ATM Business Plan Template

Written by Dave Lavinsky

ATM Business Plan

Over the past 20+ years, we have helped over 500 entrepreneurs and business owners create business plans to start and grow their ATM companies.

If you’re unfamiliar with creating an ATM business plan, you may think creating one will be a time-consuming and frustrating process. For most entrepreneurs it is, but for you, it won’t be since we’re here to help. We have the experience, resources, and knowledge to help you create a great business plan.

In this article, you will learn some background information on why business planning is important. Then, you will learn how to write an ATM business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What is an ATM Business Plan?

A business plan provides a snapshot of your ATM business as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for an ATM Business

If you’re looking to start an ATM business or grow your existing ATM company, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your ATM business to improve your chances of success. Your ATM business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for ATM Businesses

With regards to funding, the main sources of funding for an ATM business are personal savings, credit cards, bank loans, and angel investors. When it comes to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to ensure that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Personal savings and bank loans are the most common funding paths for ATM companies.

Finish Your Business Plan Today!

How to write a business plan for an atm business.

If you want to start an ATM business or expand your current one, you need a business plan. The guide below details the necessary information for how to write each essential component of your ATM business plan.

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your executive summary is to quickly engage the reader. Explain to them the kind of ATM business you are running and the status. For example, are you a startup, do you have an ATM business that you would like to grow, or are you operating a chain of ATM businesses?

Next, provide an overview of each of the subsequent sections of your plan.

- Give a brief overview of the ATM industry.

- Discuss the type of ATM business you are operating.

- Detail your direct competitors. Give an overview of your target customers.

- Provide a snapshot of your marketing strategy. Identify the key members of your team.

- Offer an overview of your financial plan.

Company Overview

In your company overview, you will detail the type of ATM business you are operating.

For example, you might specialize in one of the following types of ATM businesses:

- Independent ATM owner/operator: This is the most common type of ATM business in which an individual owns one or multiple ATM machines that can be located in a variety of places such as retail stores, shopping malls, and more.

- Mobile ATM: The owner/operator of this type of ATM business will book their mobile ATMs for events such as festivals or conventions.

- Bitcoin ATM: This type of ATM machine is for cryptocurrency transactions rather than traditional banking transactions.

- ATM installation and maintenance: This type of business provides installation and maintenance services for an ATM owner/operator.

In addition to explaining the type of ATM business you will operate, the company overview needs to provide background on the business.

Include answers to questions such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of customers served, the number of transactions completed, and reaching $X amount in revenue, etc.

- Your legal business Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry or market analysis, you need to provide an overview of the ATM industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the ATM industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your marketing strategy, particularly if your analysis identifies market trends.

The third reason is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your ATM business plan:

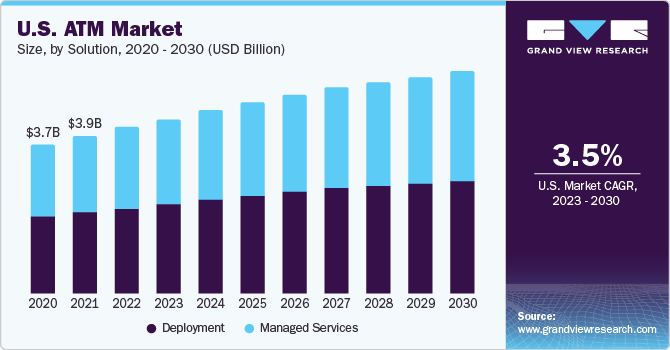

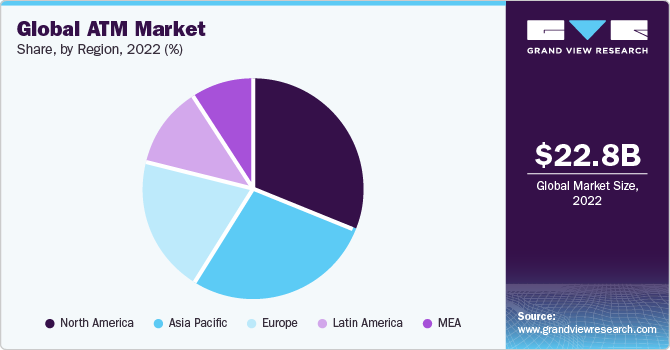

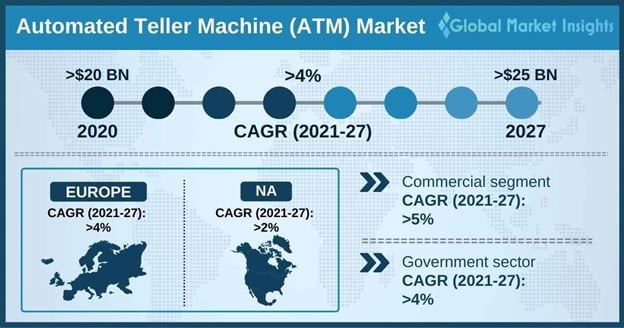

- How big is the ATM industry (in dollars)?

- Is the market declining or increasing?

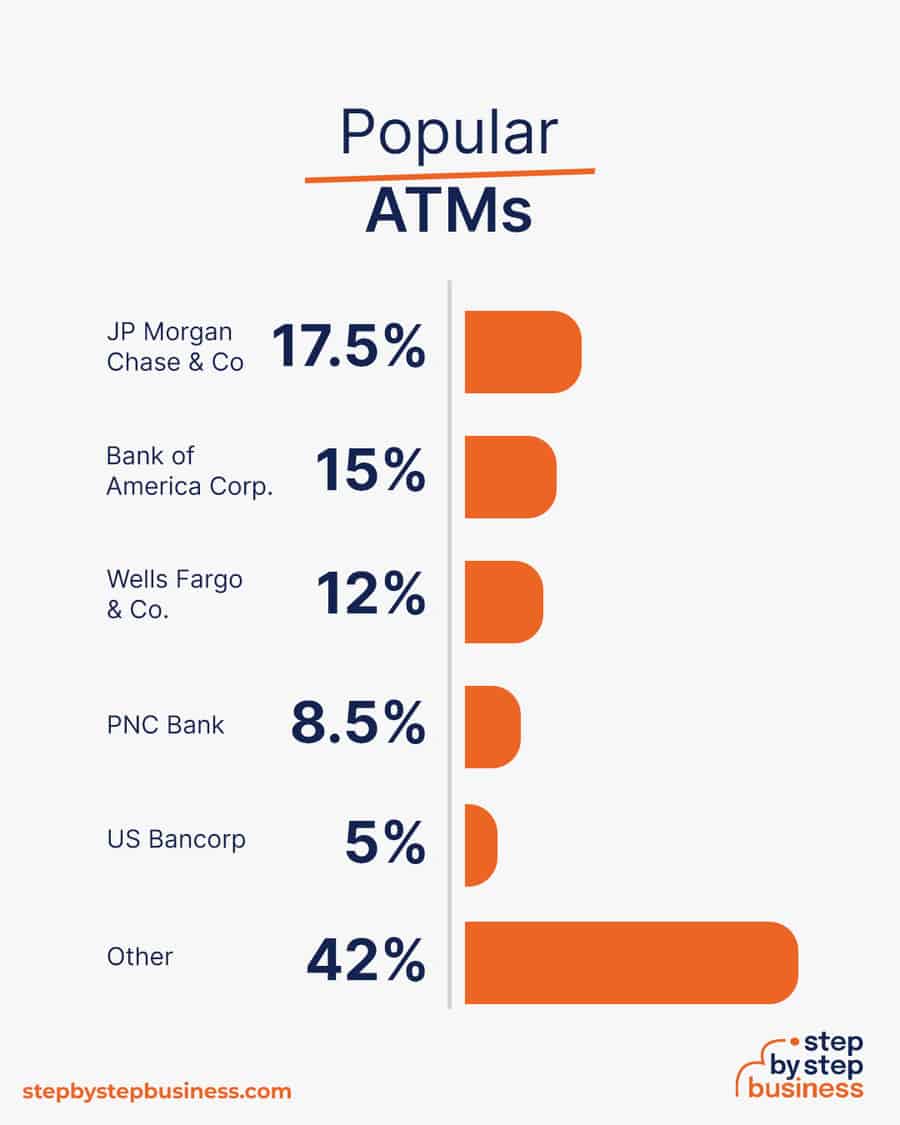

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential target market for your ATM business? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your ATM business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: individuals, schools, families, and corporations.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of ATM business you operate. Clearly, individuals would respond to different marketing promotions than corporations, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations, and income levels of the potential customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can recognize and define these needs, the better you will do in attracting and retaining your customers.

Finish Your ATM Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

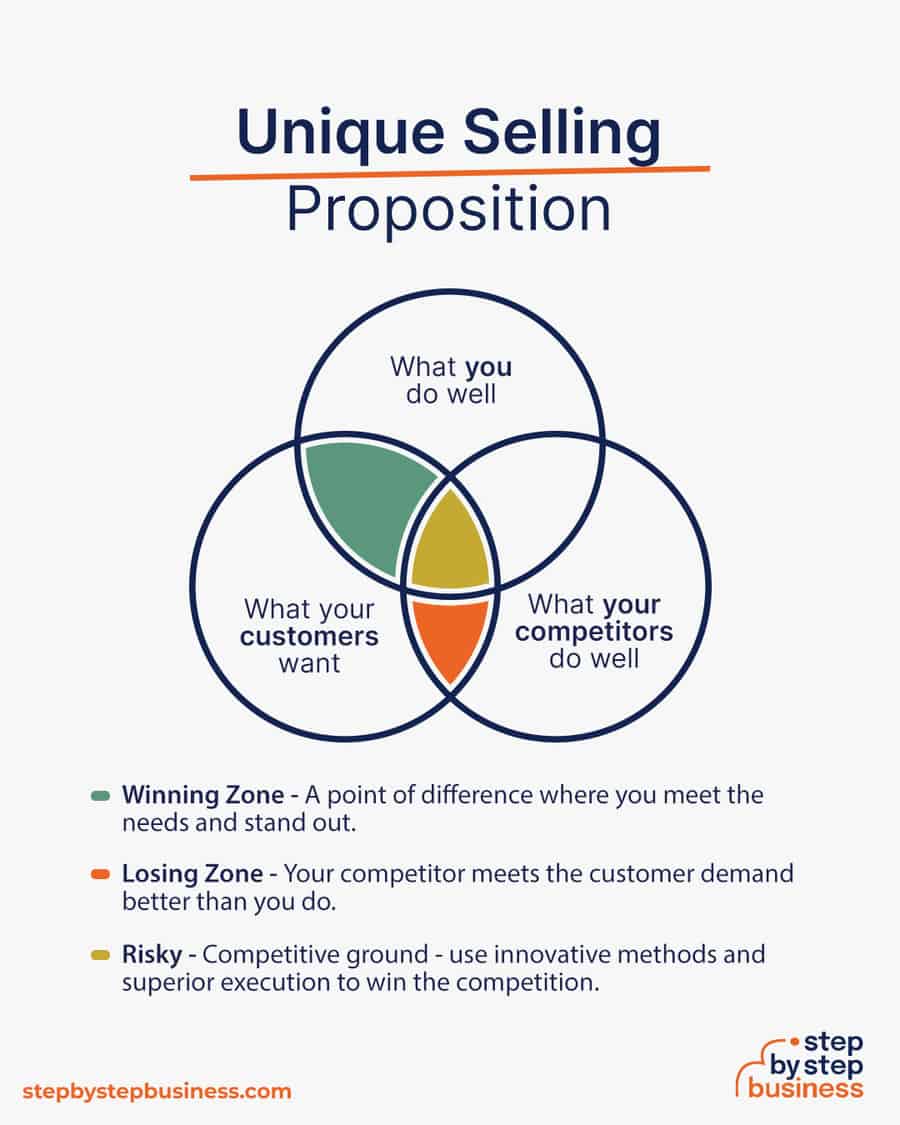

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other ATM businesses.

Indirect competitors are other options that customers have to purchase from that aren’t directly competing with your product or service. This includes online money transfer apps and traditional banking establishments. You need to mention such competition as well.

For each such competitor, provide an overview of their business and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as

- What types of customers do they serve?

- What type of ATM business are they?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you make it easier for customers to access your ATM?

- Will you offer products or services that your competition doesn’t?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a ATM business plan, your marketing strategy should include the following:

Product : In the product section, you should reiterate the type of ATM company that you documented in your company overview. Then, detail the specific products or services you will be offering. For example, will you provide mobile ATMs, bitcoin ATMs, or ATM installation services?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your plan, you are presenting the products and/or services you offer and their prices.

Place : Place refers to the site of your ATM company. Document where your company is situated and mention how the site will impact your success. For example, is your ATM business located in a busy retail district, a business district, a standalone office, or purely online? Discuss how your site might be the ideal location for your customers.

Promotions : The final part of your ATM marketing plan is where you will document how you will drive potential customers to your location(s). The following are some promotional methods you might consider:

- Advertise in local papers, radio stations and/or magazines

- Reach out to websites

- Distribute flyers

- Engage in email marketing

- Advertise on social media platforms

- Improve the SEO (search engine optimization) on your website for targeted keywords

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your ATM business, including answering calls, planning and providing therapy sessions, billing insurance and/or patients, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to install your Xth ATM, or when you hope to reach $X in revenue. It could also be when you expect to expand your ATM business to a new city.

Management Team

To demonstrate your ATM business’ potential to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in managing ATM businesses. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing an ATM business.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet, and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenue and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you install 5 ATMs in retail locations around your city, and will you charge a $2.00 fee for each transaction? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your ATM business, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a lender writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

Your cash flow statement will help determine how much money you need to start or grow your business, and ensure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

When creating your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a ATM business:

- Cost of the ATMs

- Payroll or salaries paid to staff

- Business insurance

- Other start-up expenses (if you’re a new business) like legal expenses, permits, computer software, and equipment

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your office location lease or a list of locations in which your ATMs will be installed.

Writing a business plan for your ATM business is a worthwhile endeavor. If you follow the free template above, by the time you are done, you will have an expert ATM business plan; download it to PDF to show banks and investors. You will understand the ATM industry, your competition, and your customers. You will develop a marketing strategy and will understand what it takes to launch and grow a successful ATM business.

ATM Business Plan FAQs

What is the easiest way to complete my atm business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily write your ATM business plan.

How Do You Start an ATM Business?

Starting an ATM business is easy with these 14 steps:

- Choose the Name for Your ATM Business

- Create Your ATM Business Plan

- Choose the Legal Structure for Your ATM Business

- Secure Startup Funding for ATM Business (If Needed)

- Secure a Location for Your Business

- Register Your ATM Business with the IRS

- Open a Business Bank Account

- Get a Business Credit Card

- Get the Required Business Licenses and Permits

- Get Business Insurance for Your ATM Business

- Buy or Lease the Right ATM Business Equipment

- Develop Your ATM Business Marketing Materials

- Purchase and Setup the Software Needed to Run Your ATM Business

- Open for Business

Learn more about how to start your own ATM business .

Don’t you wish there was a faster, easier way to finish your ATM business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to learn about Growthink’s business plan writing services .

Other Helpful Business Plan Articles & Templates

ATM Business Plan Template

Written by Dave Lavinsky

ATM Business Plan

You’ve come to the right place to create your ATM business plan.

We have helped over 1,000 entrepreneurs and business owners create business plans and many have used them to start or grow their ATM businesses.

Below is a template to help you create each section of your ATM business plan.

Executive Summary

Business overview.

SecureVault ATM Company is a startup ATM machine business located in Santa Cruz, California. The company is founded by Lacie Bryon, a vending machine manager who owns multiple machines throughout the city of Santa Cruz. She has built excellent relationships with the business owners from whom she rents space and electricity and, as a result, has several offers to place her ATM machines in the current locations where her name and reputation precedes her.

SecureVault ATM Company will provide reliable and secure ATM services to customers while creating mutually beneficial relationships with the location providers. There is an increased drive by consumers for cash and SecureVault ATM Company plans to build profit from that increase, particularly as the business grows. All SecureVault ATM machines will be in convenient and easily accessible locations, making it especially easy for consumers to access the ATM machines and return to it whenever needed.

Product Offering

The following are the services that SecureVault ATM Company will provide:

- Convenient and secure ATM cash withdrawals

- ATM cash machine services for tourists and out-of-country visitors

- Bank deposits that will transact within 24 hours

- Secure video panels and safety mechanisms within the machines ensure secure and safe transactions

- Proprietary app “ATM @My Location,” quickly sources and offers driving instructions to the nearest available ATM within the SecureVault ATM machines in the region

- Secure account information printouts with receipts

- Day to day management of ATM locations to maintain clean machines and surrounding areas

Customer Focus

SecureVault ATM Company will target residents of Santa Cruz. They will also target visitors from the U.S. and international visitors within the popular beach city. They will target business owners who are interested in partnerships built via the ATM machine locations. They will target businesses who will want to market services or products via the ATM app.

Management Team

SecureVault ATM Company will be owned and operated by Lacie Byron, a vending machine entrepreneur who owns multiple vending machines throughout the city of Santa Cruz. She has recruited her virtual assistant, Kayleigh Thompson, to join the startup on-site.

Lacie Byron has been a self-employed entrepreneur for over fifteen years. She has built excellent relationships with the business owners from whom she rents space and electricity and, as a result, has several offers to place her ATM machines in the current vending locations where her name and reputation precede her.

Kayleigh Thompson, the former virtual assistant, will join SecureVault ATM Company as an Administrative Assistant on-site. She will oversee all day-to-day administrative tasks. She will also be on-call for ATM emergencies 24/7 each day.

Success Factors

SecureVault ATM Company will be able to achieve success by offering the following competitive advantages:

- Friendly, knowledgeable, and highly-qualified team of SecureVault ATM Company

- Secure ATM machines that accept out-of-country debit and credit cards

- SecureVault ATM Company creates partnerships with area businesses with the intention of building up both businesses and creating mutually beneficial profitability.

Financial Highlights

SecureVault ATM Company is seeking $200,000 in debt financing to launch its SecureVault ATM Company. The funding will be dedicated toward securing the office space and purchasing office equipment and supplies. Funding will also be dedicated toward three months of overhead costs to include payroll of the staff, rent, and marketing costs for the print ads and marketing costs. The breakout of the funding is below:

- Office space build-out: $20,000

- Office equipment, supplies, and materials: $10,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Marketing costs: $10,000

- Working capital: $10,000

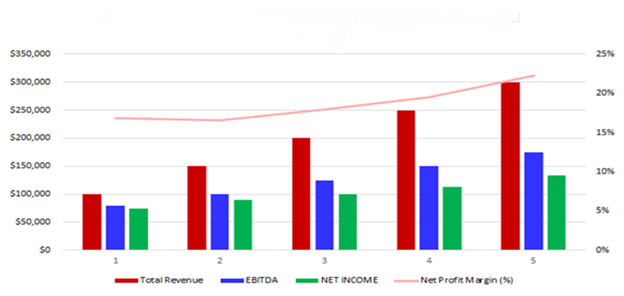

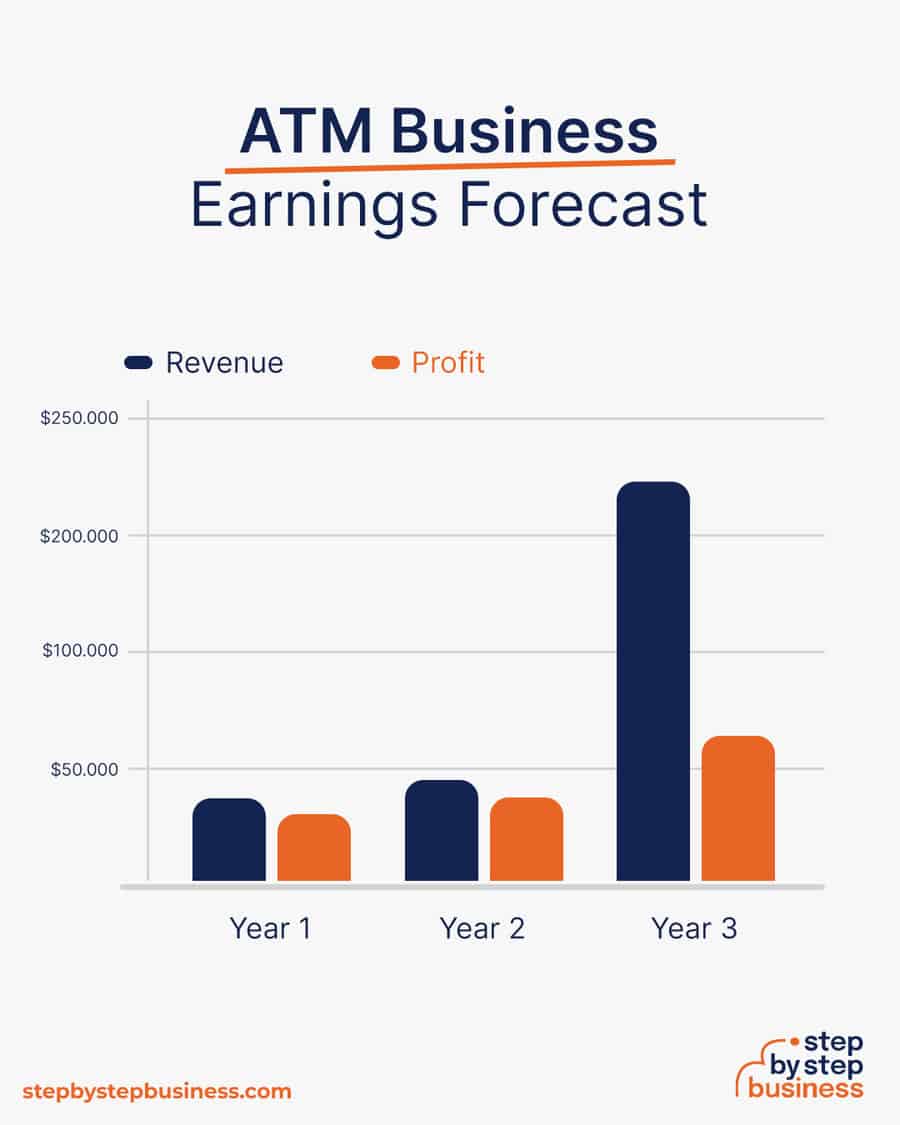

The following graph outlines the financial projections for SecureVault ATM Company.

Company Overview

Who is securevault atm company.

SecureVault ATM Company is a newly established, full-service ATM machine business in Santa Cruz, California. SecureVault ATM Company will be the most reliable, secure and convenient choice for residents, visitors and tourists from out of the country, as well as those from the surrounding communities. SecureVault ATM Company will provide a comprehensive menu of ATM choices and services for any customer to utilize. Their full-service approach includes a comprehensive set of options for cash withdrawals, deposits and other banking transactions.

SecureVault ATM Company will be able to serve hundreds of customers on a regular basis. The team of professionals in SecureVault ATM Company are highly qualified and experienced and each member of the team is trained to easily serve customers. SecureVault ATM Company removes all the headaches and issues of trying to find an ATM machine, particularly in an unfamiliar city, and ensures all issues are taken care of expeditiously while delivering the best customer service.

SecureVault ATM Company History

SecureVault ATM Company is owned and operated by Lacie Bryon, a vending machine entrepreneur who operates multiple vending machines throughout the city of Santa Cruz. She has been in business for over 15 years and has built excellent relationships with the business owners from whom she rents space and electricity and, as a result, has several offers to place her ATM machines in the current locations where her name and reputation precede her.

Since incorporation, SecureVault ATM Company has achieved the following milestones:

- Registered SecureVault ATM Company, LLC to transact business in the state of California.

- Has a contract in place for a 10,000 square foot office in a midtown building.

- Reached out to numerous contacts to include SecureVault ATM Company in their current and future location plans.

- Began recruiting a staff of three and two office personnel to work at SecureVault ATM Company.

SecureVault ATM Company Services

The following will be the services SecureVault ATM Company will provide:

Industry Analysis

The ATM machine industry is expected to grow during the next five years to over $30 million. The growth will be driven by ATM machines placed in new locations, particularly as new communities form. The growth will also be driven by new industries or sectors that conduct business in rapidly-growing cities. The growth will be driven by entrepreneurs who prefer to own and operate a business without an employer or oversight by others. Costs will likely be reduced as ATM partnerships share the costs on a more equitable level of a 50/50 split. Costs will also be reduced as new technology paves the way for improvements to ATM servicing capabilities.

Customer Analysis

Demographic profile of target market, customer segmentation.

SecureVault ATM Company will primarily target the following customer profiles:

- Residents of Santa Cruz

- U.S. visitors and international tourists

- Potential business partners for ATM placement/services

- Potential business partners who will market their business via the ATM app

Competitive Analysis

Direct and indirect competitors.

SecureVault ATM Company will face competition from other companies with similar business profiles. A description of each competitor company is below.

Quick Cash Company

Quick Cash Company provides ATM machine access throughout the Santa Cruz and Highway 1 Corridor. ATM machines are located within strip malls and adjacent to laundry facilities. The ATM machines provide cash in twenty-dollar increments up to a value of $200. The ATM machines do not accept bank deposits, nor do the ATMs accept cash deposits. There are no receipts provided. Quick Cash Company is owned and operated by Gerrie and Sandy Doney, entrepreneurs who have been in the ATM business for over ten years. The ATM machines provided by Quick Cash Company are utilized heavily near the beach amusement park area and are also popular near the southern beach portion of the Santa Cruz city. Quick Cash Company has a singular goal: that of providing cash; all other transactions are omitted from the services provided.

MoneyLink ATM Services

MoneyLink ATM Services is bank-owned and operated as a convenience for the customers of the Redwood Bank. The day-to-day management of the ATM machines owned is contracted out to a security company that refills the ATM machines with cash on a regular basis and maintains the ATM machines as needed. The Redwood Bank provides services for customers of the bank, including conducting transactions if cash or checks are deposited and paying out up to $400 if the withdrawals are from a bank customer.

MoneyLink ATM Services operates 10 ATM machines in various parts of the city of Santa Cruz, with two ATM machines near tourist shops and mini-mall stores in the downtown area of the city. The ATM servicing company maintains the ATM machine by filling them with cash as needed; however there is no cleaning of the areas around the machines, nor cleaning of the machines themselves. There are no services offered at the ATM machines, other than withdrawals and deposits.

Harrison & Company

Harrison & Company is a legal limited liability company formed between four brothers who own and operate ATM and vending machines throughout the Santa Barbara, California area. They recently expanded their business to include Santa Cruz and other beach areas. There are twenty food vending machines in the business and 15 cash vending machines within the company, each serviced and maintained by the siblings in Harrison & Company.

The food vending machines owned by Harrison & Company are located primarily in strip malls and convenience stores, where visitors can access easy and convenient cash. Harrison & Company carefully evaluates each suggested location before placing a vending or ATM machine on any site, due to the increased risk of theft or other invasive tactics by unscrupulous visitors. Harrison & Company maintain the ATM machines and food vending machines on a daily basis and have created strong and lasting partnerships with other businesses in the area in order to secure the prime locations for their machines.

Competitive Advantage

SecureVault ATM Company will be able to offer the following advantages over their competition:

- SecureVault ATM Company creates partnerships with area businesses with the intention of building up both businesses and creating mutually beneficial profitability

Marketing Plan

Brand & value proposition.

SecureVault ATM Company will offer the unique value proposition to its clientele:

- Highly-qualified team of skilled employees who are able to provide a comprehensive array of services and cash products to consumers.

- SecureVault ATM Company offers reasonable partnership value and steady income levels for partners.

Promotions Strategy

The promotions strategy for SecureVault ATM Company is as follows:

Word of Mouth/Referrals

SecureVault ATM Company has built up an extensive list of contacts over the years by providing exceptional service and expertise to her clients. Current partners and potential partners are eager to take part in the relationships of SecureVault ATM Company and help spread the word of SecureVault ATM Company.

Digital Advertising

SecureVault ATM Company will contract with a digital marketing expert to access local and regional marketing campaigns.

Social Media Campaign

SecureVault ATM Company will also contract with a social media manager to announce the launch via a series of call outs across several channels to build up to the launch date. ATM locations and specifics of the services offered will be included in the social media campaign efforts.

Print Advertising

SecureVault ATM Company will secure local newspaper ads to announce the new ATM machines in the targeted communities and regional areas. They will also send a direct mail targeted flyer to all residents within Santa Cruz county.

Website/SEO Marketing

SecureVault ATM Company will fully utilize their website. The website will be well organized, informative, and list all the services and products that SecureVault ATM Company provides. The website will list their contact information and will engage in SEO marketing tactics so that anytime someone types in the Google or Bing search engine “ATM machine that accepts international debit and credit cards” or “ATM machine near me”, SecureVault ATM Company will be listed at the top of the search results.

The pricing of SecureVault ATM Company will be moderate and on par with competitors so customers feel they receive excellent value when purchasing their services.

Operations Plan

The following will be the operations plan for SecureVault ATM Company. Operation Functions:

- Lacie Byron will be the Owner and President of the company. She will oversee all staff and manage partners and new partnership relations. She has spent the past year recruiting the following staff:

- Kayleigh Thompson, who will take on the role of Administrative Assistant and manage the office administration and act as the emergency contact.

Milestones:

SecureVault ATM Company will have the following milestones completed in the next six months.

- 5/1/202X – Finalize contract to lease office space

- 5/15/202X – Finalize personnel employment contracts for the SecureVault ATM Company

- 6/1/202X – Finalize contracts for SecureVault ATM Company partnerships

- 6/15/202X – Begin networking to find potential partners and ATM locations

- 6/22/202X – Begin moving into the SecureVault ATM Company office

- 7/1/202X – SecureVault ATM Company opens its office for business

Financial Plan

Key revenue & costs.

The revenue drivers for SecureVault ATM Company are the fees they will charge to customers for the usage of their ATM services.

The cost drivers will be the overhead costs required in order to staff SecureVault ATM Company. The expenses will be the payroll cost, rent, utilities, office supplies, and marketing materials.

Funding Requirements and Use of Funds

SecureVault ATM Company is seeking $200,000 in debt financing to launch its ATM machine business. The funding will be dedicated toward securing the office space and purchasing office equipment and supplies. Funding will also be dedicated toward three months of overhead costs to include payroll of the staff, rent, and marketing costs for the print ads and association memberships. The breakout of the funding is below:

Key Assumptions

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and in order to pay off the startup business loan.

- Number of ATM Customers Per Month: 1,600

- Average Revenue per Month: $56,500

- Office Lease per Year: $100,000

Financial Projections

Income statement, balance sheet, cash flow statement, atm business plan faqs, what is an atm business plan.

An ATM business plan is a plan to start and/or grow your ATM business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your ATM business plan using our ATM Business Plan Template here .

What are the Main Types of ATM Businesses?

There are a number of different kinds of ATM businesses , some examples include: Independent ATM owner/operator, Mobile ATM, Bitcoin ATM, and ATM installation and maintenance.

How Do You Get Funding for Your ATM Business Plan?

ATM businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start an ATM Business?

Starting an ATM business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop An ATM Business Plan - The first step in starting a business is to create a detailed ATM business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

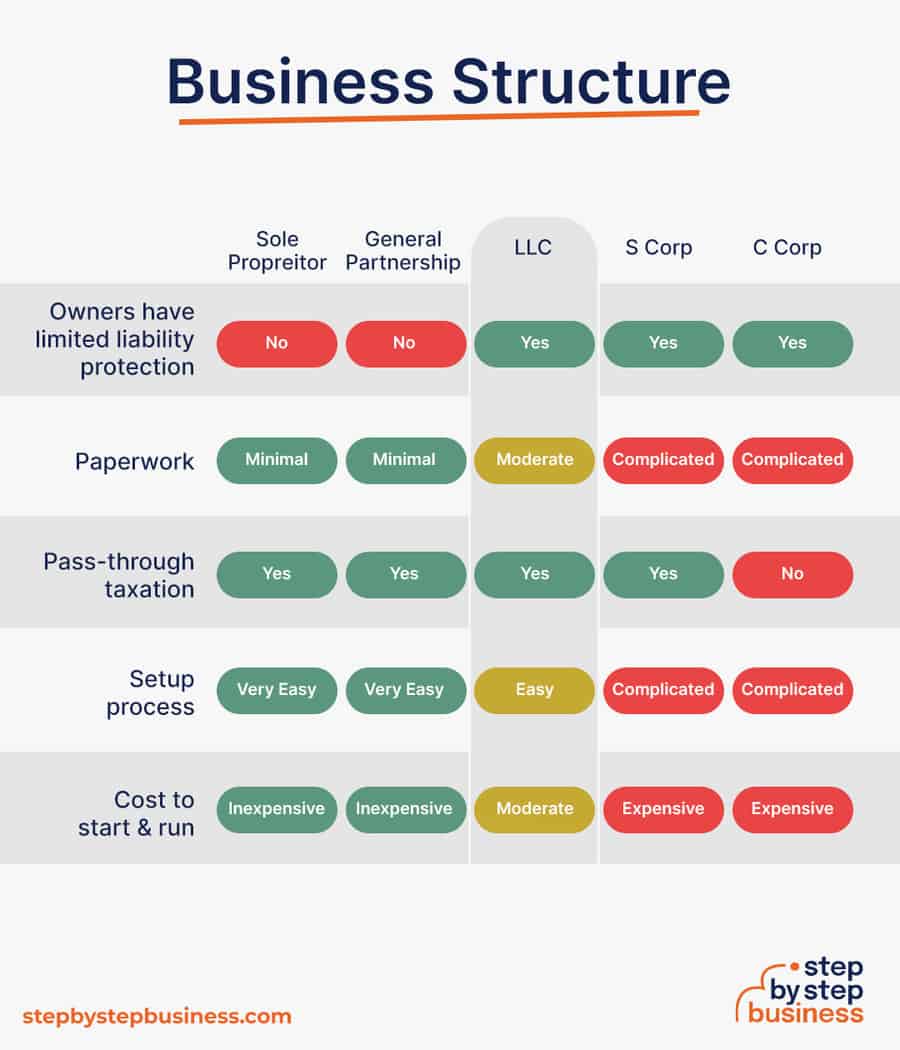

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your ATM business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your ATM business is in compliance with local laws.

3. Register Your ATM Business - Once you have chosen a legal structure, the next step is to register your ATM business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your ATM business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary ATM Equipment & Supplies - In order to start your ATM business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your ATM business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful ATM business:

- How to Start an ATM Business

How to Start an ATM Business (Complete Guide for 2024)

Starting a business may be a significant step to financial freedom. And it might surprise you, but you can actually start your own ATM business and make money off the fees when people withdraw cash. So, here’s how to start an ATM business.

- Invest in a new or used ATM machine or consider leasing one

- Find a high-traffic location where using cash is common

- Hire a cash delivery service to handle reloading the machine

- Ensure enough cash on hand to refill the machine monthly or as needed

- Plan for more minor expenses such as receipt paper, the phone connection for the machine, insurance, and ongoing maintenance

This article offers a complete guide on starting an ATM business in 2022. An ATM business is a cool source of passive income.

We’ll look at the complexities, legalities, and what life is like as an ATM owner. But I’ll also cover whether you need a business license, how much you can make off ATM fees, and what the first step in creating your business model is.

Let us dive in!

Step-by-Step Instructions on Starting an ATM Business

Starting an ATM business can be a great way to make money and provide a valuable service to customers. However, it is important to understand the process and the steps involved in order to ensure success. Here are 14 steps on starting an ATM business:

Step 1: Research the Market

Before you start your ATM business, it is important to research the market and understand the competition. Look into what other businesses are offering in terms of services, fees, and locations. This will help you determine if there is a need for your services in the area and if you can offer something unique that will set you apart from other businesses.

Step 2: Choose Your Location

Choosing the right location for your ATM business is essential for success. Consider factors such as foot traffic, visibility, security, and accessibility when selecting a location. You should also consider any local regulations or zoning laws that may affect your business.

Step 3: Obtain Licenses & Permits

Before you can open your ATM business, you will need to obtain all necessary licenses and permits from local authorities. This may include a business license, sales tax permit, or any other permits required by law in your area.

Step 4: Purchase Equipment

ATM machines are expensive pieces of equipment that require regular maintenance and upkeep. Before purchasing any equipment, make sure to research different models and compare prices from different vendors to get the best deal possible.

Step 5: Find Suppliers & Vendors

You will need to find reliable suppliers and vendors who can provide you with cash for your ATMs as well as other supplies such as paper rolls or receipt tape. Make sure to research different suppliers before making any decisions so that you can get the best prices possible.

Step 6: Set Up Your Business Structure

Before opening your ATM business, it is important to set up a legal structure such as an LLC or corporation so that you can protect yourself from personal liability in case of any legal issues or disputes with customers or vendors. Consult with an attorney or accountant who specializes in setting up businesses so that they can help guide you through this process.

Step 7: Create a Business Plan

A well-written business plan is essential for success when starting an ATM business. Your plan should include information about your target market, pricing structure, marketing strategy, financial projections, and more. This document will serve as a roadmap for running your business and should be updated regularly as needed.

Step 8: Secure Financing

Securing financing is one of the most important steps when starting an ATM business since it will determine how much money you have available for startup costs such as equipment purchases or marketing expenses. Consider applying for loans from banks or investors if needed in order to get enough capital for launching your business successfully.

Step 9: Market Your Business

Once everything is set up and ready to go, it’s time to start marketing your new ATM business! Developing a comprehensive marketing strategy that includes both online and offline tactics will help ensure that potential customers know about your services and where they can find them when they need them most!

Step 10: Train Employees & Install Equipment

Once all of the necessary paperwork has been taken care of and financing has been secured, it’s time to start training employees on how to use the equipment properly so that they can provide excellent customer service when helping customers use their ATMs! Additionally, make sure all equipment is installed correctly according to manufacturer instructions before opening up shop!

Step 11: Open For Business!

After all of these steps have been completed successfully it’s finally time to open up shop! Make sure everything is ready before opening day so that customers have a positive experience when using your ATMs!

Step 12: Monitor Performance & Adjust As Needed

Once everything has been set up properly it’s important to monitor performance regularly in order to ensure everything is running smoothly at all times! Additionally make sure adjustments are made as needed based on customer feedback or changes in market conditions so that you stay ahead of competition!

Step 13: Expand Services & Locations As Needed

As demand increases over time consider expanding services offered by adding additional features such as check cashing or bill payment options at select locations in order increase revenue potential even further! Additionally consider expanding into new locations if there appears enough demand in those areas too!

Step 14: Stay Up To Date On Regulations & Trends In The Industry

Finally make sure stay up-to-date on regulations related specifically related ATMs industry as well as trends within this sector so that you remain competitive at all times! Additionally consider attending conferences related specifically related ATMs industry too so that you stay ahead of competition at all times!

Frequently Asked Questions

How much does it cost to start an atm business.

A new indoor ATM machine is approximately $2,500. Outdoor machines are closer to $10,000. Renting space for the machine can be $100 per month. A phone line for connecting to other banks is $30 a month. Replacing receipt paper is $50 per month, and armored cash delivery can be as much as $500 per month.

And occasionally, you’ll have maintenance costs on the machine, especially if it’s outside.

But there is no exact figure that translates into the cost of starting an ATM business. I would like to believe that anyone who wants to start a business would have a budget they want to work with.

Alternatively, you may want to find out how much it will cost to generate a business plan for the finances or adjust your budget.

A number of factors influence how much money you may need to own an ATM business. Let us look at them.

Cost of ATM Machine

The cost of an ATM varies based on the model, size, and age.

You can get a machine between $2000- $3000 if it’s going INDOORS. In addition, you can choose to purchase a brand new ATM or refurbished machine. Determining the type of machine is a crucial aspect for ATM business owners.

As I said above, automated teller machines at ATM locations that are outside can cost closer to $10,000 since they have to be both weather-proof and more secure from theft.

You may want to invest in a new machine as it usually comes with a warranty. However, if you buy used machines, it may require lots of repairs, reducing the gross profit.

After settling the issue of the ATM, up next is looking for a good location.

Again, it helps if you find small business owners willing to rent out a space to you. In addition, whatever rent you agree to should not be so much that it leaves you with little or no profits.

Alternatively, you can suggest sharing the revenue from the ATM business with the location owner. This way, you are sure to avoid extra losses.

Some places will naturally benefit from having an ATM in their location (cash-only restaurants, for example) and be happy to let you place your machine for free. But others may want a fee of $100/month.

Business Structure

Another factor that affects the cost of starting an ATM business is the business structure.

You can choose between a Limited Liability Company or an incorporated business. Usually, creating a legal document may range from $150- $200.

In addition, you may have to visit the State Attorney General’s office to register the business. The cost of the registration varies depending on the business entity. However, the range is between $10- $700.

Licenses and Permits

Before you start an ATM business, you must follow your state’s licensing requirements.

You must have thought of a business name which you will register with your county clerk. In addition, you may opt for a limited liability company.

This protects you from personal liability. Furthermore, you should get all necessary business licenses and permits by paying all required fees before commencing the business.

Purchasing ATM insurance is not compulsory.

You can decide to get it or not. The cost depends on what plan covers the machine and/or cash. The number of employees and location of the business may also influence it.

But on average, expect it to cost about $500/year to insure an ATM for up to $1,000,000 in general liability coverage.

However, remember to check if an insurance policy already covers the location. If it does, this will determine the type of insurance to purchase.

Most people who start the ATM business are available to run it.

However, if you have the vision to expand to other locations, you may need to hire workers. And either way, you’ll need a system to reload the cash into the machine(s) periodically. Armored car service is the most secure but can run $500/month.

Alternatively, there are other services that can do it for about $50/visit.

So, think about how crime-ridden the neighborhood is where you have the machine, how busy it is, and how often it will need to be refilled.

Ongoing smaller expenses

As I said above, you’ll need to refill receipt paper as needed, which should cost about $50/month.

Then you’ll need a phone line so your ATM equipment can connect to other financial institutions. That is often about $30-40/month.

Thank you to Robinson’s Barbershop of Kenner, LA for choosing @advantageatm_ as it’s ATM partner! Mr. Robinson has been a successful business owner for 20+ years. We’re happy we could help! pic.twitter.com/4UcQikHRoG — cash is king. (@advantageatm_) July 11, 2020

Is owning an ATM profitable?

Yes, owning an ATM is a profitable business.

There is an ATM almost everywhere you go. They may be your only option when you are in dire need of cash but far from your local bank branch.

You may wonder what I mean by ATM business is profitable since they are affiliated with big financial institutions. However, that is not what I am talking about. Instead, I mean those ATMs you find in gas stations or convenience stores without the big names on them.

One of the key motivating factors for venturing into any business is profit. Now, to the burning question at the back of your mind: how do ATM owners get profit?

A specific transaction fee is deducted whenever a person withdraws money from the ATM. As a result, the ATM owners get paid a price of about $3 per transaction. In addition, ATM owners earn from interchange fees of about $0.10- $0.20 for each transaction.

According to Bankrate:

“An ATM operator fee or surcharge fee is charged by ATM owners to non-customers using its ATMs.”

This is another way private ATM owners make money. The average cost of surcharge fee is $3.08. Whenever someone withdraws cash from your ATM, you earn an ATM fee of about $3.

Therefore, your profit will depend on how much cash people withdraw within a period. According to ATM Depot, the average number of transactions on one ATM is 180 within a month. Therefore, you can make an average of $540 every month.

If you have more than one ATM or location is in a region with high foot traffic, then you are sure to make more profits.

Well this is different. Never seen them filling the atm before…now i know what those trucks with money are for XD pic.twitter.com/NG0q9Q35ZS — Andrew (@ajskateman) July 20, 2015

Who fills money in ATMs?

The bank obviously refills ATMs at banks or is owned by them.

However, if you are unfamiliar with the ATMs, you may wonder who actually fills these private ATMs with money since they are not affiliated with any bank.

Suppose you are the outright owner of the ATM business. You can refill the machine without involving a third party. This option may be stressful, but it is the path to maximizing profit from the business.

One problem that ATM owners may face is having enough money to refill the machine. Therefore, ATM owners must have much cash as capital for refilling.

Another issue they may face is security.

ATM business owners need to find the safest time to refill the machine. If something goes wrong, they may lose a huge amount of cash. This is primarily a risk for the free-standing type of ATMs.

Therefore, it is not uncommon for ATM owners to hire a cash management company to take care of refilling the machine with money.

Of course, this method reduces the overall profit.

But you can have your peace of mind intact. Working with a cash management company is a secure way of handling funds. The company will also have insurance which means double coverage if anything happens when filling the machine with money.

In addition, ATM owners may seek partnerships with an ATM processor.

The ATM processor is responsible for filling the machine with money. They help them map out business processes and strategies for filling the machine with cash. Although ATM owners would have to pay for this service, there is better security coverage.

WinSouth Credit Union, a financial institution based in Northeast Alabama, has partnered with ATM USA, an ATM outsourcing company, to deliver three ATMs to its new branches. #WinSouthCreditUnion #ATMUSA #ATMoutsourcing Read more: https://t.co/BWX4QIlU6R pic.twitter.com/2Q96ErcNfK — АО «САГА Технологии» (@SAGA_Tech) September 25, 2021

Are ATMs a dying business?

No, the ATM business is not a dying sector.

Some people would like to argue that the world is going digital. Therefore, there is no future for ATMs.

And 50 years from now, that will likely be true.

However, as long as cash is still in circulation, there will always be a need for ATMs. Cash has been around for thousands of years, and it will not lose relevance overnight. This is because it is the most accessible means of payment.

Many people are adopting the cashless policy.

They prefer to pay for goods and services with their debit or credit cards. The world is going digital fast. Nevertheless, ATMs are evolving to meet the need of people in the digital world.

Digital payments are risky, and that is why cash will persist. It is not easy to keep track of digital transactions. However, there is proof of transaction in your email. It would contain personal information putting you at risk of identity theft.

In addition, digital payment is a contributing factor to the digital divide.

Some people do not have access to the internet required for digital transactions. Others do not have the necessary skills to manage digital finances. Individuals living in rural areas, the unskilled, and the aged are at a disadvantage with digital transactions.

On the other hand, cash is quick.

You don’t have to wait for proof of transaction status or deal with issues of insufficient funds. Furthermore, cash is accessible to everyone irrespective of social class, educational background, or tech skills.

The events of 2020 and beyond have actually increased the usefulness of ATMs.

Banks are restricting the number of individuals who come in to follow the social distancing regulations. ATMs can be fitted with big screens for advert placement. In addition, ATMs in stores may increase foot traffic and boost business.

Found this on an atm/change machine in the casino when I went to change a 20. Someone’s having a rough start to their Vegas weekend! #Vegas #nofunds pic.twitter.com/Skm8QHgDZK — Heath Johnson (@heathjohnson80) February 15, 2020

Where is the best place to put an ATM?

The best locations for ATMs are indoor locations with a lot of foot traffic, restaurants or bars that are cash-only, or locations adjacent to large flea markets or swap meets as long as events happen regularly .

So as you may have guessed, the biggest factor that influences the success of the ATM franchise is location.

Therefore, it is essential to consider a good location because you can only profit when people use your ATMs. Here are some factors to consider before choosing a location.

Areas where cash is preferred : the ATM location should be where cash is the staple for transactions. Some organizations accept only cash, which makes them one of the best places to put an ATM.

High traffic areas : areas with more traffic increase the chances of using the ATM. This is because it is in a visible location that is easy to access. In addition, high traffic areas may make customers feel safer when using the ATM.

Other ATMs in the areas : suppose there are other machines. You may need to do a thorough investigation before placing your ATM there. If the other ATMs are old and in poor condition, you have nothing to worry about. Also, if the foot traffic is incredibly high, there may not be much competition. If otherwise is the case, you should avoid these locations.

The following are the best places for putting your ATM:

- Gas stations

- Convenience stores

- Parking lots

- Clubs and bars

- Restaurants

- Event centers

- Universities and other institutes of learning

So I would never withdraw money from a free-standing ATM (cash machine), a converting a red phone box into one is admittedly a clever idea pic.twitter.com/ncaPMYHebb — The Travelphile (@TheTravelphile) September 1, 2019

What are the types of ATMs?

There are two types of ATMs: Freestanding and Through-the-wall ATMs.

In urban cities, you can find an ATM on almost every corner, gas store, and phone line. People can use their cards (debit or credit) to withdraw cash from any location. In addition, some ATMs allow for checks and cash deposits.

Let us take a look at the difference between the two.

Free Standing ATMs

Free-standing ATMs are the most popular ATMs owned by ATM operators. They are unattached to a wall or a building.

Instead, they are held by the ground. Free-standing ATMs are often provided to increase customers’ convenience, especially for organizations that accept only cash. For example, they are popular at movie theaters, grocery stores, and restaurants.

However, these machines do not receive deposits from customers for safety reasons. The benefit of free-standing ATMs is that they can be placed in any good location provided there is enough space and a constant power supply.

Through-the-wall ATMs

Through-the-wall ATMs are attached to the wall of a building or business.

This type of ATM offers more security features than its counterpart. Only the machine’s exterior, where customers can do their transactions, is on the outside.

The filling the ATM with money and other things take place behind the wall, out of prying eyes. However, through-the-wall ATMs require much space. This is because it requires constructing a room(s) based on the number of machines.

So, if you are opting for this type of ATM, do not forget to include construction costs in your budget plan. In addition, you may need to discuss the price of the area with the property owner.

Special thanks to our awesome business partner Citizen State Bank for our new ATM machine. This will better serve our students, staff and patrons. They are a great partner. @AndrewRikli @PLCSchools pic.twitter.com/vkYTu76jhV — Jeff Johnson (@papiojeff) April 22, 2019

What is a good name for an ATM business?

Finding a good name for an ATM business is a crucial decision of a sole proprietorship. The name is a representation of the business. Let us examine the steps in choosing a good name for an ATM business.

The first thing that influences a choice of name is the goals and vision you have for the business. You need to ask yourself fundamental questions like: “what is the target market? what emotions do you want to evoke in them?”

A clear answer to these questions helps to improve your understanding of the best ways to appeal to your potential customers.

Next is the fun part, which is brainstorming.

I would advise you to use paper and pen/pencil. Imagine what adjective you would like to be associated with your business. Allow the creative juice to flow and keep writing them down as they come.

Here are some brainstorming techniques:

- You can work with the ATM business location

- You can use words that evoke some emotions like secure cash ATM, Happy ATM, etc

- You can use word puns or combine words in a fun way like Money Mill ATM, Great Citizens ATM, etc

- There is the option of keeping it short and simple, like Safe ATM

- In addition, you can use a name that represents something for you, like your favorite celebrity, your family name, etc.

Furthermore, you can try a business name generator.

The software will ask some questions that it will utilize in generating the ideal name for your business. It is okay if you do not like the name. It can be the spark you need to get name ideas flowing.

Finally, register the business name.

Before going to the appropriate office to register, it would help to find out whether the business name you chose is available. It should not come to you as a surprise if someone has already used your desired name to register their business.

What are the worst mistake to avoid when starting an ATM business?

Starting an ATM business can be a great way to make money, but there are some mistakes that can be costly. Knowing what these mistakes are and how to avoid them is essential for success.

Not Doing Your Research

One of the worst mistakes you can make when starting an ATM business is not doing your research.

You need to understand the industry, the regulations, and the competition in order to be successful. You should also research the different types of ATMs available and decide which one is best for your business. Additionally, you should research potential locations for your ATM and determine if they will be profitable.

Not Having a Business Plan

Another mistake to avoid when starting an ATM business is not having a business plan.

A business plan will help you stay organized and focused on your goals. It should include information about your target market, pricing structure, marketing strategy, and financial projections. Having a well-thought-out plan will help ensure that you are making informed decisions throughout the process of starting your business.

Not Understanding Regulations

It is also important to understand all of the regulations that apply to ATMs in your area before starting an ATM business.

Different states have different laws regarding ATMs, so it is important to familiarize yourself with these laws before getting started. Additionally, you should make sure that you are compliant with any federal regulations related to ATMs as well as any local ordinances or zoning requirements that may apply in your area.

Not Having Enough Capital

Having enough capital is essential when starting an ATM business.

You need enough money to cover start-up costs such as purchasing or leasing an ATM machine, obtaining necessary permits and licenses, and marketing expenses.

Additionally, you need enough money to cover operational costs such as maintenance fees and cash replenishment fees until your business starts generating revenue from transactions fees charged by customers using the machine.

Not Having Proper Insurance

Finally, it is important to have proper insurance when starting an ATM business in order to protect yourself from potential liabilities or losses due to theft or vandalism of the machine or other unforeseen circumstances.

Make sure that you have adequate coverage for both property damage and liability so that you are protected in case something goes wrong with your machine or someone gets injured while using it.

The ATM business is profitable.

And it can be the key to financial freedom for you. But it’s not always easy to start an ATM business, and there are some significant start-up costs to think about.

You can also read a recent article on my website about the keys to financial freedom.

There are essential factors you must consider to get the best from an ATM business. It helps if you choose a good and catchy name for the ATM business.

Also, get it registered and licensed to avoid any trouble with the law.

Before you venture into the ATM business, take time to study the location and the type of ATM best suited for it. In addition, make concrete arrangements concerning how the machine will be refilled with cash when necessary.

I hope this article has been useful in guiding potential ATM owners. Make the right decision today!

Image by Peggy und Marco Lachmann-Anke from Pixabay

Jeff Campbell

Jeff Campbell is a budget-master, father, full-time blogger, Disney-addict, musician, and Dave Ramsey fan. Click Here to learn more about me. Click Here to learn more about my site. Editorial Policies.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name and email in this browser for the next time I comment.

Top Related Posts

53 Clever Ways to Earn Extra Money on the Side in 2024

In my house, it seems like we are always a little short on cash. So I looked into the best ways to earn extra money on the side. Some of the best ways to earn extra cash include: Starting a...

How Do Beginner Bloggers Make Money? (2024 Complete Guide)

Blogging is one of those things we hear about as a side hustle or full-time income that seems too good to be true. So how do beginner bloggers make money? Initially, most beginner bloggers make...

How to Start an ATM Business

When a consumer needs access to cash, most are willing to pay a few dollars in service fees at the nearest ATM. Automatic teller machines strategically placed in public locations around town is a profitable way for entrepreneurs to earn a comfortable passive income.

Learn how to start your own ATM Business and whether it is the right fit for you.

Ready to form your LLC? Check out the Top LLC Formation Services .

Start an ATM Business by following these 10 steps:

- Plan your ATM Business

- Form your ATM Business into a Legal Entity

- Register your ATM Business for Taxes

- Open a Business Bank Account & Credit Card

- Set up Accounting for your ATM Business

- Get the Necessary Permits & Licenses for your ATM Business

- Get ATM Business Insurance

- Define your ATM Business Brand

- Create your ATM Business Website

- Set up your Business Phone System

We have put together this simple guide to starting your ATM Business. These steps will ensure that your new business is well planned out, registered properly and legally compliant.

Exploring your options? Check out other small business ideas .

STEP 1: Plan your business

A clear plan is essential for success as an entrepreneur. It will help you map out the specifics of your business and discover some unknowns. A few important topics to consider are:

What will you name your business?

- What are the startup and ongoing costs?

- Who is your target market?

How much can you charge customers?

Luckily we have done a lot of this research for you.

Choosing the right name is important and challenging. If you don’t already have a name in mind, visit our How to Name a Business guide or get help brainstorming a name with our ATM Business Name Generator

If you operate a sole proprietorship , you might want to operate under a business name other than your own name. Visit our DBA guide to learn more.

When registering a business name , we recommend researching your business name by checking:

- Your state's business records

- Federal and state trademark records

- Social media platforms

- Web domain availability .

It's very important to secure your domain name before someone else does.

Want some help naming your ATM Business?

Business name generator, what are the costs involved in opening an atm business.

While this type of business venture does not require an office space or a lot of supplies, there are a few things you will need to purchase. Total investment will be defined by how many machines you plan to start with. Each machine will cost between $3,000 and $10,000, depending upon the style you purchase. Each machine should have at least $2,000 in cash on a rotating basis. The only other items you should need is an insurance policy, a bag for transporting cash, tools for routine machine maintenance, and a reliable vehicle. Each machine must have access to a phone line or the Internet and you will need a computer for checking the status of each machine.

What are the ongoing expenses for an ATM Business?

Most machines require a minimum of $2,000 cash per week. Cash should be loaded in on a rotating basis. Many banks will charge your business a surcharge and merchants charge a monthly rent fee or commission, depending upon the contract both parties have agreed upon. New business owners are urged to conduct thorough research regarding your market, so that margins are correctly set from the beginning. This will help ensure higher profit margins for your ATM business.

Who is the target market?

Your ATM business is there to serve anyone who may need quick access to cash. Restaurants, bars, strip malls, convenience stores, and shopping malls are a great place to start.

How does an ATM Business make money?

An ATM business charges each customer a fee when they draw money out of their account.

The standard fee is $2.50 to $3.00 per transaction.

How much profit can an ATM Business make?

It’s important to choose high-traffic areas for your terminal locations. Successful business owners report an average of $500 per month, per ATM machine.

How can you make your business more profitable?

The more machines you have strategically placed, the higher your profits. Many new business owners find comfort in investing in franchises. Once you have learned the intricacies if this business venture, considering passing that knowledge on to new entrepreneurs by offering franchise opportunities.

Want a more guided approach? Access TRUiC's free Small Business Startup Guide - a step-by-step course for turning your business idea into reality. Get started today!

STEP 2: Form a legal entity

The most common business structure types are the sole proprietorship , partnership , limited liability company (LLC) , and corporation .

Establishing a legal business entity such as an LLC or corporation protects you from being held personally liable if your ATM Business is sued.

Form Your LLC

Read our Guide to Form Your Own LLC

Have a Professional Service Form your LLC for You

Two such reliable services:

You can form an LLC yourself and pay only the minimal state LLC costs or hire one of the Best LLC Services for a small, additional fee.

Recommended: You will need to elect a registered agent for your LLC. LLC formation packages usually include a free year of registered agent services . You can choose to hire a registered agent or act as your own.

STEP 3: Register for taxes

You will need to register for a variety of state and federal taxes before you can open for business.

In order to register for taxes you will need to apply for an EIN. It's really easy and free!

You can acquire your EIN through the IRS website . If you would like to learn more about EINs, read our article, What is an EIN?

There are specific state taxes that might apply to your business. Learn more about state sales tax and franchise taxes in our state sales tax guides.

STEP 4: Open a business bank account & credit card

Using dedicated business banking and credit accounts is essential for personal asset protection.

When your personal and business accounts are mixed, your personal assets (your home, car, and other valuables) are at risk in the event your business is sued. In business law, this is referred to as piercing your corporate veil .

Open a business bank account

Besides being a requirement when applying for business loans, opening a business bank account:

- Separates your personal assets from your company's assets, which is necessary for personal asset protection.

- Makes accounting and tax filing easier.

Recommended: Read our Best Banks for Small Business review to find the best national bank or credit union.

Get a business credit card

Getting a business credit card helps you:

- Separate personal and business expenses by putting your business' expenses all in one place.

- Build your company's credit history , which can be useful to raise money later on.

Recommended: Apply for an easy approval business credit card from BILL and build your business credit quickly.

STEP 5: Set up business accounting

Recording your various expenses and sources of income is critical to understanding the financial performance of your business. Keeping accurate and detailed accounts also greatly simplifies your annual tax filing.

Make LLC accounting easy with our LLC Expenses Cheat Sheet.

STEP 6: Obtain necessary permits and licenses

Failure to acquire necessary permits and licenses can result in hefty fines, or even cause your business to be shut down.

State & Local Business Licensing Requirements

Certain state permits and licenses may be needed to operate an ATM business. Learn more about licensing requirements in your state by visiting SBA’s reference to state licenses and permits .

Most businesses are required to collect sales tax on the goods or services they provide. To learn more about how sales tax will affect your business, read our article, Sales Tax for Small Businesses .

Services Contract

ATM businesses should consider requiring clients to sign a services agreement before installing a new machine. This agreement should clarify client expectations and minimize risk of legal disputes by setting out payment terms and conditions, service level expectations, and so on.

STEP 7: Get business insurance

Just as with licenses and permits, your business needs insurance in order to operate safely and lawfully. Business Insurance protects your company’s financial wellbeing in the event of a covered loss.

There are several types of insurance policies created for different types of businesses with different risks. If you’re unsure of the types of risks that your business may face, begin with General Liability Insurance . This is the most common coverage that small businesses need, so it’s a great place to start for your business.

Another notable insurance policy that many businesses need is Workers’ Compensation Insurance . If your business will have employees, it’s a good chance that your state will require you to carry Workers' Compensation Coverage.

FInd out what types of insurance your ATM Business needs and how much it will cost you by reading our guide Business Insurance for ATM Business.

STEP 8: Define your brand

Your brand is what your company stands for, as well as how your business is perceived by the public. A strong brand will help your business stand out from competitors.

If you aren't feeling confident about designing your small business logo, then check out our Design Guides for Beginners , we'll give you helpful tips and advice for creating the best unique logo for your business.

Recommended : Get a logo using Truic's free logo Generator no email or sign up required, or use a Premium Logo Maker .

If you already have a logo, you can also add it to a QR code with our Free QR Code Generator . Choose from 13 QR code types to create a code for your business cards and publications, or to help spread awareness for your new website.

How to promote & market an ATM Business

Unlike most business ventures, an ATM business requires little to no marketing. While you will not be directly interacting with your customers, you will communicate regularly with your merchants. Develop strong connections with them to ensure a long-term, mutually beneficial relationship. Networking with business owners in the community is a great way to ensure your name is recognized. When an entrepreneur opens a new business, your merchants will pass your name along, helping to solidify your business’ positive reputation.

How to keep customers coming back

It’s important to remember that each customer is coming to you out of convenience. Do not earn a reputation for having machines that are low on cash or always broken. Strive to deliver what they need, when they need it, at all times.

STEP 9: Create your business website

After defining your brand and creating your logo the next step is to create a website for your business .

While creating a website is an essential step, some may fear that it’s out of their reach because they don’t have any website-building experience. While this may have been a reasonable fear back in 2015, web technology has seen huge advancements in the past few years that makes the lives of small business owners much simpler.

Here are the main reasons why you shouldn’t delay building your website:

- All legitimate businesses have websites - full stop. The size or industry of your business does not matter when it comes to getting your business online.

- Social media accounts like Facebook pages or LinkedIn business profiles are not a replacement for a business website that you own.

- Website builder tools like the GoDaddy Website Builder have made creating a basic website extremely simple. You don’t need to hire a web developer or designer to create a website that you can be proud of.

Recommended : Get started today using our recommended website builder or check out our review of the Best Website Builders .

Other popular website builders are: WordPress , WIX , Weebly , Squarespace , and Shopify .

STEP 10: Set up your business phone system

Getting a phone set up for your business is one of the best ways to help keep your personal life and business life separate and private. That’s not the only benefit; it also helps you make your business more automated, gives your business legitimacy, and makes it easier for potential customers to find and contact you.

There are many services available to entrepreneurs who want to set up a business phone system. We’ve reviewed the top companies and rated them based on price, features, and ease of use. Check out our review of the Best Business Phone Systems 2023 to find the best phone service for your small business.

Recommended Business Phone Service: Phone.com

Phone.com is our top choice for small business phone numbers because of all the features it offers for small businesses and it's fair pricing.

Is this Business Right For You?

Are you seeking a business investment that doesn't require an immense amount of time or investment? Do you enjoy interacting with other business owners throughout the community? If so, opening an ATM business may be the perfect business opportunity.

Want to know if you are cut out to be an entrepreneur?

Take our Entrepreneurship Quiz to find out!

Entrepreneurship Quiz

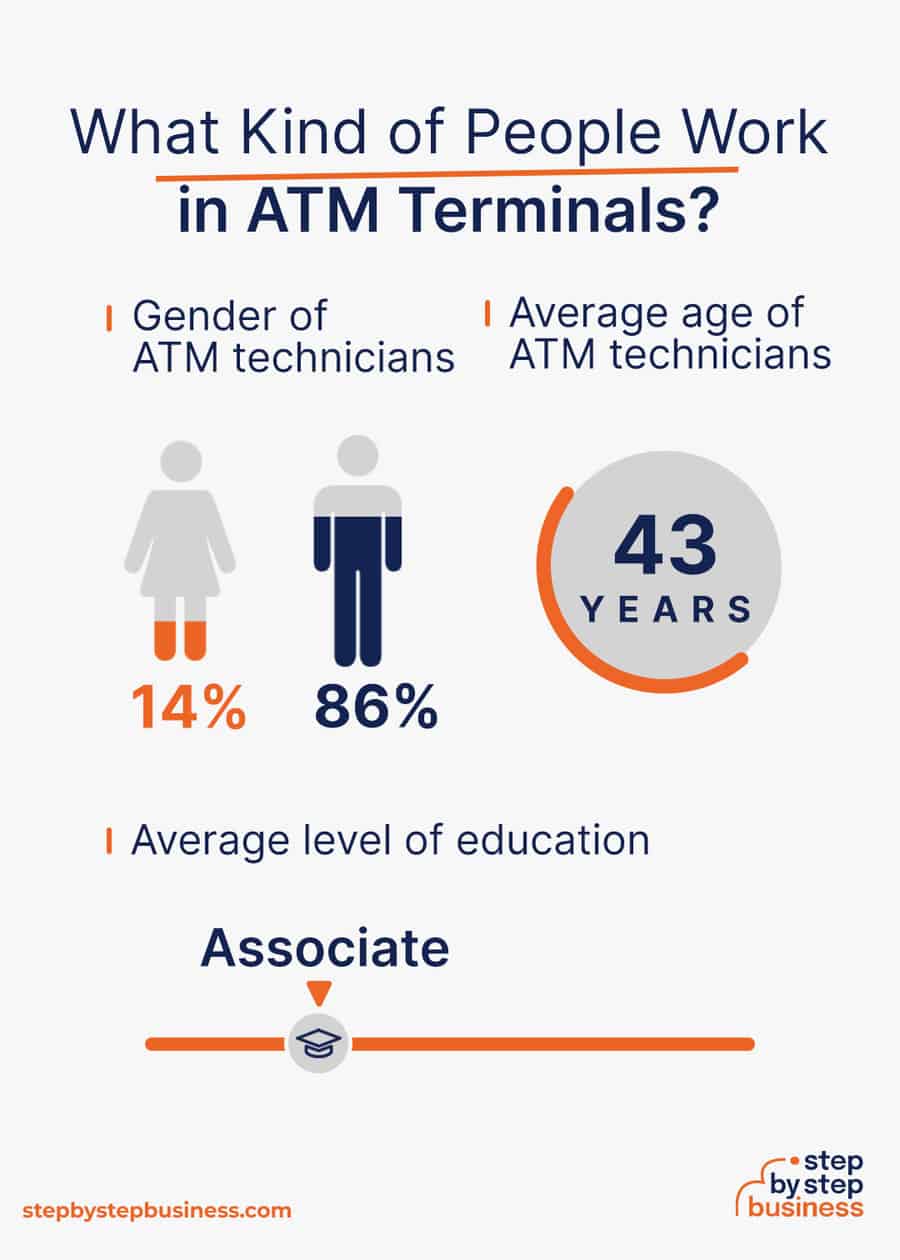

What happens during a typical day at an ATM Business?

The amount of time spent managing this type of operation varies, depending upon your skill set and the number of ATMs you own. Each machine must be kept in working order at all times. It should also contain enough cash to dispense 24/7. Anything less, and your business is losing money. Most ATM business owners have a regular route they tend to each day, where they check to ensure everything is working as it should. The rest of your team’s time is divided between administrative duties and nurturing relationships with vendors, banks, and the businesses that house your machines.

What are some skills and experiences that will help you build a successful ATM Business?

There is no formal training for owning an ATM business. Since this investment requires a significant amount of cash be on hand at all times, entrepreneurs must be skilled at handling cash and budgeting for future needs. A business degree or background is recommended. Strong interpersonal skills would also prove beneficial, as you will need to develop relationships with vendors, banks, and business owners throughout the community.

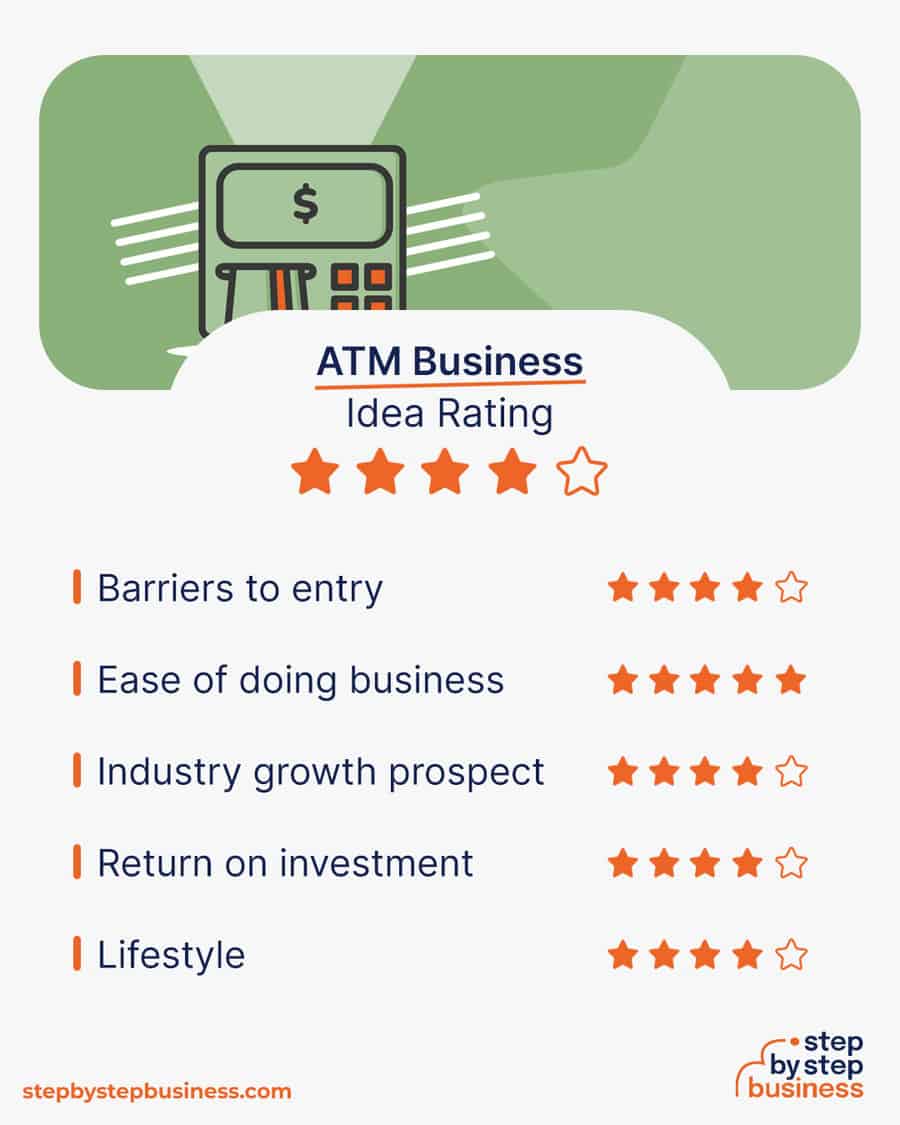

What is the growth potential for an ATM Business?

Consumers love convenience, making an ATM business a worthy long-term investment. The potential for growth is significant, as these small machines can be strategically placed wherever customers may need quick access to cash. A well thought out business plan will help you define and reach your short and long-term goals for growth and profit.

TRUiC's YouTube Channel

For fun informative videos about starting a business visit the TRUiC YouTube Channel or subscribe to view later.

Take the Next Step

Find a business mentor.

One of the greatest resources an entrepreneur can have is quality mentorship. As you start planning your business, connect with a free business resource near you to get the help you need.

Having a support network in place to turn to during tough times is a major factor of success for new business owners.

Learn from other business owners

Want to learn more about starting a business from entrepreneurs themselves? Visit Startup Savant’s startup founder series to gain entrepreneurial insights, lessons, and advice from founders themselves.

Resources to Help Women in Business

There are many resources out there specifically for women entrepreneurs. We’ve gathered necessary and useful information to help you succeed both professionally and personally:

If you’re a woman looking for some guidance in entrepreneurship, check out this great new series Women in Business created by the women of our partner Startup Savant.

What are some insider tips for jump starting an ATM Business?

Successful ATM business investors offer the following advice: