to get it right the first time. Click here to book a free discovery call to get started.

Latest News

- How to automate repetitive tasks

Apr 26, 2024 | Business , Consulting , Digital Transformation , technology

Let’s face it. There’s a high chance that your team might be stuck in a loop of doing the same tasks over and over again: updating project statuses, managing work requests, and handling loads of emails. These tasks keep them busy but don't really help your...

- Collaboration Tools for Remote Teams

Mar 28, 2024 | Business , Digital Transformation , technology

In the spring of 2020, employees of businesses worldwide began to work from home, exploring various tools to maintain productivity. Remote work became the new norm, prompting companies to find innovative solutions to enhance collaboration. Beyond mere digital...

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Submit Comment

search here

Recent posts.

- Top 14 Bookkeeping Jobs in 2024

- February 2024

- January 2024

- December 2023

- October 2023

- September 2023

- August 2023

- February 2023

- January 2023

- December 2022

- November 2022

- September 2022

- September 2019

- Digital Transformation

- Uncategorized

- Entries feed

- Comments feed

- WordPress.org

Understanding Netflix's Business Model

August 18, 2023

In this article, we will explore the intricacies of Netflix's business model and shed light on the factors that have propelled it to the top of the streaming industry.

Netflix's Business Model Demystified: Unleashing the Streaming Giant's Strategy

Before delving into the inner workings of Netflix, it is important to understand its humble beginnings. The story of Netflix dates back to 1997 when Reed Hastings and Marc Randolph, two visionary entrepreneurs, came up with the idea of a DVD rental-by-mail service.

The duo realized that the traditional video rental model, with its late fees and limited availability, was ripe for disruption. Thus, Netflix was born.

In the early days, Netflix operated out of a small office with just 30 employees and a modest DVD library. Hastings and Randolph had a clear vision in mind - to provide customers with a convenient and cost-effective way to enjoy movies.

They believed that by eliminating late fees and offering a wide selection of titles, they could revolutionize the way people consumed entertainment.

The Founding Story

Starting with their initial DVD rental service, Netflix quickly gained traction among movie enthusiasts. The convenience of receiving DVDs by mail and the absence of late fees were a breath of fresh air for customers tired of the hassles of traditional video rental stores.

As word spread about this innovative service, more and more people signed up for Netflix subscriptions.

One of the key factors that set Netflix apart from its competitors was its innovative recommendation algorithm. By analyzing customer preferences and viewing habits, Netflix was able to provide personalized movie suggestions that kept customers engaged and coming back for more.

This algorithm became the secret sauce that added a touch of magic to the Netflix experience, making it feel like the service truly understood each individual's taste in movies.

Early Challenges and Triumphs

Despite its early success, Netflix faced its fair share of challenges. The emergence of online piracy posed a significant threat to the company's growth. However, Netflix responded by offering a legal and convenient alternative to piracy through its DVD rental service.

By providing an affordable and easily accessible platform for movie lovers to enjoy their favorite films, Netflix was able to attract customers who were previously resorting to illegal means.

In 2007, Netflix introduced its streaming service, a game-changing moment that would redefine the industry. By utilizing the power of the internet and broadband connections, Netflix enabled customers to stream movies and TV shows instantly, without the need for physical discs.

This marked a major turning point for the company, as it transitioned from being primarily a DVD rental service to a leading player in the world of online streaming.

The introduction of streaming opened up a whole new world of possibilities for Netflix. It allowed the company to expand its library and offer a vast selection of movies and TV shows to its subscribers.

With the convenience of streaming, customers no longer had to wait for DVDs to arrive in the mail, making Netflix an even more attractive option for entertainment.

As Netflix continued to grow, it faced competition from other streaming services. However, the company stayed ahead of the curve by investing in original content. By producing its own shows and movies,

Netflix was able to offer exclusive content that couldn't be found anywhere else. This move not only helped Netflix differentiate itself from competitors but also solidified its position as a major player in the entertainment industry.

Today, Netflix is a household name, with millions of subscribers around the world. It has become synonymous with streaming entertainment and has revolutionized the way people consume movies and TV shows.

From its humble beginnings as a DVD rental-by-mail service to its current status as a global streaming giant, Netflix's journey has been nothing short of extraordinary.

Netflix's Revenue Model

At the core of Netflix's business model lies its revenue streams. The company primarily generates revenue through subscription services and content licensing.

Subscription services form the backbone of Netflix's revenue model. Customers can choose from a range of subscription plans, granting them access to Netflix's extensive library of content.

By offering different tiers of membership, Netflix caters to the diverse needs and budgets of its subscribers, ensuring that there is something for everyone.

Netflix's subscription services provide subscribers with unlimited access to a vast collection of movies, TV shows, documentaries, and original content. This extensive library is constantly updated with new releases and exclusive content, keeping subscribers engaged and entertained.

Moreover, Netflix's subscription model allows users to stream content on multiple devices simultaneously. This flexibility enables families and friends to enjoy their favorite shows and movies together, enhancing the overall user experience.

In addition to subscription fees, Netflix earns revenue through content licensing. By entering into partnerships with production studios and content creators, Netflix secures the rights to stream popular movies and TV shows.

This enables the company to continually refresh its library and offer a wide variety of entertainment options to its subscribers.

Content licensing is a crucial aspect of Netflix's revenue model as it allows the company to offer a diverse range of content, appealing to different demographics and interests.

Through strategic partnerships, Netflix is able to secure exclusive streaming rights for highly anticipated shows and movies, attracting more subscribers and retaining existing ones.

Furthermore, Netflix invests heavily in producing original content, which not only helps differentiate the platform from its competitors but also creates additional revenue streams. By producing their own shows and movies, Netflix can control the distribution and licensing rights, maximizing their profits and expanding their global reach.

Original content has become a significant driving force behind Netflix's success. The company has gained critical acclaim and a loyal fan base for its original series like "Stranger Things," "The Crown," and "Ozark."

These shows not only attract new subscribers but also generate additional revenue through merchandising, spin-offs, and licensing deals with other platforms.

Moreover, Netflix's revenue model benefits from its ability to leverage user data and analytics. By analyzing viewers' preferences, watching habits, and feedback, Netflix can make data-driven decisions regarding content acquisition and production.

This targeted approach ensures that the company invests in content that resonates with its audience, increasing subscriber satisfaction and retention.

In conclusion, Netflix's revenue model relies on a combination of subscription services and content licensing. By offering a diverse range of subscription plans and securing the rights to stream popular movies and TV shows,

Netflix attracts and retains a large subscriber base. Additionally, the company's investment in original content and data-driven decision-making further strengthens its revenue streams and positions Netflix as a leading player in the streaming industry.

.png)

The Shift to Streaming

The advent of high-speed internet and widespread broadband access paved the way for Netflix's transition from a DVD rental service to a streaming platform.

The Impact of Broadband

Broadband internet played a crucial role in Netflix's success. The increasing availability and affordability of high-speed internet made streaming feasible for a larger audience. This technological advancement allowed Netflix to reach more customers and expand its user base exponentially.

With the rise of broadband, people no longer had to wait for DVDs to arrive in the mail or physically go to a rental store to access their favorite movies and TV shows.

Instead, they could simply log into their Netflix accounts and instantly stream a vast library of content. This convenience and instant gratification became a game-changer for the entertainment industry.

Moreover, the improved internet speeds offered by broadband allowed for a seamless streaming experience. Gone were the days of buffering and low-quality video. With the ability to stream in high-definition and even 4K, viewers could fully immerse themselves in the content without any interruptions.

The Rise of Original Content

As Netflix grew in popularity, the company recognized the need to differentiate itself from competitors. The solution came in the form of original content. By producing its own movies and TV shows, Netflix created a unique selling point and solidified its position as an industry leader.

Netflix's foray into original content was a bold move that paid off tremendously. The company's investment in producing high-quality and diverse content attracted both critical acclaim and a loyal fan base.

From critically acclaimed series like "Stranger Things," which became a cultural phenomenon, to award-winning films like "Roma," which garnered international recognition, Netflix's original content has captivated audiences worldwide.

By creating original content, Netflix not only offered viewers something they couldn't find anywhere else but also established long-term relationships with talented creators and artists.

The freedom and creative control that Netflix provides have attracted renowned filmmakers, writers, and actors who see the streaming platform as a place to bring their unique visions to life.

Furthermore, Netflix's original content has allowed the company to cater to various demographics and interests. From gripping crime dramas to heartwarming romantic comedies, there is something for everyone in Netflix's extensive library of original content. This diversity has further solidified Netflix's position as a go-to streaming platform for a wide range of audiences.

Netflix's Global Expansion

Netflix's ambition knows no bounds. The company's strategy revolves around expanding its reach and penetrating international markets.

As Netflix continues to grow, it recognizes the importance of catering to the unique needs and preferences of audiences around the world. With its successful expansion into international markets, Netflix has become a global phenomenon, captivating viewers from different cultures and backgrounds.

International Market Penetration

One of the key drivers of Netflix's growth has been its successful expansion into international markets. By tailoring its offerings to suit the needs of different countries and cultures, Netflix has managed to strike a chord with audiences worldwide.

The company understands that entertainment preferences vary across regions, and it has made significant efforts to provide a diverse range of content that appeals to a global audience.

Netflix's localization efforts have played a crucial role in its international success. The company goes beyond simply offering subtitles and dubbing options.

It carefully curates its content library, taking into account the unique tastes and interests of viewers in each country. By partnering with local production companies and investing in original content from different regions, Netflix ensures that it offers a rich and culturally diverse viewing experience.

Moreover, Netflix's commitment to understanding local markets goes beyond content selection. The company conducts extensive research and analysis to identify the specific needs and preferences of viewers in different regions.

This allows Netflix to tailor its user interface, recommendations, and even marketing strategies to suit the cultural nuances of each market.

Localization and Customization Strategies

Netflix's commitment to localizing its content extends beyond language preferences. The company uses sophisticated algorithms to analyze user behavior and preferences, allowing it to deliver personalized recommendations that are tailored to each individual viewer.

By understanding the nuances of its diverse audience, Netflix creates a truly immersive and engaging streaming experience.

Through its customization strategies, Netflix aims to create a sense of connection and relevance for its viewers. By leveraging data analytics and machine learning, the company can identify patterns in user preferences and viewing habits.

This enables Netflix to offer a curated selection of movies and TV shows that align with each viewer's interests, increasing the chances of them discovering new content that they will love.

Furthermore, Netflix's localization efforts go beyond content recommendations. The company actively engages with local communities and partners with regional talent to create original productions that resonate with viewers on a deeper level.

By investing in local storytelling and supporting local filmmakers, Netflix not only strengthens its presence in international markets but also fosters cultural exchange and appreciation.

In conclusion, Netflix's global expansion is a testament to its commitment to delivering high-quality entertainment to audiences around the world. Through its localization and customization strategies, the company ensures that viewers from different cultures and backgrounds can enjoy a personalized and immersive streaming experience. As Netflix continues to expand its reach, it will undoubtedly continue to revolutionize the way we consume and engage with entertainment.

The Role of Data in Netflix's Success

One of Netflix's greatest assets is its wealth of data. The company has harnessed the power of data to drive its decision-making processes and fuel its success.

Personalization and Recommendation Algorithms

Netflix's recommendation algorithm is a testament to the power of data. By analyzing viewing habits, ratings, and other user data, Netflix can make accurate predictions about what content users will enjoy. This level of personalization not only enhances the user experience but also boosts customer satisfaction and loyalty.

Data-Driven Content Creation

Data plays an integral role in content creation at Netflix. By analyzing viewer preferences and trends, Netflix can identify untapped genres and niches. Armed with this knowledge, the company can produce original content that caters to specific audiences, maximizing its chances of success and further cementing its position at the forefront of the industry.

As we delve into the inner workings of Netflix's business model, it becomes clear that the company's success can be attributed to a combination of innovation, adaptability, and a deep understanding of its audience. By leveraging technology, data, and strategic partnerships, Netflix has transformed the way we consume entertainment and redefined the streaming landscape. As the company continues to evolve and push boundaries, one thing is certain: Netflix's business model will remain a force to be reckoned with in the ever-changing world of entertainment.

Are you in search of additional knowledge and insights? Explore the following articles related to business models which are highly recommended:

- Apple's Business Model

- Amazon's Busins Model Canvas

- Nike's Business Model

- Crocs' Business Model

These informative posts will expand your understanding of company strategies and operations.

- How it works

- Help center

- Get label or store design Roadmap

- Liability insurance

- Terms of Use

- Privacy Policy IP policy

- Returns Social Responsibility

- Affiliate program

The Power of Digitalization: The Netflix Story

- Conference paper

- First Online: 18 May 2020

- Cite this conference paper

- Manuel Au-Yong-Oliveira 20 , 21 ,

- Miguel Marinheiro 20 &

- João A. Costa Tavares 20

Part of the book series: Advances in Intelligent Systems and Computing ((AISC,volume 1161))

Included in the following conference series:

- World Conference on Information Systems and Technologies

5463 Accesses

2 Citations

8 Altmetric

The evolution of technology, and mainly the evolution of the Internet, has improved the way business is done. Nowadays, most services are offered through a website or through an app, as it is much more convenient and suitable for the customer. This business transformation made it possible to get a faster and cheaper service, and companies had to adapt to the change, in order to fulfill customers’ requirements. In this context, this paper relates to this digital transformation, focusing on a case study about Netflix, a former DVD rental company and currently an online streaming leader. We aimed to understand Netflix’s behavior alongside this digital wave. Thus, we performed a survey, which had 74 answers, mainly from Portugal, but also from Spain, Belgium, Italy, Turkey, Georgia and Malaysia. Of the people who answered the survey, 90.1% were stream consumers, but only 59.1% had premium TV channels. From those 90.1%, 58.3% also said that they watched streams between two and four times per week, but the majority of premium TV channel subscribers (63.8%) replied that they watch TV less than twice in a week. We see a trend in which the traditional TV industry is in decline and streaming as a service has increased in popularity. Consumer habits are changing, and people are getting used to the digitalization era. Netflix is also confirmed in our survey as the market leader of the entertainment distribution business, as stated in the literature, and the biggest strength of this platform is its content.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Leiner, B., Cerf, V., Clark, D., Kahn, R., Kleinrock, L., Lynch, D., Postel, J., Roberts, L.G., Wolff, S.: Brief History of the Internet—Internet Society (2009)

Google Scholar

Investopedia. https://www.investopedia.com/articles/personal-finance/121714/hulu-netflix-and-amazon-instant-video-comparison.asp . Accessed 03 Dec 2019

Littleton, C., Roettgers, J.: How Netflix Went From DVD Distributor to Media Giant (2018). https://variety.com/2018/digital/news/netflix-streaming-dvds-original-programming-1202910483/ . Accessed 31 Oct 2019

Business Insider. https://www.businessinsider.com/how-netflix-has-looked-over-the-years-2016-4#in-2010-streaming-begins-to-be-more-than-an-add-on-and-gets-prominent-real-estate-on-the-home-page-5 . Accessed 03 Dec 2019

Netflix. https://www.netflix.com/browse . Accessed 03 Dec 2019

Oomen, M.: Netflix: How a DVD rental company changed the way we spend our free time (2019). Business Models Inc. https://www.businessmodelsinc.com/exponential-business-model/netflix/ . Accessed 31 Oct 2019

Venkatraman, N.V.: Netflix: A Case of Transformation for the Digital Future (2017). https://medium.com/@nvenkatraman/netflix-a-case-of-transformation-for-the-digital-future-4ef612c8d8b . Accessed 31 Oct 2019

BMI - Business Models Inc. https://www.businessmodelsinc.com/exponential-business-model/netflix/ . Accessed 03 Dec 2019

Calia, R.C., Guerrini, F.M., Moura, G.L.: Innovation networks: from technological development to business model reconfiguration. Technovation 27 (8), 426–432 (2007)

Article Google Scholar

Ritter, T., Lund, C.: Digitization capability and the digitalization of business models in business-to-business firms: past, present, and future. Ind. Mark. Manag. (November), 1–11 (2019)

Hong, S.H.: The recent growth of the internet and changes in household-level demand for entertainment. Inf. Econ. Policy 19 (3–4), 304–318 (2007)

Evens, T.: Clash of TV platforms: how broadcasters and distributors build platform leadership. In: 25th European Regional Conference of the International Telecommunications Society (ITS), Brussels, Belgium, 22–25 June 2014. ECONSTOR (2014)

Aliloupour, N.P.: Impact of technology on the entertainment distribution market: the effects of Netflix and Hulu on cable revenue. Open access senior thesis. Bachelor of Arts. Claremont Graduate University (2015)

Johnson, C.M.: Cutting the cord: leveling the playing field for virtual cable companies. Law School Student Scholarship, Paper 497 (2014)

Pardo, A.: Digital hollywood: how internet and social media are changing the movie business. In: Friedrichsen, M., Muhl-Benninhaus, W. (eds.) Handbook of Social Media Management, pp. 329–348 (2013)

Bryman, A., Bell, E.: Business Research Methods, 4th edn. Oxford University Press, Oxford (2015)

Alvarez, E.: Netflix is taking a wait-and-see approach to virtual reality (2018). Engadget. https://www.engadget.com/2018/03/07/netflix-virtual-reality-not-a-priority/ . Accessed 31 Oct 2019

Nhan, J., Bowen, K., Bartula, A.: A comparison of a public and private university of the effects of low-cost streaming services and income on movie piracy. Technol. Soc. 60 , 101213 (2020)

Comissão Europeia - Portugal – A PAC no seu país. https://ec.europa.eu/info/sites/info/files/food-farming-fisheries/by_country/documents/cap-in-your-country-pt_pt.pdf . Accessed 20 Jan 2020

Gonçalves, R., Oliveira, M.A.: Interacting with technology in an ever more complex world: designing for an all-inclusive society. In: Wagner, C.G. (ed.) Strategies and Technologies for a Sustainable Future, pp. 257–268. World Future Society, Boston (2010)

Fontoura, A., Fonseca, F., Piñuel, M.D.M., Canelas, M.J., Gonçalves, R., Au-Yong-Oliveira, M.: What is the effect of new technologies on people with ages between 45 and 75? In: Rocha, Á., et al. (eds.) New Knowledge in Information Systems and Technologies, WorldCist 2019, La Toja Island, Spain, 16–19 April. Advances in Intelligent Systems and Computing (Book of the AISC Series), vol. 932, pp. 402–414. Springer (2019)

Download references

Author information

Authors and affiliations.

Department of Economics, Management, Industrial Engineering and Tourism, University of Aveiro, 3810-193, Aveiro, Portugal

Manuel Au-Yong-Oliveira, Miguel Marinheiro & João A. Costa Tavares

GOVCOPP, Aveiro, Portugal

Manuel Au-Yong-Oliveira

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Manuel Au-Yong-Oliveira .

Editor information

Editors and affiliations.

Departamento de Engenharia Informática, Universidade de Coimbra, Coimbra, Portugal

Álvaro Rocha

College of Engineering, The Ohio State University, Columbus, OH, USA

Hojjat Adeli

FEUP, Universidade do Porto, Porto, Portugal

Luís Paulo Reis

DIMES, Università della Calabria, Arcavacata, Italy

Sandra Costanzo

Faculty of Electrical Engineering, University of Montenegro, Podgorica, Montenegro

Irena Orovic

Universidade Portucalense, Porto, Portugal

Fernando Moreira

Rights and permissions

Reprints and permissions

Copyright information

© 2020 The Editor(s) (if applicable) and The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper.

Au-Yong-Oliveira, M., Marinheiro, M., Costa Tavares, J.A. (2020). The Power of Digitalization: The Netflix Story. In: Rocha, Á., Adeli, H., Reis, L., Costanzo, S., Orovic, I., Moreira, F. (eds) Trends and Innovations in Information Systems and Technologies. WorldCIST 2020. Advances in Intelligent Systems and Computing, vol 1161. Springer, Cham. https://doi.org/10.1007/978-3-030-45697-9_57

Download citation

DOI : https://doi.org/10.1007/978-3-030-45697-9_57

Published : 18 May 2020

Publisher Name : Springer, Cham

Print ISBN : 978-3-030-45696-2

Online ISBN : 978-3-030-45697-9

eBook Packages : Intelligent Technologies and Robotics Intelligent Technologies and Robotics (R0)

Share this paper

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

- Features & Opinion

- Webinars & Podcasts

Digital transformation: What can we learn from Netflix?

A couple of weeks ago at Mobile World Congress in Barcelona, I had the opportunity to listen to Reed Hastings, CEO and Co-founder of Netflix. Netflix started as a DVD rental company in 1997. It used to rent DVDs and send them by courier to subscribers in the US. In 2007, Netflix started its online streaming service, which began picking up from 2010 onwards. Today Netflix has about 100 million customers around the world and fewer than 5 million DVD customers (mostly in the US). On financials it had a top line of about $9 billion in 2016, which grew about 30 percent year on year, and a gross profit margin of over 30 percent. Netflix has done quite well to scale the business so far. There were many DVD companies in the old brick-and-mortar era, and many of them disappeared without a trace. "What did Netflix do differently?" has been a question on my mind. Apart from the fact the company was ahead of the curve in the way it digitized its business from couriering DVD to digital distribution, it has done a few other things differently too. Netflix has a great business model, huge focus on content, unique digital culture and exceptional use of technology.

Simple, scalable business model

In simple terms Netflix's model has a mass market approach, and is driven by simplicity. Netflix is available around the world (some exceptions as usual) and pricing is extremely simple. The customer experience is simple too. I was able to get going with Netflix in 2-3 minutes and a smart recommendation engine already started showing what I should watch (and it was relevant to my taste). There are three plans on offer with a 20 percent difference in amount and add-ons available, as well as monthly subscriptions (all you can eat). You get a one-month free subscription to start with. Prices range from $8-12 per month, which is targeted for the mass market. In most countries you pay a similar amount (or even higher) for a monthly cable TV subscription. No hardware required, all streamed over net (now you can download also). This model allows Netflix to scale on one hand and keeps all costs arising out of complexity at bay. It is a good example of what exponential growth means.

With smartphones getting into almost every pocket, smart TV gaining popularity in homes and internet access becoming ubiquitous, there are limited roadblocks for customers who want to use Netflix.

Work culture at Netflix

There are very few companies where culture is as discretely captured, emphasized and practised as at Netflix. I was shocked when I read about its culture -- "Hard Work - Not Relevant":

"We don’t measure people by how many hours they work or how often they are in the office. Sustained B-level performance, despite A for effort, generates a generous severance package. With respect. Sustained A-level performance, despite minimal effort, is rewarded with more responsibility and great pay."

There is a strong performance culture at Netflix and its value is based on how important it is for talent to work alongside other exceptional people. There is a 124-slide corporate HR constitution at Netflix which is available in the public domain -- Netflix Culture: Freedom and Responsibility . It is a great insight into the company culture.

Content is king