How to Write a Small Business Financial Plan

Noah Parsons

4 min. read

Updated April 22, 2024

Creating a financial plan is often the most intimidating part of writing a business plan.

It’s also one of the most vital. Businesses with well-structured and accurate financial statements are more prepared to pitch to investors, receive funding, and achieve long-term success.

Thankfully, you don’t need an accounting degree to successfully create your budget and forecasts.

Here is everything you need to include in your financial plan, along with optional performance metrics, funding specifics, mistakes to avoid , and free templates.

- Key components of a financial plan

A sound financial plan is made up of six key components that help you easily track and forecast your business financials. They include your:

Sales forecast

What do you expect to sell in a given period? Segment and organize your sales projections with a personalized sales forecast based on your business type.

Subscription sales forecast

While not too different from traditional sales forecasts—there are a few specific terms and calculations you’ll need to know when forecasting sales for a subscription-based business.

Expense budget

Create, review, and revise your expense budget to keep your business on track and more easily predict future expenses.

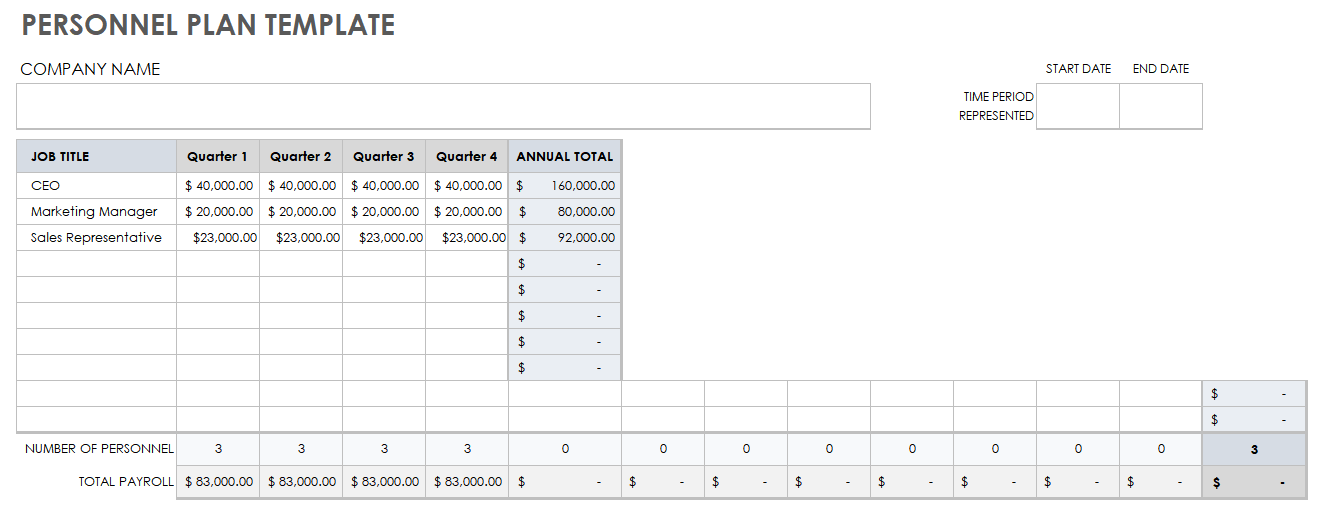

How to forecast personnel costs

How much do your current, and future, employees’ pay, taxes, and benefits cost your business? Find out by forecasting your personnel costs.

Profit and loss forecast

Track how you make money and how much you spend by listing all of your revenue streams and expenses in your profit and loss statement.

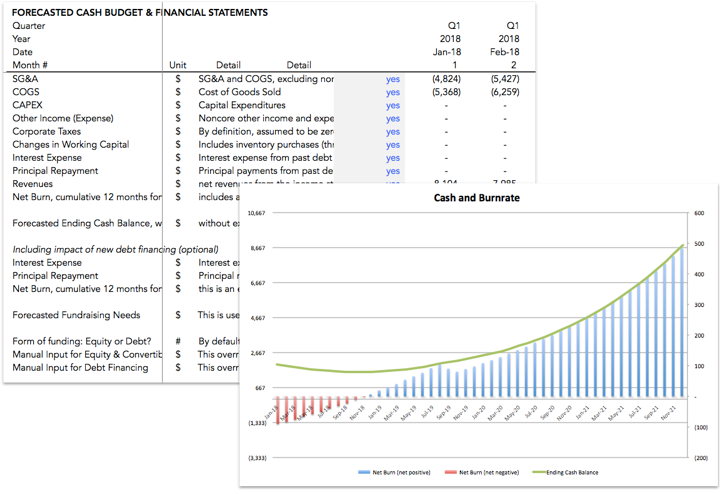

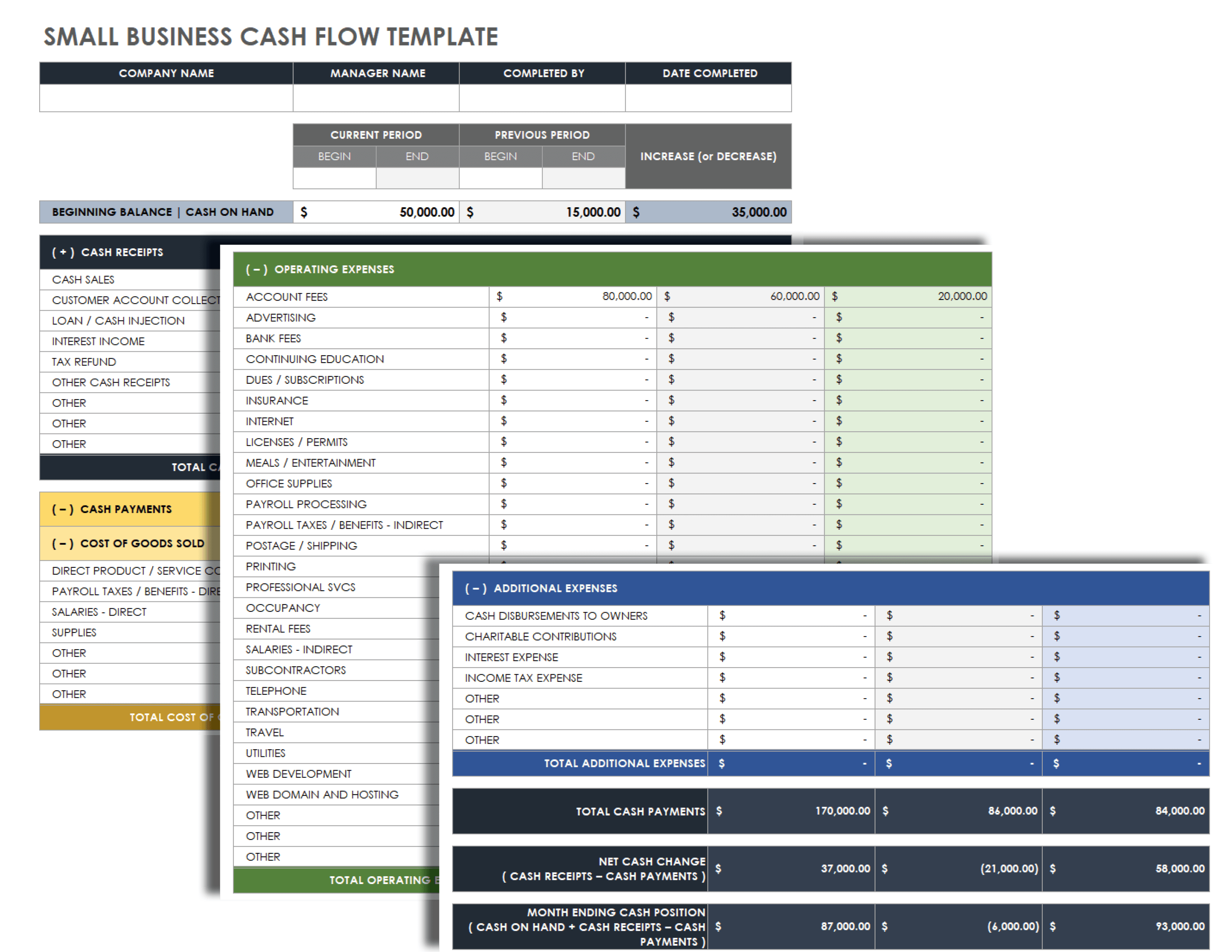

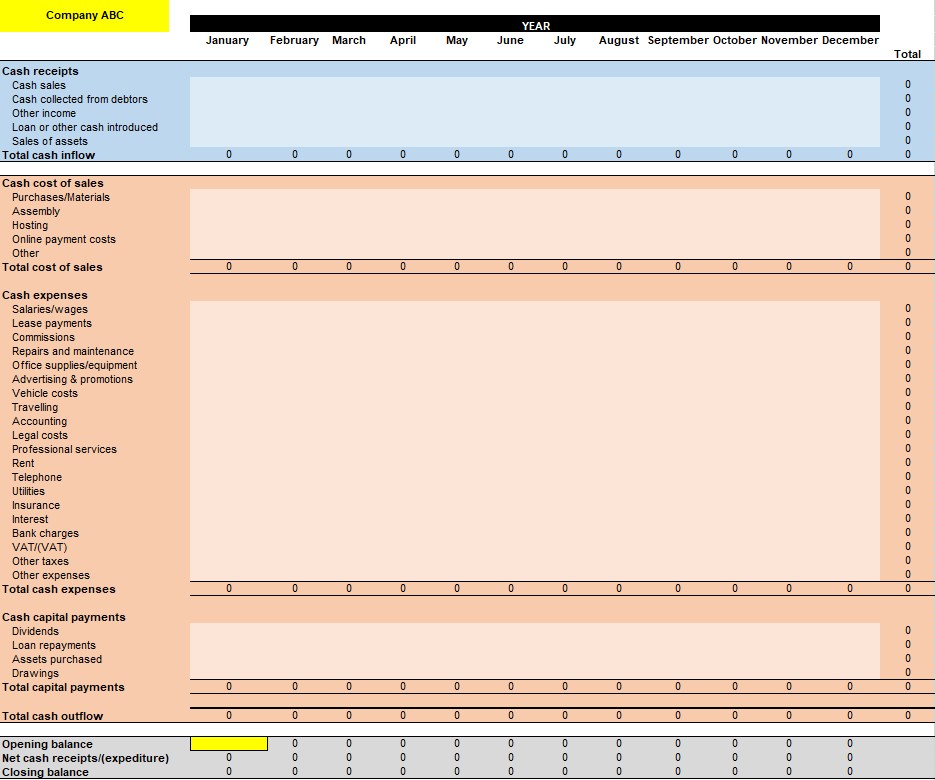

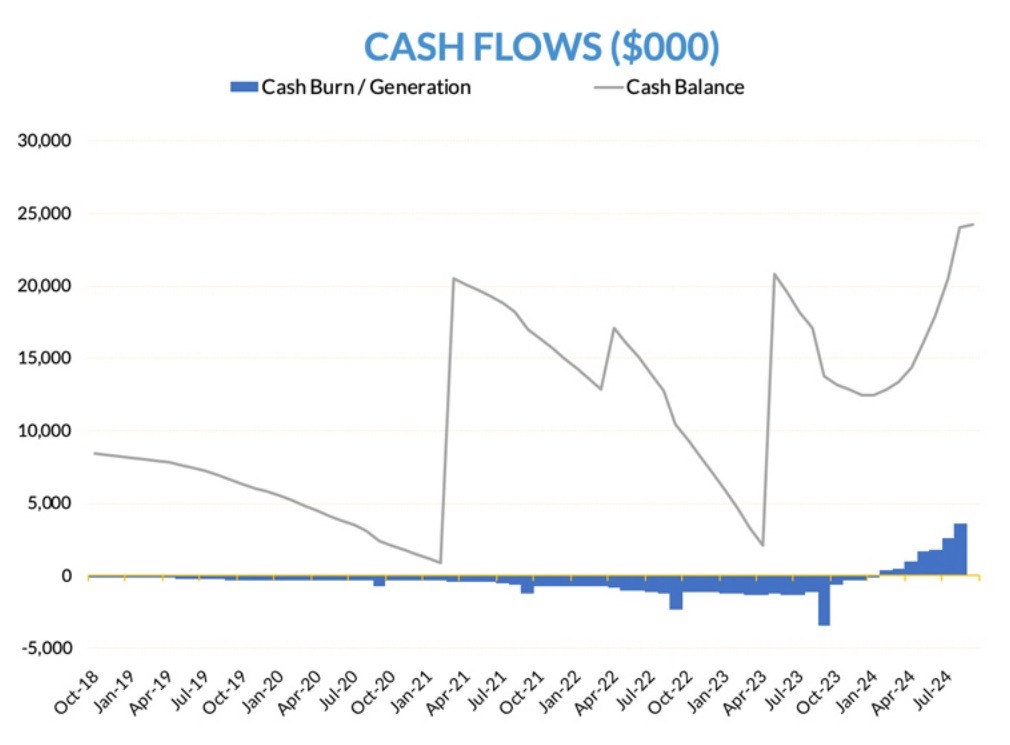

Cash flow forecast

Manage and create projections for the inflow and outflow of cash by building a cash flow statement and forecast.

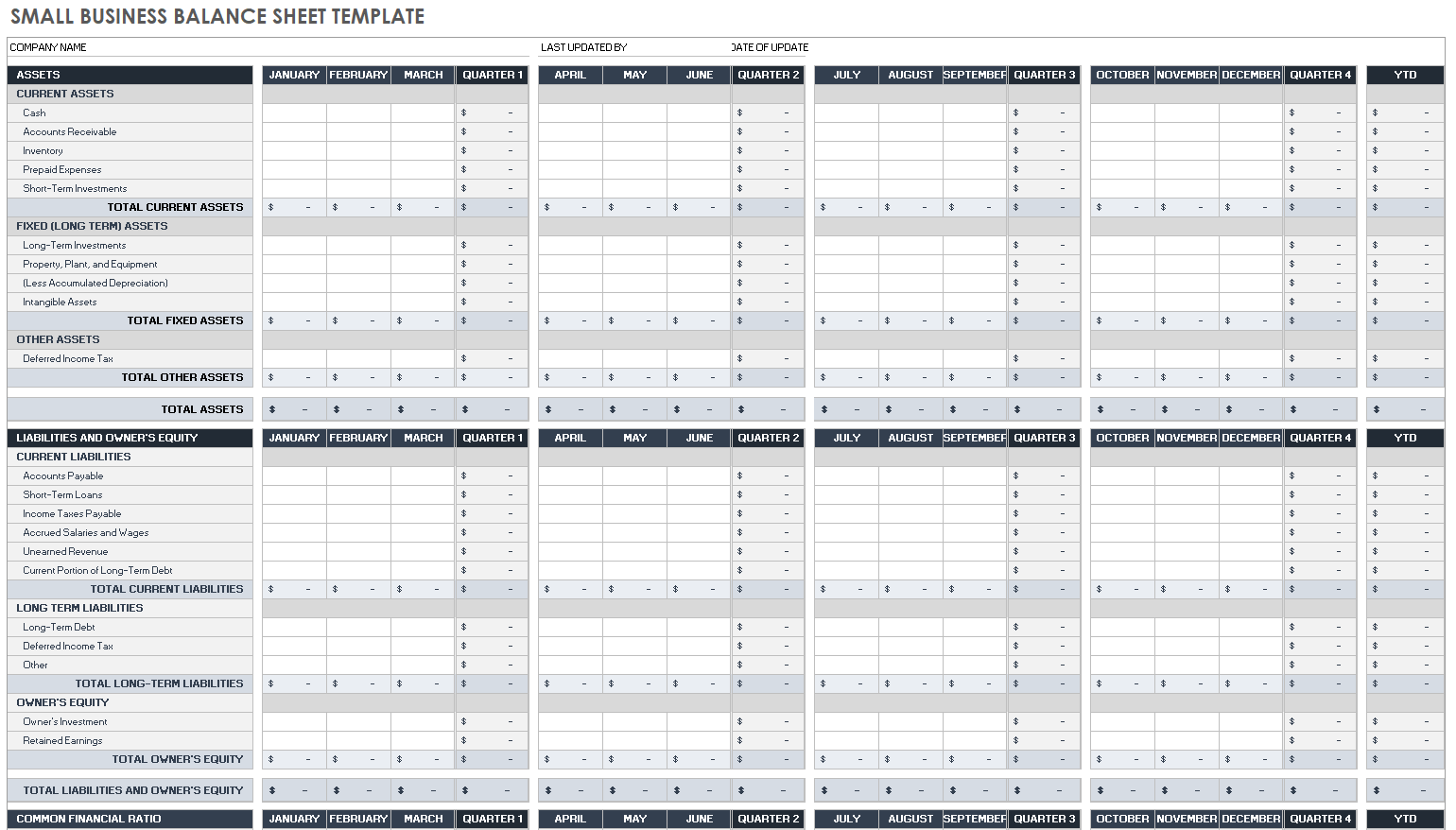

Balance sheet

Need a snapshot of your business’s financial position? Keep an eye on your assets, liabilities, and equity within the balance sheet.

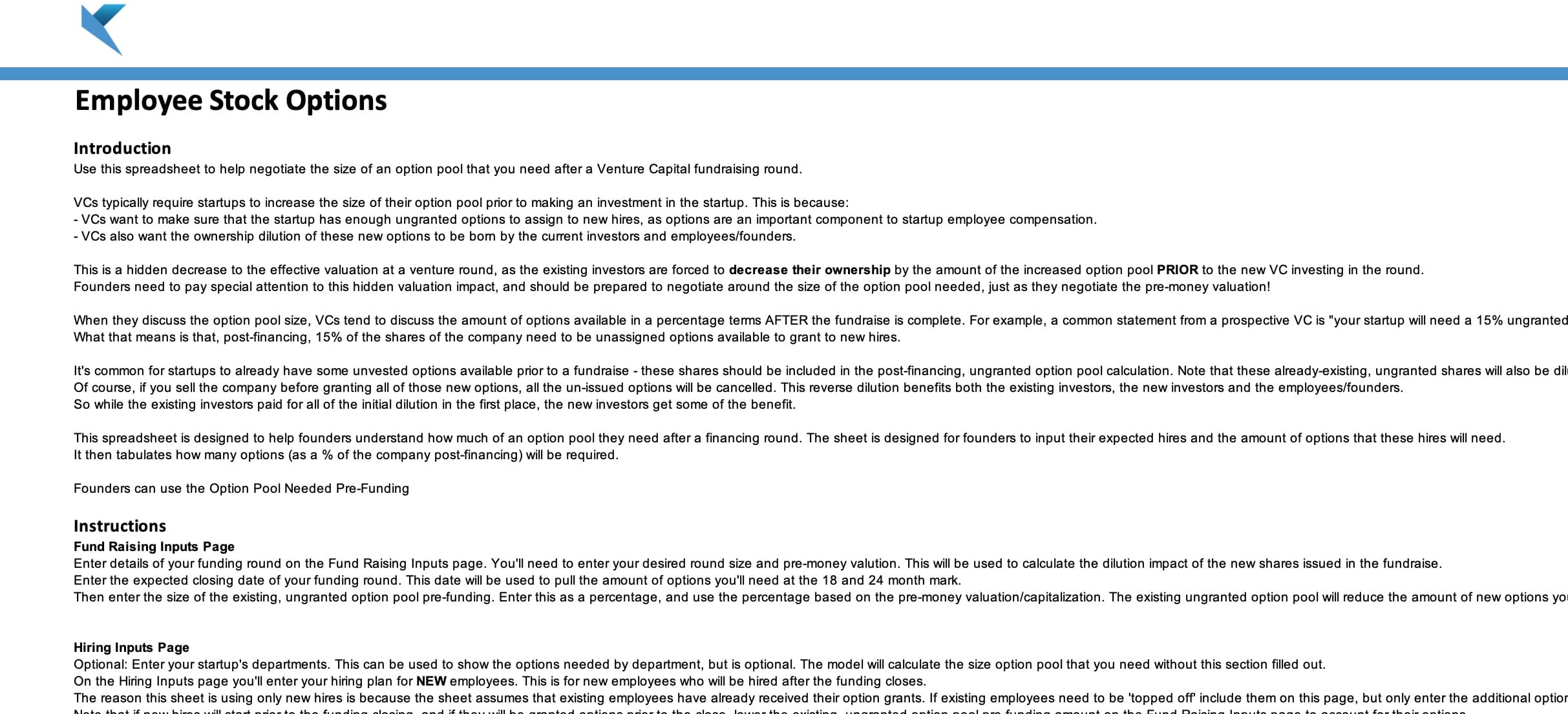

What to include if you plan to pursue funding

Do you plan to pursue any form of funding or financing? If the answer is yes, then there are a few additional pieces of information that you’ll need to include as part of your financial plan.

Highlight any risks and assumptions

Every entrepreneur takes risks with the biggest being assumptions and guesses about the future. Just be sure to track and address these unknowns in your plan early on.

Plan your exit strategy

Investors will want to know your long-term plans as a business owner. While you don’t need to have all the details, it’s worth taking the time to think through how you eventually plan to leave your business.

- Financial ratios and metrics

With your financial statements and forecasts in place, you have all the numbers needed to calculate insightful financial ratios.

While including these metrics in your plan is entirely optional, having them easily accessible can be valuable for tracking your performance and overall financial situation.

Key financial terms you should know

It’s not hard. Anybody who can run a business can understand these key financial terms. And every business owner and entrepreneur should know them.

Common business ratios

Unsure of which business ratios you should be using? Check out this list of key financial ratios that bankers, financial analysts, and investors will want to see.

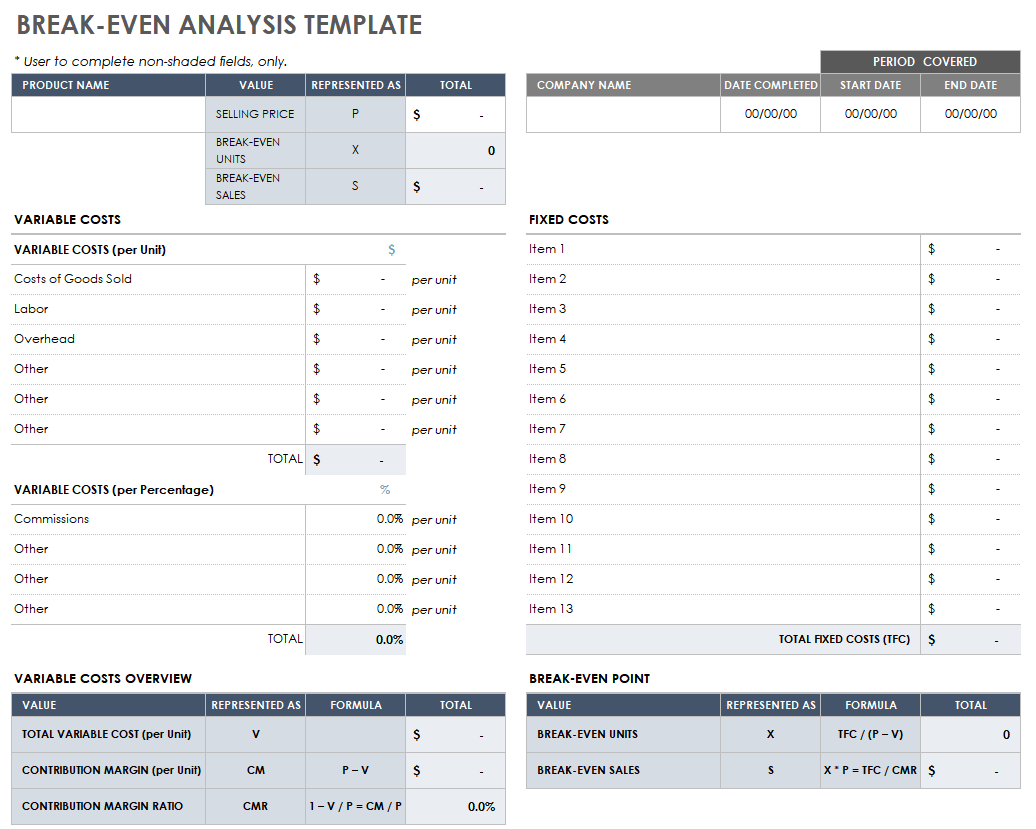

Break-even analysis

Do you want to know when you’ll become profitable? Find out how much you need to sell to offset your production costs by conducting a break-even analysis.

How to calculate ROI

How much could a business decision be worth? Evaluate the efficiency or profitability by calculating the potential return on investment (ROI).

- How to improve your financial plan

Your financial statements are the core part of your business plan that you’ll revisit most often. Instead of worrying about getting it perfect the first time, check out the following resources to learn how to improve your projections over time.

Common mistakes with business forecasts

I was glad to be asked about common mistakes with startup financial projections. I read about 100 business plans per year, and I have this list of mistakes.

How to improve your financial projections

Learn how to improve your business financial projections by following these five basic guidelines.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- Financial plan templates and tools

Download and use these free financial templates and calculators to easily create your own financial plan.

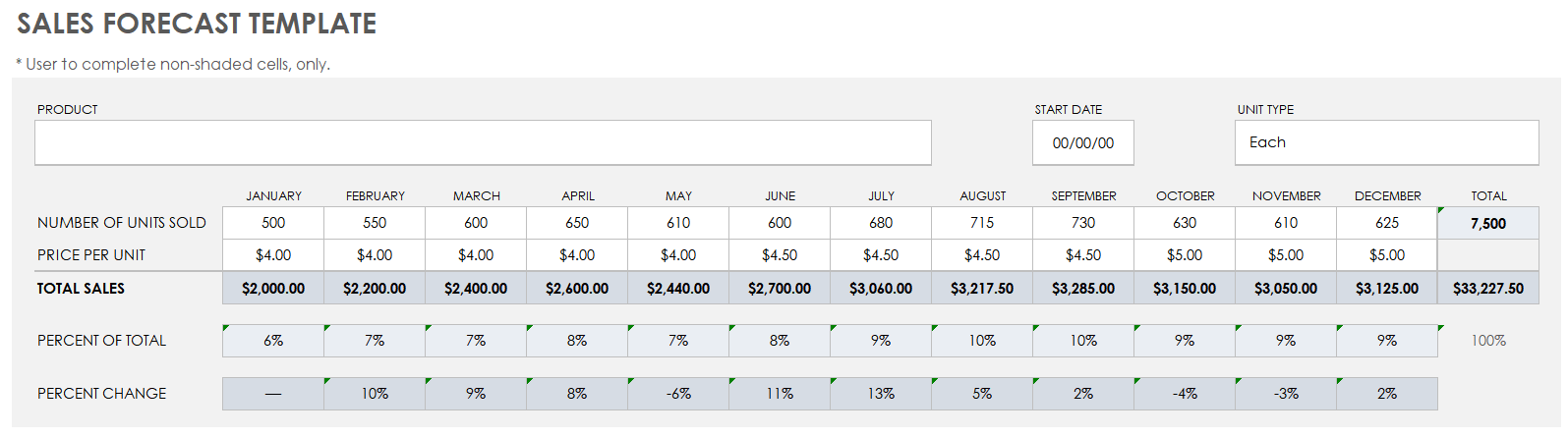

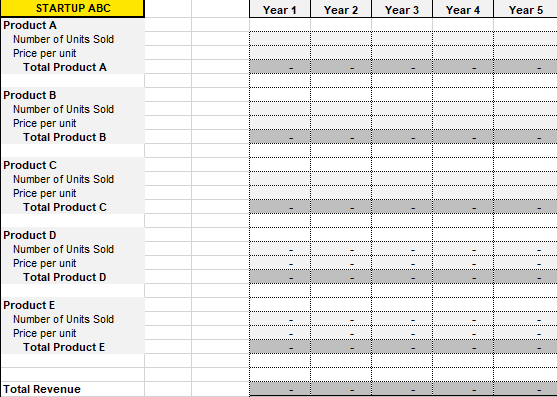

Sales forecast template

Download a free detailed sales forecast spreadsheet, with built-in formulas, to easily estimate your first full year of monthly sales.

Download Template

Accurate and easy financial forecasting

Get a full financial picture of your business with LivePlan's simple financial management tools.

Get Started

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

.png?format=auto)

Table of Contents

- What to include for funding

Related Articles

10 Min. Read

How to Set and Use Milestones in Your Business Plan

24 Min. Read

The 10 AI Prompts You Need to Write a Business Plan

3 Min. Read

What to Include in Your Business Plan Appendix

How to Write the Company Overview for a Business Plan

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

- 400+ Sample Business Plans

- WHY UPMETRICS?

Customer Success Stories

Business Plan Course

Strategic Planning Templates

E-books, Guides & More

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai Pitch Deck Generator

Strategic Planning

See How Upmetrics Works →

- Sample Plans

Small Business Tools

How to Prepare a Financial Plan for Startup Business (w/ example)

Free Financial Statements Template

Ajay Jagtap

- December 7, 2023

13 Min Read

If someone were to ask you about your business financials, could you give them a detailed answer?

Let’s say they ask—how do you allocate your operating expenses? What is your cash flow situation like? What is your exit strategy? And a series of similar other questions.

Instead of mumbling what to answer or shooting in the dark, as a founder, you must prepare yourself to answer this line of questioning—and creating a financial plan for your startup is the best way to do it.

A business plan’s financial plan section is no easy task—we get that.

But, you know what—this in-depth guide and financial plan example can make forecasting as simple as counting on your fingertips.

Ready to get started? Let’s begin by discussing startup financial planning.

What is Startup Financial Planning?

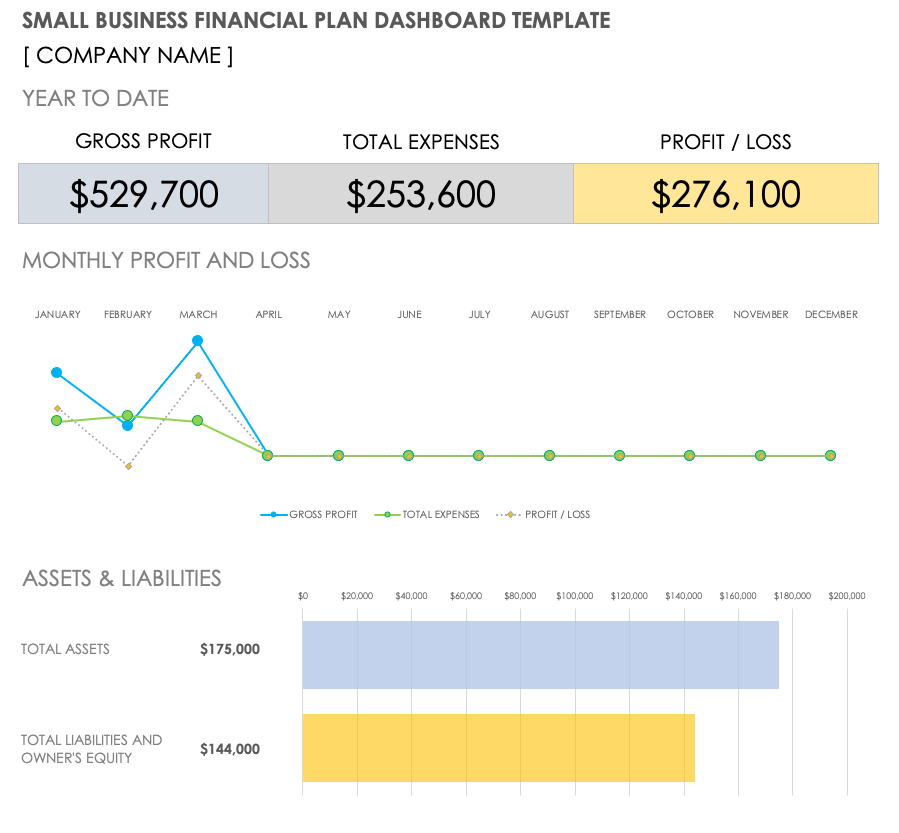

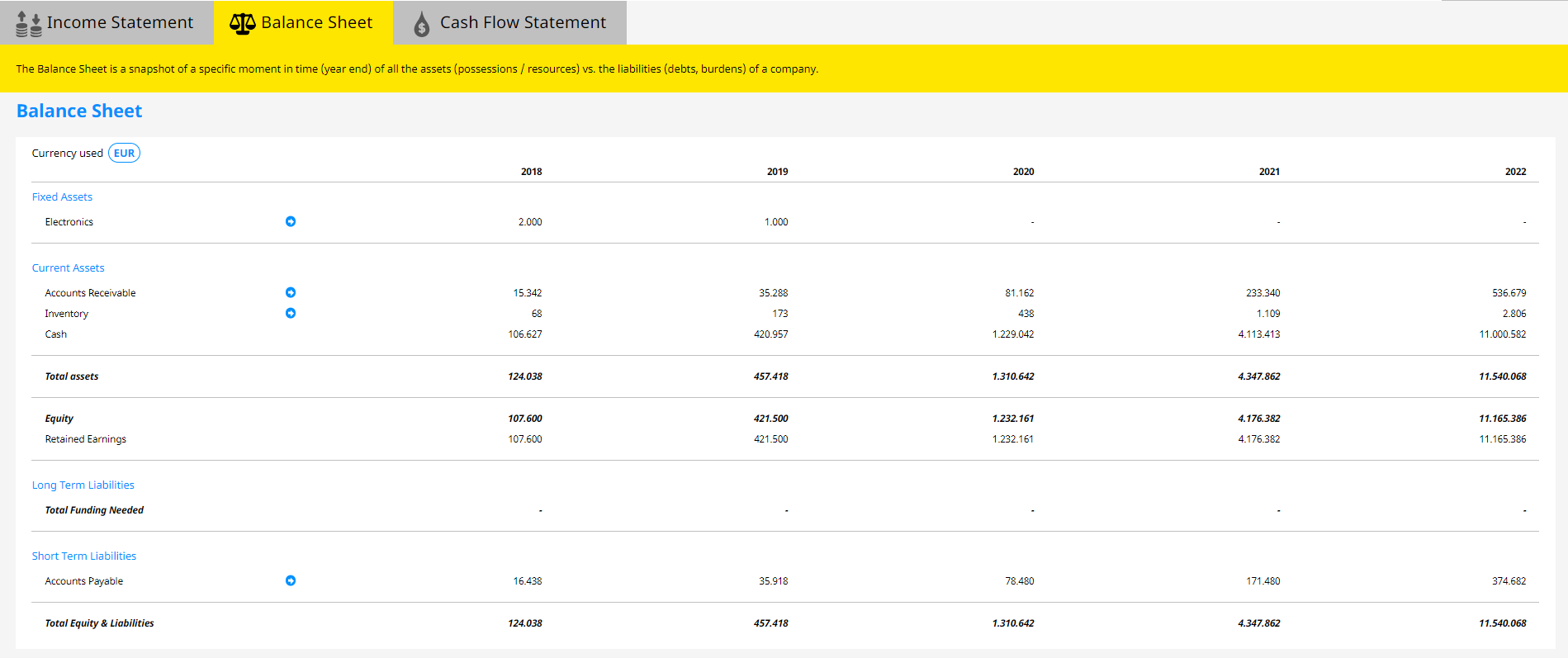

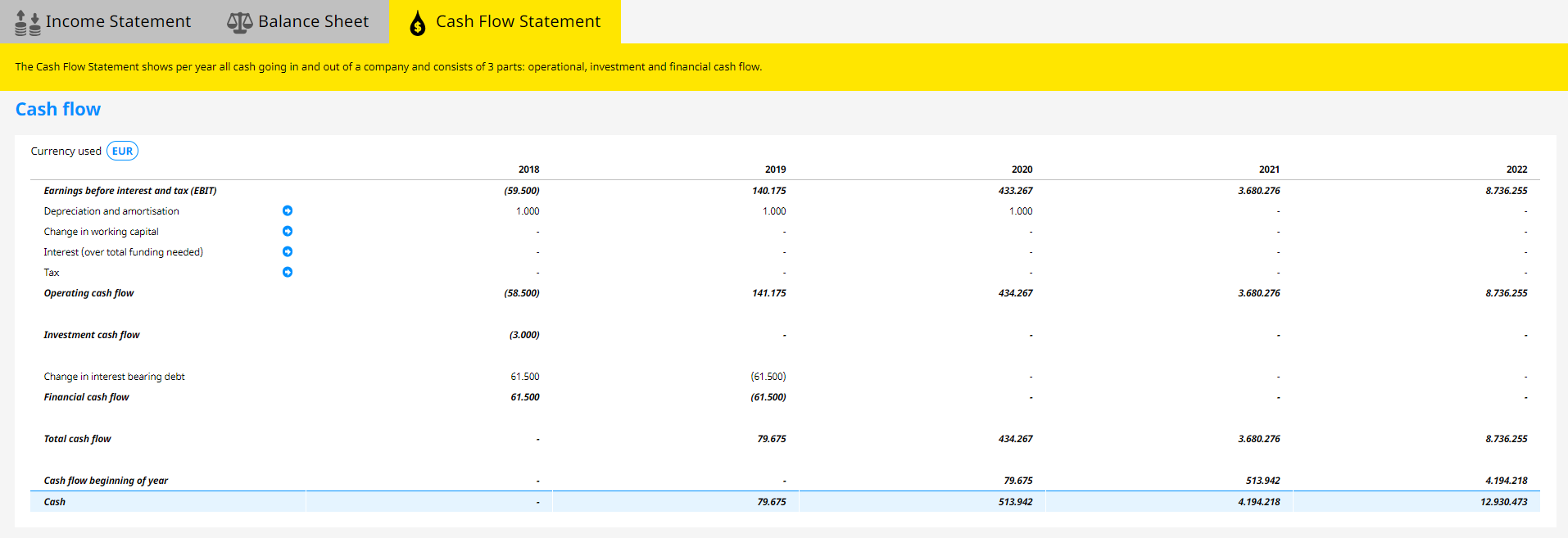

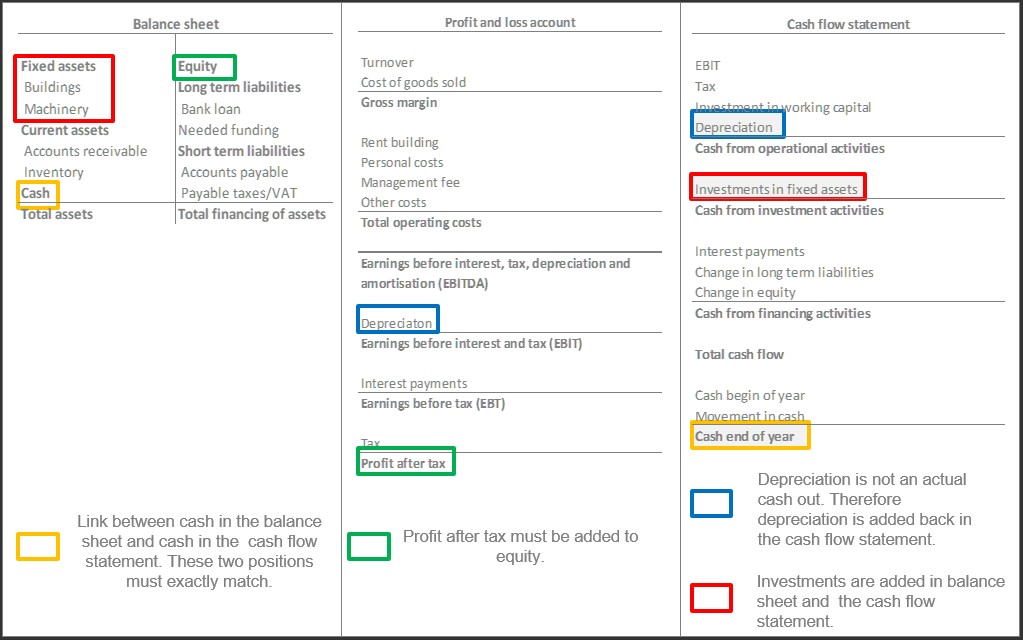

Startup financial planning, in simple terms, is a process of planning the financial aspects of a new business. It’s an integral part of a business plan and comprises its three major components: balance sheet, income statement, and cash-flow statement.

Apart from these statements, your financial section may also include revenue and sales forecasts, assets & liabilities, break-even analysis , and more. Your first financial plan may not be very detailed, but you can tweak and update it as your company grows.

Key Takeaways

- Realistic assumptions, thorough research, and a clear understanding of the market are the key to reliable financial projections.

- Cash flow projection, balance sheet, and income statement are three major components of a financial plan.

- Preparing a financial plan is easier and faster when you use a financial planning tool.

- Exploring “what-if” scenarios is an ideal method to understand the potential risks and opportunities involved in the business operations.

Why is Financial Planning Important to Your Startup?

Poor financial planning is one of the biggest reasons why most startups fail. In fact, a recent CNBC study reported that running out of cash was the reason behind 44% of startup failures in 2022.

A well-prepared financial plan provides a clear financial direction for your business, helps you set realistic financial objectives, create accurate forecasts, and shows your business is committed to its financial objectives.

It’s a key element of your business plan for winning potential investors. In fact, YC considered recent financial statements and projections to be critical elements of their Series A due diligence checklist .

Your financial plan demonstrates how your business manages expenses and generates revenue and helps them understand where your business stands today and in 5 years.

Makes sense why financial planning is important to your startup, doesn’t it? Let’s cut to the chase and discuss the key components of a startup’s financial plan.

Say goodbye to old-school excel sheets & templates

Make accurate financial plan faster with AI

Plans starting from $7/month

Key Components of a Startup Financial Plan

Whether creating a financial plan from scratch for a business venture or just modifying it for an existing one, here are the key components to consider including in your startup’s financial planning process.

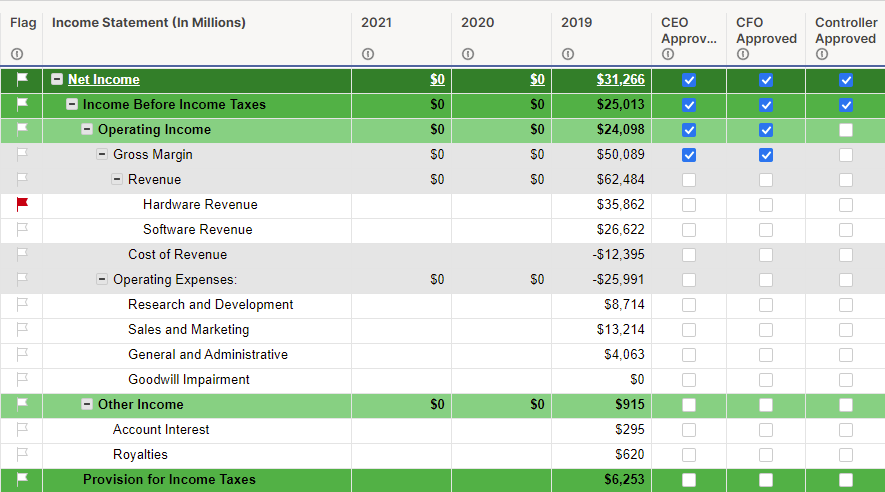

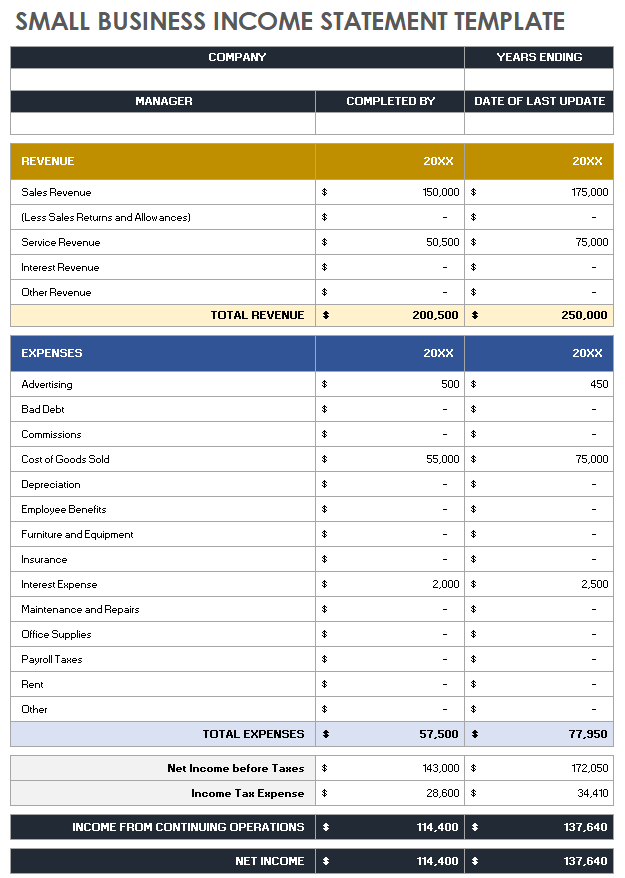

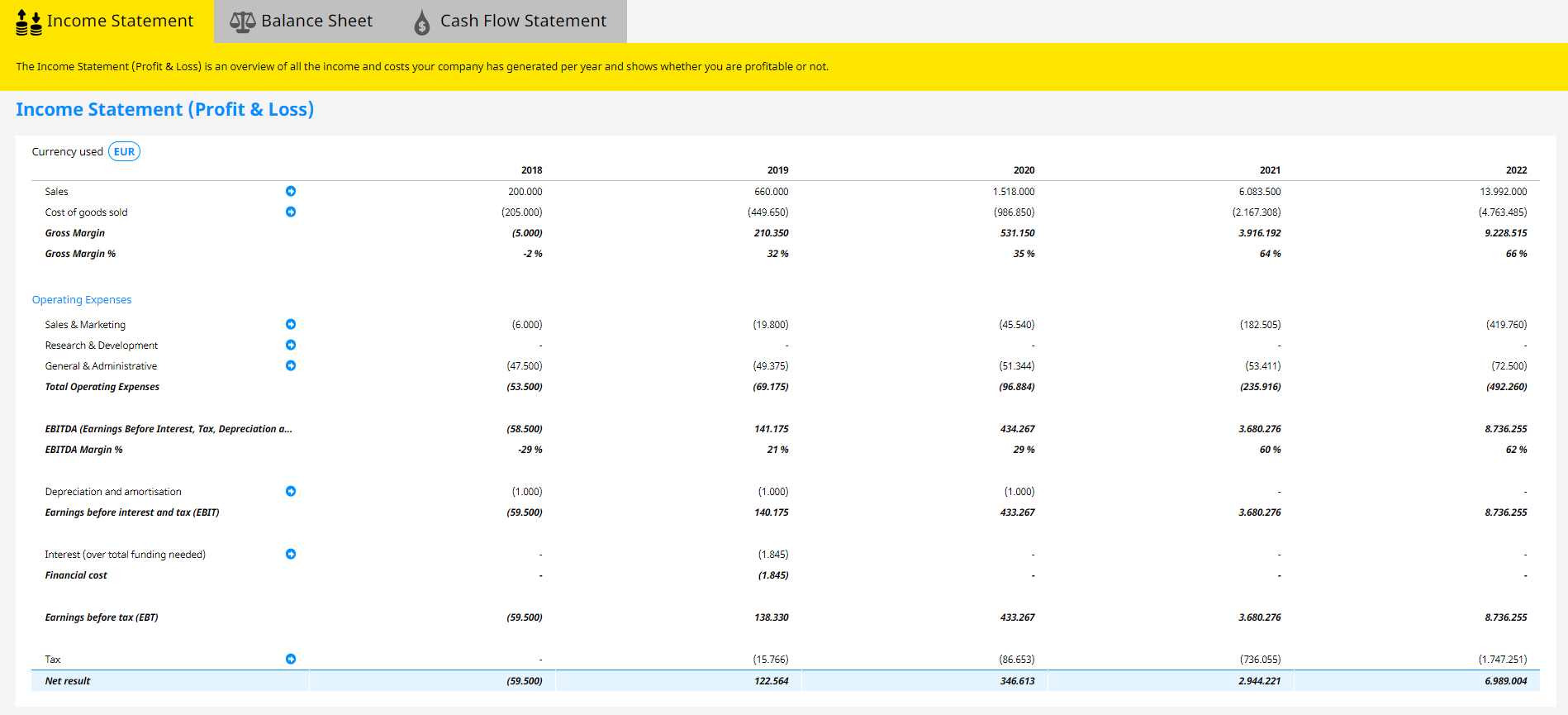

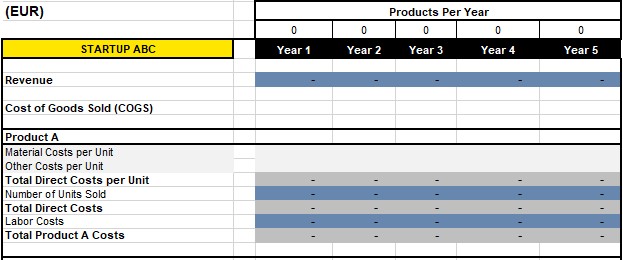

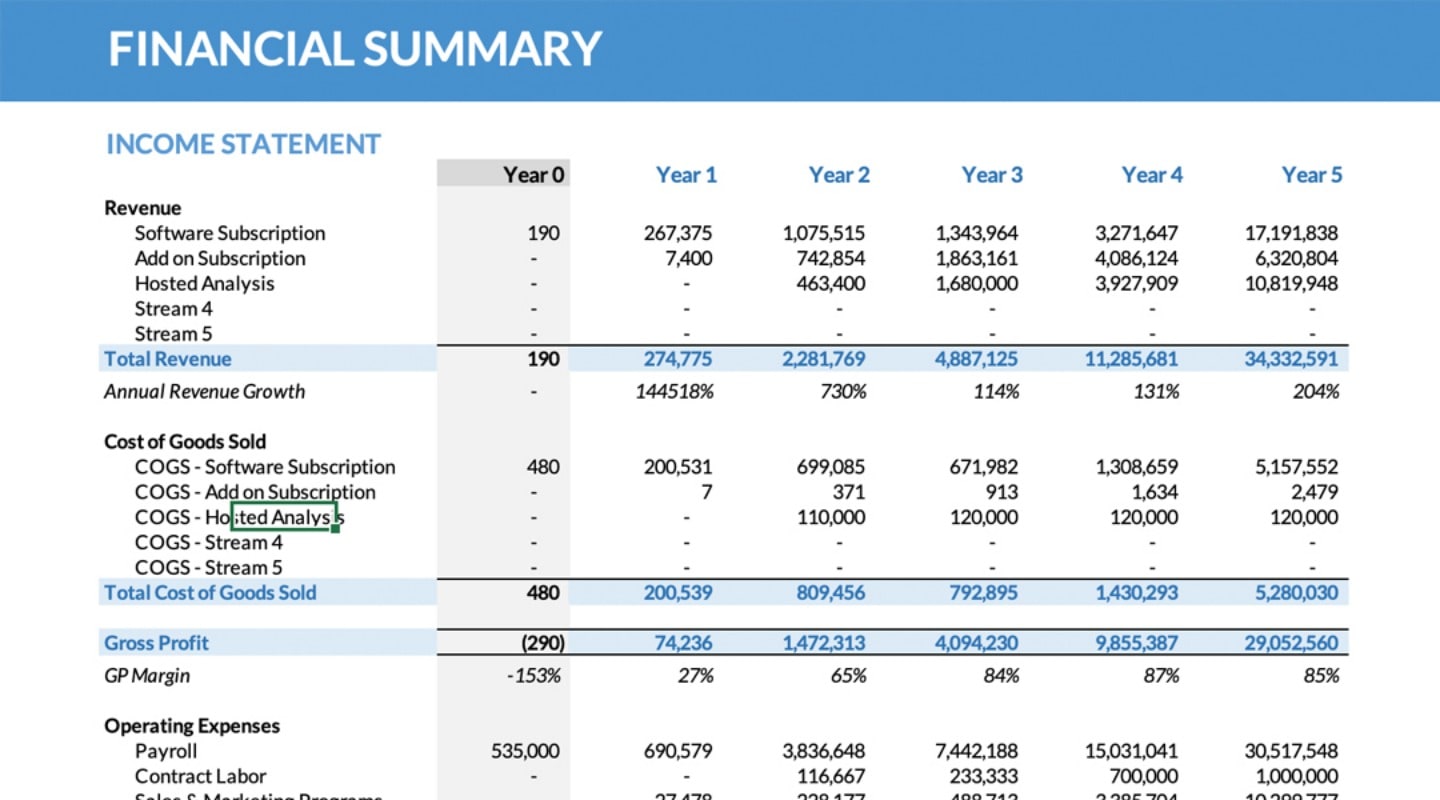

Income Statement

An Income statement , also known as a profit-and-loss statement(P&L), shows your company’s income and expenditures. It also demonstrates how your business experienced any profit or loss over a given time.

Consider it as a snapshot of your business that shows the feasibility of your business idea. An income statement can be generated considering three scenarios: worst, expected, and best.

Your income or P&L statement must list the following:

- Cost of goods or cost of sale

- Gross margin

- Operating expenses

- Revenue streams

- EBITDA (Earnings before interest, tax, depreciation , & amortization )

Established businesses can prepare annual income statements, whereas new businesses and startups should consider preparing monthly statements.

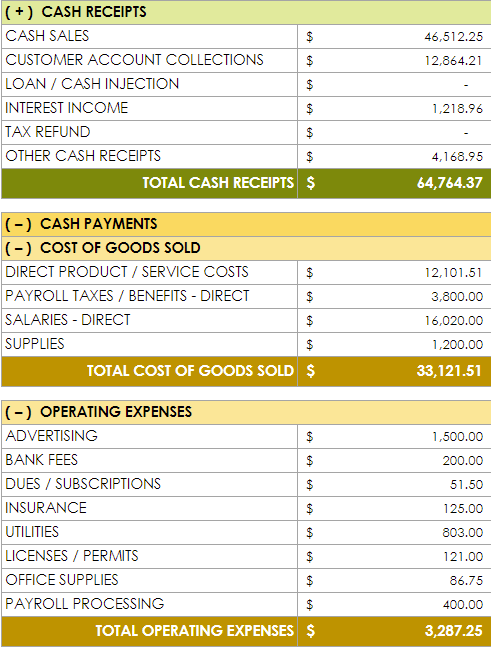

Cash flow Statement

A cash flow statement is one of the most critical financial statements for startups that summarize your business’s cash in-and-out flows over a given time.

This section provides details on the cash position of your business and its ability to meet monetary commitments on a timely basis.

Your cash flow projection consists of the following three components:

✅ Cash revenue projection: Here, you must enter each month’s estimated or expected sales figures.

✅ Cash disbursements: List expenditures that you expect to pay in cash for each month over one year.

✅ Cash flow reconciliation: Cash flow reconciliation is a process used to ensure the accuracy of cash flow projections. The adjusted amount is the cash flow balance carried over to the next month.

Furthermore, a company’s cash flow projections can be crucial while assessing liquidity, its ability to generate positive cash flows and pay off debts, and invest in growth initiatives.

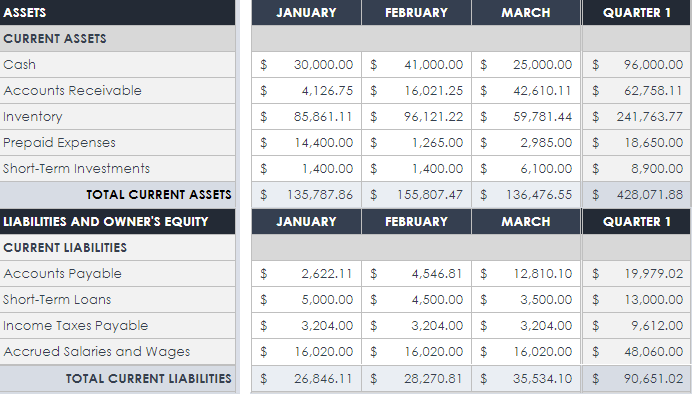

Balance Sheet

Your balance sheet is a financial statement that reports your company’s assets, liabilities, and shareholder equity at a given time.

Consider it as a snapshot of what your business owns and owes, as well as the amount invested by the shareholders.

This statement consists of three parts: assets , liabilities, and the balance calculated by the difference between the first two. The final numbers on this sheet reflect the business owner’s equity or value.

Balance sheets follow the following accounting equation with assets on one side and liabilities plus Owner’s equity on the other:

Here is what’s the core purpose of having a balance-sheet:

- Indicates the capital need of the business

- It helps to identify the allocation of resources

- It calculates the requirement of seed money you put up, and

- How much finance is required?

Since it helps investors understand the condition of your business on a given date, it’s a financial statement you can’t miss out on.

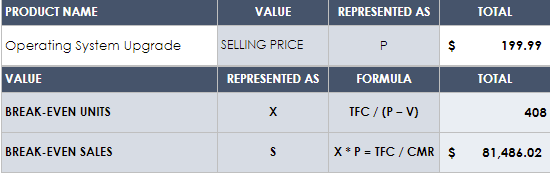

Break-even Analysis

Break-even analysis is a startup or small business accounting practice used to determine when a company, product, or service will become profitable.

For instance, a break-even analysis could help you understand how many candles you need to sell to cover your warehousing and manufacturing costs and start making profits.

Remember, anything you sell beyond the break-even point will result in profit.

You must be aware of your fixed and variable costs to accurately determine your startup’s break-even point.

- Fixed costs: fixed expenses that stay the same no matter what.

- Variable costs: expenses that fluctuate over time depending on production or sales.

A break-even point helps you smartly price your goods or services, cover fixed costs, catch missing expenses, and set sales targets while helping investors gain confidence in your business. No brainer—why it’s a key component of your startup’s financial plan.

Having covered all the key elements of a financial plan, let’s discuss how you can create a financial plan for your startup.

How to Create a Financial Section of a Startup Business Plan?

1. determine your financial needs.

You can’t start financial planning without understanding your financial requirements, can you? Get your notepad or simply open a notion doc; it’s time for some critical thinking.

Start by assessing your current situation by—calculating your income, expenses , assets, and liabilities, what the startup costs are, how much you have against them, and how much financing you need.

Assessing your current financial situation and health will help determine how much capital you need for your startup and help plan fundraising activities and outreach.

Furthermore, determining financial needs helps prioritize operational activities and expenses, effectively allocate resources, and increase the viability and sustainability of a business in the long run.

Having learned to determine financial needs, let’s head straight to setting financial goals.

2. Define Your Financial Goals

Setting realistic financial goals is fundamental in preparing an effective financial plan. So, it would help to outline your long-term strategies and goals at the beginning of your financial planning process.

Let’s understand it this way—if you are a SaaS startup pursuing VC financing rounds, you may ask investors about what matters to them the most and prepare your financial plan accordingly.

However, a coffee shop owner seeking a business loan may need to create a plan that appeals to banks, not investors. At the same time, an internal financial plan designed to offer financial direction and resource allocation may not be the same as previous examples, seeing its different use case.

Feeling overwhelmed? Just define your financial goals—you’ll be fine.

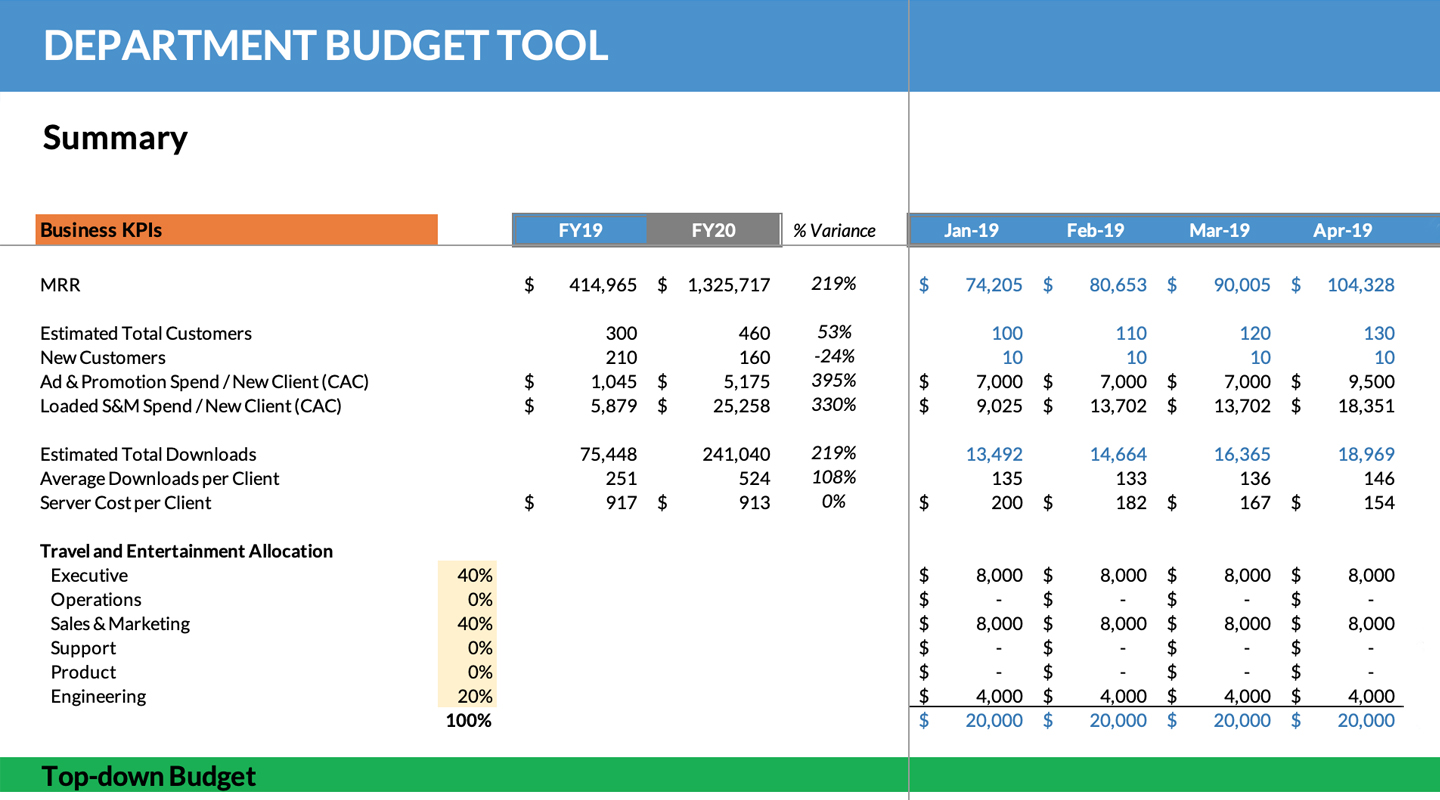

You can start by identifying your business KPIs (key performance indicators); it would be an ideal starting point.

3. Choose the Right Financial Planning Tool

Let’s face it—preparing a financial plan using Excel is no joke. One would only use this method if they had all the time in the world.

Having the right financial planning software will simplify and speed up the process and guide you through creating accurate financial forecasts.

Many financial planning software and tools claim to be the ideal solution, but it’s you who will identify and choose a tool that is best for your financial planning needs.

Create a Financial Plan with Upmetrics in no time

Enter your Financial Assumptions, and we’ll calculate your monthly/quarterly and yearly financial projections.

Start Forecasting

4. Make Assumptions Before Projecting Financials

Once you have a financial planning tool, you can move forward to the next step— making financial assumptions for your plan based on your company’s current performance and past financial records.

You’re just making predictions about your company’s financial future, so there’s no need to overthink or complicate the process.

You can gather your business’ historical financial data, market trends, and other relevant documents to help create a base for accurate financial projections.

After you have developed rough assumptions and a good understanding of your business finances, you can move forward to the next step—projecting financials.

5. Prepare Realistic Financial Projections

It’s a no-brainer—financial forecasting is the most critical yet challenging aspect of financial planning. However, it’s effortless if you’re using a financial planning software.

Upmetrics’ forecasting feature can help you project financials for up to 7 years. However, new startups usually consider planning for the next five years. Although it can be contradictory considering your financial goals and investor specifications.

Following are the two key aspects of your financial projections:

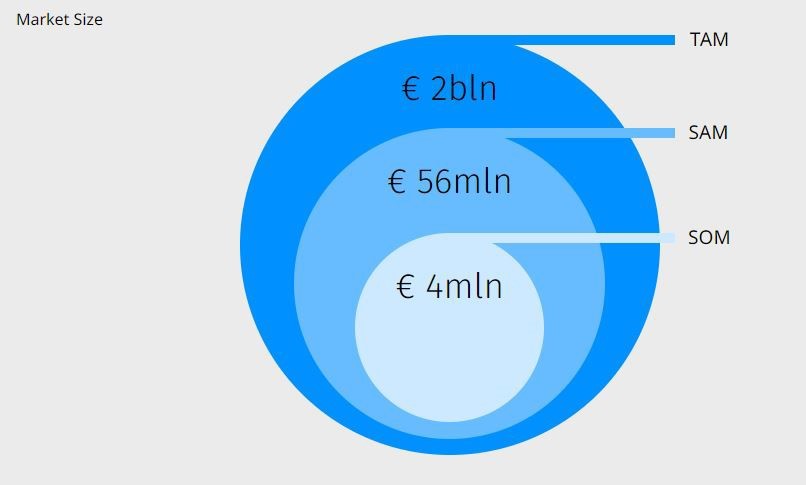

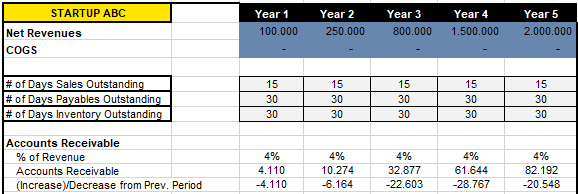

Revenue Projections

In simple terms, revenue projections help investors determine how much revenue your business plans to generate in years to come.

It generally involves conducting market research, determining pricing strategy , and cash flow analysis—which we’ve already discussed in the previous steps.

The following are the key components of an accurate revenue projection report:

- Market analysis

- Sales forecast

- Pricing strategy

- Growth assumptions

- Seasonal variations

This is a critical section for pre-revenue startups, so ensure your projections accurately align with your startup’s financial model and revenue goals.

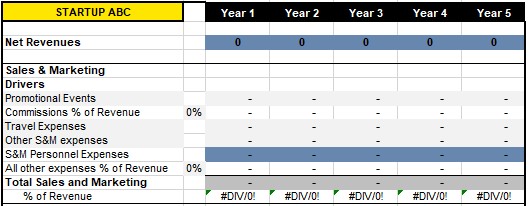

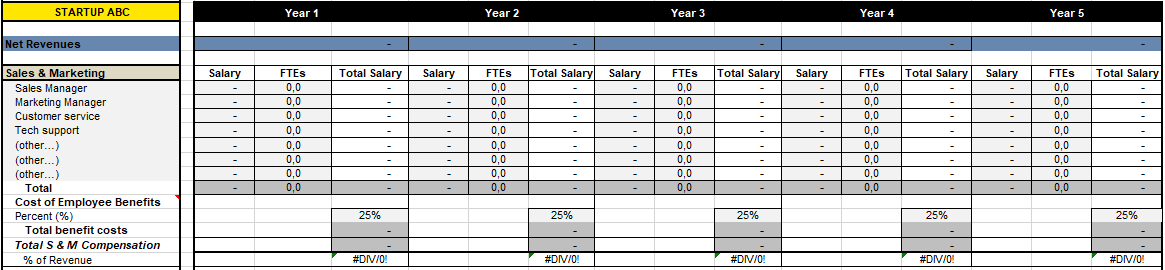

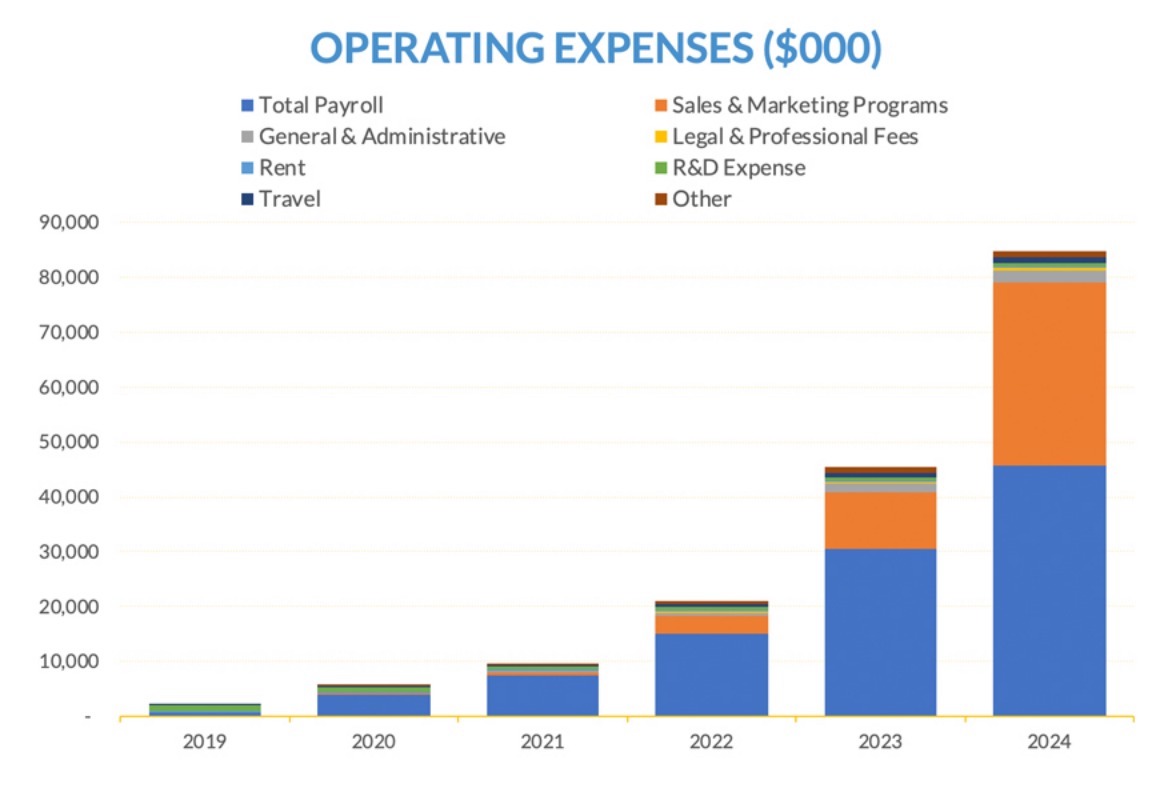

Expense Projections

Both revenue and expense projections are correlated to each other. As revenue forecasts projected revenue assumptions, expense projections will estimate expenses associated with operating your business.

Accurately estimating your expenses will help in effective cash flow analysis and proper resource allocation.

These are the most common costs to consider while projecting expenses:

- Fixed costs

- Variable costs

- Employee costs or payroll expenses

- Operational expenses

- Marketing and advertising expenses

- Emergency fund

Remember, realistic assumptions, thorough research, and a clear understanding of your market are the key to reliable financial projections.

6. Consider “What if” Scenarios

After you project your financials, it’s time to test your assumptions with what-if analysis, also known as sensitivity analysis.

Using what-if analysis with different scenarios while projecting your financials will increase transparency and help investors better understand your startup’s future with its best, expected, and worst-case scenarios.

Exploring “what-if” scenarios is the best way to better understand the potential risks and opportunities involved in business operations. This proactive exercise will help you make strategic decisions and necessary adjustments to your financial plan.

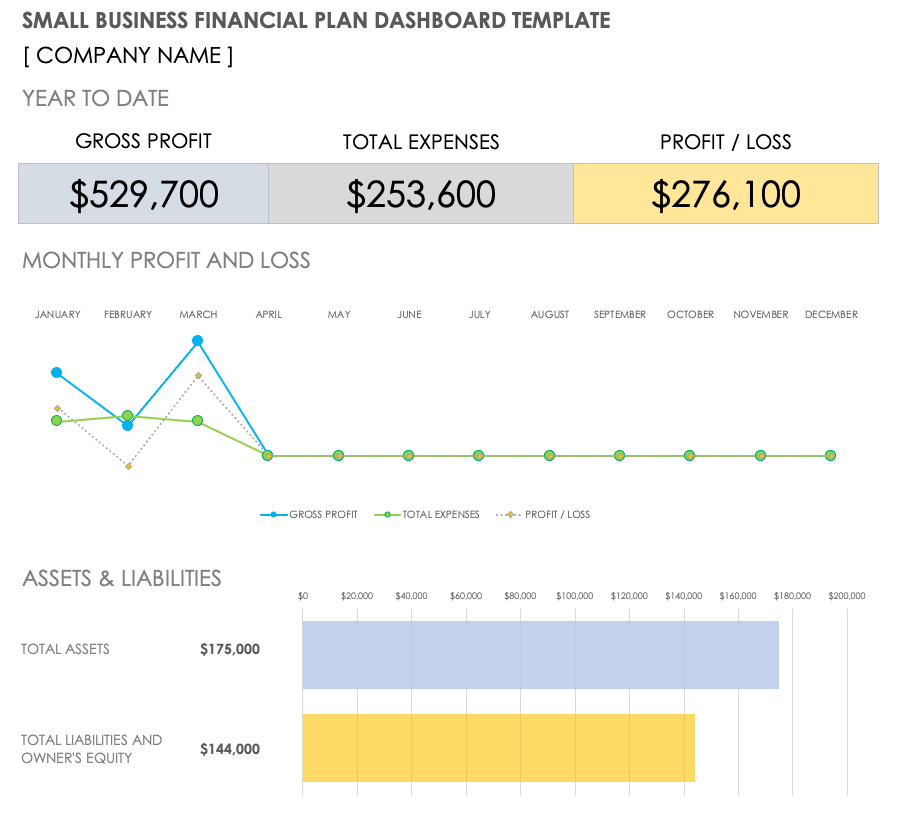

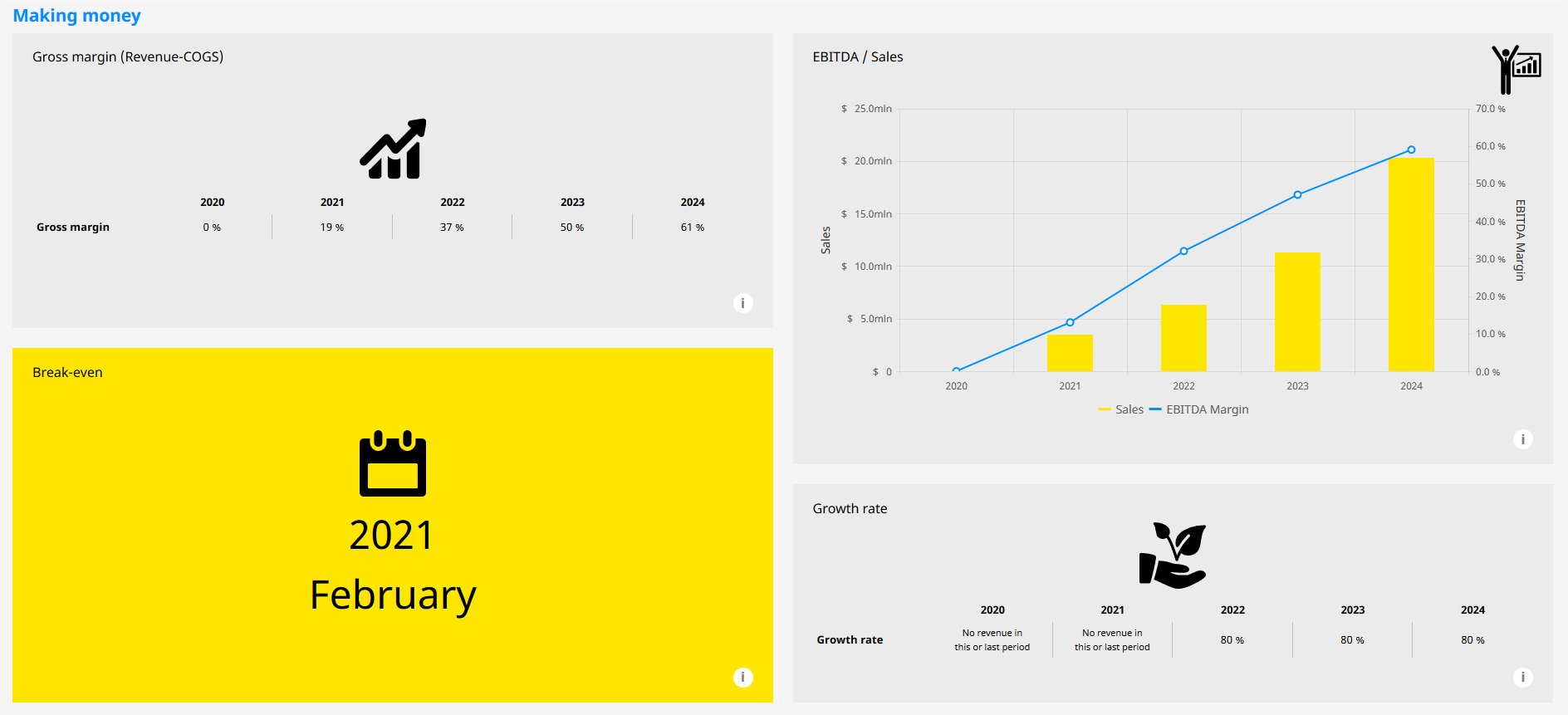

7. Build a Visual Report

If you’ve closely followed the steps leading to this, you know how to research for financial projections, create a financial plan, and test assumptions using “what-if” scenarios.

Now, we’ll prepare visual reports to present your numbers in a visually appealing and easily digestible format.

Don’t worry—it’s no extra effort. You’ve already made a visual report while creating your financial plan and forecasting financials.

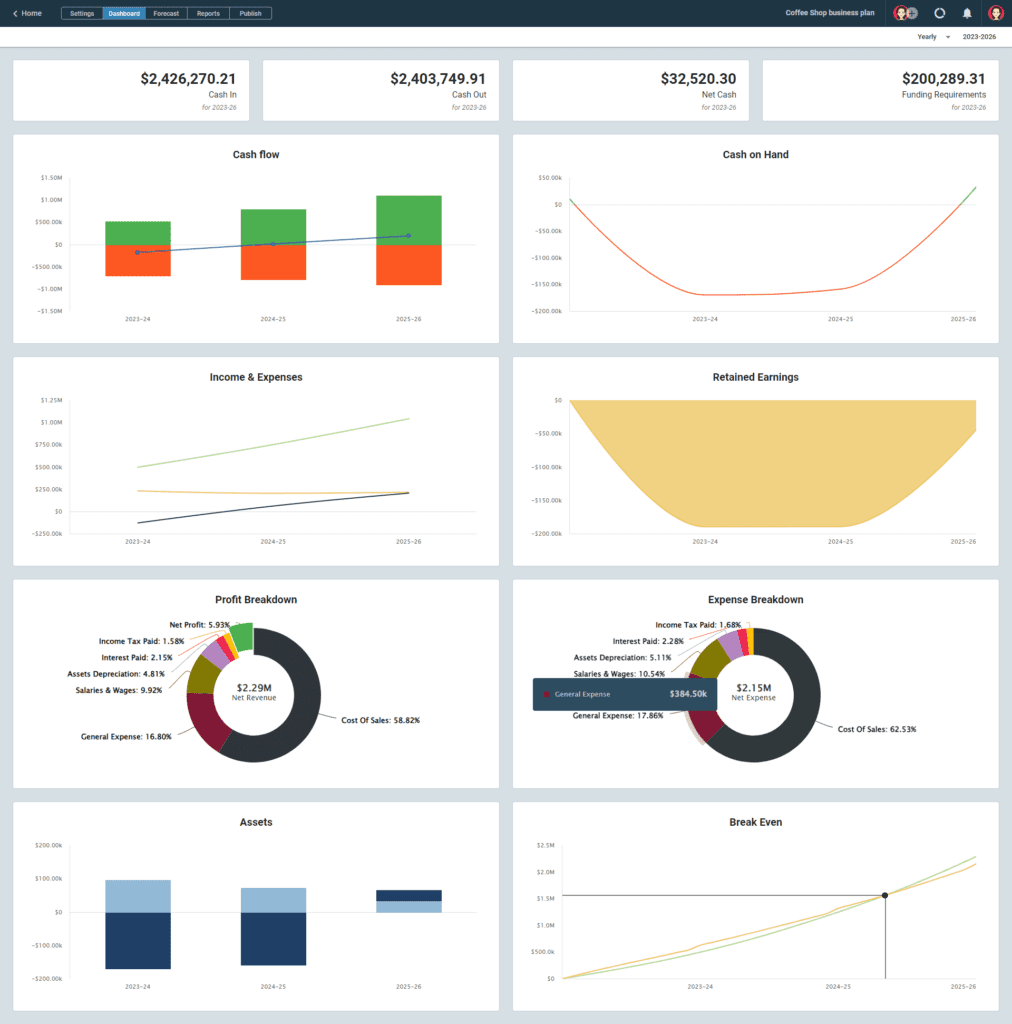

Check the dashboard to see the visual presentation of your projections and reports, and use the necessary financial data, diagrams, and graphs in the final draft of your financial plan.

Here’s what Upmetrics’ dashboard looks like:

8. Monitor and Adjust Your Financial Plan

Even though it’s not a primary step in creating a good financial plan, it’s quite essential to regularly monitor and adjust your financial plan to ensure the assumptions you made are still relevant, and you are heading in the right direction.

There are multiple ways to monitor your financial plan.

For instance, you can compare your assumptions with actual results to ensure accurate projections based on metrics like new customers acquired and acquisition costs, net profit, and gross margin.

Consider making necessary adjustments if your assumptions are not resonating with actual numbers.

Also, keep an eye on whether the changes you’ve identified are having the desired effect by monitoring their implementation.

And that was the last step in our financial planning guide. However, it’s not the end. Have a look at this financial plan example.

Startup Financial Plan Example

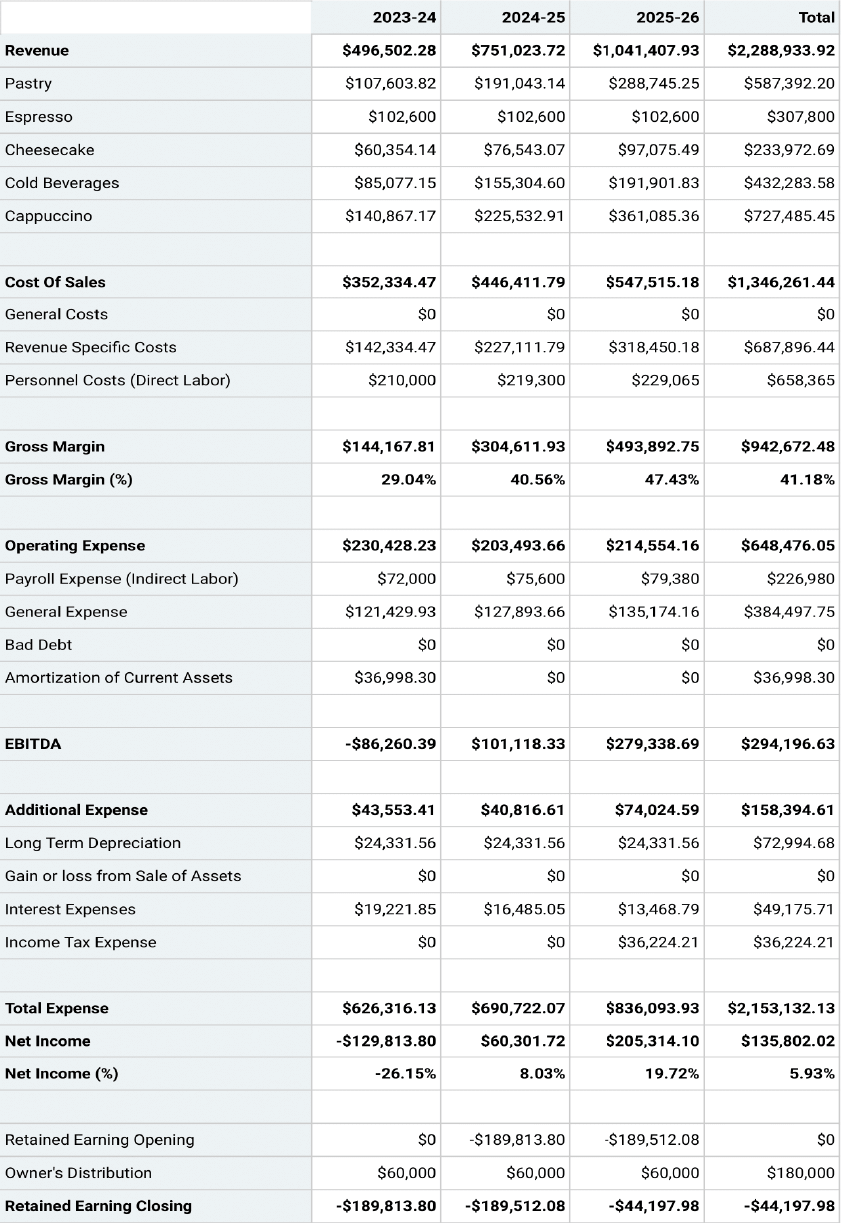

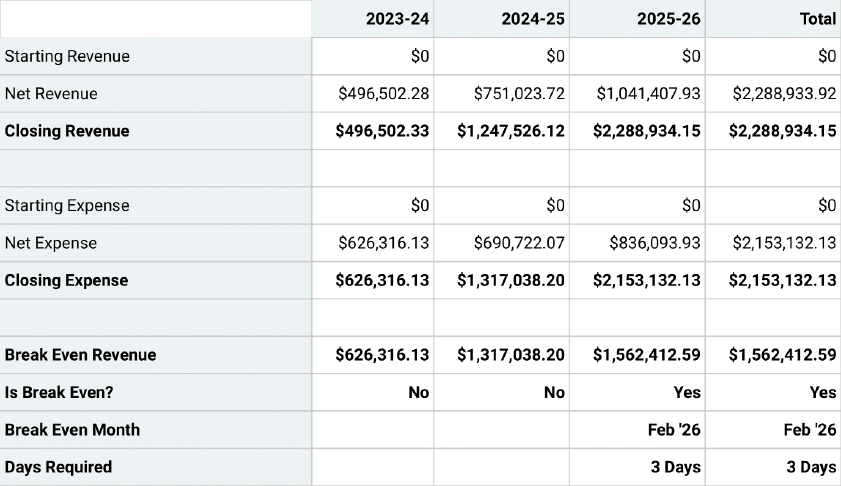

Having learned about financial planning, let’s quickly discuss a coffee shop startup financial plan example prepared using Upmetrics.

Important Assumptions

- The sales forecast is conservative and assumes a 5% increase in Year 2 and a 10% in Year 3.

- The analysis accounts for economic seasonality – wherein some months revenues peak (such as holidays ) and wanes in slower months.

- The analysis assumes the owner will not withdraw any salary till the 3rd year; at any time it is assumed that the owner’s withdrawal is available at his discretion.

- Sales are cash basis – nonaccrual accounting

- Moderate ramp- up in staff over the 5 years forecast

- Barista salary in the forecast is $36,000 in 2023.

- In general, most cafes have an 85% gross profit margin

- In general, most cafes have a 3% net profit margin

Projected Balance Sheet

Projected Cash-Flow Statement

Projected Profit & Loss Statement

Break Even Analysis

Start Preparing Your Financial Plan

We covered everything about financial planning in this guide, didn’t we? Although it doesn’t fulfill our objective to the fullest—we want you to finish your financial plan.

Sounds like a tough job? We have an easy way out for you—Upmetrics’ financial forecasting feature. Simply enter your financial assumptions, and let it do the rest.

So what are you waiting for? Try Upmetrics and create your financial plan in a snap.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

Frequently Asked Questions

How often should i update my financial projections.

Well, there is no particular rule about it. However, reviewing and updating your financial plan once a year is considered an ideal practice as it ensures that the financial aspirations you started and the projections you made are still relevant.

How do I estimate startup costs accurately?

You can estimate your startup costs by identifying and factoring various one-time, recurring, and hidden expenses. However, using a financial forecasting tool like Upmetrics will ensure accurate costs while speeding up the process.

What financial ratios should startups pay attention to?

Here’s a list of financial ratios every startup owner should keep an eye on:

- Net profit margin

- Current ratio

- Quick ratio

- Working capital

- Return on equity

- Debt-to-equity ratio

- Return on assets

- Debt-to-asset ratio

What are the 3 different scenarios in scenario analysis?

As discussed earlier, Scenario analysis is the process of ascertaining and analyzing possible events that can occur in the future. Startups or businesses often consider analyzing these three scenarios:

- base-case (expected) scenario

- Worst-case scenario

- best case scenario.

About the Author

Ajay is a SaaS writer and personal finance blogger who has been active in the space for over three years, writing about startups, business planning, budgeting, credit cards, and other topics related to personal finance. If not writing, he’s probably having a power nap. Read more

Reach Your Goals with Accurate Planning

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

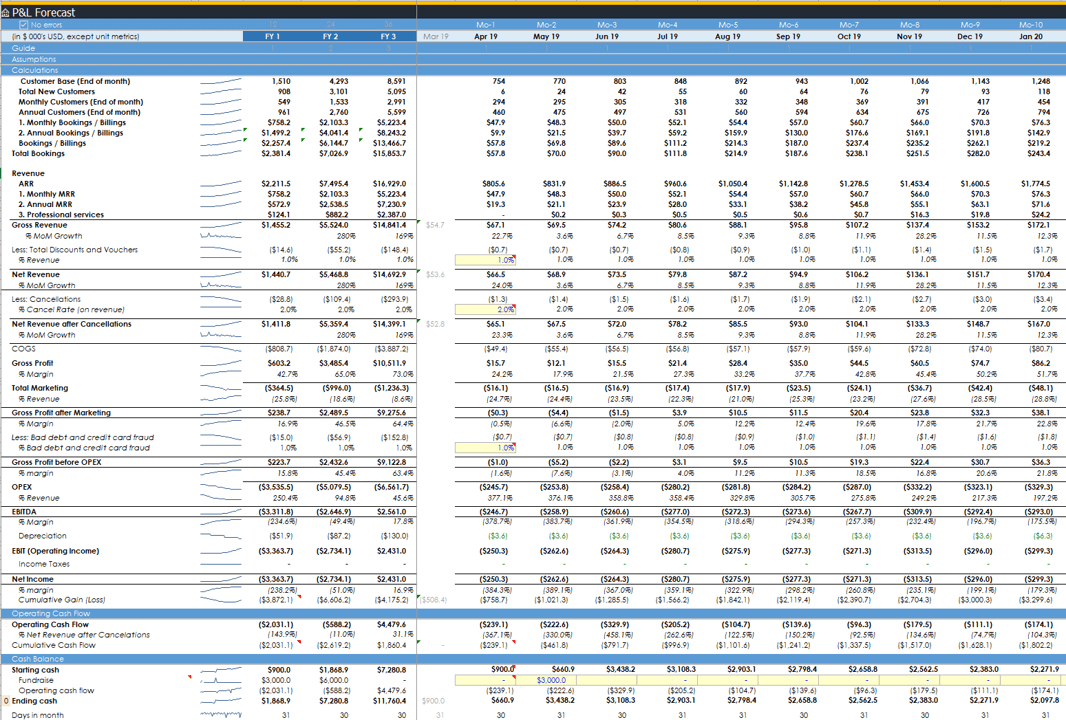

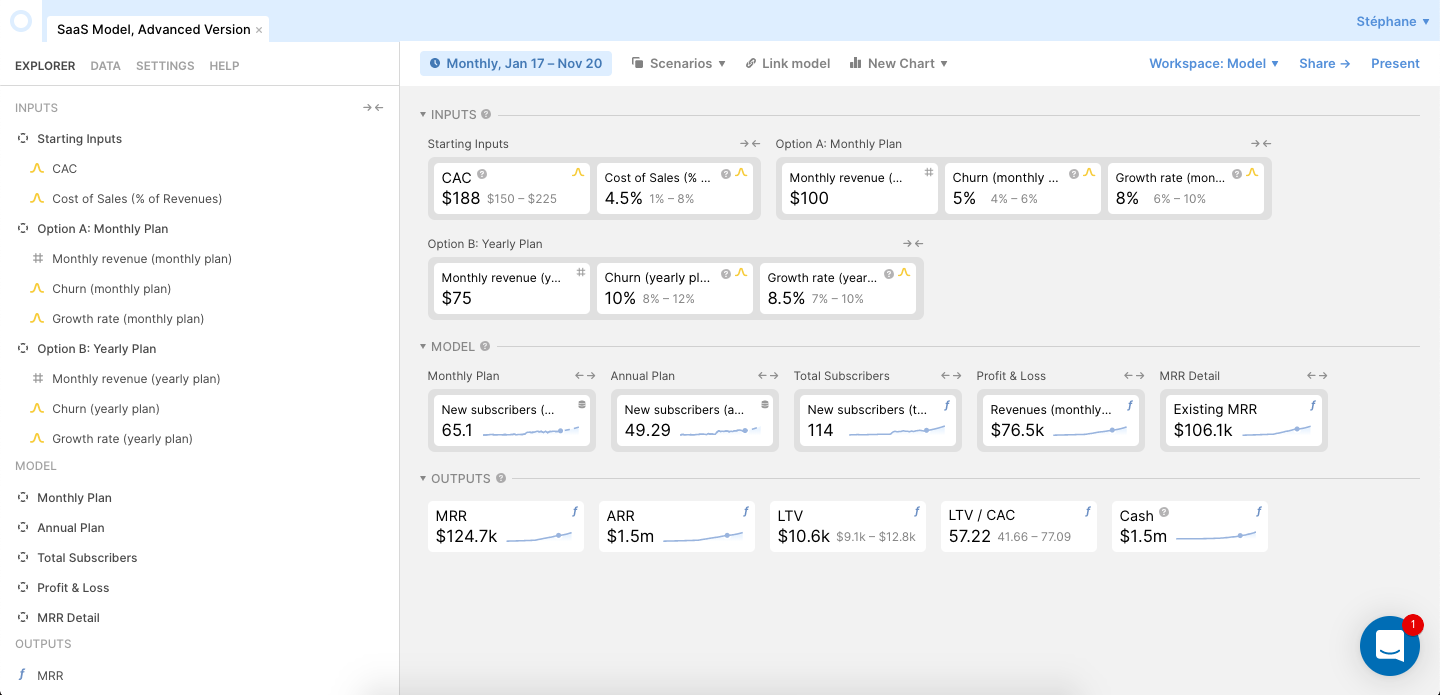

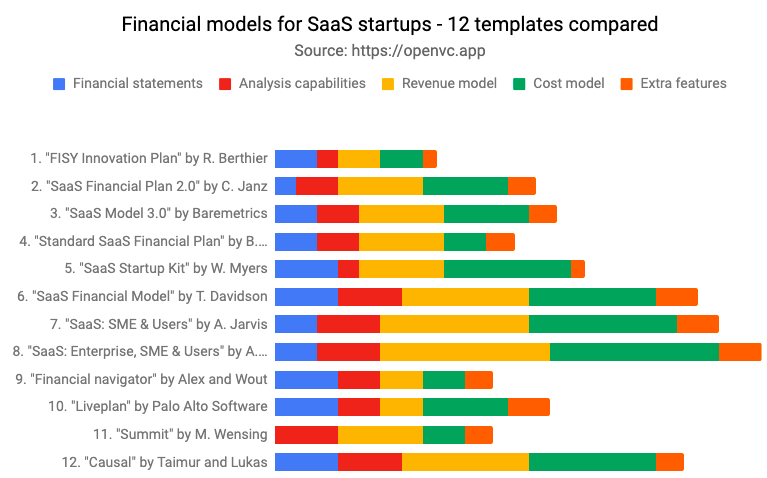

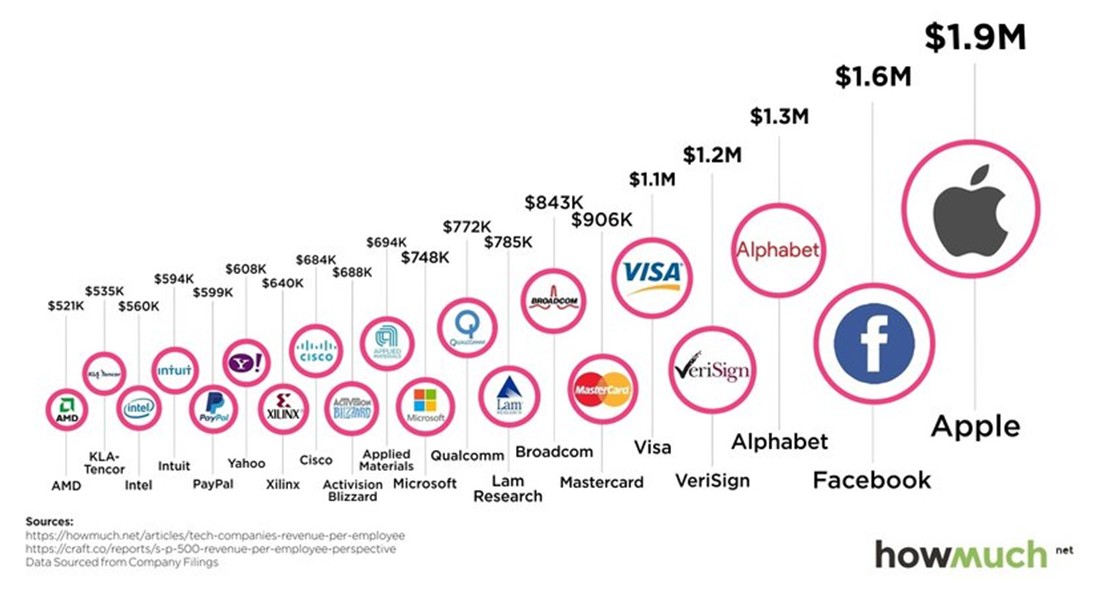

Startup financial models - 12 templates compared

Posted by Stéphane Nasser | April 20, 2020

As a founder, there comes a time when you need a business plan, complete with financial forecasts, income statements, and fancy graphs that will impress your investors.

Don't build it from scratch - use an existing model.

A financial model allows you to draft financial projections easily, fast, and in a professional manner. A great template will also force you to think through all the aspects of your project and make sure you really get the financial logic behind your business.

It can be annoying but trust me, it's worth your time.

This post compares the top 12 templates of financial models for SaaS startups. I have personally tested each model. I have ranked them on 40+ items along 5 categories. I've looked at both spreadsheets and SaaS apps, and both free and paid solutions.

If you are looking at building your SaaS financials, this article is for you.

Table of Contents

Methodology - what makes a great financial model for saas startups.

Here is the methodology I used to build this benchmark.

I compared 40 points across 5 categories: (a) financial statements, (b) analysis capabilities, (c) revenue modeling, (d) cost modeling, (e) extra features. A detailed analysis of each model is available below. In each case, I tested the software/spreadsheet myself.

Criteria 1: Financial statements

- Time scale : Are the statements over 1 year, 3 years or more? You usually want 3 years as a minimum when you speak with professional investors.

- Income statement : Does the template include an income statement? You usually want a monthly income statement, at least for year 1.

- Cash flow statement : Same as income statement

- Balance sheet : Same as income statement

- GAAP/IFRS : Are the statements compliant with GAAP and/or IFRS rules?

- Currency : How many currencies are available?

Criteria 2: Analysis capabilities

- Financial analysis : Number of typical financial metrics included e.g. breakeven point, quick ratio, average inventory, etc.

- SaaS analysis : Number of typical SaaS metrics included e.g. MRR growth, SaaS magic number, CAC/LTV, etc.

- Graphs : Number of built-in graphs

- Costs by P&L category : Does the template break down costs into P&L categories (CoGS, RD, G&A, etc.)

- Costs by departments : Does the model break down costs into departments (sales, marketing, CS, engineering, etc)

- VS Scenarios : Does the template allow you to compare multiple scenarios?

- VS Industry comparables : Does the template compare your financials against industry comparables?

- VS Actuals : Does the template allow you to run your model versus your actual numbers?

Criteria 3: Revenue modeling

- New client acquisition : How do you enter new clients into the model? Possibilities include: entering a number manually for each month or year (it sucks); autofill the model from a base number and a growth rate (sucks a bit less); autofill several streams - each stream represents a different type of client e.g SMB/enterprise (better); or even fully model each acquisition channel (the best, very rare)

- Offerings : How many offers can you define and how precisely can you model them? This includes the possibility to create one-off offers, recurring offers, or a combo, but also the possibility to create introduction times and end times for specific offers.

- Pricing model : How many pricing models can you define and how precisely: tiers (free, basic, premium), revenue models (per seat, per usage, etc), automatically increase or decrease the plans price over years.

- Existing clients : Can you model expansion, contraction, churn, reactivation?

- Commitment : Can you model monthly VS yearly VS multi-annual contracts?

- Service revenue : Can you model punctual service revenue on top of all the other pricing models and offerings?

- Enterprise specific : Does the template offer specific features to model complex enterprise sales, such as landing/expansion, custom product developments, various sales cycles, etc?

Criteria 4: Costs modeling

- Direct labor costs : The best templates allow you to correlate direct labor costs with relevant metrics. For example, your sales staff is calculated based on forecasted income and sales target per account executive. Same for customer success payroll with number of customers and workload target per CS staff.

- Direct non-labor costs : just like with labor costs, the best templates allow you to link some direct non-labor costs with relevant metrics. For instance, server costs can be a % of MRR.

- Indirect labor costs : same as above. Even for indirect costs, some templates find smart ways to tie them to some aspect of the business.

- Indirect non-labor costs : same as above

- Payment terms : Can you define the payments terms with your vendors and suppliers? May be useful if there is a hardware component to your offer.

- Hardware-friendly : This is a special mention for templates that model things like shipping costs, inventory delay, etc.

Criteria 5: Extra features

- Documentation : Is there proper documentation in the model and on the website? Are there good explainer videos? What kind of direct support (chat, email) comes with the template?

- Languages : In what language is the template available?

- Third-party integration : Third-party integrations can be useful to input or update data over time, or to display advanced graphs.

- Excel spreadsheet : Can you access your financials as a Microsoft Excel spreadsheet? This is a must if you need to share it with investors.

- Google Sheets : Does the model work in Google Sheets? Not all models that work in Microsoft Excel work in Google, so you may want to consider that point.

- Editable formulas : Some templates do not allow you to modify formulas - which is a massive bummer when it comes to customization.

Granted, it's not a perfect methodology. One could argue forever about whether cap tables should be included in a startup financial model. But it's the best I could come up with - without being a finance nerd myself :)

Disclaimers: affiliation, impartiality, and non-finito

Before jumping to the heart of the matter, please allow me three disclaimers:

- Affiliation: Some links in the article are affiliated - which means that if you end up buying a template through one of those links, OpenVC will get a few $$$. It doesn't cost you anything, and it allows us to keep writing useful articles for you.

- Impartiality: Regardless of whether there is a referral in place or not, I am committed to providing you with an honest opinion. We take great pride in being an independent, honest, and trusted source of information for entrepreneurs.

- Non finito: This is a non-finite work. We are happy to update the article if you bring new, relevant information to our knowledge. We are also happy to fix any mistake or clarify any confusion that you may find in the article.

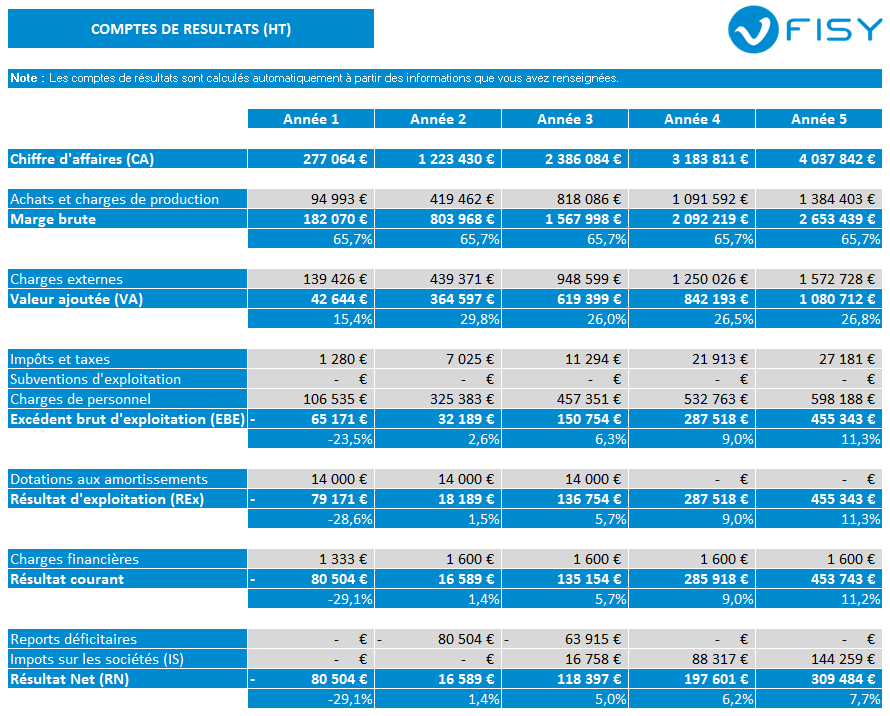

1. "FISY Innovation Plan" by Remi Berthier

Fisy Innovation Plan, by Rémi Berthier

For years, this template has been the go-to financial model for French entrepreneurs. However, it didn't age that well.

Analysis capabilities are limited: only a handful of financial metrics, zero SaaS metrics, a couple of graphs, and it's impossible to categorize costs. Modeling, be it for revenue or costs, is all too basic and requires a lot of manual input. Also, it's entirely in French.

Having said that, it remains a free-of-charge, easy-to-use, easy-to-customize template that covers all the basics while including specificities to the French ecosystem such as CIR, JEI, etc. It also offers a detailed page of instructions on the website.

This model makes a lot of sense for French entrepreneurs looking for a simple solution. For the others, keep on reading.

Edit 2023: I've re-downloaded the template in 2023 and didn't notice any significant change versus the 2017 version I had initially reviewed, so I kept my review untouched.

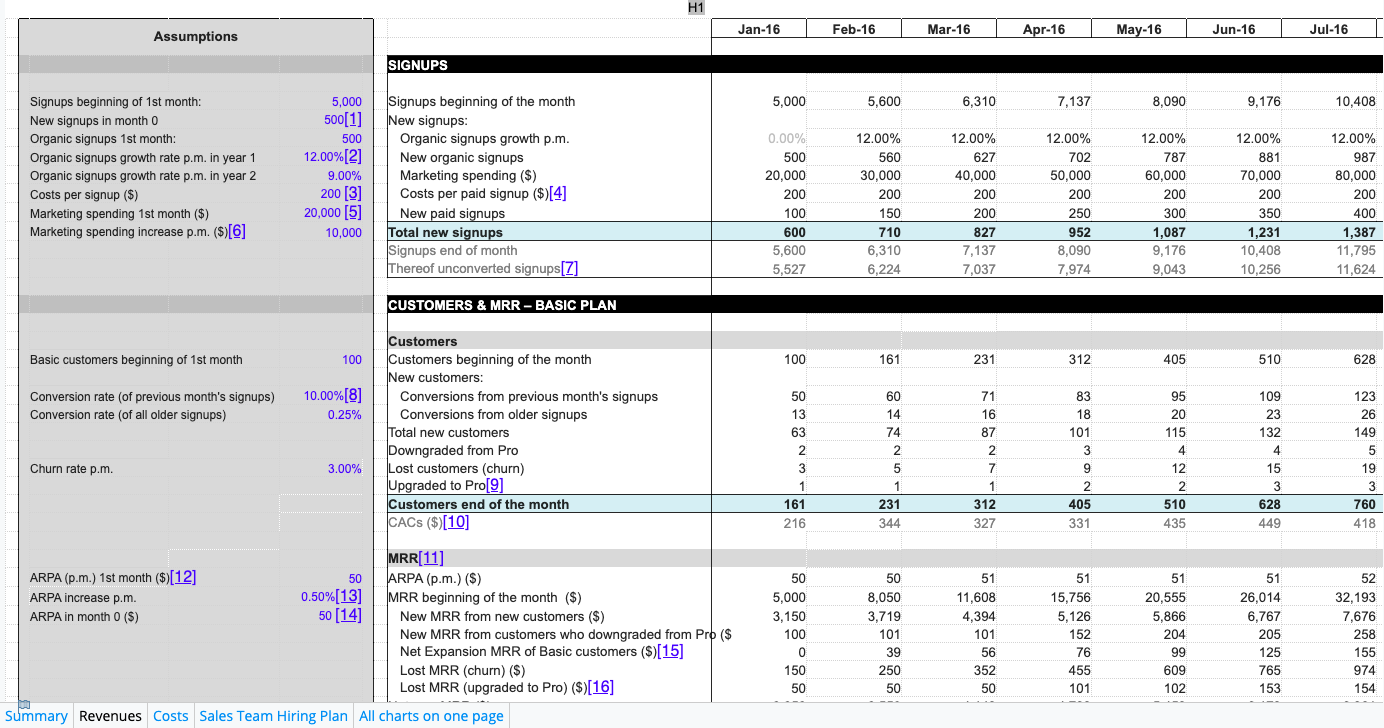

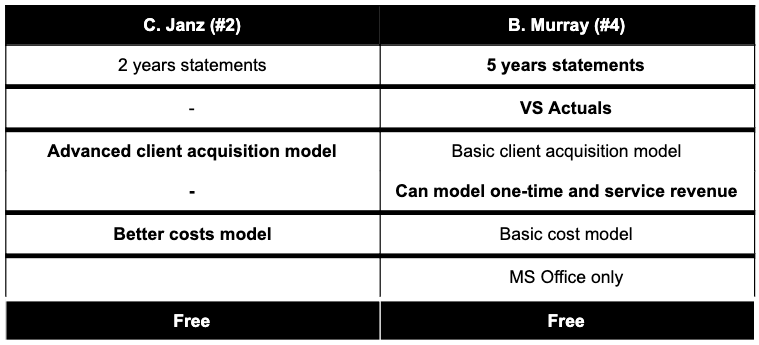

2. "SaaS Financial Plan 2.0" by Christoph Janz

SaaS Financial Plan 2.0, by Christoph Janz

This template was built by SaaS apostle Christoph Janz, and you can tell. It packs a punch of SaaS knowledge in a sleek, clear spreadsheet. You'll find lots of good stuff: basic/pro/enterprise plans, churn/upgrade/downgrade, an elegant client acquisition model and a wealth of graphs and charts.

It's not all rosy, though. You want a 5 years forecast? No, you only need 2. You want to sell annual pro plans? Too bad, pro plans are monthly and that's that. Also, no balance sheet.

This template works great if you are a typical SaaS startup and fits the vision that Christoph put into his financial plan. If not, you may be better off considering templates with broader horizons.

Edit 2023: Based on the Dropbox information, the template has not been modified since my first review in 2017, so I kept it untouched.

3. "SaaS Financial Model 3.0" by Baremetrics

SaaS Financial Model 3.0, by Baremetrics

I reviewed this model for the first time in 2017, when Jaakko Piiponen was its sole author. Since then, the Baremetrics team has substantially updated it. This new 2023 review should finally do it justice.

This SaaS Financial Model 3.0 is geared towards people who want to pilot their SaaS business, as opposed to just raising funds. Its underlying philosophy is that you need to match actual numbers with your forecasts for maximum piloting accuracy. To reach that objective, this model wants you to frequently pull data from your accounting software (e.g. Quickbooks, Xero…) and will project many assumptions based on your last 3 months - what they call "Autopilot". It's a healthy approach, and if you're ok with the extra work, it may be the right one for you.

When it comes to financial statements, this model nails it: you get a monthly view of your P&L, cash flow, and balance sheet over 5 years. However, because this model is not designed for fundraising, it doesn't include a cap table, which may be a dealbreaker to some. The whole model is in USD - you can manually change to any other currency, but you'll have to click a lot….

The Baremetrics team has also beefed up the analysis capabilities. This new version packs up all the must-have financial and SaaS metrics (Churn, ARPC, LTV, Paid CAC, Blended CAC, CAC:Payback time, CAC:LTV, MRR Breakdown), plus 11 built-in charts. A very nice attention is the Chartbuilding tab, which groups all the numbers in a clean format so you can build additional custom charts effortlessly. Like Janz's and Murray's models, you can break down expenses by category (engineering, marketing, etc.). The icing on the cake: this SaaS financial Model 3.0 is the only free model of this benchmark that lets you build a "worst case scenario" on top of your base case - and of course, compare both scenarios to your Actuals. Kudos to that!

Revenue modeling and cost modeling follow the "Autopilot" philosophy described above, with a few notable twists. For instance, the Acquisition model can be augmented with a separate "Marketing funnel" sheet (also provided by Baremetrics, also free) that models a proper 7 step funnel (visitor, signups, MQL, SQL, opportunities, trial, customer) and distinguishes between paid and organic leads. Your CMO will love it. Similarly, each expense line can be tied to specific variables to reflect dependencies.

All in all, this model by Baremetrics is a very strong contender. The only weakness I found relates to modeling complex offers, such as a Basic, a Premium and a Pro plan. It's just not possible. Even modeling annual plans seems to take a bit of work using the "Deferred revenue" tab. On the upside, this SaaS Financial Model 3.0 models expansion, contraction, churn, and even reactivation, so it's a tit for tat.

If you're looking for a free model that cares about accuracy to pilot your SaaS business the year round, and you don't mind getting your hands dirty a bit, then this is the one. Support is limited to a well-written, opinionated page of instructions, and you can contact the creators on Twitter. The model is available on Excel and Google Sheets, and all the formulas are editable.

4. "Standard SaaS Financial Plan for Startups and SMBs" by Ben Murray

SaaS Financial Plan for Startups and SMBs, by Ben Murray

This template published by Ben Murray, AKA the SaaS CFO, has a lot in common with Chris Janz's model: it's free, it's SaaS-centric and it's really good overall.

But that's where similarities stop. Let's look at what differentiates them:

- Cost modeling: Janz does a much better job as many costs are tied to activity metrics. With Murray, you have to fill it all manually. Janz 1 - 0 Murray

- Commitment: Murray allows you to define which plans are annual and which are monthly. Janz does not. Janz 1 - 1 Murray

- Client acquisition: Murray wants you to manually input new clients each month, where Janz includes 3 acquisition channels. Janz 2 - 1 Murray

- Murray also allows you to add service revenue and offers up to 5 years of forecasts. Janz 2 - 2 Murray

- Since its latest update, Murray's model also allows you to input your actual number and compare them with your forecasts. Janz 2 - 3 Murray

At the end of the day, Murray's SaaS template is great - maybe the best amongst the free templates. It is a bit disappointing when it comes to modeling new client acquisition and costs, though.

To explore more powerful (and paid) templates, read on!

5. "SaaS Startup" by Pro Forma

SaaS Startup Kit, by Pro Forma

The SaaS startup kit is the first paying template we're looking at: one-time $99.

Because you're paying, you obviously get a lot more in return: balance sheet, cap table, GAAP/IFRS compliance, 161 currencies to choose from, a ton of financial metrics and graphs, and advanced capabilities to model your costs and your revenue, including for hardware startups.

Now, because we are paying, we are a lot pickier. And I see 3 problems with this SaaS Startup Kit. First, you cannot account for upgrades and downgrades (you can model churn, though). Second, you cannot break down costs by P&L categories or departments. Third, the formulas are "locked ' so you cannot edit them. That's a big problem if, like me, you like looking under the hood. But maybe you don't care?

All in all, I cannot tell you not to look at the SaaS startup kit. It has a lot going for it, and at $99, it's priced right. But if you can stretch your budget a little more, look at the next model - it may be the right one for you.

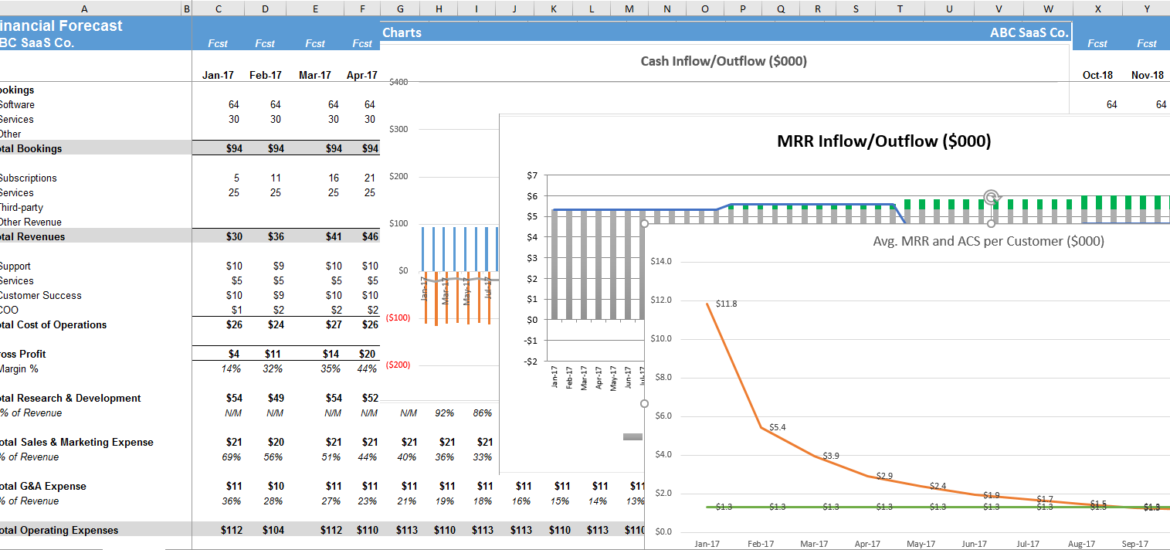

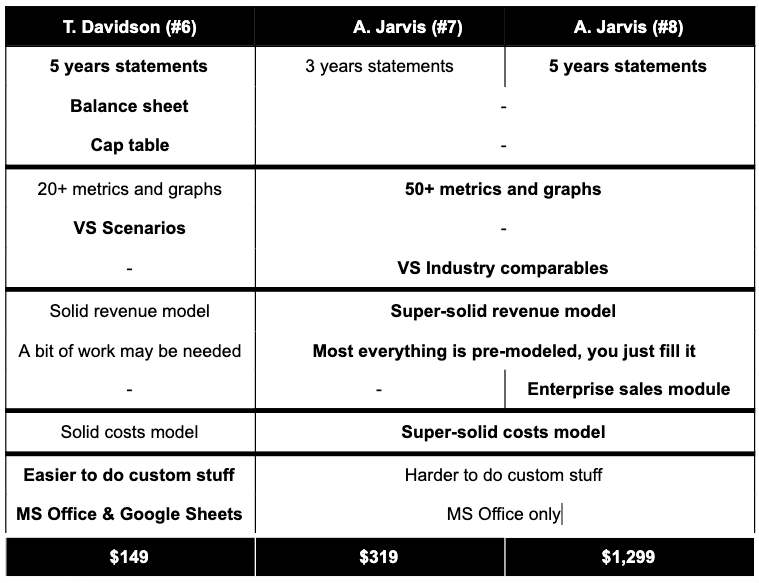

6. "SaaS Financial Model" by Taylor Davidson

"SaaS Financial Model" by Taylor Davidson

Let me start right off the bat: this "SaaS Financial Model" by Taylor Davidson is one of the best templates out there.

For $149, you get all the financial statements you may wish for, laid out over 5 years, and GAAP-compliant. Additional tabs are built-in for fundraising (assess needs and uses), valuation (ownership, DCF, waterfall exit, ROI), variants (simplified scenarios), and impact (for purpose-driven startups). Bonus point: the model works in Microsoft Excel and Google Sheets, supports all currencies, and is fully editable.

In terms of analysis capabilities, the template generates boatloads of financial and SaaS metrics, as well as 20+ beautiful graphs. Costs can be broken down by departments and P&L categories so you can make sense of all that good stuff. SaaS experts will especially appreciate the granularity provided by monthly cohort analysis - a rarity!

Modeling revenue and costs is extremely versatile. Instead of pre-modeling everything for you, the template provides you with very unique features (Pricing, Pipeline, Drivers) that allow you to customize it to your needs. Here are a few examples of what you can do:

- You can build as many subscription plans as you want.

- Contract length is not limited to monthly or annual but can be anything you want.

- Billings are separate from contract cycles, so can do an annual contract with quarterly billings, or 3-year contract with annual billings, or annual contract with monthly billings

- All costs, direct and indirect, labor and non-labor, can be tied to relevant activity metrics (revenue, headcount, etc.) which is what you would expect from this kind of template.

- All costs can also be tied that are *not* tied to an activity metric, say periodic costs that occur quarterly or annually, or costs that increase a % over time, or costs that are a % of salaries, or a % of revenues, for example. This is all built-in within the Drivers sheet and an absolute delight to use.

- For Enterprise sales, you can model a good old Pipeline in the Pipeline sheet and attribute different numbers of seats and "likelihood to close" to each deal.

True, it takes a bit of time to wrap your head around the internal logic of that model. But once you master it, there is virtually no limit to what you can do.

Thankfully, this financial model is well-documented. The website includes a long, detailed "Getting Started" page as well as specific articles and videos for technical points. The highlight is definitely the email support - I've consistently received detailed replies within 24 hours - at zero extra cost. Kudos to that.

Long story short - if you are willing to shell out $149 for a SaaS financial model, Taylor Davidon's template is arguably one of the absolute best you can get your hands on. The other one is the model built by Alexander Jarvis - read on to learn about it.

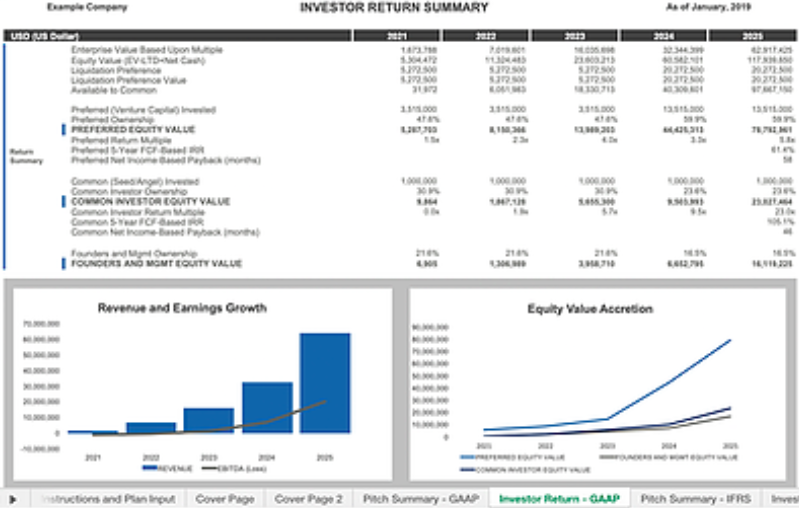

7. "SaaS: SME & Users" by Alexander Jarvis

8. "saas: enterprise, sme & users" by alexander jarvis.

"SaaS: SME & Users" by Alexander Jarvis

"SaaS: Enterprise, SME & Users" by Alexander Jarvis

It's hard to write a serious review about this template - everything about it is absolutely ridiculous. It is ridiculously rich, ridiculously detailed, ridiculously powerful. It's the kind of template that you use when you want to make a statement, like impress your investors or make your CFO feel irrelevant. It's heavy, bold, and over-the-top, in the best way possible. Brace yourselves, let's dive in.

This template by Alexander Jarvis comes in 2 versions. The "SaaS: SME & Users" is perfectly fine for most SaaS businesses. It sells at $319. The "SaaS: Enterprise, SME & Users" retails at $1,299 and includes extra logic to model enterprise sales. Because of their complexity, both models only work in Microsoft Excel (no Google Sheets).

In return for your money, you get the most advanced modeling capabilities - period.

- Each acquisition channel is modeled in great details: paid, organic, blog, social, emailing, and channel partners. Each channel can be assigned its own conversion rate from visitor to user. You can also differentiate between the customers that self-onboard and those who require sales intervention.

- You can design composite offerings based on usage fee, monthly fee and/or a one-time service fee. The templates allow 3 paid plans - typically basic, premium, pro - as well as a free trial plan, and each of these plans can exist with a monthly or annual commitment.

- Customers can upgrade, downgrade or churn, and you can even schedule module releases at different points in time, so you create new revenue streams over the years.

- All costs, direct and indirect, labor and non-labor, are modeled in a clever way i.e. they are tied to relevant activity metrics

I cannot stress enough how detailed this model is. Here is an example: the "email marketing" tab (yes, there is such a thing) takes into account 12+ inputs including stuff like the % of recipients who will share the newsletter with their friends. I love this kind of detail because it gives actionable points when thinking about execution. It also makes it easier to defend your numbers in front of investors because you can explain the underlying assumptions. If it's too much for you, you can always deactivate the advanced fields with the switch and focus on the core input.

If you buy the $1,299 version, you get an extra slew of tabs specifically dedicated to enterprise sales in all its complexity: enterprise-specific products and offerings, geographies, sales cycles, "land and expand", custom development, etc. If you are building the next Oracle or Palantir, that stuff alone is invaluable.

Documentation is ok. Instructions and comments are included inside the template, but not much in terms of FAQ/articles on the website. Having said that, I particularly appreciated the tutorial videos: one 28-min overview and 20 shorter videos that each cover a specific tab.

You want more? Time to talk about analysis capabilities. Alexander Jarvis' model is most lavish when it comes to that point. 50+ graphs are readily available - and that's without counting the sparklines that are peppered throughout the sheet. Because modeling is so detailed, the template can provide advanced SaaS metrics such as marketing leverage or expansion % of new MRR. Of course, costs can be allocated to P&L categories and departments so you really understand what's going on in your model.

When it comes to financial statements, the $319 version gives you only 3 years of forecasts, with no balance sheet and no cap table. The $1,299 version does a bit better with 5-year forecasts, but still no sign of balance sheet nor cap table. Some would argue that an early-stage startup doesn't need formal financial statements... However, this template does include a tab to compare your forecasts to your actuals, and another tab listing down industry metrics - both are very welcome additions.

If you want the best spreadsheet ever, it boils down to comparing Taylor Davidson's and Alexander Jarvis' templates, and picking the one that fits you the most. See the final section "Conclusion" for a side-by-side of both models.

However, some prefer using a specialized SaaS app to build their startup financial model. If that's your case, check out the last 4 models.

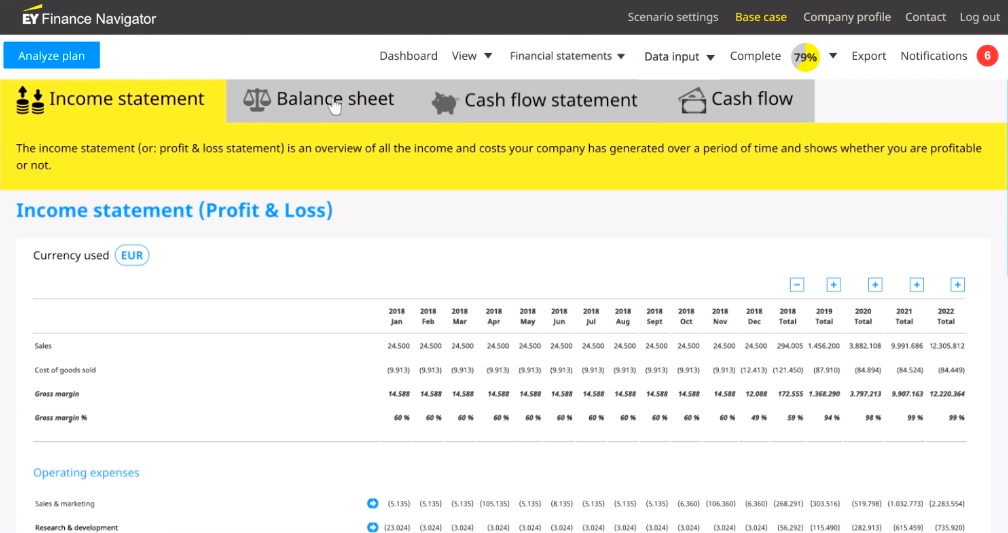

9. "EY Finance Navigator" by Alex and Wout

EY Finance Navigator, by Alex and Wout

The Finance Navigator was developed by Alexander Matthiessen and Wout Bobbink from EY's Dutch office. It's a SaaS app: you pay a monthly subscription to access an online tool. It's a fundamentally different approach from the spreadsheet-based models we've explored so far.

The Finance Navigator costs $30 per month without commitment or $380 over an 18 month period. For that price, you get very exhaustive financial statements: income statements, cash flow statements, and balance sheets over 10 years - no cap table though. All currencies are available and you can export the statements to a clean, well-designed spreadsheet format (only numbers, no formulas).

Documentation is good, with in-app guidance, website posts, a Q&A, and a 37 min walkthrough video. The tool was clearly thought to be user-friendly and the onboarding is best-in-class. You will have zero difficulties using EY's Finance Navigator whatsoever.

Unfortunately, simplicity is a double-edged sword. Revenue and cost modeling is super basic. For example, revenue is defined as a base number for month 1, then a monthly growth rate. No channels, no conversion rate, no pricing plans. The same goes for costs: you cannot tie costs to specific activity metrics, so you have to input them manually. Because it's a SaaS application, you cannot customize the model by adding fields or modifying formulas. And because it's so basic, there is only the bare minimum in terms of analysis capabilities.

At the end of the day, EY's Finance Navigator holds a lot of promises. UX is great and they have a couple of nice features like comparables and scenarios. The product has evolved over the years, adding up features and getting more usable. In my estimation, it's not quite enough to be used by advanced SaaS entrepreneurs. The product is geared towards traditional businesses - think bakery, restaurant, consulting, who just want clean and easy financials. Not the right pick for SaaS people - yet. I'd love to revisit the tool in a year and see what progress has been made.

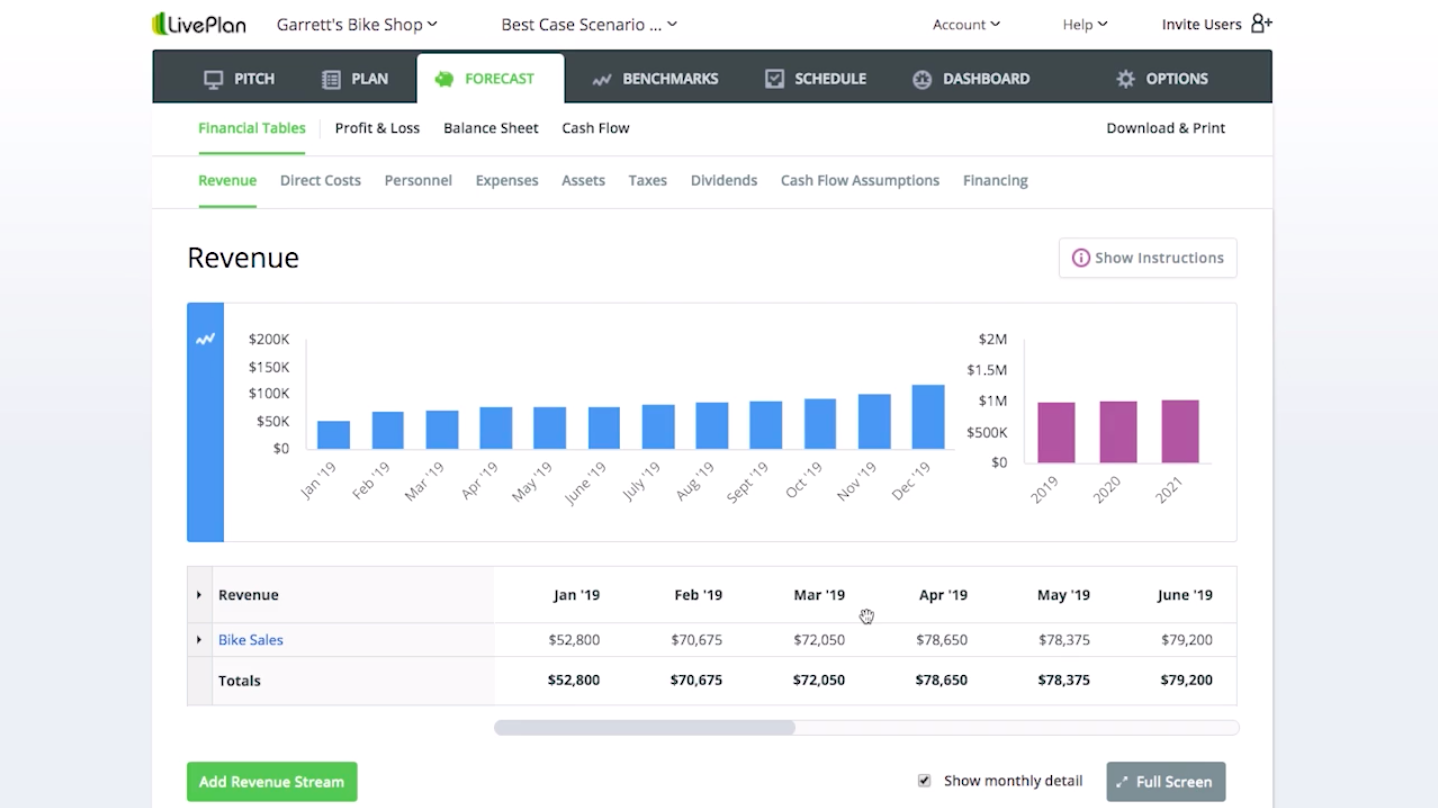

10. "Liveplan" by Palo Alto Software

Liveplan, by Palo Alto Software

Liveplan sells its financial modeling SaaS app at $20 per month ($360 over 18 months), which makes it a close competitor to EY Finance Navigator.

Starting with the strong points, Liveplan offers exhaustive statements over 5 years: income statements, cash flow statements, and balance sheets. Compared with EY's model, you have a bit more control over revenue modeling: offerings can be defined as recurring fees, billable hours, and a one-time upfront fee can also be added. Pricing can be increased automatically over time, churn can be factored in, and you can model monthly or annual plans.

When looking at cost modeling, you can adjust payment terms for clients and suppliers. There are also specific variables for hardware products. Documentation is just fine, with a tutorial video per section embedded directly in the app, as well as plenty of instructions. Liveplan exists in 5 languages, and integrates with Quickbooks, which allows importing your actual numbers and comparing them with your forecasts. You can also export your financials into a (numbers-only) spreadsheet to share with your investors.

Now, although Liveplan's software has more powerful modeling capacities than EY's, it remains insufficient in my estimation. Here are just a few examples.

- Direct labor costs can be set as a % of revenue, but do not update the number of employees accordingly.

- Indirect costs can only be set as a constant, a % of overall revenue, or a % of a specific revenue.

- New client acquisition is just manual input - as in you manually input "2" clients in March and "4" clients in April. There is no channel modeling whatsoever.

- Costs cannot be broken down by P&L categories nor departments.

When modeling is too superficial, it translates into poor analysis capabilities. In Liveplan's case, you do have a dozen financial metrics available (net cash flow, account payable, cash on hand…) and another dozen graphs. But SaaS metrics are absent, which is a bummer for SaaS entrepreneurs.

At the end of the day, LivePlan was built for non-tech entrepreneurs. Perfect for a bike shop owner, but not quite there for SaaS people.

Don't take my word for it: there is a 60-day trial, so give it a spin for free and make up your own mind.

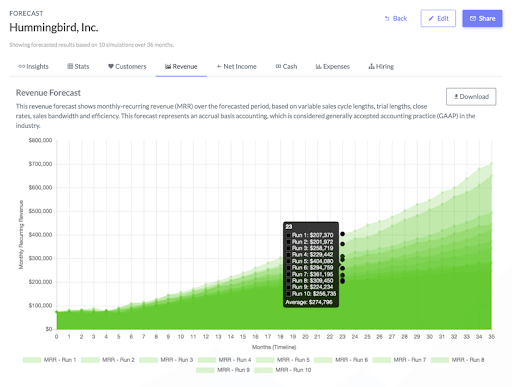

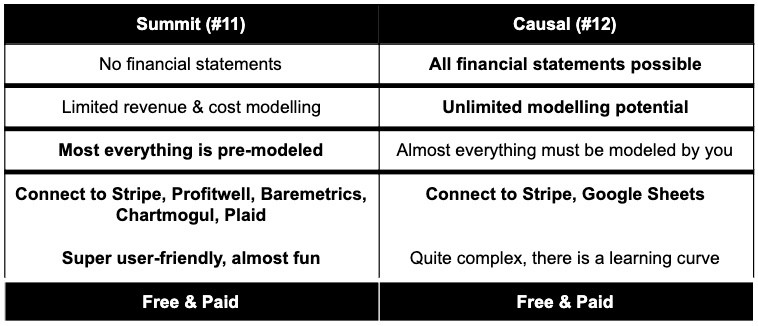

11. "Summit" by Matt Wensing

Summit, by Matt Wensing

Summit is a young startup (founded 2019) that brings a fresh take on the whole financial modeling thing with a SaaS solution.

Let's make it clear - Summit is not meant for fundraising. Forecasts on Summit are made for an 18-month period only. Costs cannot be allocated to P&L categories and departments, nor can you differentiate between labor/non-labor or direct/indirect costs. Therefore, you won't be able to generate any financial statements that your investors may require . Hell, you can't even export a spreadsheet!

So why talk about Summit? Because Summit is pretty awesome when it comes to piloting your SaaS startup with a financial model. Here is how it works. First you connect your live metrics (Stripe, Baremetrics, etc.) to your Summit account. This allows Summit to derive your future growth from the current trends. The next step consists in optimizing that future growth. To do that, you define a baseline scenario around 20+ metrics from sales, product, finance, then you play around with those variables to maximize your MRR or any other metric you like. What if we increase our close rate? What if we raise funds and funnel that money into paid ads? You instantly get clear answers. What's more, the clean dashboards and convenient built-in comments feature makes it easy and even pleasant to run those analyses and share with your team. It's a really fresh experience - no comparison possible with fuddy-duddy spreadsheets.

Summit is still a young product and there is room for improvement: currencies, tax rates, expansion and contraction of existing clients, one-off revenue. In particular, client acquisition would greatly benefit from more granularity and native integrations with social media accounts for instance.

At the end of the day, Summit is not meant to build financial statements, but to make decisions in a data-driven way. It's such a refreshing approach in the space that I highly recommend trying it out. Bonus point: it's 100% free for now, so it's a no-brainer.

12. "Causal" by Taimur and Lukas

Causal, by Taimur and Lukas

At first glance, Causal seemed very similar to Summit. It's also a SaaS solution, also founded in 2019, also bringing a new approach to modeling. But that's where the comparison stops because the philosophy behind Causal is quite unique.

Causal is not just a financial modeling tool for SaaS startups. It's a modeling tool that aims at replacing Excel for every modeling need you may have. This means that (a) Causal is super versatile and goes much deeper than Summit, and (b) Causal is much more complex with a steeper learning curve than Summit.

Looking at revenue and cost modeling, you can model anything you want on Causal with an interface that's 10x more modern and user-friendly than a spreadsheet. The same thing goes for analysis capabilities: you can generate dashboards, tables, and graphs for absolutely anything - including any financial statement your investors may want. You can also connect live data sources (Stripe and Google Sheets for now, more to come) to automatically update your models with real-time metrics.

As a SaaS entrepreneur, you don't have time to build a model from scratch. Lucky you, Causal has built-in templates - including two SaaS models built by Taylor Davidson himself (see template #6). You are then able to augment or fine-tune those models to suit your specific needs.

In terms of documentation, there are a few videos, a live chat as well as a walkthrough when you start a new model. That's not much, but Causal assumes that you are a modeling "nerd" and that your usual work environment is massive spreadsheets. If that's the case, you'll be just fine. Assuming you have the time and desire to put in the hours to learn a new tool, Causal may very well be the ultimate platform for financial modeling.

New models - reviews coming soon

"financial model template for startups" by basetemplates.

Financial Model Template, by BaseTemplates

Conclusion: this is the best financial model for SaaS startups

Best free spreadsheet

If you want a "good enough" model but are not willing to pay for it, go for Ben Murray's (model #4) or Chris Janz's (model #2) . Customize them a bit to offset their weaknesses.

See below a side-by-side comparison of the differences between both models.

Best paid spreadsheet

If you want the best financial model spreadsheet out there and are willing to pay for it, go for Taylor Davidson's (model #6) or Alexander Jarvis' (models #7/#8) . They are by far the best stuff on the market today.

See below a side-by-side comparison of the differences.

Best software

If you want to experience the future of financial modeling, go for Summit (model #11) or Causal (model #12) - while keeping in mind that both are very different.

Thanks for reading. Don't hesitate to leave a question in the comments, I try to reply personally to each one of them.

OpenVC is a radically open platform that helps tech founders connect with the right investors.

POPULAR Posts

An LP take on VC portfolio construction

How to write a top 1% cold email to VCs

Pitch deck for startups - 9 templates compared

How to Model a Venture Capital Fund

How to whitelist OpenVC

You might also enjoy

Here's our list of the absolute best 9 templates of pitch decks for startup founders. Most of what you find online - both free and paid - sucks. So we tested them all and produced a detailed benchmark for you.

Need a financial model for your startup? Fear not. I have extensively compared the top 12 templates, free and paid, so you don't have to do it.

The Complete Guide to Financial Modeling: Best Practices, Examples, and More

Whether you’ve been operating for years or are just getting started, your business has a lot of moving parts. Each piece — burn rate, valuation, cash flow — affects the next, and keeping tabs on it all can be tough. Add external factors into the mix, and things can get very complicated very fast.

You need a way to forecast these changes, a strategy to help guide your strategic decision-making and attract outside investors.

Enter, financial modeling — the backbone of a successful financial planning and analysis (FP&A) strategy.

Table of Contents

What Is a Financial Model?

A financial model is a way to consolidate the various parts of your organization. It’s a numerical snapshot that helps value your company, direct financial planning, and project financials into the future.

Financial models are typically contained in the finance team’s faithful spreadsheets found in Excel or Google Sheets, with different components connected through mathematical formulas. If the model has been built correctly, you can tweak a number — say projected revenue — and immediately see how that change would affect other aspects of your business.

Some of the primary uses of financial modeling include:

- Valuing a company

- Revenue forecasting

- Preparing for multiple scenarios

- Assessing the viability of mergers

Ultimately, the goal of financial modeling is to see how specific changes — whether they’re outside your control or not — will affect the company’s market position and bottom line today and in the future.

There are many different types of models. Different types focus on different financial aspects – some will be evergreen, models you want to continually utilize and update, while others will only be relevant at specific points in your company’s lifecycle.

A type of model that would be useful for one business — say, an investment banking firm — might not be quite as useful for an early-stage SaaS startup or a company focused on one-time purchases.

There’s no better way to show you what we mean than by looking at examples of financial modeling.

SaaS Financial Model Template

7 types of financial model.

Each financial model serves a unique purpose in business decision-making and financial analysis. In this section, we explore seven essential financial models, highlighting their specific applications and roles in shaping strategic financial insights for diverse business scenarios.

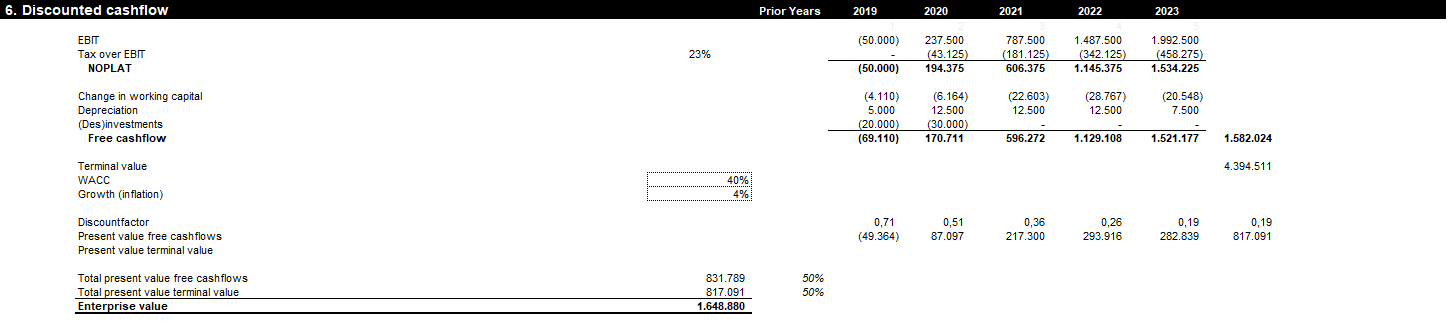

The DCF or discounted cash flow model is used mostly for valuation. Gearing up for a new round of funding? This is the model you’re looking for.

The discounted cash flow model starts with projected future cash flows, i.e., how much cash the company expects to generate in the future. It then discounts these amounts to their net present value. This might sound a little strange, but it’s related to the time value of money ($1000 is worth more today than $1000 a month from now).

Specifically, DCF looks at free cash flow , and the discount rate would usually be the company’s weighted average cost of capital (WAAC), which is how much the company pays to finance its assets.

DCF also shows a company’s internal rate of return — the discount rate that would bring the net present value to zero. Venture capital firms and investment bankers like to look at this number before jumping aboard – the higher, the better.

Be aware, though, that DCF is not as useful for valuing SaaS companies. That’s because it doesn’t focus on recurring revenue or net revenue retention. In many cases, having no free cash flow is a normal part of a startup’s business plan, but it doesn’t mean the company is worthless.

We did say “mostly used for valuation.” The other big use is for gauging returns on capital expenditures – you can see how much a project is worth today based on its projected future revenue.

Three Statement Model

The three statement model provides an overview of the company by interlinking the “big three” financial statements: the balance sheet (for measuring working capital), the income statement (profit & loss), and the cash flow statement (inflows and outflows of cash/cash equivalents). The model can also include schedules like the debt or depreciation & amortization schedule.

Once you’ve built your three-statement financial model, you can test different scenarios. For instance, say you’re planning to make the leap to series B funding in the near future. You want to see how boosting advertising spend will affect operating cash flow, so you plug in a specific number to the income statement – say $50,000 – as well as a (reasonable) number for returns and series funding.

You see your operating cash flow decrease to less-than-ideal levels. You’d then plug in a lower number — if that’s too high, you’d go lower and keep doing this until you find that “sweet spot” number.

The three statement model is foundational not only because it’s the simplest model but also because you’ll need it to build more targeted models like DCF or LBO models.

A leveraged buyout is a purchase funded by sizable debt, with a very high debt-to-equity ratio. The LBO model shows the projected returns of that purchase, helping buyers – usually investment bankers or private equity firms – decide whether it’s worth the cost.

These are some of the most complicated types of models. Why? Because they use circular references and because there are so many different financing options.

Merger Model

A merger model projects what the new company’s financials will look like after a merger or acquisition. Specifically, it shows the earnings per share. If the earnings per share go up, it’s said to have accreted — if they go down, it’s said to have diluted.

In a spreadsheet, you’d divide this into three different cells. The first includes the acquiring company, the second the acquired, and the third shows the combined company.

Looking to go public? This model can give you a good approximation of what your IPO should be. To build your IPO model, leverage comparable company analysis and consider previous funding valuations.

Option Pricing Model

These assign a theoretical value to options, approximating their value. Is it in the money or out of the money

There are a few different types, including the binomial, Black Shoales, and the Monte Carlo simulation.

Sum of the Parts Model

This model is used for companies that have diverse business segments or many assets – companies too big for a (comparatively) simple DCF analysis. This model can also provide a more complete valuation than just DCF, as it includes marketable securities, real-estate holdings, and intellectual property (among others).

How To Create a Financial Model in 4 Steps

There’s no one-size-fits-all way to build a financial model (no matter which type you’re trying to build). The steps below will give you the basic overview of how to build any model. But if you want a deeper dive into SaaS specifically, check out this episode of The Role Forward with Taylor Davidson, expert financial modeler and founder of foresight.is .

1. Identify Goals

Without an objective – whether that’s valuation or seeing the effects of a specific event – your financial model will be useless. That’s why, before you get started, you’ll need to identify your goals.

What do you want to accomplish with this model? Do you want to build a response to specific scenarios, say a decrease in investor funding or a better-than-expected rollout? Do you want to value your company or find vulnerabilities and guide your budgeting process ? Your answers will inform how complex your model needs to be.

2. Gather Data

Now, you’ll need to populate the model. There are two main inputs – historical financial data and assumptions. Different metrics will be important to different business and model types. For instance, the LTV:CAC ratio is critical for SaaS companies.

What are your assumptions? Are they backed by real-world data like industry benchmarks and historical trends? Do they align with the assumptions of your business model? Make sure to vet these before including them in the model.

Regardless of what type of model you’re building, you’ll need to look at headcount, top-line revenue, expenses, and the balance sheet — the four building blocks.

3. Build Your Model

Now, we get to the main event — actually constructing your financial model. We can break this down into several steps.

First, you’ll need to fill in your three financial statements.

Using the data and assumptions from the last step, build forecasts to chart your revenue growth rate. These aren’t just one-time expenses. SaaS companies need to track monthly recurring revenue (MRR). If possible, break that down into customer segments and pricing tiers.

Financial models should be easy to understand. After all, it’s not just the finance team that will be using it. A valuable financial model needs to be able to help the whole company, from the CEO to the marketing and sales teams. That means your financial modeling design is just as important as the data that goes into it. Follow a logical structure. Highlight aspects of interest to investors and decision-makers.

Clearly mark drivers and assumptions. Use color coding — for instance, you might use black for formulas and blue for hard-coded input cells.

At the same time, make sure you don’t overwhelm — it’s easy to want to include as much detail as possible, but financial models should get to the point as quickly as possible.

4. Test & Refine

Once the model’s built, you can put it into action. If anything is obviously way off, you’ll know there’s an error. Backtrack through the previous steps and make any necessary corrections.

You should constantly update your financial modeling based on new data and changing assumptions. You can also perform sensitivity analysis to see how vulnerable your assumptions are to inaccuracies.

The Importance of Quality Data and Technology

A financial model is only as good as the data it’s based on. It’s not hard to find examples of companies that have been over or undervalued based on flawed data. Worse than that, a flawed model could lead a company in the entirely wrong direction. We can’t overstate the importance of ensuring data sources are solid, then checking and rechecking.

Finance's Complete Guide to CRM Hygiene

What could be more solid than your company’s own internal data, recorded automatically?

That’s exactly what Mosaic does, making it much easier to build these complex models. The financial modeling software will automatically generate a baseline scenario, which you can then iterate on with different business outcomes.

Technology helps not only with modeling, but also in ensuring the data is valid and up-to-date. Especially for startups, models need to be flexible. Remember the four building blocks? Mosaic gathers them all by integrating with your HRIS, CRM, and ERPs.

All of this information is presented in real-time, so that outputs reflect your company’s current, down-to-the-hour situation. You have a complete solution for projecting, visualizing, and then acting upon that information. A connected piece are financial dashboards. Similar to a car’s dashboard, a financial dashboard provides a simple, visual summary of relevant KPIs, showing if you’re “on-track” to achieving your objective

Advanced Financial Modeling Techniques

We’ve covered the basics — what about more complex maneuvers?

The most useful is scenario planning . Why? Well, because it will reveal critical vulnerabilities in the company. To find those vulnerabilities, you ask “what-if” questions like: What if the economic scenario completely changes? What if our new product doesn’t sell as well as we’d planned, or new regulations affect our industry? Think of it as your personalized financial playground.

Mosaic makes it easy to do scenario planning by generating baseline scenarios based on your company’s headcount, revenue, balance sheet, and income statement. From there, you can stress test these different levels.

All of this is made even more helpful with AI. Using AI for financial modeling can make it easier to analyze data and uncover trends that wouldn’t otherwise be obvious. AI can also help with budgeting , and refine your basic financial models and scenario plans, adding a level of mathematical validation that wouldn’t otherwise be possible.

Mosaic’s Role in Scenario Planning and Financial Modeling

Building financial models tailored to your business is a critical part of strategic FP&A. But many businesses find it too difficult to do, or make mistakes that seem like a good choice but aren’t (financial model templates, we’re looking at you).

The best way to get around that time-consuming, difficult process is to utilize software — software that makes it intuitive to build financial models that answer any question you could imagine.

Take the guesswork out of your modeling process by building financial models based on your own data. Get a demo of Mosaic today.

Financial Modeling FAQs

What is the difference between financial forecasting and financial modeling.

On the face of it, financial forecasting and financial modeling sound very similar. Both project your business’s financial performance into the future, help guide decision-making, and are quantitative rather than qualitative.

The difference lies in how they’re used.

Something like a cash flow forecast would be used as a tool in day-to-day, month-to-month operations. The goal would be to optimize liquidity and ensure you don’t hit any shortfalls.

Financial models, on the other hand, build a more complex simulation of the entire picture. They look quarters or even a year or two down the line, to determine what the company’s financial position might be — down to equity, assets, and — if you were to take a certain action, or a certain scenario were to impact, right now.

Forecasts are like a 2-D map of your state, while financial models are a 3-D map of the entire country.

What are some common financial modeling mistakes?

Transcription errors. Double, triple-check your model to make sure all formulas are entered correctly. This can be as simple as ensuring parentheses are included.

Hardcoding financial models. To hardcode means to enter numbers without making sure they are tied to other values. That defeats the whole purpose of financial modeling — to see how changes in one or more items will affect the rest of the company (that being said, some items like taxes should be hardcoded).

Overly relying on templates. It’s easy to just Google, say, “DCF model” and utilize the first Excel template that comes up. Why not, right? Even a CFO might think it’s a good idea to use a financial model template . The thing is, every company is unique — financial models are not “one-size fits all.”

A DCF for a mature, established company would be very different from a DCF for a startup with high-growth potential. To get the most out of financial modeling, build your own models that are tailor-made for your company.

How can Mosaic help you build your financial model?

Mosaic can help you build models from scratch in our centralized canvas Our software sources real-time data so that you know your financial model is accurate and can answer ad hoc questions on the fly With hundreds of metrics, we specialize in helping SaaS track their growth, secure funding, and create a business plan that secures them against the hazards of a fast-paced, difficult marketplace.

Continue reading...

The dangers of one-size-fits-all saas financial modeling templates (and how to create the best one for your business), the latest mosaic insights, straight to your inbox, own the of your business.

How to Develop a Small Business Financial Plan

By Andy Marker | April 29, 2022

- Share on Facebook

- Share on LinkedIn

Link copied

Financial planning is critical for any successful small business, but the process can be complicated. To help you get started, we’ve created a step-by-step guide and rounded up top tips from experts.

Included on this page, you’ll find what to include in a financial plan , steps to develop one , and a downloadable starter kit .

What Is a Small Business Financial Plan?

A small business financial plan is an outline of the financial status of your business, including income statements, balance sheets, and cash flow information. A financial plan can help guide a small business toward sustainable growth.

Financial plans can aid in business goal setting and metrics tracking, as well as provide proof of profitable ideas. Craig Hewitt, Founder of Castos , shares that “creating a financial plan will show you if your business ideas are sustainable. A financial plan will show you where your business stands and help you make better decisions about resource allocation. It will also help you plan growth, survive cash flow shortages, and pitch to investors.”

Why Is It Important for a Small Business to Have a Financial Plan?

All small businesses should create a financial plan. This allows you to assess your business’s financial needs, recognize areas of opportunity, and project your growth over time. A strong financial plan is also a bonus for potential investors.

Mark Daoust , the President and CEO of Quiet Light Brokerage, Inc., explains why a financial plan is important for small businesses: “It can sometimes be difficult for business owners to evaluate their own progress, especially when starting a new company. A financial plan can be helpful in showing increased revenues, cash flow growth, and overall profit in quantifiable data. It's very encouraging for small business owners who are often working long hours and dealing with so many stressful decisions to know that they are on the right track.”

To learn more about other important considerations for a small business, peruse our list of free startup plan, budget, and cost templates .

What Does a Small Business Financial Plan Include?

All small businesses should include an income statement, a balance sheet, and a cash flow statement in their financial plan. You may also include other documents, such as personnel plans, break-even points, and sales forecasts, depending on the business and industry.

- Balance Sheet: A balance sheet determines the difference between your liabilities and assets to determine your equity. “A balance sheet is a snapshot of a business’s financial position at a particular moment in time,” says Yüzbaşıoğlu. “It adds up everything your business owns and subtracts all debts — the difference reflects the net worth of the business, also referred to as equity .” Yüzbaşıoğlu explains that this statement consists of three parts: assets, liabilities, and equity. “Assets include your money in the bank, accounts receivable, inventories, and more. Liabilities can include your accounts payables, credit card balances, and loan repayments, for example. Equity for most small businesses is just the owner’s equity, but it could also include investors’ shares, retained earnings, or stock proceeds,” he says.

- Cash Flow Statement: A cash flow statement shows where the money is coming from and where it is going. For existing businesses, this will include bank statements that list deposits and expenditures. A new business may not have much cash flow information, but it can include all startup costs and funding sources. “A cash flow statement shows how much cash is generated and used during a given period of time. It documents all the money flowing in and out of your business,” explains Yüzbaşıoğlu.

- Break-Even Analysis: A break-even analysis is a projection of how long it will take you to recoup your investments, such as expenses from startup costs or ongoing projects. In order to perform this analysis, Yüzbaşıoğlu explains, “You need to know the difference between fixed costs and variable costs. Fixed costs are the expenses that stay the same, regardless of how much you sell or don't sell. For example, expenses such as rent, wages, and accounting fees are typically fixed. Variable costs are the expenses that change in accordance with production or sales volume. “In other words, [a break-even analysis] determines the units of products or services you need to sell at least to cover your production costs. Generally, to calculate the break-even point in business, divide fixed costs by the gross profit margin. This produces a dollar figure that a company needs to break even,” Yüzbaşıoğlu shares.

- Personnel Plan: A personnel plan is an outline of various positions or departments that states what they do, why they are necessary, and how much they cost. This document is generally more useful for large businesses, or those that find themselves spending a large percentage of their budget on labor.