Guidelines for common procedures and methodologies for the supervisory review and evaluation process (SREP) and supervisory stress testing

- Status: Final and translated into the EU official languages

The Guidelines for common procedures and methodologies for the supervisory review and evaluation process (SREP) and supervisory stress testing will be applied in the supervision of all institutions across the Union and represent a major step forward in forging a consistent supervisory culture across the single market. These Guidelines provide a common framework for the work of supervisors in their assessment of risks to banks’ business models’, their solvency and liquidity as well as the conduct of supervisory stress testing.

Summary of document history

Final report on amending guidelines on common procedures and methodologies for srep and supervisory stress testing.

- Status: Applicable

- Application date:

- Compliance deadline:

EBA GL 2022 03 - GLs on common procedures and methodologies for the supervisory review and evaluation .xlsx

(49.9 KB - Excel Spreadsheet) Last update 5 October 2023

Press contacts

Franca Rosa Congiu

- [email protected]

- +33 1 86 52 7052

- Follow @EBA_News

Move fast, think slow: How financial services can strike a balance with GenAI

Take on Tomorrow @ the World Economic Forum in Davos: Energy demand

PwC’s Global Investor Survey 2023

Climate risk, resilience and adaptation

Business transformation

Sustainability assurance

The Leadership Agenda

PwC and TED

The s+b digital issue: Corporate “power changers”

The New Equation

PwC’s Global Annual Review

Committing to Net Zero

The Solvers Challenge

Loading Results

No Match Found

What is the SREP? Annual supervisory review and evaluation of institutions

Annual assessment and scoring of all significant banks in the eurozone.

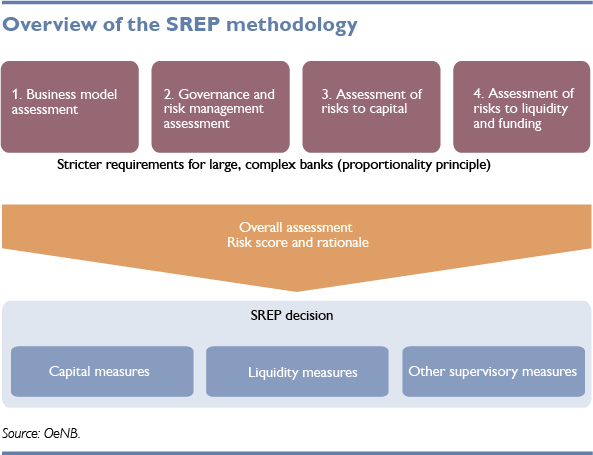

A foundational element of the supervisory practice of the ECB Banking Supervision is the Supervisory Review and Evaluation Process (SREP), basis of which is EBA/GL/2022/03 – “Guidelines on common procedures and methodologies for the supervisory review and evaluation process and supervisory stress testing“. The SREP is an annual, robust, intrusive analysis of all significant banks in the Eurozone. When performing the SREP, the ECB looks into four building blocks, each of which is separately rated with a score between 1 and 4:

- business model and strategy of the institution,

- internal governance and control framework,

- risks to capital and adequacy of own funds,

- liquidity and funding risk, as well as adequacy of liquidity.

Depending on the ECB’s assessment of the bank as a whole, the assigned scores to the four underlying building blocks as well as the detailed findings the ECB has come up with banks will

- at a minimum, receive individual capital surcharges,

- may also be obliged to adhere to additional individual liquidity requirements as wells as

- receive qualitative measures.

Adherence to these SREP measures is mandatory and will be closely monitored by the ECB.

What needs to be done?

Tackle the supervisory challenges.

PwC is your dedicated partner and well suited to helping you gain a quick and systematic overview of your bank‘s level of preparedness regarding the extensive requirements and expectations of the ECB under the SREP:

- PwC SREP: PwC can help analyse and assess the extent to which your bank's processes and documentation already meet the ECB's requirements. In doing so, we are always in line with the ECB's SREP and covers the topics of business model analysis, governance & risk appetite framework, capital adequacy and ICAAP as well as liquidity adequacy and ILAAP.

- PwC checklists: PwC has analysed the extensive requirements of the EBA and the ECB in detail. As a result of this analysis, we developed comprehensive compliance checklists to help ensure the completeness and adequacy of the prudential requirements (e.g., the annual collection of information on the ICAAP and ILAAP by the ECB represents the essential basis for assessing the governance, capital and liquidity risks of the respective bank).

- PwC benchmarks: We draw our extensive experience from numerous projects in the context of ECB banking supervision, the ongoing analysis of ECB SREP letters, results of on-site inspections and other ECB pronouncements and, last but not least, from our direct communication with the ECB. This experience helps us to identify supervisory trends at an early stage and, in particular, to read "between the lines" of published supervisory requirements.

Be on par with the ECB!

The ECB’s SREP holds up a mirror to you – and shows you a ruthless picture of your bank and your bank’s weaknesses and deficiencies.

The ECB cannot fix this. PwC can!

Thank you for your interest in PwC

We have received your information. Should you need to refer back to this submission in the future, please use reference number "refID" .

Required fields are marked with an asterisk( * )

Please correct the errors and send your information again.

By submitting your email address, you acknowledge that you have read the Privacy Statement and that you consent to our processing data in accordance with the Privacy Statement (including international transfers). If you change your mind at any time about wishing to receive the information from us, you can send us an email message using the Contact Us page.

Martin Neisen

Partner, Global Basel IV Leader, PwC Germany

Tel: +49 151 5380 0865

Benoît Sureau

Partner, PwC France

Tel: +33 7 72 37 33 32

© 2017 - 2024 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

- Legal notices

- Cookie policy

- Legal disclaimer

- Terms and conditions

To navigation

SREP – the supervisory review and evaluation process

One of the key tasks of banking supervision is to ensure the sustained viability of credit institutions. To ensure their long-term viability, banks need above all:

- an effective business model

- adequate risk management systems

- a solid capital base, and

- adequate liquidity and stable refinancing patterns

The annual supervisory review and evaluation process (SREP) has been designed to look into those four major aspects. Based on common guidelines the European Banking Authority (EBA) has provided for all EU-based supervisory authorities and on SREP methodologies applicable within the SSM, the OeNB analyzes Austrian banks in detailed SREP reviews in cooperation with the Financial Market Authority (FMA) and the European Central Bank (ECB). In line with the size and complexity of banks, the respective findings are integrated into an overall assessment, which then informs supervisory measures to be taken by the competent authorities.

The supervisory authorities may impose capital or liquidity requirements that go beyond the minimum requirements or address deficiencies in other areas. The specific requirements are communicated in the form of FMA or ECB decisions. Key analysis outcomes also inform the off-site analysis of banks and the planning process. Reviewing compliance with and implementation of the measures imposed is also an integral part of the SREP.

What issues does the SREP address?

1 Analysis of the business model covers, among other things, a bank’s core business, its economic environment and its financial plan. The focus of analysis is on adequate profitability as well as on the sustainability of the business model, with a view to ensuring that banks will stand ready to meet potential or existing capital shortfalls without external aid. If the SREP review shows that the existing business model is deficient or that restructuring plans may aggravate a bank’s financial situation, possible recovery measures will be discussed with the bank and imposed as necessary.

2 The assessment of governance issues seeks to establish whether the risk management function is sufficiently segregated, operationally independent, adequately staffed and qualified, whether internal audits have been implemented as required, and whether remuneration policies and practices comply with the legal requirements. Moreover, the reviews focus on whether banks’ internal processes are adequate in view of the complexity of their operations. For instance, there must be mechanisms in place to ensure that the senior management can take informed decisions in a timely manner. In the case of less significant banks, governance issues are reviewed by the FMA.

3 The third part deals with evaluating whether the risks banks incur may lead to losses and whether banks have sufficient capital to absorb these losses. Specifically, the SREP verifies whether all risks have been identified, measured and backed with adequate capital.

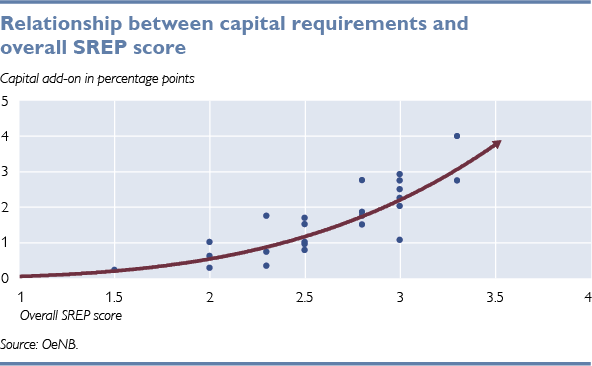

Austrian banks primarily face credit risks, essentially the risk that private and commercial borrowers may unexpectedly fail to pay back their loans. Other risks include policy rate and market price changes, currency fluctuations, IT risks and legal risks, etc. As a rule, riskier transactions will entail higher capital requirements than less risky transactions, such as banks’ traditional and generally well collateralized lending business. At the same time, weak control mechanisms for existing risks or inadequate risk management processes may also entail weaker scores and hence higher capital requirements.

Within the SREP framework, supervisors check banks’ self-assessment against regulatory requirements and assess whether banks’ own risk assessment is complete and adequately conservative. Supervisors perform plausibility checks and assess estimated amounts and possible future challenges and cross-check banks’ calculations against supervisory calculation methods. Moreover, supervisors take into account other relevant inputs and potential deficiencies established through on-site analysis or derived from other sources.

In this vein, supervisors verify all types of risk in detail and report identified weaknesses back to banks. As data plausibility is also checked during the SREP process, this makes it possible to identify any deficiencies with regard to the quality of the underlying data. Last but not least supervisors run stress tests for a multi-year horizon with a view to identifying bank-specific vulnerabilities. It is then up to the individual banks to develop adequate countermeasures and ensure adequate capitalization.

4 Similarly to the assessment of risks to capital, supervisors analyze risks to banks’ liquidity and funding which may render them unable to meet their payment obligations in a timely manner. These assessments address both excess liquidity over short-term horizons as well as long-term funding plans. In addition, supervisors assess the outcome of stress tests to make sure that banks will have enough liquidity even under more adverse external conditions. One way to ensure this is to require banks to invest excess liquidity over short-term horizons, to enable them to respond swiftly to changes in the business environment.

What are the possible outcomes of the overall SREP assessment?

Finally, the individual assessments are added up to an overall assessment and translated into scores.

As the final step in the SREP process, the FMA or the ECB will issue a decision spelling out the capital requirements established for the bank at hand. In case the capital base was found to be inadequate, banks will have to build up capital. Banks may, moreover, be required to improve their liquidity situation beyond the minimum regulatory requirements, or they may be required to remedy identified deficiencies. Together, these measures are intended to ensure that banks will be sufficiently resilient even under adverse business conditions, thus contributing to the maintenance of financial stability. Following up on the SREP process, supervisors will monitor banks’ compliance with the requirements and measures detailed in the SREP decisions in the process of off-site analysis and, if required, through on-site inspections.

To sum it up, the key outcomes of the SREP process are the overall SREP score assigned to the supervised banks and the capital add-on they are required to hold beyond regulatory own funds. Using the SREP assessments made in 2016, the chart below illustrates the relationship between SREP scores and the resulting capital requirements defined for the significant and less significant banks operating in Austria.

- ECB: The Supervisory Review and Evaluation Process in 2017

- EBA: Supervisory Review and Evaluation Process (SREP) and Pillar 2

- Diese Seite auf Deutsch.

More From Forbes

How To Create A Revenue-Generating Business Model From Scratch

- Share to Facebook

- Share to Twitter

- Share to Linkedin

Creating a revenue-generating business model is essential because it forms the foundation of a sustainable business. It ensures that your company not only survives but thrives in a competitive market.

By establishing a solid plan for generating income, you secure the necessary funds to cover operational costs, innovate, and expand. Moreover, a profitable model attracts potential investors and partners by demonstrating the business's viability and potential for growth.

Without a revenue-focused approach, a business risks stagnancy or failure, missing opportunities to scale and succeed in its objectives.

Here are some straightforward steps to building a business model that not only sustains itself but also thrives:

1. identify a market need.

The first step in creating a successful business model is to identify a clear market need. Think about what problem you solve and who are you solving it for? Conduct market research, including surveys, focus groups, and competitive analysis to validate your idea and understand your target audience’s pain points and preferences. The key is to find a niche where you can uniquely position your product or service.

2. Develop Your Value Proposition

Now you need to highlight your value proposition. This is the promise of value to be delivered to your customers and a belief from the customer that value will be experienced. Your value proposition should be compelling, differentiating your offering from competitors and making it clear why customers should choose you.

Best High-Yield Savings Accounts Of 2024

Best 5% interest savings accounts of 2024, 3. design your business model.

Map out how your business will make money. This includes defining your revenue streams, pricing strategy , sales channels, and customer segments. Common revenue models include subscription services, selling physical or digital products, offering services, or a combination of these. Choose a model that aligns with your industry and target market while also considering scalability and sustainability.

4. Build a Minimal Viable Product (MVP)

Before going all in, develop a minimal viable product (MVP) – a version of your product with just enough features to satisfy early customers and provide feedback for future product development. This approach helps minimize upfront costs and market risks by allowing you to test the waters with your concept without fully committing extensive resources.

5. Test and Iterate

Launch your MVP and closely monitor how it performs. Gather feedback from users and be ready to iterate based on what you learn. This phase is critical as it often leads to pivoting or tweaking your model based on real-world insights and customer behaviors. Flexibility and responsiveness to feedback are key components in refining your business model.

6. Scale Your Operations

Once you’ve validated your business model and started generating consistent revenue, think about scaling . This could involve expanding your product line, exploring new markets, or increasing your marketing efforts. Scaling successfully requires solid operational infrastructure, so make sure your processes, team, and technologies are equipped to handle growth.

7. Foster Customer Relationships

Invest in building relationships through excellent customer service, engaging marketing strategies, and consistent value delivery. Consider loyalty programs, personalized communications, and regular product updates to keep your customers engaged and satisfied.

8. Monitor Your Financial Health

Carefully monitor your financials. Understand your key financial metrics like cash flow, profit margins , and customer acquisition costs. Use this data to make informed decisions and adjust your business model as needed. Regular financial analysis is crucial to ensure the sustainability and profitability of your business.

The bottom line is that building a revenue-generating business model from scratch requires a mix of strategic planning, customer understanding, and continuous improvement. By following these steps and remaining adaptable to market changes, you can create a business model that not only meets the current demands of your target market but also drives long-term profitability. Remember, the most successful businesses are those that evolve with their customers and never stop optimizing their operations.

Melissa Houston, CPA is the author of Cash Confident: An Entrepreneur’s Guide to Creating a Profitable Business and the founder of She Means Profit . As a Business Strategist for small business owners, Melissa helps women making mid-career shifts, to launch their dream businesses, and I also guide established business owners to grow their businesses to more profitably.

The opinions expressed in this article are not intended to

replace any professional or expert accounting and/or tax advice whatsoever.

- Editorial Standards

- Reprints & Permissions

Join The Conversation

One Community. Many Voices. Create a free account to share your thoughts.

Forbes Community Guidelines

Our community is about connecting people through open and thoughtful conversations. We want our readers to share their views and exchange ideas and facts in a safe space.

In order to do so, please follow the posting rules in our site's Terms of Service. We've summarized some of those key rules below. Simply put, keep it civil.

Your post will be rejected if we notice that it seems to contain:

- False or intentionally out-of-context or misleading information

- Insults, profanity, incoherent, obscene or inflammatory language or threats of any kind

- Attacks on the identity of other commenters or the article's author

- Content that otherwise violates our site's terms.

User accounts will be blocked if we notice or believe that users are engaged in:

- Continuous attempts to re-post comments that have been previously moderated/rejected

- Racist, sexist, homophobic or other discriminatory comments

- Attempts or tactics that put the site security at risk

- Actions that otherwise violate our site's terms.

So, how can you be a power user?

- Stay on topic and share your insights

- Feel free to be clear and thoughtful to get your point across

- ‘Like’ or ‘Dislike’ to show your point of view.

- Protect your community.

- Use the report tool to alert us when someone breaks the rules.

Thanks for reading our community guidelines. Please read the full list of posting rules found in our site's Terms of Service.

Search Results

What is the SREP?

16 June 2016 (updated 13 November 2017)

Supervisors regularly assess and measure the risks for each bank. This core activity is called the Supervisory Review and Evaluation Process, or SREP for short. It summarises all the supervisor’s findings of a given year and gives the bank “homework”.

Specifically, the SREP shows where a bank stands in terms of capital requirements and the way it deals with risks. In the SREP decision, which the supervisor sends to the bank at the end of the process, key objectives are set to address the identified issues. The bank must then “correct” these within a specific time.

What elements do supervisors look at?

To ensure a level playing field, it is crucial to apply the same yardstick to all banks. The SREP gives supervisors a harmonised set of tools to examine a bank’s risk profile from four different angles.

How supervisors check if a bank is healthy

Does the bank have a sustainable business strategy?

Are management bodies fit and risks dealt with properly?

Does the bank have sufficient buffers to absorb losses?

Is the bank able to cover short-term cash needs?

- Business model : supervisors assess the sustainability of each bank’s set-up, in other words, whether it has a wide array of activities or whether it focuses on only a few lines of business. A bank that is focused solely on shipping, for example, would be highly vulnerable to a slowdown in global trade or overly generous lending to shipbuilders and needs to manage this risk.

- Governance and risk management : supervisors look into a bank’s organisational structure by monitoring its management bodies and checking whether risks are being managed properly.

- Risk to capital : supervisors analyse whether a bank has a sufficient safety net to absorb losses arising, for example, from cyber-attacks on the bank’s IT system, a sharp fall in oil prices, or borrowers not paying back their loans on time.

- Risk to liquidity and funding : supervisors check a bank’s ability to cover ad hoc cash needs, for example, in times of economic uncertainty when depositors may withdraw much more money than usual.

How is the SREP used?

The Joint Supervisory Teams carry out the SREP continuously and prepare an individual SREP decision once a year. Every bank receives a letter setting out the specific measures it needs to implement in the following year.

This SREP decision is tailored to each bank’s individual profile. In general, every bank has to comply with legal requirements that lay out the minimum amount of capital it has to hold. This is often referred to as “Pillar 1”.

Now the SREP enters the equation. Tailored to the individual bank, in the SREP decision, the supervisor may ask the bank to hold additional capital and/or set qualitative requirements (usually referred to as “Pillar 2”). The latter could refer to the bank’s governance structure or its management.

Also, the individual SREP decisions support other supervisory activities and contribute to a thorough and continuous monitoring of banks. They feed into the strategic and operational planning for the upcoming supervisory cycle and have a direct impact on the frequency and depth of off-site and on-site supervisory activities for a given bank.

What does this mean for the banks?

Each bank is different: some focus on traditional commercial banking, while others look after other companies’ financial assets. Some are exposed to one specific sector, whereas others spread their activities more widely across different segments.

While following one common methodology to ensure fair and consistent supervision, these differences are reflected in the scope, intensity and frequency of the individual review process for each bank. Supervisors from the ECB and the national supervisors, together in the Joint Supervisory Teams, take into account a bank’s potential impact on the financial system, its riskiness and its status, i.e. whether it is a parent entity, subsidiary or individual institution.

Typically, the supervisor will require a bank to hold more capital as an additional safety net or to sell certain portfolios of loans to reduce its credit risk. In the most extreme case, the supervisor may ask a bank to change its management or to adapt its business strategy to become more profitable.

Is the SREP something new?

The SREP itself isn't new, having previously been performed by the national supervisors. The novelty of the SREP under the Single Supervisory Mechanism is that now one common methodology and one common timeline are being applied to all significant banks under European banking supervision.

The concept of SREP was first introduced in 2004 with the Basel II accords set by the Basel Committee on Banking Supervision. Updated rules were implemented across the EU in 2006 and have been followed ever since by the different national supervisors.

The biggest banks, which are supervised directly by the ECB, know what to expect: the process is becoming more transparent and cross-border banks in particular benefit from a greater harmonisation of requirements.

The ECB sent out the first SREP decisions in early 2015. These were still based on national approaches and were complemented by the results of the 2014 health check, known as the “comprehensive assessment”.

The second round of SREP decisions, which were finalised at the end of 2015, was based, for the first time, on a common approach applied across all significant banks. This was an important step towards achieving a level playing field in European banking.

Find out more about related content

Find out more, our website uses cookies.

We are always working to improve this website for our users. To do this, we use the anonymous data provided by cookies. Learn more about how we use cookies

We have updated our privacy policy

We are always working to improve this website for our users. To do this, we use the anonymous data provided by cookies. See what has changed in our privacy policy

Your cookie preference has expired

IMAGES

VIDEO

COMMENTS

Business model assessment SREP methodology - Business model assessment in SREP 4 2 BMA methodology 2.1 Phase 1 The primary objective of Phase 1 is to conduct a materiality assessment of the business model and profitability, providing an overview of potential vulnerabilities and determining the key areas for the BMA to focus on. A deeper

The business model assessment is performed in three phases: Table 1. Business model assessment process. Figure 9. ... As the economic and regulatory environment keeps evolving, the SREP business model assessment methodology is updated regularly, for example to reflect challenges posed by climate risks and digitalisation to the sustainability of ...

The ECB carries out the SREP assessment based on a case-by-case approach using a standardised methodology applying a business and corporate governance‑neutral principle. ... The business model assessment (BMA) is aimed at creating a sound understanding of the functioning of the institution. It provides insights into the key vulnerabilities of ...

Press Release. 19 December 2014. The European Banking Authority (EBA) published today its final Guidelines for common procedures and methodologies for the supervisory review and evaluation process (SREP). These Guidelines represent a major step forward in forging a consistent supervisory culture across the Single Market and provide a common ...

The common SREP framework presented in these guidelines is built on: a. business model analysis; b. assessment of internal governance arrangements and institution-wide controls; c. assessment of risks to capital and adequacy of capital to cover these risks; and d. assessment of risks to liquidity and adequacy of liquidity resources to cover these

The changes to these Guidelines do not alter the overall SREP framework but affect its main elements, including (i) business model analysis, (ii) assessment of internal governance and institution-wide control arrangements, (iii) assessment of risks to capital and adequacy of capital to cover these risks, and (iv) assessment of risks to ...

1. Business model assessment 2. Governance and risk management assessment 3. Risk-by-risk capital assessment 4. Liquidity assessment SREP structure Supervisory Review and Evaluation Process (SREP) SREP definition and structure 1. Risk Assessment System Areas Tools Overall SREP assessment • A RAS1 is used for evaluating each of the areas ...

2.1.4 Overall SREP assessment 28 2.1.5 Dialogue with institutions, application of supervisory measures and communicating findings 28 2.2 Scoring in the SREP 29 2.2.1 Risk scores 30 ... Business model analysis 42. GL ON COMMON PROCEDURES AND METHODOLOGIES FOR SREP AND SUPERVISORY STRESS TESTING 3 4.1 General considerations 42

The review's overall goal is to conduct an in-depth assessment of Significant Institutions' business models, improving supervisors' understanding of business model and profitability risks. ... by other stakeholders. The SREP BMA is forward looking, and requires joint supervisory teams (JSTs) to form a view on a business model's ...

The Report also reflects consistent implementation into their supervisory practices of the key supervisory priorities for 2021. However, the Report sets expectations for additional efforts from Competent Authorities on topics such as ICT risks, namely cyber risk and business model challenges and the respective digital transformation.

The SREP is an annual, robust, intrusive analysis of all significant banks in the Eurozone. When performing the SREP, the ECB looks into four building blocks, each of which is separately rated with a score between 1 and 4: liquidity and funding risk, as well as adequacy of liquidity. 1. Business Model Analysis.

ts Evolution of the SREP results -SREP scores (1/2) 4 Main elements assessed by the SREP 1) Business Model and Profitability - the viability and sustainability of business models 2) Internal Governance and Risk Management - the adequacy of internal governance and risk management 3) Risk to Capital - the risks to capital (with its sub-components of credit risk, market risk, interest rate risk ...

The ECB carries out the SREP assessment based on a case-by-case approach using a standardised methodology, applying a business and corporate governance‑neutral principle. ... The business model assessment (BMA) is aimed at creating a sound understanding of the functioning of the institution. It provides insights into the key vulnerabilities ...

1 Analysis of the business model covers, among other things, a bank's core business, its economic environment and its financial plan. The focus of analysis is on adequate profitability as well as on the sustainability of the business model, with a view to ensuring that banks will stand ready to meet potential or existing capital shortfalls without external aid.

Element 1: Business model SREP scores for 2018, 2019 and 2021. Sources: SREP 2021 values based on 108 decisions; SREP 2019 values based on 109 decisions; SREP 2018 values based on 107 decisions. ... It was for this reason that the SREP assessment of credit risk focused on risk controls. 5.3.4 Focus on credit risk controls.

The guidelines specify common SREP procedures and methodologies that are proportionate to the different sizes and business models of investment firms as well as the nature, scale, and complexity of their activities. As part of SREP, a scoring system is introduced to facilitate the comparability across firms.

A business model assessment should be performed to: Get to know business strengths and weaknesses; Evaluate the team performance; Establish new goals; Delegate tasks and responsibilities to the team members assertively; Increase the market share and cash flow; Create a plan of action for every weakness or challenge perceived.

3. Design Your Business Model. Map out how your business will make money. This includes defining your revenue streams, pricing strategy, sales channels, and customer segments. Common revenue ...

Supervisory review (SREP) Supervisors assess the risks banks face and check that banks are equipped to manage those risks properly. This activity is called the Supervisory Review and Evaluation Process, or SREP, and its purpose is to allow banks' risk profiles to be assessed consistently and decisions about necessary supervisory measures to ...

Business model: supervisors assess the sustainability of each bank's set-up, in other words, whether it has a wide array of activities or whether it focuses on only a few lines of business.A bank that is focused solely on shipping, for example, would be highly vulnerable to a slowdown in global trade or overly generous lending to shipbuilders and needs to manage this risk.

The aim of the Pillar 2 processes is to enhance the link between an institution's risk profile, its risk management and risk mitigation systems, and its capital planning. Pillar 2 can be divided into two major components: (i) aimed at institutions, where those are expected to establish sound, effective and complete strategies and processes to ...

Join us at 6 PM (WAT) this Thursday May 9, 2024, as our distinguish guest will be discussing the topic: GEN-Z ACCOUNTANTS: Redefining Traditional...