Home > Finance > Loans

How to Properly Write a Business Loan Request

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .

Have to submit a business loan request letter as part of your loan application? Not sure how to get started?

We don’t blame you. These kinds of letters aren’t as common as they used to be. While online lenders don’t usually ask for small-business loan requests, some traditional banks and credit unions still do. And if you apply for an SBA business loan (a loan backed by the US Small Business Administration), you’ll need a small-business loan request as part of your loan application package.

No matter which lender you’re applying with, this guide will help you write a strong business loan request letter―and to get the business loan you need.

How to write a business loan request letter

- Start with the easy stuff

- Write a brief summary

- Add information about your business

- Explain your financing needs

- Discuss your repayment plan

- Close the letter

1. Start with the easy stuff

Writing a loan request can feel overwhelming. After all, it’s not an everyday part of being a small-business owner. What do you say when applying for a bank loan? How do you write a business proposal for your loan application? What’s your lender even looking for in a business loan request letter?

That’s why we suggest starting your request writing process with the easy bits: formatting.

You’ll want to begin your business loan request with some pretty standardized formatting that includes your contact information, the date, your lender’s contact information, a subject line, and a greeting.

Typically, you’ll want to format the beginning of your small-business loan request roughly like this:

First and last name

Business’s name

Business’s phone number

Business’s address (this one is optional)

Lender name (or loan agent’s name and title, if you have one)

Contact information for your lender or loan agent

Subject line

Obviously you can simply plug in the relevant information for most of this. Easy peasy, right?

You’ll really only have to come up with your own subject line and greeting. But don’t overthink it. Something like this will work just fine for your subject line:

- Re: [Your business’s name] business loan request for [loan amount]

Likewise, keep your greeting simple. “Dear [lender]” or “Dear [loan agent]” will do quite nicely.

Got all that? Then you’re ready to get into the actual loan request.

By signing up I agree to the Terms of Use.

2. Write a brief summary

Before you dive into the meat of your loan request, you should give a brief summary of your letter. Just write a short paragraph that says why you’re writing and what you want.

So you’ll probably want to include the following details:

- Business name

- Business industry

- Desired loan amount

- What you’ll use the loan for

No need to get fancy with this. You’re trying to condense the most important information into one or two sentences.

For example, your summary might look something like this:

- I’m writing to request a [loan amount] loan for my small business in the [industry name] industry, [business name]. With this loan, [business name] would [describe your intended business loan use].

As you can see, you don’t need much detail here. You’re just giving the reader a quick overview of what’s to come.

And now that you’ve given them that preview, it’s time to get more in depth.

Remember, your lender isn’t here to grade your writing. Try to use good spelling, grammar, and punctuation―but don’t stress about crafting beautiful sentences.

3. Add information about your business

Your next section should add more detail about your business. You’ll want to include information like this:

- Business’s legal name (if different than name used)

- Business’s legal structure (LLC, partnership, S corp, sole proprietorship, etc.)

- Business’s purpose

- Business’s age (or date it began operating)

- Annual revenue

- Annual profit (if applicable)

- Number of employees

Now, keep in mind that you’re not trying to give your reader an encyclopedic history of your business. Instead, you’re trying to show that you have a well-established business―one that’s solid enough to deserve a business loan. So focus on relevant details that show your business’s maturity.

You can keep this section as short as a few sentences or as long as a few (brief) paragraphs. Just make sure you leave plenty of room for the next two sections.

4. Explain your financing needs

After discussing your business, it’s time to explain why you need a bank loan.

That means you’ll want to offer some details about how you plan to use your business financing. For example, you can talk about the employees you plan to hire, the building you want to expand, or whatever else you intend to do with your term loan .

Take note, though, that you also need to explain why your loan request makes sense. Because your lender doesn’t really care that you want a loan―it cares whether or not it makes sense to lend to you. You need to convince your lender that you have a good plan for your loan―one that will make it easy to repay the money you borrow.

Try to answer questions like these as you write this section:

- Why should your lender want to approve your loan application?

- What happens to your business if you get your small-business loan?

- What kind of growth will your business loan allow for?

Dig into your business plan and projections to find some good stats. Explain how hiring those additional employees will increase your revenue by a certain percentage or dollar amount. Break down how opening that add-on to your restaurant will allow you to seat a number of additional customers, and how much revenue you expect that to bring in.

The more specific you can get, the better. Because again, you’re trying to convince your lender that you’re borrowing as part of a thoughtful business plan ―not just because you want some cash.

And take your time with this part. In most cases, this section and the next one will form the meat of your business loan request letter.

As a rule, you should keep your business loan request letter to one page.

5. Discuss your repayment plan

By this point, your lender should understand what your business does and why a loan would help it grow. Now you need to prove to your lender that you can repay your small-business loan.

This doesn’t mean you have to show precise calculations breaking down your desired interest rate and monthly payment. (After all, your bank probably hasn’t even committed to a specific interest rate yet.)

Instead, talk about things like your business’s past finances, other existing debts, and any projections can you offer.

So if you have a profitable business, point that out, and discuss how that will free up cash flow to repay your loan. Offer summaries of profit-and-loss statements that show your business has been growing. Tell your lender how you’ll pay off that existing loan within a few months, so they don’t need to worry about it interfering with repayment of your new term loan.

Put simply, this is your chance to convince your lender of your creditworthiness. Especially if you have a slightly low credit score or some other concern, you want to use this section to show that you will absolutely repay your loan.

6. Close the letter

Finally, you can add a few finishing touches.

Usually you should close with a short paragraph or two that refers the reader to any attached documents (like financial statements) and asks them to review your loan application.

You may also want to include a sentence expressing willingness to answer any questions―or just saying you’re looking forward to hearing back.

Then end things with your signature, list any enclosed documents, and you’re done!

Well, sort of.

At this point, we strongly recommend you print off your business loan request letter and read it―out loud, if possible. This will help you catch any errors. Because no, your lender isn’t a writing teacher, but you still want to make a good impression.

Plus, if you make typos on something like your business name or desired loan amount, that inaccuracy could lead to confusion from your lender―slowing down your loan approval process.

Once you’ve proofread your loan request letter, you’re ready to submit it to your lender. With any luck, your thoughtful letter will help convince your lender to give you that loan you want.

Loan proposal letter template

So how do all those steps look when you put them together? Something like this:

First and last name

Business’s name

Business’s phone number

Business’s address (this one is optional)

Date

Lender name (or loan agent’s name and title, if you have one)

Contact information for your lender or loan agent

Subject line

Greeting

This first paragraph should summarize the rest of your letter. Keep it to just a couple sentences.

The next one to three paragraphs add more detail about your business. Include facts about its age, revenue, profit, employees, and other relevant information.

Then explain why you need financing and how you’ll use it to grow your business. This section can be a little longer (but remember your whole letter should fit on one page).

Next, talk about how your business will repay your loan. You may want to mention how financial documents show your business’s financial health, for example.

Finally, close with a short paragraph or two that list any enclosed documents and invite the lender to consider your loan application.

Printed name

List of enclosed financial documents

That’s not so hard, is it? With this basic business loan request letter template, you can easily write your own personalized business loan proposal.

The takeaway

So there you have it―that’s how to properly write a business loan request.

Get your formatting right, include a short summary, talk about your business, explain your loan needs, prove you can repay your loan, and close things off. (And don’t forget to proofread.)

We believe in you. You can write this thing.

And good luck getting your loan application approved!

Don’t just tell your lender you can repay your business loan―make sure you can with our business loan calculator .

Related reading

Best Small Business Loans

- How to Get a Small Business Loan in 7 Simple Steps

- 6 Most Important Business Loan Requirements

- How Long Does It Take To Get a Business Loan?

- Commercial Loan Calculator

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.

5202 W Douglas Corrigan Way Salt Lake City, UT 84116

Accounting & Payroll

Point of Sale

Payment Processing

Inventory Management

Human Resources

Other Services

Best Inventory Management Software

Best Small Business Accounting Software

Best Payroll Software

Best Mobile Credit Card Readers

Best POS Systems

Best Tax Software

Stay updated on the latest products and services anytime anywhere.

By signing up, you agree to our Terms of Use and Privacy Policy .

Disclaimer: The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing. All information is subject to change. Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. For the most accurate information, please ask your customer service representative. Clarify all fees and contract details before signing a contract or finalizing your purchase.

Our mission is to help consumers make informed purchase decisions. While we strive to keep our reviews as unbiased as possible, we do receive affiliate compensation through some of our links. This can affect which services appear on our site and where we rank them. Our affiliate compensation allows us to maintain an ad-free website and provide a free service to our readers. For more information, please see our Privacy Policy Page . |

© Business.org 2024 All Rights Reserved.

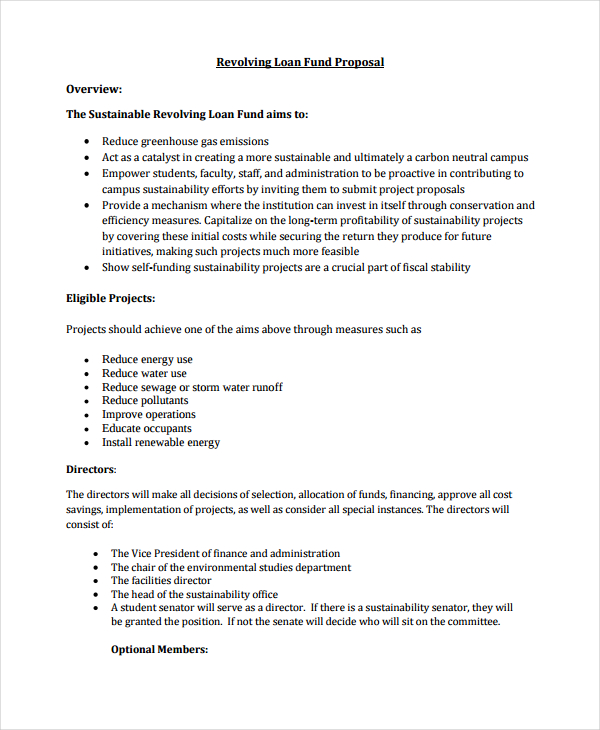

Free Business Loan Proposal Template

This business loan proposal template managed to secure funds to over 16,000 clients! If you're unsure of how your business loan requests should look, simply use this completely customizable template and get ready to close the deal! You can change the text, images, colors, your logo - it's all 100% editable.

What's in this Business Loan Proposal Template

Visually attractive cover.

No matter which industry you're writing a business loan request for, the first impression always matters. In this business loan proposal template, the first thing your creditor sees is a nicely designed cover, fit for a world-class company like yours. From the text, logo, and background image, you can change everything to make it a better fit for your needs.

The best way to start your bank loan application is with a direct and straightforward cover letter or executive summary. Use this page to clearly and briefly describe who you are, your business background, the nature of your business or start-up, and how the loan will be used to help your company succeed.

Like everything else in this proposal, it's completely editable - the colors, the text, images, layout - everything.

Business profile

Explaining what your business does and the process of using and repaying the loan may sound a bit overwhelming to small business owners. That's why we created a business profile - a page dedicated to the history of your business, along with current activity and results.

It is a perfect place to highlight your business plan, leave some links to your brochures or any other documents that will help soft sell your business.

Management experience

The best way to show potential creditors how serious you are about your business is through management experience. Describing the experience, qualifications, and skills of key members of your management team gives you the perfect opportunity to show you understand exactly what your business needs to succeed.

In this business loan proposal template, we've created a whole section for management experience. All you need to do is fill it in!

Loan request and payment

This section in the business loan proposal template is all about the numbers. Show precisely why you need business financing, the amount you are requesting, the interest rate, as well as what you will use it for.

Whether you're looking for a small business loan or a large sum of money, this is the place to write it down. Like the rest of this template, every part is editable, from the text and logo to the background image.

Financial statements

This is the section the creditor will spend the most time looking at! It is also the perfect place to include your personal financial statements, balance sheets, credit history and reports, tax returns, and any other financial document you see fit for the cause.

Next steps and supporting documents

Once the hard part of writing the loan proposal is done, use this section to attach the proof behind the story you have told. If you're feeling optimistic, you can even add a digital signature box that will allow your creditors to approve your business loan right away!

Get paid straight from the proposal

No more messing around with invoices, no more waiting for checks to clear. This proposal template lets you take payments directly from the proposal, using the integrations with PayPal, Stripe, and GoCardless.

Don't take just our word for it

Here is what some of our 10,000 users across the globe have to say

Sara K. CEO & Founder

Shade O. Business Owner

Brent R. Marketing and Advertising

150+ other free proposal templates just like these are also available inside Better Proposals

Use this professional funding proposal template to reach out to possible donors and increase your organization's visibility and credibility! The funding proposal is pre-written and saves you time while offering great success.

Find more virtual assistant jobs with this amazing virtual assistant proposal. It will help you explain your scope of work, previous roles, and even showcase a case study. Use the virtual assistant proposal to speed up the client search.

Need to write a service proposal, but not sure where to start? Use this template to create your own winning proposal.

Automate your sales process with our 50+ integration partners

Import your contacts from a CRM, receive payments, chat with prospects and manage projects. All in once place. See all integrations

Your questions, answered

Common questions about plans, designs and security

Start sending high conversion proposals today

Join 10,000+ happy customers and enjoy a simpler, faster, and more professional way to win more business.

No credit card required. Cancel anytime.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

What Is a Business Loan Proposal?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Some lenders may require a business loan proposal be included in your application for a business loan . A business loan proposal should not be confused with a business plan. While some similar information is included in both documents, a business loan proposal is more streamlined to focus attention on the loan amount you want and your repayment plan.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

How is a business loan proposal different from a business plan?

While you may be asked to include a business plan with your loan application , its use is not limited to that. Think of your business plan as a broad, long-term document that can guide you through each stage of your business, from startup to expansion to sale or closure. It includes information on how your business is structured, how it operates and your plans for the future.

In contrast, a business loan proposal is a focused, short-term document with the purpose of securing funding for your business. The loan amount you're requesting, how it will be used and your ability to repay the loan will be of key interest to lenders.

>> MORE: What is a business loan?

What makes a good business loan proposal?

Like any document, it should be organized and well-written. The loan proposal itself can be relatively short, only a few pages, but additional documents will be added as attachments. The financial information you provide in your loan proposal should demonstrate that your business is financially sound.

Your loan proposal could be laid out in a number of ways. Before you begin, ask your lender if it has a preferred format. If it doesn't, you can use short sections to provide information and highlight specific details. Documents related to each section can be included at the end. This approach will provide a concise summary of your proposal upfront followed by attachments that can back up your statements.

Business loan proposal structure

The following are some typical sections of a loan proposal. If your lender doesn’t require a specific format, then you’ll have some flexibility in heading titles and the order of sections. After completing an executive summary and the business overview, you could rearrange the sections if appropriate for your business.

Executive summary or cover letter

Use the executive summary to briefly describe yourself and your background. Also, give an overview of your business and how you plan to use the loan funds. If you need more than a paragraph to adequately provide this information, then you can convert this section to a separate cover letter that contains a few paragraphs. However, remember that this is a summary and you'll provide more personal details and business information in other sections of the loan proposal.

Business overview

Provide the relevant history of your business, its legal structure, licenses required and a brief summary of its current activity. You can choose to cover your experience, qualifications and skills in this section. Or, if your business has multiple owners or team members who are major contributors to your operation, a separate section can be created to highlight their experience and skills. Add important details about your customers, the current market, industry trends and online marketing channels, if you use them.

Owner investment

The equity you have in your business can demonstrate your commitment to its success. Discuss the monetary investment you have in your business. This includes cash amounts you’ve invested and any retained earnings you’ve held on to.

Loan request

Be clear about the amount of money you're requesting and what it will be used for. Provide details about what will be purchased. Also, explain how you determined the loan amount you needed. Include quotes and estimates you used in your calculations.

Loan repayment plan

Using the loan terms you’ve been offered or quoted and the associated repayment schedule, explain how you’ll be able to make timely loan payments based on your projected sales and cash flow. If fluctuating sales and/or cash flow are normal in your business, explain how cash reserves or another option can be used to make payments during lean times.

>> MORE: Use NerdWallet's business loan calculator to figure out payments

Financial statements

You can provide an overview of both business and personal financial statements in this section and then include the actual statements as attachments.

Lenders will want to see business financial statements for the current period and three prior years. This list includes income statements, balance sheets and net worth reconciliations for your business. Projected income statements and balance sheets are OK if you’re a startup business.

Personal financial statements will be needed for any owner who has 20% or more equity in your business. These statements, which include personal assets, liabilities and net worth, should be current. Check with your lender to see if tax returns are also needed and the number of years.

>> MORE: Best startup business loans

Income and cash-flow projections

Explain the details of your projected income and cash-flow statements in this section. You may also want to discuss what changes you’ll make to your business if you don’t reach your projections. At a minimum provide one year of projections. Multiple years of projections will be needed if a positive cash flow can’t be achieved in the first year.

Pledged collateral

This section can be used to explain what recourse the lender will have if you can’t repay the loan, or the collateral you're pledging with the loan. Summarize the assets you're willing to use as collateral, which can be sold for cash to cover the loan debt. Provide a detailed list of these assets as an attachment.

Existing liabilities

Some lenders may request information on other debts you have. You can summarize the information here and include an attachment with details about whom you owe, their addresses, amounts owed and payment schedules.

Attachments

Finally, include any documents mentioned in the sections of your loan proposal as attachments.

Compare your business loan options

The best business loan is generally the one with the lowest rates and most ideal terms. But other factors — like time to fund and your business’s qualifications — can help determine which option you should choose. NerdWallet recommends comparing small-business loans to find the right fit for your business.

On a similar note...

- Search Search Please fill out this field.

- Small Business

How to Write a Business Plan for a Loan

How to secure business financing

Matt Webber is an experienced personal finance writer, researcher, and editor. He has published widely on personal finance, marketing, and the impact of technology on contemporary arts and culture.

:max_bytes(150000):strip_icc():format(webp)/smda1_crop-f0c167dd2b2144f68f352c63d17f7db5.jpg)

A business plan is a document that explains what a company’s objectives are and how it will achieve them. It contains a road map for the company from a marketing, financial, and operational standpoint. Some business plans are more detailed than others, but they are used by all types of businesses, from large, established companies to small startups.

If you are applying for a business loan , your lender may want to see your business plan. Your plan can prove that you understand your market and your business model and that you are realistic about your goals. Even if you don’t need a business plan to apply for a loan, writing one can improve your chances of securing finance.

Key Takeaways

- Many lenders will require you to write a business plan to support your loan application.

- Though every business plan is different, there are a number of sections that appear in every business plan.

- A good business plan will define your company’s strategic priorities for the coming years and explain how you will try to achieve growth.

- Lenders will assess your plan against the “five Cs”: character, capacity, capital, conditions, and collateral.

Why Do I Need a Business Plan?

There are many reasons why all businesses should have a business plan . A business plan can improve the way that your company operates, but a well-written plan is also invaluable for attracting investment.

On an operational level, a well-written business plan has several advantages. A good plan will explain how a company is going to develop over time and will lay out the risks and contingencies that it may encounter along the way.

A business plan can act as a valuable strategic guide, reminding executives of their long-term goals amid the chaos of day-to-day business. It also allows businesses to measure their own success—without a plan, it can be difficult to determine whether a business is moving in the right direction.

A business plan is also valuable when it comes to dealing with external organizations. Indeed, banks and venture capital firms often require a viable business plan before considering whether they’ll provide capital to new businesses.

Even if a business is well-established, lenders may want to see a solid business plan before providing financing. Lenders want to reduce their risk, so they want to see that a business has a serious and realistic plan in place to generate income and repay the loan.

Sections of a Business Plan

Every business is different, and so is every business plan. Nevertheless, most business plans contain a number of generic sections. Common sections are: executive summary, company overview, products and services, market analysis, marketing and sales plan, operational plan, and management team. If you are applying for a loan, you should also include a funding request and financial statements.

Let’s look at each section in more detail.

Executive Summary

The executive summary is a summary of the information in the rest of your business plan, but it’s also where you can create interest in your business.

You should include basic information about your business, including what you do, where you are based, your products, and how long you’ve been in business. You can also mention what inspired you to start your business, your key successes so far, and your growth plans.

Company Overview

In this section, focus on the core strengths of your business, the problem you want to solve, and how you plan to address it.

Here, you should also mention any key advantages that your business has over your competitors, whether this is operating in a new market or a unique approach to an existing one. You should also include key statistics in this section, such as your annual turnover and number of employees.

Products and Services

In this section, provide some details of what you sell. A lender doesn’t need to know all the technical details of your products but will want to see that they are desirable.

You can also include information on how you make your products, or how you provide your services. This information will be useful to a lender if you are looking for financing to grow your business.

Market Analysis

A market analysis is a core section of your business plan. Here, you need to demonstrate that you understand the market you are operating in, and how you are different from your competitors. If you can find statistics on your market, and particularly on how it is projected to grow over the next few years, put them in this section.

Marketing and Sales Plan

Your marketing and sales plan gives details on what kind of new customers you are looking to attract, and how you are going to connect with them. This section should contain your sales goals and link these to marketing or advertising that you are planning.

If you are looking to expand into a new market, or to reach customers that you haven’t before, you should explain the risks and opportunities of doing so.

Operational Plan

This section explains the basic requirements of running your business on a day-to-day basis. Your exact requirements will vary depending on the type of business you run, but be as specific as possible.

If you need to rent office space, for example, you should include the cost in your operational plan. You should also include the cost of staff, equipment, and any raw materials required to run your business.

Management Team

The management team section is one of the most important sections in your business plan if you are applying for a loan. Your lender will want reassurance that you have a skilled, experienced, competent, and reliable senior management team in place.

Even if you have a small team, you should explain what makes each person qualified for their position. If you have a large team, you should include an organizational chart to explain how your team is structured.

Funding Request

If you are applying for a loan, you should add a funding request. This is where you explain how much money you are looking to borrow, and explain in detail how you are going to use it.

The most important part of the funding-request section is to explain how the loan you are asking for would improve the profitability of your business, and therefore allow you to repay your loan.

Financial Statements

Most lenders will also ask you to provide evidence of your business finances as part of your application. Graphs and charts are often a useful addition to this section, because they allow your lender to understand your finances at a glance.

The overall goal of providing financial statements is to show that your business is profitable and stable. Include three to five years of income statements, cash flow statements, and balance sheets. It can also be useful to provide further analysis, as well as projections of how your business will grow in the coming years.

What Do Lenders Look for in a Business Plan?

Lenders want to see that your business is stable, that you understand the market you are operating in, and that you have realistic plans for growth.

Your lender will base their decision on what are known as the “five Cs.” These are:

- Character : You can stress your good character in your executive summary, company overview, and your management team section.

- Capacity : This is, essentially, your ability to repay the loan. Your lender will look at your growth plans, your funding request, and your financial statements in order to assess this.

- Capital : This is the amount of money you already have in your business. The larger and more established your business is, the more likely you are to be approved for finance, so highlight your capital throughout your business plan.

- Conditions : Conditions refer to market conditions. In your market analysis, you should be able to prove that your business is well-positioned in relation to your target market and competitors.

- Collateral : Depending on your loan, you may be asked to provide collateral , so you should provide information on the assets you own in your operational plan.

How Long Does It Take to Write a Business Plan?

The length of time it takes to write a business plan depends on your business, but you should take your time to ensure it is thorough and correct. A business plan has advantages beyond applying for a loan, providing a strategic focus for your business.

What Should You Avoid When Writing a Business Plan?

The most common mistake that business owners make when writing a business plan is to be unrealistic about their growth potential. Your lender is likely to spot overly optimistic growth projections, so try to keep it reasonable.

Should I Hire Someone to Write a Business Plan for My Business?

You can hire someone to write a business plan for your business, but it can often be better to write it yourself. You are likely to understand your business better than an external consultant.

The Bottom Line

Writing a business plan can benefit your business, whether you are applying for a loan or not. A good business plan can help you develop strategic priorities and stick to them. It describes how you are going to grow your business, which can be valuable to lenders, who will want to see that you are able to repay a loan that you are applying for.

U.S. Small Business Administration. “ Write Your Business Plan .”

U.S. Small Business Administration. “ Market Research and Competitive Analysis .”

U.S. Small Business Administration. “ Fund Your Business .”

Navy Federal Credit Union. “ The 5 Cs of Credit .”

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans for May 2024 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How To Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/Term-b-business-plan-70c26342d5374095b3cd7e860d016168.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

How to write a business plan for a loan from a bank.

Learn how to increase your chances of securing a bank loan with these business proposal tips.

If you want a bank loan to start a new business or expand your existing one, you’ll need a thorough business proposal (also known as a loan proposal). It shows the bank (or lender) that you’ve got a plan that’s likely to succeed.

But loan proposals can also be tedious and complicated to draft. Use the following tips to learn how to write a business proposal for a bank loan and get a head start on success.

Why writing a business proposal for a bank loan is necessary.

When you’re considering getting a loan from a bank to support your business , one important step is creating a well-thought-out business proposal. This will not only help you explain your business plans but also play a big role in helping the bank decide whether to approve your loan request. Here are the main reasons why putting together a solid business proposal for a bank loan is so important:

- Clarity. A well-crafted business proposal helps you clearly articulate your business idea, goals, and objectives to the bank. This ensures that both you and the bank are on the same page regarding the purpose of the loan.

- Risk assessment. Banks need to assess the risk associated with lending you money. Your business proposal provides them with vital information about your business model, market analysis, and strategies, enabling them to gauge the level of risk involved.

- Repayment plan. Banks want to know how you plan to repay the loan. Your proposal should outline a clear and realistic repayment strategy, including cash flow projections and a timeline for repayment.

- Financial health. Lenders need to determine if your business is financially viable and can generate enough income to cover loan repayments. Your proposal should demonstrate the financial health of your business through financial statements, revenue projections, and profit margins.

- Legal requirements. Banks need to ensure that your business complies with all relevant laws and regulations. Your bank proposal letter for a business loan should address any legal considerations, licenses, permits, or certifications required.

What does a business plan proposal for a bank loan look like?

A business plan proposal for a bank loan is typically 20 to 30 pages long and follows a structured format:

- Cover sheet. A cover sheet is often included at the beginning of the proposal. It typically contains the business name, logo (if applicable), contact information, and the date of submission.

- Executive summary. This section provides a concise overview of the entire business proposal, summarizing key points such as the purpose of the loan, business description, financial projections, and the requested loan amount. It’s usually limited to one to two pages.

- Business description. This section offers a detailed explanation of the business, its history, mission, and vision. It also outlines the industry it operates in, its target market, and its competitive analysis.

- Market analysis. Includes market research findings, including market size, trends, and customer demographics. It should also detail your marketing and sales strategies.

- Management team. Describes the qualifications and experience of key members of your management team. Include their roles and responsibilities.

- Financial projections. Includes financial statements such as income statements, balance sheets, and cash flow projections. It should also outline how the loan will be used and how it will benefit the business.

- Loan request. Specifies the loan amount you are requesting from the bank, along with the purpose of the loan.

- Collateral and guarantees. If the loan requires collateral or personal guarantees, provide details about the assets or individuals involved.

- Repayment plan. Explains your proposed loan repayment strategy, including the terms, interest rate, and repayment schedule.

- Appendices. This section may include supporting documents, such as resumes of key team members, market research data, legal documents, and any other relevant information.

How to write a business proposal for a bank loan.

When it comes to securing a bank loan for your business, the quality of your business proposal can make all the difference. Let’s go through the process of how to write a business proposal for a bank loan.

Include critical details for the business plan in the proposal.

Your bank proposal should begin by introducing your business comprehensively. Cover essential aspects such as:

- Business overview. Introduce your business with its name, legal structure, and establishment date.

- Mission. Articulate your business’s purpose and long-term goals.

- Market analysis. Provide insights into your industry, target market, and current trends.

- Company history. Share key milestones and noteworthy achievements.

- Contact information. Include up-to-date contact details.

- Leadership team. Highlight key team members, their roles, qualifications, and relevant experience.

- Legal structure. Specify your business’s legal structure and ownership.

- Products/services. Describe your business offerings and emphasize their unique features.

Outline how you’ll pay the business loan back.

Every bank loan proposal should include some standard details like how much you need to borrow and how you’ll use the loan to advance your business.

More importantly, your business proposal should outline how you plan to pay the bank back. A few things you can write out to accomplish this include:

- Three-to-five-year sales forecasts

- Cash flow projections

- Expense estimates

The more detail you include, the better. But don’t crunch a bunch of numbers on the very first page — make sure your proposal is clearly outlined and all information is grouped logically.

Break down your backup loan repayment plan.

Part of your business proposal’s job is to convince the bank that you can pay them back, whether you meet your sales projections or not. To demonstrate this, show proof of collateral (or something that secures the loan) in case things don’t go as planned after you invest in assets like new real estate, equipment, or inventory for your business.

Simplify the business plan proposal for the bank loan process.

To enhance your business plan proposal’s effectiveness for a bank loan, consider simplifying it. Create your own business proposal and make sure you have the documents required for loan approval to jump-start your path to success. It’s easy to create a PDF online for your bank loan proposal, so it’s easily accessible to share with others for feedback.

Explore everything you can do with Adobe Acrobat today.

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

How To Write the Funding Request for Your Business Plan

What goes into the funding request, parts of the funding request, important points to remember when writing your request, frequently asked questions (faqs).

MoMo Productions / Getty Images

A business plan contains many sections, and if you plan to seek funding for your business, you will need to include the funding request section. The good news is that this section of your business plan is only needed if you plan to ask for outside business funding. If you're not seeking financial help, you can leave it out of your business plan. There are a variety of ways to fund your business without debt or investors. Below, we'll cover how to write the funding request section of your business plan.

Key Takeaways

- The funding request section of your business plan is required if you plan to seek funding from a lender or investors.

- You'll want to include information on the business, your current financial situation, how the money will be used, and more.

- Tailor each funding request to the specific funding source, and make sure you ask for enough money to keep your business going.

The funding request section provides information on your future financial plans, such as when and how much money you might need. You will also include the possible sources you could consider for securing your funds, such as loans or crowdfunding. Later, you can update this section when you need outside funding again for business growth.

An Outline of the Business

Yes, you've done this already in past sections, but you want to give potential lenders and investors a recap of your business. In some cases, you might simply share the funding request section so you need to have your business details such as what you provide, information about your target market, your structure (i.e. LLC), owners' and members' information (for partnerships and corporations), and any successes you've had to date in your business.

Current Financial Situation

Again, you've provided some financial information in the financial data section , but it doesn't hurt to summarize. If you're submitting just the funding request, you'll need this information to help financial sources understand your money situation.

Provide financial details such as income and cash flow statements, and balance sheets in your funding request section.

Offer your projected financial information as well. If you're asking for a loan for which you'll be offering collateral, include information about the asset. If the business had debt, outline your plan for paying it off. Finally, share how you'll pay the loan or what sort of return on investment (ROI) investors can expect by investing in your business.

How Much Money Do You Need Now and in the Future?

Indicate what type of funding you're asking for such as a loan or investment. Outline what you need now and what you might need in the future as far as five years out.

How Will the Funds Be Used?

Detail how you'll be using the money, whether it's for inventory, paying a debt, buying equipment, hiring help, and more. If you plan to use the money for several things, highlight each and how much money will go to each.

Most financial sources would rather invest in things that grow a thriving business than things that pay for debt or overhead expenses.

Current and Future Financial Plans

Current and future financial plans include items such as loan repayment schedules or plans to sell the business. If you're getting a loan, outline your plans for repayment (although most lenders will have their own schedules). If you have plans to sell the business, let the lender know that and how it will affect them. Other issues to consider are relocation (if you move) or a buyout. Finally, let investors know how they can exit the deal, such as cashing out (and how long before they can do that).

You're asking for money, so you need to always be professional and know your business inside and out. Here are some other things to keep in mind:

- Tailor your funding request to each financial source : Lenders and investors need different information, such as loan repayment versus ROI, so create different reports for each.

- Keep your funding sources in mind : Each resource will have different questions and concerns. Do a little research so you can address them in your report.

- Ask for enough to keep your business going : Don't be stingy, as you don't want your business to fail from a lack of money. At the same time, don't be greedy, asking for more than you need.

How do you request funding for a nonprofit?

Most nonprofits seek funding in the form of grants. Write a grant proposal that includes information on the project or organization, preliminary budget needs, and more. Be sure to format it with a cover letter, proposal summary, the introduction of the organization, problem statement, objectives, methods, evaluation, future funding needs, and the budget.

What are three methods of funding?

Grants and scholarships, equity financing, and debt financing are the main three methods of funding for small businesses . Grants and scholarships do not need to be repaid and are often best for nonprofit organizations. Equity financing is when you receive money in exchange for ownership and profits. Debt financing is when you borrow money that needs to be repaid.

Want to read more content like this? Sign up for The Balance’s newsletter for daily insights, analysis, and financial tips, all delivered straight to your inbox every morning!

Small Business Administration. " Fund Your Business ."

Congressional Research Service. " How To Develop and Write a Grant Proposal ."

Library of Congress Research Guides. " Types of Financing ."

What is a business loan proposal?

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Personal finance

- • Homeownership

- • Small business loans

- • Funding inequality

- Connect with Emily Maracle on LinkedIn Linkedin

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so you can feel confident as you’re managing your money.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Starting a business can be the start of pursuing a lifelong dream. But turning a dream into reality requires putting your ideas on paper — especially if you want to secure a small business loan from a lender.

In most cases, lenders will request prospective business owners to present a business loan proposal. This relatively straightforward document informs the lender why you believe your business would be a good investment worthy of a loan. Think of it as a pitch for why you should get the loan and how you plan to repay it.

Key Takeaways

- A business loan proposal is a streamlined pitch to a lender that explains what you need the loan for and how you would pay it back

- A good business loan proposal should include financial information about your business, a high-level explanation of how your business operates and a loan repayment plan

- Business loan proposals are important documents for getting a lender to approve your loan request

Is a business loan proposal different from a business plan?

While a business plan and a business loan proposal may sound similar, they serve different goals. A business plan is more of a guide to your entire business. It takes you through the stages from start-up to operation, lays out how your company will be structured and considers your prospects and how they might affect your plans for the future.

By contrast, a business loan proposal has a simpler purpose: secure funds to start your business. This will typically be a shorter document and includes information most important to the lender, like how you plan to repay the loan in a timely manner.

Why would lenders want a business loan proposal?

Lenders typically want a business loan proposal and a business plan to better understand your business’s financial state and short-term prospects. This allows the lender to understand where your company stands in the market and how likely you are to succeed.

Lenders want to see available cash , projected revenues and other details relevant to your ability to generate profit. Lenders also want to know how much of a risk they are taking by lending you money and the likelihood that their loan will be repaid.

How to write a business loan proposal

A successful business loan proposal should be well-written and thoughtful. You will want to include essential financial documents as attachments in addition to the details about your business.

As for the format of your proposal, there are a few options, but it is best to ask the lender if there’s a preferred format. If the lender doesn’t provide guidance, you can create a document with several sections highlighting essential information for a potential lender.

1. Executive summary

Start by offering the lender information about you and your operation. Provide a brief background on yourself and an overview of your business. You can briefly explain how you want to use the funds, but keep it short as you will provide more details later on.

2. Overview of your business model

The overview should include a short history of operation, legal structure and essential details about operations, including any licensing and your company’s current revenue. You can also include information about the market that you operate in, including industry trends and details about your customer base.

3. Owner investments

Some lenders, like the SBA, require you to exhaust all other financing options before qualifying for a loan. In this section, you should show how much equity you have in your business, what you have invested or any profits. If there are other owners, lenders will also want to see what they’ve invested.

4. Loan request

Here you’ll outline the amount of money you need and how you plan to use it. Explain what you’ll purchase with the funds — like if you plan to use it for fixed assets or working capital — and how you believe it will impact the business. The loan request should also show how you determined the loan amount.

5. Loan repayment plan

The lender will want to know your plan for repaying the loan. Use this section to lay out a repayment schedule based on the loan terms. Make clear what your plan is to ensure payments are made on time and in full and how repaying the loan is likely to affect your overall cash flow. Also, explain how you would pay back the loan in case of a downturn in sales, such as cash reserves. You can include details about pledged collateral here as well.

6. Financial statements

While you’ll want to attach financial statements in full to your business loan proposal, you can provide a brief overview in this section. Provide insight into what your books look like over the last few quarters of operation, including income statements . If your business has any existing liabilities, you can also include those details here.

Additionally, you should include personal financial statements from major stakeholders in the company, usually anyone with 20 percent or more equity. These should be an overview of assets and liabilities and personal net worth for each stakeholder.

7. Income projections

In addition to past statements about your business’s operation, lenders will want to know what to expect from your business in the future. Include your projected income and cash flow statements. Include any details regarding changes you would make to your business if you fall short of projections, and provide at least one year of projections for the lender to consider.

The bottom line

Business loan proposals are important documents for business owners seeking financial support to present to a lender. They provide key details about the business as it currently operates and how a business loan would be used so that a lender can feel secure in providing funding and recouping its investment over time.

Frequently asked questions about business loan proposals

What’s the difference between a business plan and a business loan proposal, how do i write a business loan proposal.

Related Articles

How to get a business loan in 6 steps

How to get a small business loan without collateral

What is a fast business loan and how does it work?

How do business loans work?

Business Loan Application Letter Sample: Free & Effective

In this article, I’ll guide you through the process step-by-step, drawing from my personal experiences, and provide you with a handy template to get you started. Whether you’re a seasoned business owner or just starting out, these insights will help you craft a compelling letter that stands out to lenders.

Key Takeaways

- Understand Your Audience: Know the lender’s requirements and tailor your letter accordingly.

- Be Clear and Concise: Communicate your business’s needs and how the loan will be used in a straightforward manner.

- Provide Detailed Information: Include pertinent details about your business and your plan for the loan.

- Use a Professional Tone: Maintain a formal tone throughout the letter to convey seriousness and professionalism.

- Follow a Structured Format: Use a clear and logical structure to make your letter easy to read and understand.

- Include Supporting Documents: Attach essential documents that can vouch for your business’s credibility and financial health.

Step-by-Step Guide to Writing a Business Loan Application Letter

Step 1: understand the lender’s requirements.

Before you begin writing, it’s crucial to understand the lender’s criteria. Each financial institution has its unique set of requirements for loan applications. Familiarize yourself with these to tailor your letter effectively.

Step 2: Start with Your Contact Information

Begin your letter with your contact information at the top, followed by the date and the lender’s details. This establishes a professional tone from the outset.

Your Name Your Business Name Your Business Address City, State, Zip Code Date Lender’s Name Lender’s Institution Lender’s Address City, State, Zip Code

Step 3: Craft a Compelling Introduction

Trending now: find out why.

In the opening paragraph, introduce yourself and your business. Clearly state the purpose of your letter – to apply for a business loan – and the amount you are requesting. This sets the stage for the details that follow.

Step 4: Detail Your Business Plan

This is where you shine. Outline your business plan, emphasizing how the loan will contribute to your business’s growth. Be specific about how you intend to use the funds. Will they be used for expanding operations, purchasing equipment, or maybe for bolstering your working capital? Lenders want to see that you have a clear plan in place.

Step 5: Showcase Your Business’s Financial Health

Include a brief overview of your business’s financial status. Highlight your revenue, profit margins, and financial projections. This demonstrates to lenders that you have a viable business capable of repaying the loan.

Step 6: Mention Collateral (If Applicable)

If you’re offering collateral against the loan, specify what it is. This could be equipment, real estate, or inventory. Detailing the collateral reassures lenders about the security of their investment.

Step 7: Conclude with a Call to Action

End your letter by thanking the lender for considering your application and expressing your willingness to provide further information if needed. Include a polite request for a meeting or a conversation to discuss the application further.

Step 8: Professional Sign-Off

Sign off your letter with a professional closing, such as “Sincerely,” followed by your name and position within the company.

Template for a Business Loan Application Letter

[Your Name] [Your Business Name] [Your Business Address] [City, State, Zip Code] [Date]

[Lender’s Name] [Lender’s Institution] [Lender’s Address] [City, State, Zip Code]

Dear [Lender’s Name],

I am writing to apply for a business loan of [Loan Amount] for [Your Business Name]. As [Your Position] of the company, I am committed to guiding our business to new heights, and this loan is a crucial step in our growth strategy.

Our plan is to allocate the loan towards [Specific Use of Loan]. This investment is projected to [Expected Outcome of Loan Investment], enhancing our profitability and ensuring our ability to repay the loan.

Enclosed with this letter, you will find our business plan, financial statements, and cash flow projections, providing a comprehensive view of our business’s financial health and growth potential.

Thank you for considering our loan application. I am looking forward to the opportunity to discuss this further and am happy to provide any additional information required.

[Your Name] [Your Position] [Your Contact Information]

Tips from Personal Experience

- Personalize Your Letter: While using a template is helpful, adding personal touches that reflect your business’s unique aspects can make your letter stand out.

- Be Transparent: Honesty about your business’s current financial situation and how you plan to use the loan builds trust with lenders.

- Proofread: A letter free from grammatical errors and typos shows attention to detail and professionalism.

I’d love to hear your thoughts or experiences with writing business loan application letters. Do you have any tips to share or questions about the process? Feel free to leave a comment below.

Frequently Asked Questions (FAQs)

Q: What is a business loan request?

Answer: A business loan request is a formal request made by a business to a lender or financial institution for a loan to finance business operations or expansion.

Q: What information is typically included in a business loan request?

Answer: A business loan request typically includes information about the business, including its financial history, plans for the loan proceeds, and a projected financial statement.

It may also include personal financial information about the business owner or owners.

Q: How is a business loan request typically made?

Answer: A business loan request is typically made in writing, through a loan application or business plan submitted to a lender or financial institution.

Q: What documentation is required to support a business loan request?

Answer: Documentation that may be required to support a business loan request can include financial statements, tax returns, and personal financial information.

It may also include business plan, projected financial statement, and any collateral that the business can offer.

Q: What are the potential outcomes of a business loan request?

Answer: The potential outcomes of a business loan request can include the lender or financial institution approving the loan, denying the loan, or offering a modified loan amount or terms.

The interest rate, repayment period, and other terms of the loan will be based on the creditworthiness of the business and the lender’s lending policies.

Q: What is a business loan request letter?

Answer : A business loan request letter is a formal written document submitted by an individual or a business to a financial institution or lender, seeking financial assistance in the form of a loan.

It outlines the purpose of the loan, the amount requested, and provides supporting information to convince the lender of the borrower’s creditworthiness.

Q: How do I start a business loan request letter?

Answer : To start a business loan request letter, begin by addressing it to the appropriate person or department at the lending institution.

Use a formal salutation such as “Dear [Lender’s Name]” or “To Whom It May Concern.” Introduce yourself or your business and clearly state the purpose of the letter, which is to request a loan.

Q: How should I structure a business loan request letter?

Answer : A business loan request letter should follow a professional and organized structure. It typically includes an introduction, a body, and a conclusion.

The introduction should clearly state the purpose of the letter and provide essential details about yourself or your business.

The body of the letter should elaborate on the loan request, including the amount needed, the purpose of the loan, and any supporting information or documents.

Finally, the conclusion should express appreciation for the lender’s time and consideration, while offering your contact information for further communication.

Q: What tone should I use in a business loan request letter?

Answer : A loan request letter should maintain a formal and professional tone throughout. It should be respectful, concise, and polite. Avoid using overly technical jargon or informal language.

It is important to demonstrate professionalism and credibility to increase your chances of a favorable response.

Q: How long should a business loan request letter be?

Answer : A business loan request letter should be concise and to the point, typically ranging from one to two pages.

Avoid excessive details or unnecessary information that may distract from the main purpose of the letter. Keep the content focused, clear, and persuasive.

Q: What is the purpose of a business loan request letter?

Answer : The purpose of a business loan request letter is to formally request financial assistance from a lender or financial institution.

It serves as a written proposal, outlining the borrower’s need for funds, the purpose of the loan, and the borrower’s ability to repay.

The letter aims to persuade the lender that the loan is a viable investment with a solid repayment plan and potential for positive outcomes.

Q: How important is a business loan request letter?

Answer : A business loan request letter is crucial when seeking a loan from a lender or financial institution.

It acts as a formal request, providing essential information about the borrower, the purpose of the loan, and the borrower’s ability to repay.

A well-written and persuasive loan request letter increases the likelihood of the loan being approved, as it demonstrates professionalism, credibility, and a clear understanding of the borrower’s financial needs.

Related Articles

Personal loan request letter sample: free & effective, request letter for working capital loan: the simple way, personal loan paid in full letter sample: free & effective, sample letter to bank requesting extension of time for loan payment: free & effective, ask someone for money in a letter sample: free & effective, business loan request letter sample: free & customizable, leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

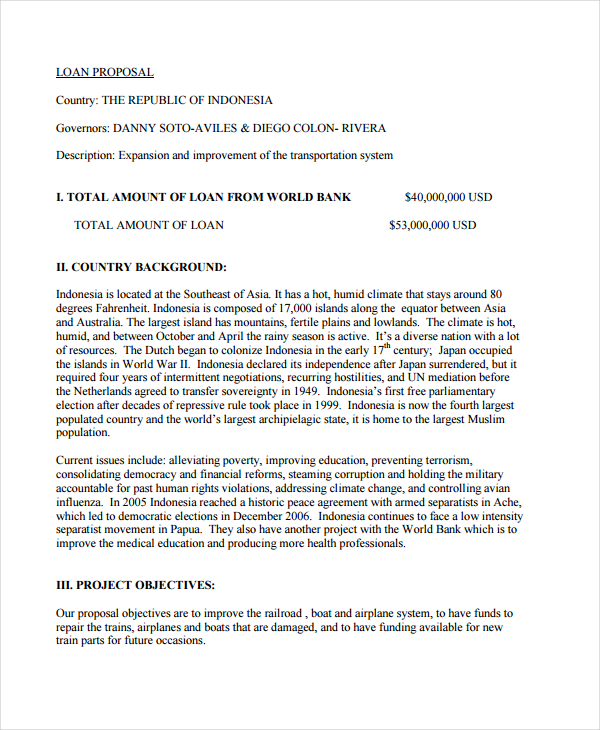

Loan Proposal

Entrepreneurship is a challenging field, but it’s a lucrative venture. If you’re hoping to establish a startup and work your way from the ground up, you will need all the funding you can get. If you’re applying for a personal loan to start a small business , you need a loan proposal to help you. A financing proposal will comprise all your plans and purposes on why you intend to apply for a loan request. It contains your business objectives as well as a fact-based reason why you deserve your business’ loan request approval.

13+ Loan Proposal Examples

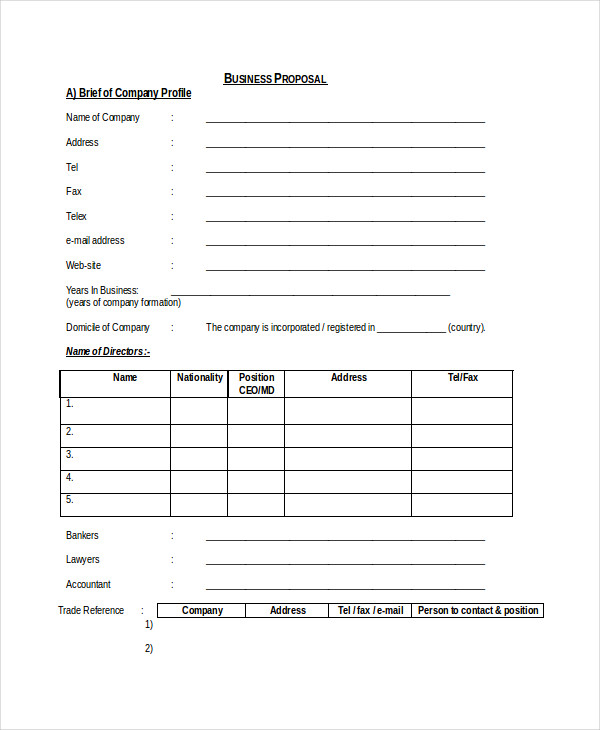

1. business loan proposal template.

- Google Docs

Size: A4 & US

2. Restaurant Loan Proposal Example

Size: A4, US

3. Loan Proposal for Startup Template

- Apple Pages

Size: 45 KB

4. Small Business Loan Proposal Template

Size: 54 KB

5. Business Loan Proposal

Size: 10 KB

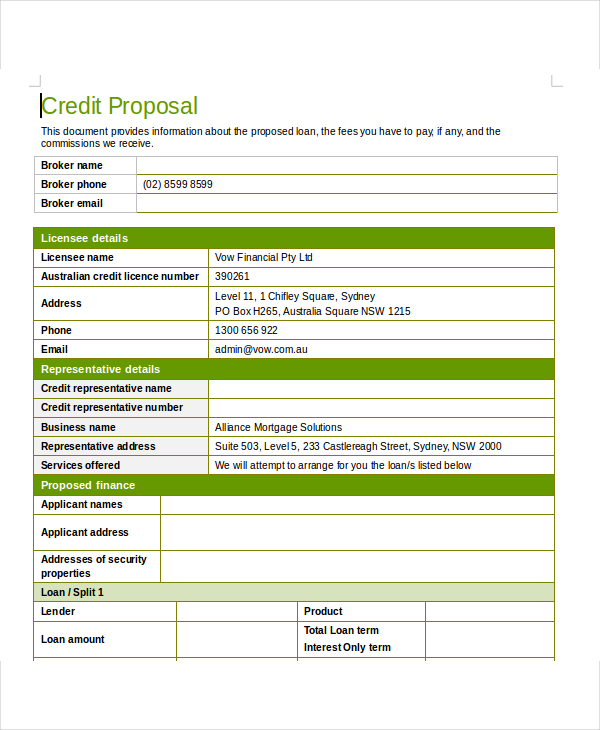

6. Credit Proposal Example

Size: 171 KB

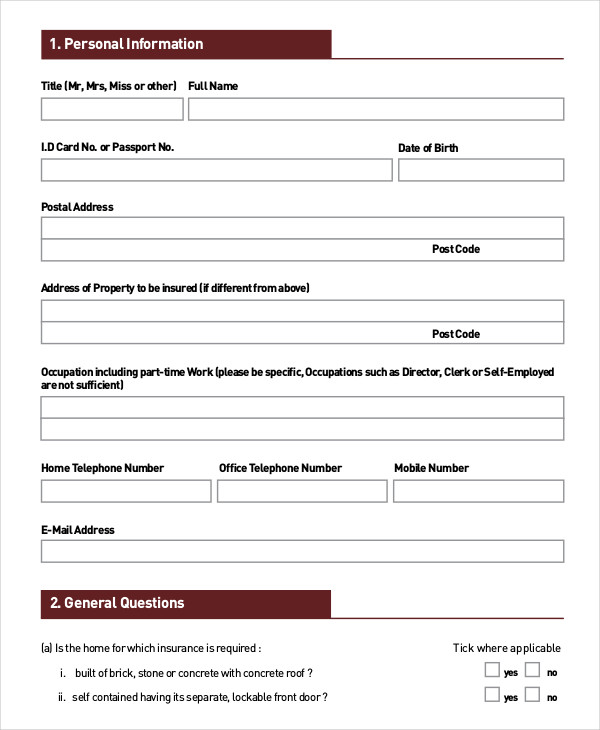

7. Home Loan Proposal Sample

Size: 40 KB

8. Bank Loan Sample Proposal

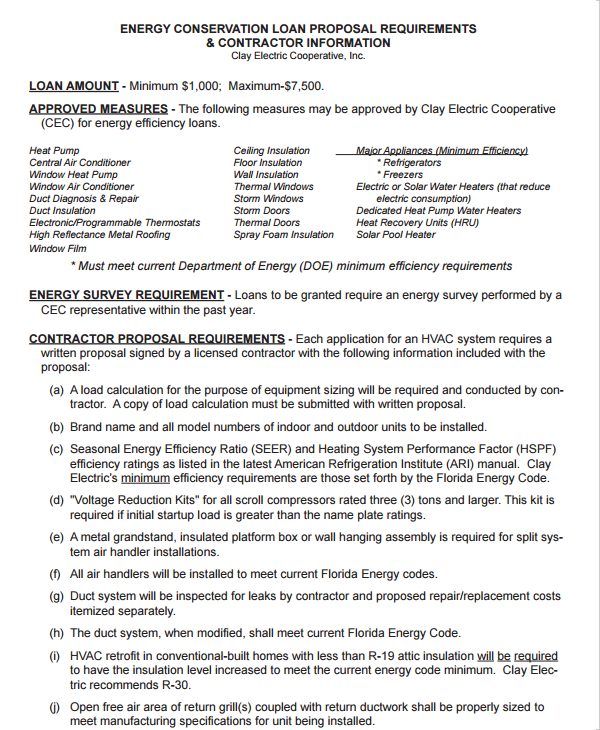

9. Contractor Loan Proposal

Size: 240 KB

10. Sample Loan Proposal

Size: 318 KB

11. Land Loan Proposal

Size: 696 KB

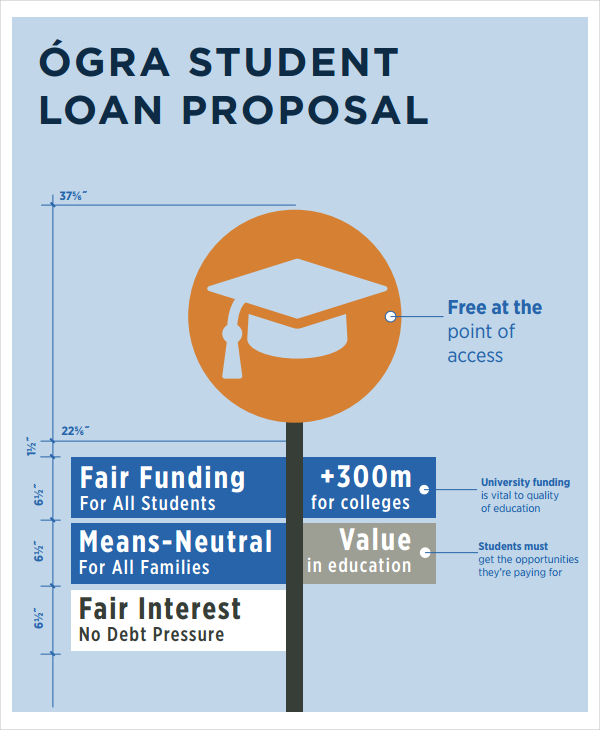

12. Student Loan Proposal

13. Simple Loan Proposal

Size: 208 KB

14. Loan Fund Proposal

Size: 232 KB

What Is a Loan Proposal?

A business loan proposal is a required document when going through a loan application prepared by aspiring borrowers. It includes not only the details of their loan but also their business description where they intend to use the money. Lenders demand a loan proposal to see if the loan candidate can pay for the credit and fulfill the loan agreement , and if his or her purpose is reasonable enough for a loan release.

How to Write a Loan Proposal

Development needs funding, and sometimes, even when your business is doing so well, there’s not just enough for expansion or building a new branch or a manufacturing facility. That and some other valuable purposes are among the viable reasons to take a business loan . The idea of a huge financial burden might be intimidating, but with the right management, they can result in great profits.

Before that happens, you need a good loan proposal to back you up. Here are some guidelines to help you:

1. Start with a Comprehensive Executive Summary

To introduce yourself and your purpose, start your proposal with a comprehensive executive summary . An executive summary employs the characteristic of a cover letter that contains you and your business’ introduction. This will help whoever will review your proposal to identify who you are easily and the nature of what you do. You can include in the summary a brief description of your business, whether or not you’re a veteran in the field or finding ways to build a new business . State the reason why you’re appealing for a loan and how it will help you achieve your objectives.

2. Provide a Business Profile

Loan requests are a big deal. Lenders and bankers need to know that the person coming to them for help is credible and trustworthy. A copy of your company profile will add significant value to the validity of your appeal. Your business profile should include a summary of your business activities and the products or services that you put out into the market. It should also provide a narrative of your target customers and the marketing strategies that you use. In many ways, your business plan contributes to the most reasons why you need loan approval.

3. State Your Loan Request

Clearly state how much you want to borrow and how you exactly plan to use the money. General statements such as “I want to raise my sales, and an added fund would help me” won’t make the cut. Be specific. How will you raise your sales through additional funding? Will you buy more equipment and increase your production? Are you building another factory because your demands are piling up? This should come in detail as the bank won’t be content with a mere statement. Provide documents showcasing your intentions and the cost it entails. Present your need by showcasing facts and a promising plan waiting to happen.

4. Introduce a Proof That You Can Pay

A business loan proposal constitutes a huge sum of money. Without any repayment assurance, your bank would probably give you a negative result. Show them how you plan to pay your loan according to your agreed timeline . Provide a copy of your income statement , projected cash flow , and budget sheet , and explain how you will customize your financial plan in order to repay the loan. A concrete plan will help you provide them with a perspective on how you will manage your debt.

FAQ’s

What are the elements of a loan proposal.

A loan proposal has numerous elements, but they are generally classified as loan description, business description, financial statements , and references.

What supporting documents does your loan proposal need?

A loan proposal needs the support of a business plan, profit and loss statement , cash flow statement, balance sheets, and financial projections.

What are viable collaterals for a personal loan?

Among the most common types of viable collaterals for a personal loan are real estate properties , vehicles, home equity, cash, savings account, and investments.

Fulfilling your business objectives requires you to overcome some of your life’s most challenging obstacles. This includes getting your loan proposal’s approval. It’s not easy, and there’s a lot of considerations that go into the planning and making of your proposal presentation. If you’re thinking about doing it to enhance your business operations , here’s your cue—do it! Start with a selection of our solid loan proposals. Make the most out of a great day and download now!

Proposal Maker

Text prompt

- Instructive

- Professional