How to Create a Law Firm Business Plan Aimed at Success

Want a successful law firm? Start with a solid business plan. Our guide covers everything that will help you create a roadmap for success.

A firm exists to serve people- so its business plan must take into account those it aims to help. A law firm's business plan lays out the key pillars that will support a practice, from operational details to marketing strategies to financial projections. Furthermore, it should provide a clear roadmap for where the firm hopes to be in the coming years.

In this blog, we will guide you through the process of creating a comprehensive law firm business plan that will help you achieve your goals . Additionally, in our latest Grow Law Firm podcast, our host Sasha Berson conversed with Omar Ochoa, the founding attorney of Omar Ochoa Law Firm, to discuss the topic of creating a law firm business plan aimed at success.

Why Is a Business Plan Important for Law Firms?

A business plan is a vital tool for any law firm to achieve success. It outlines goals, strategies, and the feasibility of business ideas, providing a clear direction and focus for the firm. The plan can be used to secure funding from investors or financial institutions by demonstrating the potential for growth and profitability.

Moreover, a business plan supports decision-making by evaluating the feasibility of new ventures and assessing potential risks and rewards. It helps to manage resources effectively by setting financial goals and tracking progress, ensuring the firm is making the most of its resources and achieving objectives.

Lastly, a law firm's business plan enables growth by identifying new opportunities and developing strategies to capitalize on them. By planning for the future and setting realistic growth targets, law firms can take their businesses to the next level. Overall, a well-developed business plan is critical for success in the legal industry, providing direction and focus, supporting decision-making, managing resources effectively, and enabling growth.

General Tips for Creating an Attorney Business Plan

Building a business plan for law firms is not an easy or intuitive process. By considering the following issues before opening your doors to clients, you have a much better chance of having a stable firm that matches your values and has a clear set of goals.

— Stay Focused

Forming a law firm can feel overwhelming. You have a lot of freedom and can easily get sidetracked into issues that either can wait or do not deserve your attention.

If having a strong law firm website design is important enough for you to include in your plan, you will spend time on that instead of less important matters.

A plan also includes a budget. The process of planning your firm's finances can ensure that you do not overspend (or underspend) as you start your own firm.

The attention to detail that comes from having a plan will help you avoid spreading yourself too thin by focusing on every issue or the wrong issues. Instead, you will maintain your focus on the important issues.

Whether you have law partners or develop a solo law firm business plan, the plan will help you stay focused on your end goals.

— Keep Track of Goals and Results

It is easy to set goals when you start a law firm and then promptly forget about them.

Your plan will set out your goals and the metrics you will use to determine your progress toward meeting them. The plan should also explain how you will know when you have met them.

For example, you might have a growth goal of reaching five lawyers within two years. Or you might have a revenue goal of collecting $200,000 your first year.

Too many businesses, including law firms, meander on their developmental path. By setting goals and the path for meeting them, you will have guardrails to keep your firm on track.

"If you want to be the number one law firm in the country by revenue right in a 20 year time period, have that be your goal and everything that you do right is in service of that goal. You might not get there, but you're gonna find that you're gonna be very successful either way."

"If you want to be the number one law firm in the country by revenue right in a 20 year time period, have that be your goal and everything that you do right is in service of that goal. You might not get there, but you're gonna find that you're gonna be very successful either way." — Omar Ochoa

— Sort Out Your Own Law Firm Strategy

Developing a clear vision is important for establishing a strategic law firm plan aimed at long-term goals . As Omar Ochoa discusses in the podcast, having very specific milestone visions like where you want to be in five, ten, or fifteen years helps drive the strategy and actions needed to get there.

It's easy to say that you'll run your law firm better. But a plan actually helps you identify how to improve by articulating a concrete strategy. The process of creating the plan will help you pinpoint problems and solutions.

A plan forces consideration of operational details often overlooked. It equates to defining your firm's purpose and then pursuing that vision with purpose-driven strategies and actions. As Omar notes, marrying vision to action through knowledge of other successful law firm models is key to achieving goals.

One area that is frequently overlooked in plans is the inclusion of law firm marketing strategies . Developing this aspect is critical for attracting clients and sustaining growth.

Level Up Your Brand

Book a Free Consultation

— Move Forward

You should view your plan as a law firm business development plan that will guide the formation and growth of your firm .

You can review the document periodically to remind you and your law partners of your growth and expansion projections. After this review, you can ensure your growth and expansion remain on track to carry you to your goals.

The review will also tell you whether you need to update your firm's goals. When you started your law firm, you might have been unduly pessimistic or optimistic in your projections. Once you have some time to operate according to your plan, you can update your goals to keep them realistic. You can also update your processes to focus on what works and discard what does not.

The review can provide your projections for what you hope to accomplish and the roadmap for accomplishing it.

Law Firm Business Plan Template

Each of the websites below includes at least one attorney business development plan template:

- Business Plan Workbook

- PracticePro

- Smith & Jones, P.A.

- Wy'East Law Firm

You can use a law firm strategic plan example from these sites to start your firm's plan, then turn the plan into a document unique to your circumstances, goals, and needs.

What to Consider before Starting Law Firm Business Plans

Before starting a law firm business plan, think through a few key issues, including:

— Setting the Goals

Reflect deeply on your firm's purpose. Think about who you represent and how you can best meet their needs. A law firm exists for its clients. As you think about your law firm goals , think about goals for providing legal services to your clients.

"We continue to try to have the biggest impact that we can because ultimately, in my opinion at least, that's what lawyers are for, is to be able to help people and be able to move us forward." — Omar Ochoa

You need to set realistic and achievable goals. These goals should reflect your reasons for starting your law firm. Thus, if you started your law firm because you expected to make more money on your own than working for someone else, set some goals for collections.

While you are setting your goals, think about how you will reach them and the ways you will measure your success. For example, if you want to expand to include ten lawyers within three years, think about intermediate goals at the end of years one and two. This helps measure your progress.

— Choosing Partnership Structure

For lawyers considering a partnership structure, it's important to select partners that complement each other's strengths and weaknesses to help the firm function effectively.

There are 2 main partnership structure options:

- A single-tier model provides equal decision-making power and liability between partners.

- Meanwhile, a two-tier structure offers tiers like equity and non-equity partners, providing flexibility and career progression opportunities.

While similarly skilled individuals may clash, partners with differing abilities can succeed together. Some attorneys also choose to run their own firm for flexibility. This allows them to leverage different specialists through occasional joint ventures tailored for specific cases, without the constraints of a single long-term partnership. Furthermore, it highlights how the law firm partnership structures impacts freedom and sustainability.

— Thinking of the Revenue You Need

Calculate how much revenue you need to cover your overhead and pay your salary. Suppose your expenses include:

- $2,000 per month for office rent

- $36,000 per year for a legal assistant salary

- $600 per month for courier expenses

- $400 per month for a copier lease

Assume you want the median annual salary for lawyers of $127,990. You need $199,990 per year in revenue to cover your salary and expenses.

But revenue is not the end of the story. Your landlord, vendors, and employees expect to get paid monthly. So, you should also calculate how much cash flow you need each month to cover your hard expenses.

You also need a reserve. Clients expect you to front expenses like filing fees. Make sure you have a reserve to pay these costs and float them until clients reimburse you.

— Defining the Rate of Payment

You need to make some difficult decisions when it comes to setting your own fee structure. If you choose a higher billing rate, you will need to work less to meet your revenue goals. But you might not find many clients who are able to pay your fees.

Whether you charge a flat fee, contingent fee, or hourly fee, you should expect potential clients to compare your fees to those of your direct and indirect competitors. Remember, your firm competes against other lawyers, online services like LegalZoom , and do-it-yourself legal forms books.

Finally, you need to comply with your state's rules of professional conduct when setting your fees. The ABA's model rules give eight factors to determine the reasonableness of a fee. These factors include the customary fee for your location and the skill required to provide the requested legal services.

— Making the Cases in Your Law Practice Meet the Revenue Needs

Figure out how much you need to work to meet your revenue target . If you charge a flat fee, you can simply divide your revenue target by your flat fee.

Hourly fee lawyers can calculate the number of hours they need to bill and collect. However, law firm owners rarely bill 100% of the hours they work due to the administrative tasks they perform to run a firm. Also, you will probably not collect 100% of your billings, and clients could take 90 days or longer to pay.

Contingency fee lawyers will find it nearly impossible to project the cases they need. You have no way of knowing the value of your cases in advance. You also have no idea when your cases will settle. You could work on a case for years before you finally get paid.

Parts of a Business Plan for Law Firm Formation: Structure

A law firm business plan is a written document that lays out your law firm goals and strategies.

For many businesses, a business plan helps secure investors. But the ethical rules prohibit law firms from seeking funding from outside investors or non-lawyer shareholders .

Your business plan is for you and your law partners. It will help you manage everyone's expectations and roles in the firm. Here is a law firm business plan example to help you see the parts and pieces in action.

— Executive Summary

An executive summary combines the important information in the business plan into a single-page overview. Your plan will include details like projections, budgets, and staffing needs. This section highlights the conclusions from those detailed analyses.

Your executive summary should include :

- A mission statement explaining the purpose of your firm in one or two sentences

- A list of the core values that your firm will use whenever it makes decisions about its future

- The firm's overarching goals for itself, its lawyers, and the clients it serves

- The unique selling proposition that sets your firm apart from other firms in the legal industry

You should think of this section as a quick way for people like lenders, potential law partners, and merger targets, to quickly understand the principles that drive your firm.

— Law Firm Description and Legal Structure

First, you will describe what your law firm does. You will describe your law practice and the clients you expect to serve.

Second, you will describe how your firm operates. The organization and management overview will explain your legal structure and the management responsibilities of you and your law partners.

This section should fill in the details about your firm's operation and structure by:

- Describing the scope of the legal services you offer and your ideal clients

- Restating your mission statement and core values and expanding upon how they will guide your firm

- Explaining your location and where your clients will come from

- Describing your business entity type and management structure

- Detailing your unique selling proposition , including the features that distinguish your firm from your competitors

When someone reads this section, they should have a clear picture of what you will create.

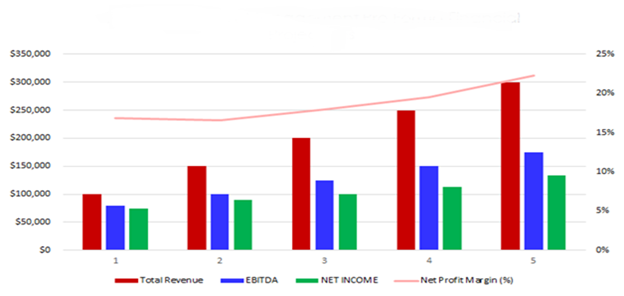

— Financial Calculations

Your attorney business plan explains where your firm's revenue comes from and where it goes. This is where your skills as a lawyer begin to diverge from your skills as a business owner. You may need to learn a few new accounting concepts so you can perform the analyses expected in a financial plan.

You will need a financial plan for at least the first year.

If you plan to seek a bank loan or line of credit, your bank may need a financial plan that covers three years or longer.

You will need more than a few rough numbers for a useful business plan. Instead, you will need to estimate your expenses and revenues as accurately as possible.

"Take some financial statements courses, take some managerial accounting courses that teach you how to track costs, how to frame costs in a way that you're looking at the important costs." — Omar Ochoa

You might need to contact vendors and service providers to get precise costs. You will probably need to track your billings with your prior firm to predict your revenues. If you are opening a law firm after law school or an in-house job, you may need a competitive analysis to show what similar law firms earn in your location and practice area.

Some reports you may need in your business plan include:

- Revenue analysis listing the fees you will collect each month

- Budget describing your monthly and annual expenses

- Financial projections combining the revenue analysis and budgeted expenses to predict your profit margins

- Cash flow statement showing how your revenues and expenses affect your cash on hand.

Your cash flow statement might be the most important financial report because it explains how your bank balance will fluctuate over time. If your clients take too long to pay their bills or you have too many accounts payable due at the same time, your cash flow statement will show you when money might get tight.

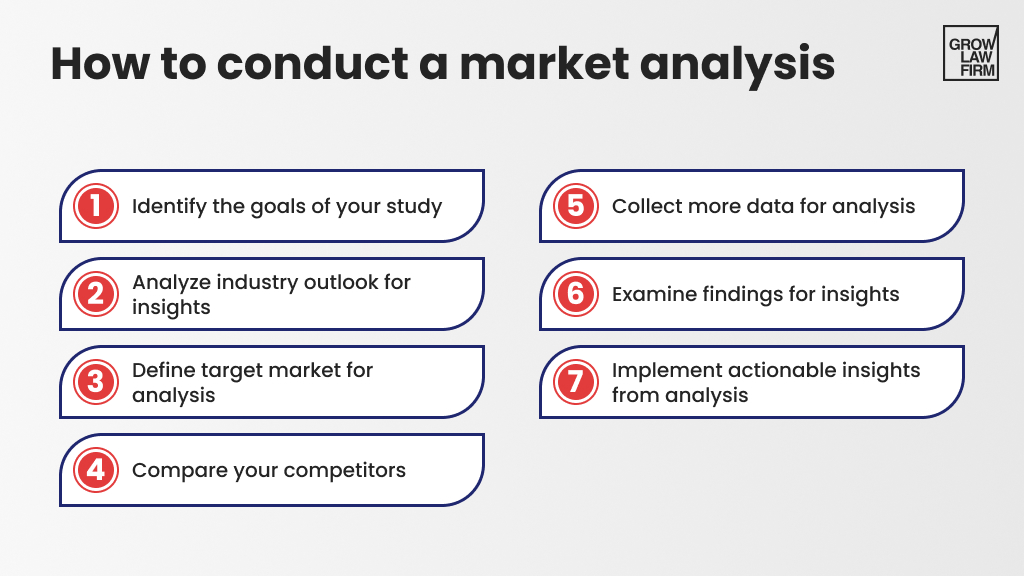

— Market Analysis

A market analysis will tell you where you fit into the legal market in your location and field. You need a competitive analysis to understand the other lawyers and law firms that will compete with you for potential clients. You can also analyze their marketing messages to figure out how to stand out from the competition.

A competitive analysis will tell you what services other firms offer, how much they charge, and what features help your competitors succeed.

Your analysis should include a discussion about your :

- Ideal clients and what you can do to help them

- Market size and whether you offer something clients need

- Competitors and what they offer to clients

- Competitive advantages and how you can market them to potential clients

You can also develop and hone your marketing strategy based on the benefits you offer to clients over your competitors. Finally, a market analysis can tell you the locations and practice areas in which your firm may expand in the future.

Your market analysis helps you focus your efforts on your legal niche.

— Marketing Plan

A marketing plan sets out the steps you will take to reach your target market. Your marketing strategy will take your market analysis and turn it into a plan of action.

You will start with the results of your market analysis identifying your clients, your competitors, and your competitive advantages. You will then discuss the message you can deliver to potential clients that captures the advantages you have over your competition.

Some advantages you might have over other lawyers and law firms might include tangible benefits like lower billing rates or local office locations. Other advantages might provide some intangible benefits like more years of experience or state-bar-certified specialists in those states that allow specialization.

You will then discuss your marketing plan. A marketing plan explains :

- Characteristics of the target market you want to reach

- What your competition offers

- The distinct benefits you offer

- A message you can use to explain what separates you from your competition

- Your action plan for delivering your message

- Your goals for your action plan, such as the number of client leads, new clients, or new cases per month

Your action plan will include the marketing channels you want to use to spread your message. Marketing specialists can help you identify the best channels for your marketing message and client base.

For example, if you practice intellectual property law, you need to reach business owners and in-house lawyers who want to protect their companies' brands, inventions, artistic works, and trade secrets. A marketing agency may help you create a marketing strategy geared toward trade publications and business magazines.

However, IP lawyers require an entirely different marketing strategy than firms that practice family law. Family lawyers need to market to individuals and will tailor their marketing efforts toward different marketing channels and messages.

Even if you expect most of your client leads to come from referrals, you still need brand recognition for those leads to find you. You should consider a website, basic SEO, legal directory, and bar association listings.

— Your Law Firm Services

You will outline the services your law firm offers to clients. Lawyers with established clients and an existing legal practice can simply describe what they already do.

Any new law firm or lawyer transitioning from other practice areas should consider:

- Practice areas you know and enjoy

- Overlapping practice fields that will not require extra staff, such as personal injury and workers' comp

- Related legal services your clients may need, such as wills and guardianship

By offering needed services you can competently provide, you can gain clients and avoid referring existing clients out to other lawyers.

— Your Law Firm Budget

You should approach your budget as a living document. You will spend more money as you add more lawyers and staff members to your firm. But you can also look for ways to reduce your operating costs through investments in technology services and other cost-saving measures .

Your budget should set out the amount you expect to initially spend on start-up expenses. As you create your start-up budget, remember many of these expenses are not recurring. Furniture, computers, and office space build-outs can last several years. In short, your budget should answer the question, "What do you need to open a law firm?"

It should also lay out the amount you plan to spend each month to operate your firm. Here, you will include your recurring expenses, such as rent, staff salaries, insurance premiums, and equipment leases.

Using your operating budget, you will determine the amount of money you need to start and run your firm. This, in turn, will tell you whether you need to take out a loan or tap into your savings to start your law firm. You will need a plan for paying your expenses and day-to-day costs while your firm gets onto its feet.

Let us help you create a digital marketing strategy and a growth plan

.webp)

Some Useful Tips on Creating a Business Plan for Law Firm Creation and Development

As you draft your law firm business plan, you should focus on the process. By putting your thoughts down in writing, you will often identify issues you had not previously considered.

Some other tips for drafting your business plan include:

— Describe Both Strengths and Weaknesses

You want to project confidence as you prepare your business plan. Remember, you will use this plan to approach potential law partners, lenders, and merger targets. You need to show that you have a solid plan backed up by your financial projections.

At the same time, you need to remain realistic. Write a business plan that describes your business challenges as well as your competitive advantages.

For example, if you have a strong competitor that has a solid law firm reputation management and many of the clients you will target, acknowledge the difficulty of getting those clients to switch law firms. Describe your marketing strategies for approaching and pitching your law firm to those clients.

— Think Ahead

Remember that your business plan sets out the roadmap for both the establishment and operation of your law firm . Think about issues that could arise as your firm grows and matures.

For example, you may have a goal of reaching ten lawyers in three years. But as your staff grows, you may need a human resources manager. You may also seek to handle your payroll in-house instead of outsourcing it to a payroll provider. These changes will create ripple effects throughout your business plans. You will incur costs when you add staff members. You will also realize benefits like increased attorney efficiency.

At the same time, any projections more than five years into the future will likely be useless. Your firm and its clients will evolve, and technology will change how you practice law.

— Be Clear about Your Intentions

As you develop your plan, you should keep its purpose in mind. First, you want to outline your core values and goals for your law firm. Set out the reasons why you started your law firm and what you intend to accomplish with it.

"You can't just be doing something because you want prestige. There's gotta be more to that, right? You have to have a purpose that you're following. And if you've got that, that purpose is like gravity, right? You will always be grounded." — Omar Ochoa

Second, you set out your path to achieving those goals. This will include boring technical information like how much you spend on legal research every month. But it will also explain your approach to solving problems consistent with your mission statement and philosophy for law firm management.

— Consult and Update If Necessary

Your plan should guide you as you build your firm. It contains your goals and the roadmap for reaching them. But your plan is not carved in stone.

As you face challenges, you will consult your plan to make sure you approach these challenges in a way consistent with achieving your goals. But under some circumstances, you might find that the plan no longer provides the right solution.

As you work with your firm and your law partners, your goals, processes, and solutions to problems may evolve. The technology your firm uses may change. Your law firm's costs may go up with inflation or down as you realize economies of scale. You should update your plan when this happens.

Final Steps

There is no recipe for creating a business plan for law firm development. What goes into your mission statement and plan will depend on several factors, including your law firm's business model. But this is a feature, not a bug of developing a business plan.

The process of business planning will help you develop solutions to issues you might have overlooked. If you have law partners, just going through the process of creating a law firm business plan can ensure that everyone is on the same page.

As you create your plan, the process itself should provoke thoughts and ideas so you can have a unique law firm tailored to your goals and values. This will help you get exactly what you wanted when you started in the legal industry.

To learn how to expand your client base as your firm grows, check out Grow Law Firm, a professional law firm SEO agency .

Founder of Omar Ochoa Law Firm

Omar Ochoa is a founding attorney with extensive experience in complex litigation, including antitrust, class actions, and securities cases. He has recovered hundreds of millions of dollars for clients and has been nationally recognized as one of the best young trial lawyers in the country.

Omar graduated from the University of Texas at Austin with degrees in business administration, accounting, and economics. He later earned his law degree from the university, serving as editor-in-chief of the Texas Law Review. He has clerked for two federal judges and has worked at the prestigious law firm Susman Godfrey L.L.P. Omar is dedicated to seeking excellence. He has been recognized for his outstanding achievements in antitrust litigation.

- Easy steps you can take to bring in more clients and up this year’s revenue

- The top website and marketing mistakes holding your law firm back

Find out how much demand there is in your geographical area

To view the calculation tailored to your law firm's needs, please provide your email address below

Consult with Sasha Berson, a legal marketing expert , to address your marketing needs.

You May Also Like

Law Firm Marketing Budget: How Much Should You Spend?

Unlocking the Secrets of Law Firm Partnership Structures: A Must-Read Guide for Success-Driven Lawyers

Lawyers Against Unbillable Hours: Joshua Lennon Maximizes Attorney Billable Hours

How to Start a Law Firm in 2024 and Succeed

Starting a Law Firm: LLP vs. PC

Don't just wait for clients, attract them!

Get our FREE Marketing Audit to find bold new ways to boost your caseload.

Contact us today to speak with one of our experts and learn more about how we can help you grow your firm.

Stay ahead of the competition!

Compare your law firm's performance to Local competitors with our instant assessment tool

Get a clear picture of your firm's performance

Boost your online presence

.webp)

Building a Business Plan for a Law Firm Partner Move

The legal market has become more and more competitive in recent years, with law firms coming under intense pressure to serve their clients more efficiently, while simultaneously increasing the amount of revenue that partners bring in. As a result, companies are now less willing to take a chance on a potential partner and instead will insist that they prove their worth. This is even more acute now that the economy has turned downwards and is likely to remain so for the foreseeable future.

Simply having the right skills and being a cultural fit is no longer enough to secure a partner position. Instead, you will need to demonstrate to the firm that you are able to earn your keep and make a profit. Because of this, it is essential that you develop a practice which is personal to you and clients and work that will move with you, should you choose to move law firms. You will then need to be able to write a detailed business plan that demonstrates your potential value to both your existing firm and any firm you may want to join.

You will need to go through a similar exercise for any internal promotion to Partner. In most cases, a firm is only going to promote you if they feel they have to in order to protect their business. This means they need to feel that if you were to leave, a significant amount of clients and work would go with you.

Now that you understand why a business plan is necessary, the question is, what information should you include? Here are our thoughts on building a business plan for law firm partner.

What Do Law Firms Want to See?

For the most part, a company will want to see a breakdown of your financial performance. You will need to demonstrate not only how much money you have brought in in the past, but also project what you will post in your first few months with the firm.

In the context of a business plan, financial performance means three different things – all of which are important, although different firms will place different weighting on them. They are:

- Client Partner Billings: The total revenue which the firm gets from the clients you manage or “own”. If you are moving, then it is the total value to the new firm of having the clients you can bring

- Matter Partner Billings: The total revenue from all the files which you are in charge of, including the billings of your subordinates or fee earners in other teams. This demonstrates the overall value of your caseload.

- Personal Billing: The revenue generated directly from your time, whether on your own files or other people’s.

Anticipating your revenue is a precise art and needs to be done with the utmost care. A law firm will hold you accountable for your figures, so it is essential that you do not inflate or under-value your estimations. Instead, you should thoroughly analyse the strength of your contacts and how much work you believe you will get from them. Another point is to pick out those who may have followed you from previous practices, as they will also add to your value.

How to Begin

When building a business plan for law firm partner, it is essential that you are able to quickly pull out the information that will prove most valuable. This is why you should begin with an executive summary.

Your summary should ideally be a one page cover sheet that summarises all the main points in your plan. It needs to be concise and capture the essence of your business plan, especially your financial projections. Once this has been done, you are ready to move on to the rest of your proposal. Here are the elements we think you should include:

Set Your Objectives

The first main section you should include when building a business plan for law firm partner is an analysis of the key objectives you want to set yourself. You should then outline how you intend to meet these targets and what your strategies will be.

There are many different ways you can demonstrate how you will hit your goals. Here are just a few:

- Expanding existing relationships: list contacts you already work with and how you intend to increase the revenue they bring in.

- Identifying important sectors : identify which areas of the market you will expand your operations in and why.

- Using your reputation : discuss how your prominence in the industry can be harnessed to bring in business.

- Providing extra services : explain how you will use your experience to provide additional services to the firm’s existing clients.

- Enhancing pitches : outline how you can help the company improve the way it bids for a specific type of work.

You should also set out a few paragraphs underneath this to provide more information about your practice and how it will add value to the firm. Alongside this, it is a good idea to discuss your reasons for wanting to move – both social and economic.

Analyse the Markets

The next step is to take a detailed look at the specific market you will be working in. Are there any issues or trends that could impact the demand for legal services? What opportunities would be available to you?

You should also outline the specific geographical areas that you will service in your first few years at the practice. Ideally, this needs to be a mix of new and existing markets. Once you have done this, go into further detail about the precise industry sectors you will focus on and list the major participants in this area, plus the reasons why they are important.

Outline Your Clients and Financials

Now we have arrived at arguably the most important part of building a business plan for law firm partner. This is where you identify the clients you think will be able to bring in quality work for the business, plus your financial information.

When listing your clients, you should identify the significant clients and discuss in detail the type of work you have carried out for them and what your measurable outcomes were – such as fees. If this is a plan for a new firm, then be specific about the clients but do not name them. That would be a flagrant breach of your duty of confidentiality and at this stage it would not be appropriate to expose yourself to that risk. Simply call them “Client A”, “Client B” etc.

You should also consider identifying opportunities to further develop your clientele. If the plan is for a move, then you should think about how you could get extra work from existing clients of the firm that those clients don’t send in at the moment. If it is an internal plan, then target existing clients of your current firm that you do not presently work for. Also, set out which new clients you want to target and why.

In terms of financials, you should outline your billing hours over the last three years. These include the hours you billed to your own clients, your current firm’s or other partner’s clients, plus any productive non-billable hours. If there are any figures you feel need explaining, such as an unusually low or high billing, consider adding a footnote underneath.

The next things you should list are your personal charge out rate for the last three years and your billings, collections and referrals. For the latter section, you should differentiate between your own billings and referrals you made to other teams, with the total amount underneath. You also need to include fees you earned from clients of another partner, where you were the main ‘matter partner’.

Finally, you need to outline the compensation you have received in the last three years. This includes your basic salary, monthly draw, plus any bonuses you may have received.

Look at Business Development

The next major area you should include when building a business plan for law firm partner is business development. There are four main sections that are important to mention, which are:

Provide a breakdown of your current team, including their position, how much of their time is dedicated to your case work and whether they are in part or full time employment. If there is anybody within your team that you wish to bring with you to your new firm, explain why this would be a good idea and list their current and expected remuneration, plus the hours they billed in the last year.

You may also need to request extra support from your new firm, in addition to your current team. If this is the case, be sure to outline who they are (for example, a junior associate) and why you believe they are necessary. A potential reason is that you envisage you will grow the business dramatically and want to focus on the more high-end clients – meaning you would need an assistant to carry out the day-to-day lawyering work.

Time Allocation

If you are intending to bring in a lot more business for the firm, or focus on new markets, you will need to outline how much time you wish to spend on this. Remember that you will also be expected to harness and grow existing clients, so it is essential that you demonstrate you are able to divide your time effectively.

Initiatives

The next thing you should outline is what marketing initiatives you intend to pursue during the next financial year. These include any sponsorships you will undertake, the conferences or seminars you plan on attending, speaking engagements and any articles you intend to write for external publication.

If there are any specific initiatives you think the firm should pursue, such as training in key areas, be sure to include this as well. It would be a good idea to also outline why this is important and, if possible, identify potential providers to work with.

Expenditure

Like any business, the law firm will want you to outline how much you expect your ventures will cost. Each time you identify something that you will need the company to provide, whether it is additional team members, a sponsorship opportunity, or extra training, you need to ensure you fully work out how much this will cost.

How You Fit Their Culture

It is important to outline why you believe you will be a good fit for the firm. After all, the company will want to know if they can work with you professionally – regardless of the amount of money you will bring in or what your plans will be. If two candidates sound the same on paper, then the business will likely go with the one they feel will integrate better into their culture. To determine whether you will be a good fit, you should carry out detailed research into the company and utilise any contacts within your network who may be able to help.

Now that you understand the basics of building a business plan for law firm partner, you should be confident in your ability to achieve your dream job. Once you have completed your plan, you may feel that you need an extra pair of eyes to advise you on any areas that may need to be tweaked. While this could come from another lawyer, you might find it more beneficial to contact a specialist legal recruiter.

Having somebody that lives and breathes the legal market in your corner could enhance your prospects in a number of areas. They will first of all be able to offer independent, and sometimes critical, input into both your client list and proposed billings.

An experienced recruiter will also be able to give your prospects of success a health-check and advise on how to fine-tune your sales pitch. In addition, they are likely to have an in-depth knowledge of the firm you are applying with, meaning they can give you essential information about the company and its culture that you may not otherwise have access to – thereby giving you a potential advantage over your competition. What is more, they could even provide details on other opportunities you may want to consider based on your experience.

If you believe that your business plan could benefit from the expertise of a specialist legal recruiter, contact Jepson Holt today. We will review your document and provide expert assistance to give you the best possible chance of success. For further information, you can also read our free eBook entitled: “Taking Control of Your Legal Career” . This handy guide details everything you need to know about progressing in your career and the actions you should take. At Jepson Holt, we aim to help you get the most out of your working life as possible.

Related Posts

Salary guide 2023, claimant group actions: a growth area in uk litigation, law firm recruiting in a looming recession.

Tax Litigation Partner – To join one of the most profitable teams in the City | Contact Mark: Email / Tel

Insolvency Litigation Partner – Join the high profile and successful team | Contact Mark: Email / Tel

Patent Litigation Partner – Remuneration Top City / US Rates | Contact Mark: Email / Tel

Automated page speed optimizations for fast site performance

Law Firm Business Plan Template

Written by Dave Lavinsky

Law Firm Plan

Over the past 20+ years, we have helped over 1,000 lawyers to create business plans to start and grow their law firms. On this page, we will first give you some background information with regards to the importance of business planning. We will then go through a law firm business plan template step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What is a Law Firm Business Plan?

A business plan provides a snapshot of your law firm as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategy for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for a Law Firm

If you’re looking to start a law firm, or grow your existing law firm, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your law firm in order to improve your chances of success. Your law firm plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Law Firms

With regards to funding, the main sources of funding for a law firm are personal savings, credit cards and bank loans. With regards to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to confirm that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business.

Finish Your Business Plan Today!

How to write a business plan for a law firm.

If you want to start a law firm or expand your current one, you need a business plan. Below are links to each section of your law firm plan template:

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of law firm you are operating and the status. For example, are you a startup, do you have a law firm that you would like to grow, or are you operating law firms in multiple cities?

Next, provide an overview of each of the subsequent sections of your plan. For example, give a brief overview of the law firm industry. Discuss the type of law firm you are operating. Detail your direct competitors. Give an overview of your target customers. Provide a snapshot of your marketing plan. Identify the key members of your team. And offer an overview of your financial plan.

Company Analysis

In your company analysis, you will detail the type of law firm you are operating.

For example, you might operate one of the following types of law firms:

- Commercial Law : this type of law firm focuses on financial matters such as merger and acquisition, raising capital, IPOs, etc.

- Criminal, Civil Negligence, and Personal Injury Law: this type of business focuses on accidents, malpractice, and criminal defense.

- Real Estate Law: this type of practice deals with property transactions and property use.

- Labor Law: this type of firm handles everything related to employment, from pensions/benefits, to contract negotiation.

In addition to explaining the type of law firm you will operate, the Company Analysis section of your business plan needs to provide background on the business.

Include answers to question such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of clients served, number of cases won, etc.

- Your legal structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry analysis, you need to provide an overview of the law firm industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the law firm industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your strategy, particularly if your research identifies market trends.

The third reason for market research is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your law firm plan:

- How big is the law firm industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential market for your law firm? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your law firm plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: businesses, households, and government organizations.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of law firm you operate. Clearly, households would respond to different marketing promotions than nonprofit organizations, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, include a discussion of the ages, genders, locations and income levels of the customers you seek to serve. Because most law firms primarily serve customers living in their same city or town, such demographic information is easy to find on government websites.

Psychographic profiles explain the wants and needs of your target customers. The more you can understand and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Law Firm Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other law firms.

Indirect competitors are other options that customers have to purchase from that aren’t direct competitors. This includes accounting firms or human resources companies. You need to mention such competition as well.

With regards to direct competition, you want to describe the other law firms with which you compete. Most likely, your direct competitors will be law firms located very close to your location.

For each such competitor, provide an overview of their businesses and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as:

- What types of customers do they serve?

- What types of cases do they accept?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide better legal advice and services?

- Will you provide services that your competitors don’t offer?

- Will you provide more responsive customer interactions?

- Will you offer better pricing or flexible pricing options?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a law firm plan, your marketing plan should include the following:

Product : In the product section, you should reiterate the type of law firm company that you documented in your Company Analysis. Then, detail the specific products you will be offering. For example, in addition to in-person consultation, will you provide virtual meetings, or any other services?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your marketing plan, you are presenting the products and services you offer and their prices.

Place : Place refers to the location of your law firm company. Document your location and mention how the location will impact your success. For example, is your law firm located in a busy business district, office building, etc. Discuss how your location might be the ideal location for your customers.

Promotions : The final part of your law firm marketing plan is the promotions section. Here you will document how you will drive customers to your location(s). The following are some promotional methods you might consider:

- Advertising in local papers and magazines

- Reaching out to local websites

- Social media marketing

- Local radio advertising

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your law firm, including filling and filing paperwork, researching precedents, appearing in court, meeting with clients, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to file your 100th lawsuit, or be on retainer with 25 business clients, or when you hope to reach $X in revenue. It could also be when you expect to expand your law firm to a new city.

Management Team

To demonstrate your law firm’ ability to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally you and/or your team members have direct experience in managing law firms. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act like mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with legal experience or with a track record of successfully running small businesses.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet and cash flow statements.

Income Statement : an income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenues and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you file 25 lawsuits per month or sign 5 retainer contracts per month? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets : Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your law firm, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a bank writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement : Your cash flow statement will help determine how much money you need to start or grow your business, and make sure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

In developing your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a law firm:

- Location build-out including design fees, construction, etc.

- Cost of licensing, software, and office supplies

- Payroll or salaries paid to staff

- Business insurance

- Taxes and permits

- Legal expenses

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your office location lease or your certificate of admission to the bar.

Putting together a business plan for your law firm is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert and know everything you need about starting a law firm business plan; once you create your plan, download it to PDF to show banks and investors. You will really understand the law firm industry, your competition, and your customers. You will have developed a marketing plan and will really understand what it takes to launch and grow a successful law firm.

Law Firm Business Plan FAQs

What is the easiest way to complete my law firm business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily complete your Law Firm Business Plan.

What is the Goal of a Business Plan's Executive Summary?

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of law firm you are operating and the status; for example, are you a startup, do you have a law firm that you would like to grow, or are you operating a chain of law firms?

Don’t you wish there was a faster, easier way to finish your Law Firm business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how Growthink’s professional business plan consulting services can create your business plan for you.

Other Helpful Business Plan Articles & Templates

Log in to Lawyerist.com

Not a Subscriber yet? Register here. (It's free!)

Username or Email Address

Remember Me

Forgot your password? Reset it here.

Subscribe to Lawyerist

Back to login.

- Hidden Date MM slash DD slash YYYY

- Name * First Last

- Password * Enter Password Confirm Password

- United States

- Which state is your firm's primary location? * Pick one. Alabama Alaska American Samoa Arizona Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Guam Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Northern Mariana Islands Ohio Oklahoma Oregon Pennsylvania Puerto Rico Rhode Island South Carolina South Dakota Tennessee Texas Utah U.S. Virgin Islands Vermont Virginia Washington West Virginia Wisconsin Wyoming Armed Forces Americas Armed Forces Europe Armed Forces Pacific State

- Which province is your firm's primary location? * Pick one. Alberta British Columbia Manitoba New Brunswick Newfoundland and Labrador Northwest Territories Nova Scotia Nunavut Ontario Prince Edward Island Quebec Saskatchewan Yukon Province

- What is the size of your firm? * Pick one. Solo practice Small firm (2–15 lawyers) Medium or large firm (16+ lawyers) I do not work at a law firm

- What is your role at your firm? * Pick one. Owner/partner Lawyer Staff Vendor (web designer, consultant, etc.) I do not work at a law firm

- What is your primary practice area? * Pick one. Bankruptcy Civil litigation (non-PI) Class Action Collections Corporate Criminal Education Employment Estate planning, probate, or elder Family General practice Immigration International Landlord/Tenant Mediation/ADR Personal injury Real estate Small business Sports/Entertainment Tax Trademark/IP Other I do not work in law

- Legal Technology Products and Services

- Building a Healthy Firm

- Comments This field is for validation purposes and should be left unchanged.

You have read all five of your free articles this month. To read this article, log in or register.

- Email This field is for validation purposes and should be left unchanged.

Part of the ‘Lawyerist Healthy Law Firm’

Legal product reviews and business guidance from industry experts.

Chapter 3/6

Developing a Business Plan for a New Law Firm

How to Start a Law Firm

10 min read

Guides Parent Form

Already an Insider? Log in to your account to receive your e-book!

Previous Chapter

Next Chapter

A law firm business plan is the foundation for everything your business does. Without a solid foundation, your firm will lack direction from the very beginning.

Starting a Law Firm Business Plan

A good business plan includes:

- Vision. Create a picture of what you’re building.

- Values. Identify the rules to guide your team’s important work.

- Law Firm Business Model. What you offer, who you offer it to, and how you’ll deliver your services.

- Targets and Priorities. Clarify metrics that indicate success.

Law Firm Vision

We worked with a lawyer who was stressed out about his vision. He spent weeks on the assignment because he couldn’t think of a statement that would make his entire office happy.

During one coaching session , he got that lightbulb moment when we told him that he was making too big of a deal of it. You don’t have to create the most amazing vision that perfectly captures everything you are hoping to build. You do need to start mapping out what you are (and aren’t) trying to create.

Picture these two lawyers:

- Lawyer 1 wants to double the size of his team in the next two years so he can handle more cases, help more people, and make more money.

- Lawyer 2 does not enjoy managing people. She wants to build a technology-based solution that she can offer clients with a recurring monthly price and that is delivered using a few key team members.

Neither vision is wrong. But, how each lawyer will make decisions to build a profitable business will look very different. You need to get a sense if you are trying to build something that looks more like Lawyer 1, Lawyer 2, or Lawyers 3-8. Get it?

Jot down thoughts now so you know where you’re headed and can start building the guardrails for future decisions.

Law Firm Values

Your values are a living embodiment of the firm culture you’re hoping to create and the approach to work your team shares. They are the guardrails of your business.

From hiring to client management to a marketing strategy, every decision you make comes from your values.

Your values are typically 3-6 factual statements that are authentically you.

Here are some tips on crafting great values:

- Your values must concretely point to your business. You want achievable values that set your business up for success .

- Your values must have actual meaning. Like the “be the best lawyer” example, you want to avoid the obvious. Sure, every firm wants to be the best. But what, precisely, does your firm want to do that sets you apart from the crowd?

- Finally, avoid table stakes values. Honesty, integrity, and hard work are all good works that all companies should have. But, they have nothing to do with your specific goals vs. any other firm.

As an example, here are Lawyerist’s values :

- Build an Inclusive Community.

- Experiment Like a Lobster.

- Grab the Marker.

- Seek Candor.

- Grow as People.

Each of these represents the culture of our company (even “ Experiment Like a Lobster ,” which describes our playful and out-of-the-box thinking process). We use these values for all of our decisions, especially hiring. When we evaluate a candidate, we study their fit: Are they open to experimenting? Are they willing to help us build an inclusive community ? Are they eager to lean into candor and compassion ?

Building your vision and values is an essential first step for your business. We can’t tell you how much easier other decisions will flow once you have these documented. You will make better decisions and alleviate some of the anxiety of decision fatigue.

Law Firm Business Model

One of the biggest perks of starting your firm is deciding your law firm business plan and model. You get to take everything you learned in school and while working at other organizations and implement the parts you like. Even better, you get to leave out the details that stressed you out.

This is an excellent place to review your vision and values. Take the time to dream about this. This is often the most rewarding part for new law firm owners. With a smart strategy, you can build your dream firm.

Ask yourself:

- What kind of place do I want to work in every day?

- What kind of clients do I want to serve? Who is my ideal client ?

- What type of pricing model do I want?

- What kind of access to justice issues do I want to tackle?

You get the gist. The questions you can ask yourself here are endless, but use your vision and values to inform your model. For example, if one of your values is “ grow as people ,” you might offer education opportunities for clients in areas related to their cases.

The important part is, it’s all up to you. This is yours. You get to decide.

Competitive Analysis

As part of finalizing your law firm business model, it can be very helpful to complete a competitive analysis. A competitive analysis not only forces you to define who your competitors are, it gives you a chance to determine what may be missing in the market so that you can address it.

Lawyers often assume as long as they practice law, there’s a market for what they want to do. Or they think they’re only competing against other lawyers when clients are often drawn to non-law solutions.

These lawyers are missing a huge opportunity. They aren’t asking clients how they heard about their firm. They’re not trying to figure out what other solutions their clients tried first. They aren’t looking at what clients want and how the market is attempting to respond.

Here are some tips for putting together a competitive analysis:

- Make a list of competitors. Simple, right? List firms in your practice area/location, your jurisdiction, and who may be serving your ideal client base.

- List the other ways your clients are solving their problems . Are they use an online service to create their will? Are they asking their cousin’s nephew’s wife, who once worked at a law firm in 1988, for advice? Get creative.

- Do field research . Ask your friends, family, and current clients what they do when they have a potential legal problem.

Once you’ve collected the data, you can begin the analysis. Think about the strengths and weaknesses of each competitor and the solution you’ve collected. Compare pricing, accessibility, marketing messages, and client service. How does it all compare to your firm? What do you do better? What could you improve?

And keep in mind: This isn’t a one-time deal. You’ll want to stay on top of competitive solutions through Google or social media alerts or by subscribing to industry emails and newsletters. At least once a year, do a complete forensic competitive analysis to see where things have changed.

Targets and Priorities

When you’re first starting a law firm business plan, you may just have a goal of “get my firm up and running.” A good goal! But, as you dream on your initial strategy, it’s helpful to set some initial short-term and excellent long-term goals. Yes, these goals may change as you learn and grow. But, setting goals upfront will give you a path to get started.

Short-term Goals

Look to your initial vision and values for your first goals. If you’re a family law firm that wants to do low-conflict divorces, you might have a client acquisition goal aligned with this.

For example, you could say: In the first six months of my firm opening, I want 50% of my new clients to be low-conflict separations and divorces. You’ll see this goal follows the S.M.A.R.T. formula: Specific, Measurable, Achievable, Relevant, Time-Bound.

Another short-term goal might be systems-oriented: I want a written client onboarding process documented in my first three months. (If not implemented.)

Think through all the different parts of your business and see if you can achieve one short-term goal.

Long-term Goals

Long-term goals can be a little trickier when you’re first starting. Thinking one, two, or even five years out might seem impossible. But this is where you can begin to dream a little.

A long-term goal might be that in three years, you want a staff of five people, a complete operations manual, 50 new clients a year, and Fridays off each week.

Remember, these goals might—and likely will—change. But give yourself something to work with in the beginning.

Key Performance Indicators (KPIs)

As you’re starting a law firm business plan, you’ll need a way to measure your firm’s health. These measurements are called KPIs. They track goals in all parts of your business, from marketing to finances to client acquisition .

Measuring and monitoring your KPIs will allow you to:

- Monitor the health of your firm . KPIs will enable you to see how well your law firm is performing. For example, KPIs make it easy to track your finances and your firm’s monthly growth. You’ll see problems and successes quickly and be able to take action by creating new goals or redirecting your team’s efforts.

- Simplify decision-making . Armed with the above information, you can make informed, rational decisions for everything in your business. You don’t have to guess if a decision is the right one. Instead, you can (and should) measure all variables to make the best decision for your firm’s future.

- Track your wins. By tracking your KPIs, you track your wins. Monitoring law firm data makes it simple to incentivize your staff’s hard work. After all, when you meet your numbers, everyone benefits.

For example, at Lawyerist, we track KPIs with a color-coded system.

Green means hitting our goal, yellow means we’re on the cusp, and red means not hitting the number. We track weekly, which means when something goes yellow, we can analyze and plan before it goes red.

And, because we track weekly, a one-week red doesn’t mean an emergency. It means we need to take time to discuss, find a cause, and make a plan.

Types of KPIs for Successful Firms

KPIs can cover all aspects of your business, including your finances, client satisfaction, marketing, and business development. Keep in mind, as you start your firm, KPIs will be new to you and can feel overwhelming. So, keep it simple in the beginning.

Start by picking three business questions you want answered. Find a way to measure that answer that you can track and update without too much work regularly. Then, start measuring. As your firm grows, you’ll develop your KPIs.

Let’s look at some examples.

Financial KPIs

Want to increase your revenue or improve your law firm’s financial health? You’ll want to track some financial KPIs , including (but not limited to):

- Revenue (cash collected)

- Monthly amount invoiced to clients

- Accounts receivable (amount clients owe you)

- Budgeted expenses

Regardless of your goals, we recommend tracking some basic financial data to keep an eye on the health of your firm. For a quick win, narrow down your financial KPIs to the top three financial numbers needed to understand your business.

Client Satisfaction KPIs

Your clients are your most valuable assets. Firm success requires that you watch specific metrics involving your clients.

Client satisfaction KPIs connect to several key law firm growth goals. These include increasing referrals, increasing revenue (happy clients are loyal clients), and improving overall client experience.

Examples of KPIs to track include:

- Net Promoter Score (NPS)

- Client retention rate

- Speed at which you close cases

Your Net Promoter Score measures whether current or former clients would recommend your legal services to others. A satisfied client is more likely to do so. This metric is most often gathered using a survey at the final delivery of your services.

Other measures, such as closing speed and retention, can give you insights into how happy your clients are with your services. Do you have a lower NPS than you expect? Are you losing clients? If so, your client satisfaction is low, and you could take action to improve it.

Marketing and Business Development KPIs

Is your current marketing strategy working? Without measuring KPIs, there’s no way of knowing. By tracking marketing metrics for your firm, you can see your marketing strategy’s performance and tweak where needed.

Some of these metrics include:

- Organic traffic to your website

- Number of leads generated

- Conversion rates

- Acquisition costs/return on investment (ROI)

For example, if you see your website traffic trending down, some fresh content might do the trick. Or, if you see low conversion rates yet high traffic, your website isn’t inspiring potential clients to give you a call. You might need to change your call-to-actions or refresh your website.

Marketing and business development go hand-in-hand—as they’re both critical to achieving long-term growth goals.

Some examples of business development metrics to track include:

- Number of new clients each month

- Competitor pricing

- Sales cycle length

- Number of leads that turn into consultations

Profitability KPIs and Law Firm Financial Ratios

Every law firm should have a documented long-term financial strategy and profitability model. Any healthy business has a written plan to forecast revenue, expenses, net profit, and cash reserves. To ensure you follow through with your plan, track your firm’s profitability and financial KPIs.

And where should you track these KPIs? Don’t think too hard on that one. At Lawyerist, we use a Google Sheets spreadsheet with a few simple formulas. Track anywhere that makes sense for your firm .

Next, we’ll outline how to use legal technology successfully.

Download the Full Guide on How to Start a Law Firm

With this guide, you’ll have the tools to plan, strategize, organize, finance, brand, launch, market, and run a new firm.

- Product Reviews

The original content within this website is © 2024. Lawyerist, Lawyerist Lab, TBD Law, Small Firm Dashboard, and

The Small Firm Scorecard are trademarks registered by Lawyerist Media, LLC.

Privacy policy // XML sitemap // Page ID: 1405448

Free Download

Law Firm Business Plan Template

Download this free law firm business plan template, with pre-filled examples, to create your own plan..

Or plan with professional support in LivePlan. Save 50% today

Available formats:

What you get with this template

A complete business plan.

Text and financials are already filled out and ready for you to update.

- SBA-lender approved format

Your plan is formatted the way lenders and investors expect.

Edit to your needs

Download as a Word document and edit your business plan right away.

- Detailed instructions

Features clear and simple instructions from expert business plan writers.

All 100% free. We're here to help you succeed in business, no strings attached.

Get the most out of your business plan example

Follow these tips to quickly develop a working business plan from this sample.

1. Don't worry about finding an exact match

We have over 550 sample business plan templates . So, make sure the plan is a close match, but don't get hung up on the details.

Your business is unique and will differ from any example or template you come across. So, use this example as a starting point and customize it to your needs.

2. Remember it's just an example

Our sample business plans are examples of what one business owner did. That doesn't make them perfect or require you to cram your business idea to fit the plan structure.

Use the information, financials, and formatting for inspiration. It will speed up and guide the plan writing process.

3. Know why you're writing a business plan

To create a plan that fits your needs , you need to know what you intend to do with it.

Are you planning to use your plan to apply for a loan or pitch to investors? Then it's worth following the format from your chosen sample plan to ensure you cover all necessary information.

But, if you don't plan to share your plan with anyone outside of your business—you likely don't need everything.

More business planning resources

How to Start a Business With No Money

How to Write a Business Plan for Investors

How to Write a Business Plan

How to Write a Law Firm Business Plan

Simple Business Plan Outline

Business Plan Template

Industry Business Planning Guides

10 Qualities of a Good Business Plan

Download your template now

Need to validate your idea, secure funding, or grow your business this template is for you..

- Fill-in-the-blank simplicity

- Expert tips & tricks

We care about your privacy. See our privacy policy .

Not ready to download right now? We'll email you the link so you can download it whenever you're ready.

Download as Docx

Download as PDF

Finish your business plan with confidence

Step-by-step guidance and world-class support from the #1 business planning software

From template to plan in 30 minutes

- Step-by-step guidance

- Crystal clear financials

- Expert advice at your fingertips

- Funding & lender ready formats

- PLUS all the tools to manage & grow

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Law Firm Business Plan Template

Written by Dave Lavinsky

Law Firm Business Plan

You’ve come to the right place to create your Law Firm business plan.

We have helped over 1,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Law Firms.

Below is a template to help you create each section of your Law Firm business plan.

Executive Summary

Business overview.

The Harris & Harris Law Firm is a startup up business that provides legal advice and services for clients located within the Scottsdale, Arizona region. The company is founded by Roger Harris and his son, Anthony. Roger Harris has been a partner in a well-established company, Foundations Law Firm, for over twenty years. Anthony Harris is a recent law school graduate who will begin his training under the scholarship of his father. With the extensive list of former clients in hand, Roger and Anthony are confident they can begin open their doors for business and grow the new law firm successfully.

Harris & Harris Law Firm will provide a comprehensive array of services for individuals or business entities who need advice and/or legal representation in court proceedings. Harris & Harris will provide a multi-prong approach to fashion specific solutions for each individual they represent; in that regard, all services are custom-packaged and provided for clients by the lawyers at Harris & Harris. This unique factor will set them above all other area lawyers, as most follow standard processes within the companies where they work.

Product Offering

The following are the services that Harris & Harris Law Firm will provide:

- Client-centric efforts in every case until resolution is found

- Unique process to fully explore client options in any dispute

- Creative and sustainable solutions on a case-by-case basis

- Prioritization of client needs above all else

- Dedication to professionalism and honesty

- Equally dedicated to securing the correct outcomes for our clients

- Team of highly-skilled lawyers who create winning solutions

Customer Focus

Harris & Harris will target the residents of Scottsdale, Arizona. They will also target medium-to-large businesses within Scottsdale, Arizona. They will target former associates and lawyers with whom they can collaborate in the future. They will target residents who have been served a summons for civil or criminal case appearances, whether as a witness, interested party or a potential defendant.

Management Team