Free Budget Proposal Templates

By Andy Marker | August 5, 2021

- Share on Facebook

- Share on LinkedIn

Link copied

We’ve compiled the most useful free budget proposal templates for organizations, project managers, grant writers, researchers, team members, and other stakeholders. You’ll also find helpful details for filling out these templates.

Included on this page, you’ll find a sample proposal budget template , a project proposal budget template , a grant proposal budget template , and a budget increase proposal template .

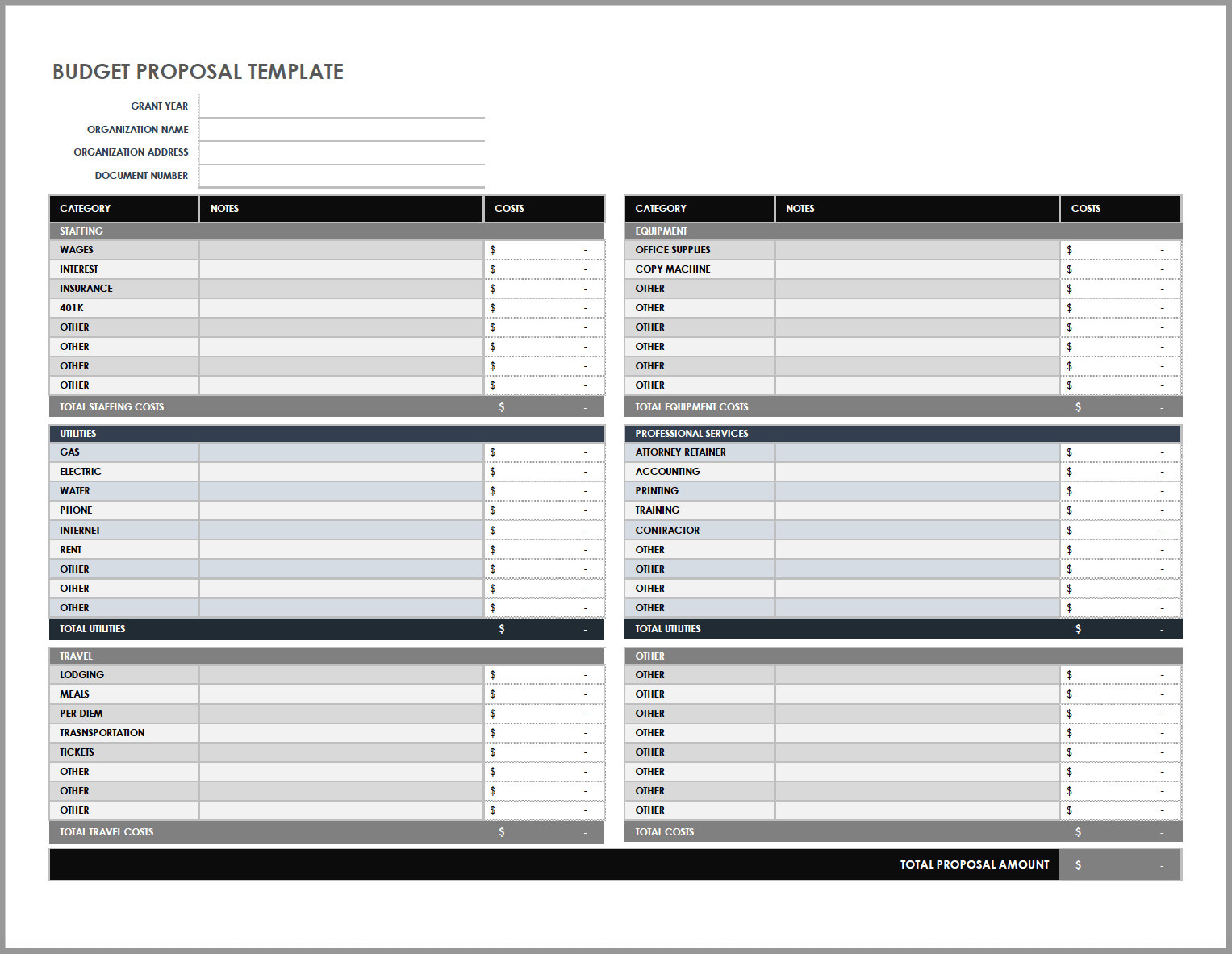

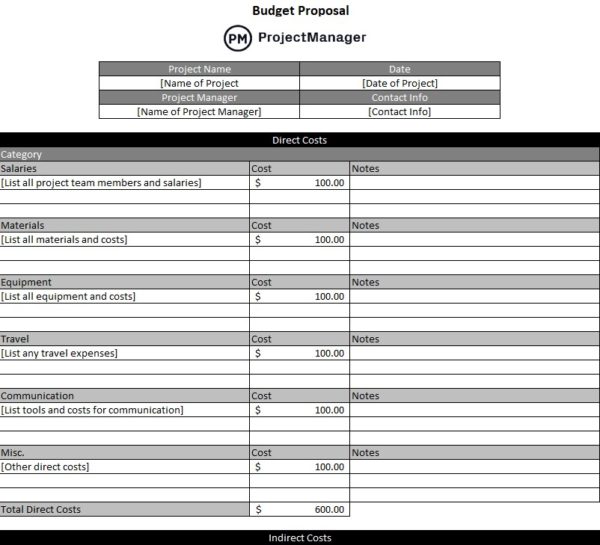

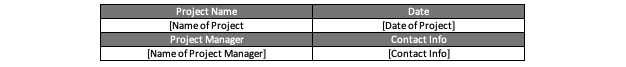

Budget Proposal Template

Download Budget Proposal Template

Microsoft Excel | Google Sheets | Adobe PDF

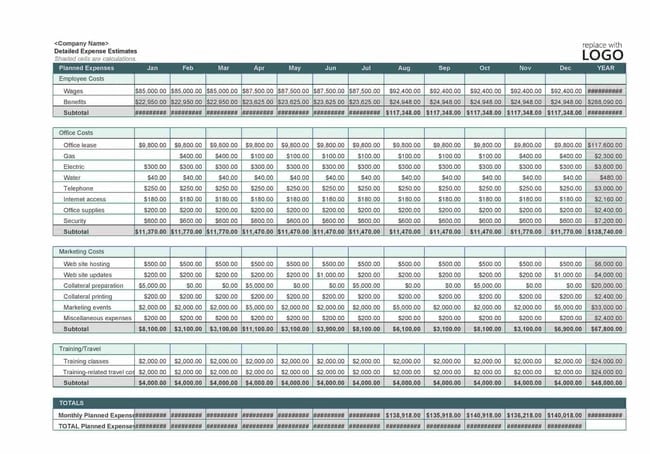

Use this universal budget proposal template to account for all the necessary resources in your organization’s operations or individual projects. Fill in proposed line-item amounts for staff salaries, benefits, equipment, professional services, memberships, occupancy expenses, and travel costs. This customizable template is the perfect tool to define any expenses an organization or project might incur, and to propose allocation of those resources.

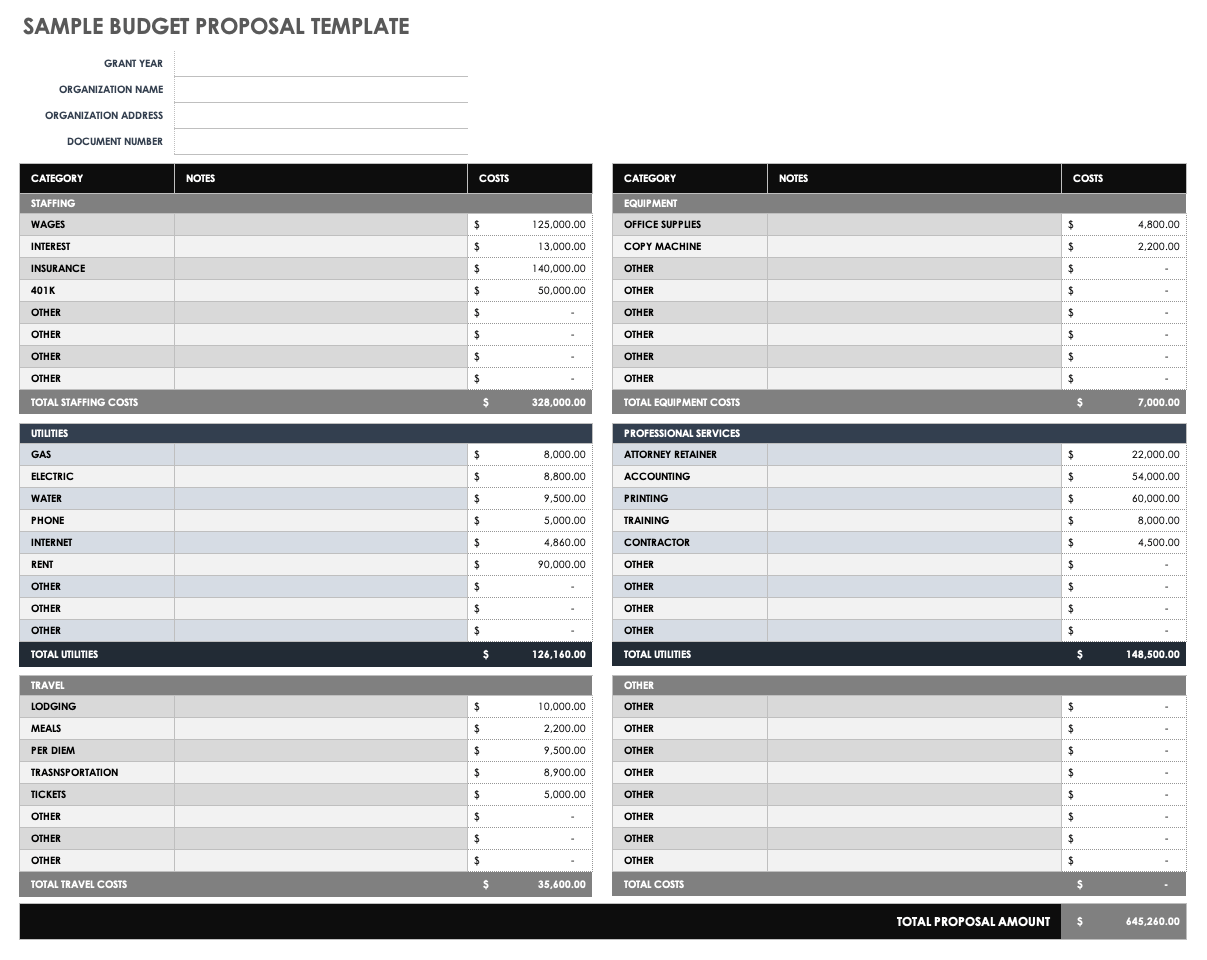

Sample Proposal Budget Template

Download Sample Proposal Budget Template

Microsoft Excel | Microsoft Word | Adobe PDF | Google Sheets | Google Docs

Take the guesswork out of creating a budget proposal with this sample proposal budget template, which comes with pre-filled example data. The template includes editable, auto-tallying sections to list details of your organization’s salaries, benefits, professional services, rent, telephone, internet services, and equipment costs. The pre-built line-item amounts help provide an accurate budget proposal to estimate your total funding requirements.

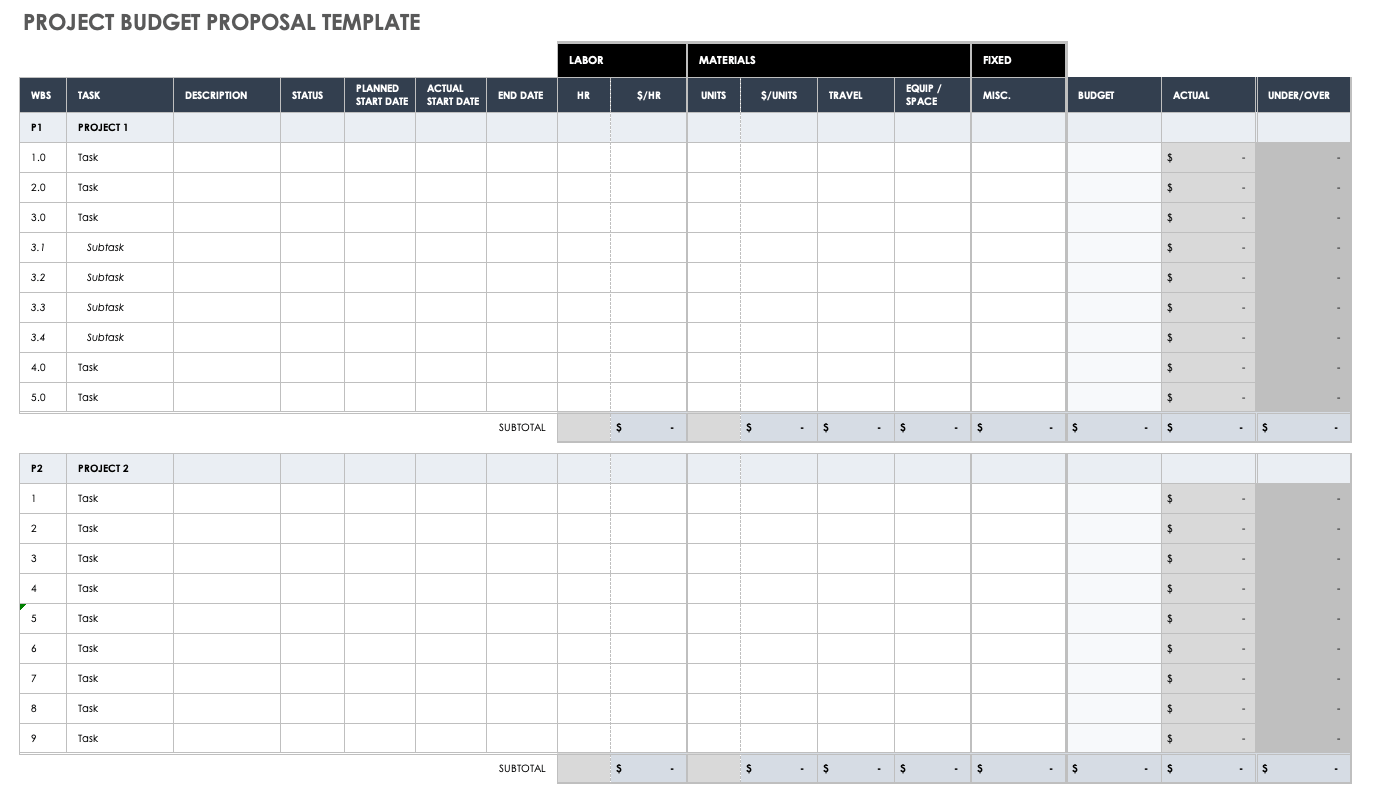

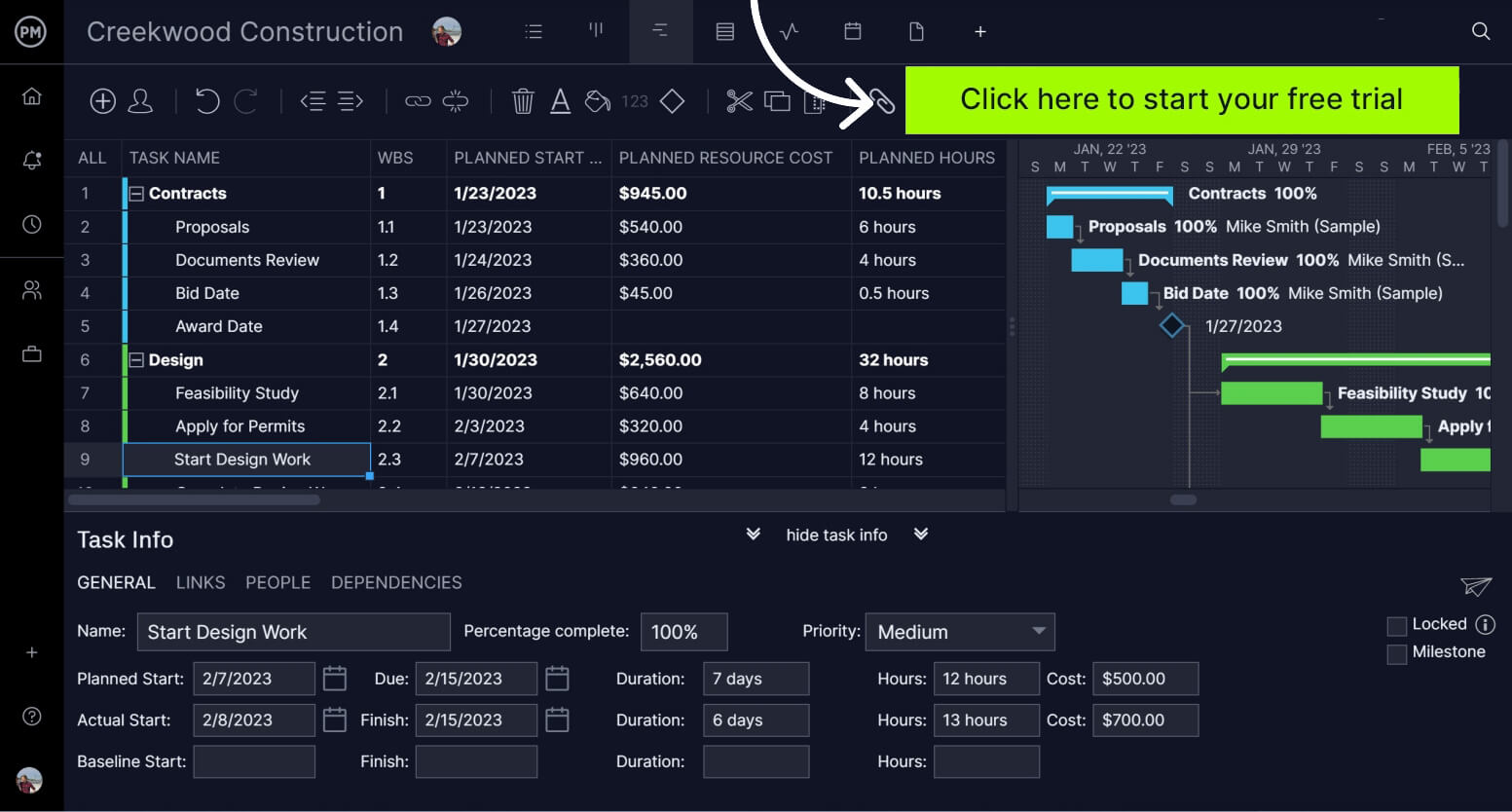

Project Proposal Budget Template

Download Project Proposal Budget Template

Microsoft Excel | Google Sheets

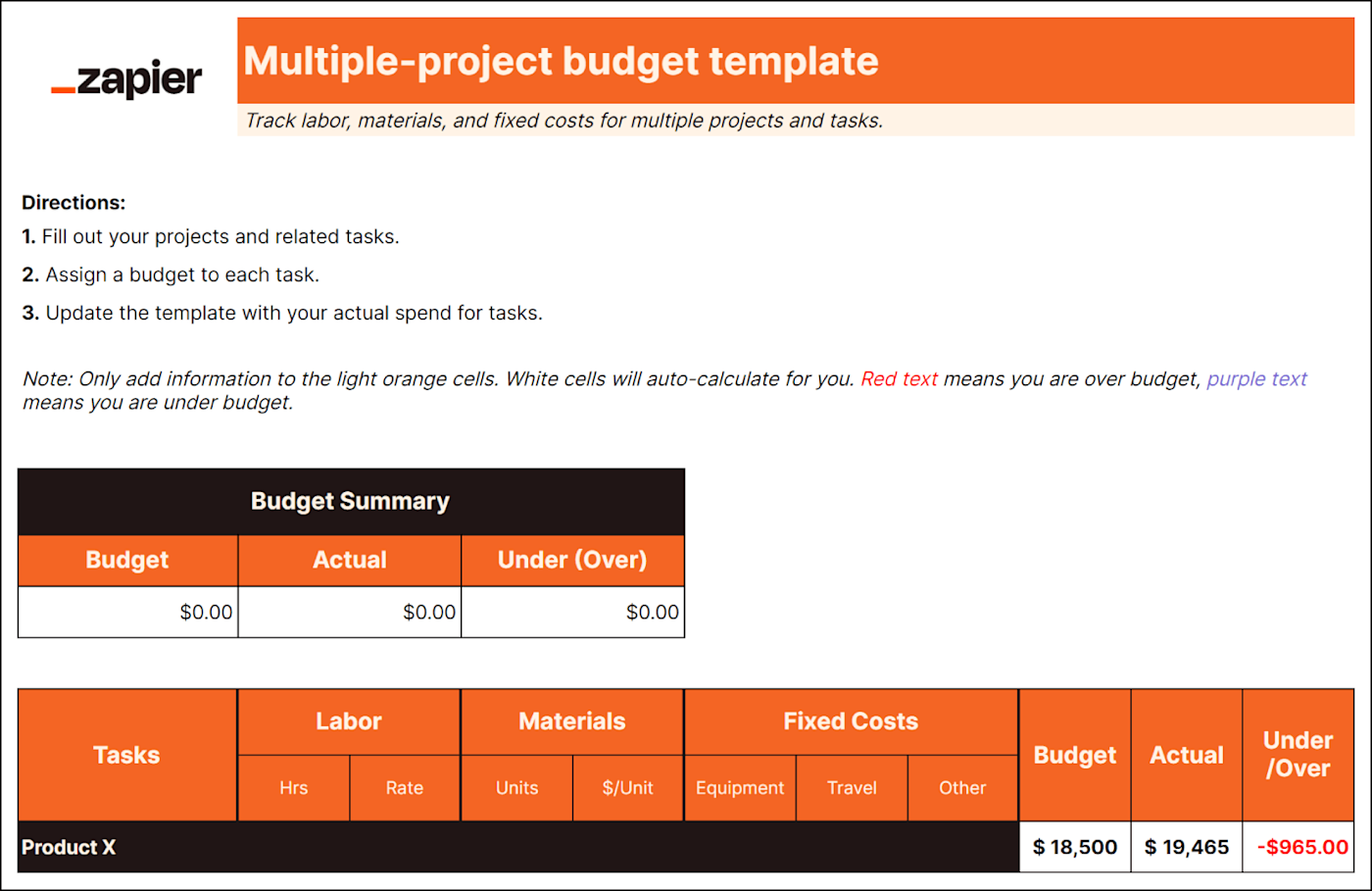

A project proposal budget helps you to stay on top of your individual and interrelated budgets, so that all stakeholders have the correct financial details on hand. Use the unique budget planning capabilities of this template to get the big picture of proposed project-by-project budgets. This template focuses on ensuring that your proposed budget calculations (including specific tasks and subtasks) accurately account for material, labor, and fixed costs. Use the template to monitor the difference between your proposed and actual budget amounts.

Read our project proposal templates article to find additional templates and learn more about getting the most out of your project proposals.

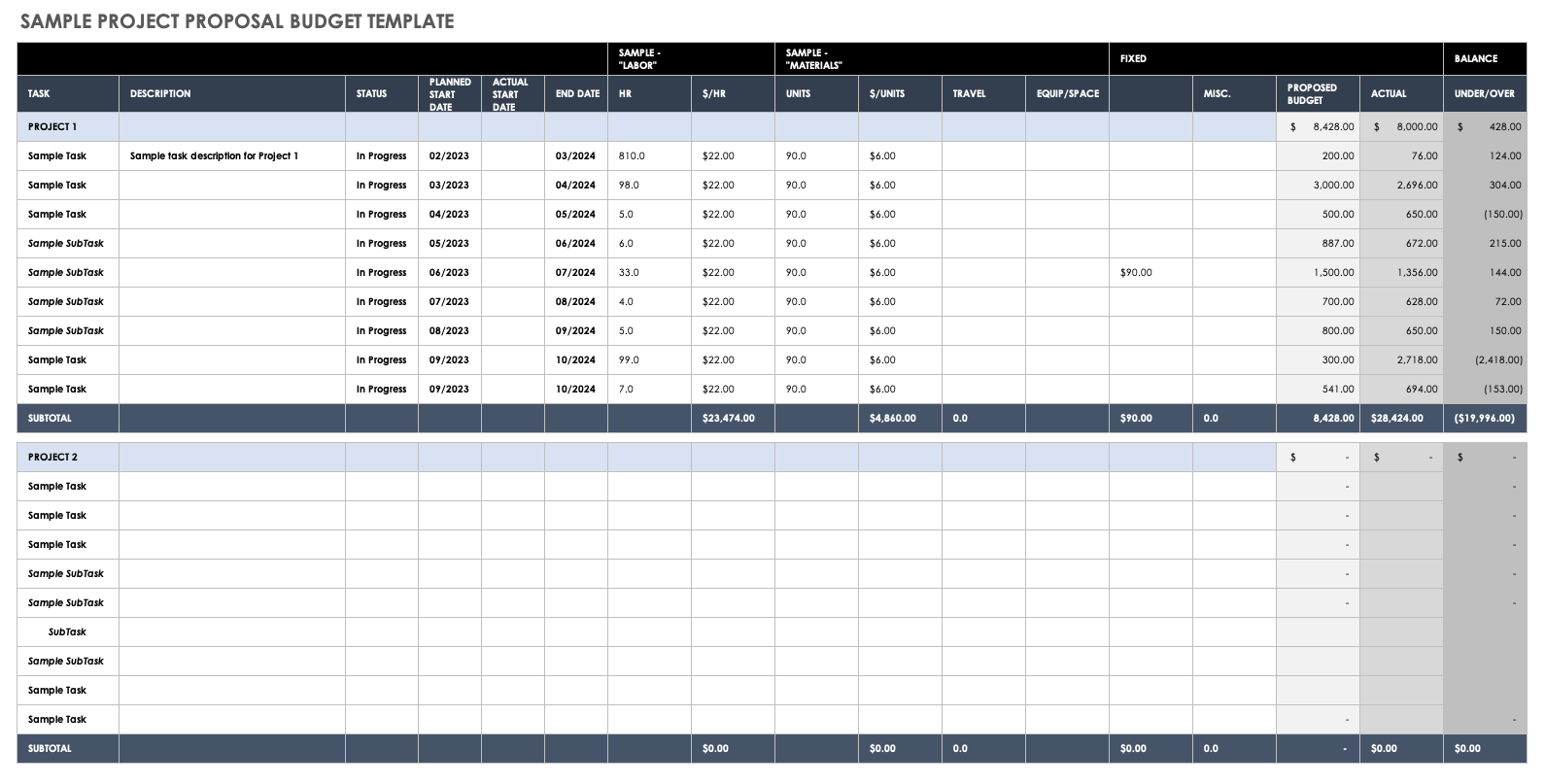

Sample Project Proposal Budget Template

Download Sample Project Proposal Budget Template

Use this project proposal budget template to guide project sponsors and other stakeholders through the financial details of your project. The template includes sample project proposal budget data with task-by-task budget specifics, which you can use to compare your projects’ proposed budget figures against actual budgeting, to arrive at a precise under/over balance. This pre-populated budget proposal template includes item-by-item proposed costs and balance tallies to ensure you plan an adequate, project-specific budget proposal.

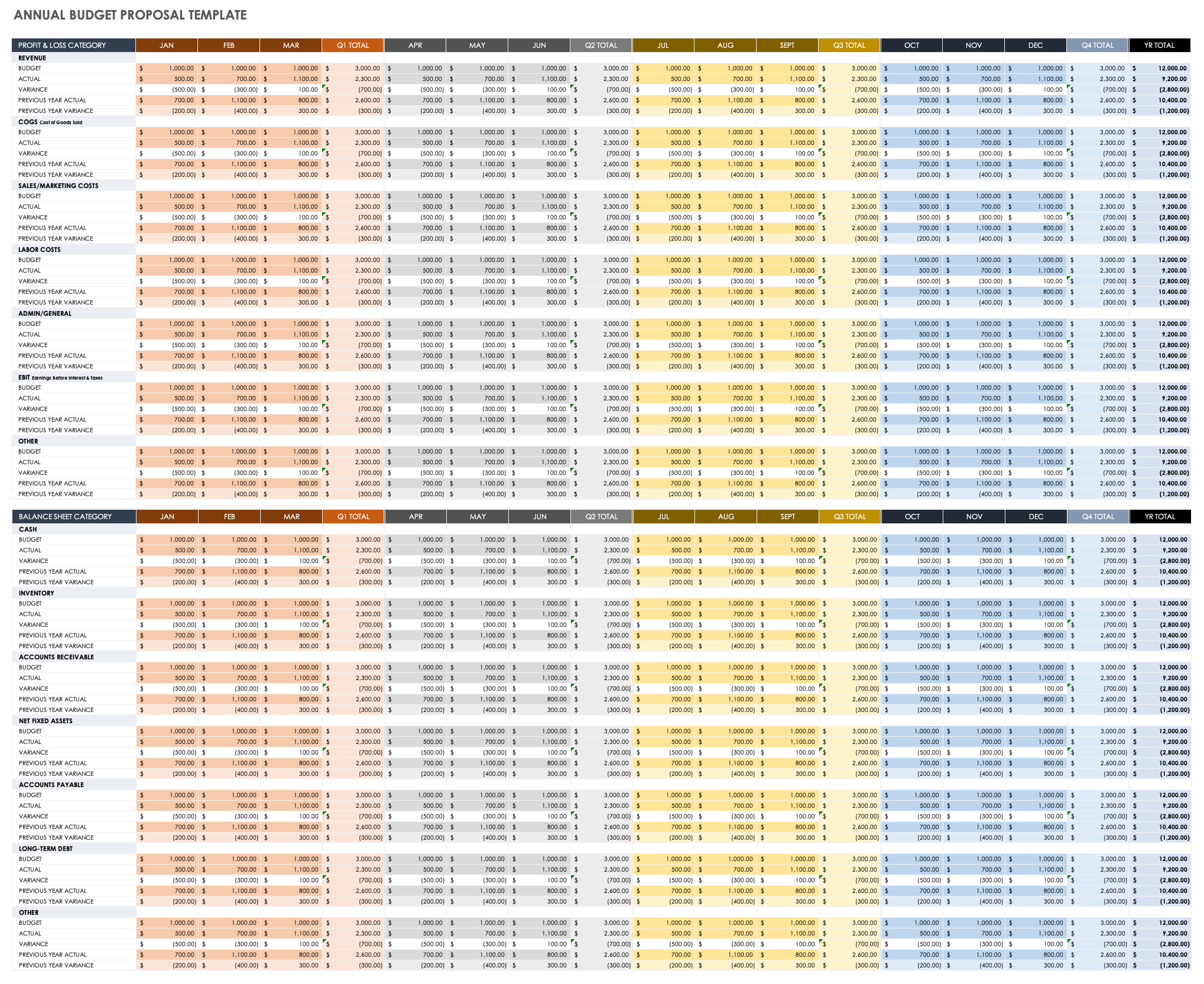

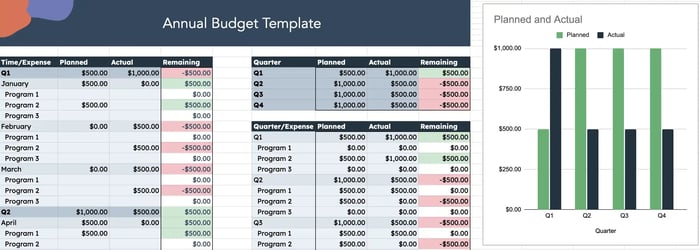

Annual Budget Proposal Template

Download Annual Budget Proposal Template

Keep accurate tabs on your proposed budget vs. actual funding with this easy-to-fill, 12-month annual budget proposal template. Enter anticipated revenue, cost of goods sold (COGS), sales and marketing costs, labor costs, admin and general expenses, and earnings before interest and taxes (EBIT). Factor in anticipated cash, accounts receivable, inventory, and long-term debt to gain quarterly and annual insight into your organization’s proposed, time-sensitive budget.

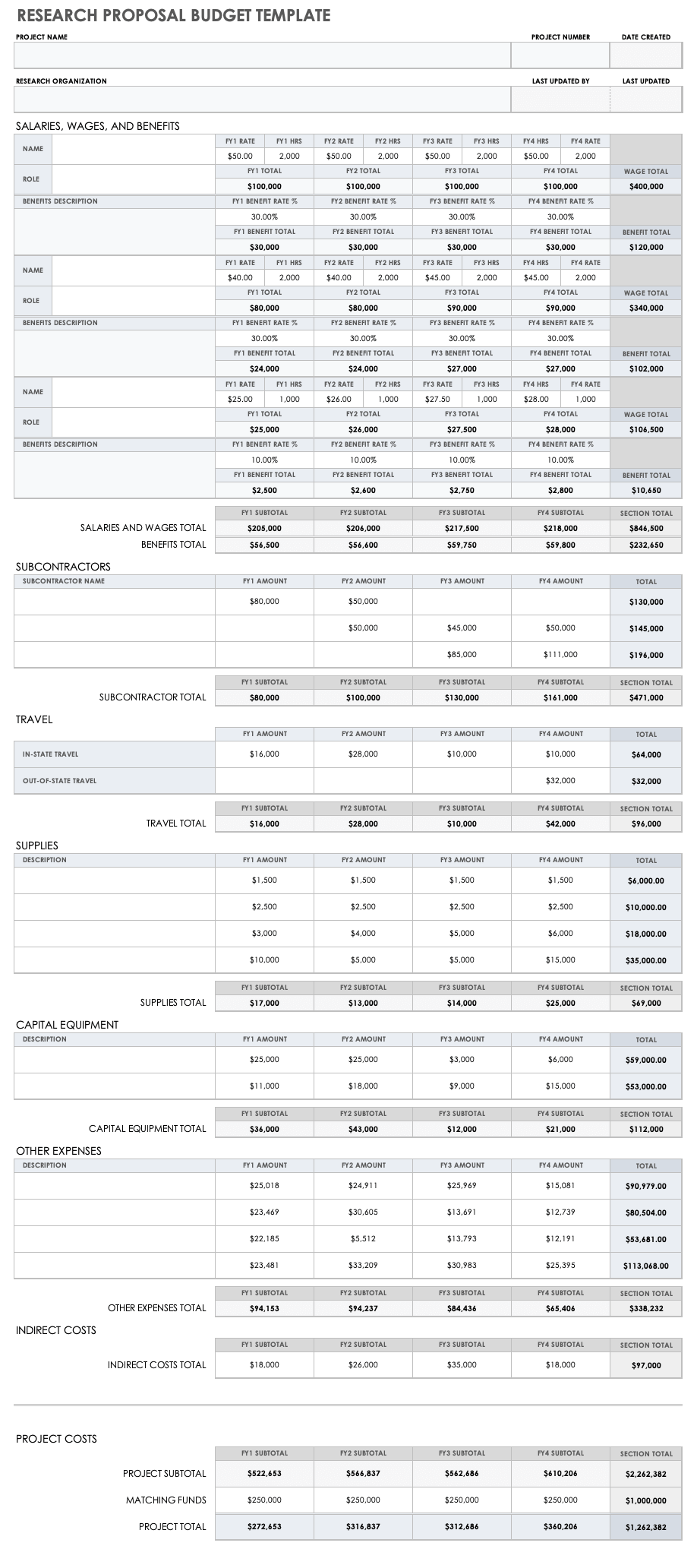

Research Proposal Budget Template

Download Research Proposal Budget Template

Microsoft Excel | Google Sheets | Adobe PDF

An itemized list of expected budget costs is one of the most valuable documents that you can provide to key stakeholders in order to clinch funding for your research. Document individual salaries and wages, potential travel costs, supplies, equipment, and other costs to create a credible picture of what the research expenditures will entail. Expedite the process of obtaining funding with this research proposal budget template, which includes a line-by-line breakdown of proposed expenses, and how they affect your potentially available financing.

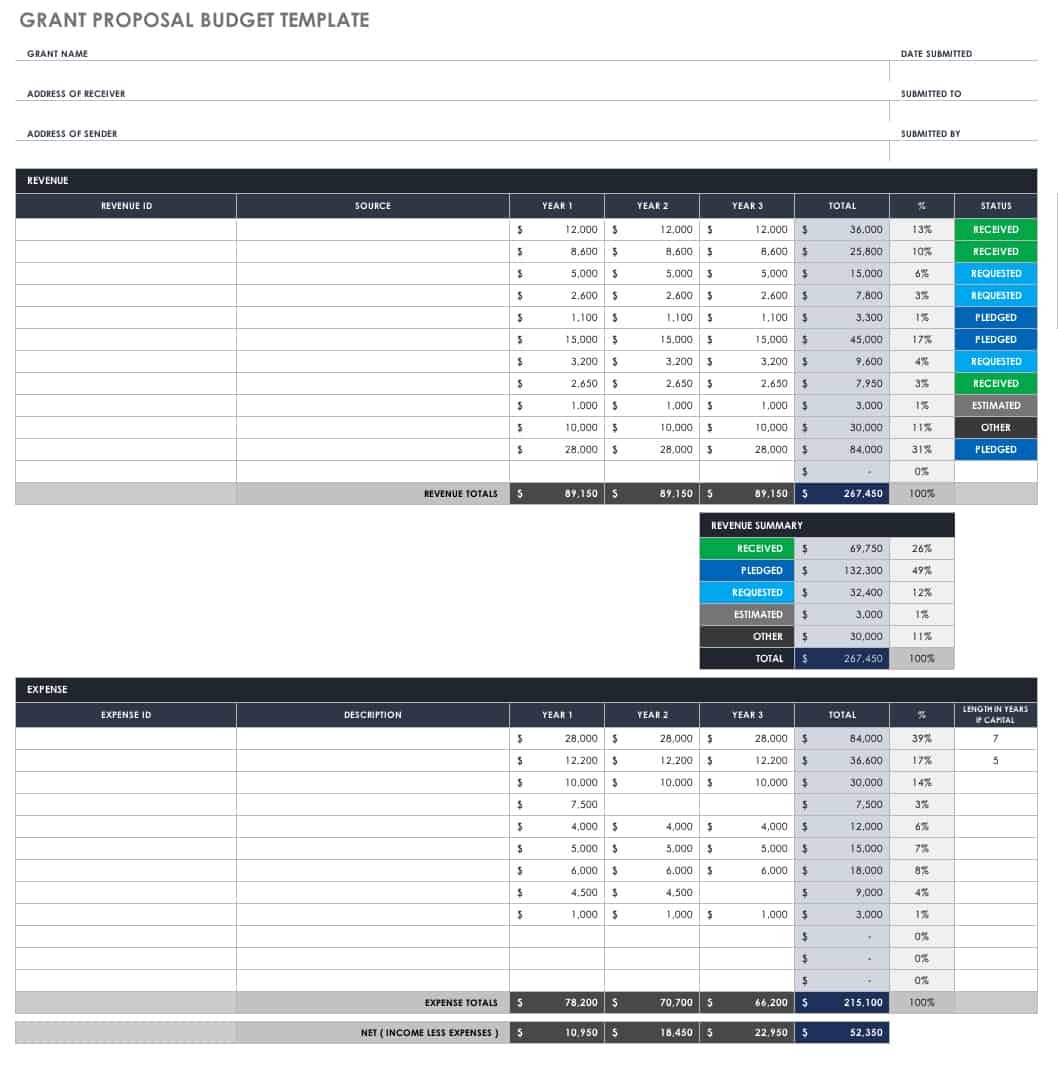

Grant Proposal Budget Template

Download Grant Proposal Budget Template

Microsoft Excel | Google Sheets

Use this comprehensive grant proposal budget template to ensure you’ve accounted for every item in the proposal. Enter unique funding revenue ID numbers and itemized budget details, and the template will automatically calculate proposed budget totals. Year-by-year columns provide a long-term picture of your grant funding requests, and also allow you to track various contributors’ endowments.

To learn more about the importance of winning bids with budget proposals, read our article on free grant proposal templates , as well as our roundup of free bid proposal templates .

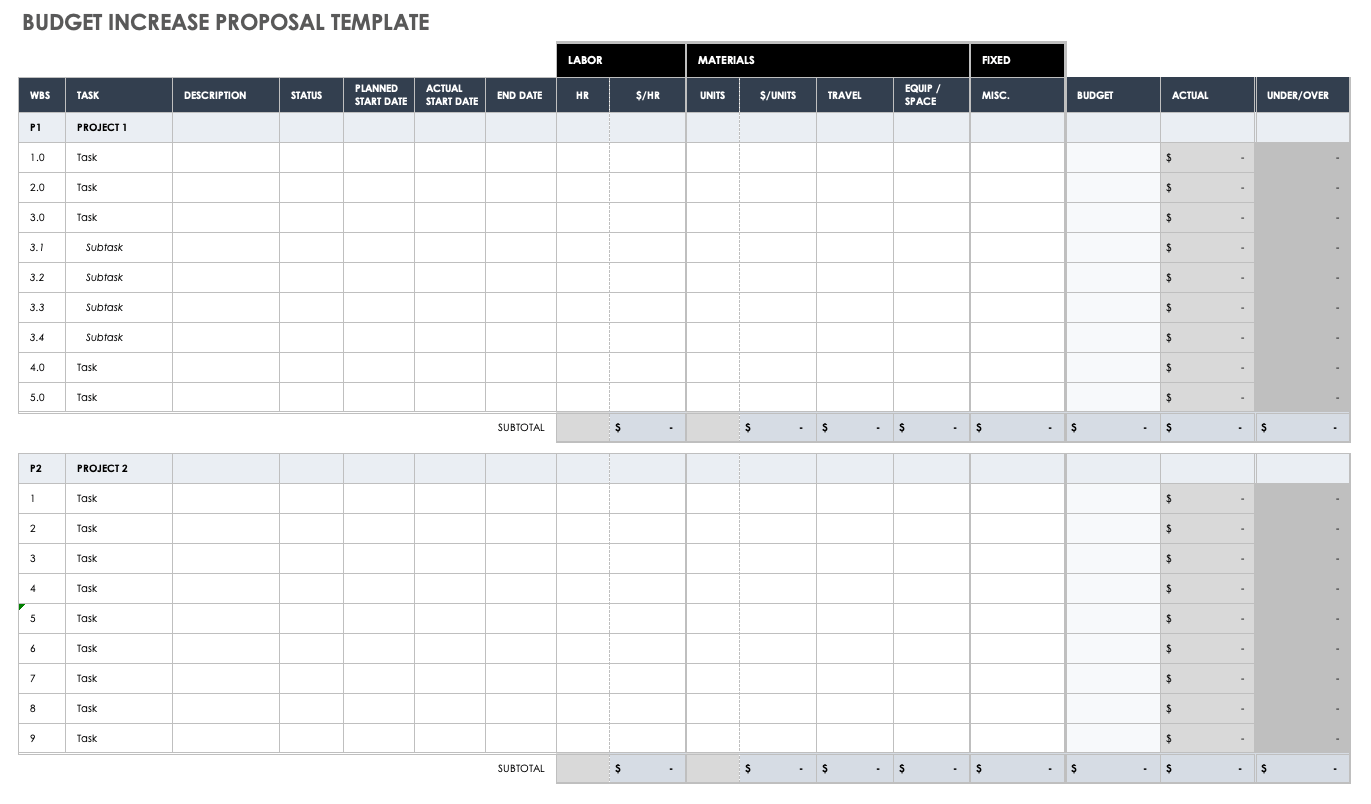

Budget Increase Proposal Template

Download Budget Increase Proposal Template

Quantify a suggested budget increase with this unique template that compares your current budget to the proposed increased budget, in order to arrive at accurate over/under amounts. Enter line-by-line costs (tasks and subtasks) and the template will automatically calculate a subtotal, as well as a proposed budget amount increase. This template also provides ample space to include details about multiple projects, as well as materials, labor, and fixed costs.

To learn more about business budget templates, see our collection of free business budget templates for any company . For more annual business budget templates, please refer to this article . We also offer a great variety of business templates for small businesses , startups , nonprofit organizations , as well as operating budget templates , that can be used across all industries.

Why You Need a Budget Proposal Template

A budget proposal template documents the suggested financial budget plan for an organization, project, research, or grant. Rather than starting from scratch, you can leverage the pre-filled criteria in a budget proposal template to gain insight into the accuracy of anticipated expenses and revenue sources.

A budget proposal template offers visibility into your organization’s or project’s projected financial picture. Templates provide an easy-to-use list of projected expenditures and expected revenue, so that you can compare any difference in your budgeted and actual amounts. You can also enter projected budget amounts for line items, such as planned salaries, equipment, professional services, occupancy, telephone, internet, and travel expenses.

While budget proposal templates are useful for anticipating expenses and revenue, you can also assess a budget’s feasibility by comparing budgeted with actual amounts. This information can help you recalibrate a budget proposal to align with actual costs and revenue for a more accurate budget.

Tips for Using a Budget Proposal Template

When filling out a budget proposal template, ensure that you account for an organization’s or project’s proposed expenditures. Most budget proposal templates include the following pre-populated sections:

- Salaries: This amount appears as a line-by-line account of anticipated labor-related expenses (e.g., salaries, bonuses, benefits, insurance, etc.).

- Equipment Costs: This section refers to projected equipment expenditures, such as computers, a server, a website, a copier, etc.

- Professional Services: Include any anticipated professional services (e.g., legal, payroll, insurance, training, bookkeeping, etc.) in this section.

- Professional Memberships: Use this field to enter employees’ membership costs for any professional organizations, associations, or societies.

- Office Space: Enter any planned occupancy costs (e.g., rent, electricity, water, internet, security, office supplies, etc.) for your organization.

- Telephone/Internet: This template section covers detailed costs for cell phone, landline, and internet service.

- Travel: Use this section to enter any travel-related costs (e.g., lodging, meals, transportation, etc.) as well as any employer-financed transit expenses.

- Sales and Marketing Costs: Include any sales or marketing-related expenses to promote your organization or project.

A budget template helps take the guesswork out of operational costs compared to available resources, so that you are able to justify your anticipated expenditures, whether for a specific project or the organization at large. It’s important to remember to enter one-time costs in a budget proposal. Additional expenditures, such as seasonal costs and promotional events, can also make an impact, so be sure to account for those in your budget. While you may have unique budget proposal items, templates are customizable, and allow you to enter tailored budget line-items to fit your needs.

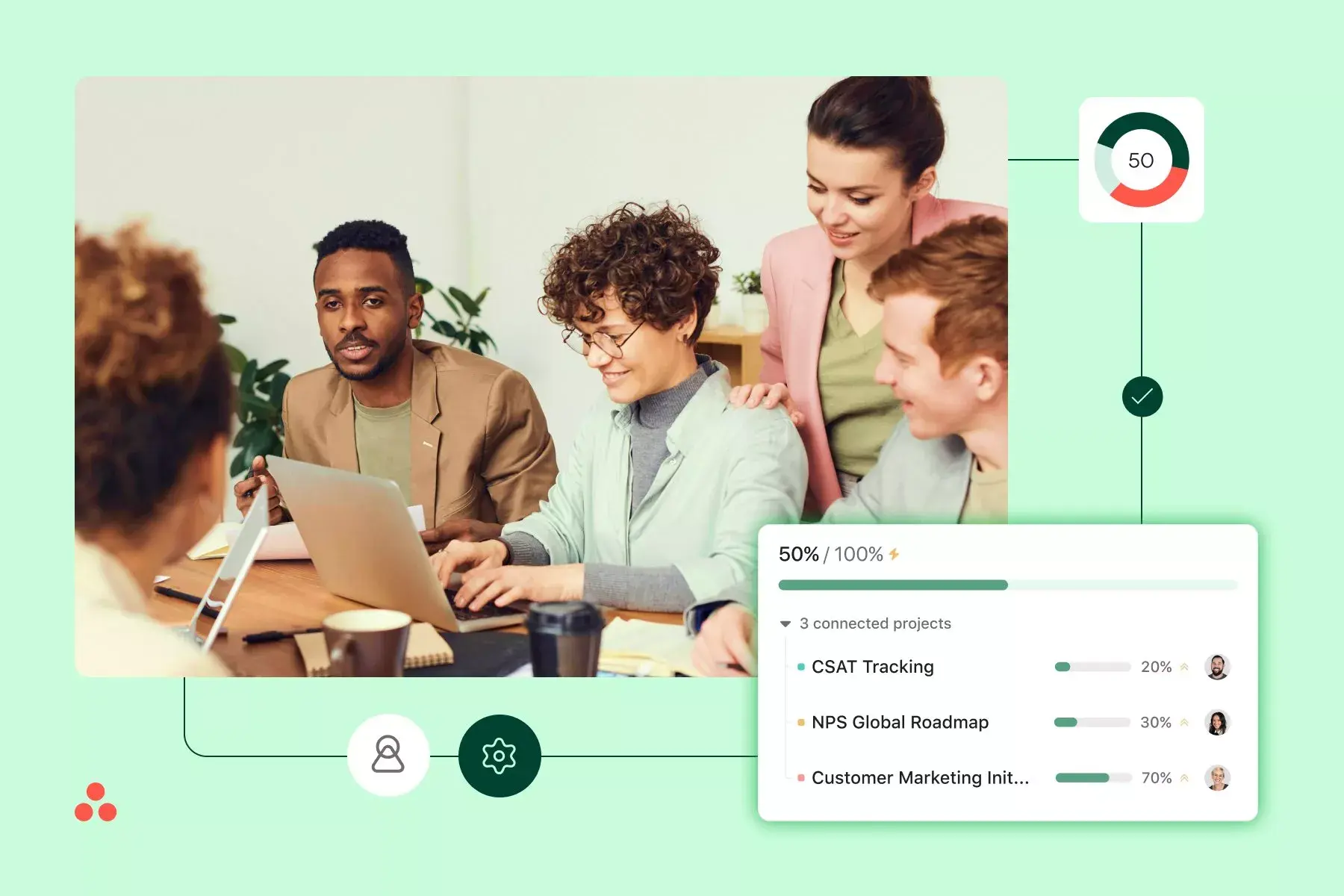

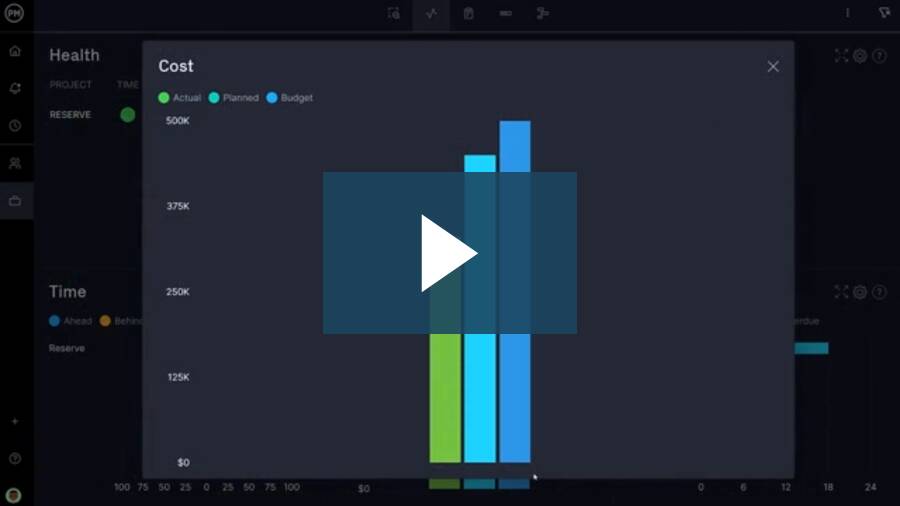

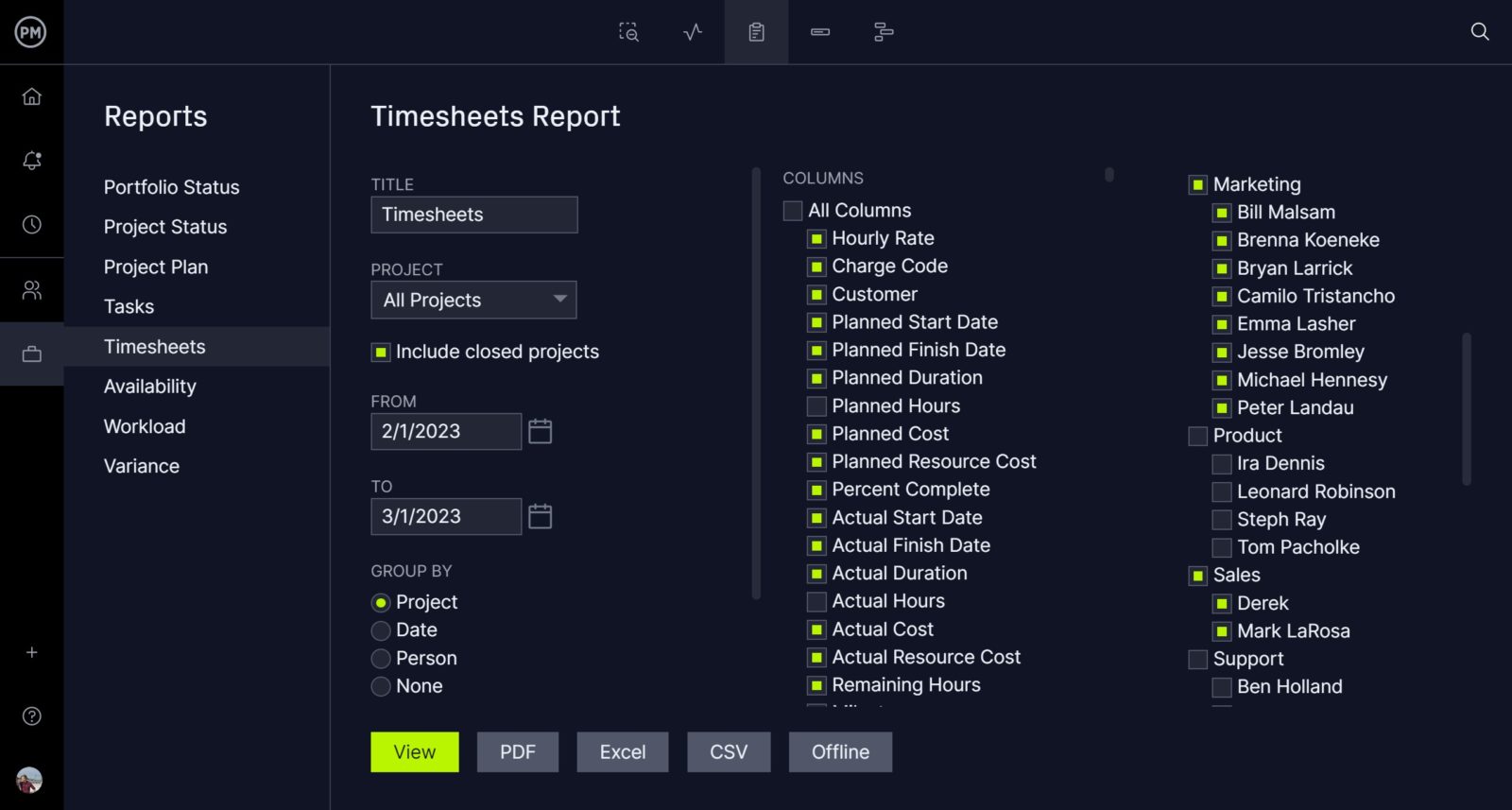

Track and Manage Budget Proposals with Real-Time Work Management in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

.css-s5s6ko{margin-right:42px;color:#F5F4F3;}@media (max-width: 1120px){.css-s5s6ko{margin-right:12px;}} Join us: Learn how to build a trusted AI strategy to support your company's intelligent transformation, featuring Forrester .css-1ixh9fn{display:inline-block;}@media (max-width: 480px){.css-1ixh9fn{display:block;margin-top:12px;}} .css-1uaoevr-heading-6{font-size:14px;line-height:24px;font-weight:500;-webkit-text-decoration:underline;text-decoration:underline;color:#F5F4F3;}.css-1uaoevr-heading-6:hover{color:#F5F4F3;} .css-ora5nu-heading-6{display:-webkit-box;display:-webkit-flex;display:-ms-flexbox;display:flex;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;-webkit-box-pack:start;-ms-flex-pack:start;-webkit-justify-content:flex-start;justify-content:flex-start;color:#0D0E10;-webkit-transition:all 0.3s;transition:all 0.3s;position:relative;font-size:16px;line-height:28px;padding:0;font-size:14px;line-height:24px;font-weight:500;-webkit-text-decoration:underline;text-decoration:underline;color:#F5F4F3;}.css-ora5nu-heading-6:hover{border-bottom:0;color:#CD4848;}.css-ora5nu-heading-6:hover path{fill:#CD4848;}.css-ora5nu-heading-6:hover div{border-color:#CD4848;}.css-ora5nu-heading-6:hover div:before{border-left-color:#CD4848;}.css-ora5nu-heading-6:active{border-bottom:0;background-color:#EBE8E8;color:#0D0E10;}.css-ora5nu-heading-6:active path{fill:#0D0E10;}.css-ora5nu-heading-6:active div{border-color:#0D0E10;}.css-ora5nu-heading-6:active div:before{border-left-color:#0D0E10;}.css-ora5nu-heading-6:hover{color:#F5F4F3;} Register now .css-1k6cidy{width:11px;height:11px;margin-left:8px;}.css-1k6cidy path{fill:currentColor;}

- Project planning |

- Budget proposal templates: 5 steps to s ...

Budget proposal templates: 5 steps to secure funding

A budget proposal summarizes the estimated costs for an upcoming project in order to secure funding from project stakeholders. You can also use budget proposals on the company or campaign level. Learn how to create a detailed budget proposal using our free template.

When you have an idea for a new project, you’ll need the right people on board to bring it to life. While your team members can create the deliverables, projects often can’t move forward without funding—which requires approval.

In this article, we’ll cover how to create a detailed budget proposal. A strong project budget proposal can be the deciding factor in whether your project initiative becomes a reality or needs to go back to the drawing board. Then, use our free template to get started.

What is a budget proposal?

A budget proposal summarizes the estimated costs for an upcoming project in order to secure funding from project stakeholders. Your budget proposal breaks down the cost elements associated with your project. This shows stakeholders the benefits and/or drawbacks of getting involved.

The costs you include in your budget proposal will likely fall into four categories:

Direct costs: Direct costs are expenses directly related to the project in question. These can include labor costs, team member hours, software, and the cost of specific project activities.

Indirect costs: Indirect costs don’t relate directly to the project in question. These items may help you run your project, but they may also help run the entire company. Indirect costs are typically expenses like utilities, insurance, IT services, and server fees.

Equipment and materials: The equipment and materials section is actually a sub-category of direct costs because these are physical items you’ll need specifically for the project in question. However, because these items are unique in nature, they get their own section in the budget proposal.

Travel and other expenses: A project may require travel expenses if clients or customers are involved. Other expenses may include training, taxes, and other unexpected or variable fees.

In this article, we cover how to draft a budget proposal for a project. However, you can also use budget proposals at the company or campaign level.

What are the benefits of using a budget proposal?

A budget proposal breaks down the expenses you’ll incur during project execution. A clear budget proposal can help your team and others involved in the following ways:

Creates financial transparency: A budget proposal offers transparency by making finances an open topic of conversation as soon as you develop a project idea. Project transparency increases team productivity because it shows team members how their work connects to the larger picture. In a similar fashion, seeing the project budget connects stakeholders to the internal work process.

Shows project value and impact: Budget proposals are a great way to give your stakeholders an idea of how the project will provide value for your organization and to the outside world. By showing what you’re spending money on—and why spending money on a particular project or initiative matters—you’re implicitly presenting the validity of your project ideas.

Displays cost efficiency: A budget proposal is a chance for you to do research and choose materials, vendors, or other services that may fit your product and target market. By breaking down the costs in each area, you can prove the cost efficiency of your project.

Helps forecast profits: If your project involves the creation of a product or service, a budget proposal can help you share your sales forecast . You’ll need to know what you plan to spend on a project so you can determine your net earnings.

Provides opportunity for comparison: Once the budget proposal is complete, stakeholders can compare it to current and past projects to decide whether to move forward.

![business budget proposal sample [inline illustration] benefits of using budget proposals (infographic)](https://assets.asana.biz/transform/724f9293-cb49-4438-8afc-b6c93537ab79/inline-project-planning-budget-proposal-template-3-2x-2?io=transform:fill,width:2560&format=webp)

While the purpose of a budget proposal is to receive funding or approval, you can also use your budget proposal as a budget plan for when the project becomes reality.

How to create a budget proposal template

Your budget proposal template is informative for stakeholders who may fund the project, but it’s also helpful for your internal team. When you get to the project planning stage, you can use your budget proposal for things like team utilization rate and resource allocation .

![business budget proposal sample [inline illustration] 5 steps for writing a project budget proposal (infographic)](https://assets.asana.biz/transform/80f928c9-4b66-4f49-aeae-8ff77fe40367/inline-project-planning-budget-proposal-template-1-2x?io=transform:fill,width:2560&format=webp)

1. Describe your project objectives

To introduce your project budget proposal, start with an overview of your project objectives . By explaining what your project is about and the goals you hope to achieve, you can provide context for your budget proposal. Without context, your potential stakeholders may have trouble understanding what—and why—you plan to spend in certain areas.

You may include a budget proposal within a larger project plan , but budget proposals can also stand alone. If a stakeholder solely has a financial stake in your project, then they may not want to read about detailed project timelines and workflows . However, they’ll need to understand the high-level purpose of the project to feel comfortable approving your project budget.

2. Summarize cost elements

After you briefly explain your project objectives, include a summary of cost elements. Your cost elements may include direct and indirect costs, equipment and materials, travel costs, and miscellaneous expenses.

This section is essentially a table of contents and lists the various types of costs you’ll break down. Every budget proposal should include a list of cost elements so stakeholders can preview the information they’re about to read.

Depending on the project type and industry you’re in, your cost elements can sway from the traditional categories. For example, SaaS companies may not need much in the way of physical equipment or materials, but they often spend money on things like online services, subscriptions, freelancers, and software. Alternatively, manufacturing companies often invest heavily in machinery and other long-term equipment. Summarize your cost elements based on your largest expense categories.

3. Break down costs

Once you’ve listed your cost elements at the category level, it’s time to break down your costs one by one. This is your chance to dig deeper into the details and give your stakeholder a clear picture of where you plan to spend it, and why these expenses are necessary.

For both direct and indirect costs, list the following details when breaking down your costs:

Cost type: List the type of cost included in each category. Cost types may include team wages, utilities, server fees, or specific project costs.

Amount: Explain what the expense costs at its most basic level. For example, you may have a team member working for $25 per hour. If you have team members with different hourly rates, put them on separate lines.

Hours: If any of your expenses occur hourly, list the number of hours associated with that cost. This may include the number of hours a team member will work on your project. This number could be anywhere from 40 hours to 1200 hours if you have multiple team members working on a project for an extended period.

Cost explanation: Provide additional detail for the cost in this section. For example, you can explain that you’ll have four team members working on the project—all paid at $25 per hour. Each team member will work 25 hours per week for 12 weeks, resulting in 1200 hours of work.

Total cost: Calculate the total cost of each expense across the entire project. For example, it will cost you $30,000 to pay all four team members for 1200 hours of work.

Equipment, travel, and miscellaneous expenses aren’t that different from your direct and indirect costs. But because these are more likely to be physical items, you can add areas for quantity and unit price versus hours. Explain each cost within your cost breakdown and provide singular and total costs for each item. This should give stakeholders a clear idea of your project budget .

4. Provide a cost summary

This section is a quick and simple look at all your expenses. Stakeholders need an itemized list of what you plan to spend money on, but they’ll also want a section of your budget proposal that clarifies total costs.

Some may also want to scan through the document and pull these numbers out quickly. This section makes your total budget clear for each cost element, as well as the total budget in its entirety.

5. Submit for approval

Once you’re confident in the budget items you’ve listed, it’s time to submit your budget proposal for approval. Add a signature area to the bottom of your document so stakeholders can sign off on the document once they’ve approved it.

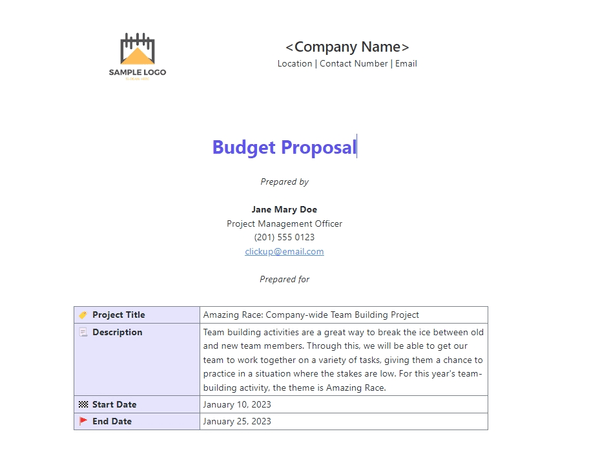

Budget proposal template and example

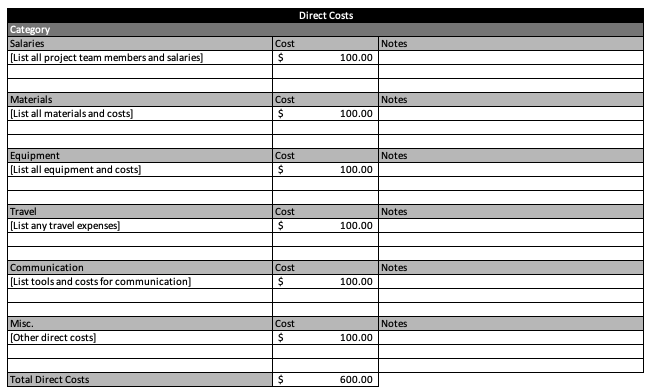

In the budget proposal sample below, you’ll see how two team members organize expected project costs for an upcoming social media campaign.

This budget proposal lists direct and indirect costs associated with the campaign, including things like team wages and utilities.

![business budget proposal sample [inline illustration] budget proposal (example)](https://assets.asana.biz/transform/753249f4-e268-4c66-ab7f-a2f5abdfa0ff/inline-project-planning-budget-proposal-template-2-2x?io=transform:fill,width:2560&format=webp)

This is only a preview of what their budget proposal may look like in its entirety. To create your own budget proposal, download a free template below.

Track and share your financial goals with Asana

A budget proposal is a great way to plan for an upcoming project. But to go further, you’ll need the right tools at your disposal. With work management software , you can create financial goals for projects and larger initiatives, and track them from initiation to completion.

As your projects expand and change, you can adjust your budget and share your data with others. Whether you’re managing expenses or running meetings, you can do it all with Asana .

Related resources

Unmanaged business goals don’t work. Here’s what does.

How Asana uses work management to drive product development

How Asana uses work management to streamline project intake processes

How Asana uses work management for smoother creative production

The Best Free Business Budget Templates

Published: October 12, 2023

Business budgets are a source of truth for your income and expenses. That includes all the money you spend — from A/B testing your marketing campaigns to your monthly office rent.

While organizing the numbers may sound difficult, using a business budget template makes the process simple. Plus, there are thousands of business budget templates for you to choose from.

We’ll share seven budget templates that can help organize your finances. But first, you’ll learn about different types of business budgets and how to create one.

What is a Business Budget?

A business budget is a spending plan that estimates the revenue and expenses of a business for a period of time, typically monthly, quarterly, or yearly.

The business budget follows a set template, which you can fill in with estimated revenues, plus any recurring or expected business expenses.

For example, say your business is planning a website redesign. You'd need to break down the costs by category: software, content and design, testing, and more.

Having a clear breakdown will help you estimate how much each category will cost and compare it with the actual costs.

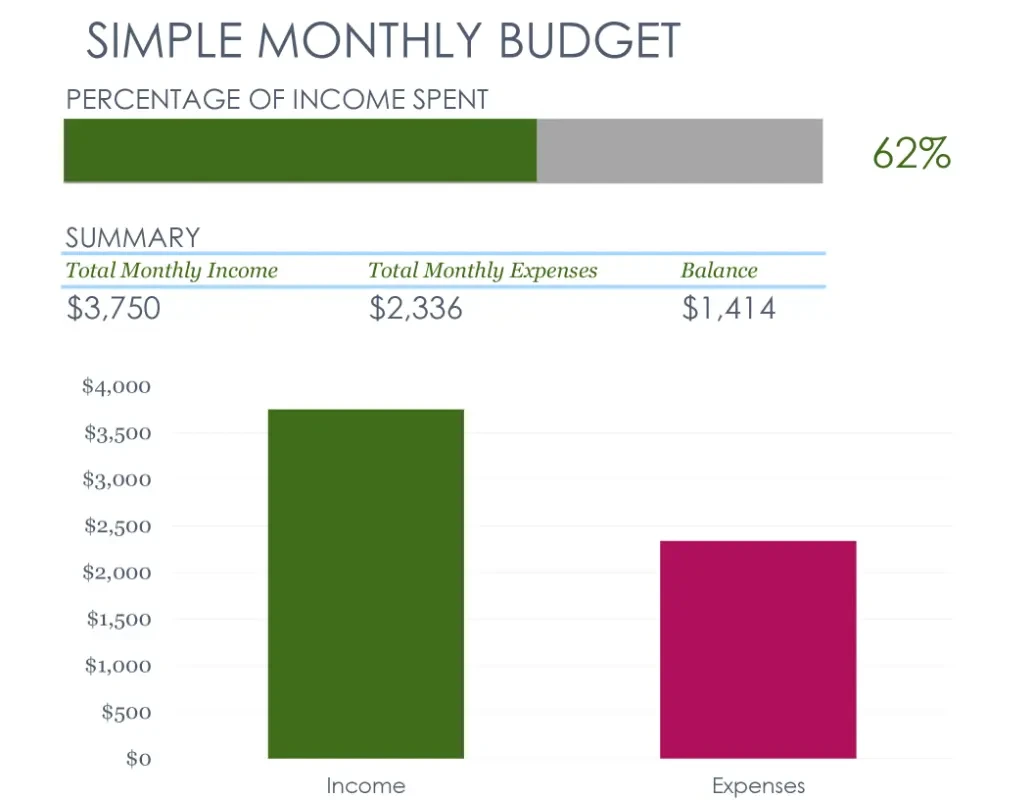

Image Source

Types of Budgets for a Business

Master budget, operating budget, cash budget, static budget, departmental budget, capital budget, labor budget, project budget.

Business budgets aren’t one size fits all. In fact, there are many different types of budgets that serve various purposes. Let’s dive into some commonly used budgets:

Think of a master budget as the superhero of budgets — it brings together all the individual budgets from different parts of your company into one big, consolidated plan. It covers everything from sales and production to marketing and finances.

It includes details like projected revenues, expenses, and profitability for each department or business unit. It also considers important financial aspects like cash flow, capital expenditures, and even creates a budgeted balance sheet to show the organization's financial position.

The master budget acts as a guide for decision-making, helps with strategic planning, and gives a clear picture of the overall financial health and performance of your company. It's like the master plan that ties everything together and helps the organization move in the right direction.

Your operating budget helps your company figure out how much money it expects to make and spend during a specific period, usually a year. It not only predicts the revenue your business will bring in, but also outlines expenses it will need to cover, like salaries, rent, bills, and other operational costs.

By comparing your actual expenses and revenue to the budgeted amounts, your company can see how it's performing and make adjustments if needed. It helps keep things in check, allowing your business to make wise financial decisions and stay on track with its goals.

.png)

Free Business Budget Templates

Manage your business, personal, and program spend on an annual, quarterly, and monthly basis.

- Personal Budget Template

- Annual Budget Template

- Program Budget Template

You're all set!

Click this link to access this resource at any time.

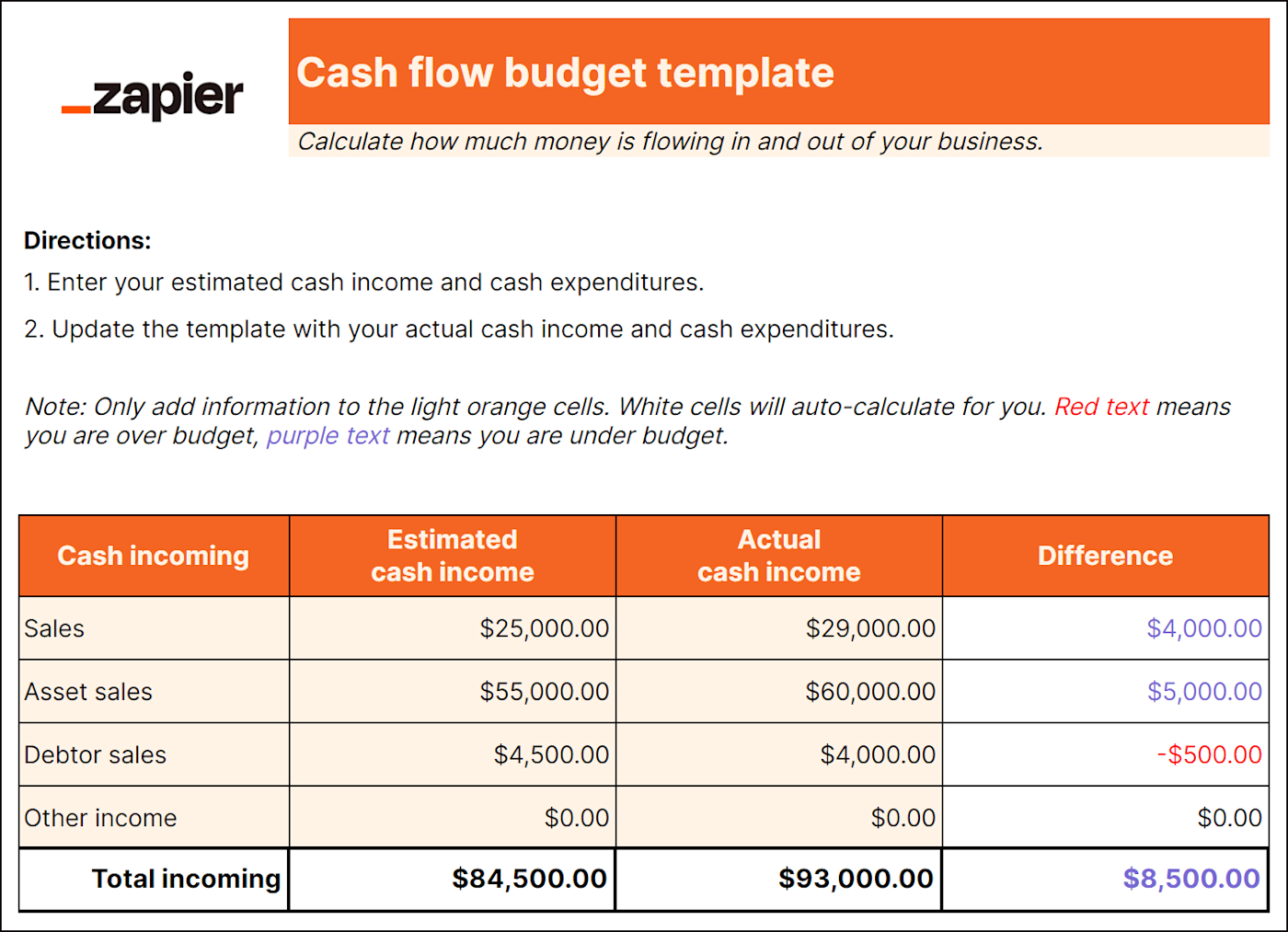

A cash budget estimates the cash inflows and outflows of your business over a specific period, typically a month, quarter, or year. It provides a detailed projection of cash sources and uses, including revenue, expenses, and financing activities.

The cash budget helps you effectively manage your cash flow, plan for cash shortages or surpluses, evaluate the need for external financing, and make informed decisions about resource allocation.

By utilizing a cash budget, your business can ensure it has enough cash on hand to meet its financial obligations, navigate fluctuations, and seize growth opportunities.

A static budget is a financial plan that remains unchanged, regardless of actual sales or production volumes.

It’s typically created at the beginning of a budget period and doesn’t account for any fluctuations or changes in business conditions. It also assumes that all variables, such as sales, expenses, and production levels, will remain the same throughout the budget period.

While a static budget provides a baseline for comparison, it may not be realistic for businesses with fluctuating sales volumes or variable expenses.

A departmental budget focuses on the financial aspects of a specific department within your company, such as sales, marketing or human resources.

When creating a departmental budget, you may look at revenue sources like departmental sales, grants, and other sources of income. On the expense side, you consider costs such as salaries, supplies, equipment, and any other expenses unique to that department.

The goal of a departmental budget is to help the department manage its finances wisely. It acts as a guide for making decisions and allocating resources effectively. By comparing the actual numbers to the budgeted amounts, department heads can see if they're on track or if adjustments need to be made.

A capital budget is all about planning for big investments in the long term. It focuses on deciding where to spend money on things like upgrading equipment, maintaining facilities, developing new products, and hiring new employees.

The budget looks at the costs of buying new stuff, upgrading existing things, and even considers depreciation, which is when something loses value over time. It also considers the return on investment, like how much money these investments might bring in or how they could save costs in the future.

The budget also looks at different ways to finance these investments, whether it's through loans, leases, or other options. It's all about making smart decisions for the future, evaluating cash flow, and choosing investments that will help the company grow and succeed.

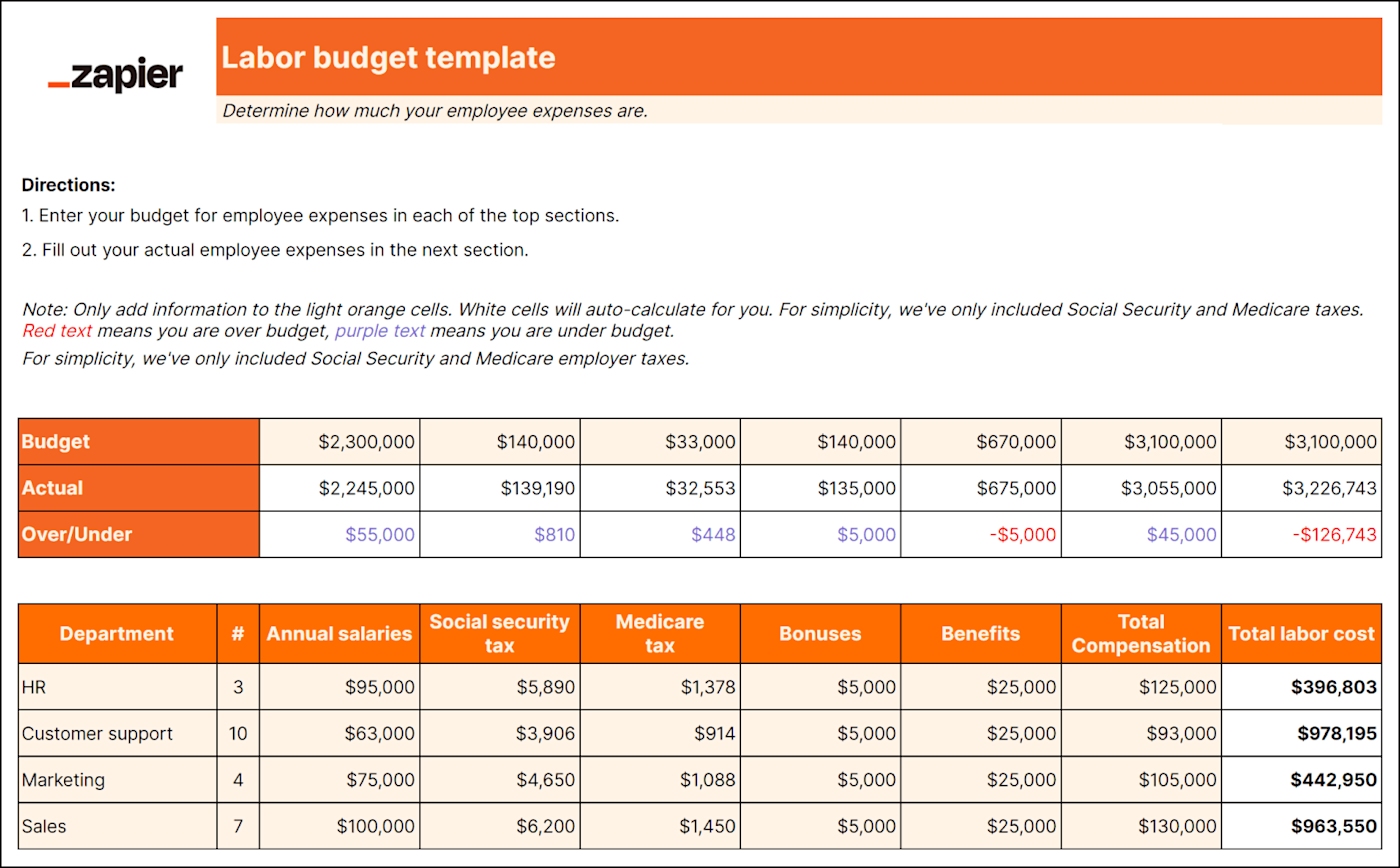

A labor budget helps you plan and manage the costs related to your employees. It involves figuring out how much your business will spend on wages, salaries, benefits, and other labor-related expenses.

To create a labor budget, you'll need to consider factors like how much work needs to be done, how many folks you'll need to get it done, and how much it'll all cost. This can help your business forecast and control labor-related expenses and ensure adequate staffing levels.

By having a labor budget in place, your business can monitor and analyze your labor costs to make informed decisions and optimize your resources effectively.

A project budget is the financial plan for a specific project.

Let's say you have an exciting new project you want to tackle. A project budget helps you figure out how much money you'll need and how it will be allocated. It covers everything from personnel to equipment and materials — basically, anything you'll need to make the project happen.

By creating a project budget, you can make sure the project is doable from a financial standpoint. It helps you keep track of how much you planned to spend versus how much you actually spend as you go along. That way, you have a clear idea of whether you're staying on track or if there are any financial challenges that need attention.

How to Create a Business Budget

While creating a business budget can be straightforward, the process may be more complex for larger companies with multiple revenue streams and expenses.

No matter the size of your business, here are the basic steps to creating a business budget.

1. Gather financial data.

Before you create a business budget, it’s important to gather insights from your past financial data. By looking at things like income statements, expense reports, and sales data, you can spot trends, learn from past experiences, and see where you can make improvements.

Going through your financial history helps you paint a true picture of your income and expenses. So, when you start creating your budget, you can set achievable targets and make sure your estimates match what's actually been happening in your business.

2. Find a template, or make a spreadsheet.

There are many free or paid budget templates online. You can start with an already existing budget template. We list a few helpful templates below.

You may also opt to make a spreadsheet with custom rows and columns based on your business.

3. Fill in revenues.

Once you have your template, start by listing all the sources of your business’ income. With a budget, you’re planning for the future, so you’ll also need to forecast revenue streams based on previous months or years. For a new small business budget, you’ll rely on your market research to estimate early revenue for your company.

When you estimate your revenue , you're essentially figuring out how much money you have to work with. This helps you decide where to allocate your resources and which expenses you can fund.

4. Subtract fixed costs for the time period.

Fixed costs are the recurring costs you have during each month, quarter, or year. Examples include insurance, rent for office space, website hosting, and internet.

The key thing to remember about fixed costs is that they stay relatively stable, regardless of changes in business activity. Even if your sales decrease or production slows down, these costs remain the same.

However, it's important to note that fixed costs can still change over the long term, such as when renegotiating lease agreements or adjusting employee salaries.

5. Consider variable costs.

Variable costs will change from time to time. Unlike fixed costs, variable costs increase or decrease as the level of production or sales changes.

Examples include raw materials needed to manufacture your products, packaging and shipping costs, utility bills, advertising costs, office supplies, and new software or technology.

You may always need to pay some variable costs, like utility bills. However, you can shift how much you spend toward other expenses, like advertising costs, when you have a lower-than-average estimated income.

6. Set aside time for business budget planning.

Unexpected expenses might come up, or you might want to save to expand your business. Either way, review your budget after including all expenses, fixed costs, and variable costs. Once completed, you can determine how much money you can save. It’s wise to create multiple savings accounts. One should be used for emergencies. The other holds money that can be spent on the business to drive growth.

Fill out the form to get the free templates.

How to manage a business budget.

There are a few key components to managing a healthy business budget.

Budget Preparation

The process all starts with properly preparing and planning the budget at the beginning of each month, quarter, or year. You can also create multiple budgets, some short-term and some long-term. During this stage, you will also set spending limits and create a system to regularly monitor the budget.

Budget Monitoring

In larger businesses, you might delegate budget tracking to multiple supervisors. But even if you’re a one-person show, keep a close eye on your budget. That means setting a time in your schedule each day or week to review the budget and track actual income and expenses. Be sure to compare the actual numbers to the estimates.

Budget Forecasting

With regular budget tracking, you always know how your business is doing. Check in regularly to determine how you are doing in terms of revenue and where you have losses. Find where you can minimize expenses and how you can move more money into savings.

Why is a Budget Important for a Business?

A budget is crucial for businesses. Without one, you could easily be drowning in expenses or unexpected costs.

The business budget helps with several operations. You can use a business budget to keep track of your finances, save money to help you grow the business or pay bonuses in the future, and prepare for unexpected expenses or emergencies.

You can also review your budget to determine when to take the next leap for your business. For example, you might be dreaming of a larger office building or the latest software, but you want to make sure you have a healthy net revenue before you make the purchase.

Best Free Business Budget Templates

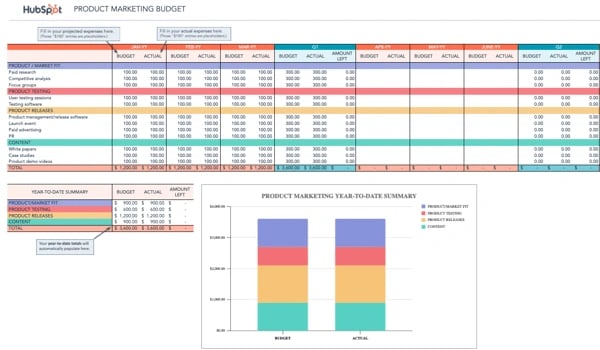

1. marketing budget template.

Knowing how to manage a marketing budget can be a challenge, but with helpful free templates like this marketing budget template bundle , you can track everything from advertising expenses to events and more.

This free bundle includes eight different templates, so you can create multiple budgets to help you determine how much money to put toward marketing, plus the return on your investment.

2. Small Business Budget Template

For small businesses, it can be hard to find the time to draw up a budget, but it’s crucial to help keep the business in good health.

Capterra offers a budget template specifically for small businesses. Plus, this template works with Excel. Start by inputting projections for the year. Then, the spreadsheet will project the month-to-month budget. You can input your actual revenue and expenses to compare, making profits and losses easy to spot.

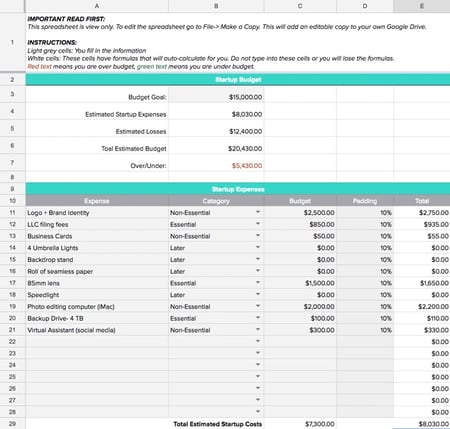

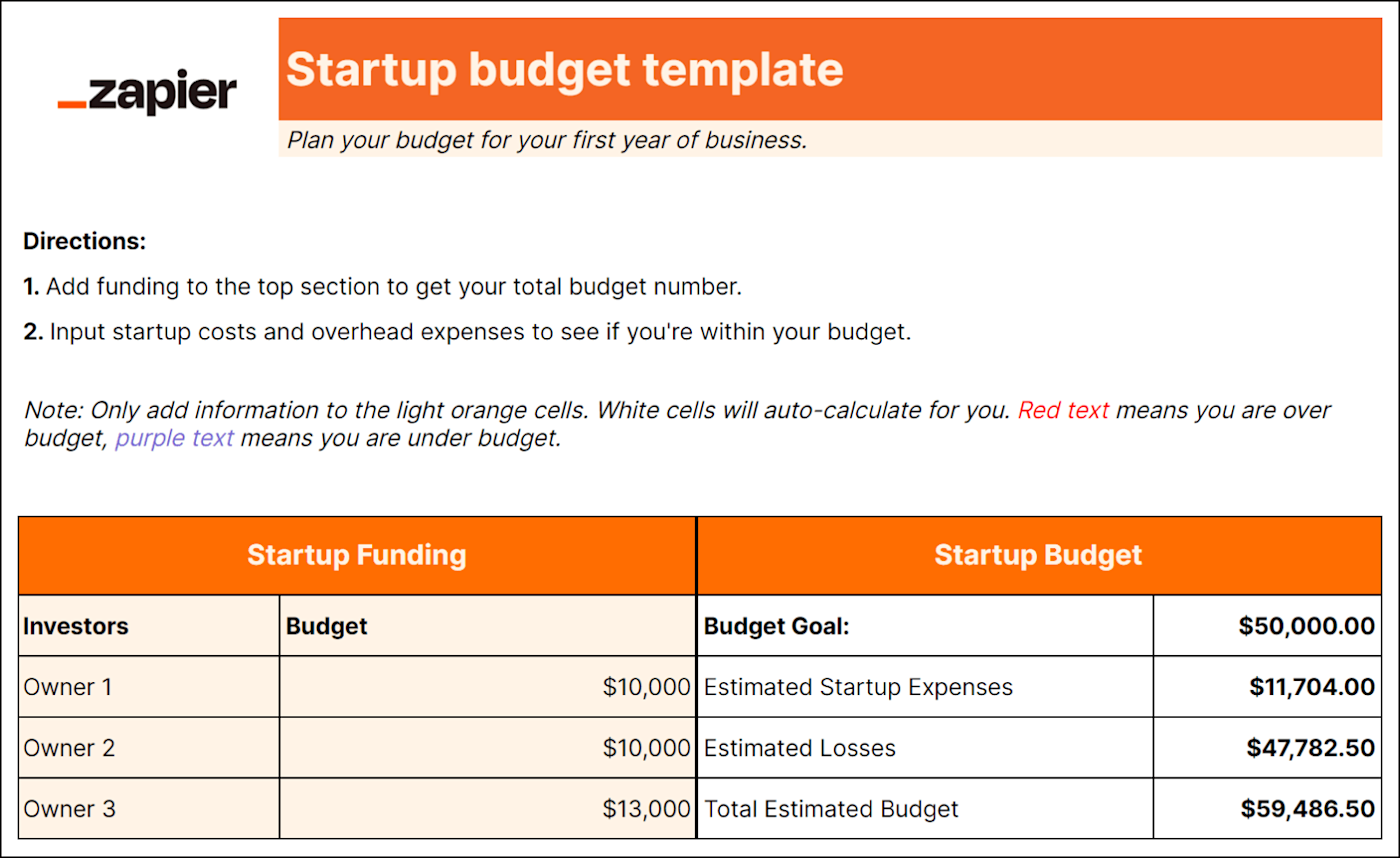

3. Startup Budget Template

What if you don’t have any previous numbers to rely on to create profit and expense estimates? If you are a startup, this Gusto budget template will help you draw up a budget before your business is officially in the market. This will help you track all the expenses you need to get your business up and running, estimate your first revenues, and determine where to pinch pennies.

4. Free Business Budget Template

You might be familiar with Intuit. Many companies, big and small, rely on Intuit’s services like Quickbooks and TurboTax. Even if you don’t use the company’s paid financial services, you can take advantage of Intuit’s free budget template , which works in Google Sheets or Excel.

It features multiple spreadsheet tabs and simple instructions. You enter your revenue in one specific tab and expenses in another. You can also add additional tabs as needed. Then, like magic, the spreadsheet uses the data in the income and expense tabs to summarize the information. This template can even determine net savings and the ending balance.

5. Department Budget Sheet

A mid- to large-size company will have multiple departments, all with different budgetary needs. These budgets will all be consolidated into a massive, company-wide budget sheet. Having a specific template for each department can help teams keep track of spending and plan for growth.

This free template from Template.net works in either document or spreadsheet formats. This budget template can help different departments keep track of their income and spending.

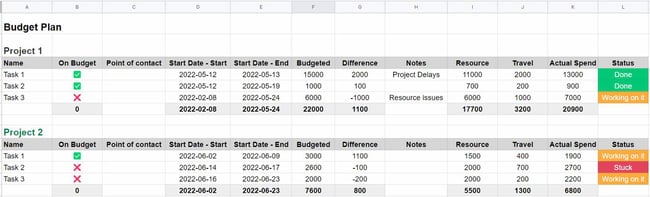

6. Project Budget Template

Every new project comes with expenses. This free budget template from Monday will help your team estimate costs before undertaking a project. You can easily spot if you're going over budget midway through a project so you can adjust.

This template is especially useful for small companies that are reporting budgets to clients and for in-house teams getting buy-in for complex projects.

7. Company Budget Template

Want to keep track of every penny? Use this template from TemplateLab to draw up a detailed budget. The list of expenses includes fixed costs, employee costs, and variable costs. This business template can be especially useful for small businesses that want to keep track of expenses in one, comprehensive document.

Create a Business Budget to Help Your Company Grow

Making your first business budget can be daunting, especially if you have several revenue streams and expenses. Using a budget template can make getting started easy. And, once you get it set up, these templates are simple to replicate.

With little planning and regular monitoring, you can plan for the future of your business.

Editor's note: This post was originally published in September 2021 and has been updated for comprehensiveness.

Don't forget to share this post!

Related articles.

![business budget proposal sample Marketing Budget: How Much Should Your Team Spend in 2024? [By Industry]](https://blog.hubspot.com/hubfs/how%20to%20spend%20your%20marketing%20budget_featured.webp)

Marketing Budget: How Much Should Your Team Spend in 2024? [By Industry]

![business budget proposal sample How Marketing Leaders are Navigating Recession [New Data]](https://blog.hubspot.com/hubfs/how%20marketing%20leaders%20are%20navigating%20recession.webp)

How Marketing Leaders are Navigating Recession [New Data]

![business budget proposal sample 3 Ways Marketers are Already Navigating Potential Recession [Data]](https://blog.hubspot.com/hubfs/how-marketers-are-navigating-recession.jpg)

3 Ways Marketers are Already Navigating Potential Recession [Data]

![business budget proposal sample Marketing Without a Budget? Use These 10 Tactics [Expert Tips]](https://blog.hubspot.com/hubfs/marketing%20without%20budget.jpg)

Marketing Without a Budget? Use These 10 Tactics [Expert Tips]

24 Ways to Spend Your Marketing Budget Next Quarter

Startup Marketing Budget: How to Write an Incredible Budget for 2023

![business budget proposal sample How to Manage Your Entire Marketing Budget [Free Budget Planner Templates]](https://blog.hubspot.com/hubfs/free-marketing-budget-templates_5.webp)

How to Manage Your Entire Marketing Budget [Free Budget Planner Templates]

10 Best Free Project Management Budget Templates for Marketers

What Marketing Leaders Are Investing in This Year

The Best Free Business Budget Worksheets

6 templates to manage your business, personal, and program spend on an annual, quarterly, and monthly basis.

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Free Small-Business Budget Templates

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

A business budget template is one of the most important tools you can use to run your small business. However, many small-business owners skip this vital business management step.

The misconceptions surrounding budgeting are plenty. It seems complicated and time-consuming. But with a good business budget template, the process can be much less daunting.

An effective small-business budget template is a living document. Creating a budget and then forgetting about it is wasted effort. You must compare your actual numbers against your budgeted numbers regularly.

Therefore, your budget should be easy to access and adjust on an ongoing basis. But you don’t have to spend a lot of money on business budgeting software , if you don't want to. There are several free small-business budget templates available online.

QuickBooks Online

Why you need a business budget template

A business budget template is an essential tool for business owners who want to take care of their bottom line. Why should you invest in a smart template from the start?

Here's how a business budget template can set you up for success:

Track cash flow, expenses and revenue.

Prepare for regular business slowdowns.

Allocate your budget to the portions of your business that need capital most.

Plan for business investments and purchases.

Project all costs to starting and running your business.

Generally speaking, your business budget template can act as a business health scorecard if you invest in setting one up properly. Here's our list of the best budget templates available so you can do just that.

Capterra’s Free Small-Business Budget Template

The Capterra small-business budget template has been a fan favorite since it was published in 2015. In this one simple Excel workbook, you can create your monthly budget, your annual budget and then compare your actual numbers to your budgeted numbers. It also has a convenient overview sheet, which gives users access to their performance at a glance.

To help you through the process, Capterra has included a detailed Instructions tab, which walks you through how to use the template step by step. Start here to save yourself hours of time and frustration. As a bonus, there are several resources linked on the Instructions tab to help you create the perfect budget for your small business.

PDFConverter.com 15 Best Budgets

Rather than one bloated Excel workbook that tries to do everything, PDFConverter.com has compiled a library of 15 small-business budget templates.

These templates cover a wide range of budgeting needs, from a basic overview of your business income and expenses to marketing budget templates. The startup budget template is ideal for newbie entrepreneurs still in the planning stage of their businesses. And the cash flow template is perfect for identifying and plugging cash flow leaks.

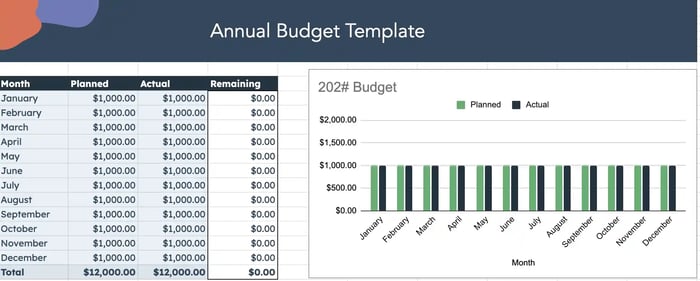

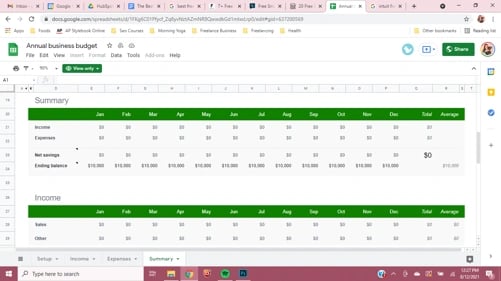

Annual Business Budget in Google Sheets

Do you love all things Google? You can create a comprehensive budget for your small business right from Google Sheets. Simply navigate to your Sheets and then click on Template Gallery . Our friends at Intuit QuickBooks have created an annual business budget you can use for free.

To fully appreciate the power of the template, review the Summary tab after you have entered your budget figures. The tables and graphs on this tab offer a visual representation of your income and expenses, making it easy to see where you stand at a glance.

Microsoft Office Template

This beautiful template from Microsoft Office focuses exclusively on expenses, but it does that job exceptionally well. There are tabs for planned and actual expenses, a tab for automatically calculated variances between the two and an expense analysis tab complete with pie charts.

Your accounting software

While not a free template per se, you likely have a powerful budgeting tool available right inside your business accounting software . Though not as flexible as a separate template, there are many advantages to using the budgeting feature of your accounting software.

The budgeting feature in your accounting software will coincide with your chart of accounts. Depending on the software you use, you can create a budget to actual comparison reports with the click of a button, making analysis a cinch.

Some software programs even let you set multiple budget scenarios and have “cloning” features, which simplify the budgeting process after the first year.

Designing your budget

Now that you’ve chosen your business budget template, it’s time to start designing your budget. This is where many small-business owners procrastinate because people typically see budgeting as restrictive or punishing.

It's time to shift your perspective on budgeting. Most people start with income and tinker with their expense amounts until they arrive at a balanced or surplus budget. This method usually leads to unrealistic projections and ends in frustration.

Instead of a top-down approach, consider “reverse engineering” your budget by following these four simple steps:

Form your income projections and write those down outside of your budget template. Put this paper or spreadsheet away until after you have completed the next step.

Enter your expenses into your budget template. Be very honest in your entries and include everything. Going through several months’ or even a year’s worth of accounting data or bank and credit card statements will ensure you capture all your spending. This is not the step where you want to try to eliminate expenses. Record everything, only excluding expenses you have already eliminated from your monthly or annual spending.

Enter your income from the projections you formed in step 1.

Review your budget. If your budget shows a projected loss, analyze your expenses and identify areas where you can reduce spending.

This approach makes sure you avoid the temptation of forcing your budget to balance. While you do want your budget to balance — or better, to show a cash surplus — having unrealistic income or expense numbers will lead to frustration and resistance during the budgeting process.

Monthly or quarterly, compare your actual income and expense numbers to your budgeted numbers. Regular tracking helps identify financial pitfalls before they become unmanageable.

Frequently asked questions

How do i make a budget template.

You can create a small-business budget template from scratch by using free software like Microsoft Excel or Google Sheets. However, it’s often more efficient to download a template (see our list above). A template with built-in tables and formulas makes plugging in your revenue and expenses and calculating your profit or loss quick and straightforward.

What is included in a small-business budget?

Your small-business budget will include your revenue, expenses and your profit or loss. Each section will be broken into subcategories. For example, under revenue, you might have sales and income from sponsorships. Expenses might be broken down into rent, employee salaries and marketing. After you tally your revenue and expenses, you can then calculate your profit and loss statement.

How much should a small-business budget be?

A budget will vary by your business and industry. For example, you can potentially start a social media consulting business for less than $5,000. But a food truck business may necessitate a budget of at least $50,000. You must tailor your small-business budget to your unique needs.

On a similar note...

Filter by Keywords

10 Free Budget Proposal Templates in Excel and ClickUp

Praburam Srinivasan

Growth Marketing Manager

February 13, 2024

When you’re looking for a budget proposal template to request money from stakeholders, investors, donors, or internal funding sources, a good template helps you get it right the first time.

We’ve got everything you need to know about choosing the right template here in our review of 10 free budget proposal templates. Check out our recommendations below!

What Is a Budget Proposal Template?

What makes a good budget proposal template, 1. clickup budget proposal template, 2. clickup simple budget template, 3. clickup event budget template, 4. clickup personal budget template, 5. clickup business budget template, 6. clickup budget report template, 7. clickup film budget template, 8. excel simple monthly budget template by microsoft, 9. sheets personal monthly budget template by vertex42, 10. monthly business budget template by vertex42.

A budget proposal template is a pre-designed document that helps you create a strategic presentation to request funding or approval for project development or businesses. These presentations detail the estimated costs, revenue projections, and resources required.

A detailed budget proposal template provides stakeholders, investors, or decision-makers with a comprehensive view of a project’s financial feasibility.

Used effectively, budget proposals help secure the necessary funding and facilitate efficient resource allocation.

Good budget proposals should be organized, easy to customize, and allow for reviews and revisions. Real-time updates and collaboration features are also helpful, especially when working with teams.

Here are some key qualities to look for in a budget proposal template:

- Clarity: The budget proposal template should be set up in a way that allows readers to easily understand the project’s goals, scope, budget, and direct costs (or indirect costs)

- Easy to customize: Choose a template that can be customized for your industry and the type of financial information you need to document

- Comprehensive: Don’t cut corners when it comes to presenting the information that matters. Look for a template that can cover all of the important details of a particular project, including indirect and direct costs for your budget proposal sample

- Revision and review: A good budget proposal template should allow for regular revisions and reviews to accommodate changes in circumstances or objectives

- Free or low-cost: Why pay for a budget proposal template when there are so many high-quality ones available?

By incorporating these elements, your budget proposal template becomes a valuable tool for presenting a well-structured and compelling financial plan.

10 Budget Proposal Template Templates to Use in 2024

Creating a budget proposal is much easier with the right business templates. Here are ten free budget proposal templates to get you started!

The awesome Budget Proposal Template by ClickUp is the ultimate tool to help you secure funding for future projects while impressing stakeholders and potential investors.

With this template, you’ll find everything neatly laid out. First up, the “Personnel Summary” page covers all manpower-related expenses, making sure everyone gets their fair share.

Next, the “Materials and Equipment” page takes care of those necessary project plan materials and equipment that keep things running smoothly.

Of course, we can’t forget about “Logistics!” It handles all the transportation expenses, so everything can get where it needs to go, so you know all the direct and indirect costs associated.

The “Event” page tracks all the expenses that pop up during the actual execution of an event!

Last but not least, we have the “Summary” page. This is where all the magic comes together, with a budget breakdown presented in a sleek pie chart. Plus, you’ll find “Terms and Conditions” and “Signatories” for that final approval!

With ClickUp’s free Budget Proposal Template, pitches, and proposed budgets have never been easier. Get ready to make your stakeholders, investors, donors, and decision-makers smile! 😄

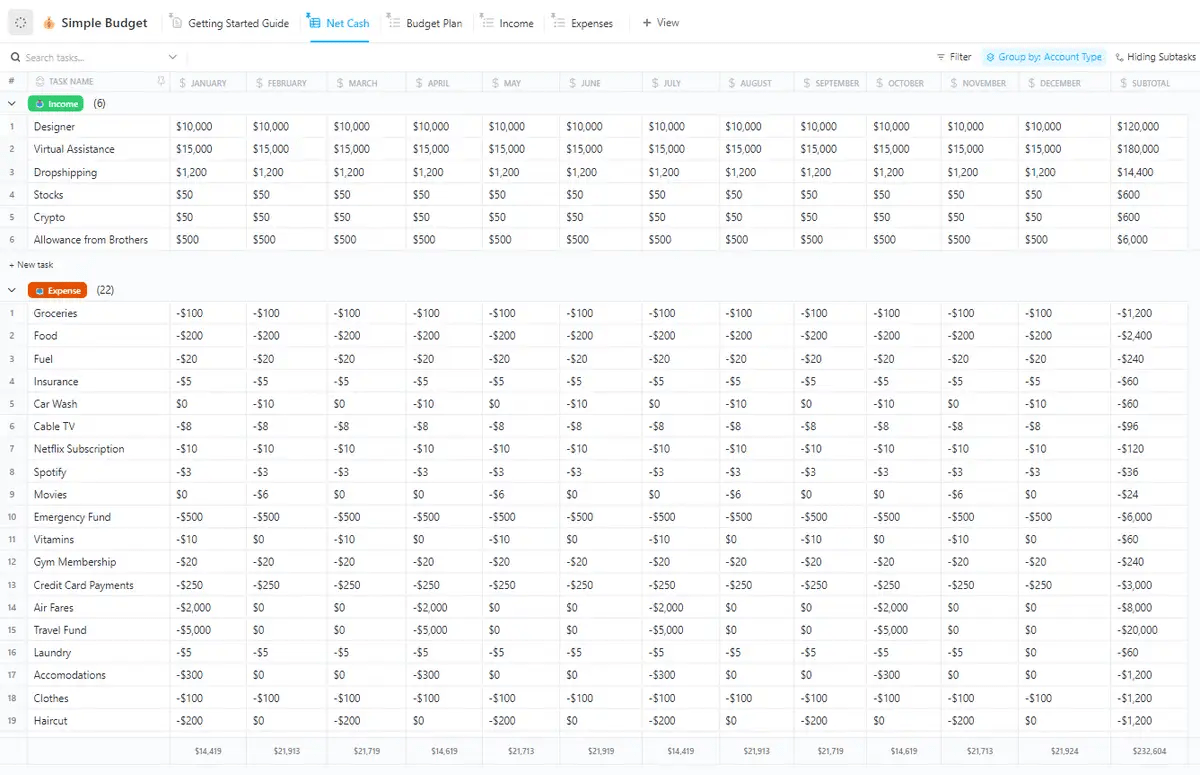

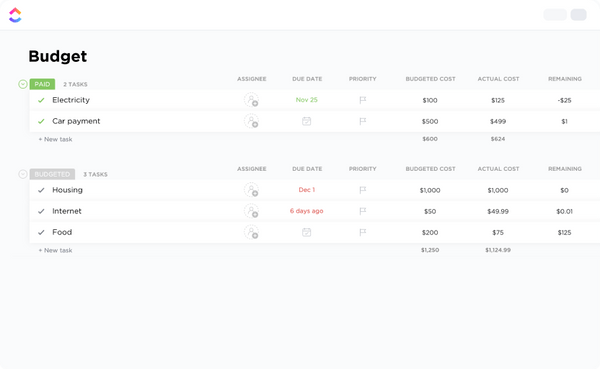

Record and share basic income and expenses with ClickUp’s Simple Budget Template , a free template to help you manage a simple budget.

The template includes views and custom fields to help you estimate your income and expenses monthly and annually.

The Simple Budget Template can be used for a proposal letter in many ways:

- Expense management : Record the estimated expenses of your project costs or business proposal, itemize expenses, and keep your budget plan organized

- Revenue projection : Forecast the potential income for pitching your proposal to potential investors or stakeholders

- Collaboration : Multiple users can update and monitor the budget in real time, or learn how to delegate using collaboration tools

- Status updates : Track the status of tasks, allowing you to monitor progress and ensure you’re staying within budget, and set up notifications to update team members on changes

- Customizability : The highly customizable template lets you tailor income and expenses around the requirements of your business proposal, adding or removing sections as necessary

To use it, you would simply input your data into the relevant fields in the template. It’s also easy to share with other stakeholders for transparency and collaboration.

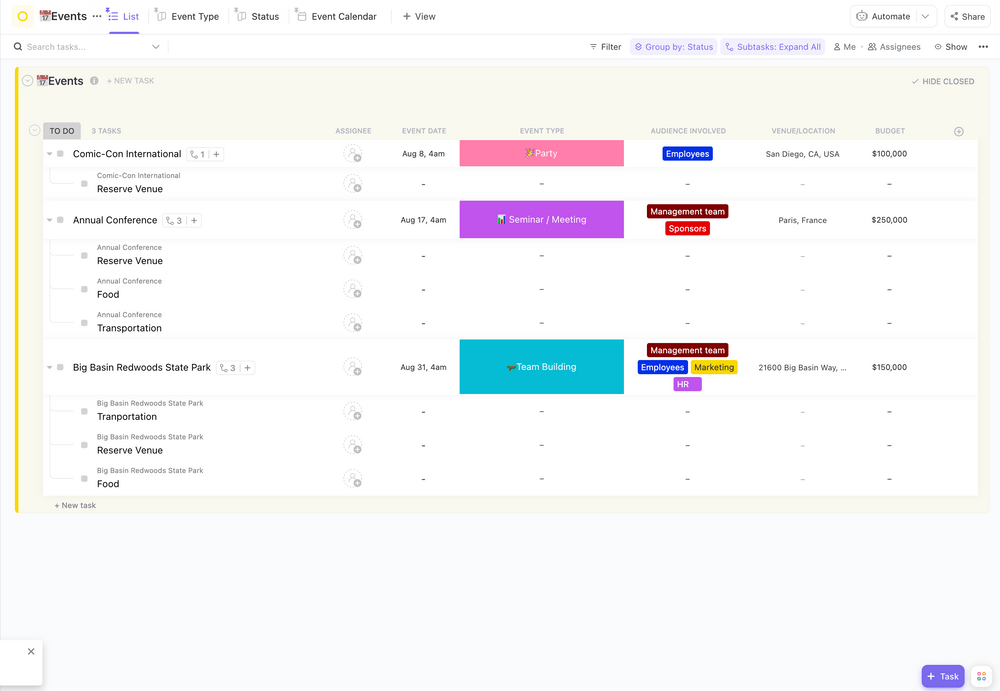

The Event Budget Template by ClickUp is a powerful tool designed to streamline and simplify your event planning and budgeting process. Whether you’re organizing a small gathering or a large-scale event, this template has got you covered! 🎉

With the Event Budget Template, you can easily record all your event-related expenses, ensuring that nothing falls through the cracks. It allows you to estimate and allocate costs for various aspects of your event, including total costs such as venue, catering, decorations, marketing, entertainment, and more.

The highly-customizable template helps you create detailed and convincing proposals. You can present a clear picture of event costs, income, and overall feasibility to potential investors or stakeholders, increasing your chances of securing approval or funding.

Want to take charge of your personal bank account? With ClickUp’s Personal Budget Template , you’ll master the art of money management effortlessly!

Discover the power of a well-planned budget as you prioritize your goals, save for the future, and make better financial decisions. ClickUp’s user-friendly template lets you easily record your income, expenses, and savings, making budgeting a breeze.

Follow our simple steps to create your personalized budget, allocating funds wisely and adjusting as needed. With real-time tracking, you’ll stay on top of your finances like a pro!

Avoid common budgeting pitfalls by setting realistic goals, regularly tracking your spending, and building an emergency fund.

While not specifically designed for business proposals, the ClickUp Personal Budget Template can certainly be adapted for this purpose, especially for smaller businesses or startups where personal and business finances may be closely intertwined.

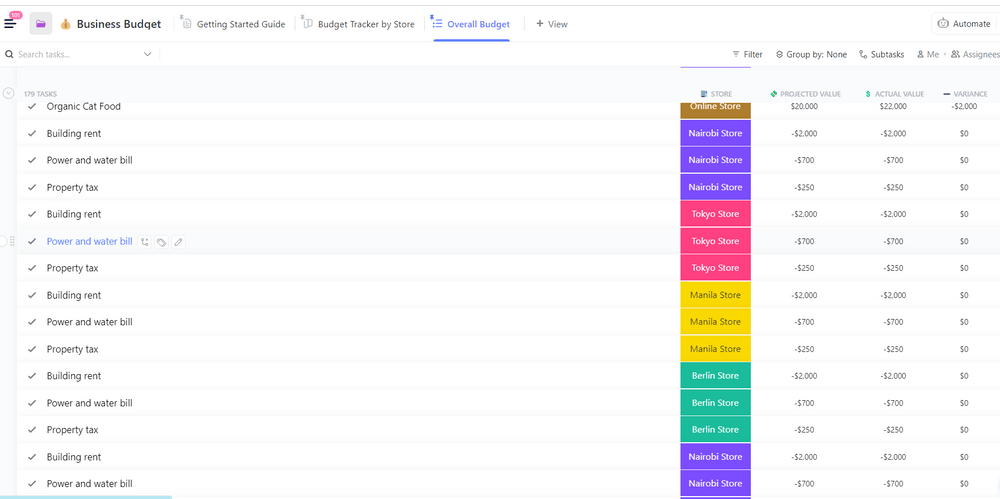

ClickUp’s Business Budget Template is a great tool to help you create more effective pitches, proposals, and funding requests.

The highly-customizable free budget proposal template provides a clear financial overview that clearly presents detailed expenses, anticipated revenue, projections, and projected profits.

The Business Budget Template includes many board views, folders, and lists to help you record key business expenses.

For example, you can track your overall budget with the “Business Budget Folder.” It includes “Overall Budget” and “Budget Tracker by Store” views to help you analyze expenses, identify cost drivers, and maximize profits.

The “Sales List” folder gives you a comprehensive overview of your company’s sales, grouped by product type and store. “Costs of Goods Sold,” helps you efficiently manage direct labor, raw materials, and overhead costs.

And you’ll have no problem keeping your operational expenses and employee salaries in check, thanks to the “Operational Expenses” and “Salaries List” views!

The ClickUp Business Budget Template helps you record business expenses and can be a great free tool to help you prepare for business proposals!

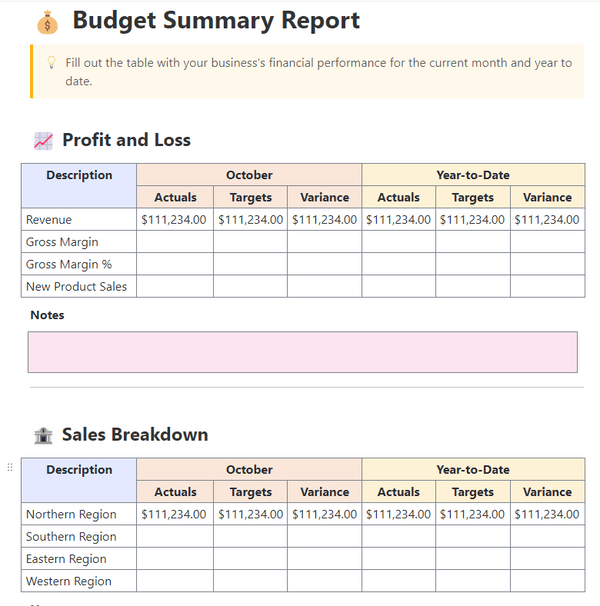

Create clear and concise budget proposals with the Budget Report Template by ClickUp . It includes several premade fields you can use to summarize your proposed budget, such as revenue, expenses, and profit. Additionally, the template allows you to customize fields to fit the specific needs of your proposal.

The budget report template can also help you to track your budget over time so you can demonstrate, to potential clients or partners, that your business is financially sound and that you have a plan for managing your expenses.

Finally, the proposal template can help you automate your budget process, saving you time while ensuring that your budget is always up-to-date.

Potential clients and partners will appreciate the organization and clarity you provide, thanks to the Budget Report Template by ClickUp.

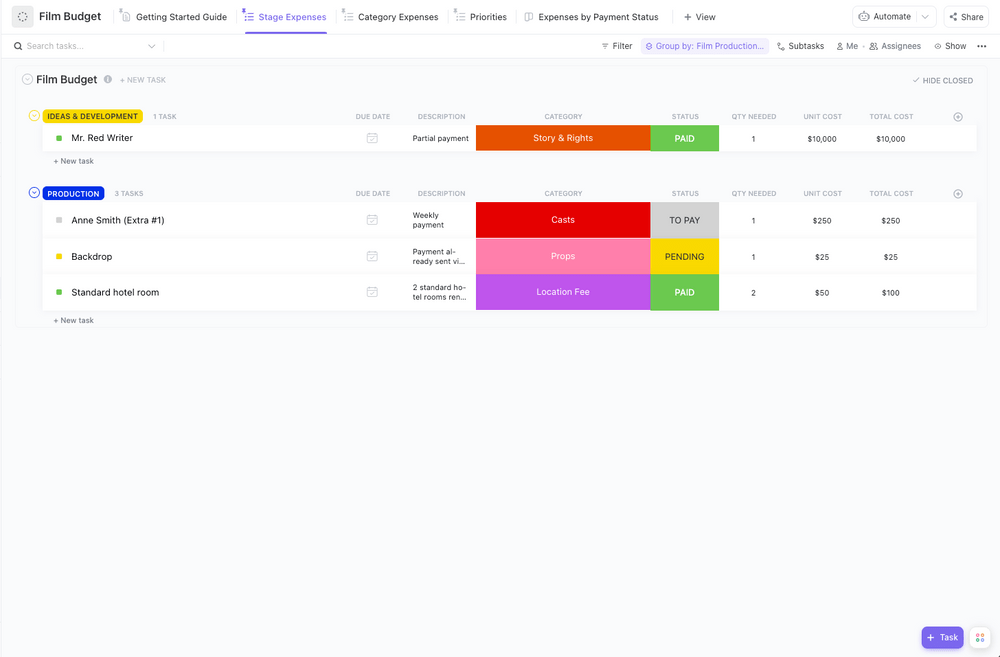

When you’re ready to seek funding for your film, the Film Budget Template by ClickUp can help you manage project budgets and craft detailed proposals.

The Film Budget Template is highly customizable and allows you to include any expenses related to your film, such as salaries, server fees, office space, labor costs, wardrobe, catering, set, and travel expenses.

Tap any expense to open a detailed view where you can add tasks and subtasks, checklists, and file attachments as supporting documents.

Once your proposal is approved, ClickUp’s all-in-one Project Management Software will help you hit the ground running with everything you need to manage tasks, project deliverables , people, budgets, proposals, and projects for your film.

For large films or small, the free Film Budget Template will help track your expenses and share them with decision makers.

The free Simple Monthly Budget Template by Microsoft provides a visual comparison of your monthly income versus expenses.

It’s a user-friendly template you can adapt to nearly any financial scenario, and it lets you customize the text, images, and more.

The fun and friendly template encourages creativity with an entire library of photos, graphics, and fonts you can add to your budget.

Creating a presentation or proposal? With this template, you can add engaging elements such as animations, transitions, or videos to make pitches more compelling. Plus its quick sharing features make it easy to share and publish your financial planning across several platforms.

Google Sheets fans may enjoy the free Personal Monthly Budget Template by Vertex42 .

Adaptable for Google Sheets, Excel, and Open Office, this template lets you track and compare your income and expenses.

You can use this template to prepare proposals or pitches for personal reasons, in nearly any format that you’re already comfortable with.

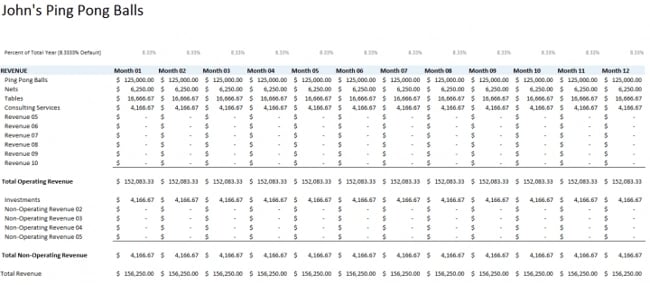

Once you’ve got your personal budget lined out, go back to the well again to organize your business finances with the Business Budget Template by Vertex42.

This simple template lets you list out income and expenses, then automatically calculates your net income so you know where you’re at financially.

Vertex42 offers a worksheet for service providers and for retailers, so it’s organized based on your company’s needs no matter the type of industry you’re in.

Bonus: Proposal Management Tools

Choosing the Best Budget Proposal Template for Your Team

There you have it! 10 free proposal templates in Excel and ClickUp for you to choose from.

A good pitch or proposal needs the best possible financial presentation, and that’s where a free budget proposal template comes in handy. They cover all the cost elements you can imagine, from travel costs, indirect costs, direct costs, and more to record and show expenses for any upcoming project.

When choosing the best budget template for your project budget, look for highly customizable templates that allow for plenty of reviews and revisions.

If you’re working with a large team, you’ll also want to find a template with real-time updates and team collaboration features that let you work together to ensure the best possible proposal. Account planning templates , operational plan templates , and office management software are also great tools to have in your stack when building effective proposals.

Compiling a proposed budget is a breeze with ClickUp, and it lets you conduct project monitoring from the same platform.

ClickUp is a powerful project management tool that can help you manage your budget proposal process from start to finish.

To begin streamlining your budget proposal process, head over to ClickUp’s platform and explore our wide selection of budget templates.

Try ClickUp today!

Questions? Comments? Visit our Help Center for support.

Receive the latest WriteClick Newsletter updates.

Thanks for subscribing to our blog!

Please enter a valid email

- Free training & 24-hour support

- Serious about security & privacy

- 99.99% uptime the last 12 months

Business growth

Business tips

7 free small business budget templates for future-proofing your finances

As a small business owner, you're likely balling with a lot more than your personal checking account. If you don't properly manage your business finances, there's more on the line than an overdraft fee—you now have an entire organization to account for.

Small business budgets are necessary to balance revenue, estimate how much you'll spend, and project financial forecasts, so you can stay out of the red and keep your business afloat.

But creating a small business budget template isn't a small task. Since I don't have a business to run, I did the heavy lifting for you—check out these free, downloadable templates for your small business budgeting.

Table of contents:

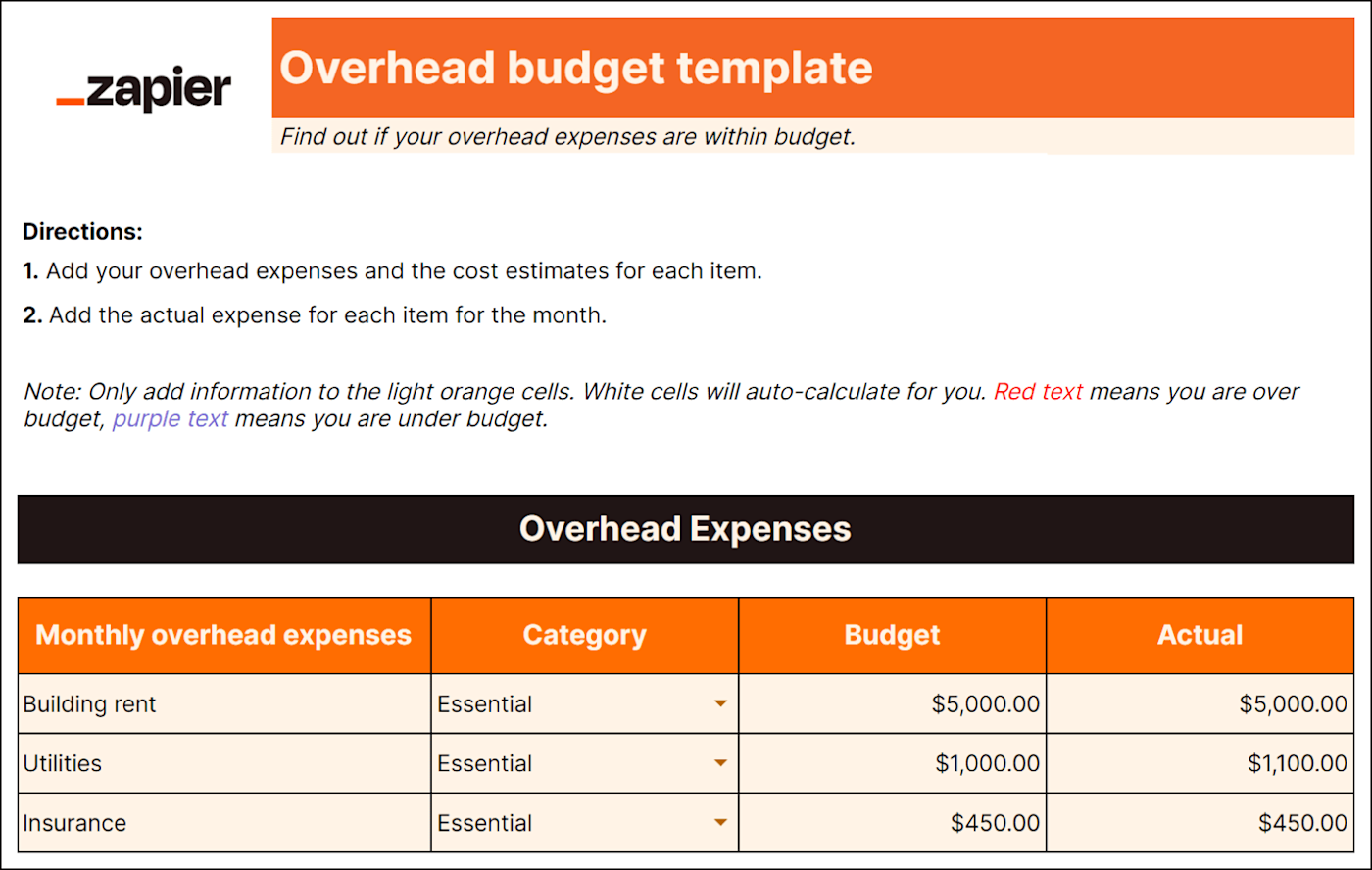

2. Overhead budget template

3. multiple-project budget template.

4. Startup budget template

5. Labor budget template

6. cash flow budget template, 7. administrative budget template, periodic budget reviews, how to design your small business budget plan, small business budget faq, 1. static budget template.

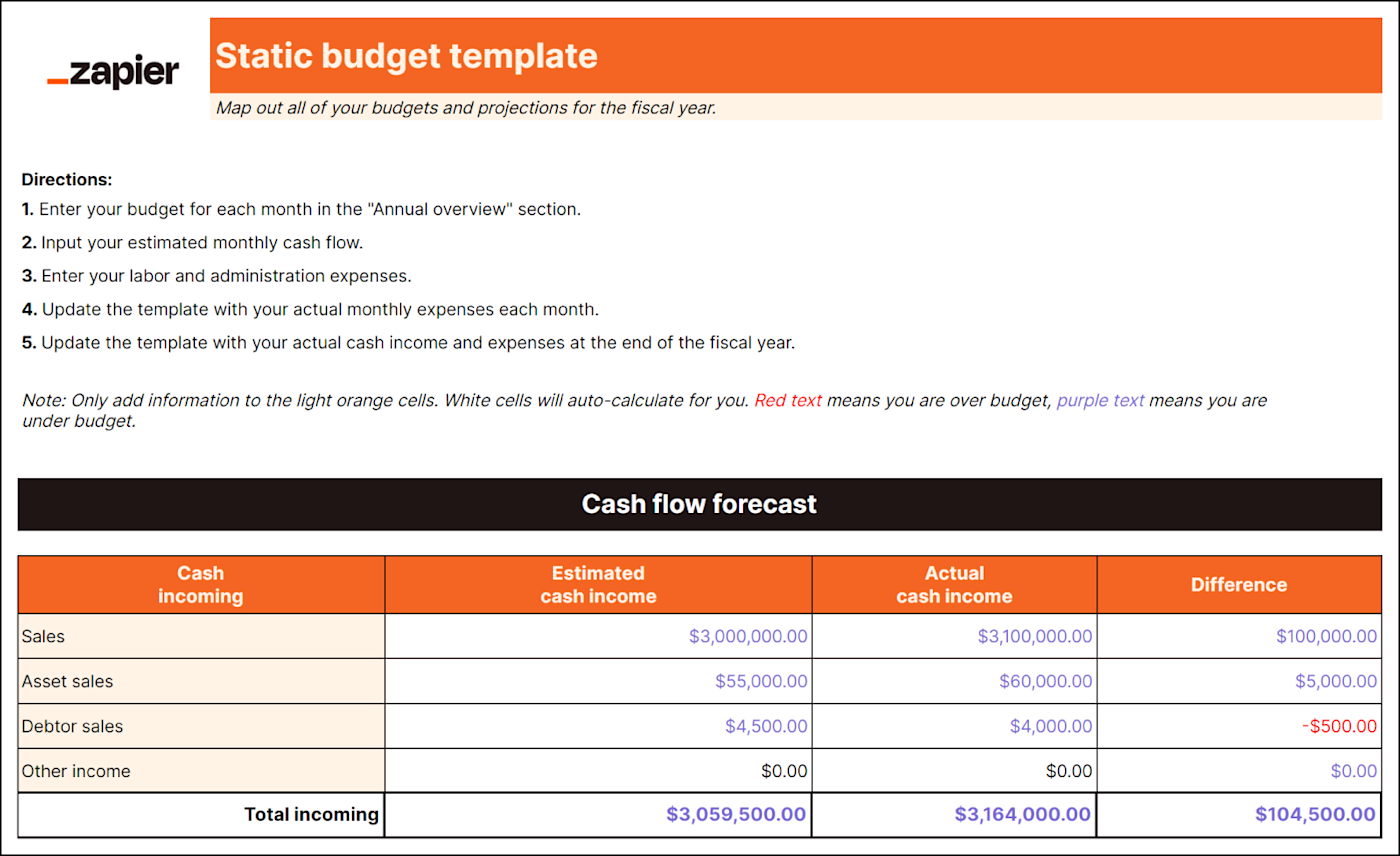

Best for: Multiple departments or revenue streams; Industries with complex operations

A static budget combines all the function-specific budgets a business uses into one. Typically, a static budget includes the following items (plus any other budgets your business might use):

Cash flow projections: Estimations of how much money will flow into and out of your business. They also help you decide when, how, and what you should spend money on.

Total expected spending: All estimated expenses, including labor and administrative costs.

By integrating all of your budgets and projections, the static budget provides a full picture of your business's estimated expenses and financial strategy for the upcoming fiscal year.

Best for: Service-based businesses

It's easy to forget about expenses that aren't directly tied to production, like delivery charges or utilities. But these costs exist (and can add up quickly), so you need an overhead budget. A detailed overhead budget template will include:

Administration expenses

It compares your budgeted amount to actual figures (warning: it may be a rude awakening) and can help improve accuracy for future financial planning.

Predicting overhead spending helps you plan how to use other funds more practically too—if you know how much you'll spend on overhead, you can make better business decisions. For example, you'd know whether you can afford to invest money into other initiatives like adding a delivery service or upgrading equipment.

Best for: Project-based industries

If you're managing multiple projects like website development or event planning, each with its own budget and expenses, you need a multiple-project budget to help keep your head on straight. This type of budget will help you track the following items per project:

Product-by-product COGS (cost of goods sold)

Labor costs

Equipment and resource costs

Indirect project expenses like travel

A multiple-projects budget establishes estimates for everything you need to get projects across the finish line. It also lets you track costs to ensure you're not spending more than you accounted for in the budget.

4. Startup budget template

Best for: New small businesses and startups

Startups need to ensure financial success from the get-go, so they can reinvest profit into the business and potentially attract more investors.

But unlike established small businesses, you don't have past financial data to base expenses on. That's why you need a startup budget to focus on expenses for your first year of business, including items like:

Funding from investors and loans

Licensing and permits

Logo and website design

Website domain

Business software

Security installation

Overhead expenses

Capital expenses

Best for: Larger businesses with lots of employees

Unless you're a one-person show, you'll need a labor budget. And even if you are a one-person show, it's good to know if you can afford to pay yourself. A labor budget breaks down all employee-related costs like:

Payroll taxes

Contract labor

Break down employee costs into direct, indirect, fixed, and variable categories to clarify how your company allocates its resources. You can also consider different scenarios more easily when you understand the breakdown of labor costs.

For example, you can simulate the impact of adding or reducing staff in specific departments or assess the effects of different compensation structures on different teams.

An accurate forecast of labor costs ensures you can sustainably meet your staffing needs and can help you make informed hiring decisions. Down the road, it can also help you determine if you can afford to give your staff raises, bonuses, or additional benefits.

Best for: Businesses with fluctuating income and expenses; Seasonal businesses; Retail

As important as it is to be mindful of how much money you're spending, you should also track how much money you're making . A cash flow budget helps estimate how money is flowing in and out of your business. It includes:

Starting balance (set at the beginning of the month, quarter, or year)

Projected cash inflow from all revenue streams

Estimated cash expenditures

Ending balance (calculated at the end of the month, quarter, or year)

This type of budget lets you proactively manage your resources, anticipate potential cash shortages, and strategize for growth. For instance, if you know you're only going to break even this year, you may wait on expanding or making a large investment.

Best for: Businesses focused on streamlining operations

An administrative budget includes all those general expenses that the company as a whole needs to function. This type of budget accounts for:

Depreciation expenses

Training and development

Communication expenses

Accounting fees

While you could technically include administrative expenses in an overhead budget and call it a day, a separate administrative budget gives more of an eagle-eye view of how well your business is operating.

Without an eye on administrative costs, you may be spending unnecessarily or lose focus on areas where it'd be wiser to invest your money. In other words, you could be spending way too much on fancy pens when you should be saving up to upgrade your cash register.

A budget isn't a "set it and forget it" deal. Regular budget reviews can help you stay on track with your financial goals and respond proactively to changing market conditions.

You should compare your estimated budget to actual spending. Then you can see where you went over and where you can splurge more. Try to review your budget monthly, quarterly, and yearly.

Monthly: Compare actual performance against your budgeted figures for the month. Identify any deviations and look for insights into cash flow, sales trends, and expense management.

Quarterly: Dive deeper into performance over the last three months. Use trends to project revenue and expenses for the upcoming quarter and identify areas for improvement.

Yearly: Reflect on your long-term financial objectives for the fiscal year. Assess the effectiveness of your budgeting strategies, and set new budget targets for the upcoming year.

It's cliched but true: you gotta spend money to make money. But that's no excuse to start throwing cash at your business willy-nilly.

Budgeting forces you to prioritize your objectives, so you spend money on the things that matter most. Here's how to create a small business budget in four steps:

Identify your working capital for the budgeting period. Add up your current assets like cash, accounts receivable, and inventory. Then subtract current liabilities like accounts payable and short-term debt. The remaining amount is what you have left to cover your operational expenses during the budgeting period.

Separate business and personal expenses. If you haven't already, open a dedicated business bank account. This makes it easier to track, categorize, and analyze your finances.

Determine your fixed and variable costs. Make a list of costs that stay the same every month (fixed costs) and what changes (variable costs). These will change based on the purpose of the budget. For instance, a labor budget will only consider employee-related costs.

Calculate your total expenses. Add up all the costs for your business, including fixed costs, variable costs, labor, and any other applicable expenses. This total is how much your business needs to run. Any leftover money from your working capital can be allocated toward other business investments.

Budgeting methods

If you've budgeted before and hated it, you may just have been using an ineffective budgeting method for your preferences. Here are a few budgeting methods to try instead:

Traditional: This budget is set for a determined amount of time and uses last year's numbers as a benchmark. Once you set your budget, you don't change it unless you get approval for an adjustment.

Rolling: This dynamic approach spans a continuous time frame instead of a fixed time period. As each month or quarter passes, you add a new budget period and drop the oldest period. This lets businesses adjust projections based on real-time performance and market conditions.

Flexible: This budget changes along with your sales forecast. As real-time sales activity deviates from budgeted amounts, you recalculate the budget to reflect the new data.

Still don't know where to start with your small business budget? Check out the answers to these common questions before you open a new Google Sheet.

What should a business budget include?

A business budget should include all income sources and expenses. Income sources could include projected revenue from sales, loans, or potential investor funding. Expenses may include items like office space rent, employee salaries, insurance, and marketing. Add anything that helps paint a full picture of your finances.

How much does the average small business startup cost?

The average small business startup costs $40,000 in its first year of business. But this will absolutely vary depending on your type of business, unique expenses, and cash income. For instance, there are multiple types of businesses you can start with $10,000 or less.

What is the best free business budgeting software?

The best free budgeting business software will depend on what your business needs, but you can try apps like Mint or Wave. Or you can use a spreadsheet—scroll up for some free small business budget templates.

Automate your small business

Knowing when or where to invest money into your business is just one of the many tasks you have on your plate as a small business owner. Learn how automation for small businesses can help take some of those recurring tasks off your hands, so you can focus on growing your business.

Related reading:

The best free small business software

The best CRMs for small businesses

How to create effective document templates

21 free Google Sheets templates to boost productivity

Get productivity tips delivered straight to your inbox

We’ll email you 1-3 times per week—and never share your information.

Cecilia Gillen

Cecilia is a content marketer with a degree in Media and Journalism from the University of South Dakota. After graduating, Cecilia moved to Omaha, Nebraska where she enjoys reading (almost as much as book buying), decor hunting at garage sales, and spending time with her two cats.

- Small business

- Finance & accounting

Related articles

How to create a sales plan (and 3 templates that do it for you)

How to create a sales plan (and 3 templates...

How to build a B2B prospecting list for cold email campaigns

How to build a B2B prospecting list for cold...

The only Gantt chart template you'll ever need for Excel (and how to automate it)

The only Gantt chart template you'll ever...

6 ways to break down organizational silos

Improve your productivity automatically. Use Zapier to get your apps working together.

Budget Proposal Template for Word, PDF

Download Free Template

Available for Word & PDF

Your download is available!

Click to download your document template in the format you need.

Your download is ready!

Download Budget Proposal Template for Word & PDF or email it to yourself later.

Download Budget Proposal Template for Word & PDF.

- Send to email

Plus, you've unlocked access to our full collection of 130 hand-built business templates!

Template Highlights

- Describe your project, the anticipated timeline, and how much it will cost (by item and in total)

- Bring it home with a strong call to action

- It's easy to customize this template to your organization -- just change the colors and add your own branding

- Download it as a Word or PDF file

- Print it, email it, crumple it up, try to throw it in the trashcan, get it in (if no one's watching) but miss by a mile (if there are other people there)

Template Preview

Budget Proposal Template

One of the essential steps in launching a new project or venture is requesting a budget to cover the associated costs. Whether you need to ask for internal or external resources, you can use this template to develop a proposal to request funding for your project idea.

HubSpot Tip: Get to know the organization from which you are requesting funding. What do they think is important information? Adapt this template to meet the specific data your funder requires.

About the Project

This section is your chance to convince the funder that your project deserves sponsorship. Describe the nature of the project and why it is important.

Tell the funder about the people and/or organizations the project would impact. Who are the key players in the project activities? Who will feel the results of its successful implementation?

Focus on the outcomes of the project. What will funding this project improve in the organization, the community, or the world? What are the goals of the project?

HubSpot Tip: If appropriate for your industry, you might consider including an evaluation plan to indicate how you will measure the success of the project and whether it meets your stated goals.

Indicate the period of performance for the project. When do you anticipate starting and by when do you think the project will be completed?

Consider showing the project timeline graphically, like in the schedule diagram below. If your project timeline is complicated, you might consider separating it into phases.

HubSpot Tip: While you might expect funders to prefer an aggressive project timeline, they are more likely to react favorably to a schedule with reasonable deadlines. Be sure to account for and document potential risks and schedule slips to show you have thought critically and deeply about your project.

Cost Information