Mutual of Omaha Medicare Supplement

Mutual of Omaha Medicare Supplement Plan G

Plan G is a very popular option with Mutual of Omaha. Similar to Plan F, G covers everything Medicare does not pay in full, the only difference between the two plans is an annual deductible of $240 per year. Often, the premium difference between the two plans is more than the Part B deductible, making Plan G with Mutual of Omaha the better option.

Like Plan F, G is accepted anywhere in the county that accepts Medicare. There are no networks or referrals needed to see specialists with MOO. You have complete freedom to see any doctor of your choice!

The Advantage of Plan G vs Plan F

- Lower rates – the premium difference often more than covers the benefit difference ($240 per year in 2024).

- Lower rate increases (explained below)

- Better long-term outlook (explained below)

Advantages of Plan G vs Plan N

- Part B excess charges are covered on Plan G

- No office copays on Plan G

Average Rate Increases On Plan G

Medicare supplement Plan G averages much lower rate increases than Plan F across the board. On average Plan F increases between 6% – 10%. Plan G on the other hand increases between 0% – 6%. You will save a lot of money over the life of the policy on Plan G.

The main reasons for larger rate increases on Plan F is that there are simply a lot more folks on Plan F and the ones who do have Plan F tend to use the plan more often. This results in more claims going to the carriers and thus high rate increases.

How To Get Quotes?

If you are looking to compare rates for Mutual of Omaha Medicare supplement plans then you have come to the right place. You can either call us directly at 877-294-1549 or use our online quote form to request a quote. We are completely independent and can show you rates with MOO and also other carries in your area to be sure you are not going to overpay for your supplemental coverage.

How To Apply For Coverage?

If you are ready to sign up for coverage then the best option is to simply call us directly at 877-294-1549 and we can get you started with a Mutual of Omaha Medicare supplement Plan G right away!

Should You Choose Mutual of Omaha For Your Medicare Supplement Plan G?

Mutual of Omaha is a very good company to go with for your Medicare supplement insurance. They maintain an A+ rating and a very large financial backing. In addition, they are very competitive for Plan G across the country. MOO pays claims electronically, so you don’t have to worry about dealing with paperwork and filing the claims yourself. This can save you a lot of headaches.

If you are considering a Medicare supplement plan with MOO or Omaha Insurance, give us a call at 877-294-1549 or use the quote form to compare rates. We offer a free quote comparison service, where we will compare rates for you, free of charge, so you get to see ALL the rates that are available in your area.

Medigap Plans

5 out of 5 based on 135 reviews

- Who Are We?

- People First

- Medicare Health Plan Types

- Original Medicare

- Medicare Part A

- Medicare Part B

- Medicare Eligibility

- Medicare Enrollment Periods

- What Is a Medicare Advantage Plan?

- Medicare Advantage vs. Medigap

- Why Medicare Advantage Plans Are Bad

- Medicare Supplement Comparison Chart

- Medicare Supplement Insurance

- Medicare Supplement Plan G

- Medicare Supplement Plan N

- Medicare Supplement Plan F

- Medicare Supplement Cost

- Medicare Supplement Eligibility

- Medicare Supplement Open Enrollment

- Dental Insurance

- Life Insurance

- Get a Quote

Mutual of Omaha Medicare Supplement Plan G

Published on December 26, 2023

Written By: Mark Prip

Mutual of Omaha Medicare Supplement Plan G is one of ten Medicare Supplement insurance plans that help pay medical expenses left after Original Medicare ( Medicare Part A and Part B ) pays its portion.

Key takeaways:

- Except for the Medicare Part B deductible, it fills in gaps left by Original Medicare.

- The highest benefit level of all Medigap plans.

- Pays Medicare Part B excess charges.

- Includes foreign travel benefits (up to plan limits)

What Does Mutual of Omaha Medicare Supplement Plan G Cover?

Plan g will cover:.

- Initial pints of blood

- Medicare Part A deductible

- Medicare Part A hospital costs

- Part A expenses

- Part A Hospice Care Coinsurance

- Skilled nursing facility care

Medicare Part B costs:

- Charges over the amount Medicare allows – “ Part B Excess Charges ”

- Durable medical equipment

- Foreign travel emergency care (lifetime plan limits apply)

- Medicare Part B coinsurance and copays

Note: Medigap Plan G will not cover the Part B deductible.

How Much Does Mutual of Omaha Plan G Cost?

Here’s an idea of what a 65-year-old woman, a nonsmoker, might pay for Medicare Supplement insurance Plan G compared to other popular Medigap plans:

- Attained age: Premiums increase yearly based on age.

- Community-Rated: Everyone joining Medigap Plan G pays the same regardless of age.

- Issue age: Your premium is based on your age when you enroll.

Is Medicare Supplement Plan G the Best Medigap Option?

Yes, and here’s why:

- It’s the most comprehensive coverage available for those new to Medicare.

- No network limitation; go anywhere Medicare is accepted.

- Plan G fills in all gaps in Original Medicare except for the Part B deductible, so you have no other out-of-pocket costs to pay.

- Like all Medicare Supplement insurance plans, you’re guaranteed acceptance if you enroll in Medicare Plan G when you first become eligible for Medicare .

Mutual of Omaha Medicare Supplement Plan G is an ideal option for newcomers to Medicare. It offers comprehensive coverage, filling gaps left by Original Medicare except for the Part B deductible. Additionally, it covers Part B excess charges, providing peace of mind and better healthcare coverage.

Plan G rates vary based on age, gender, location, and tobacco use, so compare options before enrolling. With comprehensive benefits and low costs, Mutual of Omaha Medicare Supplement Plan G is an excellent choice for reliable coverage.

Plan G coverage does not include the Part B deductible. For those whose Medicare start date is Jan. 1, 2020, no Medicare Supplement plan covers the Part B deductible.

Mutual of Omaha’s Plan G costs between $115 to $300 per month, depending on age, location, and several other factors.

Mutual Of Omaha’s Plan G is one of the best Medigap options. With consistently competitive rates, it has earned its reputation as their most sought-after plan by a wide margin.

Since 2003, Mark Prip has been leading Policy Guide, Inc. , providing knowledgeable information about Medicare, life insurance, and dental coverage to clients in over forty states. With his unparalleled hands-on experience aiding countless Medicare beneficiaries in selecting an appropriate health plan, he is a prime example amongst other competitors for expertise and assistance. Mark has held his Florida Health & Life Insurance License (E051889) since 2003. View his license profile on the Florida Department of Insurance website .

- Mutual Of Omaha Plan G Benefits

- Mutual of Omaga Plan G Cost

Related Topics

Ace medicare supplement review 2024, aetna vs. mutual of omaha medicare: which is better, aetna vs. blue cross blue shield medicare: which is better, medicare hmo vs ppo: what’s the difference.

- Mutual of Omaha Medicare Supplement Plan G

Mutual of Omaha Medicare Supplement Plan G is one of the most comprehensive Medicare Supplement plans available today because it covers all Original Medicare gaps except for the Part B deductible.

There are a few things you should know about Medicare Plan G:

- First, Plan G is the best option for low monthly premiums with high-deductible options .

- Plan G includes foreign travel emergency care and Medicare Part B excess charges.

- Approximately 1.4 million Medicare beneficiaries chose the Mutual of Omaha insurance company for their supplemental policy.

Mutual of Omaha Medicare Supplement Plan G Benefits

Plan G covers the following whether you select Mutual of Omaha as your insurance company or go with another leading insurer:

- Part A coinsurance

- Hospital inpatient costs (up to 365 days after Original Medicare benefits are exhausted)

- Copays for emergency room visits

- Part A hospice care copays or coinsurance

- Part A deductible

- Part B preventive office visit coinsurance

- Part B coinsurance or copayment

- Part B Excess charges

- First three pints of blood (for medical procedures)

- Skilled nursing facility coinsurance

- 80% of foreign travel emergency care expenses (up to plan limits)

- Plan G does NOT cover the Medicare Part B deductible.

Mutual of Omaha Medicare Supplement Plan G Cost

The average price for Medicare Supplement Plan G is $94 - $170 per month for a 65 year-old-female that does not use tobacco.

Two things you should know about Medicare Supplement plan pricing:

- Mutual of Omaha uses attained-age ratings. That means your rates are based on your age when you enroll in the Medigap policy . The older you are, the more you're likely to pay.

- The Household Discount can reduce your monthly premium by up to 12% if you live with someone 60 years or older, even if they aren't Mutual of Omaha customers.

Rate Increase History

Mutual of Omaha rate increases tend to fall between 3% and 10%, comparable to many other insurance companies. Various factors can determine when and how much a rate increases, but Mutual of Omaha tends to have lower and less frequent increases than small insurers.

Since the company uses attained-age pricing to set rates, policyholders may notice rate increases as they age with the plan. That is common for insurance providers to use age attainment as a rating model. In addition, there is a 12-month rate lock that ensures your rate doesn't increase within the first year, and beneficiaries can cancel their Medigap plan within the first 30 days without penalty.

Is a Mutual of Omaha Medicare Supplement Plan G Right for You?

With over 100 years in business, Mutual of Omaha is a trusted and reliable provider. Countless seniors in all 50 states have chosen affordable, top-of-the-line Medicare Supplement policies offered by Mutual of Omaha. We highly recommend purchasing your plan from them. When you purchase Medicare Supplement insurance, you are freeing yourself and your family from worrying about financial catastrophe if you fall ill.

Ready to Learn More?

We help educate Medicare beneficiaries on their Medigap options and help them go through the process of reviewing and comparing plans. We work with some of the nation's top-rated Medigap carriers. So give us a call today, or request a quote online to learn more about Aetna Medicare Supplement plan G and Mutual of Omaha Medicare Supplement plan G in your state.

Mutual of Omaha Medigap Plan G does not cover the Medicare Part B deductible. However, the current deductible is low, at $226 a year.

Plan G will pay hospital deductibles, copayments, and coinsurance.

Plan G costs range from $94 to $170 per month, depending on the insurance provider, location, age, and health status.

You can change at any time, but if you do not have a guaranteed issue circumstance or are outside of your Medigap Open Enrollment Period, in that case, you can be denied coverage if your health conditions cannot pass the underwriting process.

Suppose you apply for Medicare Supplemental insurance outside the Medigap Open Enrollment Period and do not have guaranteed issue rights. In that case, you may be denied coverage by the insurance company based on your medical history or existing health conditions.

For over 15 years, Matt Kiggins has been the senior editor at Simple Advisor, giving detailed advice on Medicare, life insurance, and dental coverage to thousands of clients in more than forty states. His demonstrated expertise in assisting people with their health plan selection is remarkable — it’s evident that he stands out among competitors as the go-to source for knowledge and support.

Matt holds a resident 2–15 Florida Health & Life (Including Annuities & Variable Contracts) Agent License in Florida, his state license number is P116762 (Issued 10/1/2007).

Matt Kiggins is the producer appointed to oversee the content written on SimpleAdvisor.com.

Every agent representing PG holds a state-issued producer license for the states they serve.

Below is a list of Matt's active state license numbers:

Connecticut

Mississippi

New Hampshire

North Carolina

Pennsylvania

Rhode Island

South Carolina

South Dakota

West Virginia

Article Resources:

- How Much Does a Medicare Supplement Plan Cost?

- Compare Medigap Plans

- When Can I Apply for a Medicare Supplement Plan?

Related Topics:

- Medicare Supplement Insurance

- Best Medigap Plans for 2023

- Medicare Supplement Plans in California

- Medicare Supplement Plans in Florida

- Medicare Supplement Plans in Pennsylvania

- Medicare Supplement Plans in New Jersey

- Medicare Supplement Plans in Texas

Please note that the average quotes provided are for demonstration purposes only. Your actual premiums will be determined based on several factors, such as your health conditions, age, location, tobacco status, gender, and insurance provider.

Call to speak with a licensed insurance agent now.

Or enter your zip code to shop online

Talk to one of our licensed insurance agents about your Medicare or Life Insurance plan options.

By completing this form, you agree that an authorized representative or licensed insurance agent may contact you about Medicare plans. This website is not connected with the federal government or the federal Medicare program. We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options. Copyright © 2024 Simple Advisor. All Rights Reserved.

Mutual of Omaha Medicare Supplement Plan G

Home / Medicare Supplement Insurance / Mutual of Omaha Medicare Supplement Plans / Mutual of Omaha Medicare Supplement Plan G

Published on December 28, 2023

Written By: Mark Prip

Mutual of Omaha Medicare Supplement Plan G helps beneficiaries cover expenses that Original Medicare benefits don’t cover. Because payments like copays, deductibles, and coinsurances can add up, having Medicare Supplement insurance can give you peace of mind.

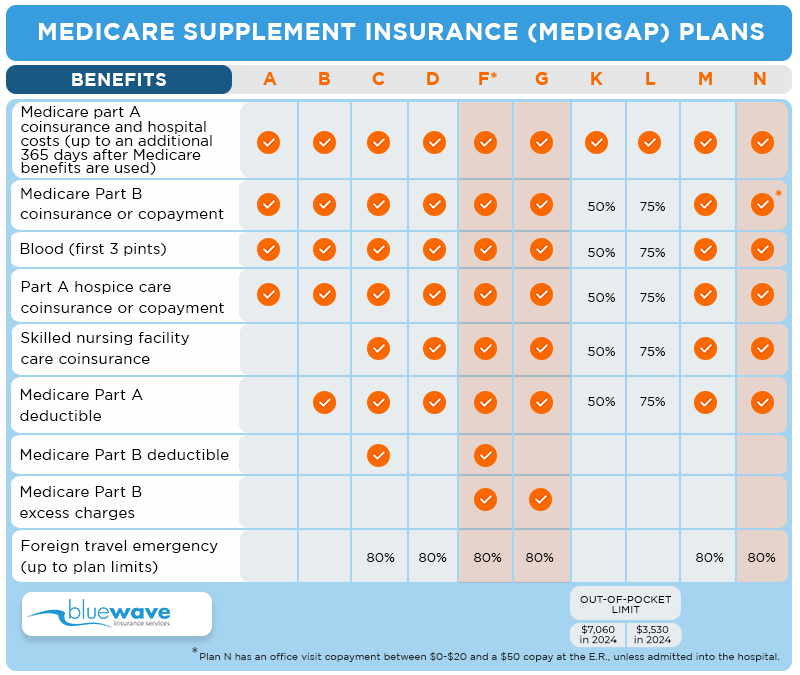

There are ten standardized Medigap plans – A, B, C, D, F , G , K, L, M, and N . But Plan G is rapidly becoming one of the most popular plans.

Here’s a look at why:

- Medicare Supplement Plan G provides the highest benefit of all the Medigap plans offered to new Medicare enrollees after January 1, 2020.

- Plan G covers all the gaps to Original Medicare apart from the Part B deductible.

- Plan G has the best option for low monthly premiums with high-deductible options.

- Medicare Supplement Plan G includes foreign travel emergency care and Medicare Part B excess charges.

Mutual of Omaha Medicare Supplement Plan G Benefits

Plan G covers:

- Part A hospital coinsurance

- Inpatient hospital costs for up to 365 days after your Original Medicare hospitalization benefits end

- Medicare Part A hospice care copays or coinsurance

- Medicare Part A deductible

- Medicare Part B coinsurance for preventive care and outpatient visits

- Medicare Part B coinsurance or copays

- Medicare Part B excess charges

- The first three pints of blood, if needed for a medical procedure

- Skilled nursing facility care coinsurance

- Foreign travel emergency care up to plan limits

- Please note: The $240 Medicare Part B deductible for 2024 is not covered

How Much Does Mutual of Omaha Plan G Cost?

Here are sample premiums for a 65-year-old female, non-smoker , living in Texas:

How much you pay for your Medicare Supplement Plan G monthly premium with Mutual of Omaha depends on where you live and your personal health information.

Your actual Medicare Supplement Plan G monthly premium depends on where you live and your personal health information.

What Is the Rate Increase History With Mutual of Omaha?

Even though rate increases are inevitable no matter what health insurance company you use, Mutual of Omaha keeps them as low as possible. Because Mutual of Omaha Medicare Supplement ensures a more significant number of beneficiaries than smaller companies, they can sustain risk better than their competition. And the result of this is smaller increases in premium rates.

On average, rate increases with MOO, as with many other companies, fall between 3% and 10%, depending on several factors. To protect yourself from a rate increase, you can enroll in a plan that offers a 12-month rate lock. This guarantees that your rates won’t go up during the first year of your coverage.

Mutual of Omaha also offers a Free Look Period for 30 days. You can cancel your policy anytime and for any reason during the 30 days.

Frequently Asked Questions:

Mutual of Omaha Medicare Supplement insurance plans do not cover dental or vision care services. However, Mutual Omaha offers enrollment opportunities in several insurance plans that cover dental care. From straightforward, routine exams and procedures to more complicated and expensive ones, you may find supplemental insurance for dental care to enhance your Medicare benefits.

Mutual of Omaha wants to empower seniors with good health. That’s why they have created the Mutually Well Senior Wellness Program. Mutually Well is available for customers with Medicare Supplement plans who want to become members. Membership in the Mutually Well program is separate from your Omaha Medicare Supplement plan, but pricing is reasonable so everyone can join.

Yes, they are a competitive option for most customers buying Medicare Supplement plans. 94% of all customers are satisfied with their supplement insurance. 90% recommend Mutual of Omaha to a family member or friend. They carry an A+ from the Better Business Bureau.

We specialize in guiding Medicare beneficiaries through their Medicare insurance options. We work with some of the nation’s top-rated Medigap carriers to ensure you’re getting the best possible service. Review our Medicare Supplement Plans Comparison Chart and look deeper at the plans. Additionally, you can give us a call today to learn more or request a quote online .

Article Resources:

- Mutual of Omaha Medicare Supplement Plan Options

- How To Compare Medigap Plans

- How Much Does a Medigap Plan Cost?

- When Can I Apply for a Medicare Supplement Plan?

- Does Mutual of Omaha Medicare Supplement Cover Dental?

- Can I Be Denied Medigap Coverage?

- CMS Medicare Services

For more than two decades, Mark Prip at My Medigap Plans has been an authority figure in the insurance industry and continues to uphold a mission to provide customers with comprehensive information about Medicare, life, and dental coverage. In addition, his expertise is unmatched - having helped thousands of Medicare beneficiaries choose suitable healthcare plans for themselves - making him stand out above competitors.

Request a Quote

- Type 2 Diabetes

- Heart Disease

- Digestive Health

- Multiple Sclerosis

- Diet & Nutrition

- Supplements

- Health Insurance

- Public Health

- Patient Rights

- Caregivers & Loved Ones

- End of Life Concerns

- Health News

- Thyroid Test Analyzer

- Doctor Discussion Guides

- Hemoglobin A1c Test Analyzer

- Lipid Test Analyzer

- Complete Blood Count (CBC) Analyzer

- What to Buy

- Editorial Process

- Meet Our Medical Expert Board

We independently evaluate all recommended products and services. If you click on links we provide, we may receive compensation. Learn more .

Best Medicare Supplement Plan G Providers

Guidance for choosing the best extra coverage options for Medicare

Medicare Supplement Plan G, like other Medigap plans (A through N), is standardized by the federal government. Available in all states but Massachusetts, Minnesota, and Wisconsin, it covers most out-of-pocket costs for Original Medicare, including copays and coinsurance for approved Part A and Part B services, along with the Part A deductible.

Medicare Supplement G Plans have stepped up as the leader in having the lowest out-of-pocket costs, covering everything F Plans do, with the exception of the Part B deductible ($240 in 2024). (Medigap F Plans aren't available if you became eligible for Medicare in or after 2020.)

To help you find the best Medicare Supplement Plan G provider, we compared and ranked the top plans, taking into consideration price, discounts, geographic coverage, user experience, and more.

We found that Blue Cross Blue Shield and Mutual of Omaha are tied for the best overall Medicare Supplement Plan G companies. Mutual of Omaha has good rates and its high-deductible Plan G is widely available across the U.S. Blue Cross Blue Shield also has competitive rates, and dental, hearing, and vision coverage is available to add on.

- Best Overall (Tie): Mutual of Omaha

- Best Overall (Tie): Blue Cross Blue Shield

- Great for Detailed Plan Descriptions: Cigna

- Lowest Cost Plan G: AARP/UnitedHealthcare

- Our Top Picks

- Mutual of Omaha

- Blue Cross Blue Shield

- AARP/UnitedHealthcare

- See More (1)

The Bottom Line

- Shop and Compare Medicare Supplement Plan G

Frequently Asked Questions

Methodology, best overall (tie) : mutual of omaha.

Mutual_of_Omaha

Offers an affordable high-deductible Plan G in 45 states and Washington, D.C.

Includes fitness, vision, and hearing discounts

Also offers Part D and dental insurance (for a fee)

A+ financial strength rating

Excellent Plan G pricing

Limited customer support for Medicare plans

Mutual of Omaha offers excellent pricing for Medicare Supplement plan G—only UnitedHealthcare offers lower average monthly premiums. Plus, it’s one of the few companies that offers a high-deductible Plan G in most states. High-deductible plans can save you money on premiums, so if you’re on a tight budget and don’t need to access much health care, it could be right for you.

Additional perks, including discounts on healthy living products and services, fitness benefits, and discounts on hearing care and vision care, are also included at no cost. You can buy Part D coverage and dental insurance from the company as well.

Mutual of Omaha received an A+ (Superior) financial strength rating from A.M. Best, which indicates the company has a superior ability to meet its financial obligations, including paying claims. State Farm was the only Medigap provider to receive a higher grade.

However, details about Mutual of Omaha’s plans on the company website are limited, and customer support is only available during business hours. Some other companies offer weekend hours or even 24/7 support.

Monthly costs vary by state, age, and gender. It’s worth it to compare individual quotes across a few providers. In some states, for example, Blue Cross Blue Shield offers better pricing.

Best Overall (Tie) : Blue Cross Blue Shield

Blue Cross Blue Shield

Low average costs for Plan G

Access to a 24/7 nurse line

Extensive discount program

Affordable dental, hearing, and vision package

High-deductible Plan G only available in select states

Blue Cross Blue Shield also offers excellent pricing and beats Mutual of Omaha in some states. There’s also a multi-policy discount when at least two members are within the same household, such as South Carolina BCBS’s 5% household discount.

Blue Cross Blue Shield offers a dental, hearing, and vision package to Medicare supplement members (including Plan G) for an affordable price. For instance, in Michigan, this coverage is $17.25 per month. It covers most of your preventive in-network dental care, vision exams with standard lenses once per year, and an annual hearing exam. Plus, you may be eligible for a discount of up to 60% on hearing aids through the Blue365 program.

All Medicare supplement plans from Blue Cross Blue Shield also come with access to a 24/7 nurse line, an online surgery decision guide, free webinars, and an extensive members discount program, Blue365. What’s more, the company is financially strong, with an average overall grade of A (Excellent) from A.M. Best.

Great for Detailed Plan Descriptions : Cigna

User-friendly website with thorough description of each plan

Access to 24/7 Health Information Line

Helpful online resources about Plan G and Medicare

Includes access to Cigna “Healthy Rewards” discount program

Household discount is available for some plan members

High-deductible Plan G only available in a few states

Higher premiums on Plan G than competitors

Must provide your contact information to get a quote or compare plans

Cigna stands out for its detailed plan descriptions on its website, which makes it easy to understand your plan options and the coverages available within each plan. The company also publishes some helpful online resources about Plan G and Medicare. However, Cigna doesn’t allow you to get a free quote without submitting personal details, like your age and current insurance situation, as well as your phone number and email address.

After submitting your contact information, Cigna will reach out to discuss your plan options. While it can be helpful to speak with a representative if you’re seriously considering Cigna as your Plan G provider, it can also be bothersome if you’re just getting a feel for your options.

Cigna’s high-deductible Plan G is only available in a handful of states. Another negative: Cigna’s premiums are higher than other competitors on this list.

Cigna does offer a household discount for certain members, but the discount isn’t available in Hawaii, Idaho, Minnesota, or Vermont. Additionally, the household discount is only available to spouses for members who live in Washington.

Lowest Cost Plan G : AARP/UnitedHealthcare

AARP by UnitedHealthcare

Lowest average premium for Plan G

Highest average NCQA rating across Medicare supplement providers we researched

Live chat support

Generous new enrollment discount

Top provider of Part D plans

Must be an AARP member to enroll

Doesn’t offer high-deductible Plan G

UnitedHealthcare offers the lowest average premium for Plan G of any insurer we reviewed. Plus, there’s an opportunity for substantial new enrollment discounts. For example, some applicants ages 65 through 68 can save 39% on their premiums, though the discount decreases with age. Also available is a 7% multi-insured discount, and a $24 per year electronic payment discount.

To enroll in a low-cost plan from UnitedHealthcare, you must be an AARP member. The membership costs $16 annually, so the cost may be offset by the savings.

UnitedHealthcare offers a package of vision, dental, and hearing discounts, a free gym membership, and a 24/7 nurse line with all its Medigap plans. There’s also live chat support, which is unusual in this industry.

Plus, the company has excellent third-party ratings, including a 3.9 out of 5 stars NCQA rating for its plan quality and customer satisfaction. And an A+ (Superior) financial strength rating from A.M. Best. But if you’re looking for a high-deductible Plan G, you’ll need to choose a different provider.

Blue Cross Blue Shield and Mutual of Omaha are the best overall Medicare Supplement Plan G providers. Mutual of Omaha stands out because the company offers a widely available high-deductible Plan G, has excellent pricing, and high financial strength ratings. Those looking for a low-cost vision, hearing, and dental add-on will be best served by Blue Cross Blue Shield, which also has very competitive Plan G rates.

It’s wise to compare prices at all companies that offer the plan type you’re looking for, since pricing and benefits can vary by state. For example, Blue Cross Blue Shield offers a unique Plan G Plus in some states that includes vision and dental benefits.

How to Shop and Compare Medicare Supplement Plan G

Step 1: choose between original medicare and medicare advantage.

When you sign up for Medicare, or during open enrollment , you must decide if you want to be on Original Medicare or Medicare Advantage . Original Medicare has a nationwide network of providers but has fixed benefits and no limit on out-of-pocket expenses. Medicare Advantage plans are typically based on a local network of providers but can offer additional benefits. If you sign up for Original Medicare, you are eligible for a Medicare supplement plan.

Step 2: Determine Which Types of Medicare Supplement Plan G Are Available

Medicare.gov offers a plan finder that lets you search for Medigap plans by ZIP code. For more accurate pricing, enter your age, gender, and whether or not you use tobacco. Scroll to Medicare Plan G or Medicare Plan G-high deductible to get a quick overview of costs and coverage. Then, select “View Policies” for a list of specific insurance companies offering that plan in your area.

Step 3: Choose a Regular or High-Deductible Plan G

High-deductible plans will pay your Medicare out-of-pocket costs after you pay an annual deductible, which is set at $2,800 for 2024. These plans will have lower monthly premiums than a regular plan. You will need to decide if paying higher monthly payments makes more sense financially than paying higher costs when you need care.

Step 4: Ask a Medicare Specialist About Medicare Supplement Plan G

Common issues include when to sign up for the best rates (Medigap Open Enrollment is different from Medicare Open Enrollment), understanding guaranteed issue rights, and transitioning from a Medicare SELECT plan to Medigap. Your local state health insurance assistance program or Medicare.gov's help line or live chat can help you navigate issues like these.

Step 5: Enroll in Medicare Supplement Plan G

Some plans allow you to enroll online on their company website. Others may require you to speak with an agent. Regardless, you will need to gather the necessary information to complete your application. There is no option to sign up on the Medicare website.

Every Medicare Supplement Plan G covers the same items. In that way, choosing the best plan is less about coverage than it is about pricing, customer service, and incentives offered. After researching the companies offering Plan G in all 50 states, the companies above stood out for their cost, website friendliness, availability, and perks.

Medicare F Went Away. Will Plan G Stick Around?

There are no publicized plans to discontinue Plan G. When Congress passed the Medicare Access and CHIP Reauthorization Act (MACRA) of 2015, it changed which Medicare supplement plans could be made available to new Medicare beneficiaries. On Jan. 1, 2020, Medicare Plans C and F were no longer available to people who were newly eligible for Medicare. Plan G was intended to replace Plan F.

Does Medicare Plan G Cover Acupuncture Services?

Medicare supplement plans do not pay for health services directly. Instead, they cover the leftover costs for Medicare-approved services that Part A or Part B did not pay in full. Original Medicare covers acupuncture for chronic low back pain . If you meet the specific criteria for acupuncture services, Plan G will cover your 20% coinsurance amount. Medicare does not cover acupuncture for other indications.

Does Medicare Plan G Cover Chiropractic Services?

Medicare covers limited chiropractic services. Specifically, it covers spinal manipulation to correct a subluxation , an alignment issue of the spine that causes pain and/or functional impairments. Part B covers 80% of those costs and Plan G will cover the remaining 20%. Other chiropractic services like X-rays or massage are not covered.

What Is the Typical Cost of a Medicare Supplement Plan G?

Costs for Medicare supplement plans vary widely depending on your age, gender, and where you live. Chronic medical conditions are taken into account if you apply outside Medigap Open Enrollment, including whether or not you smoke. The one-time Medigap Open Enrollment Period starts when you first enroll in Medicare Part B and ends six months later.

We reviewed Plan G costs in the two states with the highest Medicare enrollment for 2023. Based on quotes for male and female, 65-year-old, non-smoking applicants, Plan G costs ranged from $241 to $363 in the Southeast (Florida) and $103 to $160 in the South (Texas). High-deductible Plan G costs ranged from $97 to $114 and $39 to $57, respectively.

We identified top companies by market share within the industry offering Medicare Advantage plans from various business and market insight databases including Statistia, Plunkett, and Gale. We also considered user-generated data from Google to determine public interest and trends in Medicare plans.

Our data was collected from third-party rating agencies like the credit rating agency AM Best and the National Committee for Quality Assurance (NCQA), an independent organization that rates health care plans on quality and customer satisfaction. We also gathered data from government websites and databases provided by the Centers for Medicare and Medicaid Services (CMS) such as CMS.gov and HealthCare.gov, and directly from companies via websites, media contacts, and existing partnerships. The data collection process spanned Sept. 15-29, 2023.

We then developed a quantitative model that scores each Medicare plan based on five major categories and 22 criteria that are crucial in evaluating the plan’s offerings and benefits.

Data was verified to ensure data integrity and accuracy by cross-referencing the records and adding citations that correspond to each data point with our primary sources.

BananaStock / Getty Images Plus

CMS.gov. “ 2024 Medicare Parts A and B Premiums and Deductibles .”

South Caroline Blue Cross Blue Shield. " New Medicare Supplement Plan Discounts ."

Blue Cross Blue Shied Blue Care Network. " Medicare Supplement Plans ."

AARP. " What Is the Cost of an AARP Membership? "

CMS.gov. " F, G & J Deductible Announcements ."

By Tanya Feke, MD Dr. Feke is a board-certified family physician, patient advocate and best-selling author of "Medicare Essentials: A Physician Insider Explains the Fine Print."

Speak to a licensed agent 1-800-208-4974

Compare Plans

Bluewave Insurance

Home » Medigap Carrier Reviews » Mutual of Omaha Medicare Supplement Plans

Mutual of Omaha Medicare Supplement Plans

We are proud to offer Mutual Of Omaha as one of our trusted carriers. If you are looking for a free comparison contact us directly at (800) 208-4974 or apply directly online here.

Compare Medicare Supplement quotes from the Nation's top rated carriers for Free

Call us at 800-208-4974 or enter your details below for instant access

- View Quotes Instantly!

- Top A-Rated Carriers

- Compare All Plans

Carrier Background

Mutual of omaha medicare supplement plan f, mutual of omaha medicare supplement plan g reviews, mutual of omaha medicare supplement plan n, mutual of omaha medicare supplement plans in 2023, mutual of omaha medicare supplement rates, easy to use online policyholder portal, common client questions, our professional opinion.

Mutual Of Omaha Insurance Company was chartered in 1909 and offers a wide range of individual and group health and accident products across the country.

Mutual Of Omaha offers Medicare supplement plans A, F, G and N depending on the state you are in. Plans A and F are offered in ALL states. MOO is a mutual company and its subsidiaries include:

- United Of Omaha Life Insurance Company

- Companion Life Insurance Company

- United World Life Company

- Omaha Insurance Company

- Mutual Of Omaha Investors Services

- Omaha Financial Holdings

When you purchase a Medicare Supplement plan with Mutual of Omaha you get the following benefits:

- Portable Coverage

- Ability to see any doctor that accepts Medicare

- Guaranteed renewable coverage for life

- 30 Day free look period

- No policy fee

- 12% household discount (where available)

- Initial 12-month rate lock-in

- Foreign travel emergency coverage

Highlights with Mutual Of Omaha Medigap Policy:

- Easy electronic application

- Policies issued the same day (in most cases)

- Email delivery of temporary ID cards

- A convenient online portal to view EOB benefits

- Top-rated customer service and claims handling

Plan F is offered by Mutual Of Omaha, either direct or by one of their subsidiary companies. Because Plan F is a standardized Medigap plan, it is exactly the same no matter what company is offering it.

Plan F covers 100% of what Medicare does not pay in full; it is the most comprehensive Medigap plan available. Also, it is the most expensive premium wise.

We always recommend Plan G vs Plan F for reasons outlined here . See the chart below that shows what each Medigap plan covers.

Mutual Of Omaha Plan G

The Mutual Of Omaha Plan G is a very popular plan across the nation. Folks who purchase a Mutual Of Omaha Plan G pay a low monthly premium and have a fixed, annual deductible at the doctor’s office. The deductible on Plan G is $240 for 2024 . There are no copays with Plan G when you visit the doctor or specialist.

The chart above outlines the coverage between the most popular Medigap plans, F, G, and N. You will notice that the only difference between F and G is that the Part B deductible is not covered on Plan G. Other than that, there are no differences in coverage.

Top Reasons To Buy A Plan G From Mutual Of Omaha:

- Limited out-of-pocket costs of $240 in 2024

- Plan F may be unavailable for some folks.

View Plans Online

Compare rates online instantly.

Medicare Plan G remains one of the top Medigap plans in the country. We have many clients that are extremely satisfied with their supplemental plan from Mutual of Omaha. Plan G provides 100% coverage for all the “gaps” left over by Original Medicare (except for the Part B deductible). The Medicare Part B coinsurance is covered in full.

As with all companies, rates will go up over time. Mutual is no exception to this rule.

Plan N is the 3rd most popular Medigap plan and is offered by MOO. N is similar to G as it has the $240 annual deductible. Also, N has an office copay up to $20, $50 E.R. copay (waived if admitted), and Part B excess charges are not covered. (Excess charges can be easily avoided if you make sure the doctor is set up with “Medicare assignment”).

Read more: Part B Excess Charges

Plan N can be a great option for someone who doesn’t mind the office copays and wants to enjoy a lower premium than G or N.

Mutual Of Omaha will continue to offer Medigap plans in 2023. Plan F will no longer be offered to people who are turning 65 after January 1st, 2020. Folks who currently have a Plan F can keep it indefinitely, or they can change to a Plan G or N for a reduced premium.

Those people who were eligible for Medicare prior to Jan. 1st 2020 can still purchase a Plan F.

There are many factors that affect the price of your policy such as age, location, and gender. Here are some sample rates for a female age 65, non-tobacco in Dallas, Texas:

Agent Tip View personalized, custom quotes online instantly here.

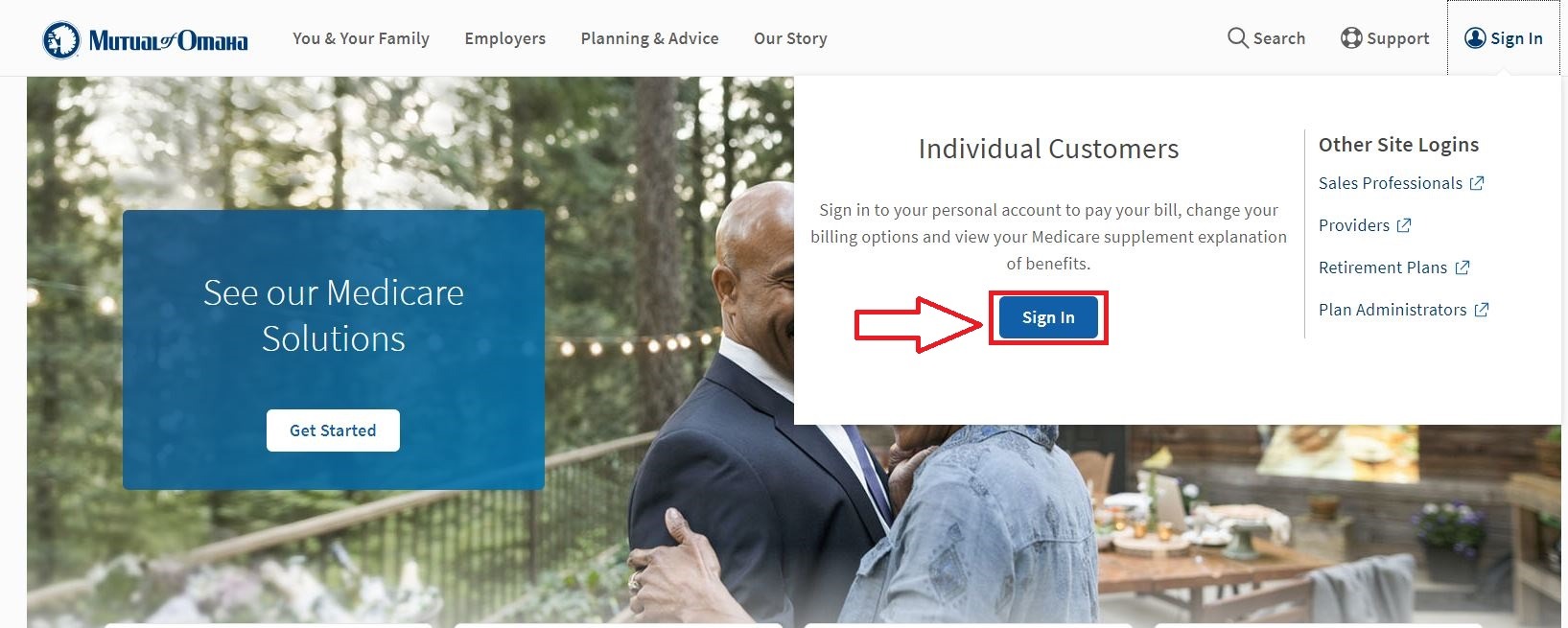

Mutual Of Omaha has one of the best online portals. Once your policy is issued you can register for an account online. Our clients find this extremely easy to use. Among other things, you will have the ability to view your explanation of benefits (EOB) online was your claims are processed. This can save you a lot of time, you won’t have to wait on hold with customer service just to order a new ID card or to pay a bill.

With the online portal you can do the following:

- Get Your Current Account Summary

- Review Your Policy Benefits and Claims Info

- Pay Bills Online

- Get a Duplicate ID Card or Policy

Yes, Mutual Of Omaha is a great option for your health insurance, a solid company with excellent customer service.

Mutual Of Omaha does have a dental plan option. The cost varies depending on where you live. This would be a separate policy from your Medicare supplement.

In most states, a vision benefit is included in your Medigap plan. This will cover basic things. Call us for any questions on this coverage.

In some states you will get a hearing discount program included with your supplement policy from Mutual of Omaha.

Part D is offered by Mutual in most states. Part D is separate from your Medigap plan and covers the prescriptions you get at the pharmacy. A separate premium is paid for Part D.

In most states, you can add a gym benefit to your Mutual of Omaha Medigap plan. The benefit is referred to as “Mutually Well.” It is an additional $25 per month and allows you to access over 10,000 gyms.

Our Mutual Of Omaha Medicare supplement review is overall a strong recommendation. The Medicare Plan G is the most popular plan offered by Mutual, mostly because there are no office visit copays to worry about.

A winning combination of stability and excellent customer service makes MOO a great option for your Medicare supplement insurance. The ability to receive ID cards and policies via email and through regular mail is a great feature that our clients love. In addition, Mutual Of Omaha boasts solid financial backing and great brand recognition among consumers.

For assistance, simply call us direct at (800) 208-4974, or you can APPLY ONLINE HERE . We would be happy to help you with your decision.

We are a unique insurance agency dedicated to assisting folks with Medicare. Learn how we are different here.

Alex Wender is the founder and CEO of Bluewave Insurance. He has been blogging about Medicare-related topics since 2010. Since then, he and his agency have helped thousands of people across the country choose the right Medicare to fit their needs.

Our Services

- Medicare Supplement Plans

- Medicare Advantage Plans

- Long Term Care Insurance

- Medicare Supplement FAQs

- Medicare 101

- Give Us A Call: 800-208-4974

- Rate Lookout

- Testimonials

Let’s Connect

- Share full article

Advertisement

Supported by

DealBook Newsletter

How Bad Is A.I. for the Climate?

Tech giants are building power-hungry data centers to run their artificial intelligence tools. The costs of that demand surge are becoming clearer.

By Andrew Ross Sorkin , Ravi Mattu , Bernhard Warner , Sarah Kessler , Michael J. de la Merced , Lauren Hirsch and Ephrat Livni

A.I.’s carbon problem

The boom in artificial intelligence has minted billions in (paper) wealth for tech giants like Microsoft and Amazon . But there’s an overlooked set of winners as well: utilities and energy companies.

The power demands of the huge data centers that underpin the A.I. revolution keep growing. Wall Street is taking notice — but the climate effect isn’t getting as much attention.

The A.I. boom is supercharging markets’ interest in power . One sign of investor enthusiasm: The S&P 500’s utilities sector is up nearly 8 percent this year, outpacing the benchmark index overall.

Tech’s energy needs are coming into focus as investors get to grips with how much of an “ energy hog ” generative A.I. is becoming. Analysts at Wells Fargo see the A.I. boom helping to push up U.S. electricity demand by as much as 20 percent by 2030.

Shares in Dominion Energy rose last week after the company said it expected to supply 15 new data centers this year, some requiring a gigawatt or more of electricity. (For perspective, a gigawatt powers about 750,000 homes.)

And Microsoft announced a $10 billion green-energy deal with Brookfield Asset Management to supply electricity to some of its data centers.

Reporting earnings on Tuesday is Duke Energy, another utility with a big data center business.

But the A.I. revolution will largely run on fossil fuels. There’s a push underway to ensure that this increased energy demand is met with lower-carbon sources — consider the Microsoft initiative, or Amazon’s $650 million acquisition of a Pennsylvania center that sits next to one of the biggest U.S. nuclear power plants .

However, A.I. power demands are likely to be fulfilled largely by natural gas this decade, according to the Wells Fargo analysts. That could throw the climate pledges of utilities and tech giants alike into disarray.

Surya Hendry, an analyst at Rystad Energy, wrote in a research note last month that “rising data center demand creates a tough problem for utility companies, technology companies and policymakers who want clean energy.”

That energy crunch could affect climate policy. The Environmental Protection Agency last month issued new emission-cutting guidelines for power plants that run on fossil fuels.

But there already is pushback : There are “concerns that the rule could threaten grid reliability at a time when energy demand needs from A.I. is rising,” Sara Mahaffy, an analyst at RBC Capital Markets, wrote to investors last week.

HERE’S WHAT’S HAPPENING

Howard Schultz pushes Starbucks to fix its slumping business. The coffee chain’s former C.E.O., who left the company in April 2023, wrote on LinkedIn that its “U.S. operations are the primary reason for the company’s fall from grace ” and called for improvements to mobile ordering and more. The company reported disappointing quarterly earnings and profit forecasts last week, in part because of a drop in customer visits to stores.

Paramount begins deal negotiations with Sony and Apollo. The move to begin formal talks with the consortium about its $26 billion takeover bid, first reported by The Times, came after Paramount’s board let a period of exclusive merger talks lapse with the studio Skydance. That said, Paramount is continuing discussions with Skydance as well.

The Israeli military warns thousands in Rafah to leave. The announcement to residents of areas of the Gazan city signals that Prime Minister Benjamin Netanyahu may order an invasion that Israeli allies, including the U.S., have warned him against.

Andrew’s dispatch from Omaha

I just got back from Omaha, where 18,000 people gathered for Warren Buffett’s annual “Woodstock for capitalists,” also known as Berkshire Hathaway’s annual meeting . I have to admit that I cried twice this year. Once was during a movie about Buffett’s friendship with his longtime business partner, Charlie Munger, who died last year at age 99. ( Watch it here ). The other was when Buffett highlighted the $1 billion gift of Berkshire shares that Ruth Gottesman gave this year to the Albert Einstein College of Medicine, designed to make the Bronx school tuition-free in perpetuity. It underscored what a successful business can do for society: “That’s why Charlie and I have had so much fun running Berkshire,” Buffett said.

The Oracle of Omaha was still in good form at age 93 without Munger, though he acknowledged being less energetic in several instances during the meeting. In one poignant moment, when he finished one of his answers, he accidentally said “Charlie?” out of habit instead of calling on his chosen successor, Greg Abel, who sat next to him for the first time (along with Ajit Jain, Berkshire’s insurance guru).

The biggest news of the day was his disclosure that he trimmed his position in Apple — though he also praised Tim Cook, who was in the audience. Politics aficionados will try to read the tea leaves on what Buffett, historically a Democrat, meant about the upcoming election when he said this: “I shouldn’t be taking on any four-year employment contracts, like several people are doing in this world.”

Buffett ended the day by saying, “I not only hope you come next year, I hope I come next year.”

Xi Jinping bets on Europe to take on the U.S.

President Xi Jinping of China will meet his French counterpart, Emmanuel Macron, in Paris on Monday, with trade high on the agenda.

It’s Xi’s first trip to Europe in five years , and Beijing believes it can exploit tensions between the continent and the U.S. to disrupt President Biden’s use of global alliances to counter China.

Washington will be watching closely. Macron has called for Europe to take a different approach to China than the U.S. is taking. That’s despite him also warning that Europe risks falling behind in key sectors, including electric vehicles.

Macron and Ursula von der Leyen, the president of the European Commission, are expected to press Xi on reducing Europe’s €291 billion ($313 billion) trade imbalance with China, as well as Beijing’s support of Russia’s full-scale invasion of Ukraine. Xi will warn about trade protectionism and economic security, Yu Jie, a senior fellow on China at the British think tank Chatham House, told DealBook.

There are areas of potential cooperation. The French cosmetics and agricultural industries hope the talks will lead to better access to the Chinese market. And a big Chinese order for Airbus planes may also be on the agenda.

But the meeting has implications for China’s wider relations with the West. Biden has worked with other governments to blunt China’s influence and reach. Some European companies, such as the Dutch semiconductor equipment supplier ASML, are playing ball.

But Beijing sees weak points in that united front, especially if Donald Trump is re-elected and withdraws support for Ukraine. That could prod Europe to turn to China to help end the Russian invasion.

There are plenty of divides between Europe and the U.S. on China. Macron told Politico last year that Europe shouldn’t blindly follow Washington on issues like Taiwan. And von der Leyen has called for “de-risking” rather than “decoupling” when it comes to China.

Germany looms large, even though Xi isn’t going there this trip. China is Germany’s biggest trading partner , and German investments there hit a record last year. Beijing is hoping to exploit those close links: The German government is considering scaling back plans to increase scrutiny of Chinese investments, The Wall Street Journal reported last month.

The divisions are playing out in electric vehicles. Biden has called Chinese E.V.s a national security threat, and some European carmakers , like France’s Renault, want restrictions to protect them.

But German giants, including Mercedes-Benz and Volkswagen , are warning that protectionism would hurt competition and innovation.

What to expect from the Davos of the West

The Beverly Hills Hotel is full of suits and security this week, which means one thing: It’s time for this year’s Milken Institute Global Conference.

The annual event is no longer just for financiers. Corporate executives, politicians and celebrities come to network, raise money, or to do both. (At least one of Bravo’s Real Housewives was seen dining at a nearby hotel, and while DealBook couldn’t confirm whether she was attending the conference, her dining companion was talking about one of their SPACs, a Milken-relevant topic.)

DealBook’s Lauren Hirsch is on hand in Los Angeles to get the inside dish from the Davos of the West.

Plenty of prominent attendees are set to speak. Starting on Monday, panels will feature:

Ken Griffin, the C.E.O. of Citadel, who most likely will be asked to weigh in on the election (he backed Nikki Haley) and on college student protests (he cut his funding to Harvard last year);

Senators Joe Manchin of West Virginia and Kyrsten Sinema of Arizona, who are on a panel about the polarized state of U.S. politics. Will Sinema say what her post-retirement gig is?

Elon Musk, who is set to close out Monday’s activities in what is sure to be a hotly attended event;

And Bill Clinton, who’ll be centerpiece of a closing plenary on Wednesday.

For those in need of a workout, free exercise classes are being provided by Dogpound, the celebrity gym known for preparing Taylor Swift for her Eras tour .

The conference isn’t shying away from divisive topics, unlike other gatherings such as the World Economic Forum and Saudi Arabia’s Future Investment Initiative. One panel is focused on antisemitism, with speakers including Daniel Lubetzky, the founder of the snack company Kind, and the journalist Bari Weiss.

An invite-only panel is devoted to the “progress and pushback” around the corporate diversity, equity and inclusion movement, featuring the financier Bill Ackman and John Hope Bryant, the founder of the nonprofit Operation Hope.

Is Milken becoming a safe space for C.E.O.s? Some attendees have mused to DealBook that the gathering is becoming a more welcoming place for them to speak out than, say, at Davos.

That might become even more true if Donald Trump, who has had a complex relationship with Davos and who as president pardoned Michael Milken , were to be re-elected.

The week ahead

Earnings and iPads are dominating the calendar. Here’s what to watch:

Tuesday: Apple plans to introduce new iPads amid a slowdown in its tablet business. On the earnings front, BP, Disney, and Saudi Aramco are set to release quarterly results.

Wednesday: AB InBev, Airbnb, Arm, Shopify and Uber will report earnings.

Thursday: It’s decision day for the Bank of England. The central bank is expected to stand pat on interest rates and to give further clues on whether it’s ready to cut them as soon as next month.

Friday: The University of Michigan is scheduled to publish its latest consumer sentiment survey.

THE SPEED READ

“Tensions Rise in Silicon Valley Over Sales of Start-Up Stocks ” (NYT)

The board of Sabadell, a Spanish bank, is reportedly meeting on Monday to consider a $12.9 billion takeover bid by its larger rival Santander, which would create one of Europe’s biggest lenders. (Reuters)

How the Biden administration is rushing to prevent Donald Trump from undoing its raft of regulatory changes via executive order if he wins in November. (WSJ)

“The Rise, Reinvention and Incomplete Fall of a Washington Lobbying Legend ” (Politico)

Best of the rest

Shell is said to have sold millions of phantom carbon credits to Canadian shale oil producers. (FT)

How a wave of American investors transformed the English soccer experience , and upset fans. (NYT Magazine)

We’d like your feedback! Please email thoughts and suggestions to [email protected] .

Andrew Ross Sorkin is a columnist and the founder and editor at large of DealBook. He is a co-anchor of CNBC’s "Squawk Box" and the author of “Too Big to Fail.” He is also a co-creator of the Showtime drama series "Billions." More about Andrew Ross Sorkin

Ravi Mattu is the managing editor of DealBook, based in London. He joined The New York Times in 2022 from the Financial Times, where he held a number of senior roles in Hong Kong and London. More about Ravi Mattu

Bernhard Warner is a senior editor for DealBook, a newsletter from The Times, covering business trends, the economy and the markets. More about Bernhard Warner

Sarah Kessler is an editor for the DealBook newsletter and writes features on business and how workplaces are changing. More about Sarah Kessler

Michael de la Merced joined The Times as a reporter in 2006, covering Wall Street and finance. Among his main coverage areas are mergers and acquisitions, bankruptcies and the private equity industry. More about Michael J. de la Merced

Lauren Hirsch joined The Times from CNBC in 2020, covering deals and the biggest stories on Wall Street. More about Lauren Hirsch

Ephrat Livni reports from Washington on the intersection of business and policy for DealBook. Previously, she was a senior reporter at Quartz, covering law and politics, and has practiced law in the public and private sectors. More about Ephrat Livni

IMAGES

COMMENTS

Learn about the benefits, costs and availability of Plan G, a popular Medigap plan that covers most Medicare out-of-pocket costs. Compare Plan G with other standardized Medigap plans and find out if Mutual of Omaha offers it in your area.

Plan G is a popular option with Mutual of Omaha that covers everything Medicare does not pay, except for a $240 deductible per year. Learn how Plan G can save you money, lower rate increases, and offer more freedom than Plan F or N.

Plan G covers most of the Medicare Part A and Part B costs, except for the Part B deductible ($240 in 2024) or a high deductible option ($2,800 in 2024). Learn how Plan G compares to other Medigap plans and how to apply for it from Mutual of Omaha.

Learn how Medicare supplement insurance policies can help cover out-of-pocket costs and provide flexibility and security. Compare plans, prices, and benefits of Mutual of Omaha, underwritten by Mutual of Omaha Insurance Company.

Medicare Supplement Plan G is the most comprehensive plan for new Medicare beneficiaries, covering all Medicare-related costs after the Part B deductible. Learn how Plan G works, what it covers, and how much it costs in different markets.

Medigap Plan G is the most comprehensive Medicare Supplement Insurance plan that all Medicare members can buy. It's also the most popular of these plan types. [1] . Plan G covers nearly all of ...

Compare and apply for Medicare supplement insurance plans underwritten by United World Life Insurance Company. Find out about prescription drug plans, dental insurance, and other benefits and services.

Learn about the different Medicare Supplement plans, including Plan G, which covers everything except the Part B deductible. Compare the benefits, costs and limitations of each plan and find out how to enroll.

See why Mutual of Omaha Medicare Plan G is one of the best options on the market today. You get network freedom and comprehensive coverage. ... a nonsmoker, might pay for Medicare Supplement insurance Plan G compared to other popular Medigap plans: Medigap Plan Premium Gender/Age State; Plan G: $105.62: Male/65: TX: Plan F: $195.00: Female/70 ...

Learn about the benefits, costs, and coverage of Mutual of Omaha Medicare Supplement Plan G, one of the most comprehensive plans that covers all Original Medicare gaps except for the Part B deductible. Compare rates, find plans in your area, and get expert advice from SimpleAdvisor.com.

Learn about the benefits, costs, and rate increases of Plan G, the most popular Medigap plan that covers all gaps to Original Medicare except the Part B deductible. Compare Plan G with other plans and find out how to enroll with Mutual of Omaha.

Find an Affordable Medicare Supplement Insurance Plan Today! Compare free quotes from each type of plan in your area. Enter ZIP Code. Get started. Or chat with a licensed agent to learn more. 1-800-995-6408. 1-800-995-6408. * Rating only refers to the overall financial status of the company and is not a recommendation of the specific policy ...

Mutual of Omaha offers Plan G, which is the most comprehensive Medicare Supplement Insurance plan that covers all out-of-pocket expenses except the Part B deductible. Learn about the benefits, costs, and enrollment of Plan G from this reputable insurer.

Mutual of Omaha's Plan G costs roughly $120 per month, which is competitive industry-wide for Plan G. On average, rates increase across the insurance industry 6% to 9% per year and are specific ...

On average, Mutual of Omaha's estimated prices for Medigap Plan G were about 22% higher than the least-expensive Plan G policy in the area. Mutual of Omaha price Medicare.gov lowest price

The Bottom Line. Blue Cross Blue Shield and Mutual of Omaha are the best overall Medicare Supplement Plan G providers. Mutual of Omaha stands out because the company offers a widely available high-deductible Plan G, has excellent pricing, and high financial strength ratings.

Mutual of Omaha is one of the many private insurers that offer Medigap policies, including Plan G. Founded in 1909, this insurance and financial services company has a long-standing, reputable history. Mutual of Omaha offers Medigap insurance in 49 US states, as well as Washington, DC. When you purchase Medicare Supplement Plan G through Mutual ...

Folks who purchase a Mutual Of Omaha Plan G pay a low monthly premium and have a fixed, annual deductible at the doctor's office. The deductible on Plan G is $240 for 2024. There are no copays with Plan G when you visit the doctor or specialist. The chart above outlines the coverage between the most popular Medigap plans, F, G, and N.

The plans are guaranteed renewable, meaning they will not be cancelled as long as premiums are paid on time. To learn more about the Medicare Supplement Insurance plans available from Mutual of Omaha Insurance Company call 1-800-995-4219 or request a free plan comparison online.

Customer Access is a secure customer service application provided by Mutual of Omaha. Please login or register to access your policy and customer information.

Licensed insurance agents are authorized to sell this Medicare supplement insurance policy on behalf of Mutual of Omaha Insurance Company. This information may be verified by contacting the Ohio Department of Insurance at 50 W. Town St., 3rd Fl., Suite 300, Columbus, OH 43215 or call 1-800-686-1526 .

Company, Omaha Insurance Company, United World Life Insurance Company and Omaha Supplemental Insurance Company. 2American Academy of Ophthalmology, "Frequency of Ocular Examinations," 2009. Not available in NY. Now, it's easier than ever to care for your eyes - and your overall health. Your Mutual of Omaha company¹ insurance policy(s ...

Accounts - Mutual of Omaha ... Loading… ...

Shares in Dominion Energy rose last week after the company said it expected to supply 15 new data ... Berkshire's insurance guru). ... Apple plans to introduce new iPads amid a slowdown in its ...