SAP BPC – What is Business Planning and Consolidation?

What is SAP BPC?

SAP BPC is a SAP module that provides planning, budget, forecast, and financial consolidation capabilities. SAP BPC meaning Business Planning and Consolidation. It provides a single view of financial and operational data and a unified solution that supports Performance Management processes like adjust plans and forecasts or speed up the budget and closing cycles.

It delivers built-in functionalities for

- Strategic Planning

- Forecasting

There are two platforms in SAP BPC finance. About 80% of its functionality is same except the difference in the back-end. In each platform, there is two version.

- SAP BPC MS (Microsoft Platform) – SAP BPC 7.5 MS and SAP EPM 10

- SAP BPC NW (Net Weaver Platform) – SAP BPC 7.5 NW and SAP BPC 10 NW.

Like any other module, SAP BPC module too holds master and transaction data. BPC in SAP is divided into two components namely “ Administration ” and “ Reporting “.

SAP BPC Overview

For any organization to run a business successfully financial planning, budgeting, and forecasting are important attributes. SAP BPC software provide everything in one package.

- Unified – Planning and Consolidation in One Product. Single application lessens maintenance, enhance data integrity, and simplifies deployment. It also enables flexible planning & consolidation functions

- Owned and Managed by Business Users : – Business users manage processes, models & reports with little IT dependence.

- An open, adaptable application : – Extends the value of your investment in both SAP and non-SAP environments

- Familiar, Easy to use : – It is easy to use and support native Microsoft Office tools (e.g. Excel) and web browsers accessing a central database.

- Align Financial and Operational plans : – It helps to determine financial goals and operational plans with strategic objectives.

- Reduce budget cycle time : – It helps to reduce budget cycle time.

Let’s see each attribute of SAP BPC in detail,

It helps management team to formulate its vision, mission, core values, and objectives. The team develops strategic plans to uphold its competitive advantage in the marketplace. It helps them to answer the following questions.

- What does corporate want to be?

- What to do?

- How to measure what we do?

- What do operating units need to do to achieve corporate objectives?

It is not just a prediction of future results. It is also a plan of actions and expected operations of the organization over the next year. Budgeting is done for proactive management and measurement of corporate performance.

- How to execute corporate strategy at operating unit level?

- How to measure what operating units do?

- What is the quantitative execution plan of operating units?

It ensures performance progress is monitored, problems are anticipated, and continuous improvement efforts are promoted.

- How to measure that we perform towards achieving our targets and objectives?

- What information would help management decision making?

- How to control performance of corporate?

It is the act of predicting outcomes. It is done throughout the year to reflect changes that have occurred both in the internal and external environment. It determines how the internal or external environment impact on the original plans and budgets? The main objective is to provide more accurate information for less risk management planning and decision making.

What is EPM in SAP?

The EPM solution use is widening over the financial divisions. It is similar to CPM (Corporate Performance Management), BPM( Business Performance Management) and FPM (Finance Performance Management). EPM is being used as a unique repository to manage relevant information.

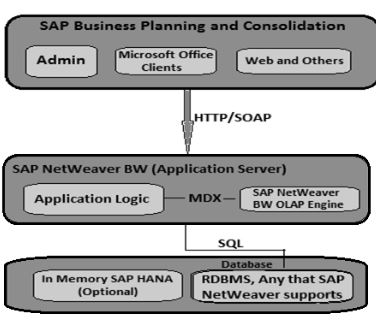

SAP BPC Architecture

SAP BPC Architecture. It uses various business rules and script logics for doing the planning. The key components in BPC architecture are shown in the image below.

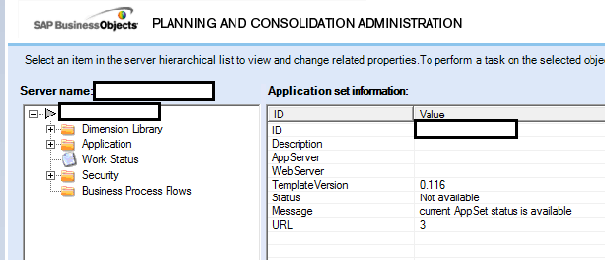

BPC Administration

BPC Administration allows administrators to perform maintenance and setup tasks for BPC client applications.

How to start BPC administration

BPC financial administration has two interfaces; a client application and a web interface. The administration action pane lists the available tasks for both interfaces

To start BPC administration

- Open a browser and type http://<server name>/osoft, where <server name> is the name of your BPC server.

- From the Windows Start menu, select SAP > BPC

- From your Windows Desktop, click the BPC icon

- From the Launch page, select BPC Administration

- From the Administration action pane, select the desired task

The console client is a Microsoft explorer-like window. Where we manage items such as application sets, applications, business rules, dimensions and business process flows. The browser client allows to control application set and application properties, as well as maintain BPC web parameters.

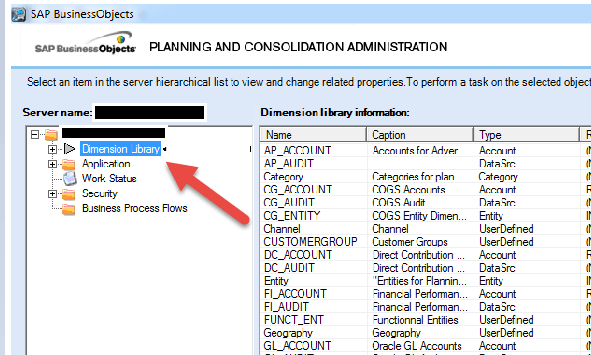

Creating a new dimension

Dimensions represent the entities of a business (e.g., accounts, company codes, and categories). They represent the master, text, and hierarchy data for each of the business entities.

It is possible to create new dimensions in a BPC application set. There is no restriction to create a number of dimensions in SAP BPC. These dimensions then become shared dimensions that are available for use in any application within the appset.

Some dimensions are required dimensions. It must exist in all the applications within an application set. While the dimension type determines the default properties to be included in the dimension. It is possible to add additional properties as needed.

Dimension types

Required in each application

- A = Account type dimension

- C = Category type dimension

- E = Entity type dimension

- T = Time type dimension

Required in each application set

- R = Currency type dimension

Needed to validate currencies that are input in Entity type dimension. This may not be part of any applications within the application set

Required for Intercompany Eliminations

- I = Intercompany

It is also possible to create additional dimensions as a requirement

Un = User defined dimension type. For each user-defined dimension, the number ‘n’ will be incremented. For e.g; U1, U2, U3 and so on

Creating Dimensions

Select Dimension Library on the left side. The action pane will display the related dimension tasks.

To create a new dimension, click on “Add a new dimension”.

Similarly, it is possible to copy, modify, process and delete dimensions. While adding dimensions, you need to enter reference type.

Next in this SAP BPC training, we will learn about BPC reporting.

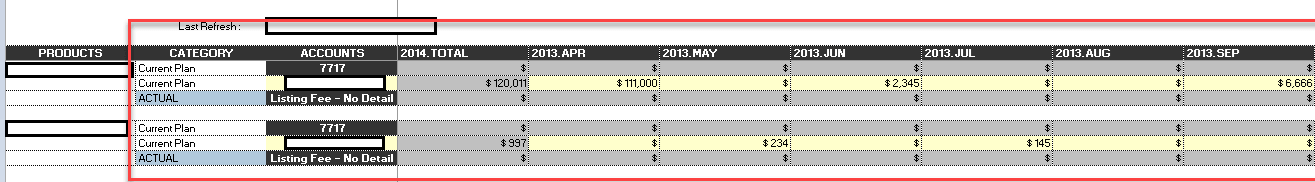

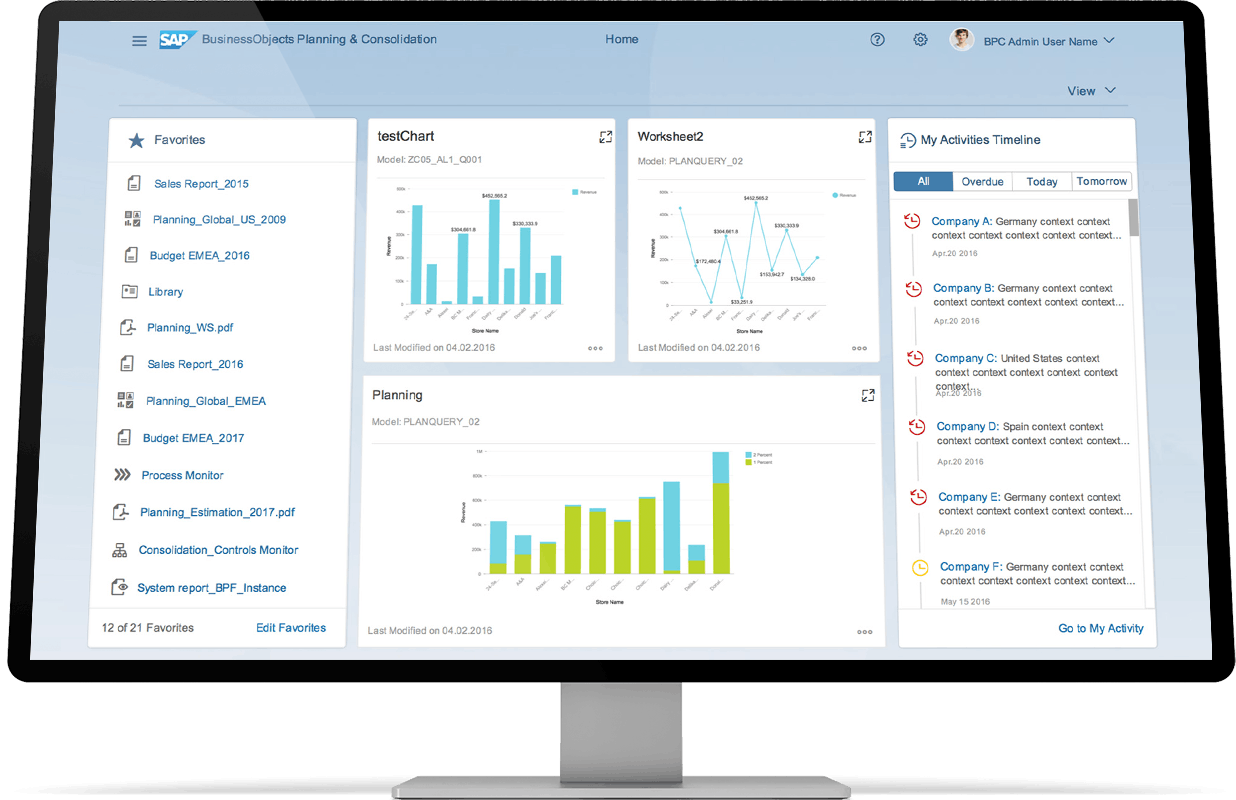

BPC Reporting

BPC for Office combines the power of BPC with the rich functionality of Microsoft Excel , Word, and Powerpoint. With BPC for Office, we have all of the Microsoft functionality we are used to. On top of it documents, worksheets, and slideshows can be linked directly to the BPC database that has Company’s reporting data.

BPC for Office allows to collect data, build reports, perform real-time analysis and publish reports in a variety of formats. You can save your reports so that you can use them disconnected from the database. You can take reports completely offline and distribute them based on user access rights

A sample layout looks as follows

BPC Security

BPC security is managed in Administration Console. There are four key components in BPC security?

- Users : It is used to add users to the environment and manage their access rights

- Teams : You can define a group of users with same access rights

- Data Access Profiles : It enables setting up profiles for tasks to be performed.

- Task Profiles : It is used to set up profiles and enable access to data in models.

- BPC definition or SAP BPC means: A SAP module that provides planning, budget, forecast, and financial consolidation capabilities.

- BPC stands for Business Planning and Consolidation.

- SAP BPC provides you with a single view of financial and operational data.

- SAP BPC delivers built-in functionalities for

- SAP BPC Administration is a tool that allows administrators to perform setup and maintenance tasks for BPC client applications.

- SAP BPC supports Microsoft Excel, Word, and Powerpoint. SAP Business Planning Consolidation for Office allows to collect data, build reports, perform real-time analysis and publish reports in a variety of formats.

- Search Search Please fill out this field.

What Is Business Consolidation?

How business consolidation works, types of business consolidation.

- Advantages and Disadvantages

Example of Business Consolidation

- Corporate Finance

Business Consolidation: Definition, How It Works, and Example

:max_bytes(150000):strip_icc():format(webp)/wk_headshot_aug_2018_02__william_kenton-5bfc261446e0fb005118afc9.jpg)

The term business consolidation refers to the combination of different business units or companies into a single, larger organization. Business consolidation is a legal strategy that is often initiated to improve operational efficiency by reducing redundant personnel and processes. Often associated with mergers and acquisitions (M&A), business consolidation can result in long-term cost savings and a concentration of market share no matter how expensive and complex it may be in the short term.

There are various types of business consolidation, including statutory consolidation and variable interest entities.

Key Takeaways

- Business consolidation is a combination of several business units or companies into a single, larger organization.

- The reasons behind consolidation include operational efficiency, eliminating competition, and getting access to new markets.

- There are different types of business consolidation, including statutory consolidation, statutory mergers, stock acquisitions, and variable interest entities.

- Consolidation can lead to a concentration of market share and a bigger customer base.

- Some of the disadvantages of consolidation include dealing with cultural differences between firms and potential issues with personnel.

Consolidation happens when two or more companies merge to become one. Also known as amalgamation , business consolidation is most often associated with M&A activity. This generally happens when several similar, smaller businesses combine to form a new, larger legal entity. In most cases, the smaller entities cease to exist after being swallowed up by the acquirer.

Combining multiple companies or business units into a brand new entity is the most drastic option. This may be an expensive proposition if one of the merging companies is liquidated . The process may carry additional costs associated with creating a new brand . But businesses that want to consolidate their operations have other options at their disposal, including the movement of smaller operations into an existing company that won't be dismantled.

The reasons behind consolidation vary, and there are many. They include but aren't limited to:

- Operational efficiency

- Eliminating the competition for customers and/or resources

- Access to and expansion into new markets

- Innovation and new products

- Cheaper financing options for bigger businesses

- Shared operations

- Increased revenue

Regardless of the rationale, businesses can't and shouldn't take the decision to consolidate lightly. Not only are the costs associated with consolidation fairly heavy, but there are also other things to consider. For instance, executives and other key personnel have to satisfy the concerns of shareholders , they must consider what happens with workforce redundancies, whether to sell assets , and how to market and brand the new company once the whole process is complete.

There are antitrust laws and regulations in place to discourage monopolies that may arise as a result of business consolidation.

Just like company types, there are many different kinds of business consolidation. It all depends on the strategy, the desired outcome, and the nature of the businesses involved.

- Statutory Consolidation: When businesses are combined into a new entity, the original companies cease to exist. By combining them together, they create a new, larger corporation . As such, statutory consolidation is normally done through a merger .

- Statutory Merger: This kind of business consolidation occurs when the acquirer liquidates the assets of its target. Once done, the acquirer incorporates or dismantling the target company's operations. Unlike a statutory consolidation, the acquiring company keeps its operations going, while the acquired entity no longer exists.

- Stock Acquisition: This is a combination of businesses in which an acquiring company buys a majority share or a controlling interest of another company. In order for it to be a majority share, the acquirer must buy more than 50% of the target. Both companies end up surviving.

- Variable Interest Entity: When an acquiring entity owns a controlling interest in a company that is not based on a majority of voting rights, it is referred to as a variable interest entity . These entities are normally established as special purpose vehicles (SPVs).

Advantages and Disadvantages of Business Consolidation

There are many advantages to combining two or more business entities together. But with the positives, there also comes a lot of negatives. We've listed some of the key pros and cons for this business strategy.

As noted above, combining businesses or business units into a larger entity often increases the new company's bottom line. This means it may be able to cut costs and boost revenue . The new company may also be able to use its larger size to extract better terms from suppliers. That's because it is more likely to buy more units to satisfy a larger consumer base.

Newer, smaller, and/or struggling businesses may have problems getting access to capital in order to grow. But consolidated businesses may have an easier time obtaining financing —often at cheaper rates. This is especially true if the newly formed entity is more stable, more profitable, or has more assets to use as collateral .

Business consolidations can result in a concentration of market share, a more expansive product lineup, a greater geographical reach, and therefore a bigger customer base.

Disadvantages

Companies that combine operations must deal with cultural differences between firms. For example, merging an older, established technology company with a small startup company may achieve a transfer of knowledge, experience, and skills, but it may also lead to clashes. The older firm's management may feel more comfortable with strict corporate hierarchies , while the startup company may prefer less administrative authority over operations.

Some businesses may find that their synergies are well-suited for consolidation. But that may backfire if one or the other has far too much debt . Consolidation, therefore, may increase the new company's debt load. If not addressed, it can be problematic for the company's management and, ultimately, its shareholders if the company is public.

While it may lead to cost-cutting and increased revenue, business consolidation does have a negative economic effect. That's because it often leads to redundancies in the workforce, which often ends in layoffs and unemployment , even if not on a major scale.

Cut costs, boost revenue, and get better terms from suppliers

Easy access to (cheaper) financing

Larger market share, product line, geographical reach, and customer base

Cultural differences between firms

Increase in debt load

Redundancies in the workforce often lead to layoffs and unemployment

As noted above, the process of business consolidation is often associated with mergers and acquisitions. To show how it works, let's use a hypothetical example. Suppose Company 1 (the larger company) decides it wants to acquire smaller rival Company 2. Shareholders, management, and the board of directors of both companies all approve of the deal. Once the consolidation takes place, both companies operate under Company 1's name while Company 2 ceases to exist.

Askinglot. " What is business consolidation? " Accessed May 25, 2021.

GoCardless. " What is business consolidation? " Accessed May 25, 2021.

CFI. " Motives for Mergers ." Accessed May 25, 2021.

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1136354448-f080c26a0c514086b116f718d030d06f.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- ERP Glossary of Terms

- S/4HANA Integrations & Extensions

- Grow with SAP Program

- Know Before You Grow, Mini Video Series

- ByDesign Integrations & Extensions

- ByDesign Pricing

- What's New in SAP Business ByDesign

- Product Functionality Videos

- Business One Integrations & Extensions

- Business One Pricing

- On-premise to Cloud Migration

- What's New in SAP Business One

- ERP Integrations & Extensions

- ByDesign vs. Business One

- Med Device Turn-Key Package

- Bio Pharma Manuf.

- Biotechnology

- Cell & Gene Therapy

- Contract Development & Manufacturing

- Research Management

- Validation Services

- Professional Services

- Business to Business (B2B)

- Business to Consumer (B2C)

- Direct to Consumer (DTC)

- CPG Distribution Package

- CPG Manuf. Package

- 2023 Consumer Product - Trend Report

- Food & Beverage

- Food & Beverage Manufacturers

- Consumer Product Manufacturers

- Industrial Product Manufacturers

- Life Sciences Manufacturers

- Save Our System (SOS)

- Optimization Services

- Customer Care & Support

- Customer Education Webinars

- Business One On-premise to Cloud Migration

- SAP S/4 HANA Cloud, Public Edition Demo

- SAP Business ByDesign Demo

- SAP Business One Demo

Navigator Blog

- ByDesign Video Library

- Business One Video Library

- Client Success Stories

- News & Press

- Navigator Leadership

What Is SAP Business Planning and Consolidation?

SAP is one of the leading providers of enterprise resource planning (ERP) systems. It’s better than similar services in its category; SAP even outperforms Oracle ERP .

SAP Business Planning and Consolidation (SAP BPC), one of the top corporate performance management (CPM) systems, is another of its high-quality offerings. It enables companies to create and adjust strategic plans, speed up budget and closing cycles, and ensure financial reporting standards.

It’s a great module to add to your existing SAP Business ByDesign ERP, letting you consolidate all your business processes into a single all-in-one solution—without significantly affecting your SAP ByDesign implementation costs .

SAP BPC is a planning and consolidation solution that greatly benefits fast-growing and rapidly changing small to mid-market businesses. It delivers operation and financial capabilities, including planning, budgeting, forecasting, and financial consolidation functionalities, allowing enterprises to improve strategic planning and results to drive revenue and profitability.

Benefits of SAP Business Planning and Consolidation

SAP BPC can be greatly advantageous, directly affecting how your business makes decisions, collaborates between departments, and achieves its goals. Here are some reasons why you should consider adding it to your SAP Business ByDesign ERP:

High Usability

SAP BPC is a single-deployment solution for various planning and financial tasks. These include planning, budgeting, forecasting, reporting, and management consolidations. It has various uses that can increase efficiency in different departments.

Better Decision Making

SAP BPC can provide budget plans, forecasts, and analysis that can help you derive better insights to inform your business decision-making. You can base plans on what-if analyses and scenario planning for better outcomes, as well as assess budgets and forecast models in real-time, adjusting as needed.

Improved Collaboration

Your teams can work together on a single viewpoint in SAP BPC. This lets you break down communication barriers and information silos, improving accountability and work accuracy with it.

Increased Efficiency

Connect your departments to the same data points and processes with SAP BPC, allowing you to shrink cycle times, close the books fast, reduce your forecasting cycle, and accurately align your plans with strategic goals.

Flexible Deployment

SAP BPC is available as both on-premise and cloud deployment. Being able to choose your method of implementation allows you to increase accessibility on your own terms.

Key Functions of SAP Business Planning and Consolidation

SAP BPC helps you create an even more integrated ERP system. Here are the key functionalities that you can benefit from after implementation:

Unified Planning and Collaboration

SAP BPC, added to SAP Business ByDesign, completes an all-in-one integrated software solution for business planning and consolidation. This allows you to save time and reduce errors as you come up with strategies and achieve your goals.

Financial Intelligence

SAP BPC comes with robust financial intelligence tools that enable you to automate aggregations, allocations, and other manual processes. It allows you to speed up planning cycles and identify quick course corrections for every what-if scenario.

Microsoft Office and Web Reporting

SAP BPC can help you engage stakeholders across finance touchpoints and throughout the platform with Microsoft Office and HTML5. It also gives you enhanced visualization with SAP Analytics Cloud.

Management Consolidations

Complete all your financial reporting requirements with speed and accuracy with SAP BPC’s management consolidation functionalities (which include automation).

Budgeting and Forecasting

Generate what-if models and scenario plans to assess your business’s budget suitability in real-time. SAP BPC also lets you build forecast models that you can update and adjust as you go.

Get SAP ERP With Navigator Business Solutions

SAP Business ByDesign consolidates all your business processes into one system. The all-in-one solution meets all your departmental needs, and this is made even easier with SAP BPC.

Find out how SAP Business ByDesign and SAP BPC can fit your business requirements and how you can get started in integrating its modules into your operations.

Related Posts

Want to stay informed with the latest info, popular posts.

CDMOs, CMOs and CROs: What's the Difference?

Steps of Quality Control in the Pharmaceutical Industry

Why ERP Is Important to a Company

Examples of Companies That Use ERP

The Benefits of Using a SAP System

Top categories.

- Life Sciences 58

- Cloud ERP 37

- ERP Software 37

- SAP Business ByDesign 33

- [email protected]

- 919.576.0075

How Can SAP BPC Help? Overview and Key Benefits

Home > Insights > How Can SAP BPC Help? Overview and Key Benefits

Have you ever wondered what it would be like if there was a one-stop-shop solution that allowed you to build budgets, adjust plans, and consolidate organizational activities in the same place? Well, with SAP , there is.

Cue SAP Business Planning and Consolidation (SAP BPC).

Read on to learn how the solution can help streamline your business processes and maximize your technical investment, as well as how our team of consultants can provide the support you need to succeed.

What is SAP BPC?

SAP Business Planning and Consolidation is a native SAP module that provides budgeting, planning, forecasting, and financial consolidation capabilities to help companies adjust business plans, improve the efficiency of financial cycles, and ensure compliance.

The SAP BP&C application offers pre-built functionality for improved:

- Strategic planning

- Forecasting

The BPC platform also offers functionality for two platforms, Microsoft Excel and Microsoft Office (SAP BPC MS) and SAP NetWeaver (SAP BPC NW), and each platform contains two versions to provide the most accurate and reliable tools to hold, manage, and store transaction and master data.

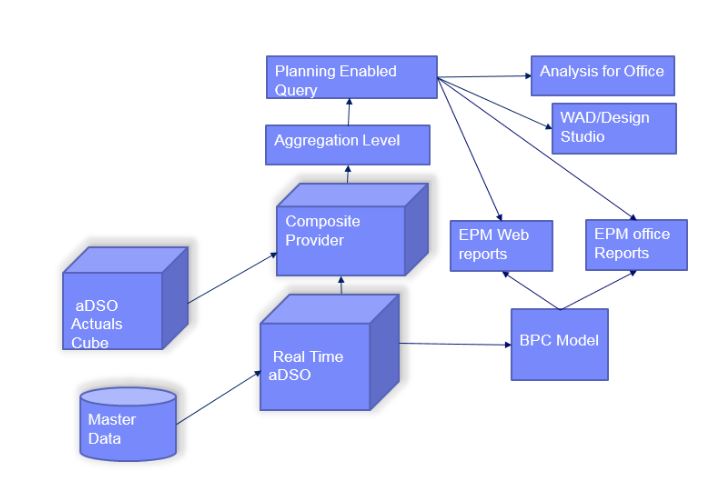

SAP BPC as an EPM Solution

SAP Business Planning and Consolidation provides users with an enterprise performance management (EPM) solution that helps companies build a unique repository for relevant business data and improve planning, reporting, and analysis features within the SAP Analytics Cloud.

With SAP EWM and BPC solutions, companies can improve operational and financial performance management processes, like financial consolidation, supply chain performance management, business strategy management, and more.

Key Capabilities of the Solution

Now that you have a better understanding of BPC in SAP let’s take a closer look at the key capabilities of the solution.

Built-in Business Intelligence

The SAP Business Planning and Consolidation solution offers built-in financial intelligence features that help companies eliminate the need for manual data entry and other business processes and run “what-if” scenarios to ensure they are adequately prepared for any business or market change.

With BPC’s intelligent features, automating tedious manual processes, like allocations or aggregations, is simplified, making way for faster, more efficient planning cycles.

Integration with SAP Analytics Cloud and SAP S/4HANA

On the one hand, BPC can be integrated with the SAP Analytics Cloud to provide a more collaborative approach to crucial planning processes, enhance financial data visualization, and improve predictive analysis functionality.

Conversely, the BPC platform is also embedded within the SAP S/4HANA cloud, making it even easier for companies to plan, consolidate, and analyze business process flows in real-time. And, because BPC’s integrated software solution is embedded in an on-premise solution like S/4HANA, integrations between critical financial and operational functions within SAP are simplified.

SAP BPC also helps engage important stakeholders throughout the enterprise by connecting core SAP functionality with other external solutions like Microsoft Excel and HTML5.

Unified Planning Solutions

SAP BPC offers a single software solution with built-in integration capabilities to not only help customers save valuable time by automating manual tasks but also reduce data entry, duplication, and migration errors with a single source of truth.

With one solution and pre-built integrations between applications and modules, companies will have the correct data whenever and wherever they need it.

More Accurate Business Consolidations

With SAP BPC, users can automate the consolidation process and enable better productivity across their entire SAP landscape.

This means that instead of wasting valuable time handling tedious auditing and closing processes, the BPC solution automates legal and management consolidations to help you deliver a quick and accurate close.

Automation of your financial processes not only enables you to meet financial reporting standards but also provides a complete and accurate audit trail to keep up with financial operations in the long run.

Improved Reporting and Forecasting

Improved web reporting, “what if” modeling, and strategic scenario planning features help companies assess their budget and closing cycles in real-time and enhance engagement and visualization.

The BPC solution allows companies to build in-depth budget models and determine the best course of action when budgeting or forecasting changes need to be made.

Top 5 Advantages for Your Company

Here are a few main advantages of SAP BPC for your organization:

Organizational alignment:

Alignment between employees, teams, and areas of your organization is crucial to the success of your entire organization.

BPC improves alignment by offering a single source for all of your organizational data and streamlines data management processes to determine organizational goals and outline plans to achieve them.

Improved productivity:

SAP BPC automates time-consuming manual processes, saving your team valuable time and maximizing budget cycle efficiency in the process.

With its automation capabilities, integration compatibility with other systems, and one-stop-shop solution for data monitoring, reporting, and analysis, the SAP Business Planning and Consolidation solution improves overall system efficiency and employee productivity.

Adaptable system organization:

With SAP’s business planning and consolidation features, SAP customers have all the tools needed to simplify legal and management reporting processes and store all necessary operational and financial data in one place on-premise or in the cloud. Users can also easily change data management and organizational operations to meet growing or evolving market needs over time.

Maintained legal compliance:

With BPC functionality, customers can leverage advanced reporting capabilities and detailed financial records to manage, consolidate, and store vital financial records safely and securely.

In the case of an audit, these well-structured records and reports help companies remain compliant with local, state, and federal regulations and provide quick and easy access to internal records whenever they’re needed.

More profitable decisions:

SAP BPC offers advanced capabilities that allow users to more accurately and efficiently process real-time data and outline more accurate projections for future financial budgeting and risk purposes.

With the SAP Business Planning and Consolidation platform, companies can not only allocate their resources more efficiently but also use more comprehensive data to make more informed and profitable decisions.

Partnering with Experts

Interested in learning how SAP’s Business Planning and Consolidation platform can improve the functionality and efficiency of your management team? Want to know more about how our team of consultants can help improve the reporting and analysis of important data, process cash flow statements and other records more accurately, and meet external financial reporting requirements? Surety Systems is here to help!

With extensive experience in virtually every SAP module and application and skillsets that have been built upon for years, our team of senior-level SAP consultants has what it takes to lead your team to success… the first time . Regardless of your organization’s size, location, industry, or complexity, we have the right consultant to meet all of your project needs.

How Can We Help?

Whether you need help deciding between SAP BPC versions, additional support understanding the built-in reporting and analysis features in the BPC platform, an extra hand leveraging BPC functionality to optimize business operations, or anything in between, our team is here to help.

And, to give you a better idea of what to expect when partnering with us, we’ve included a snapshot of one of our top-notch SAP consultants:

Surety Senior SAP BPC Consultant

- 20+ years of SAP BPC experience

- Excels as an SAP Solution Architect and hands-on Developer

- Well-versed using S/4HANA, SAP BPC, SAC, and Group Reporting

- SAP Certified Application Associate – SAP BusinessObjects Planning and Consolidation 10/11

- Delivered multiple Full Life Cycle SAP/BPC Implementations

- Prior experience working directly at SAP America

Contact us today to learn more about our SAP support services, or get started with one of our expert BPC SAP consultants.

You May Also Be Interested In...

Your Guide to Maintaining SAP Material Master Data and Records

In the modern SAP landscape, where precision and efficiency govern the intricacies of critical business operations, the material master data and records assume an increasingly...

SAP MaxDB: Navigating Data Management in SAP Operating Systems

In the dynamic realm of enterprise database management, SAP MaxDB emerges as a robust and versatile solution, playing a pivotal role in supporting the data...

SAP STO: How to Drive Efficient Stock Movements Across Locations

Precision and efficiency are paramount in the intricate world of materials management, purchasing, and strategic sourcing, and SAP Stock Transfer Order emerges as a linchpin...

Already know exactly what you need?

Fill out the form below and let’s get started!

- Name * First Last

- Company Name *

- Technology * Technology Healthcare Interoperability JD Edwards UKG/Kronos/Ultipro Infor/Lawson Salesforce SAP Workday Epic Oracle Cloud ERP Other

- What's your situation? * What's your situation? We have a high-priority project Our team needs an expert boost Our team is a man down We're ready to team up with a new consulting firm Our project is behind schedule We need an unbiased audit Something Else

- Anything else we should know?

Not sure how to get started with your project?

We’ve got you covered.

- NEW TO SAP EPM & BPC

- ALREADY USING SAP EPM & BPC

- TRAINING & EDUCATION

- TECHNICAL & FUNCTIONAL SERVICES

- PROGRAM MANAGEMENT

- HOSTING & MANAGED SERVICE

- BPC APPLICATION REVIEW + EPM ASSESSMENT

- SAP BPC ROADMAP WORKSHOP

- EPM - ENTERPRISE PERFORMANCE MANAGEMENT

- xP&A - EXTENDED PLANNING & ANALYSIS

- BPC - BUSINESS PLANNING & CONSOLIDATION

- BI - BUSINESS INTELLIGENCE

- DISCLOSURE MANAGEMENT

- S/4HANA GROUP REPORTING

- SAC CALCULATOR

- SAP FINANCIAL CONSOLIDATION

- CASE STUDIES

- EPM PERFORMANCE CENTER

- EPM SUMMIT NETWORK

- WEBINAR LIBRARY

- ASSESSMENTS

What is SAP BPC?

SAP Business Planning and Consolidation (BPC) is SAP’s flagship product for planning, budgeting, forecasting, and both legal and management consolidations. SAP BPC provides a highly scalable, robust database combined with business process and logic capabilities to provide a true Enterprise Performance Management (EPM) platform. SAP BPC is a unified solution that does not require individual software components to perform a core set of business functions and tasks.

Let’s begin to understand BPC’s capabilities with an overview of the five core EPM business processes it is most commonly used to address.

Core Capabilities

- Planning Planning is typically defined as long-range planning spanning multiple years, that can be entered in any combination of periodicity (week, month, quarter year). Some companies use models with strategic or long-range planning that span years or decades into the future. These plans are usually at a higher level than the budget or forecast. The planning cycle also combines a variety of financial and non-financial information to form a complete view. BPC provides a platform to integrate business planning, connecting strategy, operations and financial processes.

- Budgeting A budget cycle is a full outlook for the upcoming year based on your business calendar. Some budgets start out with predefined assumptions or targets (top-down), while others begin with a set of detailed inputs from various participants across the organization (bottom-up). It is quite common for organizations to develop a budget with a combination of both top-down and bottom-up assumptions, with multiple versions being developed during an iterative and collaborative process.

- Forecasting Many companies have abandoned the traditional 12-month budget in favor of a rolling forecast, which looks at the remaining months of the year and a full 12-18 months (or more) into the future. BPC easily combines the actual periods with forecast periods into one category or version. This facilitates more efficient reporting and analysis. For example, the May forecast version (category) would have four periods of actual data (January – April), and at least eight periods of forecast data. This also allows users to easily compare the current forecast to previous forecast periods.

- Consolidations BPC has built-in financial intelligence including robust legal and management consolidation capabilities. These capabilities include the ability to import data from various data sources. SAP BPC customers can enjoy a variety of integration options, including real-time consolidations with SAP’s flagship ERP solution, S/4HANA. BPC also fully supports non-SAP ERP systems. Many BPC users have multiple ERPs – one of our customers had so many acquisitions they consolidate over 90 different GLs with different COAs. Additional consolidation features include currency translation, intercompany eliminations, allocations, partial ownership, equity pick-up, journals, and reporting and analysis. Reporting and analysis features include P&L, Balance Sheet, Cash Flow statements to accommodate internal and external financial reporting requirements.

- Legal and Management Reporting & Analysis for both Operations and Finance BPC enables a wide variety of reporting and analysis formats including what-if scenarios with real-time modeling, by leveraging Excel to dynamically read data and write back to the database. Users can easily develop both ad-hoc and production reports, including financial statements, in their required format. BPC includes a book publication wizard within the Excel interface that dynamically generates any combination of cost centers, profit centers, product lines, etc. and product books into a distributable PDF document. An optional Disclosure Management solution is available from SAP to help automate filing with various regulatory agencies, including SEC.

SAP BPC Versions Read Less

BPC currently supports several database platforms, but SAP will eventually phase into ongoing support of two main platforms, described below.

Version 1, BPC Microsoft 10.1 is the latest version that is available on the Microsoft technology stack, and leverages the latest versions of Microsoft SQL Server and Analysis Services.

Version 2, BPC 11, version for BW/4HANA , is the most recent version of BPC, and leverages SAP’s HANA in memory database as the engine. BW/4HANA was released in Q4 of 2016 and is the next-generation version of SAP’s Data Warehouse software. Much like SAP’s introduction of S/4HANA as the successor to ECC, BW/4HANA is not just an upgrade from BW, but an entirely new platform fundamentally changing the way SAP approaches EPM. BPC 11 allows cloud deployment across a variety of platforms including Amazon Web Services (AWS), Microsoft Azure, Google Cloud and SAP’s HANA Enterprise Cloud (HEC). Column5 has developed flexible options allowing customers to deploy BPC as a cloud service across those same platforms, with added private and public infrastructure service options.

Both versions of BPC use the same Excel Add-in (Analysis Plug-in and EPM Plug-in), but may exhibit additional functionality and features when enabled in Excel, depending on your backend database.

BPC supports two model types - Standard and Embedded . For a more detailed comparison of BPC Standard vs. Embedded please visit " SAP BPC NW 10.1 Standard and Embedded Compared ".

The Standard model is a BPC model structure (or cube) with a single account dimension. The Embedded model structure supports multiple ‘key figures’ and shares more of the SAP ERP structures, reducing replication of both data and master data (dimensions). BPC Microsoft 10.1 supports the Standard configuration. BPC 11, version for BW/4HANA supports both the Standard and Embedded configuration, and can be customized to run the two side-by-side. Customers who are using S/4HANA also have the option to leverage pre-built content, known as “BPC Optimized for S/4HANA”. Column5 can help you determine which model configuration (Standard, Embedded or both) meets your existing and ongoing business requirements.

SAP Analytics Cloud provides cutting-edge visualization capabilities along with advanced analytics, combining business intelligence, planning and predictive analytics. To better understand the benefits of SAP Analytics Cloud with BPC please see our blog entitled “ Using SAP Analytics Cloud as a Client to BPC .”

History of SAP BPC Read Less

In 2007, SAP acquired the foundation of today’s BPC solution from OutlookSoft, a software company founded in 1999 by two of Hyperion Software’s key executives. A couple of years earlier, Arbor Software (original developer of the Essbase multidimensional OLAP engine) merged with Hyperion Software and decided to move forward with the Essbase database as the platform for future software development. This helped ignite the vision for the founders of OutlookSoft: They wanted to build a next generation Enterprise Performance Management (EPM) solution on a robust, open and multi-dimensional platform, leveraging Microsoft Excel as the database’s primary interface.

Taking advantage of a unique opportunity to develop the solution on the Microsoft technology stack, OutlookSoft leveraged both Microsoft SQL Server and Microsoft Analysis Services, providing the most complete integration with Microsoft Office. Hyperion was eventually acquired by Oracle and OutlookSoft was acquired by SAP.

BPC was originally designed to leverage Microsoft Excel with planning, budgeting and consolidation capabilities, along with patented technology to interface with the Microsoft technology stack. Not even Microsoft could create a more efficient interface.

SAP BPC Today Read Less

BPC also includes Business Process Flows (BPFs) that can be used as a formal workflow for both financial and operational processes, or as a menu to organize various assets including input forms, reports, books and dashboards.

BPC attracts users with its innovative user experience, including native Excel integration. BPC’s founders at OutlookSoft understood that Excel was crucial for finance users to accomplish their daily tasks. Copying and pasting information into a proprietary tool or using a web interface cannot match the flexibility, power, variety, and convenience of Excel. They successfully turned Excel into a “window to the database” and they removed many of the traditional pain points previously associated with Excel.

Today, the Excel Add-in for BPC is called Analysis Office. Analysis Office (AO) is comprised of two “Plug-ins”, the Analysis Plug-in and the EPM Plug-in. Additional information along with recommended use cases from SAP can be found in the . In summary, SAP recommends the following:

- For any BPC Standard model, SAP recommends using the EPM Plug-in.

- For the BPC Embedded model, SAP recommends using the Analysis Plug-in due to its superior integration into BW metadata. The EPM Plug-in has some architectural limitations and will not receive any functional enhancements on the Embedded model.

- Both EPM and Analysis Plug-ins will be maintained and developed as part of the Analysis Office release based on these recommendations.

SAP has invested heavily into improving BPC since the OutlookSoft acquisition. Today, BPC’s Excel interface is truly exceptional – we think it’s the best on the market. Please contact us to experience the latest version of BPC through an informative demonstration and personalized conversation.

In addition to the built-in financial intelligence capabilities, BPC is also a robust analytic application development platform. BPC can solve a variety of business needs that fall outside the core five standard business processes. Rather than making sacrifices and changes to your existing processes, BPC can be configured to meet your specific requirements; it is not limited by a software platform. This flexibility is key as businesses evolve and you make processes improve. The BPC platform allows customers to be nimble and dynamic in their design and to expand their use of the solution as business grows or changes.

SAP BPC Customer Profile Read Less

There are over 6,000 BPC customers worldwide. While they all share the core common set of capabilities, due to the flexible nature of the platform, each customer has a unique BPC implementation. They can configure the solution with their “secret sauce” and other best practices to give them a competitive edge in their industry. Customers range from small and medium-sized businesses to top ten members of the Fortune 500.

SAP BPC Demo Read Less

We invite you to take advantage of a free demonstration and workshop from Column5 that can show how your organization can benefit from SAP BPC or SAP Analytics Cloud.

Helpful Links:

Death of the Budget - Long live the Rolling Forecast

What Should an SAP BPC Implementation Team Look Like?

5 Overlooked Features of BPC

Y ou Might Be in Excel Hell If...

Replace a Working Spreadsheet Based Forecasting Model with SAP BPC?

3 Reasons You Will Be Happy w / BPC

11 Dirty Secrets of EPM Projects

7 Deadly Sins of a BPC Implementation

Looking to upgrade from BPC v7.x to 10.x?

Download the FREE Performance Tips eBook!

Column5 Consulting Group, LLC

2820 S Alma School Rd

Suite 18-645

Chandler, AZ 85286

Toll Free: +1.800.360.7839

Email: [email protected]

Column5 Consulting UK

19 Highfield Rd, Edgbaston

Birmingham, B15 3BH

Phone: +44 20 7183 0760

- Consulting & Implementation

- Training & Education

- Technical & Functional Services

- Program Management

- Hosting & Managed Service

- BPC Application Review + EPM Assessment

- SAP BPC Roadmap Workshop

- Disclosure Management

- S/4HANA Group Reporting

- SAP Analytics Cloud

- SAC Calculator

- SAP Financial Consolidation

- Case Studies

- EPM Performance Center

- EPM Summit Network

- Webinar Library

SAP BPC Business Planning and Consolidation

What is business planning and consolidation (sap bpc).

SAP BPC is one of the important tools of SAP systems and it stands for Business Planning and Consolidation also known as Outlook Soft.

SAP BPC is a high-performance management tool that enables all types of planning, future forecasting, and consolidation. At the same time SAP allows for an easy integration and consolidation at all levels. Besides that, with SAP BPC it’s quite easy to make use of reporting tools.

Why SAP BPC is so important?

Chief Financial Officers of all companies are always under great pressure to produce maximum profits and increase the profitability of all processes. They are also under pressure to minimize risk, reduce operational costs to as much as possible, and enhance the shareholder confidence in their companies. All of these tasks are easier for CFO by using SAP BPC , which is the leading technology product in the business. BPC helps your organization to integrate all your business processes and technologies onto just one single platform which supports both high-end as well as shoestring budgets, making your planning, forecasting, and reporting activities much easier.

Advantages of SAP BPC

1. With the help of Business Planning and Consolidation you can plan and monitor business activities in a more comprehensive manner and helps better decision making.

2. Most importantly, SAP Business Planning and Consolidation gives you the space and freedom to use your most skilled employees to work at more high-value or high-end work than spend all their time at mundane and boring work that could be easily done by anybody who is less capable.

3. It makes it possible for you to improve your cross-organization collaboration and increases your organization’s responsiveness to a much more dynamic business environment.

4. More than anything else, SAP Business Planning and Consolidation allows you to reduce the cost of your training and minimize your IT resources significantly. Further SAP has a very user-friendly interface that integrates perfectly with Microsoft Office and Internet Explorer, even when it is implemented on a Microsoft or on an SAP NetWeaver platform.

5. SAP BPC works on the back end by enhancing the business transparency and speeds up filing financials by using the highly sophisticated Extensible Business Reporting Language (XBRL) extension, and allows for a statutory consolidation in combination with GAAP, IAS, IFRS, FASB, or Sarbanes-Oxley.

Important features of SAP BPC

- SAP BPC is Multi-Dimensional

The multidimensional nature of SAP BPC makes it possible for business organizations to “slice and dice” the data and the information in accordance to their needs.

- SAP BPC is Dynamic

SAP BPC makes use of the OLAP technology, which makes the data available right at the time of entry. There is no need for aggregate data.

- Allows for Workflow Management

SAP systems makes it possible for a business to track and closely monitor its progress through a sophisticated budgeting and forecasting process

- BPC integrates and unifies all processes

Other planning and consolidation software products use different modules for consolidation and future forecasting. But SAP BPC unifies and integrates both modules within a single software process.

- SAP BPC is integrated with Microsoft Office

Business Planning and Consolidation is perfectly integrated with Microsoft Excel and has the ability to report directly using Microsoft Word as well as PowerPoint documents.

- BPC comes with a special Zero footprint Option

SAP BPC can access data and share reports without install the client add-ins. Indeed, you don’t even have to install Microsoft Office for BPC, and it produces reports in Microsoft Word, Excel or PowerPoint software.

- You can store comments with SAP BPC

It makes it possible for a user to store commentary at any data point while working on an application.

SAP BPC versions

SAP BPC provides a multi-user platform and is integrated with Microsoft Excel. The earlier versions of SAP Business Planning and Consolidation (BPC) leveraged the Microsoft SQL Server and Analysis Services. But the latest version of BPC only uses SAP Netweaver as its only back-end database. While both versions of SAP BPC are very similar in concept, in functionality they differ considerably.

Financial Planning, Consolidation and Analysis for fast growing organisation >>

SAP Business Planning & Consolidation (BPC)

A flexible, robust and proven solution for planning and consolidation

What is SAP Business Planning & Consolidation (BPC)

SAP Business Planning and Consolidation (SAP BPC) , as globally embraced , robust and reliable CPM tool, delivers planning, budgeting, forecasting, and financial consolidation capabilities . Companies using SAP BPC can easily create and adjust plans and forecasts, speed up budget and closing cycles and ensure compliance with financial reporting standards .

This proven solution for planning and consolidation provides many benefits to rapidly changing organizations , among which efficiency gains , streamlined planning and accurate ‘closing’ processes .

SAP Business Planning and Consolidation (SAP BPC) enables organizations to better strategize and plan, analyze , optimize , close and disclose results, to increase revenue and profitability.

SAP BPC has different versions. If you want to know more about the differences between these versions and which version of SAP BPC is suitable for your organization contact us or select one of the links below:

- The different versions of SAP BPC>>

- How to choose among different versions of SAP BPC>>

We, at cpm view , help global enterprises of different sizes with their requirements around consolidation and reporting . We work with modern and leading consolidation and reporting s olutions that meet legal and managerial requirements.

Key Benefits of SAP BPC

Leverage usability

SAP BPC is a single deployment solution for planning, budgeting, forecasting and management consolidations and reporting , as well as statutory consolidations.

A comprehensive consolidation engine is included in SAP BPC. The legal and management consolidation processes can be automated, establishing efficiency gains and eliminating error-prone reporting steps. The possibility for multi-GAAP reporting is standard available.

Leverage visualization

W hat-if modeling and scenario planning assess B udget suitability in real – time . Forecast models can quickly be updated and easily be compared with Budgets and Actuals.

SAP BPC integrates financial and operational planning , both top-down and bottom-up , enabling accurate decision-making and reducing throughput time in the reporting processes . The automated update of Actual data e nables continuous planning and rolling forecasts to meet rapidly changing business conditions .

Increase Productivity

SAP BPC uses an add-in on Microsoft Office that enables users to open reports from Word, PowerPoint and Excel.

Workflow and reports can also be opened from any device with a n intuitive HTML web interface. The tool combines the strong features of Microsoft Office with robust process features, automated business rules and workflows of SAP BPC in a single data source .

Intelligent Action Panes

An offline mode is available to share input templates and reports with users without a software license.

Input schedules can be returned and provided data records can be s aved into the database by one click.

Leverage Big Data

Powerful data tracking capabilities are offered in SAP BPC. SAP BPC can cope with large data volumes.

Data is stored in a single database and data security settings can easily be applied per user or per group of users . Data models in SAP BPC translate raw data into valuable information.

On-premise or Cloud deployment

SAP BPC is available for both, Cloud and On-premise deployment.

SAP BPC has different versions. What are the differences between these versions and which version of SAP BPC is suitable for your organization?

Related articles

Sap bpc versions – update and advice 2019, sap bpc: how to choose among different versions, sap bpc 11.1 for bw4/hana 2.0 – more power under the hood, why is cpmview a specialist in sap business planning & consolidation.

Cpmview is recognized by SAP as ‘Expertise Partner’ for SAP Business Planning & Consolidation (SAP BPC) implementations. We are specialized in Corporate Performance Management.

We develop best of breed solutions, incorporating our great scale of best practices that we composed over the past decades. Our solutions can easily be adopted by any company using SAP BPC.

W e have built an extensive track record with successful and global SAP BPC implementations . Y ou can benefit from our many years of experience in implementing SAP BPC. Our consultants implemented SAP BPC, formally OutlookSoft , as one of the first consolidation and planning solutions in the Netherlands , back in 2003.

Summary of SAP BPC benefits

SAP Business Planning and Consolidation is a robust and reliable solution that meets all your requirements in the area of budgeting, planning, consolidation and reporting.

From a single application, SAP BPC supports your financial and operational planning, but also your consolidation process. Both top-down and bottom-up. This means that you are assured of smooth and punctual financial closings. The result is that you always comply with the increasingly strict regulations and global reporting requirements. Our expertise and proven methodology help you utilise the full potential for consolidation, planning and budgeting, reporting and analysis.

Do you want full control over your financial processes, now and in the future? SAP BPC can help you to achieve this, because it gives you control over:

- Financial reporting and analysis

- Consolidation

- Business planning & budgeting

- Forecasting

- Audit trails and workflows

SAP BPC – What is Business Planning and Consolidation? : All you need to know [ OverView ]

Last updated on 05th Nov 2022, Artciles, Blog

- In this article you will get

Preface to SAP Business Planning and connection

Sap bpc overview, what’s epm in sap, sap bpc architecture, core capabilities.

SAP BPC is a SAP module that provides planning, budgeting, soothsaying and fiscal connection capabilities. SAP BPC stands for Business Planning and connection. It provides a single view of fiscal and functional data and an intertwined result that supports performance operation processes similar as conforming plans and vaticinations or accelerating budgeting and ending cycles.

It provides erected-in functionality for:

- Strategic plan

SAP BPC Finance has two platforms. It’s nearly 80% the same functionality except for the difference in the reverse- end. Each platform has two performances.

SAP BPC MS( Microsoft Platform) – SAP BPC7.5 MS and SAP EPM 10.

SAP BPC NW( NetWeaver Platform) – SAP BPC7.5 NW and SAP BPC 10 NW.

Like any other module, the SAP BPC module also contains master and sale data. BPC in SAP is divided into two factors called “ Administration ” and “ Reporting ”.

Fiscal planning, budgeting and soothsaying are important rates for any organization to run a business successfully. Integrated – planning and connection into one product. Single operation reduces conservation, increases data integrity, and simplifies deployment. It also enables flexible planning and connection functions.

Strategic plan:

It helps the operation platoon to formulate its vision, charge, core values and objects. The platoon develops strategic plans to maintain its competitive advantage in the business.

It isn’t simply a vaccination of unborn issues. It’s also a plan of the organization’s conduct and anticipated operations in the coming time. The budget is prepared for active operation and dimension of commercial performance.

This ensures that performance progress is covered, problems are anticipated, and nonstop enhancement sweats are promoted.

It’s the act of prognosticating the results. This is done to show the changes in the internal and external terrain throughout the time. What determines how the internal or external terrain affects the original plans and budget? The main ideal is to give lower threat operation planning and more accurate information for decision timber.

The use of EPM results is getting wider in the fiscal divisions. It’s analogous to CPM( Corporate Performance Management), BPM( Business Performance operation) and FPM( Finance Performance Management). EPM is being used as a unique depository for managing applicable information.

Business needs benefits and features:

- Process Control Business Process Flow( BPF) ways for environment- Driven Workflow and Process effectiveness.

- Centralized data and operation operation.

- Status monitoring and workflow operation.

- Part- grounded security and stoner authentication.

- Dimensional inspection trail for budget, cast and factual.

- Interpretation control supports any number of performances.

- Data lockdown as per dimension or specified period.

- Compliance and auditability inspection follows the history of the entire planning, reporting and vaticinating.

- “ A Single interpretation of the verity ” at reported figures.

- Data- grounded translucency – and data change – visibility.

- Ensures responsibility as belief in figures increases power responsibility.

SAP BPC Architecture. It uses colorful business rules and script sense for planning.

BPC Administration:

BPC Administration allows directors to perform conservation and setup tasks for BPC customer operations.BPC fiscal administration has two interfaces; A customer operation and a web interface. The Administration conduct pane lists the conduct available for both interfaces.

To start BPC administration:

Any of the following will work.

- Open a cybersurfer and type http:// / osoft, where is the name of your BPC garçon.

- From the Windows Start menu, choose SAP> BPC

- From your Windows desktop, click on the BPC icon

- From the Launch runner, elect BPC Administration

- From the Administration conduct pane, elect the task you want

The press customer is a Microsoft Explorer- suchlike window. Where we manage particulars similar as operation sets, operations, business rules, confines and business process flows. The cybersurfer allows customer operations to set and control operation parcels, as well as to maintain BPC web parameters.

Creating a new dimension:

Confines represent the realities of a business( eg, accounts, company canons, and orders). They represent master, textbook, and scale data for each business reality.It’s possible to produce new confines in a BPC operation set. There’s no restriction to produce multiple confines in SAP BPC. These confines also come with participating confines that are available for use in any operation within the app set.Some confines are needed. It must be present in all operations within the operation set. Whereas the dimension type determines the dereliction parcels to be included in the dimension. It’s possible to add fresh parcels as demanded.

BPC Reporting:

With BPC for Office, we’ve all the functionality of Microsoft that we’re used to. BPC for Office allows to collect data, induce reports, perform real time analysis and publish reports in colorful formats.You can take reports fully offline and distribute them grounded on stoner access rights.

BPC Security:

Druggies This is used to add druggies to the terrain and manage their access rights.Brigades You can define a group of druggies with the same access rights.Data Access Profile It enables setting up biographies for the tasks to be performed.Task Profile This is used to set up biographies and enable access to data in models.

SAP BPC client Profile:

There are over,000 BPC guests around the world. While they all partake in an introductory common set of capabilities, due to the flexible nature of the platform, each client has a unique BPC perpetration. They can configure results with their “ secret sauce ” and other stylish practices to give them a competitive edge in their assiduity. guests range from small and medium- sized businesses to the top ten members of the Fortune 500.

SAP bpc moment:

BPC also includes Business Process Flow( BPF) which can be used as a formal workflow for both fiscal and functional processes, or as a menu to organize colorful means including input forms, reports, books and dashboards. can be used as

BPC attracts druggies with its innovative stoner experience including native Excel integration. The authors of BPC at Outlook Soft understood that Excel was important for fiscal druggies to carry out their diurnal tasks. Copying and pasting information into a personal tool or using a web interface can not match the inflexibility, power, variety, and convenience of Excel. They successfully turned Excel into a “ window for databases ” and they removed numerous of the traditional pain points associated with Excel.

Planning is generally defined as a long- range plan gauging several times, which can be entered into any combination of periodicity( weeks, months, quarter times). Some companies use models with strategic or long- range planning that run times or indeed decades into the future. These plans are generally at a advanced position than calculated or read. The planning cycle also combines colorful types of fiscal and non-financial information to form a complete view. BPC provides a platform to integrate business planning, strategy, operations and fiscal processes.

A budget cycle is a complete outlook for the forthcoming time grounded on your business timetable. Some budgets begin with predefined hypotheticals or pretensions( top- down), while others begin with a set of detailed inputs from colorful actors in the organization( bottom- up). It’s relatively common for organizations to develop a budget that contains a combination of both top-down and nethermost-up hypotheticals, with multiple performances being developed during an iterative and cooperative process.

numerous companies have abandoned the traditional 12- month budget in favor of a rolling cast, which looks at the remaining months of the time and a full 12- 18 months( or further) into the future. BPC simply combines factual ages with cast ages into an order or interpretation. It facilitates more effective reporting and analysis. For illustration, the May cast interpretation( order) will have four ages( January – April) of factual data, and at least eight ages of cast data. It allows druggies to fluently compare the current cast with the former cast ages.

BPC has erected- in fiscal intelligence, including strong legal and operation connection capabilities. These capabilities include the capability to import data from colorful data sources. SAP BPC guests can enjoy a variety of integration options including real- time integration with SAP’s leading ERP result, S/ 4HANA. BPC also completely supports non-SAP ERP systems.

Numerous BPC druggies have multiple ERPs – One of our guests had so numerous accessions that they consolidated over 90 different GLs with different COA’s. fresh connection features include currency restatement, intercompany elimination, allocation, fractional power, equity pick- up, journal, and reporting and analysis. Reporting and analysis features include P&L, balance distance, cash inflow statement to accommodate internal and external fiscal reporting requirements.

Are you looking training with Right Jobs?

Related Articles

- Hadoop Tutorial

- Hadoop Interview Questions and Answers

- How to Become a Hadoop Developer?

- Hadoop Architecture Tutorial

- What Are the Skills Needed to Learn Hadoop?

Popular Courses

- Hadoop Developer Training 11025 Learners

- Apache Spark With Scala Training 12022 Learners

- Apache Storm Training 11141 Learners

Latest Articles

- What is Dimension Reduction? | Know the techniques

- Difference between Data Lake vs Data Warehouse: A Complete Guide For Beginners with Best Practices

- What does the Yield keyword do and How to use Yield in python ? [ OverView ]

- Agile Sprint Planning | Everything You Need to Know

Request for Information

- IND : +91 91769 54999

- Drop A Querry

- [email protected]

- Freshers Masters Program

- Data Science Masters Program

- AWS Cloud Architect Masters Program

- DevOps Master Program

- Cloud Computing Master Program

- Digital Marketing Masters Program

- Six Sigma Expert Masters Program

- Cyber Security Expert Masters Program

- Artificial Intelligence Masters Program

- Full Stack Master Program

- Data Analyst Masters Program

- Python Master Program

- Java Master Programs

- Software Testing Master Program

- Web Designing & PHP Development Master Program

- Android Online Training

- Angular Online Training

- Java Online Course

- J2EE Online Training

- Python Training Online

- Node.js Certification Online Training

- Hadoop Training in Chennai

- Dot NET Online Training

- UNIX Shell Scripting Online Training

- C Programming & Data Structures Online Training

- LoadRunner Online Training

- Selenium Certification Training

- Selenium Web Driver Training

- WebServices with Soap UI Online Training

- Selenium with Python Training Course Online

- Selenium with C# Online Training

- Ranorex Testing Online Training

- Salesforce Admin Training Online

- Salesforce Online Training

- VMWare Online Training

- DevOps On Google Cloud Platform Online Training

- AWS Aurora DB Online Training

- AWS RDS Online Training

- Amazon DynamoDB Online Training

- Pega Online Training

- Websphere Online Training

- Mainframe Online Training

- Mainframe System Admin Training

- Websphere Message Broker Online Training

- Websphere MQ System Admin Online Training

- SQL Server Developer Online Training

- Oracle Apps DBA Online Training

- Teradata Certification Online Training

- Oracle SQL/PLSQL Online Training

- MongoDB Online Training

- Oracle Performance Tuning Online Training

- MongoDB Admin Online Training

- Oracle ADF Online Training

- WebLogic Server Online Training

- Big Data Hadoop Developer Certification Online Training Course

- Apache spark with Python Online Training

- Big Data Analytics Certification Online Courses

- Data Science Course Online

- Hadoop Administration Online Training

- Data Science with R Training

- Data Science with Python Online Training

- Apache Hive Training

- SEO Online Training

- Google Analytics Training

- Digital Marketing Online Course

- Google Ads PPC Online Training

- YouTube Marketing Online Course

- On-Page SEO Online Training

- LinkedIn Marketing Online Training

- Off-Page SEO Online Training

- Facebook Marketing Online Training

- SEM Online Training

- Powershell Online Training

- Sharepoint Admin Online Training

- SharePoint Developer Online Training

- MicroSoft SSIS Training

- MicroSoft SSRS Training

- MicroSoft SSAS Training

- MVC Training

- Pentaho Online Training

- Cognos Online Training

- MicroStrategy Certification Online Training

- Informatica Certification Online Training

- Informatica MDM Online Training

- DataStage Online Training

- Oracle Database 11g: Backup and Recovery Workshop Certification Online Course

- ETL Testing Online Training

- Oracle Apps Finance Online Training

- Oracle Apps Technical Online Training

- SAP HANA Certification Online Training

- SAP ABAP Online Course

- SAP MM Online Training

- SAP FICO Online Training

- CyberArk Online Training

- Oracle Fusion Financials Online Training

- French Language Online Training

- German Online Training

- Spanish Language Online Training

- Chinese Language Online Training

- Learn Japanese Online Training

- IELTS Online Training

- TOEFL Online Training

- Blue Prism Online Training

- UI Developer Online Training

- Automation Anywhere Online Training

- OpenSpan Online Training

- Ethical Hacking Online Training

- Primavera P6 Online Training

- Project Management and Methodologies Certification Online Training

- Blockchain Online Training

- IoT Online Training

- CCNA Online Course

- Spoken English Online Course

- Embedded Systems Online Training

- Photoshop Online Course

- Adobe Illustrator Online Course

- Tally Online Training

- CCNP Online Training

- Hardware & Networking Online Training

- Data Science and Ai

- OS & Server Maintenance

- Designing & Animation

- MSBI Training in Hyderabad

- CRM Software

- Email Marketing Software

- Help Desk Software

- Human Resource Software

- Project Management Software

- Browse All Categories

- Accounting Firms

- Digital Marketing Agencies

- Advertising Agencies

- SEO Companies

- Web Design Companies

- Blog & Research

SAP Business Planning and Consolidation

What is sap business planning and consolidation .

Business planning and consolidation solution that offers financial forecasting, budgeting, scenario planning, consolidation and collaboration tools.

Capterra offers objective, independent research and verified user reviews. We may earn a referral fee when you visit a vendor through our links. Learn more

Compare with a popular alternative

Green rating bars show the winning product based on the average rating and number of reviews.

Other great alternatives to SAP Business Planning and Consolidation

QuickBooks Online

SAP Business Planning and Consolidation Reviews

This product has an Excel interface so everyone was pretty comfortable using this application. When I needed to call support, they were fantastic and went above and beyond.

Ease of use by finance community with XL friendly add-on; multi dimensional cubes ease the reporting capabilities.

The application is extremely powerful in terms of data collection and consolidation leading to effective business planning.

Overall extremely pleased with the application. It was seamless in terms of installation and deployment.

It should be noted that the errors were due to settings that came by default.

Limited documentation on scripts. Training on scripts is very specialized and intensive.

Overall, I would say that functionality of this software is greatly limited by the slow performance. I am constantly getting errors that are complete gibberish and never get resolved.

The script logic language and the BADI programming is not simple and the documentation is limited. SAP does not provide training for SAP Script logic.

Most Helpful Reviews for SAP Business Planning and Consolidation

Popular SAP Business Planning and Consolidation Comparisons

- SAP Business Planning and Consolidation vs Agicap

- SAP Business Planning and Consolidation vs QuickBooks Online

- SAP Business Planning and Consolidation vs NetSuite

- SAP Business Planning and Consolidation vs Martus

- SAP Business Planning and Consolidation vs LucaNet

Uplatz Blog

Uplatz is a global IT Training & Consulting company

- Data Science

- Machine Learning

- Cybersecurity

- Interview Preparation

Get £100 off on SAP, Oracle, Salesforce, Digital Marketing, SEO, DevOps, AWS, Azure, Google Cloud, Python, R, Java courses

Send email to [email protected] to ask for a customized course

What is SAP Embedded BPC (Business Planning and Consolidation)

SAP Embedded BPC (Business Planning and Consolidation) is a specific deployment option within the SAP BPC suite. Unlike the standard version of SAP BPC, which uses a separate application server, the Embedded version is embedded directly within the SAP BW (Business Warehouse) system. Here are some key points about SAP Embedded BPC:

- Integration with SAP BW: SAP Embedded BPC is tightly integrated with SAP BW, allowing for a seamless flow of data and metadata between the two systems. This integration enables organizations to leverage their existing SAP infrastructure.

- Unified Platform: It provides a unified platform for business planning, budgeting, forecasting, and financial consolidation, making it easier to manage financial processes.

- Real-Time Planning: With Embedded BPC, you can perform real-time planning and analysis using data stored in SAP BW, ensuring that your financial plans are based on the latest information.

- Simplified Data Models: Embedded BPC leverages SAP BW data models, simplifying the process of creating and maintaining planning models.

- Leveraging SAP HANA: Many organizations that use SAP Embedded BPC also take advantage of SAP HANA, an in-memory database platform, for enhanced performance and analytics.

- Customization: SAP Embedded BPC allows for more extensive customization and flexibility in designing planning and consolidation solutions to meet specific business requirements.

- Scalability: It is suitable for organizations of varying sizes, from small to large enterprises, and can scale to accommodate growing data and planning needs.

SAP Embedded BPC is a popular choice for organizations that are already using SAP BW and want to streamline their financial planning and consolidation processes by utilizing their existing SAP landscape. It offers a robust and integrated solution for financial management and reporting within the SAP ecosystem.

- Side Hustles

- Power Players

- Young Success

- Save and Invest

- Become Debt-Free

- Land the Job

- Closing the Gap

- Science of Success

- Pop Culture and Media

- Psychology and Relationships

- Health and Wellness

- Real Estate

- Most Popular

Related Stories

- Earn Over 150,000 student loan borrowers will soon have their debt forgiven

- Become Debt-Free Student debt relief due to financial hardship could be on its way

- Become Debt-Free Some student loan borrowers will start seeing their debt forgiven in February

- Become Debt-Free President Biden forgives student debt for nearly 78,000 borrowers through PSLF

- Earn Americans making student loan payments have up to 36% less saved for retirement

25 million student loan borrowers could see their balances shrink under Biden’s new forgiveness plan

President Joe Biden and his administration are moving forward with plans to provide student debt relief to as many people as possible.

The administration announced Monday the details of its new plan to reduce student debt balances for millions of borrowers. The proposed regulations — which were drafted as part of the months-long negotiated rulemaking process — feature several different ways for borrowers to see their debt balances reduced, if not eliminated entirely.

The provisions of the plan include forgiving excessive interest that has accrued, discharging balances that have been in repayment for 20 years or more and relief for borrowers who attended now-closed or insolvent institutions.

"[The] plan is focused on the reasons that people are struggling with their student loan debt," James Kvaal, Under Secretary of Education, told CNBC Make It.