- Search Search Please fill out this field.

What Is a Venture Capitalist?

Understanding venture capitalists, venture capital structure, the bottom line.

- Alternative Investments

- Private Equity & VC

Venture Capitalists Definition: Who Are They and What Do They Do?

Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University.

:max_bytes(150000):strip_icc():format(webp)/CharleneRhinehartHeadshot-CharleneRhinehart-ca4b769506e94a92bc29e4acc6f0f9a5.jpg)

Skylar Clarine is a fact-checker and expert in personal finance with a range of experience including veterinary technology and film studies.

A venture capitalist (VC) is a private equity investor that provides capital to companies with high growth potential in exchange for an equity stake. A VC investment could involve funding startup ventures or supporting small companies that wish to expand but have no access to the equities markets .

Key Takeaways

- A venture capitalist (VC) is an investor who provides young companies with capital in exchange for equity.

- Startups often turn to VCs for funding to scale and commercialize their products.

- Due to the uncertainties of investing in unproven companies, venture capitalists tend to experience high rates of failure.

- However, the rewards are substantial for those investments that do pan out.

- Some of the most well-known venture capitalists are Jim Breyer, an early investor in Facebook, and Peter Fenton, an investor in X (formerly Twitter).

Investopedia / Joules Garcia

Venture capitalist firms are usually formed as limited partnerships (LPs) where the partners invest in the VC fund. A committee is usually tasked with making investment decisions. Once those promising emerging growth companies are identified, the pooled investor capital is deployed to fund these companies in exchange for a sizable equity stake.

Contrary to common belief, VCs do not normally fund a startup at its outset. Instead, VCs seek to target firms bringing in revenue and looking for more money to commercialize their ideas. The VC fund will buy a stake in these firms, nurture their growth, and look to cash out with a substantial return on investment (ROI) .

Venture capitalists typically look for companies with a strong management team, a large potential market, and a unique product or service with a strong competitive advantage. They also look for opportunities in industries that they are familiar with, as well as the chance to own a large percentage of the company so that they can influence its direction.

VC firms control a pool of various investors' money, unlike angel investors , who use their own money.

VCs are willing to risk investing in such companies because they can earn a massive return on their investments if they are successful. However, VCs experience high rates of failure due to the uncertainty involved with new and unproven companies.

Wealthy individuals, insurance companies, pension funds , foundations, and corporate pension funds may pool money in a fund to be controlled by a VC firm. The venture capital firm is the general partner (GP), while the other companies/individuals are limited partners (LP). All partners have part ownership of the fund.

The general structure of the roles within a venture capital firm varies among firms, but they can be broken down into roughly three positions:

- Associates : These individuals usually come to VC firms with experience in either business consulting or finance and, sometimes, degrees in business. They tend to do more analytical work, analyzing business models, industry trends, and sectors. They also work with the companies in a firm's portfolio. Although they do not make key decisions, associates may introduce promising companies to the firm's upper management.

- Principals : A principal is a mid-level professional. They usually serve on the boards of portfolio companies and ensure that they operate without major hiccups. Principals are also in charge of identifying investment opportunities for VC firms and negotiating terms for both acquisition and exit. Principals are on a "partner track" that depends on the returns they can generate from the deals they make.

- Partners : The higher profile partners primarily identify areas or specific businesses to invest in, approve deals (whether investments or exits), occasionally sit on the board of portfolio companies, and generally represent their VC firms.

The VC firm, as the GP, controls where the money is invested. Investments are usually in businesses or ventures that most banks or capital markets avoid due to the high degree of risk.

Venture capitalists must follow regulations as they conduct their business. Private equity firms and venture capitalists fall under U.S. Securities and Exchange Commission (SEC) regulatory control. Banks and other financial institutions must follow anti-money laundering regulations.

Venture capital fund managers are paid management fees and carried interest . Depending on the firm, roughly 20% of the profits are paid to the company managing the private equity fund, while the rest goes to the limited partners who invested in the fund. General partners are usually due an additional 2% fee.

History of Venture Capital

The first venture capital firms in the U.S. started in the mid-twentieth century. Georges Doriot, a Frenchman who moved to the U.S. to get a business degree, became an instructor at Harvard's business school and worked at an investment bank. In 1946, he became president of American Research and Development Corporation (ARDC), the first publicly funded venture capital firm.

ARDC was remarkable in that, for the first time, a startup could raise money from private sources other than wealthy families. Previously, new companies looked to families such as the Rockefellers or Vanderbilts for the capital they needed to grow. ARDC soon had millions in its account from educational institutions and insurers. Firms such as Morgan Holland Ventures and Greylock Partners were founded by ARDC alums.

Startup financing began to resemble the modern-day venture capital industry after the passing of the Investment Act of 1958. The act enabled small business investment companies to be licensed by the Small Business Administration (established five years earlier).

Venture capital, by its nature, invests in new businesses with great growth potential (but also an amount of risk substantial enough to scare off lending by banks). Fairchild Semiconductor (FCS), one of the earliest and most successful semiconductor companies, was the first venture capital-backed startup, setting a pattern for venture capital's close relationship with emerging technologies in the San Francisco Bay Area.

Venture capital firms in that region and period also established the standards of practice used today. They set up limited partnerships to hold investments, with professionals acting as general partners. Those supplying the capital would serve as passive partners with more limited control. The number of independent venture capital firms increased in the following decade, prompting the founding of the National Venture Capital Association in 1973.

Venture capital has since grown into a hundred-billion-dollar industry. Today, well-known venture capitalists include Jim Breyer, an early Facebook ( META ) investor, Peter Fenton, an early investor in X, and Peter Thiel, the co-founder of PayPal ( PYPL ).

$348 billion

The record-setting value of all U.S. venture capital investments in 2021. The following two years posted other impressive figures, with 2022 venture capital activity valued at $242.2 billion and total capital in 2023 at $170.6.

How Are Venture Capitalist Firms Structured?

VC firms typically control a pool of funds collected from wealthy individuals, insurance companies, pension funds, and other institutional investors. Although all of the partners have partial ownership of the fund, the VC firm decides how the monies will be invested. Investments are usually made in businesses with attractive growth potential that are considered too risky for banks or capital markets. The venture capital firm is referred to as the general partner, and the other financiers are referred to as limited partners.

How Are Venture Capitalists Compensated?

Venture capitalists make money from the carried interest of their investments, as well as management fees. Most VC firms collect about 20% of the profits from the private equity fund, while the rest goes to their limited partners. General partners may also collect an additional 2% fee.

What Are the Prominent Roles in a VC Firm?

Each VC fund is different, but their roles can be divided into roughly three positions: associate, principal, and partner. As the most junior role, associates are usually involved in analytical work, but they may also help introduce new prospects to the firm. Principals are higher-level and more closely involved in the operations of the VC firm's portfolio companies. At the highest tier, partners are primarily focused on identifying specific businesses or market areas to invest in and approving new investments or exits.

Venture capitalists are investors who form limited partnerships to pool investment funds. They use that money to fund startup companies in return for equity stakes in those companies. VCs usually make their investments after a startup has been bringing in revenue rather than in its initial stage.

VC investments can be vital to startups because their business concepts are typically unproven and, thus, they pose too much risk for traditional providers of funding.

Harvard Business School, Baker Library Historical Collections. " Georges F. Doriot ."

Cambridge Historical Society. " Innovation in Cambridge ."

Small Business Administration. " Small Business Investment Act of 1958 ."

Small Business Administration. " Organization ."

Fairchild Semiconductors. " History of Fairchild ."

U.S. Securities and Exchange Commission. " Speech by SEC Staff: The Future of Securities Regulation ."

National Venture Capital Association. " NVCA Celebrates 50 Years of Empowering the Entrepreneurial Ecosystem ."

National Venture Capital Association. " About Us ."

National Venture Capital Association. " PitchBook-NVCA Venture Monitor Q4 2023 ," Page 6.

:max_bytes(150000):strip_icc():format(webp)/thinkstockphotos-166162153-5bfc2b5746e0fb0083c0735f.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Starting Up

- Growing a Business

- Inspiration

- For Subscribers

- Write for Entrepreneur

- Entrepreneur Store

- United States

- Asia Pacific

- Middle East

- South Africa

Copyright © 2024 Entrepreneur Media, LLC All rights reserved. Entrepreneur® and its related marks are registered trademarks of Entrepreneur Media LLC

Understanding The VC Business Model Investor Dany Farha addresses the business model of venture capital, and what it takes to for VCs to take calculated risks investing in startups: a strong entrepreneurial team that is mission-driven.

By Dany Farha • May 29, 2016

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur Middle East, an international franchise of Entrepreneur Media.

Firstly, we need to address the business model of venture capital (VC), and in doing so, dispel the myth that VC is a "gamble," where we invest and hope for the best. The business model of more traditional investment asset classes such as private equity and asset management is governed by the mathematical concept of outperforming on a normal distribution graph. That means that most investments end up slightly below or ahead of the mean/median, and those investors that outperform an index, end up with a slightly higher weighting of their investments to the right of the mean/median. In VC, our business model is governed by the "power law:" what this means in essence, is that out of every ten early-stage investments , around two will create all the returns and the rest will underperform by generating little to no returns. Once this concept has been understood, it is then easier for our investors to understand our business model.

We are in the business of taking calculated risks investing in strong entrepreneurial teams. The other key mathematical driver to understanding our business model is that we invest in <1% of the deals that we see every year. That means if we see 1000 deals, which we are on track to see this year, we will invest in <10 deals at the early stages. It is worth noting that we have waited four years for the MENA ecosystem to grow and mature to a level whereby we will see 1000 deals this year. The final mathematical concept for investors to understand is that of "discipline," which is the discipline we have to maintain in only following on with further funds in those teams who demonstrate strong execution amongst other business drivers.

Related: Middle East VCs Give You Three Industry Insider Rules To Note

How the deal flow works

Top quartile VC funds generate strong returns of > 30% internal rate of returns (IRRs). The top one percentile, meaning those that generate better returns than 99% of their peers, generate outstanding returns of 70%, and even 90% in some cases. These top one percentile firms invest in 0.5% of the deals they see, have three or four companies generating multiple times the entire size of the vintage in question, and a small proportion of their dry powder goes to the investments that don't perform, in some cases as little as 20%, which comes down to a rigorous and disciplined approach to deploying follow-on funds.

These top one percentile firms receive the best deal flow which comes down to having a team of partners who hail from entrepreneurial backgrounds, being ex-founder's matched by functional experts, who work tirelessly to grow their ecosystem and specifically their portfolio companies. We at BECO have configured ourselves accordingly and are building out a family of mission-driven entrepreneurs and functional experts to make a significant impact in finding and funding the best teams to build large businesses that can make a tremendous impact on our region and make it a better place to live and work.

Related: Making Monetary Sense: How To Understand Your VC Term Sheet

Why your mission matters

This brings us to the next extremely important matter: mission. We believe that the best entrepreneurs are mission-driven which drives them with the passion required to obsess about solving a big problem, no matter how hard things get. We ourselves at BECO are mission-driven. Our mission is to leapfrog our region to participate in the technological revolution that is upon us and is only going to accelerate over the coming decades.

We believe that investors have bought into our vision, mission and strategy, and once on board, they will support us when they can, but broadly, they give us the freedom to execute. We have a strong fiduciary obligation to our shareholders and with this ensure a very high level of governance around keeping our shareholders updated on our progress. We do this by sending out regular business updates, newsletters, detailed semiannual and annual reports, audited financial statements, and we organize an annual general meeting where we present the past, present and future with detailed updates from the BECO team, portfolio companies and the professional service providers that we work with to produce accurate and high quality reporting. All this is supported by a very high quality board of directors, who meet at least quarterly and work tirelessly to steer, ensure shareholder value creation and accountability through a strong best in class governance framework.

This is no different to what we as investors expect from our portfolio companies and hence, we lead by example, and expect the same excellence.

Related: Swaying A VC In Your Favor: Five Questions That Can Make Or Break The Deal

Co-founder and CEO, BECO Capital

Most Popular Red Arrow

4 ways to build a strong online brand (despite the chaos of the internet).

Building trust and influence in a digital world is an ongoing process, and embracing these trends will help you navigate the ever-changing landscape of personal branding.

This Once Single Mom Had Negative $1,500 in Her Bank Account Before She Started a Lucrative Side Hustle — and Earned $100,000 Within 1 Year

Dixie Bagley did a friend a favor — and it turned into a high-paying business opportunity.

Zillow Co-Founder Shares a 'Misunderstood' Truth About Starting, Funding and Selling Your Company

Now that he runs a venture fund himself, Spencer Rascoff is sitting on the other side of the table, and he sees what founders get wrong when pitching investors.

Walgreens Boots Alliance Gets Bill for $2.7 Billion From the IRS After Tax Audit

'Tis the (tax) season.

Want to Test Your Business Idea Without Spending Much Money? Use the "Mousetrap" Model

Instead of building products and then learning who wants them, you can test demand before really investing your time and energy.

4 Steps to Grow to 1 Million Followers on TikTok

With daily work and consistency, you can build an audience in less than 24 months.

Successfully copied link

- Venture Capitalist (VC)

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on November 23, 2023

Get Any Financial Question Answered

Table of contents, venture capitalist definition.

A Venture Capitalist is a private investor that provides early capital to new companies that exhibit a strong potential for growth and success. This is typically in exchange for a significant equity stake.

Venture Capitalists can provide funding for startups or small businesses in need of capital that do not have access to equities markets because the companies are too new.

The projects they invest in are usually high risk / high reward ventures.

As such they are unappealing investments to most investors, especially those who are risk averse, but prime targets for venture capitalists who are willing to accept a greater risk for a potentially greater payout.

What Does a Venture Capitalist Do?

Venture capital investors usually come together to create limited partnerships, or LPs , where members contribute to a pool of funds .

These funds will often be overseen by a committee tasked with identifying companies with emerging growth potential, making investment decisions, and deploying investor capital.

Identify and Nurture Promising Startups

VCs possess a keen eye for spotting potential. They sift through thousands of startup pitches, seeking out those golden ideas with disruptive potential.

Once they identify a promising startup, they don't just provide funds; they nurture these companies, guiding them through the treacherous waters of the business world.

Not all startups are created equal. It's the VC's role to pinpoint those with the best chances of success, often relying on a combination of market analysis, intuition, and experience.

They then help these startups refine their vision and strategy, setting them on a path to success.

Provide Capital and Strategic Support

While funding is essential, VCs offer more than just capital . They bring a wealth of experience, industry contacts, and strategic insight to the table.

This support can be invaluable for a fledgling company, providing mentorship and opening doors to partnership opportunities. Venture capitalists can also play a pivotal role in guiding a startup's growth trajectory.

From organizational structure to hiring decisions, the strategic support offered by VCs can help startups navigate complex decisions and avoid common pitfalls.

Facilitate Growth and Scaling Opportunities

As startups mature, they face the challenge of scaling — growing their operations to meet increasing demand without compromising on quality or efficiency.

VCs play a crucial role here, leveraging their resources and network to help these businesses expand responsibly and sustainably.

Furthermore, venture capitalists may introduce startups to potential partners, clients, or even future employees.

These introductions can propel a startup's growth, helping them reach new markets and tap into larger customer bases.

Types of Venture Capitalists

Angel investors.

Angel investors are affluent individuals who provide capital to startups in exchange for ownership equity or convertible debt.

Often, they're the first external investors in a new business, stepping in when the risk is highest.

While they invest smaller amounts than other types of VCs, angel investors can offer invaluable mentorship and guidance.

Many are seasoned entrepreneurs themselves, eager to give back to the next generation of innovators.

Corporate Venture Capitalists (CVCs)

Corporate Venture Capitalists (CVCs) are subsidiaries of larger corporations that invest in startups.

They often seek startups that align with the parent company's strategic goals, providing not just funds but also access to resources, distribution channels, and a vast network.

CVCs differ from traditional VCs in that they typically prioritize strategic returns over financial ones.

Their investments are a way to foster innovation, explore emerging markets, and maintain a competitive edge.

Venture Capital Firms

Venture capital firms are professional groups that manage pooled funds from many investors to invest in startups and small businesses.

They come with a team of professionals experienced in various aspects of business, from technology to marketing.

Such firms typically have a more extended investment horizon and can provide larger amounts of capital compared to angel investors or CVCs.

They also bring rigorous due diligence processes and a vast network of resources and contacts to their portfolio companies.

Venture Capital Process

Deal sourcing and screening.

VCs constantly search for promising startups, attending pitch events, networking sessions, or even tapping into their networks. Once potential deals are sourced, they're screened to shortlist the most promising candidates.

During the screening process, VCs look for startups that fit their investment criteria. This could be based on the startup's industry, stage of development, market potential, or any other specific criteria the VC prioritizes.

Due Diligence and Evaluation

Once a startup is shortlisted, VCs dive deep into due diligence . They assess the startup's business model, financial projections, management team, market potential, and more.

This rigorous evaluation is crucial to determine the startup's valuation and potential return on investment .

It's during this phase that VCs might consult industry experts, conduct market research, or even visit the startup's operations. The goal is to ascertain the potential risks and rewards of the investment.

Term Sheet Negotiation

If a VC decides to move forward, they draft a term sheet. This document outlines the terms of the investment, including the amount of capital, the equity offered in return, and other conditions of the investment.

It serves as a blueprint for the official investment contract. Negotiating the term sheet can be intricate, as both parties work to protect their interests.

Common points of contention include valuation , equity stake, and clauses related to governance or exit strategies.

Investment Decision and Funding

With the term sheet agreed upon, the VC makes the official investment decision. If the decision is positive, funds are transferred to the startup in exchange for equity or other agreed-upon terms.

This capital injection often serves as a lifeline for startups, allowing them to scale operations, hire key personnel, invest in marketing, or develop new products.

Post-investment Monitoring and Value Addition

The VC's role doesn't end with funding. They continually monitor their investments , often taking board positions to influence the startup's direction.

They also seek to add value, providing mentorship, opening networking opportunities, and guiding the startup through challenges.

For VCs, this active involvement maximizes the chances of a successful exit, be it through an initial public offering (IPO) , a merger, or an acquisition .

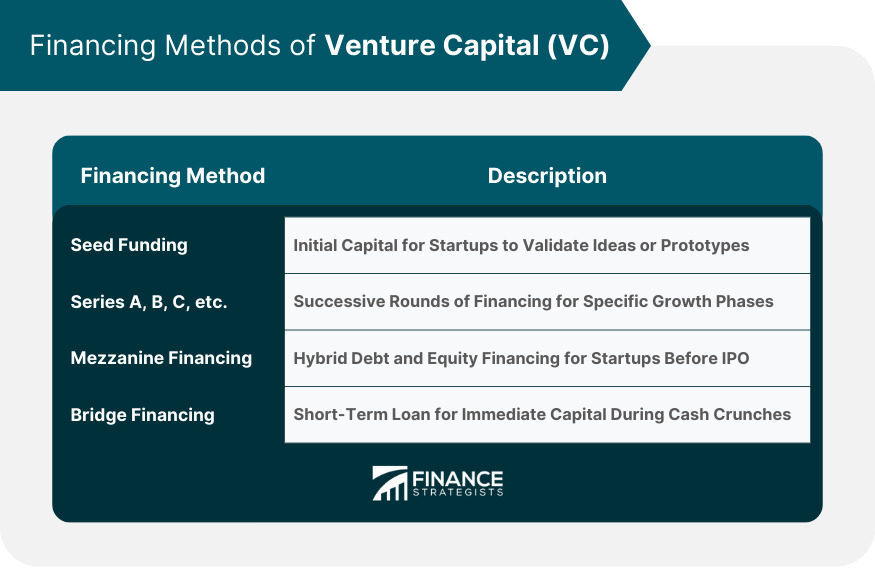

Financing Methods of Venture Capital

Seed funding.

Seed funding is the initial capital that startups raise, often used to validate their business idea or develop a prototype.

It's a small amount of capital, provided when the risk is high but the potential for growth is evident.

This financing helps entrepreneurs bridge the gap between ideation and creating a market-ready product.

For VCs, seed funding offers an opportunity to invest early, securing a larger equity stake for a smaller investment.

Series A, B, C, etc.

As startups grow, their capital requirements evolve. Series A, B, C, and so on represent successive rounds of financing, each catering to a specific growth phase.

Series A typically focuses on optimizing the business model and scaling operations. By Series B, the startup has a proven track record, and funds might go towards expanding into new markets.

Series C and beyond often target further scaling, acquisitions, or even preparations for an IPO.

Mezzanine Financing

Mezzanine financing is a hybrid of debt and equity financing, typically used by startups preparing for an IPO.

It provides immediate capital without diluting ownership, as the funds are structured as debt that can convert to equity if not repaid by a specified date.

For VCs, mezzanine financing offers a final opportunity to invest before a company goes public. It comes with higher risks but can offer substantial returns if the IPO proves successful.

Bridge Financing

Bridge financing is a short-term loan that provides immediate capital to startups facing a temporary cash crunch.

It's called "bridge" financing because it bridges the gap between immediate financing needs and long-term funding solutions, such as the next round of equity financing.

For VCs, bridge loans can be a way to support their existing investments, ensuring that the startup remains solvent and continues to grow until the next financing round.

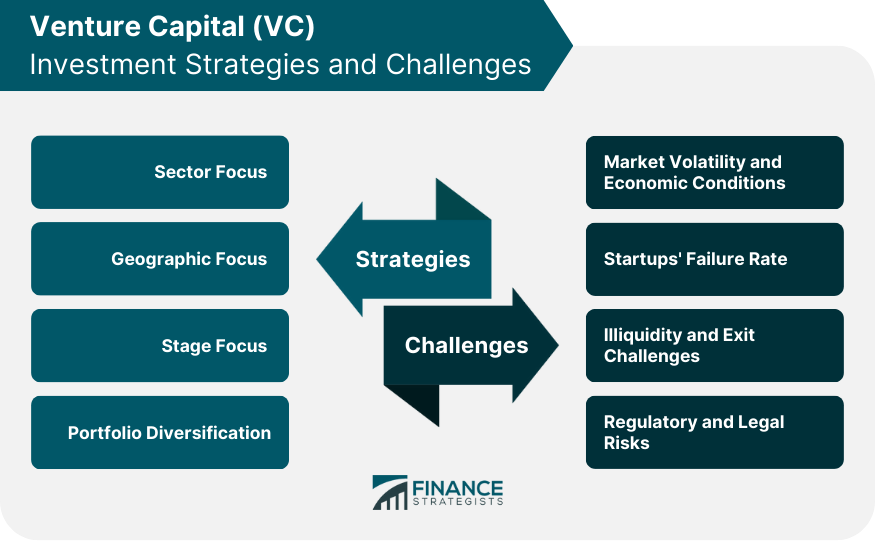

Venture Capital Investment Strategies

Sector focus.

Different VCs have distinct areas of expertise and interest. Some may focus exclusively on technology startups, while others may be drawn to the healthcare or clean energy sectors.

This specialization allows VCs to harness their expertise and network, maximizing the potential for successful investments.

Having a sector focus also means VCs can offer targeted support to their portfolio companies, guiding them through industry-specific challenges and trends.

Geographic Focus

Just as VCs may specialize in sectors, they can also have a geographic focus. Some might prioritize local startups, believing in the potential of their home market.

Others might have an international focus, seeking out the best opportunities worldwide. This geographic strategy shapes a VC's investment decisions, deal sourcing methods, and post-investment support.

For instance, a VC focused on international investments might have a network that spans multiple countries, aiding startups in global expansion.

Stage Focus

Different startups require different support. Early-stage startups might need guidance refining their product, while late-stage ones might seek help navigating the complexities of an IPO.

VCs often have a stage focus, aligning their expertise with startups at a particular development phase.

This focus dictates the size and type of investments a VC makes, as well as the kind of support and mentorship they provide to their portfolio companies.

Portfolio Diversification

Like all investors, VCs aim to diversify their portfolios . By investing in a mix of sectors, geographies, and stages, they spread their risk, increasing the chances of a few high-performing investments offsetting any underperformers.

Diversification isn't just about spreading risk. It's also a way for VCs to tap into various markets, trends, and opportunities, ensuring they're always at the forefront of innovation.

Challenges Faced by Venture Capitalists

Market volatility and economic conditions.

Venture capitalists operate in a world of uncertainty. Market volatility can significantly affect a startup's prospects, with economic downturns, geopolitical events, or industry shifts turning a promising investment sour.

VCs must constantly monitor these factors, adjusting their strategies and providing guidance to their portfolio companies on navigating these turbulent waters.

Startups' Failure Rate

The harsh reality is that many startups fail. Whether it's due to market conditions, poor management, or simply a product that doesn't resonate, VCs face the risk of their investments not yielding returns.

This inherent risk is why VCs conduct rigorous due diligence before investing and remain actively involved post-investment. However, even with these measures, the failure rate remains a persistent challenge.

Illiquidity and Exit Challenges

Venture capital investments are typically illiquid, meaning VCs can't easily convert them into cash. They rely on exit strategies like IPOs, mergers, or acquisitions to realize their returns.

However, successful exits aren't guaranteed. An IPO might underperform, acquisition offers might be lower than expected, or a merger might fall through.

These challenges highlight the importance of a VC's strategic guidance, ensuring their portfolio companies are positioned for successful exits.

Regulatory and Legal Risks

Venture capitalists must navigate a complex web of regulations and legal considerations.

From ensuring compliance with investment laws to navigating international regulations when investing abroad, VCs face constant legal challenges.

Moreover, as the regulatory landscape evolves, VCs must adapt, ensuring their investments remain compliant and that they're aware of any new opportunities or constraints these changes might bring.

Common Misconception About Venture Capitalists

Contrary to popular opinion, venture capitalists do not commonly fund startups from the onset.

Rather, they look for companies that are at the point of preparing to commercialize their idea, when they have the highest potential for growth.

When evaluating a company, venture capitalists look for strong management, a significant potential market, and unique products or services that have a competitive edge.

Venture Capitalists are private investors who provide early capital to new companies in exchange for significant equity stakes.

By identifying and nurturing promising startups, venture capitalists ensure that innovative ideas get the financial backing and strategic support needed to succeed.

They offer more than just capital, their vast experience, industry contacts, and strategic insight guide startups through the challenges of the business world.

Moreover, venture capitalists facilitate growth and scaling opportunities, leveraging their resources and network to help businesses expand responsibly.

However, venture capital investing comes with its challenges, such as market volatility, startups' failure rate, illiquidity, and regulatory risks.

Nonetheless, by employing diversified investment strategies and thorough due diligence, venture capitalists aim to generate attractive returns while supporting the growth of the next generation of innovators.

Venture Capitalist (VC) FAQs

What is a venture capitalist.

A venture capitalist is a private investor who provides early capital to new companies that exhibit a strong potential for growth and success.

What do Venture Capitalists do?

Venture capital investors usually come together to create limited partnerships, or LPs, where members contribute to a pool of funds that are used to invest in companies with emerging growth potential.

When do Venture Capitalists usually invest in companies?

Contrary to popular opinion, venture capitalists look for companies that are at the point of preparing to commercialize their idea, when they have the highest potential for growth.

Is it risky to be a Venture Capitalist?

Investments from venture capitalists are usually high risk/high reward. As such they are unappealing investments to most investors, especially those who are risk averse,. These are prime targets for venture capitalists who are willing to accept a greater risk for potentially greater payout.

What do Venture Capitalists look for in a company?

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- Angel Investing and Networking

- Become an Angel Investor

- Seed Capital

- Venture Capital

- Venture Capital Funds

- Advanced Diploma in Financial Planning

- Are Financial Advisor Fees Tax Deductible?

- Cash Flow-Based Financial Planning

- Challenges of Financial Advisors

- Charitable Financial Planning

- Components of a Good Financial Plan

- Creating a Small Business Financial Plan

- Fee-Only Financial Planning

- Financial Advisor vs Financial Consultant

- Financial Contingency Planning

- Financial Planning Career Pathway

- Financial Planning Pyramid

- Financial Planning Tips

- Financial Planning Trends

- Financial Planning and Analysis

- Financial Planning for Married Couples

- Financial Planning for Startups

- Financial Planning vs Budgeting

- Financial Tips for Young Adults

- How Does Passive Income Affect Social Security Benefits

- How to Build a 5-Year Financial Plan

- Is Passive Income Subject to Self Employment Tax?

- Limitations of Financial Planning

- Passive Income Taxation

Ask a Financial Professional Any Question

Meet top certified financial advisors near you, find advisor near you, our recommended advisors.

Taylor Kovar, CFP®

WHY WE RECOMMEND:

Fee-Only Financial Advisor Show explanation

Certified financial planner™, 3x investopedia top 100 advisor, author of the 5 money personalities & keynote speaker.

IDEAL CLIENTS:

Business Owners, Executives & Medical Professionals

Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation

Claudia Valladares

Bilingual in english / spanish, founder of wisedollarmom.com, quoted in gobanking rates, yahoo finance & forbes.

Retirees, Immigrants & Sudden Wealth / Inheritance

Retirement Planning, Personal finance, Goals-based Planning & Community Impact

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

Fact Checked

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

Hey, did we answer your financial question.

We want to make sure that all of our readers get their questions answered.

Great, Want to Test Your Knowledge of This Lesson?

Create an Account to Test Your Knowledge of This Topic and Thousands of Others.

Get Your Question Answered by a Financial Professional

Create a free account and submit your question. We'll make sure a financial professional gets back to you shortly.

Exploring the Ins and Outs of Venture Capital (VC)

Venture Capital (VC) is an essential pillar of the startup ecosystem, providing vital funding, expertise, and strategic guidance to promising companies in their early stages. It is the fuel that empowers entrepreneurs to transform bold ideas into disruptive realities.

In this blog, we invite you to explore the captivating world of Venture Capital (VC) and discover the driving force behind its success—Venture Capitalists. These visionary investors possess a unique ability to identify and nurture high-potential startups, propelling them towards market dominance and exponential growth.

What is Venture Capital (VC)?

The concept of venture capital (VC) centres around supporting these companies during their early stages when they have limited access to traditional funding sources. Venture capitalists not only provide financial investment but also offer strategic guidance, mentorship, and industry expertise to help these companies succeed.

Venture Capital Meaning and Definition

VC is a form of private equity financing provided to early-stage and high-growth companies. It involves investors, known as venture capitalists, who provide capital in exchange for an ownership stake in the company. This type of financing is typically provided to startups and small businesses that have innovative ideas and significant growth potential.

Features of Venture Capital

Venture Capital (VC) possesses distinct features that differentiate it from other forms of financing:

- Equity Investment: Venture Capitalists provide funding in exchange for equity ownership in the company, becoming shareholders.

- High-Risk, High-Reward: VC involves investing in early-stage or high-growth companies, offering the potential for significant returns but also carrying risks.

- Active Involvement: Venture Capitalists go beyond capital, actively participating in strategic decision-making, mentoring, and providing industry connections.

- Long-Term Perspective: Venture Capitalists embrace a long-term outlook, recognizing that startups require time to grow and achieve profitability.

- Sector Focus: Venture Capitalists often specialize in specific industries, leveraging their expertise and networks for informed investment decisions.

- Funding Stages: Venture Capital supports companies at various growth stages, including seed funding, series funding, and later-stage funding.

- Exit Strategy: Venture Capitalists seek exit opportunities through IPOs, acquisitions, or secondary market sales to realize their returns.

History Of Venture Capital (VC)

Venture capital (VC) has a long and storied history that originated in the mid-20th century in the United States. It was designed to provide funding to innovative and high-growth companies. The industry gained momentum in the 1970s and 1980s with the establishment of prominent venture capital firms.

Throughout its evolution, venture capital (VC) has played a crucial role in fueling the growth of successful companies like Apple, Google, and Facebook. These notable successes have contributed to the popularity of venture capital as an investment asset class, attracting an increasing number of investors and entrepreneurs to participate in the sector.

Latest Venture Capital Trends

In recent years, the venture capital (VC) landscape has witnessed several trends and developments. Here are some notable trends:

- Sustainable investing: Venture capital is increasingly focused on funding companies that prioritize environmental, social, and governance (ESG) factors.

- Disruptive technologies: Investments are directed towards startups leveraging emerging technologies like artificial intelligence, blockchain, and renewable energy.

- Remote work and digital solutions: The pandemic has accelerated the adoption of remote work and digital solutions, attracting venture capital investments in areas like remote collaboration tools, telemedicine, and e-commerce.

- Diversity and inclusion: Venture capital is recognizing the importance of diversity and investing in companies led by underrepresented founders to foster a more inclusive startup ecosystem.

- Impact investing: Investors are seeking opportunities that generate positive social or environmental impact alongside financial returns.

- Regional startup ecosystems: Besides traditional startup hubs, venture capital is expanding into emerging markets and nurturing regional startup ecosystems worldwide.

- The blurring of sector boundaries: Startups are disrupting traditional industries by integrating technologies, creating new business models, and redefining sector boundaries.

- Early-stage funding growth: There is a continued emphasis on early-stage funding, supporting startups in their initial phases of development and growth.

Types of Venture Capital (VC)

Venture capital (VC) can be classified into various categories depending on the stage of investment, industry focus, and funding structure. Here are some common types:

1. Seed Capital

Seed capital refers to the initial investment provided to startups during their early stages. It is one of the stages of Venture Capital that helps entrepreneurs convert their ideas into viable businesses. Seed capital is typically sourced from angel investors or early-stage venture capital firms.

2. Early-Stage Venture Capital

This type of venture capital targets startups that have progressed beyond the seed stage and have a proven concept or prototype. It aims to support startups in refining their products, building their team, and preparing for market entry.

3. Expansion or Growth Capital

Expansion or growth capital is provided to established companies seeking to expand their operations, enter new markets, or scale their business. It helps companies in the growth phase to accelerate their growth trajectory.

4. Mezzanine Financing

Mezzanine financing involves a combination of debt and equity financing. It is commonly offered to mature companies that are close to going public or undergoing significant events such as acquisitions or management buyouts. Mezzanine financing bridges the gap between equity and debt financing.

5. Sector-Specific Venture Capital

Sector-specific VC focuses on particular industries or sectors such as technology, healthcare, clean energy, or biotechnology. These venture capital firms have specialized knowledge and networks within their target sectors, allowing them to provide tailored support to startups operating in those industries.

6. Corporate Venture Capital (VC)

Corporate VC refers to investments made by established companies into startups that align with their strategic objectives. It enables corporations to gain exposure to innovative technologies, expand into new markets, or diversify their product offerings.

When Should One Go For Venture Capital (VC)?

Determining the right timing for seeking VC funding depends on various factors and the specific circumstances of your business. Here are some considerations to help you make an informed decision:

1. Scalability and Growth Potential

Venture capital funding is typically sought by startups with high growth potential and scalable business models. If your business operates in an industry with significant market opportunities and requires substantial funding for rapid expansion, VC funding may be worth considering.

2. Proof of Concept and Traction

Venture capitalists often look for startups that have demonstrated a validated proof of concept and some level of market traction. This could include a strong customer base, revenue generation, or notable partnerships. Having evidence of your business’s viability can increase your chances of attracting VC investment.

3. VC Funding Requirements

Venture capital (VC) is well-suited for businesses that require a significant amount of capital to fuel growth, develop new products, expand into new markets, or invest in research and development. If your funding needs surpass what can be achieved through traditional loans, personal savings, or smaller investors, VC may be a suitable option.

4. Expertise and Network

In addition to financial resources, venture capitalists often bring valuable industry expertise, mentorship, and networking opportunities. If your business can benefit from strategic guidance, introductions to potential partners or customers, or access to specialized knowledge, venture capital can provide these additional advantages.

5. Long-Term Vision and Alignment

Venture capital investment usually involves dilution of ownership and sharing control of the business. Therefore, it’s crucial to align your long-term vision with the expectations of venture capitalists. If you are open to collaboration, receptive to working with a board of directors, and focused on creating substantial long-term value, venture capital financing may be a viable option.

How Venture Capital Works?

Interested in knowing about how VC works? Here you go:

A. Sourcing and Evaluating Investment Opportunities: Venture capital firms actively search for investment opportunities through networking, industry events, and thorough analysis of business proposals. They assess factors like market potential, team capabilities, and growth prospects to identify promising startups.

B. Due Diligence and Investment Decision-Making: Once a potential investment is identified, extensive due diligence is conducted. This involves assessing the company’s financials, business model, market position, intellectual property, and competition. Based on the findings, the venture capital firm makes an informed investment decision.

C. Financing Structures and Investment Terms: Venture capital investments can take various forms, including equity shares , convertible debt, or preference shares . The specific terms of the investment, such as the amount invested, ownership percentage, and exit strategies, are negotiated between the venture capital firm and the startup. Additionally, venture capitalists often provide strategic guidance and mentorship to entrepreneurs.

In a nutshell, venture capital firms provide financial support, industry expertise, and valuable resources to startups in exchange for an ownership stake. This partnership aims to fuel the growth and success of the startup, with the ultimate goal of achieving a profitable exit strategy, such as an initial public offering ( IPO ) or acquisition.

What is the Role of Venture Capital (VC) in the Startup Ecosystem?

VC plays a critical role in the startup ecosystem by providing essential funding, strategic guidance, and fostering innovation. Its impact can be summarized as follows:

- Funding High-Potential Startups: VC offers financial support to startups with promising growth prospects and limited access to traditional funding sources. This funding enables them to develop their products, expand operations, and enter new markets.

- Driving Innovation: Venture capital fuels innovation by supporting startups that introduce disruptive ideas and technologies. These startups often operate in emerging sectors and have the potential to transform industries and drive economic progress.

- Strategic Mentorship: Venture capitalists bring more than just funding. They offer valuable industry expertise, guidance, and mentorship to startups. This assistance helps startups navigate challenges, refine their business strategies, and accelerate their growth.

- Long-Term Partnership: Venture capitalists become long-term partners with the startups they invest in. They provide ongoing support, actively monitor performance, and contribute insights and connections to help startups achieve their goals.

- Job Creation and Economic Impact: Venture-backed startups have the potential to create jobs and contribute to economic development. By expanding their operations, hiring talent, and engaging in research and development, these startups generate employment opportunities and stimulate local economies.

- Risk Management: Venture capitalists understand the risks associated with investing in startups. They perform thorough due diligence, diversify their investment portfolios, and actively support their portfolio companies to mitigate risks and increase the likelihood of success.

Benefits of Venture Capital (VC)

Some of the benefits of VC include:

- Access to Capital: VC provides startups and early-stage companies with essential funding to support their growth and development. This capital can be used for various purposes, such as product development, expansion into new markets, and talent acquisition.

- Strategic Guidance: Venture capitalists bring not only financial resources but also valuable expertise and industry knowledge. They offer strategic guidance, mentorship, and advice to entrepreneurs, helping them navigate challenges, make informed decisions, and optimize their business strategies.

- Extensive Network: Venture capitalists often have extensive networks in the business and investment community. This network can provide startups with valuable connections to potential customers, partners, and industry experts. It opens doors to new opportunities, collaborations, and market insights.

- Credibility and Validation: Securing venture capital funding or VC funding can provide validation and credibility to a startup. It demonstrates that the business has undergone thorough due diligence and has been deemed worthy of investment by experienced professionals. This credibility can attract further investors, customers, and partners.

- Long-Term Partnership: Venture capital firms typically take a long-term perspective and aim to build long-lasting partnerships with the companies they invest in. They provide ongoing support, guidance, and resources to help the startup succeed at different stages of its growth journey.

Risks of Venture Capital (VC)

Along with the benefits, VC also brings in some amount of risks, including;

- Business Failure: Startups and early-stage companies face a higher risk of failure, which can lead to a loss of invested capital.

- Lack of Liquidity: Venture capital investments are illiquid, making it challenging to convert them into cash quickly.

- Dilution of Ownership: Entrepreneurs may experience ownership dilution as additional funding rounds are raised.

- Regulatory and Legal Risks: VC investments are subject to compliance with securities laws, tax regulations, and contractual obligations.

- Market Volatility: Investments in high-growth sectors are exposed to market shifts, economic downturns, and changes in consumer preferences.

Venture Capital Investment Strategies

Venture capital investment strategies involve:

A. Specializing in specific industries or sectors: Venture capital firms concentrate their investments in particular industries or sectors where they possess deep knowledge and expertise. This focused approach allows them to identify promising startups and provide tailored support and guidance.

B. Considering geographic preferences and global investment trends: Venture capital firms may have preferences for specific regions or countries with vibrant startup ecosystems. They also keep an eye on global investment trends to spot emerging markets or sectors with high growth potential, ensuring they stay ahead of investment opportunities.

C. Utilizing different investment types: Venture capital firms employ various investment instruments, such as equity and convertible debt. Equity investments involve acquiring partial ownership in startups, while convertible debt allows for conversion into equity at a later stage. These investment types are chosen based on the specific needs of startups and the risk-return profile sought by the venture capital firm.

Role of Venture Capital in Startup Growth

Venture capital plays a crucial role in driving the growth of startups. Here are key aspects to consider:

A. Support provided beyond financial investment: Venture capital firms go beyond providing funding. They offer valuable support through mentorship, guidance, and networking opportunities. Experienced investors bring industry knowledge and strategic insights, helping startups navigate challenges and seize growth opportunities.

B. Impact on innovation, job creation, and economic growth: Venture capital fuels innovation by funding disruptive ideas and technologies. It leads to job creation as startups expand and hire talent. The growth of venture capital-backed startups contributes to economic growth, driving prosperity in various sectors.

C. Success stories and notable examples: Many successful companies owe their growth to venture capital investments. Companies like Airbnb, Uber, and SpaceX have received significant funding in their early stages, enabling them to achieve remarkable milestones, disrupt industries, and generate substantial returns for investors.

Challenges and Opportunities in Venture Capital (VC)

VC presents both challenges and opportunities in the investment landscape. Here are some key aspects to consider:

A. Managing risk and uncertainty in early-stage investments

VC often involves investing in startups and early-stage companies, which carry a higher level of risk and uncertainty. VC firms face the challenge of assessing the viability and potential of these ventures, as well as managing the risk associated with their investments. However, successful investments in such companies can lead to substantial returns and significant growth opportunities.

B. Navigating regulatory and legal considerations

Venture capital investments are subject to various regulatory and legal considerations. VC firms need to stay informed about regulatory frameworks, compliance requirements, and legal obligations. Navigating these complexities requires expertise and careful due diligence to ensure compliance and mitigate legal risks.

C. Emerging trends and opportunities in venture capital (VC)

Venture capital (VC) is a dynamic field that continually evolves with emerging trends and opportunities. Factors such as impact investing and sustainability are gaining prominence in the VC industry.

Investors and VC firms are increasingly looking for opportunities to support companies that have a positive social or environmental impact. This presents new avenues for investment and the potential to drive positive change while generating financial returns.

Venture Capital vs Angel Investing: What are the differences between the two?

Venture capital and angel investment are two distinct forms of funding for startups and early-stage companies. While they share similarities, there are key differences between the two. Here’s the comparison:

1. Source of Funding

Venture capital funding is typically provided by institutional investors, such as venture capital firms or corporate entities, who pool their resources to invest in startups.

Angel investment, on the other hand, Funding comes from individual angel investors who invest their personal funds in startups.

2. Investment Size

VC investments are usually larger, ranging from millions to billions of dollars, as venture capital firms seek substantial equity stakes in companies.

On the other hand, Angel Investments are typically smaller, ranging from thousands to hundreds of thousands of dollars, as individual angel investors provide seed capital to early-stage companies.

3. Stage of Investment

VC primarily focused on later-stage startups that have demonstrated market traction and potential for rapid growth.

Angel investment, on the other hand, is often targeted at early-stage startups or entrepreneurs with promising ideas, providing seed funding to help them get off the ground.

4. Control and Involvement

VC firms often play an active role in the management and strategic decision-making of portfolio companies, leveraging their expertise and networks.

On the other hand, Angel investors may offer guidance and mentorship to startups but typically have less direct control over the company’s operations.

5. Investment Criteria

VC emphasizes the potential for high returns on investment, scalability, and market disruption. Thorough due diligence is conducted to assess the business model, market potential, and team.

Angel investment, on the other hand, focuses on personal interest, passion, and belief in the entrepreneur or idea. Investment decisions are often influenced by the angel investor’s domain expertise or personal connection.

What is the Meaning of Venture Capitalism?

Venture capitalism is a form of investment in which venture capitalists provide capital to early-stage or high-growth companies in exchange for an ownership stake. It involves taking calculated risks and offering support to startups to facilitate their growth and profitability.

Besides funding, venture capitalists also bring industry expertise, networking opportunities, and guidance to the companies they invest in. The objective of venture capitalism is to generate substantial returns by identifying and supporting companies with strong growth potential.

To Wrap It Up…

In conclusion, venture capital plays a pivotal role in driving innovation, fostering economic growth, and supporting the development of startups. It provides essential funding, expertise, and valuable networks to early-stage and high-growth companies.

Additionally, venture capitalists take calculated risks and actively contribute to the strategic growth of their portfolio companies. However, venture capital investments come with inherent risks, they offer the potential for substantial returns.

Venture capital (VC) refers to an investment approach where investors provide financing to early-stage or high-growth companies in exchange for an ownership stake. It involves taking calculated risks and offering support to startups to help them grow and achieve profitability.

Venture capitalists generate returns through successful exits. They invest capital in startups and aim to sell their ownership stake at a higher value when the company reaches a significant milestone, such as an initial public offering (IPO) or acquisition.

The three main types of venture capital are: – Seed Stage Funding – Early Stage Funding – Late Stage Funding

Venture Capital fund receives capital from various sources, including institutional investors such as pension funds, endowments, and foundations. They may also raise funds from high-net-worth individuals, corporate investors, and government entities.

The key elements of venture capital include: – Risk-taking – Long-term perspective – Equity participation – Value-added support – Exit strategies

smallcase Technologies Private Limited #51, 3rd Floor, Le Parc Richmonde, Richmond Road, Shanthala Nagar, Richmond Town, Bangalore - 560025

Download App

Popular smallcases

- All Weather Investing

- Top 100 Stocks

- Equity & Gold

- Green Energy Portfolio

smallcase Guides

- What is smallcase?

- smallcase fees & charges

- smallcase subscription

smallcase Calculators

- SIP Calculator

- Lumpsum Calculator

- Compound Interest Calculator

- Post Office RD Calculator

- NPS Calculator

- RD Calculator

- SSY Calculator

Stock Portfolio Collections

- Green Energy Stocks

- Chemical Stocks

- Electric Vehicle (EV) Stocks

- Dividend Stocks

- REIT Stocks

- Fertilizer Stocks

- Semi Conductor Stocks

- Search Stocks

Company: About | Disclosures | Terms & Conditions | Privacy Policy | User Created smallcases | Investment Tools | Press | For Businesses

Investment 101: Portfolio Investing | Dow Theory | Coffee Can Investing | Stocks SIP | NIFTY Index

Star Investors: Rakesh Jhunjhunwala Portfolio | Rekha Jhunjhunwala Portfolio | Azim Premji Portfolio | Radhakishan Damani Portfolio | Vijay Kedia Portfolio | Dolly Khanna Portfolio | Sunil Singhania Portfolio | Mukul Agrawal Portfolio | Ashish Dhawan Portfolio | Shankar Sharma Portfolio | Ashish Kacholia Portfolio

Stocks on smallcase: EKI Energy (EKI) | Bhansali Engineering (BHAN) | Max Financial Services LTD (MAXI) | AU Small Finance Bank (AUFI) | Reliance Industries (RELI) | Infosys (INFY) | Ambica Agarbathies (AAAI) | Mos Utility (MSS) | Gautam Gems | Infollion Research Services Ltd (INFOL) | Tata Motors (TAMO) | Sg Finserve Ltd (SGFIN) | See All Stocks

Dislaimer: This platform is intended for informational purposes only and is not intended to provide investment advice. The stock prices displayed are delayed and may not reflect the most current market conditions. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. You can also consider consulting a financial advisor before making any investment decisions. Smallcase Technologies Private Limited shall not be responsible for any losses that may occur as a result of using this platform.

The views expressed in this article are those of the author and do not necessarily reflect the views of Smallcase Technologies Private Limited (STPL) or any of its associates. The information provided in this article is for educational and informational purposes only. Investors are responsible for their investment decisions and are responsible to validate all the information used to make the investment decision. Investors should understand that his/her investment decision is based on personal investment needs and risk tolerance, and performance information available on here is one amongst many other things that should be considered while making an investment decision. Past performance does not guarantee future returns.

Investments in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The examples and/or scurities quoted (if any) are for illustration only and are not recommendatory.

The content and data available on the website, including but not limited to index value, return numbers and rationale are for information and illustration purposes only. Charts and performance numbers do not include the impact of transaction fee and other related costs. Past performance does not guarantee future returns and performances of the portfolios are subject to market risk. Data used for calculation of live returns and other information is provided by exchange approved third party vendors and has neither been audited nor validated by the Company. Detailed return calculation methodology is available here . Detailed volatility calculation methodology is available here .

The user agrees to assume complete and full responsibility for the outcomes of all of his/her investment decisions that he/she makes, including any direct, indirect, incidental, consequential, special, punitive or any other losses/damages if any that may be incurred by him/her. Smallcase Technologies shall not be responsible or liable for any direct, indirect, incidental, consequential, special, punitive or any other losses/damages arising out of the recipient's investments. For disclosures related to Smallcase Technologies Pvt Ltd, please visit this page .

All smallcases present in the articles are created by SEBI licensed entities. The disclosure of these entities can be found below:

INH200007645

INH100008717

INA000017541

INH100008513

INA100015717

INP000004946

INA000016825

INA000007623

INA200013770

INH000009445

INH000006077

INH000006448

INA000015701

INA000016436

INA000017231

INP000006749

INH000004635

INH300006607

INA300002022

INH000009630

INA200013798

INA300017038

INA000017198

INH200003208

INA300012547

INA000016463

INH000008677

INA000014915

INA100004608

INP000006253

INH000007216

INA100013205

INA300008614

INA200010904

INA000016056

INH000001139

INA000010584

INH100009488

INA100015115

INH200009935

INH000008312

INH100008638

INA100014426

INA000015747

INH000008075

INH000006156

INA300003616

INH000008552

INH100008726

INH000001469

INH000009047

INH100008799

INH100008939

INA100010402

INH200009032

INH200008653

Financial Tips, Guides & Know-Hows

Home > Finance > Venture Capitalists Definition: Who Are They And What Do They Do?

Venture Capitalists Definition: Who Are They And What Do They Do?

Modified: February 21, 2024

Discover the role and purpose of venture capitalists in the world of finance. Learn who they are and how they contribute to startup growth and investment opportunities.

- Definition starting with V

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more )

Venture Capitalists Definition: Who Are They and What Do They Do?

When it comes to the world of finance, venture capitalists play a crucial role. But who exactly are these individuals, and what do they do? In this blog post, we will delve into the definition of venture capitalists and unravel the mysteries around their work.

Key Takeaways:

- Venture capitalists are investors who provide capital to startups and small businesses in exchange for an equity stake.

- They not only provide funding but also offer mentorship, guidance, and industry connections to help startups succeed.

Venture capitalists, often referred to as VCs, are individuals or firms that invest in early-stage startups or companies that have high-growth potential. These investors provide the capital needed to fuel the growth and development of these businesses. In return for their investment, venture capitalists receive an equity stake in the company.

So, what does the work of a venture capitalist entail? Let’s take a closer look:

- Evaluating Investment Opportunities: Venture capitalists are constantly on the lookout for promising investment opportunities. They review business plans, perform due diligence, and assess the potential for growth and profitability.

- Providing Funding: Once a venture capitalist identifies a suitable investment opportunity, they provide the necessary funding to the startup or business. This funding helps the company cover operating expenses, hire talent, develop new products, and expand their market reach.

- Offering Strategic Guidance: Venture capitalists don’t just invest money; they also offer valuable guidance and mentorship to the entrepreneurs they support. They share their expertise, industry knowledge, and networks to help startups navigate challenges and make strategic decisions.

- Driving Growth: Venture capitalists play an active role in the growth of the businesses they invest in. They work closely with the founders and management teams, providing guidance and resources to accelerate growth and maximize the company’s potential.

- Exit Strategy: Venture capitalists aim to generate a return on their investment. They help companies navigate options such as mergers and acquisitions or initial public offerings (IPOs) to create an exit strategy that allows them to realize their financial gains.

As you can see, venture capitalists are not just financial backers but also strategic partners for startups. They bring more to the table than just funding , offering a wealth of expertise, guidance, and connections that can significantly increase the chances of success for aspiring entrepreneurs.

If you are an entrepreneur or a startup looking to take your business to the next level, seeking out venture capitalists might be a viable option for financial backing and mentorship. However, it’s important to do your due diligence and find the right venture capitalists who align with your vision and goals.

In conclusion, venture capitalists are investors who provide financial backing and strategic support to startups and small businesses. Their role extends beyond funding as they actively contribute to the growth and success of the companies they invest in. With their expertise and guidance, venture capitalists play a significant role in shaping the future of the entrepreneurial landscape.

Our Review on The Credit One Credit Card

20 Quick Tips To Saving Your Way To A Million Dollars

How To Apply For A 60-Day Grace Period

What Are Appraisal Costs? Definition, How They Work, And Examples

Latest articles.

Understanding XRP’s Role in the Future of Money Transfers

Written By:

Navigating Post-Accident Challenges with Automobile Accident Lawyers

Navigating Disability Benefits Denial in Philadelphia: How a Disability Lawyer Can Help

Preparing for the Unexpected: Building a Robust Insurance Strategy for Your Business

Custom Marketplace Development: Creating Unique Online Shopping Experiences

Related post.

By: • Finance

Please accept our Privacy Policy.

We uses cookies to improve your experience and to show you personalized ads. Please review our privacy policy by clicking here .

- https://livewell.com/finance/venture-capitalists-definition-who-are-they-and-what-do-they-do/

What is venture capital?

What are venture capital funds, what is a venture capital firm, how venture capital works.

- Pros and cons

How to invest in venture capital

Venture capital vs. private equity.

- The bottom line

What is venture capital: A beginners guide to investing in venture capital

Paid non-client promotion: Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate investing products to write unbiased product reviews.

- Venture capital (VC) is a type of private equity and financing for startups believed to have the potential for long-term growth.

- Venture capitalists fund startups in exchange for ownership stake in the company.

- Accredited investors can invest in venture capital through VC firms, which operate and manage VC funds.

Venture capital investments are the epitome of the bigger the risk, the higher the rewards. But what does it mean to be a venture capitalist? How does venture capital actually work? And how can you invest?

Venture capital funding is an important economic stimulant that helps give new industries and ideas the chance to thrive. In turn, this can generate new job growth, create new business models, and encourage innovation in the current market.

Here's everything you need to know about venture capital, VC funds, and more.

Venture capital (VC) is a type of private equity and financing for entrepreneurs, and startups. In exchange for preferred equity in the startup, investors (aka venture capitalists) support startups believed to have the potential for long-term growth with the hope of getting outsized returns.

Matt Malone, the head of investment management at Opto Investments , explains, "These companies may not have a proven product or revenue stream, so traditional funding sources are not an option for them. Venture capitalists are willing to assume and manage the risks associated with startups."

VC is an alternative investment, like hedge funds or managed futures , often only available to certain high-net-worth investors and institutions. Keep in mind that investing in venture capital comes with significant risk.

Venture capitalists are typically accredited and wealthy individuals, financial institutions, or investment banks that are able to provide significant capital funding, managerial guidance, or technological expertise to early-stage companies and startups.